Arctic Norwegian Equities Monthly Report July 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Grieg NL Joins Grieg Seafood Family of Regions

Grieg NL joins Grieg Seafood family of regions Marystown, Newfoundland and Labrador, Canada – February 6, 2020 Grieg Newfoundland Salmon Ltd (Grieg NL) is acquired by Grieg Seafood ASA. The Placentia Bay Aquaculture Project of Grieg NL has made significant progress and is soon ready for the first eggs to be released into the new freshwater facility. With almost 30 years of experience from fresh water, post-smolt and sea water production of salmon in similar conditions to Placentia Bay, Grieg Seafood will bring world-class expertise to complete the next phase of the project. Grieg Seafood is the world’s 7th largest salmon farming company with production in the North and South of Norway, Scotland in the UK and British Columbia in Canada. The company will this year harvest 100 000 tonnes of salmon globally. Grieg Seafood will make significant investments into the Newfoundland region in the coming years to develop state- of-the-art salmon farms and ensure responsible farming practices. Grieg Seafood is in a strong position to bring stable and sustainable jobs to the coastal communities of Placentia Bay for years to come. All of Grieg NL’s development plans and agreements with local companies or Governmental Authorities will be honored and continued. Plans for service and processing are unchanged. Newfoundland processing company Ocean Choice International will remain a valued local partner in the project. The Placentia Bay Aquaculture Project will at completion contribute with at least 37 direct jobs on land and 101 direct marine jobs. In addition, we envision that the project will generate hundreds of indirect local jobs. -

2018 Equinor Pensjon Årsberetning Og Regnskap Annual Report and Accounts

2018 Equinor pensjon Årsberetning og regnskap Annual report and accounts EQUINOR PENSJON - 2018 ÅRSRAPPORT 1 NØKKELTALL BELØP I MILLIONER KR 2018 2017 2016 2015 2014 Premieinntekter 1 864 1 688 1 289 2 445 3 060 Pensjonsutbetalinger 1 256 1 143 1 031 903 778 Totalresultat 215 729 348 291 543 Forvaltningskapital 67 346 69 623 65 103 66 746 65 964 Egenkapital 7 623 7 408 6 679 6 331 6 040 Verdijustert avkastning -1,8 % 7,8 % 3,7 % 4,3 % 7,6 % Antall pensjonister* 4 409 4 217 4 164 3 829 3 507 Aktive medlemmer * 4 589 4 992 5 102 5 797 19 515 Antall personer med fripoliser * 24 753 24 792 24 230 23 917 5 734 * Ansatte som hadde mer enn 15 år igjen til pensjonsalder ble 1.4.2015 overført til den nye innskuddspensjonsordningen. Det ble i forbindelse med overgangen utstedt fripoliser for opptjente rettigheter til ca 13.000 medlemmer. Pensjonsutbetalinger pr. kategori Aktive medlemmer mill NOK 1 200 20 000 1 000 15 000 800 600 10 000 400 5 000 200 0 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 Alder Uføre Ektefelle Barn STYRE OG ADMINISTRASJON Styre Styret består av åtte representanter, alle med personlig vara. Fire av representantene er utnevnt av medlemsbedriftene, tre av representantene er valgt av medlemmene og i tillegg er det en uavhengig representant. Medlemsbedriftenes Uavhengig representanter: representant: Hans Henrik Klouman, Ove Christian Norheim 1 styrets leder Geir Johan Husøy Daglig leder Siv Solem Solveig Åsland Marit Lunde 3 4 Medlemmenes representanter: Stig Erling Sandvik Oddvar Karlsen Jorunn Birkeland Medlembedriftene Uavhengige Medlemmene Nøkkeltall 3 Aktuarberetning 33 Styre og administrasjon 3 Revisjonsberetning 34 Styrets årsberetning 4 English version 37 Årsregnskap 7 INNHOLD EQUINOR PENSJON - 2018 ÅRSRAPPORT 3 STYRETS ÅRSBERETNING 2018 Om virksomheten som godt forberedt til å møte det nye kravet. -

Appendix 1: Firm & Industry Data

Appendix 1: Firm & Industry Data NORWAY ROYAL SALMON Appendix 1.1: Diverse Information RegionRegion North (NRS Q4 North 2016 Report) – Troms Two new sites in a new area approved ° Lubben and Korsnes ° Improve possibilities for split of each generation to reduce biological risks ° Improve growth possibilities New hatchery – NRS Settefisk ° Purchased land in Karlsøy municipality, Troms ° Planned production capacity of 10 million smolts NORWAY ROYAL SALMON ° Construction starts when necessary approvals have been given, Region South estimated within 1,5 to 2 years Region South (NRS Q4 2016 Report) ° Provide NRS with predictable ° planningOperates with in theregards Haugesund to smolts area, both in Rogaland and Hordaland county ° Region South holds a total of 6 licenses ° Owned 100 % through NRS Feøy AS 8 ° One single MAB Zone ° Enables smoother and better utilization of MAB ° Harvesting at Espevær Laks 35 02 Position of salmon 2.8 Supply of farmed and wild salmonids Wild & Farmed Salmon, historical annual supply (Marine Harvest, 2017) 2 400 Wild Farmed 2 200 2 000 1 800 1 600 1 400 1 200 1 000 800 Thousand Thousand tonnes GWE 600 400 200 - 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 The general supply of seafood in the world is shifting more towards aquaculture as the supply from wild catch is stagnating in several regions and for many important species. Wild catch of salmonids is varying04 between 700Salmon 000 and 1 000 Supply000 tonnes GWE, whereas farmed salmonids are increasing. The first year the total supply of salmonids was dominated by farmed, was in 1999. -

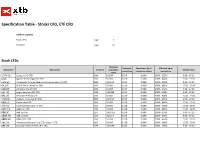

Specification Table - Stocks CFD, ETF CFD

Specification Table - Stocks CFD, ETF CFD Table of contents Stock CFDs page 1 ETF CFDs page 61 Stock CFDs Minimum Minimum Commission (% of XTB mark-up on Instrument Description Currency transaction Trading Hours commission transaction value) commission value 1COV.DE Covestro AG CFD EUR 50 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 A.US Agilent Technologies Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 A3M.ES Atresmedia Corp de Medios de Comunicacion SA CFD EUR 100 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 AA.US* CLOSE ONLY / Alcoa Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AAD.DE Amadeus Fire AG CFD EUR 50 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 AAL.UK Anglo American PLC CFD GBP 100 GBP 8 EUR 0.08% 100% - 200% 9:00 - 17:30 AAL.US American Airlines CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AALB.NL Aalberts Industries NV CFD EUR 100 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 AAN.US Aaron's Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AAP.US Advance Auto Parts Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AAPL.US Apple Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 ABB.SE ABB Ltd CFD SEK 1000 SEK 8 EUR 0.08% 100% - 430% 9:00 - 17:25 ABBN.CH ABB Ltd CFD CHF 150 CHF 8 EUR 0.08% 100% - 375% 9:00 - 17:20 ABBV.US Abbvie Inc. -

FTSE Publications

2 FTSE Russell Publications FTSE Developed Europe SMID Cap 19 August 2021 Tradable Plus Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.72 UNITED Bureau Veritas S.A. 0.42 FRANCE Gjensidige Forsikring ASA 0.17 NORWAY KINGDOM Campari 0.31 ITALY Gn Store Nordic 0.53 DENMARK AAK 0.18 SWEDEN Carl Zeiss Meditec 0.33 GERMANY Halma 0.66 UNITED Aalberts NV 0.24 NETHERLANDS Castellum 0.32 SWEDEN KINGDOM ABN AMRO Bank NV 0.23 NETHERLANDS Centrica 0.2 UNITED Hargreaves Lansdown 0.39 UNITED Acciona S.A. 0.16 SPAIN KINGDOM KINGDOM Accor 0.32 FRANCE Chr. Hansen Holding A/S 0.43 DENMARK Hays 0.16 UNITED ACS Actividades Cons y Serv 0.3 SPAIN Clariant 0.21 SWITZERLAND KINGDOM Adecco Group AG 0.49 SWITZERLAND Coca-Cola HBC AG 0.33 UNITED HeidelbergCement AG 0.6 GERMANY Adevinta 0.21 NORWAY KINGDOM HelloFresh SE 0.67 GERMANY Admiral Group 0.43 UNITED Cofinimmo 0.21 BELGIUM Helvetia Holding AG 0.18 SWITZERLAND KINGDOM Commerzbank 0.35 GERMANY Hikma Pharmaceuticals 0.27 UNITED Aedifica 0.22 BELGIUM ConvaTec Group 0.25 UNITED KINGDOM Aegon NV 0.34 NETHERLANDS KINGDOM Hiscox 0.18 UNITED KINGDOM Aeroports de Paris 0.17 FRANCE Countryside Properties 0.16 UNITED Holmen AB 0.2 SWEDEN Ageas 0.46 BELGIUM KINGDOM Homeserve 0.17 UNITED Aker BP ASA 0.16 NORWAY Covestro AG 0.54 GERMANY KINGDOM Alfa Laval 0.52 SWEDEN Covivio 0.2 FRANCE Howden Joinery Group 0.3 UNITED Alstom 0.7 FRANCE Croda International 0.64 UNITED KINGDOM KINGDOM Alten 0.18 -

Quarterly Report, Q1 2020

Q1 2020 Quarterly Report: WilderHill Clean Energy Index®, March 31, 2020 The Clean Energy Index® (ECO) began 1st Quarter 2020 around 70 and it ended Q1 near 56, down -20%; but there was more to this Q1. A remarkable, volatile, exhilarating, frightening, roller coaster Q1 first had gone up sharply +30%, over 90 in mid-February, then crashed latter Q1 to below 50. Intra-day moves were abrupt: in a few hours March 24, ECO sprang up +15%. Or seen longer since 2017, when the ECO Index® was 38, last 3 years it’s risen some +55%. An independent tracking fund at start of 2017 was about 18.5, start of 2018 was about 25.5, start of 2019 was about 21.5, start of 2020 around 34 and at end of Q1 fell to around 27. ECO passively captures an emerging highly volatile theme; it thusly can & does at times also ‘drop like a rock’ – as was amply proven for instance Q1 2020. Big gains have occurred here – as well too as bigger declines. Plus we offer a mere observation: it’s counter-intuitive perhaps yet ECO’s theme has now spiked up at times in Bush II & Trump Presidencies - though neither greatly promoted green energy. Meanwhile drops were seen 8 years of an Obama Presidency that favored this sector (yet 2008-2016 was a bit singular as China undertook to enter and gain major market share in clean energy, a goal that since came to fruition). Look back last 5 years at Benchmark ECO Index®, live since 2004 & 1st for climate solutions, and it’s near nil, negligibly up a few percent. -

Renewable Hydrogen, Made Cost Competitive

SPECIAL FEATURE – HYDROGEN ENERGY Renewable hydrogen, made cost competitive An interview with Jon André Løkke, CEO of Nel ASA, by Joanna Sampson magine a time before petroleum and electricity – horse- drawn carriages dominated the highways and byways and candles provided artificial lighting. The world was I transformed by fossil solutions in just a few centuries. But we are currently being faced with the side effects of utilising fossil energy – climate change and pollution. The obvious solution to these problems is exchanging fossil fuels with new renewable energies like solar, wind, and wave power. According to one company in Norway, it’s time for another global transformation. This time, it will be transformed by hydrogen, the simplest and most abundant element in the universe. In 1940, Nel undertook the world’s largest water Nel ASA has a vision of empowering generations with clean electrolysis installation at Rjukan, Norway, with a total 3 energy forever. To achieve this, CEO Jon André Løkke hydrogen production capacity exceeding 30,000Nm /hour believes hydrogen, along with renewable energy, must from hydropower. play a main role in the biggest energy transition since the Just over a decade later, in 1953, Nel started up a second discovery of oil. large-scale hydro-powered electrolyser plant for supplying Three quarters of the sun is made from hydrogen, providing hydrogen to ammonia production in Glomfjord, Norway. us with all the clean energy we need for at least another And in 1959 the company completely redesigned the five billion years. Realising that we have unlimited access electrolyser unit, forming the basis for today’s atmospheric to the sun raises an interesting question though: how do we electrolyser. -

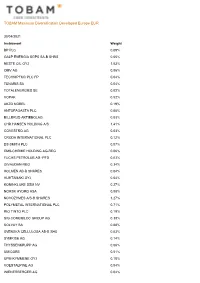

TOBAM Maximum Diversification Developed Europe EUR

TOBAM Maximum Diversification Developed Europe EUR 30/04/2021 Instrument Weight BP PLC 0.09% GALP ENERGIA SGPS SA-B SHRS 0.05% NESTE OIL OYJ 1.03% OMV AG 0.06% TECHNIPFMC PLC FP 0.04% TENARIS SA 0.04% TOTALENERGIES SE 0.02% VOPAK 0.52% AKZO NOBEL 0.19% ANTOFAGASTA PLC 0.05% BILLERUD AKTIEBOLAG 0.03% CHR HANSEN HOLDING A/S 1.41% COVESTRO AG 0.03% CRODA INTERNATIONAL PLC 0.12% DS SMITH PLC 0.07% EMS-CHEMIE HOLDING AG-REG 0.06% FUCHS PETROLUB AG -PFD 0.03% GIVAUDAN-REG 0.34% HOLMEN AB-B SHARES 0.04% HUHTAMAKI OYJ 0.04% KONINKLIJKE DSM NV 0.27% NORSK HYDRO ASA 0.08% NOVOZYMES A/S-B SHARES 1.27% POLYMETAL INTERNATIONAL PLC 0.71% RIO TINTO PLC 0.19% SIG COMBIBLOC GROUP AG 0.38% SOLVAY SA 0.08% SVENSKA CELLULOSA AB-B SHS 0.03% SYMRISE AG 0.14% THYSSENKRUPP AG 0.06% UMICORE 0.51% UPM-KYMMENE OYJ 0.18% VOESTALPINE AG 0.04% WIENERBERGER AG 0.04% TOBAM Maximum Diversification Developed Europe EUR 30/04/2021 Instrument Weight YARA INTERNATIONAL ASA 0.08% A P MOLLER - MAERSK A/S - A 0.06% A P MOLLER - MAERSK A/S - B 0.08% ACS ACTIVIDADES CONS Y SERV 0.07% ADDTECH AB-B SHARES 0.03% ADP 0.04% AENA SA 0.11% ALSTOM 0.17% ANDRITZ AG 0.03% ATLANTIA SPA 0.08% BELIMO HOLDING AG-REG 0.04% BUCHER INDUSTRIES AG-REG 0.04% BUNZL PLC 0.10% DEUTSCHE LUFTHANSA-REG 0.05% DIPLOMA PLC 0.04% DSV PANALPINA A/S 0.45% EASYJET PLC 0.20% ELIS SA 0.03% EPIROC AB-A 0.10% EPIROC AB-B 0.06% FERROVIAL SA 0.05% FLUGHAFEN ZURICH AG-REG 0.03% GEA GROUP AG 0.06% GEBERIT AG-REG 0.21% HAYS PLC 0.03% HOMESERVE PLC 0.04% HOWDEN JOINERY GROUP PLC 0.06% IMCD GROUP NV 0.07% IMI PLC 0.05% -

High Impact Sector Companies Analysed in the CDP Europe Report – 2019 Disclosure Year

High impact sector companies analysed in the CDP Europe Report – 2019 disclosure year The materials, energy and transport sectors, along with agriculture, comprise CDP’s high impact sectors. However due to lack of reporting data, the Agriculture sector was not included in the high- impact company analysis. Organization name Country Sector EVN AG Austria Electric utilities Mayr-Melnhof Karton Aktiengesellschaft Austria Paper & forestry OMV AG Austria Oil & gas Österreichische Post AG Austria Transport services VERBUND AG Austria Electric utilities Voestalpine AG Austria Steel Food, beverage & Anheuser Busch InBev Belgium tobacco Bekaert NV Belgium Metals & mining bpost Belgium Transport services Elia System Operator Belgium Electric utilities Fluxys Belgium Belgium Oil & gas Nyrstar NV Belgium Metals & mining Ontex Group NV Belgium Paper & forestry Solvay S.A. Belgium Chemicals CEZ Czechia Electric utilities A.P. Moller - Maersk Denmark Transport services Food, beverage & Carlsberg Breweries A/S Denmark tobacco Food, beverage & Chr. Hansen Holding A/S Denmark tobacco Dampskibsselskabet NORDEN A/S Denmark Transport services DFDS A/S Denmark Transport Services DSV A/S Denmark Transport services Novozymes A/S Denmark Chemicals Ørsted Denmark Electric utilities Finnair Finland Transport services Fortum Oyj Finland Electric utilities Huhtamäki Oyj Finland Paper & forestry Kemira Corporation Finland Chemicals Metsä Board Finland Paper & forestry Neste Oyj Finland Oil & gas Outokumpu Oyj Finland Steel Stora Enso Oyj Finland Paper & forestry UPM-Kymmene -

Storebrand Innkalling Saksvedlegg 2021 Norsk

Notice of the Annual General Meeting 2021 Important information: Due to the Covid-19 pandemic, the health authorities have introduced strict infection prevention measures, which include the requirement for people to maintain a physical distance from each other. Storebrand shareholders are therefore urged to abstain from attending the Annual General Meeting physically, and encouraged to exercise their right to vote in advance or by proxy as per the detailed instructions in the notice of the meeting. The meeting will be conducted with limited participation from Storebrand’s board and management team. There will be no refreshments. Storebrand complies with all applicable recommendations issued by the health authorities at any given time. It will also be possible to follow the meeting via a webcast. Please visit www.storebrand.no/ir or further details. It will also be possible to pose questions to the company’s board and management team by email. Please write to: [email protected] Notice of the annual general Date: Thursday, 8 April 2021 at 16:30 CET meeting of Storebrand ASA Place: Storebrand ASA’s head office, Professor Kohts vei 9, 1366 Lysaker, Norway Registration deadline: Tuesday 6 April 2021 at 12.00 CET Managers may not attend or vote at the General Meeting for any The following items are on the agenda: shares registered in a special management account. In such cases, 1. Opening of the General Meeting by Attorney Anders Arnkværn, the individual shareholders must transfer the shares to an account and presentation of the list of shareholders and proxies present. in their own name in order to be eligible to attend and vote. -

Annual Report Storebrand ASA 2020

Innhold Introduksjon 1. This is Storebrand 2. Customer relations 3. People 4. Keeping Our House in Order Storebrand ASA 5. Director´s report 6. Finansielle mål 7. Konsernets resultaterAnnual 2020 Report 8. Utbytte for 2020 9. Kapitalforhold 10. Rating 11. fremtidsutsikter 12. Risiko 13. arbeidsmiljø og HMS 14. Annual Accounts and notes 15. Shareholder matters 16. Sustainability assurance 17. Appendix 2020 Table of contents Introduction 6. Shareholder matters How to navigate in the Annual 3 Facts and figures 2020 report 5 Letter from the Group Chief Executive Officer 7. Annual Accounts 7 Chairman’s foreword and Notes 1. This is Storebrand Storebrand Group 10 About Storebrand 78 Income statement Previous page 11 Organisation 79 Statement of total comprehensive income 14 Executive management 80 Statement of financial position 15 Board of directors 82 Statement of changes in equity 83 Statement of cash flow Next page 2. Customer relations 85 Notes 19 Greater financial security and freedom 21 Engaging, relevant and responsible advice Storebrand ASA 22 Digital innovator in financial services 163 Income statement 23 Simple and seamless customer experiences 163 Statement of total comprehensive income Full screen 24 Key performance indicators 164 Statement of financial position 165 Statement of changes in equity 3. People 166 Statement of cash flow 26 A culture for learning 167 Notes 28 Engaged, competent and courageous employees 180 Declaration by member of the Board and the CEO 29 Diversity and equality 181 Independent auditor´s report Table of contents 31 Key performance indicators 8. Governance On the left hand side, you will always 4. Keeping Our House 189 Corporate Governance have access to the table of contents. -

Active Ownership Report: 2019 Danske Invest Asset Management March 2020 Active Ownership Report: 2019 the Two Parts of the Report

Active Ownership Report: 2019 Danske Invest Asset Management March 2020 Active Ownership Report: 2019 The two parts of the report When customers entrust us with their assets and savings, it is our duty to serve their interests by providing investment solutions with the goal to deliver competitive and long-term performance. Our firm commitment to Sustainable Investment with ESG Inside is an integral part of this duty. ESG Inside is about making better-informed investment decisions – addressing issues of risk, problems, and dilemmas, and influencing portfolio companies through active ownership to contribute to a positive outcome. Active ownership – through direct dialogue and voting at the annual general meetings – is an important part of our ability to create long-term value to the companies we invest in and to our customers. We believe it is more responsible to address material ESG Part 1: Part 2: matters as investors rather than refraining from investing Engagement Report Voting Report when issues of concern arise, leaving the problem to someone else to solve. Our portfolio managers are the change agents who can impact companies to manage risks and opportunities. The aim of our Active Ownership Report covering two parts ‘Engagement Report’ and ‘Voting Report’ is to provide our customers and stakeholders with regular updates on our progress and results. 2 Active Ownership Report: 2019 Part 1: Engagement Report This presentation is intended to be used as marketing material as defined by the European Directive 2014/65/EU dated 15 May 2014 (MiFID II) in Austria, Belgium, Denmark, Finland, France, Germany, Luxembourg, the Netherlands, Norway, Sweden, Switzerland and the United Kingdom.