Electranet Pty Ltd Eyre Peninsula Analysis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

For Personal Use Only

31 January 2020 QUARTERLY ACTIVITIES REPORT For the period ended 31 December 2019 Highlights • The Hon Michael McCormack MP, Deputy Prime Minister and Minister for Infrastructure, Transport and Regional Development announced on 15 December 2019 that $25 million will be provided by the Federal Government to support the Cape Hardy port precinct in order to enhance regional economic growth benefits in the Eyre Peninsula that will arise from more efficient supply-chain and export infrastructure. • Cape Hardy Stage I port development update released 31 October 2019 indicating a capital cost estimate of $167 million for marine and landside facilities. • Stage I port capex estimate based on definitive CEIP feasibility study port design, further supported by supplementary 2019 vendor estimates and industry cost comparison analysis. • Iron Road, in collaboration with Eyre Peninsula Cooperative Bulk Handling (EPCBH), continues to advance Cape Hardy Stage I financing plan and delivery model - several potential strategic investors and debt finance providers engaged following announcement of Federal government funding support. • During November 2019 the Company’s General Manager, Mr Larry Ingle succeeded Mr Andrew Stocks as Iron Road’s Chief Executive Officer. For personal use only Extract of 15 December 2019 media release by the Hon Michael McCormack MP, Deputy Prime Minister and Minister for Infrastructure, Transport and Regional Development (full media release and MYEFO 2019-20 extract attached). GPO Box 1164, Adelaide 5001 South Australia | T +61 (8) 8214 4400 [email protected] | ironroadlimited.com.au | ABN: 51 128 698 108 Central Eyre Iron Project (CEIP) Project Commercialisation The Hon Michael McCormack MP, Deputy Prime Minister and Minister for Infrastructure, Transport and Regional Development announced on 15 December 2019 that $25 million will be provided to support the Cape Hardy port precinct in South Australia’s Eyre Peninsula. -

ASX ANNOUNCEMENT Iron Road Limited (Iron Road, ASX:IRD)

13 December 2016 ASX ANNOUNCEMENT Iron Road Limited (Iron Road, ASX:IRD) CAPE HARDY PORT DEVELOPMENT – CALLS FOR PRELIMINARY REGISTRATIONS OF INTEREST Opportunity for Regional Businesses to Utilise First Capesize Capable Port Facilities for South Australia Iron Road Limited (Iron Road, ASX: IRD) is pleased to announce that Regional Development Australia Whyalla and Eyre Peninsula (RDAWEP), on behalf of Iron Road, has commenced a Registration of Preliminary Interest process in relation to the Cape Hardy port development. An invitation for individuals and businesses seeking to utilise the proposed facilities, located 7km south of Port Neill on the eastern Eyre Peninsula, in South Australia, is now open. RDAWEP and Iron Road are keen to maximise the benefits of this important development to the region and encourage any parties that may be interested in the import or export of commodities, goods and services to register a non-binding preliminary interest. Service providers essential to general port operations are also invited to participate. Cape Hardy is a deep water development that will support vessels up to Capesize class, allowing some of the world’s most efficient dry cargo ships and bulk carriers to service the port. Regional Development Australia is an Australian Government initiative established to encourage partnership between all levels of government and industry to enhance the growth and development of Australia’s regional communities. RDAWEP is the peak body driving the expansion and growth of economic activity across Eyre Peninsula. Iron Road Managing Director Mr Andrew Stocks said that RDAWEP was contracted to undertake this important process on behalf of the Company due to its knowledge of, and commitment to, economic development in the region. -

The ISA Discussion Paper (DP) Identifies The

The ISA Discussion Paper (DP) identifies the following four projects within the Eyre & Western Region as priorities ‐• 6‐Star $500m International Holiday Resort • Competitive Export Pathways for Primary Industries • Super School in Whyalla Education & Training Precinct • Energy Transmission and Generation on EP. This information is sourced (acknowledged) from the RDSA Infrastructure Priorities Report. The priorities require updating to reflect changes since the report was published and the report, within the context of this region and ISA’s objectives, requires a broader perspective. For instance RDAWEP has successfully supported and advocated for; the $100m Super School (due for completion in 2021) and has broadened the agenda to advocate for an integrated Education and Innovation Precinct (EIP) an $280m upgrade of the energy transmission network (Electranet due to commence construction in 2020) and is progressing various energy generation projects across the region – however the planned transmission upgrade will be at maximum capacity when completed and therefore requires greater capacity than is planned Competitive Export Pathways for Primary Industries which is a catch‐all for the ports of Thevenard, Port Lincoln, Lucky Bay, Whyalla, approved port at Cape Hardy together with bulk handling, storage and transport network efficiencies, including road & rail, for agriculture, mining and processing – this catch‐all represents many projects that drives efficiency, enhances global competitiveness and collectively exceeds $1bn, ranging from maintenance and enhancement of existing assets (i.e. dredging Thevenard) to building new Infrastructure (i.e. Cape Hardy Port and connection to national rail grid) Early high level master planning, identification of key stakeholders, location & land acquisition and potential partners for a multi experience International Resort. -

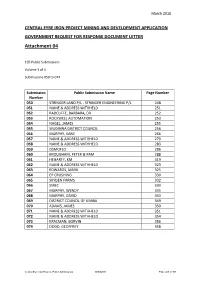

Attachment 04

CENTRAL EYRE IRON PROJECT MINING AND DEVELOPMENT APPLICATION GOVERNMENT REQUEST FOR RESPONSE DOCUMENT LETTER Attachment 04 105 Public Submissions Volume 3 of 4 Submissions 050 to 074 Submission Public Submission Name Page Number Number 050 STRINGER LAND P/L - STRINGER ENGINEERING P/L 248 051 NAME & ADDRESS WITHHELD 251 052 RADCLIFFE, BARBARA, DR 252 053 ROCKWELL AUTOMATION 253 054 NAGEL, JAMES 255 055 WUDINNA DISTRICT COUNCIL 256 056 MURPHY, KANE 266 057 NAME & ADDRESS WITHHELD 270 058 NAME & ADDRESS WITHHELD 283 059 OSMOFLO 286 060 BROUGHAM, PETER & PAM 288 061 HEGARTY, KM 319 062 NAME & ADDRESS WITHHELD 323 063 EDWARDS, MARK 325 064 EP CRUSHING 330 065 SKYDEN FARMS 332 066 SMEC 333 067 MURPHY, WENDY 335 068 MURPHY, DAVID 343 069 DISTRICT COUNCIL OF KIMBA 349 070 ADAMS, JAMES 350 071 NAME & ADDRESS WITHHELD 351 072 NAME & ADDRESS WITHHELD 354 073 KRACMAN, BORVIN 356 074 DODD, GEOFFREY 358 Central Eyre Iron Project - Public Submissions 03/09/2016 Page 247 of 917 Central Eyre Iron Project - Public Submissions 03/09/2016 Page 248 of 917 Central Eyre Iron Project - Public Submissions 03/09/2016 Page 249 of 917 Central Eyre Iron Project - Public Submissions 03/09/2016 Page 250 of 917 Central Eyre Iron Project - Public Submissions 03/09/2016 Page 251 of 917 Central Eyre Iron Project - Public Submissions 03/09/2016 Page 252 of 917 Central Eyre Iron Project - Public Submissions 03/09/2016 Page 253 of 917 Central Eyre Iron Project - Public Submissions 03/09/2016 Page 254 of 917 Central Eyre Iron Project - Public Submissions 03/09/2016 Page 255 -

Iron Road Limited

CENTRAL EYRE IRON PROJECT Mining Lease Proposal Response Document This page is left deliberately blank Table of Contents 1 Executive Summary ..................................................................................................... 1 1.1 Joint Consultation Process ................................................................................................... 2 1.2 Submissions ......................................................................................................................... 2 1.3 Response Documents .......................................................................................................... 2 2 Introduction ................................................................................................................ 4 2.1 Declaration ........................................................................................................................... 4 2.2 Background .......................................................................................................................... 4 3 Results of the Public Consultation Process ................................................................... 5 3.1 Out of Scope Comments ...................................................................................................... 5 3.2 Content of Submissions ....................................................................................................... 6 3.3 Notes to Consider ............................................................................................................... -

Iron Road Limited (ASX: IRD) Hold INITIATION REPORT: Paving the Road to Feasibility $0.275

19 December 2013 Iron Road Limited (ASX: IRD) Hold INITIATION REPORT: Paving the Road to Feasibility $0.275 Lachlan Rutherford PhD MBA Investment Highlights +618 8217 3900 [email protected] • Iron Road Ltd (ASX: IRD) is assessing the development of magnetite iron resources in the Gawler Craton region of South Australia. Capital Summary • Flagship Central Eyre Iron Project (”CEIP”) has a JORC Total Mineral Resource of 3.7Bt @ 16% Fe at Warramboo. Issued Capital: 581.9m ords 3.3m opts • In addition to the Mineral Resource, an Exploration Target of 8–17 Bt @ Share Price (19/12/13): $0.275 14–20% Fe has been identified elsewhere within the CEIP. 52 week low/high: $0.15 / $0.355 • Metallurgical test work has demonstrated that a high-grade 67% Fe Market Capitalisation: $160.0m magnetite concentrate can be produced at a relatively coarse grind Market Capitalisation (dil.1): $160.9m size (>-130µm). Cash (30/09/13): $51.96m • Resource is amenable to low cost, open pit bulk mining methods. 2 Enterprise Value : $108.1m Preliminary operating cost estimate of A$59/dmt is in the second 1 Fully diluted. quartile of the 2013 price adjusted CFR China cost curve. 2 EV = Market capitalisation – cash + debt. • Definitive Feasibility Study (“DFS”) is assessing the production and export of 20Mtpa of magnetite iron concentrate for +20 years. Directors & Key Management • Capesize vessel capable port and rail infrastructure would be Dr Peter Cassidy Chairman scalable, allowing expansion to meet future primary industry needs of the Mr Jerry Ellis Non-executive Director region. Mr Leigh Hall AM Non-executive Director • CEIP product could be used directly in sintering and pelletising at Mr Julian Gosse Non-executive Director Chinese blast furnaces, marketed as substitute for Brazilian Fines, Mr Ian Hume Non-executive Director Pilbara Fines and Chinese domestic concentrates. -

Chapter 3: Project Alternatives

Central Eyre Iron Project Environmental Impact Statement CHAPTER 3: PROJECT ALTERNATIVES CHAPTER 3 PROJECT ALTERNATIVES COPYRIGHT Copyright © Iron Road Limited, 2015 All rights reserved This document and any related documentation is protected by copyright owned by Iron Road Limited. The content of this document and any related documentation may only be copied and distributed for the purposes of section 46B of the Development Act, 1993 (SA) and otherwise with the prior written consent of Iron Road Limited. DISCLAIMER Iron Road Limited has taken all reasonable steps to review the information contained in this document and to ensure its accuracy as at the date of submission. Note that: (a) in writing this document, Iron Road Limited has relied on information provided by specialist consultants, government agencies, and other third parties. Iron Road Limited has reviewed all information to the best of its ability but does not take responsibility for the accuracy or completeness; and (b) this document has been prepared for information purposes only and, to the full extent permitted by law, Iron Road Limited, in respect of all persons other than the relevant government departments, makes no representation and gives no warranty or undertaking, express or implied, in respect to the information contained herein, and does not accept responsibility and is not liable for any loss or liability whatsoever arising as a result of any person acting or refraining from acting on any information contained within it. 3 Project Alternatives ............................................... 3-1 3.1 Location of Port Site................................................................................................................. 3-2 3.1.1 Existing Export Facilities ........................................................................................... 3-2 3.1.2 Greenfield Port Option Evaluation Criteria ............................................................. -

2011 Resources and Energy Infrastructure Demand Study 2161807A

Resources and Energy Sector Infrastructure Council VOLUME 2 VOLUME 2011 RESOURCES AND ENERGY INFRASTRUCTURE DEMAND STUDY 2161807A NOVEMBER 2011 APPENDICES ©Parsons Brinckerhoff Australia Pty Limited [2011]. Copyright in the drawings, information and data recorded in this document (the information) is the property of Parsons Brinckerhoff. The contents of this document are for general information only and are not intended as professional advice. The Department of Primary Industries and Resources SA (and the Government of South Australia) and Parsons Brinckerhoff make no representation, express or implied, as to the accuracy or completeness of the information contained in this document or as to the suitability of the said information for any particular purpose. Use of or reliance upon the information contained in this document is at the sole risk of the user in all things. The Department of Primary Industries and Resources SA (and the Government of South Australia) and Parsons Brinckerhoff undertake no duty and disclaim any responsibility for that use or reliance and any liability to the user. Author: N Flanagan, J Nottage, P Williams ..................................................................................... Signed: ........................................................................................................................................... Reviewer: J Nottage, N Flanagan ....................................................................................................... Signed: .......................................................................................................................................... -

E-F-82-TEM-0026 0 (Geology Govermental

Central Eyre Iron Project Environmental Impact Statement APPENDIX Y SOCIAL IMPACT ASSESSMENT COPYRIGHT Copyright © Iron Road Limited, 2015 All rights reserved This document and any related documentation is protected by copyright owned by Iron Road Limited. The content of this document and any related documentation may only be copied and distributed for the purposes of section 46B of the Development Act, 1993 (SA) and otherwise with the prior written consent of Iron Road Limited. DISCLAIMER Iron Road Limited has taken all reasonable steps to review the information contained in this document and to ensure its accuracy as at the date of submission. Note that: (a) in writing this document, Iron Road Limited has relied on information provided by specialist consultants, government agencies, and other third parties. Iron Road Limited has reviewed all information to the best of its ability but does not take responsibility for the accuracy or completeness; and (b) this document has been prepared for information purposes only and, to the full extent permitted by law, Iron Road Limited, in respect of all persons other than the relevant government departments, makes no representation and gives no warranty or undertaking, express or implied, in respect to the information contained herein, and does not accept responsibility and is not liable for any loss or liability whatsoever arising as a result of any person acting or refraining from acting on any information contained within it. CENTRAL EYRE IRON PROJECT SOCIAL BASELINE AND SOCIAL IMPACT ASSESSMENT TECHNICAL REPORT E-F-34-RPT-0037 APRIL 2015 Revision Issue Date Revision Description Document Writer Authorised By B 8/4/15 Final Rose Bowey H Franks This page intentionally left blank Final CEIP Social Baseline and Social Impact Assessment Report 30/10/2015 Page 2 of 201 Prepared by Rose Bowey and Associates Contents List of Figures ........................................................................................................................................................... -

ASX ANNOUNCEMENT Iron Road Limited (Iron Road, ASX:IRD)

14 November 2017 ASX ANNOUNCEMENT Iron Road Limited (Iron Road, ASX:IRD) IRON ROAD SIGNS MOU WITH EYRE PENINSULA CO-OPERATIVE BULK HANDLING Agreement signals consortium approach to the development of a world class export grain terminal at Cape Hardy Highlights Memorandum of Understanding (MoU) with Eyre Peninsula Co-operative Bulk Handling Limited (EPCBH) to progress development of a world class, globally competitive grain terminal and export facility at Cape Hardy. MoU complements existing partnership between Iron Road and Emerald Grain. EPCBH group expected to be instrumental in securing additional supply to the proposed grain terminal and export facility at Cape Hardy. Iron Road Limited (Iron Road, ASX: IRD) is pleased to advise that the Company has signed an MoU with EPCBH, a farmers co-operative recently formed by prominent Eyre Peninsula grain growers. Under the MoU, Iron Road and EPCBH will work collaboratively to establish a grains export business with facilities at Cape Hardy. EPCBH’s primary objective is to improve the competitiveness of the region’s grain industry by using a collaborative approach to enhance returns to growers and farm businesses. At the time of EPCBH’s formation, the group expressed its intention to negotiate a partnership with Iron Road and visited the proposed port site at Cape Hardy with Iron Road to develop a better understanding of the opportunities a multi-commodity port could provide. The MoU with EPCBH is complementary to an existing partnership with Emerald Grain, a wholly owned subsidiary of Sumitomo, where the two parties are working together to develop a new grain distribution and supply chain network utilising Iron Road’s planned rail and port facilities at Cape Hardy. -

Central Eyre Iron Project - Frequently Asked Questions Regarding the Applications for Iron Road’S Central Eyre Iron Project

NOVEMBER 2015 Central Eyre Iron Project - Frequently Asked Questions regarding the applications for Iron Road’s Central Eyre Iron Project. Please note that answers to questions relating to the specific content of the applications and its potential impacts are available from Iron Road’s website at: www.ironroadlimited.com.au Central Eyre Iron Project - Frequently Asked Questions regarding the applications for Iron Road’s Central Eyre Iron Project. ........................................................................................................................ 1 1. What is the Central Eyre Iron Project? ........................................................................................... 2 2. What applications have been received by Government for the CEIP? ........................................... 2 3. What happens next - and when? .................................................................................................... 3 4. Where can I access Iron Road’s applications? ................................................................................ 4 5. Can I get a printed copy of the applications? ................................................................................. 5 6. Why is Public Consultation being run on applications for the proposed mine and related infrastructure at the same time? ............................................................................................................ 5 7. How do I lodge a submission?........................................................................................................ -

Chapter 1: Introduction

Central Eyre Iron Project Environmental Impact Statement CHAPTER 1: INTRODUCTION CHAPTER 1 INTRODUCTION COPYRIGHT Copyright © Iron Road Limited, 2015 All rights reserved This document and any related documentation is protected by copyright owned by Iron Road Limited. The content of this document and any related documentation may only be copied and distributed for the purposes of section 46B of the Development Act, 1993 (SA) and otherwise with the prior written consent of Iron Road Limited. DISCLAIMER Iron Road Limited has taken all reasonable steps to review the information contained in this document and to ensure its accuracy as at the date of submission. Note that: (a) in writing this document, Iron Road Limited has relied on information provided by specialist consultants, government agencies, and other third parties. Iron Road Limited has reviewed all information to the best of its ability but does not take responsibility for the accuracy or completeness; and (b) this document has been prepared for information purposes only and, to the full extent permitted by law, Iron Road Limited, in respect of all persons other than the relevant government departments, makes no representation and gives no warranty or undertaking, express or implied, in respect to the information contained herein, and does not accept responsibility and is not liable for any loss or liability whatsoever arising as a result of any person acting or refraining from acting on any information contained within it. 1 Introduction ........................................................... 1-1 1.1 Iron Road Company Profile ...................................................................................................... 1-2 1.2 History of the CEIP ................................................................................................................... 1-3 1.2.1 Environmental Policy ...............................................................................................