Driven 2 0 1 7 a N N U a L R E P O R T 2017 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

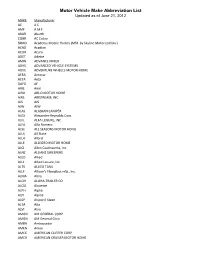

Motor Vehicle Make Abbreviation List Updated As of June 21, 2012 MAKE Manufacturer AC a C AMF a M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd

Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 MAKE Manufacturer AC A C AMF A M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd. by Skyline Motorized Div.) ACAD Acadian ACUR Acura ADET Adette AMIN ADVANCE MIXER ADVS ADVANCED VEHICLE SYSTEMS ADVE ADVENTURE WHEELS MOTOR HOME AERA Aerocar AETA Aeta DAFD AF ARIE Airel AIRO AIR-O MOTOR HOME AIRS AIRSTREAM, INC AJS AJS AJW AJW ALAS ALASKAN CAMPER ALEX Alexander-Reynolds Corp. ALFL ALFA LEISURE, INC ALFA Alfa Romero ALSE ALL SEASONS MOTOR HOME ALLS All State ALLA Allard ALLE ALLEGRO MOTOR HOME ALCI Allen Coachworks, Inc. ALNZ ALLIANZ SWEEPERS ALED Allied ALLL Allied Leisure, Inc. ALTK ALLIED TANK ALLF Allison's Fiberglass mfg., Inc. ALMA Alma ALOH ALOHA-TRAILER CO ALOU Alouette ALPH Alpha ALPI Alpine ALSP Alsport/ Steen ALTA Alta ALVI Alvis AMGN AM GENERAL CORP AMGN AM General Corp. AMBA Ambassador AMEN Amen AMCC AMERICAN CLIPPER CORP AMCR AMERICAN CRUISER MOTOR HOME Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 AEAG American Eagle AMEL AMERICAN ECONOMOBILE HILIF AMEV AMERICAN ELECTRIC VEHICLE LAFR AMERICAN LA FRANCE AMI American Microcar, Inc. AMER American Motors AMER AMERICAN MOTORS GENERAL BUS AMER AMERICAN MOTORS JEEP AMPT AMERICAN TRANSPORTATION AMRR AMERITRANS BY TMC GROUP, INC AMME Ammex AMPH Amphicar AMPT Amphicat AMTC AMTRAN CORP FANF ANC MOTOR HOME TRUCK ANGL Angel API API APOL APOLLO HOMES APRI APRILIA NEWM AR CORP. ARCA Arctic Cat ARGO Argonaut State Limousine ARGS ARGOSY TRAVEL TRAILER AGYL Argyle ARIT Arista ARIS ARISTOCRAT MOTOR HOME ARMR ARMOR MOBILE SYSTEMS, INC ARMS Armstrong Siddeley ARNO Arnolt-Bristol ARRO ARROW ARTI Artie ASA ASA ARSC Ascort ASHL Ashley ASPS Aspes ASVE Assembled Vehicle ASTO Aston Martin ASUN Asuna CAT CATERPILLAR TRACTOR CO ATK ATK America, Inc. -

Chargedevs.Com Electric Vehicles Magazine

ELECTRIC VEHICLES MAGAZINE CHARGEDEVS.COM 2014 MEDIA KIT v1402 ISENTROPIC MEDIA ELECTRIC VEHICLES MAGAZINE EVs are here. Try to keep up. Industry activity and public interest in electric vehicles are at an all-time high, and we are dedicated to help bring EVs to prime time. Charged is a mirror for the EV industry, shining a light on the good ideas and innovators where we can find them, in our best effort to help connect the dots. Editorial Overview: Charged splits industry coverage into three categories: The Vehicles - In-depth features highlighting auto maker electrification strategies, fleet options, well-suited EV niches, racing, and other marketing efforts. The Tech - A closer look at pushing the limits of EVs through the beauty of well-engineered products - batteries, power electronics, and other EV-optimized automotive systems. The Infrastructure - Charging at home, at work, in public, and the implications for the utilities. Frequency: 6x Distribution: Charged is distributed to over 12,000 qualified subscribers. Hard copies are mailed direct to subscribers in North America and distributed at all of the leading industry events. International readers receive the popular digital edition, averaging over 78,000 views per issue. (All the digital issues, with current view counts, can be found at issuu.com/chargedevs/docs) Readership: Charged qualified subscribers are key decision makers throughout the electric vehicle industry, from small start-ups to the biggest automakers, independent design firms to Tier One suppliers, government officials -

Commissioners Keith Heck, Cherryl Walker, and Simon G. Hare; Linda Mcelmurry, Recorder Chair Keith Heck Called the Meeting to Order at 2:00 P.M

APPROVED ON FEBRUARY25, 2015 BY THE BOARD OF COUNTY COMMISSIONERS AT THE WEEKLY BUSINESS SESSION General Discussion; February 12, 2015 2:00 p. m.— BCC Conference Room Commissioners Keith Heck, Cherryl Walker, and Simon G. Hare; Linda McElmurry, Recorder Chair Keith Heck called the meeting to order at 2:00 p.m. 1. Economic Development Recommendation/ Proposal Arthur O' Hare, Finance Director presented Exhibit A, Economic Development showing the updated figures for the Fund. He suggested the Board find ways to alleviate the pressure on the General Fund and consider using Economic Development funds to create a Community Development Director position when Dennis Lewis, Planning Director leaves so they can have someone to assist them. Commissioner Walker reviewed the information that she had provided to the Board, Exhibit B, Economic Development Recommendation. The packet outlined services and programs provided by SOREDI, IVCDO, and SBDC. She then reviewed her recommendations on spending Economic Development Funds. The Board agreed this was a great start. After some discussion, it was decided to bring it back on Tuesday during General Discussion. 2. Other( ORS 192.640( 1) ". notice shall include a list of the principal subjects anticipated to be considered at the meeting, but this requirement shall not limit the ability of a governing body to consider additional subjects.") The Board discussed the necessity of a Liaison for CASA, it was assigned to Commissioner Hare. The Board discussed the underground tanks at the Dimmick site, Commissioner Hare said Karen Homolac with Business Oregon is endeavoring to find funding for that project. Commissioner Heck let the Board know he has relayed their decision to Jack Swift regarding his request for a Resolution on the second amendment. -

Mv680491 Arizona Department of Transportation Mv579d Motor Vehicle Division 1801 West Jefferson Phoenix, Arizona 85001 December

MV680491 ARIZONA DEPARTMENT OF TRANSPORTATION MV579D MOTOR VEHICLE DIVISION 1801 WEST JEFFERSON PHOENIX, ARIZONA 85001 DECEMBER 2012 2012 LICENSED AUTOMOTIVE RECYCLER -- AR BROKER -- B DISTRIBUTOR -- DS MOBILE HOME DEALER FOR PLATES ONLY -- M MANUFACTURER -- MF NEW MOTOR VEHICLE DEALER -- N PUBLIC CONSIGNMENT -- PC TITLE SERVICE COMPANY -- TS USED MOTOR VEHICLE DEALER -- U WHOLESALE AUCTION DEALER -- WA - 1- LICENSE DEALERSHIP NAME AND ADDRESS PHONE NO EXP DATE PRODUCTS AUTHORIZED TO SELL _______ ___________________________ ________ __________ ___________________________ ------ AR ------ L00000021 A A A 20TH STREET AUTO WRECKING INC 6022582020 12/31/2013 (AR112) 3244 S 40TH ST PHOENIX AZ 850401623 L00000057 A A NATIONAL TOWING AUTO PARTS 6022725331 12/31/2012 (AR165) 3410 W WASHINGTON ST PHOENIX AZ 850094705 P O BOX 42321 PHOENIX AZ 85080 L00000175 A AND S AUTO WRECKING 6022439119 12/31/2012 (AR458) 2449 W BROADWAY RD PHOENIX AZ 850412003 L00000125 A C S AUTO WRECKING ** DBA: MUNCHINO INVESTMENT INC L00000302 A TO Z AUTO RECYCLER 6022721680 12/31/2012 (AR595) 2724 W BUCKEYE RD PHOENIX AZ 850095742 L00011804 A-ONE AUTO PARTS & RECYCLER ** DBA: A-ONE AUTO WRECKING LLC L00011804 A-ONE AUTO WRECKING LLC 4803322266 03/31/2013 3419 W WASHINGTON ST PHOENIX AZ 850094704 10221 N 60TH LN GLENDALE AZ 853021257 DBA: A-ONE AUTO PARTS & RECYCLER - 2- LICENSE DEALERSHIP NAME AND ADDRESS PHONE NO EXP DATE PRODUCTS AUTHORIZED TO SELL _______ ___________________________ ________ __________ ___________________________ ------ AR ------ L00010226 A-Z QUALITY -

PLUG-IN ELECTRIC VEHICLE DEPLOYMENT in the NORTHEAST a Market Overview and Literature Review

PLUG-IN ELECTRIC VEHICLE DEPLOYMENT IN THE NORTHEAST A Market Overview and Literature Review By Charles Zhu and Nick Nigro Center for Climate and Energy Solutions (C2ES) Prepared for the Transportation and Climate Initiative, Georgetown Climate Center, and New York State Energy Research and Development Authority Funded by the U.S. Department of Energy September 2012 NOTICE This material is based upon work supported by the Department of Energy under Award Number #DE-‐EE0005586. This report was prepared as an account of work sponsored by an agency of the United States Government, the New York State Energy Research and Development Authority, and the State of New York. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of any information, apparatus, product, or process disclosed, or represents that its use would not infringe privately owned rights. Reference herein to any specific commercial product, process, or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply its endorsement, recommendation, or favoring by the United States Government or any agency thereof. The views and opinions of authors expressed herein do notessarily nec state or reflect those of the United States Government or any agency thereof. Information and documents published under the name of the Transportation and Climate Initiative (TCI) represent work produced in support of the TCI or its projects. TCI materials do not necessarily reflect the positions of individual jurisdictions or agencies unless explicitly stated. -

Child Seats: Equipment: Safety Defect/Noncompliance Notices Received During May 2013

SAFETY DEFECT/NONCOMPLIANCE NOTICES RECEIVED DURING MAY 2013 Published June 11, 2013 CHILD SEATS: None during May 2013. EQUIPMENT: Koni North America (KONI) is recalling certain shock absorbers with model numbers 8245-1146L, 8245- 1146R, 8245-1201L, 8245-1201R, 8245-1203L, and 8245-1203R. These shock absorbers were manufactured January 2008 through April 2013. The affected absorbers were manufactured with an incorrectly welded bracket which may cause the shock absorber to bend and rest on the drive shaft. A bent shock absorber may compromise vehicle handling, increasing the risk of a crash. KONI will notify distributors and advise them to contact their customers of the recall. The shock absorbers will be replaced free of charge. The recall began on May 16, 2013. Customers may contact KONI at 1-800-209-3350. 13E-023 Dorman is recalling certain master cylinders, model number M630274-BX, manufactured by Bosch. The brake fluid level indicator (FLI) may not properly detect a low brake fluid level situation and warn the driver. If the brake system develops an external leak, it may result in a loss of brake fluid below the detection level of the fluid indicator switch. Without a warning, the driver may be unaware that the brake fluid level is low. A low brake fluid level may reduce the available braking force which could lengthen the required stopping distance and increase the risk of a crash. Dorman will notify owners and Bosch will replace the fluid level indicator switch free of charge. The recall is expected to begin during June 2013. Owners may contact Dorman Customer Service at 1-800-523-2492. -

Harley-Davidson, Inc. (Exact Name of Registrant As Specified in Its Charter) Wisconsin 39-1382325 (State of Organization) (I.R.S

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-Q ☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended September 27, 2020 ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-9183 Harley-Davidson, Inc. (Exact name of registrant as specified in its charter) Wisconsin 39-1382325 (State of organization) (I.R.S. Employer Identification No.) 3700 West Juneau Avenue Milwaukee Wisconsin 53208 (Address of principal executive offices) (Zip code) Registrant's telephone number, including area code: (414) 342-4680 None (Former name, former address and former fiscal year, if changed since last report) Securities Registered Pursuant to Section 12(b) of the Act: Title of each class Trading Symbol Name of each exchange on which registered Common Stock Par Value $.01 PER SHARE HOG New York Stock Exchange Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). -

EEVC NEWSLETTER Published by the Eastern Electric Vehicle Club Peter Cleaveland, Editor Vol 27 No 9 Club Address: P.O

EEVC NEWSLETTER Published by the Eastern Electric Vehicle Club Peter Cleaveland, Editor Vol 27 No 9 Club Address: P.O. Box 134, Valley Forge, PA 19481-0134 SEPTEMBER, 2007 email: [email protected]. Web site: www.eevc.info President: Oliver Perry, 5 Old Stagecoach Turn Shamong, NJ 08088, (609) 268-0944 Copyright © 2007, Eastern Electric Vehicle Club, all rights reserved Now affiliated with EAA SO WHAT'S REALLY BEEN GOING ON? "Jiminy Peak!" Oliver Perry The spectacular “blade lift” in the $3.9 mil- yacht carrying wind-farm critic Robert lion, 1.5 megawatt Jiminy Peak, Vermont Kennedy Jr. displaying a sign that read, wind turbine, finally took place Thursday “Bobby you are on the wrong boat.” Green- afternoon, July 12th. The wind turbine, called peace activists advocate “The Cape Wind “Zephyr,” is the biggest construction project Project” that wants to place 130 wind genera- at the mountain since it was opened as a tors on Horseshoe Shoal in Nantucket Sound resort in 1948 and is the only wind generator to “gracefully harness the wind.” According in North America built by a ski resort to pro- to an editorial in the Wall Street Journal for duce its own power. It is also the first wind Aug 8, 07, the well to do residents around turbine in the megawatt class to be purchased Cape Cod are again facing off against Green- in the U.S. by a private company. The turbine peace over the purposed wind farm to be is predicted to produce 33% of the energy placed in the middle of their privileged view. -

POLARIS INC. (Exact Name of Registrant As Specified in Its Charter) Minnesota 41-1790959 (State Or Other Jurisdiction of Incorporation Or Organization) (I.R.S

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 001-11411 POLARIS INC. (Exact name of registrant as specified in its charter) Minnesota 41-1790959 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 2100 Highway 55, Medina, Minnesota 55340 (Address of Principal Executive Offices) (Zip Code) (763) 542-0500 Registrant's telephone number, including area code Securities registered pursuant to Section 12(b) of the Act Title of Class Trading Symbols Name of Each Exchange on Which Registered Common Stock, $.01 par value PII New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

90416 Federal Register/Vol. 81, No. 240/Wednesday, December 14, 2016/Rules and Regulations

90416 Federal Register / Vol. 81, No. 240 / Wednesday, December 14, 2016 / Rules and Regulations DEPARTMENT OF TRANSPORTATION For non-legal issues, Mr. Mike Pyne, Regulation Identifier Number (RIN) Office of Crash Avoidance Standards I. Executive Summary National Highway Traffic Safety (telephone: 202–366–4171) (fax: 202– Administration 493–2990). Mr. Pyne’s mailing address The PSEA requires NHTSA to is National Highway Traffic Safety establish performance requirements for 49 CFR Parts 571 and 585 Administration, NVS–123, 1200 New an alert sound that is recognizable as a [Docket No. NHTSA–2016–0125] Jersey Avenue SE., Washington, DC motor vehicle in operation that allows 20590. blind and other pedestrians to detect RIN 2127–AK93 For legal issues, Mr. Thomas Healy, nearby electric vehicles or hybrid Office of the Chief Counsel (telephone: vehicles operating at lower speeds. This Federal Motor Vehicle Safety 202–366–2992) (fax: 202–366–3820). Standards; Minimum Sound final rule establishes FMVSS No.141, Mr. Healy’s mailing address is National Minimum Sound Requirements for Requirements for Hybrid and Electric Highway Traffic Safety Administration, Vehicles Hybrid and Electric Vehicles, which NCC–112, 1200 New Jersey Avenue SE., requires hybrid and electric passenger AGENCY: National Highway Traffic Washington, DC 20590. cars and LTVs with a gross vehicle Safety Administration (NHTSA), SUPPLEMENTARY INFORMATION: weight rating (GVWR) of 4,536 kg Department of Transportation (DOT). Table of Contents (10,000 lbs.) or less and LSVs, to ACTION: Final rule. produce sounds meeting the I. Executive Summary requirements of this standard so both SUMMARY: To reduce the risk of A. Summary of Requirements of the Final blind and sighted pedestrians can more pedestrian crashes, especially for the Rule B. -

Electric Vehicles: 10 Predictions for 2014

WHITE PAPER Electric Vehicles: 10 Predictions for 2014 Published 1Q 2014 John Gartner Research Director Electric Vehicles: 10 Predictions for 2014 Section 1 INTRODUCTION During 2014, the global electric vehicle (EV) industry is poised to grow by 86% and will surpass more than 346,000 new vehicles sold. North America, Europe, and Asia Pacific will continue to drive EV sales, as the technology will have only limited availability in the emerging markets of Latin America and Africa. The selection of models will increase as luxury automakers Audi, BMW, Cadillac, Mercedes, Saab, and Volvo will all introduce their first plug-in cars. These vehicles will expand the higher end of the market while also putting competitive pressure on Tesla Motors. More affordable options will also be introduced by Kia, Mahindra, Skoda, and Volkswagen, which will bring new customers to these established companies. Nissan’s upcoming electric van, the e-NV200, will give fleets a new option for reducing their carbon emissions footprint. Increasing interest in natural gas for the truck segment will continue to reduce the opportunity for EVs in that segment, though a few companies will likely announce their intent to develop a plug-in electric truck by year’s end. Electric alternatives to owning a passenger car will continue to impact the automotive market. EVs will play a supporting role in carsharing programs, while many younger urbanites will opt for electric bikes, scooters, and motorcycles as cost-effective and easier-to-park vehicles. Local governments will continue to provide incentives to reduce the number of cars burning gasoline or diesel in cities, which will result in tangible air quality benefits. -

Market Update

First Quarter 2012 MARKET UPDATE New Cars Available … Batteries Included Every once in a while at North Sky we get to do something beyond the normal routine of research, meeting with companies or fund managers, or deciphering wind velocity test results and the like. A few weeks ago we got to drive a Fisker Karma – a $107,000 luxury Batmobile. For the uninitiated, the Karma is a four-door, four-passenger sporty daily driver…and it is a plug-in hybrid electric vehicle (PHEV) that can go 50 miles on battery power alone and another 200 miles using a gasoline-powered generator. You can drive across country in this car, without an extension cord. It does 0-60 MPH in 6 seconds, corners like an Indy Car and is strangely, magnificently silent. It instantly induces a big grin on anyone who buckles in and stomps on the gas pedal (electron pedal?). Driving the Karma was a blast. We had a similar experience in 2008 when we got to drive a traffic-stopping, sunburst orange Tesla Roadster in downtown San Francisco before the car was available to the general public. But that is another story. Anyway, we grinned until our face muscles were sore at the Fisker dealership. Mostly because the Karma was so impressive but also because it made us realize that the faster, lighter and roomier Tesla Model S that hits the streets in July is going to be every bit as incredible and at roughly half the price. The Tesla is a pure electric vehicle (EV), as opposed to a PHEV like the Karma which adds a combustion engine to power the battery or to turn the wheels.