Jtc Plc Prospectus

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

COVID-19 Proxy Governance Update

COVID-19 Proxy Governance Update 2020 AGM mid-season review FROM EQUINITI 01 Looking back and planning ahead It is incredible to note that it has been over 12 weeks since the official announcement on 23 March of the UK Government’s Stay at Home Measures, and nearly seven months since the severity of the pandemic became apparent in China. Over the said period, PLC boards, company secretaries and investor relations officers have kept their corporate calendars going thanks to rapid adoption of modified regulatory guidelines and inventive modes of engagement with investors. With annual general meetings being an obvious highlight in the corporate calendar, we take stock of the progress made so far over the 2020 AGM season, as well as using what we learned to plan ahead. Now that we are over the first ‘hump’ with the busy period of May AGMs out of the way, we are readying for the second ‘peak’ of June and July AGMs, and then an ‘easing’ until the second ‘mini’ season in the early autumn. As such, in this update, we look at: • 2020 AGM season statistics…so far • Proxy adviser engagement and ISS recommendations review • High-level assumptions for Q3 and Q4 • Relevant updates from the regulators, industry bodies and proxy advisers • Communications in the COVID-19 world – special commentary by leading financial PR firm,Camarco • How has COVID-19 impacted activism – special commentary by international law firm,White & Case 02 2020 AGM Season Statistics…so far Scope of data To assess progress and forecast what is to come, we look at the key statistics for the UK AGM season 2020 thus far. -

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Description Iresscode Exchange Current Margin New Margin 3I

Description IRESSCode Exchange Current Margin New Margin 3I INFRASTRUCTURE PLC 3IN LSE 20 20 888 HOLDINGS PLC 888 LSE 20 20 ASSOCIATED BRITISH ABF LSE 10 10 ADMIRAL GROUP PLC ADM LSE 10 10 AGGREKO PLC AGK LSE 20 20 ASHTEAD GROUP PLC AHT LSE 10 10 ANTOFAGASTA PLC ANTO LSE 15 10 ASOS PLC ASC LSE 20 20 ASHMORE GROUP PLC ASHM LSE 20 20 ABERFORTH SMALLER COM ASL LSE 20 20 AVEVA GROUP PLC AVV LSE 20 20 AVIVA PLC AV LSE 10 10 ASTRAZENECA PLC AZN LSE 10 10 BABCOCK INTERNATIONAL BAB LSE 20 20 BARR PLC BAG LSE 25 20 BARCLAYS PLC BARC LSE 10 10 BRITISH AMERICAN TOBA BATS LSE 10 10 BAE SYSTEMS PLC BA LSE 10 10 BALFOUR BEATTY PLC BBY LSE 20 20 BARRATT DEVELOPMENTS BDEV LSE 10 10 BARING EMERGING EUROP BEE LSE 50 100 BEAZLEY PLC BEZ LSE 20 20 BH GLOBAL LIMITED BHGG LSE 30 100 BOWLEVEN PLC BLVN LSE 60 50 BANKERS INVESTMENT BNKR LSE 20 20 BUNZL PLC BNZL LSE 10 10 BODYCOTE PLC BOY LSE 20 20 BP PLC BP LSE 10 10 BURBERRY GROUP PLC BRBY LSE 10 10 BLACKROCK WORLD MININ BRWM LSE 20 65 BT GROUP PLC BT-A LSE 10 10 BRITVIC PLC BVIC LSE 20 20 BOVIS HOMES GROUP PLC BVS LSE 20 20 BROWN GROUP PLC BWNG LSE 25 20 BELLWAY PLC BWY LSE 20 20 BIG YELLOW GROUP PLC BYG LSE 20 20 CENTRAL ASIA METALS PLC CAML LSE 40 30 CLOSE BROTHERS GROUP CBG LSE 20 20 CARNIVAL PLC CCL LSE 10 10 CENTAMIN PLC CEY LSE 20 20 CHARIOT OIL & GAS LTD CHAR LSE 100 100 CHEMRING GROUP PLC CHG LSE 25 20 CONYGAR INVESTMENT CIC LSE 50 40 CALEDONIA INVESTMENTS CLDN LSE 25 20 CARILLION PLC CLLN LSE 100 100 COMMUNISIS PLC CMS LSE 50 100 CENTRICA PLC CNA LSE 10 10 CAIRN ENERGY PLC CNE LSE 30 30 COBHAM PLC -

Stoxx® Europe Ipo (60 Months) Index

STOXX® EUROPE IPO (60 MONTHS) INDEX Components1 Company Supersector Country Weight (%) CELLNEX TELECOM Telecommunications ES 6.13 DELIVERY HERO Retail DE 5.29 JUST EAT TAKEAWAY.COM NV Retail NL 5.21 SCOUT24 Technology DE 3.41 COVESTRO Chemicals DE 2.72 AUTO TRADER GROUP Media GB 2.50 HELLOFRESH AG Retail DE 2.18 AMUNDI Financial Services FR 2.08 KOJAMO OYJ Real Estate FI 2.00 GALENICA SANTE AG Retail CH 1.92 VAT GROUP AG Industrial Goods & Services CH 1.91 ASR NEDERLAND NV Insurance NL 1.79 SIG COMBIBLOC GROUP AG Industrial Goods & Services CH 1.72 CONVATEC PLC Health Care GB 1.70 SIGNIFY Industrial Goods & Services NL 1.54 NEXI SPA Industrial Goods & Services IT 1.50 TEAMVIEWER AG Technology DE 1.49 INWIT Telecommunications IT 1.43 AVAST PLC Technology GB 1.41 LA FRANCAISE DES JEUX Travel & Leisure FR 1.28 STADLER RAIL AG Industrial Goods & Services CH 1.19 BAWAG GROUP AG Banks AT 1.05 NETCOMPANY GROUP AS Technology DK 1.03 SOFTCAT Technology GB 0.89 PIRELLI & C. S.P.A. Automobiles & Parts IT 0.89 COUNTRYSIDE PROPERTIES PLC Personal & Household Goods GB 0.88 LANDIS GYR GROUP AG Industrial Goods & Services CH 0.86 INTEGRAFIN HOLDINGS PLC Financial Services GB 0.81 DOMETIC GROUP AB Personal & Household Goods SE 0.77 BRAVIDA HOLDING AB Industrial Goods & Services SE 0.72 SILTRONIC Technology DE 0.69 TRAINLINE PLC Travel & Leisure GB 0.68 SPIE Industrial Goods & Services FR 0.68 INTERTRUST NV Financial Services NL 0.68 ZUR ROSE GROUP Retail CH 0.66 ASCENTIAL PLC Media GB 0.64 SINCH Technology SE 0.64 Virgin Money UK Banks GB 0.62 HASTINGS -

Sanne Group Plc Annual Report and Accounts 2020 1 Sanne at a Glance

Annual Report and Accounts 2020 Sanne is a leading global provider of alternative asset and corporate services. Contents 01 03 04 Introduction Governance Financial Statements 01 Financial and operational highlights of 56 Chairman’s Introduction 110 Independent Auditors' Report YMJ^JFW 58 Corporate Governance Report 118 Consolidated Income Statement 02 Sanne at a glance 60 Board of Directors 119 Consolidated Statement of Comprehensive Income 62 Sanne’s Executive Committee 120 Consolidated Balance Sheet 02 63 Leadership 121 Consolidated Statement of Changes in Equity 64 Board Effectiveness Strategic Report 122 Consolidated Cash Flow Statement 70 Directors’ Report 123 Notes to the Consolidated 06 Chairman’s Statement 74 Nomination and Governance Financial Statements Committee Report 08 Chief Executive Officer’s Statement 171 Glossary of Terms 77 Audit Committee Report 12 Value Chain 173 Shareholder and Corporate Information 82 Risk Committee Report 14 Business Model 85 Directors’ Remuneration at-a-glance 16 Our Stakeholders 86 Remuneration Committee Report 20 Strategy Review 97 Annual Report on Remuneration 24 Key Performance Indicators 107 Directors’ Responsibilities Statement 28 Segmental Review 30 Chief Financial Officer’s Review 34 Alternative Performance Measure definitions 36 ESG and Sustainability 46 Risk Management 52 Viability Statement www.sannegroup.com/annualreport Introduction Strategic Report Governance Financial Statements Financial and operational highlights of the year Robust financial performance, 2 1 with strong profit -

Old Mutual Global Investors Series Plc

OLD MUTUAL GLOBAL INVESTORS SERIES PLC An investment company with variable capital incorporated with limited liability in Ireland, established as an umbrella fund with segregated liability between Sub-Funds and authorised pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations, 2011, as amended, and the Central Bank (Supervision and Enforcement) Act 2013 (Section 48(1)) (Undertakings for Collective Investment in Transferable Securities) Regulations 2015 (Registered Number 271517) Interim Report and Unaudited Financial Statements for the financial period ended 30 June 2018 Old Mutual Global Investors Series Plc Interim Report and Unaudited Financial Statements for the financial period ended 30 June 2018 CONTENTS PAGE Directory 4 - 8 GeneralInformation 9-12 Investment Advisers’ Reports: Old Mutual China Equity Fund 13 Old Mutual Global Strategic Bond Fund (IRL) 14 Old Mutual World Equity Fund 15 Old Mutual Pacific Equity Fund 16 Old Mutual European Equity Fund 17 Old Mutual Japanese Equity Fund^ 18 Old Mutual US Equity Income Fund 19 Old Mutual North American Equity Fund 20 Old Mutual Total Return USD Bond Fund 21 Old Mutual Emerging Market Debt Fund 22 OldMutualEuropeanBestIdeasFund 23 Old Mutual Investment Grade Corporate Bond Fund 24 Old Mutual Global Emerging Markets Fund 25 Old Mutual Asian Equity Income Fund 26 Old Mutual Local Currency Emerging Market Debt Fund 27 Old Mutual UK Alpha Fund (IRL) 28 Old Mutual UK Smaller Companies Focus Fund 29 Old Mutual UK Dynamic Equity -

Northamptonshire Pension Fund Proxy Voting

Northamptonshire Pension Fund Proxy Voting April 2020 – June 2020 Meeting Vote Issuer Name Proposal Text Proponent Date Instruction RM Plc 06/04/2020 Accept Financial Statements and Statutory Reports Annual For RM Plc 06/04/2020 Approve Final Dividend Annual For RM Plc 06/04/2020 Re-elect John Poulter as Director Annual For RM Plc 06/04/2020 Re-elect Andy Blundell as Director Annual For RM Plc 06/04/2020 Re-elect David Brooks as Director Annual For RM Plc 06/04/2020 Elect Paul Dean as Director Annual For RM Plc 06/04/2020 Re-elect Patrick Martell as Director Annual For RM Plc 06/04/2020 Re-elect Neil Martin as Director Annual For RM Plc 06/04/2020 Re-elect Deena Mattar as Director Annual For RM Plc 06/04/2020 Reappoint KPMG LLP as Auditors Annual For RM Plc 06/04/2020 Authorise Board to Fix Remuneration of Auditors Annual For RM Plc 06/04/2020 Approve Remuneration Report Annual For 1 Northamptonshire Pension Fund Proxy Voting April 2020 – June 2020 Meeting Vote Issuer Name Proposal Text Proponent Date Instruction RM Plc 06/04/2020 Authorise Issue of Equity Annual For RM Plc 06/04/2020 Authorise Issue of Equity without Pre-emptive Rights Annual For RM Plc 06/04/2020 Authorise Issue of Equity without Pre-emptive Rights in Annual For Connection with an Acquisition or Other Capital Investment RM Plc 06/04/2020 Authorise Market Purchase of Ordinary Shares Annual For RM Plc 06/04/2020 Authorise the Company to Call General Meeting with Two Annual For Weeks' Notice Rio Tinto Plc 08/04/2020 Accept Financial Statements and Statutory Reports Annual -

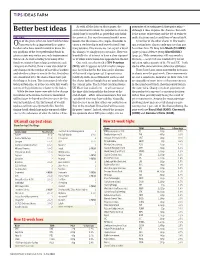

Better Best Ideas Extra Information About the Popularity of Stocks Although It Does Improve the Chances

TIPS IDEAS FARM As with all the data on these pages, the guarantee of securing good share price gains – Better best ideas extra information about the popularity of stocks although it does improve the chances. But such should not be regarded as providing any defini- is the nature of investing and the job of trying to ALGY HALL tive pointers. It is easy for normal market move- make decisions under conditions of uncertainty. ne of the plans when we launched the Ideas ments over the course of a couple of months to A number of the other shares in this week’s OFarm was to keep improving these pages. cause a stock to slip in and out of a fund’s top tips section have also recently appeared on our Readers who have found it useful to know the few positions. This means we can expect a lot of best ideas lists: US drug firmMerck (US:MRK) top positions of the best-performing funds in the changes to simply represent noise. However, (page 32) and defence group QinetiQ (QQ.) given sectors may notice one such improvement hopefully it is of interest to have a clear signpost (page 31). With coronavirus still very much a this week. As well as listing how many of the as to when a new name has appeared on the list. live issue – as we’ve been reminded by recent funds we monitor have a large position in each One such case this week is XPS Pensions infection spikes in parts of the US and UK – both company on the list, there is now also detail of (XPS), which appears as a UK smaller compa- stocks offer some welcome defensive attributes. -

Trendsetup: Europa 03 Giugno 2020

TrendSetup: Europa 03 Giugno 2020 Market status EU Commodities UPTREND Eurostoxx 50 UPTREND Gold 1695.00 DOWNTREND Eurostoxx 600 UPTREND Oil Wti 39.00 Dax 30 UPTREND Bond Cac 40 UPTREND BUND (rendimento) -0.363% Ftse 100 UPTREND OAT (rendimento) -0.003% Ibex 35 UPTREND GILT (rendimento) 0.271% Swi 20 UPTREND Valute NEUTRAL EUR/USD 1.1175 UPTREND EUR/GBP 0.892 * ddati rilevati tra il martedì e il mercoledì www.ruffoadvisor.com - [email protected] Trend Setup: Europa Trend Setup: the easy way to the stock picking “Trend Setup è un algoritmo proprietario basato su un approccio scientifico. Fornisce idee di investimento su large, mid e small cap individuando i futuri leader per i prossimi 12-18 mesi” Cosa puoi fare con Trend Setup • Costruire il tuo portafoglio • Ribilanciare le tue posizioni • Migliorare il rendimento del tuo portafoglio • Creare liste di titoli vincenti • Applicare la tua strategia di investimento www.ruffoadvisor.com - [email protected] EUROPA:205 Idee di investimento LARGE CAP Market Cap Up/Down Price vs 200 Symb Name Industry Name weeks in Entry Price CurR Price Diff. % entry RS Rating Rs short term A/D Rating Relat. Perf. (Bil) Vol MA DE:TL0 Tesla Consumer Cyclical 178,90 19 812,20 791,50 -3% 99 95 A 1,05 2,51 86,2% DE:SRT3 Sartorius Aktiengesellschaft Healthcare 17,40 6 257,40 322,00 25% 97 97 A 1,12 1,90 55,5% DE:ZAL Zalando SE Consumer Cyclical 10,43 6 42,00 61,10 45% 95 98 A 1,15 1,53 41,8% DE:ABR Barrick Gold Corporation Basic Materials 27,48 27 15,70 21,57 37% 94 85 A 0,49 1,50 23,3% PA:DIM Sartorius Stedim -

Interim Report & Financial Statements

Interim Report & Financial Statements FP Octopus Investments UCITS Funds For the six months ended 31 August 2019 (unaudited) Page FP Octopus Investments UCITS Funds Authorised Corporate Director's (“ACD”) Report 3 Certification of Financial Statements by Directors of the ACD* 4 Notes to the Interim Financial Statements 5 FP Octopus UK Micro Cap Growth Fund 6 FP Octopus UK Multi Cap Income Fund 14 General Information 23 Contact information 24 * Collectively these comprise the ACD’s Report. contents 2 FP Octopus Investments UCITS Funds Authorised Corporate Director's (“ACD”) Report* We are pleased to present the Interim Report & unaudited Financial Statements for FP Octopus Investments UCITS Funds for the six months ended 31 August 2019. Authorised Status FP Octopus Investments UCITS Funds (“the Company”) is an investment company with variable capital (“ICVC”) incorporated in England and Wales under registered number IC001071 and authorised by the Financial Conduct Authority (“FCA”), with effect from 23 August 2016. The Company has an unlimited duration. Shareholders are not liable for the debts of the Company. Head Office is at Second Floor (East), 52-54 Gracechurch Street, London, EC3V 0EH. The Head Office is the address of the place in the UK for service on the Company of notices or other documents required or authorised to be served on it. Structure of the Company The Company is structured as an umbrella company, in that different Funds may be established from time to time by the ACD with the approval of the FCA. On the introduction of any new Fund or Share Class, a revised prospectus will be prepared setting out the relevant details of each Fund or Shares Class. -

Brinker Capital Destinations Trust Form NPORT-P Filed 2021-07-27

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-07-27 | Period of Report: 2021-05-31 SEC Accession No. 0001752724-21-156355 (HTML Version on secdatabase.com) FILER Brinker Capital Destinations Trust Mailing Address Business Address 1055 WESTLAKES DRIVE, 1055 WESTLAKES DRIVE, CIK:1688680| IRS No.: 816867493 | State of Incorp.:DE | Fiscal Year End: 0228 SUITE 250 SUITE 250 Type: NPORT-P | Act: 40 | File No.: 811-23207 | Film No.: 211116475 BERWYN PA 19312 BERWYN PA 19312 (610) 407-8348 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Schedules of Investments May 28, 2021# (unaudited) Destinations Large Cap Equity Fund Shares/Units Security Value COMMON STOCKS - 98.2% BASIC MATERIALS - 2.7% Chemicals - 1.8% 2,675 Air Products & Chemicals Inc. $ 801,590 1,370 Albemarle Corp. 228,899 61,035 Celanese Corp., Class A Shares 10,098,241 219,580 CF Industries Holdings Inc. 11,675,068 145,409 Dow Inc. 9,948,884 331,412 DuPont de Nemours Inc. 28,034,141 80,177 Eastman Chemical Co. 10,054,196 2,921 Ecolab Inc. 628,249 1,591 FMC Corp. 185,654 2,921 International Flavors & Fragrances Inc. 413,818 19,007 Linde PLC 5,713,504 91,292 LyondellBasell Industries NV, Class A Shares 10,281,305 4,052 Mosaic Co. 146,439 2,783 PPG Industries Inc. 500,161 2,841 Sherwin-Williams Co. 805,509 Total Chemicals 89,515,658 Forest Products & Paper - 0.3% 163,480 International Paper Co. 10,315,588 62,625 West Fraser Timber Co., Ltd. -

28-June-18 AUSTRALIA 1.Margin 2.Can Go 3.Guaranteed Stock Ticker Rate Short?* Stop Premium

28-June-18 AUSTRALIA 1.Margin 2.Can go 3.Guaranteed Stock Ticker Rate short?* stop premium AGL Energy Limited AGL.AX / AGL AU 5% ✓ 0.3% ALS Limited ALQ.AX / ALQ AU 10% ✓ 1% AMA Group Limited AMA.AX / AMA AU 75% ☎ 1% AMP Limited AMP.AX / AMP AU 5% ✓ 0.3% APA Group APA.AX / APA AU 10% ✓ 0.3% APN Outdoor Group Limited APO.AX / APO AU 10% ✓ 1% APN Property Group Limited APD.AX / APD AU 25% ✘ 1% ARB Corporation Limited ARB.AX / ARB AU 20% ✓ 1% ASX Limited ASX.AX / ASX AU 10% ✓ 0.3% AVJennings Limited AVJ.AX / AVJ AU 25% ✘ 1% AWE Limited AWE.AX / AWE AU 25% ✘ 0.3% Abacus Property Group ABP.AX / ABP AU 20% ✓ 0.7% Accent Group Limited AX1.AX / AX1 AU 25% ✓ 1% Adelaide Brighton Limited ABC.AX / ABC AU 10% ✓ 0.3% Admedus Limited AHZ.AX / AHZ AU 25% ✘ 0.7% Ainsworth Game Technology Limited AGI.AX / AGI AU 25% ✓ 0.7% Alkane Resources Limited ALK.AX / ALK AU 25% ✘ 1% Altium Limited ALU.AX / ALU AU 15% ✓ 1% Altura Mining Limited AJM.AX / AJM AU 25% ☎ 1% Alumina Limited AWC.AX / AWC AU 10% ✓ 0.3% Amcil Limited AMH.AX / AMH AU 25% ✘ 1% Amcor Limited AMC.AX / AMC AU 5% ✓ 0.3% Ansell Limited ANN.AX / ANN AU 10% ✓ 0.3% Ardent Leisure Group AAD.AX / AAD AU 20% ✓ 1% Arena REIT ARF.AX / ARF AU 25% ☎ 1% Argosy Minerals Limited AGY.AX / AGY AU 25% ✘ 1% Aristocrat Leisure Limited ALL.AX / ALL AU 5% ✓ 0.3% Artemis Resources Limited ARV.AX / ARV AU 25% ✘ 1% Asaleo Care Limited AHY.AX / AHY AU 20% ✓ 0.7% Asian Masters Fund Limited AUF.AX / AUF AU 10% ✘ 0.3% Atlas Arteria Limited ALX.AX / ALX AU 10% ✓ 0.3% Aurelia Metals Limited AMI.AX / AMI AU 25% ☎ 1% Aurizon Holdings