Mastering the Rules of S Corporation Shareholder-Employee Compensation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kiiara Drops New Track & Music Video “Open My Mouth

KIIARA DROPS NEW TRACK & MUSIC VIDEO “OPEN MY MOUTH” – OUT NOW FEATURING DESIGNER CHRISTIAN COWAN AND HIS FALL FW19 RUNWAY LOOKS DEBUT ALBUM SET FOR RELEASE FALL 2019 “OPEN MY MOUTH” SINGLE ART HERE (PHOTO CREDIT: TRENT BARBOZA) NEW YORK, NY (June 7, 2019) – Today, 24-year-old multiplatinum singer-songwriter and “Princess of Chop-Pop” KIIARA debuts a brand new song, “Open My Mouth,” which marks the lead single from her highly anticipated debut album set for release this fall via Atlantic Records. The track, and its accompanying video, gives fans a taste of what’s to come off the forthcoming record – listen HERE. “Open My Mouth,” co-written by Kiiara, Amy Allen (Halsey’s “Without Me”, Selena Gomez’s “Back To You”), Scott Harris (Shawn Mendes’ “Treat You Better” and “There’s Nothin’ Holding Me Back”), Ian Kirkpatrick (Dua Lipa’s “New Rules”, Julia Michaels’ EP), and Joe London (Pitbull, Jason Derulo, Fifth Harmony) showcases Kiiara’s unique ability to blur the lines between genres with her signature vocals and honest lyrics. “Art is open for interpretation, so while some will listen to this song and relate to it based on relationships they’ve had in their lives, for me this song is about the relationship I have with myself,” Kiiara says of the new track. “I’ve struggled with mental health issues for my entire life. I’ve felt silenced, I’ve felt alone, and I’ve felt afraid. To me, this song is about facing these realities and putting it all out there. It feels empowering to open up and finally speak my truth, and I hope in doing so I can encourage others to let their guard down and do the same, so they don’t feel so alone and helpless.” The accompanying music video, directed by Juliana Carpino, features designer Christian Cowan and fashion from his FW19 line along with a special cameo appearance from Austin Mahone – watch HERE. -

Tracy Nowlin & DJG Madison Win Guymon

MAY 9, 2017 Volume 11: Issue 19 In this issue... • No Bull Grand Slam, pg 15 • BRAT Attack, pg 25 • Josey Reunion, pg 29 • Lucky Dog, pg 34 • Yellow Rose, pg 41 fast horses, fast news • ID Barrel Futurity, pg 46 Published Weekly Online at www.BarrelRacingReport.com - Since 2007 Tracy Nowlin & DJG Madison Win Guymon Pioneer Days By Tanya Randall Tracy Nowlin and her gritty, little mare DJG Madison (“Dolly IRST OWN ASH OYAL UICK ASH F D D Jo”) captured the Guymon Pioneer Days Rodeo Championship R Q D SI 105 in the Panhandle of Oklahoma by the narrowest of margins. The SI 101 2016 Prairie Circuit Finals Rodeo Champion and 14-time Interna- HAREMS CHOICE ROYAL BLUE CHEW CHEW SI 85 tional Finals Rodeo qualifier edged newly crowned RFD-TV’s The SI 101 American’s Champion Barrel Racer Hailey Kinsel and her tough MANION mare DM Sissy Hayday by 2/100ths of a second in the two-run CHEW CHEW CHA BOOGIE SI 92 average. SI 96 “I thought I needed to be a .3 on my second run to win,” laughed WINE OF ROSES Nowlin, who wanted to thank her family for their support. “I was DJG MADISON surprised. It couldn’t have been any closer.” SI 74, 2006 BROWN MARE Nowlin picked up $4,830 for the victory. She and Dolly Jo were STREAKIN SIX fifth in the first round on Friday morning slack with a 17.59 and SI 104 SUNSET SIX came back to place third in the second round after making their run SI 105 of 17.41 on Sunday afternoon. -

The Evolution of Commercial Rap Music Maurice L

Florida State University Libraries Electronic Theses, Treatises and Dissertations The Graduate School 2011 A Historical Analysis: The Evolution of Commercial Rap Music Maurice L. Johnson II Follow this and additional works at the FSU Digital Library. For more information, please contact [email protected] THE FLORIDA STATE UNIVERSITY COLLEGE OF COMMUNICATION A HISTORICAL ANALYSIS: THE EVOLUTION OF COMMERCIAL RAP MUSIC By MAURICE L. JOHNSON II A Thesis submitted to the Department of Communication in partial fulfillment of the requirements for the degree of Master of Science Degree Awarded: Summer Semester 2011 The members of the committee approve the thesis of Maurice L. Johnson II, defended on April 7, 2011. _____________________________ Jonathan Adams Thesis Committee Chair _____________________________ Gary Heald Committee Member _____________________________ Stephen McDowell Committee Member The Graduate School has verified and approved the above-named committee members. ii I dedicated this to the collective loving memory of Marlena Curry-Gatewood, Dr. Milton Howard Johnson and Rashad Kendrick Williams. iii ACKNOWLEDGEMENTS I would like to express my sincere gratitude to the individuals, both in the physical and the spiritual realms, whom have assisted and encouraged me in the completion of my thesis. During the process, I faced numerous challenges from the narrowing of content and focus on the subject at hand, to seemingly unjust legal and administrative circumstances. Dr. Jonathan Adams, whose gracious support, interest, and tutelage, and knowledge in the fields of both music and communications studies, are greatly appreciated. Dr. Gary Heald encouraged me to complete my thesis as the foundation for future doctoral studies, and dissertation research. -

Midwest Music Fest 2015 Listener's Guide

Organizers Board of Directors Trina Barrett, Sam Brown, Charlie Brown, Sean Burke, Julie Fassbender, Jacob Grippen, Zach Krage,Jim Trouten, Doug Westerman Managing Director Parker Forsell MWMF Assistant Director Dave Casey Booking Manager 168 E. 3rd St. Isaac Sammis Winona, MN 55987 Merchandise Annika Gunderson, On Three Printing GET TICKETS AND MORE Volunteer Coordinator INFO HERE Rebecca Richter Ticketing Coordinator www.midwestmusicfest.org Nicole Kirchner Music Committee Megan Hanson, Brianna Haupt, Stage Design Tim Fair, Doug Harden, Sean Brianna Truax - Modern Design Concepts Burke, Matt Marek, Alex Stevens Production Education Committee Ben Assef - Northern Sun Productions Jacob Grippen, Kelly Blau, Mike Graphic Design Costello, Brianna Haupt, Isaac Danielle Barck Sammis, Nick Novotny, Nick Elstad Fundraising Committee Printed by Sean Burke, Julie Fassbender, Cherie Harkenrider Listener’s Guide Adam Wiltgen, Jonathon Roberts, Brian Voerding, Chris Rodgers, Jim Many thanks Schmidt to the volunteers, Photography artists and sponsors Shannon Porter, Sidney Swanson, - you truly make this Ben Steinquist festival the place Hub Window Design “where music and Sarah Johnson community meet”. 3 Winona Film Society 4 5 North Light Songwriters’ Showcase Friday, April 24 • Winona Arts Center • 6pm - 10pm Frankie Lee • Nicole Rae (The Traveling Suitcase) Eddie Danger • Lydia Liza (Bomba de Luz) Mike Munson • Rachel Kilgour • J.E. Sunde Christopher the Conquered • Jaybone Bell • A gathering of nine accomplished songwriters from Minnesota, Wisconsin, -

Rock Album Discography Last Up-Date: September 27Th, 2021

Rock Album Discography Last up-date: September 27th, 2021 Rock Album Discography “Music was my first love, and it will be my last” was the first line of the virteous song “Music” on the album “Rebel”, which was produced by Alan Parson, sung by John Miles, and released I n 1976. From my point of view, there is no other citation, which more properly expresses the emotional impact of music to human beings. People come and go, but music remains forever, since acoustic waves are not bound to matter like monuments, paintings, or sculptures. In contrast, music as sound in general is transmitted by matter vibrations and can be reproduced independent of space and time. In this way, music is able to connect humans from the earliest high cultures to people of our present societies all over the world. Music is indeed a universal language and likely not restricted to our planetary society. The importance of music to the human society is also underlined by the Voyager mission: Both Voyager spacecrafts, which were launched at August 20th and September 05th, 1977, are bound for the stars, now, after their visits to the outer planets of our solar system (mission status: https://voyager.jpl.nasa.gov/mission/status/). They carry a gold- plated copper phonograph record, which comprises 90 minutes of music selected from all cultures next to sounds, spoken messages, and images from our planet Earth. There is rather little hope that any extraterrestrial form of life will ever come along the Voyager spacecrafts. But if this is yet going to happen they are likely able to understand the sound of music from these records at least. -

Mastering the Rules of S Corporation Shareholder

Mastering the Rules of S Corporation Shareholder-Employee Compensation Reporting Health Insurance Payments, ACA Requirements, and Meeting the Reasonable Compensation Standard THURSDAY, DECEMBER 3, 2015, 1:00-2:50 pm Eastern IMPORTANT INFORMATION This program is approved for 2 CPE credit hours. To earn credit you must: • Participate in the program on your own computer connection (no sharing) – if you need to register additional people, please call customer service at 1-800-926-7926 x10 (or 404-881-1141 x10). Strafford accepts American Express, Visa, MasterCard, Discover. • Listen on-line via your computer speakers. • Respond to five prompts during the program plus a single verification code. You will have to write down only the final verification code on the attestation form, which will be emailed to registered attendees. • To earn full credit, you must remain connected for the entire program. WHO TO CONTACT For Additional Registrations: -Call Strafford Customer Service 1-800-926-7926 x10 (or 404-881-1141 x10) For Assistance During the Program: -On the web, use the chat box at the bottom left of the screen If you get disconnected during the program, you can simply log in using your original instructions and PIN. Taxpayer’s Comprehensive Guide to LLCs and S Corps 2015 Edition (incrementally, but it’s a good one!) by Watson CPA Group Certified Public Accountants Copyright 2015 by Watson CPA Group 9475 Briar Village Point Suite 325 Colorado Springs, Colorado 80920 719-387-9800 www.watsoncpagroup.com All rights reserved. ISBN-13: 978-0692279649 (Watson CPA Group) ISBN-10: 0692279644 Team Profile Our book is written by the Watson CPA Group’s entire professional team to ensure accuracy and comprehensiveness. -

Winter/Spring 2020

folk forum Winter/Spring 2020 “I’m sick and tired of shortsighted, narrow minded, of knowledge or diplomatic skills endangers a world already hypocrites…Just Give me some truth…” John Lennon in turmoil. Undying loyalty to “his base” (extremist elements in America, anti-environmental industrial oligarchs, racists, religious extremists, and jingoistic military hawks to name “We have a mental illness problem in America” Donald just a few) have made him a serious danger to the whole Trump speaking on the gun issue planet and all of its living inhabitants. The ramifications of replacing experienced foreign policy members of the state “I hasten to laugh at everything for fear of being obliged to dept. and cutting the budgets for diplomacy have been spread weep” - the Barber of Seville across all aspects of the challenges we need to face in the very near future. Gunboat diplomacy and anti-environmental Hello Travelers and Sojourners, attitudes prevent essential solutions in this 21st century 2020 began very quietly in Oak Center. The lone car going world. Using the old rhetoric of making the world safe for thru this obsolete little town at 4am under the crush of “Democracy” will not help a world where an increasingly “civilization” - an impedance perhaps to the march of unstable climate requires all people globally to work together “PROGRESS” for the multi headed Medusa of Industrio- to rapidly move toward returning to a sustainable energy, techno-digito Beastio. This car does so each day as it’s driver industrial, and agricultural systems. That will requires leaders dutifully goes to work in a job so vital that they make the with integrity and an ability to think beyond personal gain drive at 4am each day regardless of weather or as in this case, whether ego or wealth. -

DJ Music Catalog by Title

Artist Title Artist Title Artist Title Dev Feat. Nef The Pharaoh #1 Kellie Pickler 100 Proof [Radio Edit] Rick Ross Feat. Jay-Z And Dr. Dre 3 Kings Cobra Starship Feat. My Name is Kay #1Nite Andrea Burns 100 Stories [Josh Harris Vocal Club Edit Yo Gotti, Fabolous & DJ Khaled 3 Kings [Clean] Rev Theory #AlphaKing Five For Fighting 100 Years Josh Wilson 3 Minute Song [Album Version] Tank Feat. Chris Brown, Siya And Sa #BDay [Clean] Crystal Waters 100% Pure Love TK N' Cash 3 Times In A Row [Clean] Mariah Carey Feat. Miguel #Beautiful Frenship 1000 Nights Elliott Yamin 3 Words Mariah Carey Feat. Miguel #Beautiful [Louie Vega EOL Remix - Clean Rachel Platten 1000 Ships [Single Version] Britney Spears 3 [Groove Police Radio Edit] Mariah Carey Feat. Miguel And A$AP #Beautiful [Remix - Clean] Prince 1000 X's & O's Queens Of The Stone Age 3's & 7's [LP] Mariah Carey Feat. Miguel And Jeezy #Beautiful [Remix - Edited] Godsmack 1000hp [Radio Edit] Emblem3 3,000 Miles Mariah Carey Feat. Miguel #Beautiful/#Hermosa [Spanglish Version]d Colton James 101 Proof [Granny With A Gold Tooth Radi Lonely Island Feat. Justin Timberla 3-Way (The Golden Rule) [Edited] Tucker #Country Colton James 101 Proof [The Full 101 Proof] Sho Baraka feat. Courtney Orlando 30 & Up, 1986 [Radio] Nate Harasim #HarmonyPark Wrabel 11 Blocks Vinyl Theatre 30 Seconds Neighbourhood Feat. French Montana #icanteven Dinosaur Pile-Up 11:11 Jay-Z 30 Something [Amended] Eric Nolan #OMW (On My Way) Rodrigo Y Gabriela 11:11 [KBCO Edit] Childish Gambino 3005 Chainsmokers #Selfie Rodrigo Y Gabriela 11:11 [Radio Edit] Future 31 Days [Xtra Clean] My Chemical Romance #SING It For Japan Michael Franti & Spearhead Feat. -

Kenny Loggins Éÿ³æ¨‚Å°ˆè¼¯ ĸ²È¡Œ (ĸ“Ⱦ‘ & Æ—¶É—´È¡¨)

Kenny Loggins 音樂專輯 串行 (专辑 & 时间表) Return to Pooh Corner https://zh.listvote.com/lists/music/albums/return-to-pooh-corner-17028633/songs More Songs from Pooh https://zh.listvote.com/lists/music/albums/more-songs-from-pooh-corner-6911042/songs Corner Celebrate Me Home https://zh.listvote.com/lists/music/albums/celebrate-me-home-5057581/songs Leap of Faith https://zh.listvote.com/lists/music/albums/leap-of-faith-6509932/songs High Adventure https://zh.listvote.com/lists/music/albums/high-adventure-5754867/songs Nightwatch https://zh.listvote.com/lists/music/albums/nightwatch-7034076/songs Keep the Fire https://zh.listvote.com/lists/music/albums/keep-the-fire-6383168/songs The Unimaginable Life https://zh.listvote.com/lists/music/albums/the-unimaginable-life-7771522/songs It's About Time https://zh.listvote.com/lists/music/albums/it%27s-about-time-6089681/songs All Join In https://zh.listvote.com/lists/music/albums/all-join-in-4729041/songs How About Now https://zh.listvote.com/lists/music/albums/how-about-now-5917373/songs December https://zh.listvote.com/lists/music/albums/december-5248907/songs Back to Avalon https://zh.listvote.com/lists/music/albums/back-to-avalon-4839372/songs Kenny Loggins Alive https://zh.listvote.com/lists/music/albums/kenny-loggins-alive-6391129/songs Yesterday, Today, Tomorrow https://zh.listvote.com/lists/music/albums/yesterday%2C-today%2C-tomorrow-8052961/songs Love Songs of Kenny Loggins https://zh.listvote.com/lists/music/albums/love-songs-of-kenny-loggins-17035932/songs Vox Humana https://zh.listvote.com/lists/music/albums/vox-humana-7942348/songs The Essential Kenny Loggins https://zh.listvote.com/lists/music/albums/the-essential-kenny-loggins-16954571/songs Outside: From the Redwoods https://zh.listvote.com/lists/music/albums/outside%3A-from-the-redwoods-7112933/songs. -

Musicians List Pdf Site

lin’/2002, west coast coolin’/2004, stay with me/2007 – Paul Brown white sand/2007 – Jonathan Butler surrender/2002 Alex Acuña – Cafe Soul All Stars/Love Pages various artists/2005 – Vanessa Carlton be not nobody/2002 – Chiara Civello last quarter percussion, drums moon/2005 – Steve Cole between us/2000, ny la/2003 – Brian Culbertson nice & slow/2001, come on up/2003, it’s on Los Angeles - 1978-2007 tonight/2005, a soulful christmas/2006 – Eric Darius just getting started/2006 – Will Downing emotions/2003, soul sym- AO R Light Mellow cool sound edition/2001 – AO R Light Mellow warner edition/2001 – Anri 16th summer breeze/1994, phony/2005 – George Duke duke/2005 – Richard Elliot chill factor/1999, crush/2001 – Forever, for always, for luther twin soul/1997 – David Baerwald bedtime stories/1990 – David Benoit full circle/2006 – Stephen Bishop saudade/2007 various artists/2004 – Michael Franks rendezvous in rio/2006 – Kenny G paradise/2002 – Jeff Golub do it again/2002, soul – Boys Club boys club/1988 – Brian Bromberg choices/2004 – Jackson Browne world in motion/1989 – Severin Browne sessions/2003 – Euge Groove euge groove/2000, play date/2002, livin’ large/2004 – Everette Harp for the love/2000, all from the edge of the world/1995 – Larry Carlton friends/1983, last nite/1987, kid gloves/1992 – Oscar Castro-Neves all for you/2004, in the moment/2006 – Paul Jackson, Jr. the power of the string/2001, still small voice/2003 – Bob James one/2006 – Joe Cocker night calls/1991 – Shawn Colvin fat city/1992 – Rita Coolidge and so is love/2005 -

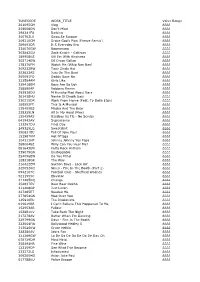

TUNECODE WORK TITLE Value Range 261095CM

TUNECODE WORK_TITLE Value Range 261095CM Vlog ££££ 259008DN Don't Mind ££££ 298241FU Barking ££££ 300703LV Swag Se Swagat ££££ 309210CM Drake God's Plan (Freeze Remix) ££££ 289693DR It S Everyday Bro ££££ 234070GW Boomerang ££££ 302842GU Zack Knight - Galtiyan ££££ 189958KS Kill Em With Kindness ££££ 302714EW Dil Diyan Gallan ££££ 178176FM Watch Me (Whip Nae Nae) ££££ 309232BW Tiger Zinda Hai ££££ 253823AS Juju On The Beat ££££ 265091FQ Daddy Says No ££££ 232584AM Girls Like ££££ 329418BM Boys Are So Ugh ££££ 258890AP Robbery Remix ££££ 292938DU M Huncho Mad About Bars ££££ 261438HU Nashe Si Chadh Gayi ££££ 230215DR Work From Home (Feat. Ty Dolla $Ign) ££££ 188552FT This Is A Musical ££££ 135455BS Masha And The Bear ££££ 238329LN All In My Head (Flex) ££££ 155459AS Bassboy Vs Tlc - No Scrubs ££££ 041942AV Supernanny ££££ 133267DU Final Day ££££ 249325LQ Sweatshirt ££££ 290631EU Fall Of Jake Paul ££££ 153987KM Hot N*Gga ££££ 304111HP Johnny Johnny Yes Papa ££££ 2680048Z Willy Can You Hear Me? ££££ 081643EN Party Rock Anthem ££££ 239079GN Unstoppable ££££ 254096EW Do You Mind ££££ 128318GR The Way ££££ 216422EM Section Boyz - Lock Arf ££££ 325052KQ Nines - Fire In The Booth (Part 2) ££££ 0942107C Football Club - Sheffield Wednes ££££ 5211555C Elevator ££££ 311205DQ Change ££££ 254637EV Baar Baar Dekho ££££ 311408GP Just Listen ££££ 227485ET Needed Me ££££ 277854GN Mad Over You ££££ 125910EU The Illusionists ££££ 019619BR I Can't Believe This Happened To Me ££££ 152953AR Fallout ££££ 153881KV Take Back The Night ££££ 217278AV Better When -

The First Canadians in France : the Chronicle of a Military Hospital in The

D 629.F8 B433f 1917 01110280R ivnoiivn 3NIOI03W JO A aNiDiaaw jo Aavaan ivnoiivn 3NOIQ3W jo xavaan o a. NATIONAL LIBR. NATIONAL LIBRARY OF MEDICINE NATIONAL LIBRARY OF MEDICINE NATIONAL LIBRARY OF MEDICINE NATIONAL LIBRARY C NATIONAL LIBRARY OF MEDICINE NATIONAL LIBRARY O 3NI01Q3W jo Aavaan ivnoiivn 3nioiq3w jo Aavaai NATIONAL LIBRARY OF MEDICINE NATIONAL LIBRARY OF THE FIRST CANADIANS IN FRANCE F. McKELVEY BELL "HE IS A MAN AFTER MY OWN HEART!" EXCLAIMED MADAME COUILLARD THE FIRST CANADIANS IN FRANCE THE CHRONICLE OF A MILITARY HOSPITAL IN THE WAR ZONE F. McKELVEY BELL ILLUSTRATED BY CHRISTOPHER FULLEYLOVE NEW YORK GEORGE H. DORAN COMPANY LIPR^RY COPYRIGHT, 1917, BT GEORGE H. DORAN COMPANY PRINTED IN THE UNITED STATES OF AMERICA TO SURGEON-GENERAL GUY CARLETON JONES, C.M.G. AND TO THE CANADIAN MEDICAL SERVICES OVERSEAS THESE PAGES ARE DEDICATED The wise and skillful guidance of the former and the efficient fulfilment of onerous duties by all have given to the Canadian Medical Service a status second to none in the Empire: The sick and wounded soldier has been made to feel that a Military Hospital may be not only a highly scientific institution—but a Home. PREFACE In glancing through these pages, now that they are written, I realise that insufficient stress has been laid upon the heroism and self- sacrifice of the non-commissioned officers and men of the Army Medical Corps—the boys who, in the dull monotony of hospital life, de- nied the exhilaration and stimulus of the firing line, are, alas, too often forgotten. All honour to them that in spite of this handicap they give of their best, and give it whole-heartedly to their stricken comrades.