Capital Services and Total Factor Productivity Measure- Ments: Impact of Various Methodologies for Belgium

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Biodiversity, Ecosystem Services and Wealth Accounting

Draft: January 27, 2011 BIODIVERSITY, ECOSYSTEM SERVICES AND WEALTH ACCOUNTING Charles Perrings ecoSERVICES Group, Arizona State University, Tempe. AZ 85287 Abstract The appropriate measure on which to compare the economic performance of different countries at a point in time, or the performance of a particular country over time, is per capita wealth. This is the only measure that tests whether the wellbeing generated by a flow of services is expected to be sustainable (non-declining over time), and so the only measure that allows sustainability comparisons between countries. This paper considers the implications of (a) changes in our understanding of ecosystem services, and (b) the welfare theoretic basis for wealth accounting, for the generation of comprehensive asset accounts. It argues that the set of accounts used to measure the growth, equity and sustainability of resource use should cover all surficial assets on which human wellbeing depends, and that estimates of the value of surficial assets should include off-site ecosystem service flows. 1. Posing the problem There is accumulating evidence that human ‘management’ of the biosphere is having a major effect on the abundance and diversity of other species, on ecological functioning, and on ecosystem processes. The most heralded impact of the conversion of land to human use is the extinction of other species, but anthropogenic environmental change has many other dimensions. Emissions to air, soil and water are affecting ecosystem processes at many different scales, extending from the global effect of greenhouse gas emissions on climate to the local effects of nitrate emissions on groundwater. Two global assessments have documented the effect of people’s use of terrestrial and marine resources on biodiversity change, and have offered some evidence for why it matters. -

Measuring Capital -- OECD Manual

« STATISTICS ON E LIN BL E A IL A V A E www.SourceOECD.org N G I D L I N SP E ONIBLE Measuring Capital OECD Manual MEASUREMENT OF CAPITAL STOCKS, CONSUMPTION OF FIXED CAPITAL AND CAPITAL SERVICES © OECD, 2001. © Software: 1987-1996, Acrobat is a trademark of ADOBE. All rights reserved. OECD grants you the right to use one copy of this Program for your personal use only. Unauthorised reproduction, lending, hiring, transmission or distribution of any data or software is prohibited. You must treat the Program and associated materials and any elements thereof like any other copyrighted material. All requests should be made to: Head of Publications Service, OECD Publications Service, 2, rue André-Pascal, 75775 Paris Cedex 16, France. « STATISTICS Measuring Capital OECD Manual MEASUREMENT OF CAPITAL STOCKS, CONSUMPTION OF FIXED CAPITAL AND CAPITAL SERVICES 2001 ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT Pursuant to Article 1 of the Convention signed in Paris on 14th December 1960, and which came into force on 30th September 1961, the Organisation for Economic Co-operation and Development (OECD) shall promote policies designed: – to achieve the highest sustainable economic growth and employment and a rising standard of living in Member countries, while maintaining financial stability, and thus to contribute to the development of the world economy; – to contribute to sound economic expansion in Member as well as non-member countries in the process of economic development; and – to contribute to the expansion of world trade on a multilateral, non-discriminatory basis in accordance with international obligations. The original Member countries of the OECD are Austria, Belgium, Canada, Denmark, France, Germany, Greece, Iceland, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Turkey, the United Kingdom and the United States. -

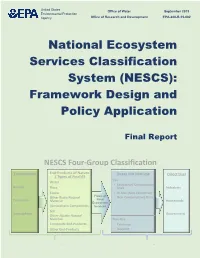

National Ecosystem Services Classification System (NESCS): Framework Design and Policy Application

United States Office of Water September 2015 Environmental Protection Agency Office of Research and Development EPA-800-R-15-002 National Ecosystem Services Classification System (NESCS): Framework Design and Policy Application Final Report NESCS Four-Group Classification Environment End-Products of Nature Direct Use Non-Use Direct User Structure / Types of Final ES Use Water • Extractive/ Consumptive Aquatic Flora Uses Industries Fauna • In-Situ (Non-Extractive/ Flows of Non-Consumptive) Uses Other Biotic Natural Final Terrestrial Material Households Ecosystem Atmospheric Components Services Soil Atmospheric Government Other Abiotic Natural Material Non-Use Composite End-Products • Existence Other End-Products • Bequest (Supply) (Demand) ACKNOWLEDGEMENTS The authors thank Jennifer Richkus, Jennifer Phelan, Robert Truesdale, Mary Barber, David Bellard, and others from RTI International for providing feedback and research support during the development of this report. The early leadership of former EPA employee John Powers proved instrumental in launching this effort. The authors thank Amanda Nahlik, Tony Olsen, Kevin Summers, Kathryn Saterson, Randy Bruins, Christine Davis, Bryan Hubbell, Julie Hewitt, Ashley Allen, Todd Doley, Karen Milam, David Simpson, and others at EPA for their discussion and feedback on earlier versions of this document. In addition, the authors thank V. Kerry Smith, Neville D. Crossman, and Brendan Fisher for review comments. Finally, the authors would like to thank participants of the two NESCS Workshops held in 2012 and 2013, as well as participants of an ACES session in 2014. Any factual or attribution errors are the responsibility of the authors alone. ADDITIONAL INFORMATION This document was developed under U.S. EPA Contract EP-W-11-029 with RTI International (Paramita Sinha and George Van Houtven), in collaboration with the ORISE Participant Program between U.S. -

Measuring Capital – OECD Manual SECOND EDITION

AVI A LABLE ON LINE 2009 Measuring Capital – OECD Manual SECOND EDITION Capital – in particular of the physical sort – plays several roles in economic life: it constitutes wealth and it provides services in production processes. Capital is invested, disinvested and it depreciates and becomes obsolescent and there is a question how to measure all these dimensions of capital in industry and national accounts. The present revised Capital Manual is the first comprehensive guide to the approaches toward capital measurement. It is directed at statisticians, researchers and analysts and aims at giving practical advice while providing theoretical background and an overview of the relevant literature. The manual comes in three parts – a first part with a non-technical description with the main concepts and steps involved in measuring capital; a second part directed at implementation and a third part outlining theory and a more complete mathematical formulation of the measurement process. Measuring Capital OECD Manual SECOND EDITION Measuring Capital – OECD Manual Manual MeasuringOECD Capital– SECONDEDITION The full text of this book is available on line via these links: www.sourceoecd.org/generaleconomics/9789264025639 www.sourceoecd.org/statisticssourcesmethods/9789264025639 Those with access to all OECD books on line should use this link: www.sourceoecd.org/9789264025639 SourceOECD is the OECD’s online library of books, periodicals and statistical databases. For more information about this award-winning service and free trials ask your librarian, or write to us at [email protected]. 2009 isBN 978-92-64-02563-9 30 2009 12 1 P www.oecd.org/publishing -:HSTCQE=UWZ[X^: 2009 302009121cov.indd 1 25-Aug-2009 1:41:54 PM Measuring Capital OECD MANUAL 2009 Second Edition ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT The OECD is a unique forum where the governments of 30 democracies work together to address the economic, social and environmental challenges of globalisation. -

Quality of Life and the Distribution of Wealth and Resources

Consensus Chapter 12 Quality of Life and the Distribution of Wealth and Resources J. Farley, R. Costanza, P. Templet, M. Corson, Ph. Crabbe, R. Esquivel, K. Furusawa, W. Fyfe, O. Loucks, K. MacDonald, L. MacPhee, L. McArthur, C. Miller, P. O’Brien, G. Patterson, J. Ribemboim and S.J. Wilson Abstract All anthropocentric definitions of sustainability, at least implicitly, place a central focus on sustaining an acceptable level of human quality of life (QOL). Within the dominant ideology of free market capitalism, it is believed that reducing wealth and resource consumption also reduces QOL within a generation, yet it appears that excessive resource consumption on the part of the current generation threatens dramatic reductions to the QOL of future generations. Continued economic growth substantially increases this threat. If current levels of QOL do indeed depend on current consumption levels, this would mean that ensuring sustainability for future generations requires a reduction in QOL for at least some of the people alive today. We show in this chapter that in reality, above a certain level, greater wealth and resource consumption are not tightly linked to QOL. Thus, a more fair distribution of resources and wealth within and between generations need not require a sacrifice in QOL for the current generation, increasing the feasibility of policies directed towards this outcome. 1. How do we define Quality of Life (QOL)? Philosophers have been discussing the issue of QOL at least since the time of Aris- totle, and have yet to reach any kind of consensus on what it means. In chapter 11, we presented the following definition of QOL, “a multidimensional evaluation of an individual’s current life circumstances in the context of the culture in which they live and the values they hold. -

Biodiversity, Ecosystem Services and Governance – Targets Beyond 2010« on Tjärnö, Sweden, 4-6 September 2009

Biodiversity, Ecosystem Services and Resilience Governance for a Future with Global Changes Background report for the scientific workshop »Biodiversity, ecosystem services and governance – targets beyond 2010« on Tjärnö, Sweden, 4-6 September 2009. published by: Albaeco citation: Huitric M (Ed.), Walker B, Moberg F, Österblom H, Sandin L, Grandin U, Olsson P and Bodegård J. 2009. Biodiversity, Ecosystem Services and Resilience – Governance for a Future with Global Changes. Background report for the scientific workshop »Biodiversity, ecosystem services and governance – targets beyond 2010« on Tjärnö, Sweden, 4-6 September 2009. Albaeco, Stockholm, Sweden. editor: Miriam Huitric, Albaeco. design: Clifstock Form images: Azote, Christine Clifstock and flickr. printing: Wassberg & Skotte Tryckeri AB The carbon dioxide emissions from the pulp manufacturing, electricity consumption and transport of the paper in this publication have been offset. isbn: 978-91-978427-0-9 Abstract This scientific background report concludes that halting biodiversity loss and sustaining ecosystem services for human well-being beyond 2010 requires recognition of the dynamic interplay between biodiversity, ecosystem services and human development in the context of rapid global environmental change. Biodiversity, through its links to ecosystem services production, is crucial for human well-being, economic development and poverty alleviation. However, biodiversity is in serious decline in Europe, and beyond, as a result of multiple human impacts. Biodiversity constitutes an important component of ecosystem resilience, i.e. the capacity of a system to deal with change and withstand shocks without shifting into a qualitatively different state. Resilience has increasingly been acknowledged as an important factor in determining ecosystems’ capacity to continue generating ecosystem services. -

Do Local Communities Have Capacity to Regulate the Tourism Commons? the Case of Tourism Resource in Communal Land Conservancies, Namibia

IASCP Europe Regional Meeting Building the European Commons: from Open Fields to Open Source Brescia - Italy - March 23-25, 2006 Do Local Communities Have Capacity to Regulate the Tourism Commons? The Case of Tourism Resource in Communal Land Conservancies, Namibia. Renaud LAPEYRE1 Center for Economics and Ethics in the Environment and Development, (C3ED) at UVSQ Université de Versailles Saint Quentin-en-Yvelines, 47, Bd Vauban, 78047 Cedex, France, “The State shall actively promote and maintain the welfare of the people by adopting (...) policies aimed at (...) maintenance of ecosystems, essential ecological processes and biological diversity of Namibia and utilisation of living natural resources on a sustainable basis for the benefit of all Namibians, both present and future(…)”. Article 95 of the Namibian Constitution Abstract Namibia sustainable development depends on the country’s rich natural capital. Thus, nature tourism is thought to be a tool to reconcile apparently opposite objectives of conservation and poverty alleviation in communal lands. Tourism in Namibian communal lands is based on natural resources and amenities that can be considered as impure public goods. Rivalness and zero-exclusion conditions lead to rent dissipating externalities and threaten sustainability of the resource-system. Multiple actors compete to capture rent from natural resources-flows. Land use conflicts increase transaction and governance costs. This paper aims at analysing institutions that emerge in Namibian rural areas to regulate what is said to be the “tourism commons”. Supply of governance structures is made through devolution of new property rights to local communities that register as conservancies (CBNRM programme). We analyse the emergence of such local institutions by referring to Williamson’s (2000) four level model of institutions. -

The Emergence of Intangible Capital

JYVÄSKYLÄ STUDIES IN HUMANITIES 285 Olli Turunen The Emergence of Intangible Capital Human, Social, and Intellectual Capital in Nineteenth Century British, French, and German Economic Thought JYVÄSKYLÄ STUDIES IN HUMANITIES 285 Olli Turunen The Emergence of Intangible Capital Human, Social, and Intellectual Capital in Nineteenth Century British, French, and German Economic Thought Esitetään Jyväskylän yliopiston humanistisen tiedekunnan suostumuksella julkisesti tarkastettavaksi yliopiston vanhassa juhlasalissa S212 huhtikuun 22. päivänä 2016 kello 12. Academic dissertation to be publicly discussed, by permission of the Faculty of Humanities of the University of Jyväskylä, in building Seminarium, auditorium S212, on April 22, 2016 at 12 o’clock noon. UNIVERSITY OF JYVÄSKYLÄ JYVÄSKYLÄ 2016 The Emergence of Intangible Capital Human, Social, and Intellectual Capital in Nineteenth Century British, French, and German Economic Thought JYVÄSKYLÄ STUDIES IN HUMANITIES 285 Olli Turunen The Emergence of Intangible Capital Human, Social, and Intellectual Capital in Nineteenth Century British, French, and German Economic Thought UNIVERSITY OF JYVÄSKYLÄ JYVÄSKYLÄ 2016 Editors Ilkka Nummela Department of History and Ethnology, University of Jyväskylä Pekka Olsbo, Ville Korkiakangas Publishing Unit, University Library of Jyväskylä Jyväskylä Studies in Humanities Editorial Board Editor in Chief Heikki Hanka, Department of Art and Culture Studies, University of Jyväskylä Petri Karonen, Department of History and Ethnology, University of Jyväskylä Paula -

Value, Capital and Nature

Value, Capital and Nature Rethinking the foundations of ecological economics Elke Pirgmaier Submitted in accordance with the requirements for the degree of PhD in Economics The University of Leeds Leeds University Business School & School of Earth and Environment September 2018 The candidate confirms that the work submitted is his/her own and that appropriate credit has been given where reference has been made to the work of others. The work in chapter 2 of the thesis has appeared in the following publication: Pirgmaier, E. (2017). The Neoclassical Trojan Horse of Steady-State Economics, Ecological Economics 133, 52-61. This copy has been supplied on the understanding that it is copyright material and that no quotation from the thesis may be published without proper acknowledgement. The right of Elke Pirgmaier to be identified as Author of this work has been asserted by her in accordance with the Copyright, Designs and Patents Act 1988. © 2018 The University of Leeds and Elke Pirgmaier ii Acknowledgements Writing a PhD is not an individual achievement. This PhD would not have been possible without the continuous intellectual and emotional support of several wonderful people. Above all, I would like to express my deep gratitude to my supervisors: Andrew Brown, Julia Steinberger and David Spencer, for allowing me to explore bigger questions, providing so much of their time and energy and for being genuinely nice people. Andy, you have been a continuous and invaluable source of support in many ways. Thanks for opening doors for me, to Marxian economics, dialectics, the importance of clear and systematic thinking, and the madness of mainstream economics. -

The Conceptual Overlap Between Public Goods, Externalities and Merit Goods Abstract in a Given Situation, Any Good Has the Foll

The conceptual overlap between public goods, externalities and merit goods By João Rogério Sanson Economist; professor (retired) of economics, Universidade Federal de Santa Catarina, Brazil Abstract In a given situation, any good has the following characteristics: rivalry, exclusion, space, and time. The last two characteristics of a good are the usual physical variables of position in space and time. Rivalry may be seen as an intrinsic physical quality of any good and appears as a binomial variable with the categories yes and no, usually denominated as rival and non-rival. Exclusion reflects the institutional handling of the allocation of a good and appears as a continuous variable that measures the resource cost for enforcing property norms. In a continuous transaction cost function, non- rivalry is only one of the elements that affect its shape and the productivity of the necessary inputs for exclusion. With these two characteristics most goods may be classified in a market economy, from pure private goods to pure public goods, with an infinite number of intermediary cases. Space is associated with local public goods. Externalities may be considered as a joint production of a rival or non-rival good that results from a market transaction. Finally, merit or demerit goods may be seen as a form of externality deduced from preferences of a group that prefer to affect another. Key words: public good, rivalry, exclusion, externalities, merit goods. 1. Introduction Public goods, externalities, and merit goods may be described with basis on some common characteristics of all goods: rivalry, exclusion, position in space, and time. Rivalry, discussed also in terms of its negation, non-rivalry, is an intrinsic characteristic of a good and of a physical nature. -

Report by the Commission on the Measurement of Economic Performance and Social Progress

Report by the Commission on the Measurement of Economic Performance and Social Progress Professor Joseph E. S TIGLITZ , Chair, Columbia University Professor Amartya S EN , Chair Adviser, Harvard University Professor Jean-Paul F ITOUSSI , Coordinator of the Commission, IEP www.stiglitz-sen-fitoussi.fr Other Members Bina A GARWAL University of Delhi Anthony B. A TKINSON Warden of Nuffield College François B OURGUIGNON School of Economics, Jean-Philippe C OTIS Insee, Angus S. D EATON Princeton University Kemal D ERVIS UNPD Marc F LEURBAEY Université Paris 5 Nancy F OLBRE University of Massachussets Jean G ADREY Université Lille Enrico G IOVANNINI OECD Roger G UESNERIE Collège de France James J. H ECKMAN Chicago University Geoffrey H EAL Columbia University Claude H ENRY Sciences-Po/Columbia University Daniel K AHNEMAN Princeton University Alan B. K RUEGER Princeton University Andrew J. O SWALD University of Warwick Robert D. P UTNAM Harvard University Nick S TERN London School of Economics Cass S UNSTEIN University of Chicago Philippe W EIL Sciences Po Rapporteurs Jean-Etienne C HAPRON INSEE General Rapporteur Didier B LANCHET INSEE Jacques L E C ACHEUX OFCE Marco M IRA D’E RCOLE OCDE Pierre-Alain P IONNIER INSEE Laurence R IOUX INSEE/CREST Paul S CHREYER OCDE Xavier T IMBEAU OFCE Vincent M ARCUS INSEE Table of contents EXECUTIVE SUMMARY I. SHORT NARRATIVE ON THE CONTENT OF THE REPORT Chapter 1: Classical GDP Issues . 21 Chapter 2: Quality of Life . 41 Chapter 3: Sustainable Development and Environment . 61 II. SUBSTANTIAL ARGUMENTS PRESENTED IN THE REPORT Chapter 1: Classical GDP Issues . -

THE WORKWEEK of CAPITAL and ITS CYCLICAL IMPLICATIONS Finn

THE WORKWEEK OF CAPITAL AND ITS CYCLICAL IMPLICATIONS Finn E. Kydland Edward C. Prescott Carnegie-Mellon University Federal Reserve Bank of Minneapolis and University of Minnesota Revised October 1986 EC. Abstract The neoclassical growth model studied in Kydland and Prescott [1982] is modified to permit the capital utilization rate to vary. The effect of this modification is to increase the ampli• tude of the aggregate fluctuations predicted by theory as the equilibrium response to technological shocks. If following Solow [1957], the changes in output not accounted for by changes in the labor and tangible capital inputs are interpreted as being the technology shocks, the statistical properties of the fluctuations in the post-war United States economy are close in magintude and nature to those predicted by theory. Send communications to: Edward C. Prescott Research Department Federal Reserve Bank of Minneapolis 250 Marquette Avenue Minneapolis, Minnesota 55480 I. Introduction In Kydland and Preacott [1982], the competitive neo• classical growth model with shocks to technology is studied. Leisure was introduced as an additional argument affecting prefer• ences and labor services as an input to the aggregate production function. This artificial economy was calibrated so that its equilibrium would display the growth observations of Kuznets [1966]. In particular, its average consumption and investment shares of output match those of the post-war U.S. economy as do the capital-output ratios and factor shares. Further, the alloca• tion of time between market and nonmarket production activities is consistent with household studies and does not change secularly as technology advances. Services from inventory stocks were introduced as a factor of production and a production period for new capital consistent with micro observations assumed.