Sanne Group Plc Annual Report and Accounts 2020 1 Sanne at a Glance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

COVID-19 Proxy Governance Update

COVID-19 Proxy Governance Update 2020 AGM mid-season review FROM EQUINITI 01 Looking back and planning ahead It is incredible to note that it has been over 12 weeks since the official announcement on 23 March of the UK Government’s Stay at Home Measures, and nearly seven months since the severity of the pandemic became apparent in China. Over the said period, PLC boards, company secretaries and investor relations officers have kept their corporate calendars going thanks to rapid adoption of modified regulatory guidelines and inventive modes of engagement with investors. With annual general meetings being an obvious highlight in the corporate calendar, we take stock of the progress made so far over the 2020 AGM season, as well as using what we learned to plan ahead. Now that we are over the first ‘hump’ with the busy period of May AGMs out of the way, we are readying for the second ‘peak’ of June and July AGMs, and then an ‘easing’ until the second ‘mini’ season in the early autumn. As such, in this update, we look at: • 2020 AGM season statistics…so far • Proxy adviser engagement and ISS recommendations review • High-level assumptions for Q3 and Q4 • Relevant updates from the regulators, industry bodies and proxy advisers • Communications in the COVID-19 world – special commentary by leading financial PR firm,Camarco • How has COVID-19 impacted activism – special commentary by international law firm,White & Case 02 2020 AGM Season Statistics…so far Scope of data To assess progress and forecast what is to come, we look at the key statistics for the UK AGM season 2020 thus far. -

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Description Iresscode Exchange Current Margin New Margin 3I

Description IRESSCode Exchange Current Margin New Margin 3I INFRASTRUCTURE PLC 3IN LSE 20 20 888 HOLDINGS PLC 888 LSE 20 20 ASSOCIATED BRITISH ABF LSE 10 10 ADMIRAL GROUP PLC ADM LSE 10 10 AGGREKO PLC AGK LSE 20 20 ASHTEAD GROUP PLC AHT LSE 10 10 ANTOFAGASTA PLC ANTO LSE 15 10 ASOS PLC ASC LSE 20 20 ASHMORE GROUP PLC ASHM LSE 20 20 ABERFORTH SMALLER COM ASL LSE 20 20 AVEVA GROUP PLC AVV LSE 20 20 AVIVA PLC AV LSE 10 10 ASTRAZENECA PLC AZN LSE 10 10 BABCOCK INTERNATIONAL BAB LSE 20 20 BARR PLC BAG LSE 25 20 BARCLAYS PLC BARC LSE 10 10 BRITISH AMERICAN TOBA BATS LSE 10 10 BAE SYSTEMS PLC BA LSE 10 10 BALFOUR BEATTY PLC BBY LSE 20 20 BARRATT DEVELOPMENTS BDEV LSE 10 10 BARING EMERGING EUROP BEE LSE 50 100 BEAZLEY PLC BEZ LSE 20 20 BH GLOBAL LIMITED BHGG LSE 30 100 BOWLEVEN PLC BLVN LSE 60 50 BANKERS INVESTMENT BNKR LSE 20 20 BUNZL PLC BNZL LSE 10 10 BODYCOTE PLC BOY LSE 20 20 BP PLC BP LSE 10 10 BURBERRY GROUP PLC BRBY LSE 10 10 BLACKROCK WORLD MININ BRWM LSE 20 65 BT GROUP PLC BT-A LSE 10 10 BRITVIC PLC BVIC LSE 20 20 BOVIS HOMES GROUP PLC BVS LSE 20 20 BROWN GROUP PLC BWNG LSE 25 20 BELLWAY PLC BWY LSE 20 20 BIG YELLOW GROUP PLC BYG LSE 20 20 CENTRAL ASIA METALS PLC CAML LSE 40 30 CLOSE BROTHERS GROUP CBG LSE 20 20 CARNIVAL PLC CCL LSE 10 10 CENTAMIN PLC CEY LSE 20 20 CHARIOT OIL & GAS LTD CHAR LSE 100 100 CHEMRING GROUP PLC CHG LSE 25 20 CONYGAR INVESTMENT CIC LSE 50 40 CALEDONIA INVESTMENTS CLDN LSE 25 20 CARILLION PLC CLLN LSE 100 100 COMMUNISIS PLC CMS LSE 50 100 CENTRICA PLC CNA LSE 10 10 CAIRN ENERGY PLC CNE LSE 30 30 COBHAM PLC -

Jtc Plc Prospectus

JTC PLC PROSPECTUS MARCH 2018 FUND SERVICES | CORPORATE SERVICES | PRIVATE WEALTH SERVICES THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to what action you should take, you should immediately consult a person authorised for the purposes of the Financial Services and Markets Act 2000 (as amended) who specialises in advising on the acquisition of shares and other securities. This document comprises a prospectus (the Prospectus) relating to JTC PLC (the Company) and has been prepared in accordance with the Prospectus LR2.2.10(2)(a) Rules of the Financial Conduct Authority (the FCA) made under section 73A of the Financial Services and Markets Act 2000, as amended (FSMA). This Prospectus has been approved by the FCA in accordance with section 87A of FSMA and has been made available to the public as required by the Prospectus Rules. Applications have been made to the FCA for all of the ordinary shares of £0.01 each in the capital of the Company (the Ordinary Shares), issued and to PR Annex III be issued in connection with the Offer, to be admitted to the premium listing segment of the Official List of the FCA (the Official List) and to London (6.1) Stock Exchange plc (the London Stock Exchange) for such Ordinary Shares to be admitted to trading on its main market for listed securities (together LR2.2.3 Admission). Admission to trading on the London Stock Exchange constitutes admission to trading on a regulated market. It is expected that Admission will become effective and that unconditional dealings will commence in the Ordinary Shares on the London Stock Exchange at 8.00 a.m. -

Stoxx® Europe Ipo (60 Months) Index

STOXX® EUROPE IPO (60 MONTHS) INDEX Components1 Company Supersector Country Weight (%) CELLNEX TELECOM Telecommunications ES 6.13 DELIVERY HERO Retail DE 5.29 JUST EAT TAKEAWAY.COM NV Retail NL 5.21 SCOUT24 Technology DE 3.41 COVESTRO Chemicals DE 2.72 AUTO TRADER GROUP Media GB 2.50 HELLOFRESH AG Retail DE 2.18 AMUNDI Financial Services FR 2.08 KOJAMO OYJ Real Estate FI 2.00 GALENICA SANTE AG Retail CH 1.92 VAT GROUP AG Industrial Goods & Services CH 1.91 ASR NEDERLAND NV Insurance NL 1.79 SIG COMBIBLOC GROUP AG Industrial Goods & Services CH 1.72 CONVATEC PLC Health Care GB 1.70 SIGNIFY Industrial Goods & Services NL 1.54 NEXI SPA Industrial Goods & Services IT 1.50 TEAMVIEWER AG Technology DE 1.49 INWIT Telecommunications IT 1.43 AVAST PLC Technology GB 1.41 LA FRANCAISE DES JEUX Travel & Leisure FR 1.28 STADLER RAIL AG Industrial Goods & Services CH 1.19 BAWAG GROUP AG Banks AT 1.05 NETCOMPANY GROUP AS Technology DK 1.03 SOFTCAT Technology GB 0.89 PIRELLI & C. S.P.A. Automobiles & Parts IT 0.89 COUNTRYSIDE PROPERTIES PLC Personal & Household Goods GB 0.88 LANDIS GYR GROUP AG Industrial Goods & Services CH 0.86 INTEGRAFIN HOLDINGS PLC Financial Services GB 0.81 DOMETIC GROUP AB Personal & Household Goods SE 0.77 BRAVIDA HOLDING AB Industrial Goods & Services SE 0.72 SILTRONIC Technology DE 0.69 TRAINLINE PLC Travel & Leisure GB 0.68 SPIE Industrial Goods & Services FR 0.68 INTERTRUST NV Financial Services NL 0.68 ZUR ROSE GROUP Retail CH 0.66 ASCENTIAL PLC Media GB 0.64 SINCH Technology SE 0.64 Virgin Money UK Banks GB 0.62 HASTINGS -

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 30 January 2020 AA AA. Support Services — GBP 0.4766 at close 30 January 2020 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 30-Jan-2020 30-Jan-2020 30-Jan-2020 1 120 120 1D WTD MTD YTD Absolute -4.2 -9.3 -18.0 -18.0 110 110 0.9 Rel.Sector -3.4 -7.9 -18.2 -18.2 Rel.Market -3.0 -6.9 -16.2 -16.2 100 100 0.8 90 90 VALUATION 0.7 80 80 Trailing RelativePrice RelativePrice 70 70 0.6 PE 8.5 Absolute Price (local (local Absolute currency)Price 60 60 EV/EBITDA 9.2 0.5 PB -ve 50 50 PCF 2.7 0.4 40 40 Div Yield 3.4 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Price/Sales 0.4 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity - 100 90 90 Div Payout 28.6 90 80 80 ROE - 80 70 70 70 Index) Share Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 40 40 The principal activity of the Company is providing 40 RSI RSI (Absolute) service of consumer roadside assistance. 30 30 30 20 20 20 10 10 10 RSI (Relative to FTSE UKFTSE All to RSI (Relative RSI (Relative to FTSE UKFTSE All to RSI (Relative 0 0 0 Jan-2019 Mar-2019 May-2019 Jul-2019 Sep-2019 Nov-2019 Jan-2019 Mar-2019 May-2019 Jul-2019 Sep-2019 Nov-2019 Jan-2019 Mar-2019 May-2019 Jul-2019 Sep-2019 Nov-2019 See final page and http://www.londonstockexchange.com/prices-and-markets/stocks/services-stock/ftse-note.htm for further details. -

Case 20-32299-KLP Doc 208 Filed 06/01/20 Entered 06/01/20 16

Case 20-32299-KLP Doc 208 Filed 06/01/20 Entered 06/01/20 16:57:32 Desc Main Document Page 1 of 137 Case 20-32299-KLP Doc 208 Filed 06/01/20 Entered 06/01/20 16:57:32 Desc Main Document Page 2 of 137 Exhibit A Case 20-32299-KLP Doc 208 Filed 06/01/20 Entered 06/01/20 16:57:32 Desc Main Document Page 3 of 137 Exhibit A1 Served via Overnight Mail Name Attention Address 1 Address 2 City State Zip Country Aastha Broadcasting Network Limited Attn: Legal Unit213 MezzanineFl Morya LandMark1 Off Link Road, Andheri (West) Mumbai 400053 IN Abs Global LTD Attn: Legal O'Hara House 3 Bermudiana Road Hamilton HM08 BM Abs-Cbn Global Limited Attn: Legal Mother Ignacia Quezon City Manila PH Aditya Jain S/O Sudhir Kumar Jain Attn: Legal 12, Printing Press Area behind Punjab Kesari Wazirpur Delhi 110035 IN AdminNacinl TelecomunicacionUruguay Complejo Torre De Telecomuniciones Guatemala 1075. Nivel 22 HojaDeEntrada 1000007292 5000009660 Montevideo CP 11800 UY Advert Bereau Company Limited Attn: Legal East Legon Ars Obojo Road Asafoatse Accra GH Africa Digital Network Limited c/o Nation Media Group Nation Centre 7th Floor Kimathi St PO Box 28753-00100 Nairobi KE Africa Media Group Limited Attn: Legal Jamhuri/Zaramo Streets Dar Es Salaam TZ Africa Mobile Network Communication Attn: Legal 2 Jide Close, Idimu Council Alimosho Lagos NG Africa Mobile Networks Cameroon Attn: Legal 131Rue1221 Entree Des Hydrocarbures Derriere Star Land Hotel Bonapriso-Douala Douala CM Africa Mobile Networks Cameroon Attn: Legal BP12153 Bonapriso Douala CM Africa Mobile Networks Gb, -

Annual Report and Accounts for the Year Ended 31 December 2018 Sannegroup.Com Stock Code: SNN Code: Stock

a Sanne Group plc Group Sanne Annual Report for the year ended 31 December 2018 Annual Report and Accounts for the year ended 31 December 2018 sannegroup.com Stock code: SNN Sanne Group Plc AR2018 - Front.indd 3 08/04/2019 11:49:23 26236 8 April 2019 11:48 am Proof 13 Welcome to Sanne Group plc’s 2018 Annual Report and Accounts SANNE is a leading global provider of outsourced alternative asset and corporate services. We provide high quality administration, reporting and fiduciary services to the leading alternative asset managers, financial institutions, family offices and corporates. We service clients from 18 locations spread across the Americas, Europe, Africa and Asia- Pacific. Our dedicated asset class and market experts are supported by the latest industry technology, systems and accredited business processes. Sanne Group Plc AR2018 - Front.indd 4 08/04/2019 11:49:24 26236 8 April 2019 11:48 am Proof 13 Annual Report and Accounts for the year ended 2018 Stock code: SNN sannegroup.com notes-heading-level- one What you’ll find inside this report notes-heading-level-two notes-heading-level-three notes-heading-level-four SANNE operates across global markets and in a highly Introduction notes-strapline specialised industry, serving a wide range of alternative Investment Proposition 4 notes-text-body asset managers, financial institutions, family offices Operational Highlights 6 > notes-list-bullet and corporates. Chairman’s Statement 8 > notes-list-bespoke Chief Executive Officer’s Statement 10 − notes-list-dash Strategic Report d. notes-list-alpha Strategy 16 5. notes-list-number Investment Strategic KPIs 18 vi. -

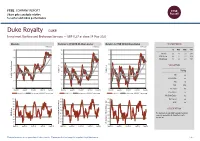

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Duke Royalty DUKE Investment Banking and Brokerage Services — GBP 0.37 at close 14 May 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 14-May-2021 14-May-2021 14-May-2021 0.4 180 180 1D WTD MTD YTD Absolute 2.8 1.4 2.8 21.3 170 170 Rel.Sector 0.4 1.7 3.1 18.2 0.35 160 Rel.Market 1.6 2.7 2.1 11.1 160 150 150 0.3 VALUATION 140 140 130 Trailing Relative Price Relative 0.25 Price Relative 130 120 PE -ve Absolute Price (local (local currency) AbsolutePrice 120 EV/EBITDA -ve 110 0.2 PB 1.3 100 110 PCF 17.3 0.15 90 100 Div Yield 7.5 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 Price/Sales -ve Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.2 100 90 90 Div Payout -ve 90 80 80 ROE -ve 80 70 70 70 Index) Share Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 40 The Company is a globally focused investment 40 40 RSI RSI (Absolute) 30 company specialising in diversified royalty 30 investment. -

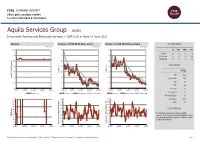

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Aquila Services Group AQSG Investment Banking and Brokerage Services — GBP 0.26 at close 18 June 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 18-Jun-2021 18-Jun-2021 18-Jun-2021 0.35 115 115 1D WTD MTD YTD Absolute 0.0 0.0 0.0 0.0 0.3 110 110 Rel.Sector 1.9 2.8 1.0 -2.0 Rel.Market 1.7 1.7 0.4 -8.2 0.25 105 105 VALUATION 0.2 100 100 Trailing 0.15 95 95 Relative Price Relative Price Relative PE 82.2 Absolute Price (local (local currency) AbsolutePrice 0.1 90 90 EV/EBITDA 38.4 0.05 85 85 PB 2.0 PCF +ve 0 80 80 Div Yield 1.1 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Price/Sales 1.3 Absolute Price Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.1 100 90 90 Div Payout 90.5 90 80 80 ROE 2.6 80 70 70 70 Index) Share Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 40 The Company operates as a venture capital 40 40 RSI RSI (Absolute) 30 company. The Company provides financing for one or 30 30 more growing unquoted companies looking for capital 20 20 to expand the business. -

Old Mutual Global Investors Series Plc

OLD MUTUAL GLOBAL INVESTORS SERIES PLC An investment company with variable capital incorporated with limited liability in Ireland, established as an umbrella fund with segregated liability between Sub-Funds and authorised pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations, 2011, as amended, and the Central Bank (Supervision and Enforcement) Act 2013 (Section 48(1)) (Undertakings for Collective Investment in Transferable Securities) Regulations 2015 (Registered Number 271517) Interim Report and Unaudited Financial Statements for the financial period ended 30 June 2018 Old Mutual Global Investors Series Plc Interim Report and Unaudited Financial Statements for the financial period ended 30 June 2018 CONTENTS PAGE Directory 4 - 8 GeneralInformation 9-12 Investment Advisers’ Reports: Old Mutual China Equity Fund 13 Old Mutual Global Strategic Bond Fund (IRL) 14 Old Mutual World Equity Fund 15 Old Mutual Pacific Equity Fund 16 Old Mutual European Equity Fund 17 Old Mutual Japanese Equity Fund^ 18 Old Mutual US Equity Income Fund 19 Old Mutual North American Equity Fund 20 Old Mutual Total Return USD Bond Fund 21 Old Mutual Emerging Market Debt Fund 22 OldMutualEuropeanBestIdeasFund 23 Old Mutual Investment Grade Corporate Bond Fund 24 Old Mutual Global Emerging Markets Fund 25 Old Mutual Asian Equity Income Fund 26 Old Mutual Local Currency Emerging Market Debt Fund 27 Old Mutual UK Alpha Fund (IRL) 28 Old Mutual UK Smaller Companies Focus Fund 29 Old Mutual UK Dynamic Equity -

Creating the World's Largest Interdealer Broker

TP ICAP Annual Report and Accounts 2016 Creating the world’s largest interdealer broker Annual Report and Accounts 2016 Introduction TP ICAP is a global brokerage and information firm that plays Strategic report a central role at the heart of the world’s wholesale financial, Highlights 1 Who we are 2 energy and commodities markets. Our transformation and the > Our brokers match buyers and sellers of financial, energy and benefits it creates 4 commodities products and facilitate price discovery Our business model 6 Our strategy 8 > We provide independent data to participants in the financial, Key performance indicators 10 energy and commodities markets, including live and historical Chairman’s statement 12 pricing content, and advanced valuation and risk analytics Chief Executive’s review 14 Business and operating review 18 > We are a trusted partner to our clients, enabling them to transact Financial review 26 with confidence Risk management 32 > We facilitate the flow of capital and commodities around the world, Our principal risks and uncertainties 34 enhancing investment and contributing to economic growth Resources, relationships and responsibilities 38 Governance report Chairman’s Governance review 42 Board of Directors 44 This Annual Report has been prepared for, and only for, the members of the Company as a body, and no other persons. The Company, Corporate governance report 46 its Directors, employees, agents or advisers do not accept or assume responsibility to any other person to whom this document is shown or into whose hands it may come and such responsibility is expressly disclaimed. By their nature, the statements concerning the risks Report of the Nominations Committee 50 and uncertainties facing the Group in this Annual Report involve uncertainty since future events and circumstances can cause results Report of the Audit Committee 51 and developments to differ materially from those anticipated.