Madagascar Madagascar

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

June 2021 Indices Des Prix De Détail Relatif Aux Dépenses De La Vie Courante Des Fonctionnaires De L'onu New York = 100, Date D'indice = Juin 2021

Price indices Indices des prix Retail price indices relating to living expenditures of United Nations Officials New York City = 100, Index date = June 2021 Indices des prix de détail relatif aux dépenses de la vie courante des fonctionnaires de l'ONU New York = 100, Date d'indice = Juin 2021 National currency per US $ Index - Indice Monnaie nationale du $ E.U. Excluding Country or Area Duty Station housing 2 Pays ou Zone Villes-postes Per US$ 1 Currency Total Non compris 1 Cours du $E-U Monnaie l'habitation 2 Afghanistan Kabul 78.070 Afghani 86 93 Albania - Albanie Tirana 98.480 Lek 78 82 Algeria - Algérie Algiers 132.977 Algerian dinar 80 85 Angola Luanda 643.121 Kwanza 84 93 Argentina - Argentine Buenos Aires 94.517 Argentine peso 81 84 Armenia - Arménie Yerevan 518.300 Dram 75 80 Australia - Australie Sydney 1.291 Australian dollar 82 88 Austria - Autriche Vienna 0.820 Euro 91 100 Azerbaijan - Azerbaïdjan Baku 1.695 Azerbaijan manat 81 87 Bahamas Nassau 1.000 Bahamian dollar 100 96 Bahrain - Bahreïn Manama 0.377 Bahraini dinar 83 86 Bangladesh Dhaka 84.735 Taka 81 89 Barbados - Barbade Bridgetown 2.000 Barbados dollar 90 95 Belarus - Bélarus Minsk 2.524 New Belarusian ruble 85 91 Belgium - Belgique Brussels 0.820 Euro 84 92 Belize Belmopan 2.000 Belize dollar 76 80 Benin - Bénin Cotonou 537.714 CFA franc 83 92 Bhutan - Bhoutan Thimpu 72.580 Ngultrum 77 83 Bolivia (Plurinational State of) - Bolivie (État plurinational de) La Paz 6.848 Boliviano 73 80 Bosnia and Herzegovina - Bosnie-Herzégovine Sarajevo 1.603 Convertible mark 73 79 Botswana Gaborone 10.582 Pula 75 83 Brazil - Brésil Brasilia 5.295 Real 71 82 British Virgin Islands - Îles Vierges britanniques Road Town 1.000 US dollar 87 93 Bulgaria - Bulgarie Sofia 1.603 Lev 70 85 Burkina Faso Ouagadougou 537.714 CFA franc 80 87 Burundi Bujumbura 1,953.863 Burundi franc 82 90 Cabo Verde - Cap-Vert Praia 90.389 CV escudo 79 87 Cambodia - Cambodge Phnom Penh 4,098.000 Riel 82 88 Cameroon - Cameroun Yaounde 537.714 CFA franc 83 91 Canada Montreal 1.208 Canadian dollar 91 96 Central African Rep. -

Crown Agents Bank's Currency Capabilities

Crown Agents Bank’s Currency Capabilities September 2020 Country Currency Code Foreign Exchange RTGS ACH Mobile Payments E/M/F Majors Australia Australian Dollar AUD ✓ ✓ - - M Canada Canadian Dollar CAD ✓ ✓ - - M Denmark Danish Krone DKK ✓ ✓ - - M Europe European Euro EUR ✓ ✓ - - M Japan Japanese Yen JPY ✓ ✓ - - M New Zealand New Zealand Dollar NZD ✓ ✓ - - M Norway Norwegian Krone NOK ✓ ✓ - - M Singapore Singapore Dollar SGD ✓ ✓ - - E Sweden Swedish Krona SEK ✓ ✓ - - M Switzerland Swiss Franc CHF ✓ ✓ - - M United Kingdom British Pound GBP ✓ ✓ - - M United States United States Dollar USD ✓ ✓ - - M Africa Angola Angolan Kwanza AOA ✓* - - - F Benin West African Franc XOF ✓ ✓ ✓ - F Botswana Botswana Pula BWP ✓ ✓ ✓ - F Burkina Faso West African Franc XOF ✓ ✓ ✓ - F Cameroon Central African Franc XAF ✓ ✓ ✓ - F C.A.R. Central African Franc XAF ✓ ✓ ✓ - F Chad Central African Franc XAF ✓ ✓ ✓ - F Cote D’Ivoire West African Franc XOF ✓ ✓ ✓ ✓ F DR Congo Congolese Franc CDF ✓ - - ✓ F Congo (Republic) Central African Franc XAF ✓ ✓ ✓ - F Egypt Egyptian Pound EGP ✓ ✓ - - F Equatorial Guinea Central African Franc XAF ✓ ✓ ✓ - F Eswatini Swazi Lilangeni SZL ✓ ✓ - - F Ethiopia Ethiopian Birr ETB ✓ ✓ N/A - F 1 Country Currency Code Foreign Exchange RTGS ACH Mobile Payments E/M/F Africa Gabon Central African Franc XAF ✓ ✓ ✓ - F Gambia Gambian Dalasi GMD ✓ - - - F Ghana Ghanaian Cedi GHS ✓ ✓ - ✓ F Guinea Guinean Franc GNF ✓ - ✓ - F Guinea-Bissau West African Franc XOF ✓ ✓ - - F Kenya Kenyan Shilling KES ✓ ✓ ✓ ✓ F Lesotho Lesotho Loti LSL ✓ ✓ - - E Liberia Liberian -

Country Codes and Currency Codes in Research Datasets Technical Report 2020-01

Country codes and currency codes in research datasets Technical Report 2020-01 Technical Report: version 1 Deutsche Bundesbank, Research Data and Service Centre Harald Stahl Deutsche Bundesbank Research Data and Service Centre 2 Abstract We describe the country and currency codes provided in research datasets. Keywords: country, currency, iso-3166, iso-4217 Technical Report: version 1 DOI: 10.12757/BBk.CountryCodes.01.01 Citation: Stahl, H. (2020). Country codes and currency codes in research datasets: Technical Report 2020-01 – Deutsche Bundesbank, Research Data and Service Centre. 3 Contents Special cases ......................................... 4 1 Appendix: Alpha code .................................. 6 1.1 Countries sorted by code . 6 1.2 Countries sorted by description . 11 1.3 Currencies sorted by code . 17 1.4 Currencies sorted by descriptio . 23 2 Appendix: previous numeric code ............................ 30 2.1 Countries numeric by code . 30 2.2 Countries by description . 35 Deutsche Bundesbank Research Data and Service Centre 4 Special cases From 2020 on research datasets shall provide ISO-3166 two-letter code. However, there are addi- tional codes beginning with ‘X’ that are requested by the European Commission for some statistics and the breakdown of countries may vary between datasets. For bank related data it is import- ant to have separate data for Guernsey, Jersey and Isle of Man, whereas researchers of the real economy have an interest in small territories like Ceuta and Melilla that are not always covered by ISO-3166. Countries that are treated differently in different statistics are described below. These are – United Kingdom of Great Britain and Northern Ireland – France – Spain – Former Yugoslavia – Serbia United Kingdom of Great Britain and Northern Ireland. -

Madagascar Location Geography

Madagascar Location Madagascar lies off the east coast of Africa in the Indian Ocean. The Mozambique channel divides the island with the African continent. It is the largest of the Indian Ocean’s many islands, and is the fourth largest island in the world, following Greenland, New Guinea, and Borneo. The land aeria isw about the size of the states of Pennsylvania, Ohio, Indiana, Illinois, and Iowa combined and covers 226,658 square miles. The island is 976 miles long and 335 miles across at it’s widest point, and is shaped like an irregular oval. It has some smaller islands surrounding it, including Nosy Be, eight miles off of the coast in the Bay of Ampasindava in the northwest. Saint-Marie off the east coast and Nosy Be off the west coast are islands large enough to support inhabitants. There are also several tiny uninhabited islands in the Mozambique Channel: Nosy Mitsio, the Radama Islands, Chesterfield Island, and the Barren Islands. Geography This unique country is divided into three regions that run north and south along the length of the island. On the eastern side, along the Indian Ocean, there is a narrow piece of tropical lowlands, consisting mostly of flat plains. It is about 30 miles wide and includes marshes, but is very fertile. The eastern coast is unique in that for almost 1000 miles, it runs in a straight almost uninterrupted line from southwest to northeast. It has many white sand beaches with coral reefs, and the ocean is the roughest on this side of the island, facing out to the Indian Ocean. -

West Africa from Franco CFA to Eco: Economic Issues

ISSN: 2278-3369 International Journal of Advances in Management and Economics Available online at: www.managementjournal.info REVIEW ARTICLE West Africa from Franco CFA to Eco: Economic Issues Palumbo Vincenzo*, Villani Chiara Universita’ di Napoli Federico II Italy. *Corresponding Author Email: [email protected] Abstract: Born 73 years ago, exactly on December 26, 1945, the day France ratified the Bretton Woods agreements, the CFA franc is the currency adopted by 14 African states and for years the subject of controversy at the local level as well as in France itself. For some months the debate has become international and now this often criticized currency will give way to a new common currency called Eco. Keywords: West Africa, Economic issue, Franco CFA. Article Received: 01 Jan 2021 Revised: 24 Jan 2021 Accepted: 15 Feb. 2021 Introduction First of all, we need to take a big step back in single and independent currency it finally time: It was December 1945 when a decree appears to them as a concrete step in the signed by General Charles de Gaulle actually instituted a currency. Thus was born the direction of real autonomy. But the reality is CFA franc, which at the time when Paris more complex and beyond ideological and ratified the Bretton Woods accords meant political positions there is an objective way in Franco of the French colonies of Africa. which it is possible to approach the issue: economic science. Thus a monetary union was born. The 14 nations that are part of it today are in fact CFA: Economic Technicisms between divided into the Economic and Monetary Advantages and Disadvantages Union of West Africa (UEMOA) and the Substantially, the Economic Technical Economic and Monetary Community of Characteristics on Which the CFA Central Africa (CEMAC). -

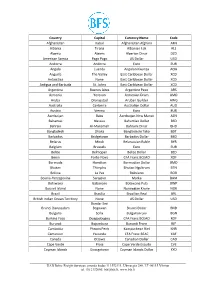

Countries Codes and Currencies 2020.Xlsx

World Bank Country Code Country Name WHO Region Currency Name Currency Code Income Group (2018) AFG Afghanistan EMR Low Afghanistan Afghani AFN ALB Albania EUR Upper‐middle Albanian Lek ALL DZA Algeria AFR Upper‐middle Algerian Dinar DZD AND Andorra EUR High Euro EUR AGO Angola AFR Lower‐middle Angolan Kwanza AON ATG Antigua and Barbuda AMR High Eastern Caribbean Dollar XCD ARG Argentina AMR Upper‐middle Argentine Peso ARS ARM Armenia EUR Upper‐middle Dram AMD AUS Australia WPR High Australian Dollar AUD AUT Austria EUR High Euro EUR AZE Azerbaijan EUR Upper‐middle Manat AZN BHS Bahamas AMR High Bahamian Dollar BSD BHR Bahrain EMR High Baharaini Dinar BHD BGD Bangladesh SEAR Lower‐middle Taka BDT BRB Barbados AMR High Barbados Dollar BBD BLR Belarus EUR Upper‐middle Belarusian Ruble BYN BEL Belgium EUR High Euro EUR BLZ Belize AMR Upper‐middle Belize Dollar BZD BEN Benin AFR Low CFA Franc XOF BTN Bhutan SEAR Lower‐middle Ngultrum BTN BOL Bolivia Plurinational States of AMR Lower‐middle Boliviano BOB BIH Bosnia and Herzegovina EUR Upper‐middle Convertible Mark BAM BWA Botswana AFR Upper‐middle Botswana Pula BWP BRA Brazil AMR Upper‐middle Brazilian Real BRL BRN Brunei Darussalam WPR High Brunei Dollar BND BGR Bulgaria EUR Upper‐middle Bulgarian Lev BGL BFA Burkina Faso AFR Low CFA Franc XOF BDI Burundi AFR Low Burundi Franc BIF CPV Cabo Verde Republic of AFR Lower‐middle Cape Verde Escudo CVE KHM Cambodia WPR Lower‐middle Riel KHR CMR Cameroon AFR Lower‐middle CFA Franc XAF CAN Canada AMR High Canadian Dollar CAD CAF Central African Republic -

WM/Refinitiv Closing Spot Rates

The WM/Refinitiv Closing Spot Rates The WM/Refinitiv Closing Exchange Rates are available on Eikon via monitor pages or RICs. To access the index page, type WMRSPOT01 and <Return> For access to the RICs, please use the following generic codes :- USDxxxFIXz=WM Use M for mid rate or omit for bid / ask rates Use USD, EUR, GBP or CHF xxx can be any of the following currencies :- Albania Lek ALL Austrian Schilling ATS Belarus Ruble BYN Belgian Franc BEF Bosnia Herzegovina Mark BAM Bulgarian Lev BGN Croatian Kuna HRK Cyprus Pound CYP Czech Koruna CZK Danish Krone DKK Estonian Kroon EEK Ecu XEU Euro EUR Finnish Markka FIM French Franc FRF Deutsche Mark DEM Greek Drachma GRD Hungarian Forint HUF Iceland Krona ISK Irish Punt IEP Italian Lira ITL Latvian Lat LVL Lithuanian Litas LTL Luxembourg Franc LUF Macedonia Denar MKD Maltese Lira MTL Moldova Leu MDL Dutch Guilder NLG Norwegian Krone NOK Polish Zloty PLN Portugese Escudo PTE Romanian Leu RON Russian Rouble RUB Slovakian Koruna SKK Slovenian Tolar SIT Spanish Peseta ESP Sterling GBP Swedish Krona SEK Swiss Franc CHF New Turkish Lira TRY Ukraine Hryvnia UAH Serbian Dinar RSD Special Drawing Rights XDR Algerian Dinar DZD Angola Kwanza AOA Bahrain Dinar BHD Botswana Pula BWP Burundi Franc BIF Central African Franc XAF Comoros Franc KMF Congo Democratic Rep. Franc CDF Cote D’Ivorie Franc XOF Egyptian Pound EGP Ethiopia Birr ETB Gambian Dalasi GMD Ghana Cedi GHS Guinea Franc GNF Israeli Shekel ILS Jordanian Dinar JOD Kenyan Schilling KES Kuwaiti Dinar KWD Lebanese Pound LBP Lesotho Loti LSL Malagasy -

International Currency Codes

Country Capital Currency Name Code Afghanistan Kabul Afghanistan Afghani AFN Albania Tirana Albanian Lek ALL Algeria Algiers Algerian Dinar DZD American Samoa Pago Pago US Dollar USD Andorra Andorra Euro EUR Angola Luanda Angolan Kwanza AOA Anguilla The Valley East Caribbean Dollar XCD Antarctica None East Caribbean Dollar XCD Antigua and Barbuda St. Johns East Caribbean Dollar XCD Argentina Buenos Aires Argentine Peso ARS Armenia Yerevan Armenian Dram AMD Aruba Oranjestad Aruban Guilder AWG Australia Canberra Australian Dollar AUD Austria Vienna Euro EUR Azerbaijan Baku Azerbaijan New Manat AZN Bahamas Nassau Bahamian Dollar BSD Bahrain Al-Manamah Bahraini Dinar BHD Bangladesh Dhaka Bangladeshi Taka BDT Barbados Bridgetown Barbados Dollar BBD Belarus Minsk Belarussian Ruble BYR Belgium Brussels Euro EUR Belize Belmopan Belize Dollar BZD Benin Porto-Novo CFA Franc BCEAO XOF Bermuda Hamilton Bermudian Dollar BMD Bhutan Thimphu Bhutan Ngultrum BTN Bolivia La Paz Boliviano BOB Bosnia-Herzegovina Sarajevo Marka BAM Botswana Gaborone Botswana Pula BWP Bouvet Island None Norwegian Krone NOK Brazil Brasilia Brazilian Real BRL British Indian Ocean Territory None US Dollar USD Bandar Seri Brunei Darussalam Begawan Brunei Dollar BND Bulgaria Sofia Bulgarian Lev BGN Burkina Faso Ouagadougou CFA Franc BCEAO XOF Burundi Bujumbura Burundi Franc BIF Cambodia Phnom Penh Kampuchean Riel KHR Cameroon Yaounde CFA Franc BEAC XAF Canada Ottawa Canadian Dollar CAD Cape Verde Praia Cape Verde Escudo CVE Cayman Islands Georgetown Cayman Islands Dollar KYD _____________________________________________________________________________________________ -

The Big Reset: War on Gold and the Financial Endgame

WILL s A system reset seems imminent. The world’s finan- cial system will need to find a new anchor before the year 2020. Since the beginning of the credit s crisis, the US realized the dollar will lose its role em as the world’s reserve currency, and has been planning for a monetary reset. According to Willem Middelkoop, this reset MIDD Willem will be designed to keep the US in the driver’s seat, allowing the new monetary system to include significant roles for other currencies such as the euro and China’s renminbi. s Middelkoop PREPARE FOR THE COMING RESET E In all likelihood gold will be re-introduced as one of the pillars LKOOP of this next phase in the global financial system. The predic- s tion is that gold could be revalued at $ 7,000 per troy ounce. By looking past the American ‘smokescreen’ surrounding gold TWarh on Golde and the dollar long ago, China and Russia have been accumu- lating massive amounts of gold reserves, positioning them- THE selves for a more prominent role in the future to come. The and the reset will come as a shock to many. The Big Reset will help everyone who wants to be fully prepared. Financial illem Middelkoop (1962) is founder of the Commodity BIG Endgame Discovery Fund and a bestsell- s ing author, who has been writing about the world’s financial system since the early 2000s. Between 2001 W RESET and 2008 he was a market commentator for RTL Television in the Netherlands and also BIG appeared on CNBC. -

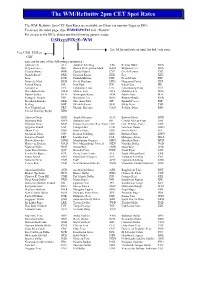

WM/Refinitiv 2Pm CET Spot Rates

The WM/Refinitiv 2pm CET Spot Rates The WM/ Refinitiv 2pm CET Spot Rates are available on Eikon via monitor Pages or RICs. To access the index page, type WMRESPOT01 and <Return> For access to the RICs, please use the following generic codes : USDxxxFIXzE=WM Use M for mid rate or omit for bid / ask rates Use USD, EUR or GBP xxx can be any of the following currencies : Albania Lek ALL Austrian Schilling ATS Belarus Ruble BYN Belgian Franc BEF Bosnia Herzegovina Mark BAM Bulgarian Lev BGN Croatian Kuna HRK Cyprus Pound CYP Czech Koruna CZK Danish Krone DKK Estonian Kroon EEK Ecu XEU Euro EUR Finnish Markka FIM French Franc FRF Deutsche Mark DEM Greek Drachma GRD Hungarian Forint HUF Iceland Krona ISK Irish Punt IEP Italian Lira ITL Latvian Lat LVL Lithuanian Litas LTL Luxembourg Franc LUF Macedonia Denar MKD Maltese Lira MTL Moldova Leu MDL Dutch Guilder NLG Norwegian Krone NOK Polish Zloty PLN Portugese Escudo PTE Romanian Leu RON Russian Rouble RUB Slovakian Koruna SKK Slovenian Tolar SIT Spanish Peseta ESP Sterling GBP Swedish Krona SEK Swiss Franc CHF New Turkish Lira TRY Ukraine Hryvnia UAH Serbian Dinar RSD Special Drawing Rights XDR Algerian Dinar DZD Angola Kwanza AOA Bahrain Dinar BHD Botswana Pula BWP Burundi Franc BIF Central African Franc XAF Comoros Franc KMF Congo Democratic Rep. Franc CDF Cote D’Ivorie Franc XOF Egyptian Pound EGP Ethiopia Birr ETB Gambian Dalasi GMD Ghana Cedi GHS Guinea Franc GNF Israeli Shekel ILS Jordanian Dinar JOD Kenyan Schilling KES Kuwaiti Dinar KWD Lebanese Pound LBP Lesotho Loti LSL Malagasy Ariary -

FAO Country Name ISO Currency Code* Currency Name*

FAO Country Name ISO Currency Code* Currency Name* Afghanistan AFA Afghani Albania ALL Lek Algeria DZD Algerian Dinar Amer Samoa USD US Dollar Andorra ADP Andorran Peseta Angola AON New Kwanza Anguilla XCD East Caribbean Dollar Antigua Barb XCD East Caribbean Dollar Argentina ARS Argentine Peso Armenia AMD Armeniam Dram Aruba AWG Aruban Guilder Australia AUD Australian Dollar Austria ATS Schilling Azerbaijan AZM Azerbaijanian Manat Bahamas BSD Bahamian Dollar Bahrain BHD Bahraini Dinar Bangladesh BDT Taka Barbados BBD Barbados Dollar Belarus BYB Belarussian Ruble Belgium BEF Belgian Franc Belize BZD Belize Dollar Benin XOF CFA Franc Bermuda BMD Bermudian Dollar Bhutan BTN Ngultrum Bolivia BOB Boliviano Botswana BWP Pula Br Ind Oc Tr USD US Dollar Br Virgin Is USD US Dollar Brazil BRL Brazilian Real Brunei Darsm BND Brunei Dollar Bulgaria BGN New Lev Burkina Faso XOF CFA Franc Burundi BIF Burundi Franc Côte dIvoire XOF CFA Franc Cambodia KHR Riel Cameroon XAF CFA Franc Canada CAD Canadian Dollar Cape Verde CVE Cape Verde Escudo Cayman Is KYD Cayman Islands Dollar Cent Afr Rep XAF CFA Franc Chad XAF CFA Franc Channel Is GBP Pound Sterling Chile CLP Chilean Peso China CNY Yuan Renminbi China, Macao MOP Pataca China,H.Kong HKD Hong Kong Dollar China,Taiwan TWD New Taiwan Dollar Christmas Is AUD Australian Dollar Cocos Is AUD Australian Dollar Colombia COP Colombian Peso Comoros KMF Comoro Franc FAO Country Name ISO Currency Code* Currency Name* Congo Dem R CDF Franc Congolais Congo Rep XAF CFA Franc Cook Is NZD New Zealand Dollar Costa Rica -

The Franc Zone

The franc zone The franc zone is an economic, monetary and cultural area that is equivalent to none other in the world. It is made up of very diverse states and territories and results from developments and changes in the former French colonial empire. After attaining their independence, most of the newly-created African states decided to remain within a homogenous group characterised by a new institutional framework and a common exchange rate mechanism. Fact Sheet The franc zone is made up of France and 15 African states: Benin, Burkina Faso, Côte d’Ivoire, Guinea Bissau, Mali, Niger, Senegal and Togo in West Africa, Cameroon, Central African Republic, Chad, Congo, Equatorial Guinea and Gabon in Central Africa, and the Comoros. The franc zone is a rare example of close institutionalised cooperation between countries from two continents that share a common language and history. The Banque de France has developed close ties with the franc zone central banks, with which it works towards ensuring the smooth functioning of the area’s shared institutions. This Fact Sheet describes the franc zone’s institutional structures and the changes they are undergoing, and brings to the fore the franc zone countries’ determination to forge ahead with regional integration in order to support growth and reduce poverty. The franc zone annual report provides detailed information on the eco- nomic and financial situation of the franc zone. It is published by the Banque de France and available on its website www.banque-france.fr n° 127 April 2002 updated July 2010 Communication Directorate 1. HISTORY OF THE FRANC ZONE 1.1.