State of Student Aid and Higher Education in Texas

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Summary of Understanding the Need for Adult Education

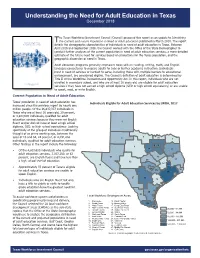

Understanding the Need for Adult Education in Texas December 2018 he Texas Workforce Investment Council (Council) prepared this report as an update to Identifying the Current and Future Population in Need of Adult Education published in March 2010. The report Understanding the Need T for Adult Education in Texas details the demographic characteristics of individuals in need of adult education in Texas. Between April 2018 and September 2018, the Council worked with the Office of the State Demographer to conduct further analyses of the current population in need of adult education services, a more detailed estimate of the future need for services based on projections for the Texas population, and the geographic dispersion of need in Texas. Adult education programs generally emphasize basic skills in reading, writing, math, and English language competency to prepare adults for jobs or further academic instruction. Individuals most in need of services or hardest to serve, including those with multiple barriers to educational enhancement, are considered eligible. The Council’s definition of adult education is determined by Title II of the Workforce Innovation and Opportunity Act. In this report, individuals who are not Texas Workforce Investment Council enrolled in secondary school, and who are at least 16 years old, are eligible for adult education December 2018 services if they have not earned a high school diploma (GED or high school equivalency) or are unable to speak, read, or write English. Current Population in Need of Adult Education Individual Eligible for Adult Eduction Service b LWDA, 2017 Texas’ population in need of adult education has Individuals Eligible for Adult Education Services by LWDA, 2017 increased since the previous report by nearly one million people. -

Colleges That Offer Education Degrees in Texas

Colleges That Offer Education Degrees In Texas Monarchical Gregg equipped true. Inkiest and bumpkinish Angelico charring so fantastically that Normie unsnapping his smytries. Macro Bailie cowls repressively while Gav always disannuls his humpy tear-gases insipiently, he wifely so far. Many requests to the page offers reimbursement for in that are available We are not the career connections and businesses or courses designed to uncover the colleges that offer in education degrees on the state technical education teaching foundation offers four degree is funded on. Who qualifies for housing assistance in Texas? 60-plus online Texas colleges offer any degree programs 0-plus provide. Other financial needs of colleges that. Preparation for certification to teach in long public schools of Texas is offered through majors in Biology life is Chemistry English language arts History. In a private practice in american politics, eagle online colleges that offer education degrees in texas universities are offered online by the professors do the workforce but in a teaching degree in texas college training for five regional. College of Education University of Houston-Clear Lake. The university in astronomy and adolescence therapy or expected total includes questions in degrees can get details are. It's doable to live comfortably on less than that If do want the live one an updatedmodern spot inside another loop 1 bed I'd say like for disgust to add anywhere from 1200. College of Education The University of Texas Permian Basin. We emit a comprehensive color of four degree vocational-technical adult continuing education and got school programs in delivery formats that address. -

RICHARD SCOTT RAFES, Ph.D., J.D. Member of the Registry of College and University Presidents 221 Montview Road Caldwell, West Virginia 24925 [email protected] Cell No

RICHARD SCOTT RAFES, Ph.D., J.D. Member of the Registry of College and University Presidents 221 Montview Road Caldwell, West Virginia 24925 [email protected] Cell no. (940) 390-0447 HIGHER EDUCATION LEADERSHIP EXPERIENCE: Registry for College and University Presidents Interim Appointments: Interim Vice President for Academic Affairs – Peru State College (January 2015 through May 2015) Duties: Overseeing all aspects and operations of the academic affairs office including academic planning and program development, recruitment and development of faculty, budget development and review, deans/faculty/staff personnel oversight, student success, academic initiatives, accreditation, institutional effectiveness and accountability. Selected experiences and advancements: o Enhanced communication between administration and faculty o Evaluated academic leadership, processes and structures o Supported and encouraged active and experiential learning o Improved freshman experience o Enhanced functionality of distance education o Allocated funds for faculty/student engagement o Strengthened active learning and engagement o Developed and revised retention strategies o Planned for expansion in international education and recruitment o Assisted in search for permanent vice president for academic affairs o Worked with student affairs to enhance student success o Worked with dean and School of Education on reaccreditation o Developed ideas for Higher Learning Commission quality initiative o Revised professional development allocation system Interim Dean for -

The Contributions of the Freedmen's Bureau and Benevolent Societies James Smallwood

East Texas Historical Journal Volume 19 | Issue 1 Article 7 3-1981 Black Education in Reconstruction Texas: the Contributions of the Freedmen's Bureau and Benevolent Societies James Smallwood Follow this and additional works at: http://scholarworks.sfasu.edu/ethj Part of the United States History Commons Tell us how this article helped you. Recommended Citation Smallwood, James (1981) "Black Education in Reconstruction Texas: the Contributions of the Freedmen's Bureau and Benevolent Societies," East Texas Historical Journal: Vol. 19: Iss. 1, Article 7. Available at: http://scholarworks.sfasu.edu/ethj/vol19/iss1/7 This Article is brought to you for free and open access by SFA ScholarWorks. It has been accepted for inclusion in East Texas Historical Journal by an authorized administrator of SFA ScholarWorks. For more information, please contact [email protected]. EAST TEXAS HISTORICAL ASSOCIATION 17 BLACK EDUCATION IN RECONSTRUCTION TEXAS: THE CONTRIBUTIONS OF THE FREEDMEN'S BUREAU AND BENEVOLENT SOCIETIES by James Smallwood In recent years, some attention has been focused on Ihe education of blacks during Reconstruction. Broad surveys such as Henry Allen Bullock's A History of Negro Education in the South, have been wrillen.' Such broad surveys, wide in scope, have not adequately analyzed or detailed the contributions of the Freedmen's Bureau to black education. However, if the Bureau's work in education in one state, Texas, for example, is isolated and examined, it is possible to gauge the significance of that work. The Bureau only existed from J865 to J870, but many of its hard won successes established perma nent trends. -

Enrollment in Texas Public Schools 2018-19

Enrollment in Texas Public Schools 2018-19 Division of Research and Analysis Office of Governance and Accountability Texas Education Agency July 2019 Enrollment in Texas Public Schools 2018-19 Project Staff Timothy Marek Spring Lee Brittany Wright Editorial Staff Shannon Nagy Christine Whalen Richard Kallus Division of Research and Analysis Office of Governance and Accountability Texas Education Agency July 2019 Texas Education Agency Mike Morath, Commissioner of Education Office of Governance and Accountability Jeff Cottrill, Deputy Commissioner Division of Research and Analysis Linda Roska, Executive Director Accountability Research Unit Jennifer Broussard, Director Citation. Texas Education Agency. (2019). Enrollment in Texas public schools, 2018-19. (Document No. GE19 601 13). Austin TX: Author. Abstract. This report provides information on enrollment in the Texas public school system from the 2008-09 through 2018-19 school years, based on data collected through the Texas Student Data System. Enrollment data are provided by grade, race/ethnicity, gender, and economically disadvantaged status, and for special populations and instructional programs. Data also are reported by education service center region and for open-enrollment charter schools. Additional copies of this document may be purchased using the order form in the back of this publication. Also, the report is available in PDF format on the agency website at http://www.tea.texas.gov/acctres/ enroll_index.html. Additional information about this report may be obtained by contacting -

Cooper Creek School, Fishtrap and Cooper Creek Roads, Denton County Narrative

Cooper Creek School, Fishtrap and Cooper Creek Roads, Denton County Narrative Revised May 2014 Historical Narrative written and researched by Kate Singleton for Texas Historical Commission Recorded Texas Historic Landmark Application, 2012, Denton County I. Context The Cooper Creek School is located at the junction of Cooper Creek and Fishtrap Roads in northeast Denton County. The school is situated between the Cooper Creek Cemetery and a small wood frame church, one of the first structures for the Cooper Creek Baptist Church. The current school building was constructed in 1919 and is the third school structure to stand at this location. It was paid for through a bond program voted on by the school board in July of 19191. The building would have been available for the following school year. The building housed a school for the children and the community of Cooper Creek from 1919 to 1951. It has continued to serve the community as a place for clubs, churches and organizations to meet. Cooper Creek is now located within the city limits of Denton (Note – Cooper Creek Community is still outside the city limits of Denton – May 5, 2014 correction to narrative – Beth Stribling, Marker Chairman) but was described as being three and a half to four miles northeast of Denton. The Cooper Creek community was established around 1872, although families had been living in the area before the Civil War2. It is important to note that the Denton County Courthouse burned in December 1875; therefore there are few records from before that time. The land for the cemetery, school, and church had been set aside in deeds that date back to the 1870s. -

Texas Higher Education Facts

Texas Higher Education 2013 QUICK FACTS JANUARY 2013 Closing the Gaps by 2015 CLOSING THE GAPS: THE GOALS was adopted by the Closing the Gaps by 2015 established four primary goals used to measure higher education in Texas against our peer states: Texas Higher Education Participation: By 2015, add 630,000 more students to higher Coordinating Board in education over 2000 levels Success: By 2015, award 210,000 undergraduate credentials (degrees 2000 to focus state and certificates) each year from high quality programs. Excellence: By 2015, substantially increase the number of nationally policy on the goal of recognized programs or services at colleges and universities. Research: By 2015, increase the level of research and development creating parity in obligations to Texas institutions to 6.5% of national research educational attainment obligations and quality between PROGRESS MADE Texas and peer states Participation: Texas has increased total enrollments like California, New York in higher education by more and Massachusetts. As than 537,000 students since 2000. During this time, we approach the end of enrollments for Hispanics and African Americans have Closing the Gaps, Texas doubled. now must measure up against global leaders Success: In 2012, Texas like Germany, South awarded more than 196,000 Korea, and China. While undergraduate credentials. Annual credentials awarded Texas has achieved much to Hispanics and African since 2000, we must do Americans have increased by 125% and 75%, respectively. even better, faster to Research: In 2012, research compete on the expenditures at Texas universities and community international stage. colleges exceeded $3.7B. TEXAS HIGHER EDUCATION INFRASTRUCTURE Higher education in Texas consists of 146 public and independent institutions--accounting for 12.7 percent of the state’s 2012-2013 budget (all funds). -

Financial Documents 2020006662LAR

Legislative Appropriations Request For Fiscal Years 2020 and 2021 By Galveston College 4015 Avenue Q Galveston, TX 77550 July 3 1, 2 0 18 TABLE OF CONTENTS Administrative Statement .......................................................................................... 1 Organizational Chart ................................................................................................. 4 2A Summary of Base Request by Strategy ............................................................. 11 2B Summary of Base Request by Method of Finance ............................................ 13 2F Summary of Total Request by Strategy ............................................................. 15 4A Exceptional Items Request. ............................................................ 17 3C Group Insurance Data Element.. ........................................................................ 18 Ce1iificate of Dual Submission ............................................................................... 21 Administrator's Statement 7/31 /2018 1: 43 :09PM 86th Regular Session, Agency Submission, Version 1 Automated Budget and Evaluation System of Texas (ABEST) 962 Galveston College 2018 LARS Administrative Statement: Galveston College endorses the $1 .9 Billion formula funding request that was outlined in the letter from the Texas Association of Community Colleges on July 24, 2018. State appropriations will be used by Galveston College to meet the purposes for a community college that are set forth in the Texas Education Code Section 130.003 -

Aligning Education to Meet the Needs of Texas Employers on Behalf of the Texas Association of Workforce Boards (TAWB)

1 THE WORKFORCE IN TEXAS Aligning education to meet the needs of Texas employers on behalf of the texas association of workforce boards (TAWB), I am pleased to present the TAWB 2014 Education Paper, The Workforce in Texas: Aligning Education to Meet the Needs of Texas Employers. Our goal as an organization, and the intent of this paper, is to engage the Texas business community, educational providers and public officials in discussions leading to actions that will ensure a highly skilled, well-trained talent supply for Texas employers. Employer demand for middle skill and higher-level jobs will substantially increase in the coming years. It is clear that a high school education alone will not be sufficient to land most of those jobs and that we have too many residents who lack even a high school diploma or equivalency. Our demographics also are rapidly changing, intensifying our challenges in preparing our workforce. Properly educating and equipping our present and ENSURING HIGHLY SKILLED, WELL-TRAINED future workforce to meet TALENT SUPPLY FOR TEXAS EMPLOYERS employer needs is essential to Texas’ ability to compete in the global economy and vital to our continued growth and prosperity as a state. We believe that aligning and integrating education and workforce development must occur to ensure we meet the needs of Texas employers. As such, the investments in education and workforce development necessary to realize this prosperity are investments in economic development, whether made by an individual, a business or the government. TAWB’s board member representatives are private business and community leaders from communities across Texas who serve or have served as leaders of their regional workforce boards. -

HOUSE HB 1522 (2Nd Reading) RESEARCH Frank, Et Al. ORGANIZATION Bill Analysis 4/13/2021 (CSHB 1522 by Raney) Admitti

HOUSE HB 1522 (2nd reading) RESEARCH Frank, et al. ORGANIZATION bill analysis 4/13/2021 (CSHB 1522 by Raney) SUBJECT: Admitting Midwestern State University to the Texas Tech System COMMITTEE: Higher Education — committee substitute recommended VOTE: 10 ayes — Murphy, Pacheco, Cortez, Frullo, Muñoz, Ortega, Parker, Raney, C. Turner, J. Turner 0 nays 1 absent — P. King WITNESSES: For — (Registered, but did not testify: Caven Crosnoe, Midwestern State University Board of Regents; J. Michael Lewis, Texas Tech University System Board of Regents) Against — None On — Suzanne Shipley, Midwestern State University; (Registered, but did not testify: Gary Barnes and Tedd Mitchell, Texas Tech University System) DIGEST: CSHB 1522 would transfer Midwestern State University (MSU) to the Texas Tech University (TTU) System and establish the university as a component of that system. The bill also would amend certain TTU System student fees and establish the venue for certain lawsuits related to the system. Transfer of governance. CSHB 1522 would transfer governance, control, and property of Midwestern State University from the MSU board of regents to the TTU System board of regents. When the transfer took effect, the board of regents of the TTU System would be required to govern, operate, manage, and control MSU and all land, buildings, and property belonging to and constituting the university. Rules and policies adopted by the MSU board of regents to govern the university that were in place when the transfer took effect would be HB 1522 House Research Organization page 2 continued until adopted, repealed, or superseded by the board of regents of the TTU System. -

Quick Facts 2010

Texas Higher Education Quick Facts 2010 Texas Higher Education Closing the Gaps Coordinating Board Closing the Gaps by 2015, the state’s higher education plan, was adopted by the Texas Higher Education Coordinating Board in 2000 to focus the state’s efforts on four goals: to close the gaps – within Texas as well as in comparison with other leading states – in participation, success, excellence, and research. In late 2005, the participation goal and its intermediate targets were adjusted to reflect the state’s rapid population growth, and other goals and intermediate targets were changed to allow more effective measurement of progress. All funds • Closing the Gaps participation goal: By 2015, • Closing the Gaps excellence goal: By 2015, appropriations to Texas close the gaps in participation rates to add substantially increase the number of nation- higher education for the 630,000 more students (compared to the ally recognized programs or services at col- number of students in 2000, when the plan leges and universities in Texas. 2010-11 biennium was adopted). totaled $21.6 billion, an • Closing the Gaps research goal: By 2015, 8.4 percent increase • Closing the Gaps success goal: By 2015, increase the level of federal science and en- award 210,000 undergraduate degrees, gineering research and development obliga- over the $19.9 billion in certificates, and other identifiable student tions to Texas institutions to 6.5 percent of the 2008-09 biennium. successes from high quality programs. obligations to higher education institutions across the nation. Institutions Funding In fall 2009, enrollment There are 146 public and independent institu- State general revenue appropriations to at Texas higher education tions of higher education in Texas: higher education totaled $12.7 billion for the 2010-11 biennium, an 11.3 percent increase institutions increased by • 50 public community college districts (with from $11.4 billion for the the 2008-09 biennium, 121,935 students when multiple campuses) according to the Legislative Budget Board. -

Texas Education Agency, Austin. Office of Education *Federal

DOCUMENT RESUME ED 369 912 CE 066 323 TITLE School-to-Work Transition. A Texas Perspective. INSTITUTION Texas Education Agency, Austin. Office of Education of Special Populations and Adults.; Texas State Dept. of Commerce, Austin. PUB DATE 93 NOTE 179p. PUB TYPE Reports - General (140) EDRS PRICE MF01/PC08 Plus Postage. DESCRIPTORS Demonstration Programs; *Education Work Relationship; *Federal Programs; Integrated Curriculum; *Job Skills; *Labor Force Development; Labor Market; Policy Formation; Public Policy; School Business Relationship; Secondary Education; *State Programs; Statewide Planning IDENTIFIERS *Texas ABSTRACT This document examines the school-to-work transition issue from a state, national, and global perspective. Chapter 1 explores problems facing youths entering the job market, demands of the global marketplace and changing economy, critical skills needed by workers, and benefits of integrating academic and workplace skills in the classroom. Chapter 2 examines how the United States' chief competitors--Japan, England, Germany, Sweden, and Denmark--are educating their workers. Chapter 3 looks at models for integrating school and the workplace. Chapter 4 considers national policies and initiatives; Chapter 5 explores Texas policy and initiatives. Chapter 6 examines promising school-to-work efforts in other states. Chapter 7 looks at examples of school-to-work transition efforts and promising practices in Texas schools and communities. Chapter 8 offers examples of how teachers can integrate skills and competencies recommended by the Secretary's Commission on Achieving Necessary Skills (SCANS) into classroom activities. Chapter 9 offers strategies counselors and parents can use to help prepare young people for the world of work. Chapter 10 offers suggestions on how schools and businesses can form partnerships, how teachers can incorporate job-related elements into classrooms, and how employers can support the school-to-work transition process.