Notice of Convocation (Including Business

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Alma Eikoh Japan Large Cap Equity Fund a Sub-Fund of Alma Capital Investment Funds SICAV

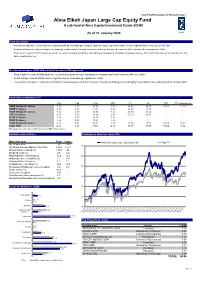

FOR PROFESSIONAL INVESTORS ONLY Alma Eikoh Japan Large Cap Equity Fund A sub-fund of Alma Capital Investment Funds SICAV As of 31 January 2020 Eikoh Fund description • Investment objective: seek long-term capital growth by investing generally in Japanese large cap stocks (with market capitalisation in excess of US$ 1bn) • Investment process: analyse long term company fundamentals through extensive in-house bottom up research with a strong risk management ethos • Portfolio of around 25-30 companies which are well managed, profitable and with good prospects. Portfolio managers believe that Cash Flow Return on Investment and value creation are key Investment manager: ACIM (Alma Capital Investment Management) • Alma Capital Investment Management is a Luxembourg based asset management company and holds a branch office in London • ACIM manages assets of $4bn and is regulated by the Luxembourg regulator the CSSF • The portfolio managers, led by James Pulsford, worked together at Eikoh Research Investment Management managing the portfolio before joining ACIM in January 2020 Cumulative performance (%) 1 M 3 M 6 M YTD 1Y 3Y ITD ITD (annualized) I GBP Hedged C shares -0.29 4.47 12.94 -0.29 24.54 26.44 86.03 11.36 I GBP C shares -0.58 2.63 4.95 -0.58 23.80 24.93 - - I EUR Hedged C shares -0.43 4.29 12.94 -0.43 23.69 23.44 - - I JPY C shares -0.35 4.53 13.85 -0.35 25.10 26.48 - - I EUR C shares 1.36 5.60 14.74 1.36 - - - - I EUR D shares 1.36 5.58 14.67 1.36 - - - - I USD Hedged C shares -0.20 5.06 14.81 -0.20 27.84 33.92 94.05 12.47 Topix (TR) -2.14 1.21 8.88 -2.14 10.17 18.46 53.20 7.86 Fund launched on 12 June 2014 (I USD Hedged C and I GBP Hedged C shares) Portfolio characteristics Performance (Indexed - Base 100) Main indicators Fund Index Alma Eikoh Japan Large Cap Equity Fund Topix TR No. -

Sumitomo Corporation's Dirty Energy Trade

SUMITOMO CORPORATION’S DIRTY ENERGY TRADE Biomass, Coal and Japan’s Energy Future DECEMBER 2019 SUMITOMO CORPORATION’S DIRTY ENERGY TRADE Biomass, Coal and Japan’s Energy Future CONTRIBUTORS Authors: Roger Smith, Jessie Mannisto, Ryan Cunningham of Mighty Earth Translation: EcoNetworks Co. Design: Cecily Anderson, anagramdesignstudio.com Any errors or inaccuracies remain the responsibility of Mighty Earth. 2 © Jan-Joseph Stok / Greenpeace CONTENTS 4 Introduction 7 Japan’s Embrace of Dirty Energy 7 Coal vs the Climate 11 Biomass Burning: Missing the Forest for the Trees 22 Sumitomo Corporation’s Coal Business: Unrepentant Polluter 22 Feeding Japan’s Coal Reliance 23 Building Dirty Power Plants Abroad and at Home 27 Sumitomo Corporation, climate laggard 29 Sumitomo Corporation’s Biomass Business: Trashing Forests for Fuel 29 Global Forests at Risk 34 Sumitomo and Southeastern Forests 39 Canadian Wood Pellet Production 42 Vietnam 44 Sumitomo Corporation and Japanese Biomass Power Plants 47 Sumitomo Corporation and You 47 TBC Corporation 49 National Tire Wholesale 50 Sumitomo Corporation: Needed Policy Changes 3 Wetland forest logging tied to Enviva’s biomass plant in Southampton, North Carolina. Dogwood Alliance INTRODUCTION SUMITOMO CORPORATION’S DIRTY ENERGY TRADE—AND ITS OPPORTUNITY TO CHANGE While the rest of the developed world accelerates its deployment of clean, renewable energy, Japan is running backwards. It is putting in place policies which double down on its reliance on coal, and indiscriminately subsidize biomass power technologies that accelerate climate change. Government policy is not the only driver of Japan’s dirty energy expansion – the private sector also plays a pivotal role in growing the country’s energy carbon footprint. -

Group Companies (As of March 31, 2007)

Group Companies (as of March 31, 2007) SUMITOMO MITSUI Financial Group www.smfg.co.jp/english/ The companies under the umbrella of Sumitomo Mitsui Financial Group Company Name: Sumitomo Mitsui Financial Group, Inc. (SMFG) offer diversified financial services centering on banking opera- Business Description: tions, and including leasing, securities and credit card services, and Management of the affairs of banking subsidiaries (under the stipula- information services. tions of the Banking Law) and of non-bank subsidiaries, and ancillary functions Establishment: December 2, 2002 Our Mission Head Office: 1-2, Yurakucho 1-chome, Chiyoda-ku, Tokyo, Japan Chairman of the Board: Masayuki Oku • To provide optimum added value to our customers (Concurrent President at Sumitomo Mitsui Banking Corporation) and together with them achieve growth President: Teisuke Kitayama To create sustainable shareholder value through (Concurrent Chairman of the Board at Sumitomo Mitsui Banking • Corporation) business growth Capital Stock: ¥1,420.9 billion • To provide a challenging and professionally reward- Stock Exchange Listings: ing work environment for our dedicated employees Tokyo Stock Exchange (First Section) Osaka Securities Exchange (First Section) Nagoya Stock Exchange (First Section) www.smbc.co.jp/global/ SUMITOMO MITSUI Banking Corporation Sumitomo Mitsui Banking Corporation (SMBC) Company Name: Sumitomo Mitsui Banking Corporation was established in April 2001 through the merger Business Profile: Banking of two leading banks, The Sakura Bank, Limited Establishment: June 6, 1996 Head Office: 1-2, Yurakucho 1-chome, and The Sumitomo Bank, Limited. In December Credit Ratings (as of July 31, 2007) Chiyoda-ku, Tokyo 2002, Sumitomo Mitsui Financial Group, Inc. was Long-term Short-term established through a stock transfer as a holding President & CEO: Masayuki Oku Moody’s Aa2 P–1 company, under which SMBC became a wholly Number of Employees: 16,407 S&P A+ A–1 Network: Fitch A F1 owned subsidiary. -

Published on July 21, 2021 1. Changes in Constituents 2

Results of the Periodic Review and Component Stocks of Tokyo Stock Exchange Dividend Focus 100 Index (Effective July 30, 2021) Published on July 21, 2021 1. Changes in Constituents Addition(18) Deletion(18) CodeName Code Name 1414SHO-BOND Holdings Co.,Ltd. 1801 TAISEI CORPORATION 2154BeNext-Yumeshin Group Co. 1802 OBAYASHI CORPORATION 3191JOYFUL HONDA CO.,LTD. 1812 KAJIMA CORPORATION 4452Kao Corporation 2502 Asahi Group Holdings,Ltd. 5401NIPPON STEEL CORPORATION 4004 Showa Denko K.K. 5713Sumitomo Metal Mining Co.,Ltd. 4183 Mitsui Chemicals,Inc. 5802Sumitomo Electric Industries,Ltd. 4204 Sekisui Chemical Co.,Ltd. 5851RYOBI LIMITED 4324 DENTSU GROUP INC. 6028TechnoPro Holdings,Inc. 4768 OTSUKA CORPORATION 6502TOSHIBA CORPORATION 4927 POLA ORBIS HOLDINGS INC. 6503Mitsubishi Electric Corporation 5105 Toyo Tire Corporation 6988NITTO DENKO CORPORATION 5301 TOKAI CARBON CO.,LTD. 7011Mitsubishi Heavy Industries,Ltd. 6269 MODEC,INC. 7202ISUZU MOTORS LIMITED 6448 BROTHER INDUSTRIES,LTD. 7267HONDA MOTOR CO.,LTD. 6501 Hitachi,Ltd. 7956PIGEON CORPORATION 7270 SUBARU CORPORATION 9062NIPPON EXPRESS CO.,LTD. 8015 TOYOTA TSUSHO CORPORATION 9101Nippon Yusen Kabushiki Kaisha 8473 SBI Holdings,Inc. 2.Dividend yield (estimated) 3.50% 3. Constituent Issues (sort by local code) No. local code name 1 1414 SHO-BOND Holdings Co.,Ltd. 2 1605 INPEX CORPORATION 3 1878 DAITO TRUST CONSTRUCTION CO.,LTD. 4 1911 Sumitomo Forestry Co.,Ltd. 5 1925 DAIWA HOUSE INDUSTRY CO.,LTD. 6 1954 Nippon Koei Co.,Ltd. 7 2154 BeNext-Yumeshin Group Co. 8 2503 Kirin Holdings Company,Limited 9 2579 Coca-Cola Bottlers Japan Holdings Inc. 10 2914 JAPAN TOBACCO INC. 11 3003 Hulic Co.,Ltd. 12 3105 Nisshinbo Holdings Inc. 13 3191 JOYFUL HONDA CO.,LTD. -

United Japan Growth Fund

United Japan Growth Fund Semi Annual Report for the half year ended 30 June 2021 United Japan Growth Fund (Constituted under a Trust Deed in the Republic of Singapore) MANAGER UOB Asset Management Ltd Registered Address: 80 Raffles Place UOB Plaza Singapore 048624 Company Registration No. : 198600120Z Tel: 1800 22 22 228 DIRECTORS OF UOB ASSET MANAGEMENT LTD Lee Wai Fai Eric Tham Kah Jin PehKianHeng Thio Boon Kiat TRUSTEE State Street Trust (SG) Limited 168 Robinson Road #33-01, Capital Tower Singapore 068912 CUSTODIAN / ADMINISTRATOR / REGISTRAR State Street Bank and Trust Company, acting through its Singapore Branch 168 Robinson Road #33-01, Capital Tower Singapore 068912 AUDITOR PricewaterhouseCoopers LLP 7 Straits View, Marina One East Tower, Level 12 Singapore 018936 SUB-MANAGER Fukoku Capital Management, Inc. 1-3-1 Uchisaiwaicho Chiyoda-Ku Saiwai Building 3rd Floor Tokyo 100-0011, Japan -1- United Japan Growth Fund (Constituted under a Trust Deed in the Republic of Singapore) A) Fund Performance Since Inception 18 August 3yr 5yr 10 yr 1995 3mth 6mth 1yr Ann Ann Ann Ann Fund Performance/ % % % Comp Comp Comp Comp Benchmark Returns Growth Growth Growth Ret Ret Ret Ret United Japan Growth Fund -2.42 -2.27 16.23 3.68 5.17 4.75 2.57 Benchmark -0.24 3.01 20.29 6.73 10.16 8.13 0.60 Source: Morningstar. Note: The performance returns of the Fund are in Singapore Dollar based on a NAV-to-NAV basis with dividends and distributions reinvested, if any. The benchmark of the Fund: Aug 95 – Dec 04: Nikkei 225 Stock Average; Jan 05 – Dec 10: Topix; Jan 11 to Present: MSCI Japan Index. -

Factset-Top Ten-0521.Xlsm

Pax International Sustainable Economy Fund USD 7/31/2021 Port. Ending Market Value Portfolio Weight ASML Holding NV 34,391,879.94 4.3 Roche Holding Ltd 28,162,840.25 3.5 Novo Nordisk A/S Class B 17,719,993.74 2.2 SAP SE 17,154,858.23 2.1 AstraZeneca PLC 15,759,939.73 2.0 Unilever PLC 13,234,315.16 1.7 Commonwealth Bank of Australia 13,046,820.57 1.6 L'Oreal SA 10,415,009.32 1.3 Schneider Electric SE 10,269,506.68 1.3 GlaxoSmithKline plc 9,942,271.59 1.2 Allianz SE 9,890,811.85 1.2 Hong Kong Exchanges & Clearing Ltd. 9,477,680.83 1.2 Lonza Group AG 9,369,993.95 1.2 RELX PLC 9,269,729.12 1.2 BNP Paribas SA Class A 8,824,299.39 1.1 Takeda Pharmaceutical Co. Ltd. 8,557,780.88 1.1 Air Liquide SA 8,445,618.28 1.1 KDDI Corporation 7,560,223.63 0.9 Recruit Holdings Co., Ltd. 7,424,282.72 0.9 HOYA CORPORATION 7,295,471.27 0.9 ABB Ltd. 7,293,350.84 0.9 BASF SE 7,257,816.71 0.9 Tokyo Electron Ltd. 7,049,583.59 0.9 Munich Reinsurance Company 7,019,776.96 0.9 ASSA ABLOY AB Class B 6,982,707.69 0.9 Vestas Wind Systems A/S 6,965,518.08 0.9 Merck KGaA 6,868,081.50 0.9 Iberdrola SA 6,581,084.07 0.8 Compagnie Generale des Etablissements Michelin SCA 6,555,056.14 0.8 Straumann Holding AG 6,480,282.66 0.8 Atlas Copco AB Class B 6,194,910.19 0.8 Deutsche Boerse AG 6,186,305.10 0.8 UPM-Kymmene Oyj 5,956,283.07 0.7 Deutsche Post AG 5,851,177.11 0.7 Enel SpA 5,808,234.13 0.7 AXA SA 5,790,969.55 0.7 Nintendo Co., Ltd. -

Itraxx Japan Series 35 Final Membership List March 2021

iTraxx Japan Series 35 Final Membership List March 2021 Copyright © 2021 IHS Markit Ltd T180614 iTraxx Japan Series 35 Final Membership List 1 iTraxx Japan Series 35 Final Membership List...........................................3 2 iTraxx Japan Series 35 Final vs. Series 34................................................ 5 3 Further information .....................................................................................6 Copyright © 2021 IHS Markit Ltd | 2 T180614 iTraxx Japan Series 35 Final Membership List 1 iTraxx Japan Series 35 Final Membership List IHS Markit Ticker IHS Markit Long Name ACOM ACOM CO., LTD. JUSCO AEON CO., LTD. ANAHOL ANA HOLDINGS INC. FUJITS FUJITSU LIMITED HITACH HITACHI, LTD. HNDA HONDA MOTOR CO., LTD. CITOH ITOCHU CORPORATION JAPTOB JAPAN TOBACCO INC. JFEHLD JFE HOLDINGS, INC. KAWHI KAWASAKI HEAVY INDUSTRIES, LTD. KAWKIS KAWASAKI KISEN KAISHA, LTD. KINTGRO KINTETSU GROUP HOLDINGS CO., LTD. KOBSTL KOBE STEEL, LTD. KOMATS KOMATSU LTD. MARUB MARUBENI CORPORATION MITCO MITSUBISHI CORPORATION MITHI MITSUBISHI HEAVY INDUSTRIES, LTD. MITSCO MITSUI & CO., LTD. MITTOA MITSUI CHEMICALS, INC. MITSOL MITSUI O.S.K. LINES, LTD. NECORP NEC CORPORATION NPG-NPI NIPPON PAPER INDUSTRIES CO.,LTD. NIPPSTAA NIPPON STEEL CORPORATION NIPYU NIPPON YUSEN KABUSHIKI KAISHA NSANY NISSAN MOTOR CO., LTD. OJIHOL OJI HOLDINGS CORPORATION ORIX ORIX CORPORATION PC PANASONIC CORPORATION RAKUTE RAKUTEN, INC. RICOH RICOH COMPANY, LTD. SHIMIZ SHIMIZU CORPORATION SOFTGRO SOFTBANK GROUP CORP. SNE SONY CORPORATION Copyright © 2021 IHS Markit Ltd | 3 T180614 iTraxx Japan Series 35 Final Membership List SUMICH SUMITOMO CHEMICAL COMPANY, LIMITED SUMI SUMITOMO CORPORATION SUMIRD SUMITOMO REALTY & DEVELOPMENT CO., LTD. TFARMA TAKEDA PHARMACEUTICAL COMPANY LIMITED TOKYOEL TOKYO ELECTRIC POWER COMPANY HOLDINGS, INCORPORATED TOSH TOSHIBA CORPORATION TOYOTA TOYOTA MOTOR CORPORATION Copyright © 2021 IHS Markit Ltd | 4 T180614 iTraxx Japan Series 35 Final Membership List 2 iTraxx Japan Series 35 Final vs. -

Notice of Convocation of the 71St Annual General Meeting of Shareholders

(Note) This document has been translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. Securities Code: 6141 March 4, 2019 To Our Shareholders 106 Kitakoriyama-cho, Yamato-Koriyama City, Nara DMG MORI CO., LTD. Masahiko Mori, President Notice of Convocation of the 71st Annual General Meeting of Shareholders You are cordially invited to attend the 71st Annual General Meeting of Shareholders of DMG MORI CO., LTD. (the “Company”) to be held as described below. In the event that you are unable to attend the meeting, you may exercise your voting rights in writing. Please indicate your approval or disapproval on the enclosed Exercise of Voting Rights form and return the form to us no later than 5:00 p.m. (the end of the business day) on March 20, 2019 after reviewing the attached Reference Material for the General Meeting of Shareholders. 1. Date and time: Friday, March 22, 2019 at 1:00 p.m. Reception for attendees begins at 11:30 a.m. 2. Venue: Grand Hall, DMG MORI YAMATO KORIYAMAJO HALL 211-3 Kitakoriyama-cho, Yamato-Koriyama City, Nara 3. Agenda: Matters to be reported: 1. Business Report, Consolidated Financial Statements and Non-consolidated Financial Statements for the 71st Fiscal Year (from January 1, 2018 to December 31, 2018) 2. Audit Reports of the Consolidated Financial Statements by the Financial Auditor and the Audit & Supervisory Board for the 71st Fiscal Year Matters to be resolved: Proposal 1: Reduction in amount of capital reserve Proposal 2: Appropriation of surplus Proposal 3: Election of eleven (11) Directors Proposal 4: Election of two (2) Audit & Supervisory Board Members Proposal 5: Revision of remuneration amount for Directors Request ◎ Attendees are kindly requested to submit their Exercise of Voting Rights form to the receptionist on the day of the meeting. -

May 19, 2014 Mitsubishi Corporation Marubeni Corporation Sumitomo

May 19, 2014 Mitsubishi Corporation Marubeni Corporation Sumitomo Corporation Commencement of Sales of Thilawa Industrial Park Development in Myanmar A consortium made up of Mitsubishi Corporation, Marubeni Corporation and Sumitomo Corporation (“the three companies”) joined forces with Myanmar Thilawa SEZ Holding Public Limited on January 11, 2014 to established Myanmar Japan Thilawa Development Ltd., (“MJTD”). MJTD has been developing the 396 hectare “Class A Area” of the Thilawa Special Economic Zone in Myanmar, which is scheduled to open in the middle of 2015. The three companies, as Japanese marketing agents of MJTD, will start the sale of leasehold rights for the Class A Area (50 years + 25 years as optional) in stages from May 19, 2014. Any of the three companies may be contacted for details on these lots, such as the available lot size, rent and other conditions. The Class A Area is located approximately 20 km southeast of the capital Yangon, and offers various incentives as a special economic zone. This is a key location, not only for export processing bases, but also for production bases targeting domestic demand. The three companies will provide high levels of infrastructure and utility services by applying the extensive know-how they have developed in the industrial park business in ASEAN countries. Attracting Japanese and other foreign investment to the Class A Area will also contribute to job creation and the economic development of Myanmar. In addition, on April 23 this year, the Japan International Cooperation Agency (JICA) signed a joint venture agreement for MJTD, making the development of Thilawa Class A the first public-private partnership business between Japan and Myanmar. -

Financial Crime

Japan’s Shifting Geopolitical and Geo-economic relations in Africa A view from Japan Inc. By Dr Martyn Davies, Managing Director: Emerging Markets & Africa, Frontier Advisory Deloitte and Kira McDonald, Research Analyst, Frontier Advisory Deloitte The Japanese translation was published in changer” in Africa since the turn of the century; Building Hitotsubashi Business Review geopolitical stature and influence in Africa with a (Vol. 63, No. 1, June 2015, pp. 24-41). potential view toward gaining a permanent seat on the United Nations Security Council (UNSC); and the strategic Introduction need for securing resource assets with special emphasis on energy resources and key metals for its industrial Japan has been grappling with defining its Africa economy.1 strategy. Historically, Japanese engagement with Since 2000, Japan’s strategy toward Africa has begun Africa has emphasised aid and development rather to shift. Whereas previously the relationship was than focused pragmatic commercial interest. Japan’s characterised by a donor-recipient model to a more engagement in Africa is seen as benign due in large part commercially-orientated approach, encouraging to its non-involvement in the continent’s colonial history. development through private investment, and However, Japan’s engagement of Africa is undergoing a incorporating a greater focus on business aligned shift due in large part by the increased prominence of the to the interests of Japan Inc. But as Africa itself is African continent and rising competition from emerging rapidly changing, so too much the foreign policy and actors who this century are rapidly accumulating both commercial strategy of Japan toward the continent. geopolitical and geo-economic capital on the continent. -

International Trading Companies: Building on the Japanese Model Robert W

Northwestern Journal of International Law & Business Volume 4 Issue 2 Fall Fall 1982 International Trading Companies: Building on the Japanese Model Robert W. Dziubla Follow this and additional works at: http://scholarlycommons.law.northwestern.edu/njilb Part of the International Law Commons Recommended Citation Robert W. Dziubla, International Trading Companies: Building on the Japanese Model, 4 Nw. J. Int'l L. & Bus. 422 (1982) This Article is brought to you for free and open access by Northwestern University School of Law Scholarly Commons. It has been accepted for inclusion in Northwestern Journal of International Law & Business by an authorized administrator of Northwestern University School of Law Scholarly Commons. Northwestern Journal of International Law & Business International Trading Companies: Building On The Japanese Model Robert W. Dziubla* Passageof the Export Trading Company Act of 1982provides new op- portunitiesfor American business to organize and operate general trading companies. Afterpresenting a thorough history and description of the Japa- nese sogoshosha, Mr. Dziubla gives several compelling reasonsfor Ameri- cans to establish export trading companies. He also examines the changes in United States banking and antitrust laws that have resultedfrom passage of the act, and offers suggestionsfor draftingguidelines, rules, and regula- tionsfor the Export Trading Company Act. For several years, American legislators and businessmen have warned that if America is to balance its international trade-and in particular offset the cost of importing billions of dollars worth of oil- she must take concrete steps to increase her exporting capabilities., On October 8, 1982, the United States took just such a step when President Reagan signed into law the Export Trading Company Act of 1982,2 which provides for the development of international general trading companies similar to the ones used so successfully by the Japanese. -

The Demonstra#On of Smart City and Expansion to the Urban Disaster

1 The demonstraon of smart city and expansion to the urban disaster recovery promo-on area in Japan Toshiba corporaon Community Solu-on Div. Yoshimasa Kudo 2 Contents ! " Japanese Smart City Demonstraon ! " Toshiba’s success story - Miyako island smart grid system - Yokohama smart city project ! " Concept of Toshiba’s smart city ! " Urban disaster recovery area in Japan 3 Contents ! " Japanese Smart City Demonstraon ! " Toshiba’s success story - Miyako island smart grid system - Yokohama smart city project ! " Concept of Toshiba’s smart city ! " Urban disaster recovery area in Japan 4 Roadmap of smart city project 2009 2010 2011 2012 2013 2014 2015 - Miyako island smart grid project Energy stabilization Demand response project Effects & evaluaon of large PV/ many PV Distribution network system of next generations Energy management of Realiza<on of electric and thermal control smart city Energy conservaon project (BEMS/HEMS) Demonstration Smart EV project of basic technology (EV charging) New Mexico smart grid project (Overseas project) & others Demonstration The four-location smart city operational experiments (Japanese project) & others of smart city Business model project Earthquake (DR, Aggregator) 5 Contents ! " Japanese Smart City Demonstraon ! " Toshiba’s success story - Miyako island smart grid system - Yokohama smart city project ! " Concept of Toshiba’s smart city ! " Urban disaster recovery area in Japan 6 Miyako island smart grid system 7 Major smart city project in Japan 4 areas were selected as the smart city of first pilot