Capital-Goods Market Definition

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

9 Some Implications of Capital Heterogeneity Benjamin Powell*

Macintosh HD:Users:Raydens:Public:RAYDENS IMAC JOBS:12345- EE - BOETTKE (EE1):BOETTKE TEXT (M2294) Macintosh HD:Users:Raydens:Public:RAYDENS IMAC JOBS:12345- EE - BOETTKE (EE1):BOETTKE TEXT (M2294) 9 Some implications of capital heterogeneity Benjamin Powell* 9.1 Introduction A tractor is not a hammer. Both are capital goods but they usually serve different purposes. Yet both can be used to accomplish more than one goal. A tractor can be used to plow a field, pull a trailer, or any number of other tasks. A hammer could be used by a carpenter to build a house or by an automobile mechanic to fix a car. The fact that a tractor and hammer serve different purposes but yet each is capable of serving more than one single purpose should seem obvious. Yet the consistent applica- tion of this observation to economic theory is one of the unique aspects of the Austrian school and it has led the Austrian school to come to unique conclusions in areas ranging from socialist calculation, to business cycles and to economic development among others. Capital goods are those goods that are valued because of their ability to produce other goods that are the ultimate object for consumption. Because these capital goods are heterogeneous and yet have multi- specific uses we must coordinate economic activity to best align the structure of capital goods to most efficiently produce consumer goods without leaving any higher valued consumption wants left unsatisfied. The coordina- tion of consumption plans with the billions of ways the capital structure could be combined to satisfy those consumption plans is one of the major tasks any economy must accomplish. -

Delays in Public Goods

ISSN 1178-2293 (Online) University of Otago Economics Discussion Papers No. 1702 FEBRUARY 2017 Delays in Public Goods • Santanu Chatterjee, University of Georgia • Olaf Posch, Universität Hamburg and CREATES • Dennis Wesselbaum, University of Otago Address for correspondence: Dennis Wesselbaum Department of Economics University of Otago PO Box 56 Dunedin NEW ZEALAND Email: [email protected] Telephone: 64 3 479 8643 Delays in Public Goods∗ Santanu Chatterjee† Olaf Posch‡ Dennis Wesselbaum§ University of Georgia Universität Hamburg University of Otago and CREATES January 31, 2017 Abstract In this paper, we analyze the consequences of delays and cost overruns typically associated with the provision of public infrastructure in the context of a growing econ- omy. Our results indicate that uncertainty about the arrival of public capital can more than offset its positive spillovers for private-sector productivity. In a decentralized economy, unanticipated delays in the provision of public capital generate too much consumption and too little private investment relative to the first-best optimum. The characterization of the first-best optimum is also affected: facing delays in the arrival of public goods, a social planner allocates more resources to private investment and less to consumption relative to the first-best outcome in the canonical model (without delays). The presence of delays also lowers equilibrium growth, and leads to a diverging growth path relative to that implied by the canonical model. This suggests that delays in public capital provision may be a potential determinant of cross-country differences in income and economic growth. Keywords: Public goods, delays, time overrun, cost overrun, implementation lags, fiscal policy, economic growth. -

Capital Goods Imports and Long-Run Growth

NBER WORKING PAPER SERIES CAPITAL GOODS IMPORTS AND LONG-RUN GROWFH Jong-Wha Lee Working Paper No. 4725 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachuseus Avenue Cambridge, MA 02138 April 1994 The author is grateful to Robert Barro, Susan Collins and Elhanan Helpman for their helpful comments on earlier drafts of this paper. This paper is part of NBER's research programs in Growth and International Trade and Investment. Any opinions expressed are those of the author and not those of the National Bureau of Economic Research. NBER Working Paper #4725 April1994 CAPITAL GOODS IMPORTS ANDLONG-RUN GROWIH ABSTRACT This paper presents an endogenous growth model of an open economy in which the growth rate of income is higher if foreign capital goods are used relatively more than domestic capital goods for the production of capital stock. Empirical results, using cross country data for the period 1960-85, confirm that the ratio of imported to domestically produced capital goods in the composition of investment has a significant positive effect on per capita income growth rates across countries, in particular, in developing countries. Hence, the composition of investment in addition to the volume of total capital accumulation is highlighted as an important detenninant of economic growth. Jong-Wha Lee Department of Economics Korea University Anam-Dong, Sungbuk-Ku Seoul 136-701 KOREA and NBER I. Introduction The links between international trade and economicgrowth haveinterested economists for a longtime. Caninternational trade increase the growth -

The Wealth of Networks How Social Production Transforms Markets and Freedom

Name /yal05/27282_u00 01/27/06 10:25AM Plate # 0-Composite pg 3 # 3 The Wealth of Networks How Social Production Transforms Markets and Freedom Yochai Benkler Yale University Press Ϫ1 New Haven and London 0 ϩ1 Name /yal05/27282_u00 01/27/06 10:25AM Plate # 0-Composite pg 4 # 4 Copyright ᭧ 2006 by Yochai Benkler. All rights reserved. Subject to the exception immediately following, this book may not be repro- duced, in whole or in part, including illustrations, in any form (beyond that copy- ing permitted by Sections 107 and 108 of the U.S. Copyright Law and except by reviewers for the public press), without written permission from the publishers. The author has made an online version of the book available under a Creative Commons Noncommercial Sharealike license; it can be accessed through the author’s website at http://www.benkler.org. Printed in the United States of America. Library of Congress Cataloging-in-Publication Data Benkler, Yochai. The wealth of networks : how social production transforms markets and freedom / Yochai Benkler. p. cm. Includes bibliographical references and index. ISBN-13: 978-0-300-11056-2 (alk. paper) ISBN-10: 0-300-11056-1 (alk. paper) 1. Information society. 2. Information networks. 3. Computer networks—Social aspects. 4. Computer networks—Economic aspects. I. Title. HM851.B457 2006 303.48'33—dc22 2005028316 A catalogue record for this book is available from the British Library. The paper in this book meets the guidelines for permanence and durability of the Committee on Production Guidelines for Book Longevity of the Council on Library Resources. -

Is Published Semi-Annually by the Journal on Telecommunications & High Technology Law, Campus Box 401, Boulder, CO 80309-040

JOURNAL ON TELECOMMUNICATIONS & HIGH TECHNOLOGY LAW is published semi-annually by the Journal on Telecommunications & High Technology Law, Campus Box 401, Boulder, CO 80309-0401 ISSN: 1543-8899 Copyright © 2009 by the Journal on Telecommunications & High Technology Law an association of students sponsored by the University of Colorado School of Law and the Silicon Flatirons Telecommunications Program. POSTMASTER: Please send address changes to JTHTL, Campus Box 401, Boulder, CO 80309-0401 Subscriptions Domestic volume subscriptions are available for $45.00. City of Boulder subscribers please add $3.74 sales tax. Boulder County subscribers outside the City of Boulder please add $2.14 sales tax. Metro Denver subscribers outside of Boulder County please add $1.85 sales tax. Colorado subscribers outside of Metro Denver please add $1.31 sales tax. International volume subscriptions are available for $50.00. Inquiries concerning ongoing subscriptions or obtaining an individual issue should be directed to the attention of JTHTL Managing Editor at [email protected] or by writing JTHTL Managing Editor, Campus Box 401, Boulder, CO 80309-0401. Back issues in complete sets, volumes, or single issues may be obtained from: William S. Hein & Co., Inc., 1285 Main Street, Buffalo, NY 14209. Back issues may also be found in electronic format for all your research needs on HeinOnline http://heinonline.org/. Manuscripts JTHTL invites the submission of unsolicited manuscripts. Please send softcopy manuscripts to the attention of JTHTL Articles Editors at [email protected] in Word or PDF formats or through ExpressO at http://law.bepress.com/expresso. Hardcopy submissions may be sent to JTHTL Articles Editors, Campus Box 401, Boulder, CO 80309-0401. -

Economic Calculation and the Limits of Organization

Economic Calculation and the Limits of Organization Peter G. Klein conomists have become increasingly frustrated with the text- book model of the firm. The "firm" of intermediate microeco- Enomics is a production function, a mysterious "black box" whose insides are off-limits to respectable economic theory (relegated instead to the lesser disciplines of management, organization theory, industrial psychology, and the like). Though useful in certain contexts, the textbook model has proven unable to account for a variety of real- world business practices: vertical and lateral integration, geographic and product-line diversification, franchising, long-term commercial contract- ing, transfer pricing, research joint ventures, and many others. As an al- ternative to viewing the firm as a production function, economists are turning to a new body ofliterature that views the firm as anorganization, itself worthy of economic analysis. This emerging literature is the best- developed part of what has come to be called the "new institutional eco- nomics."' The new perspective has deeply enhanced and enriched our un- derstanding of firms and other organizations, such that we can no longer agree with Ronald Coase's 1988 statement that "[wlhy firms exist, what determines the number of firms, what determines what firms do . are not questions of interest to most economists" (Coase 1988a, p. 5).The new theory is not without its critics; Richard Nelson (1991), for example, ob- jects that the new institutional economics tends to downplay discretion- ary differences among firms. Still, the new institutional economics-in particular, agency theory and transaction cost economics-has been *Peter G. Klein is assistant professor of economics at the University of Georgia. -

Biodiversity, Ecosystem Services and Wealth Accounting

Draft: January 27, 2011 BIODIVERSITY, ECOSYSTEM SERVICES AND WEALTH ACCOUNTING Charles Perrings ecoSERVICES Group, Arizona State University, Tempe. AZ 85287 Abstract The appropriate measure on which to compare the economic performance of different countries at a point in time, or the performance of a particular country over time, is per capita wealth. This is the only measure that tests whether the wellbeing generated by a flow of services is expected to be sustainable (non-declining over time), and so the only measure that allows sustainability comparisons between countries. This paper considers the implications of (a) changes in our understanding of ecosystem services, and (b) the welfare theoretic basis for wealth accounting, for the generation of comprehensive asset accounts. It argues that the set of accounts used to measure the growth, equity and sustainability of resource use should cover all surficial assets on which human wellbeing depends, and that estimates of the value of surficial assets should include off-site ecosystem service flows. 1. Posing the problem There is accumulating evidence that human ‘management’ of the biosphere is having a major effect on the abundance and diversity of other species, on ecological functioning, and on ecosystem processes. The most heralded impact of the conversion of land to human use is the extinction of other species, but anthropogenic environmental change has many other dimensions. Emissions to air, soil and water are affecting ecosystem processes at many different scales, extending from the global effect of greenhouse gas emissions on climate to the local effects of nitrate emissions on groundwater. Two global assessments have documented the effect of people’s use of terrestrial and marine resources on biodiversity change, and have offered some evidence for why it matters. -

Public Goods, Sustainable Development and Business Accountability

al Science tic & li P o u Bardy, J Pol Sci Pub Aff 2018, 6:4 P b f l i o c Journal of Political Sciences & Public l DOI: 10.4172/2332-0761.1000339 A a f n f r a u i r o s J Affairs ISSN: 2332-0761 Review Article Open Access Public Goods, Sustainable Development and Business Accountability: Connecting Corporate Performance and Preservation of the Commons Bardy R* Lutgert College of Business, Florida Gulf Coast University, Florida, USA *Corresponding author: Bardy R, Executive Professor, Lutgert College of Business, Florida Gulf Coast University, Florida, USA, Tel: 0012395668469; E-mail: [email protected] Received date: Oct 04, 2018; Accepted date: Oct 23, 2018; Published date: Nov 02, 2018 Copyright: © 2018 Bardy R. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited. Abstract Sustainable Development is about preserving and maintaining public goods. This comes out both from the intra- and intergenerational aspect of the Brundtland definition (“meeting the needs of the present without compromising the ability of future generations to meet their own needs”; World Commission on Environment and Development). In consequence, whoever uses public goods is liable for their preservation, for their maintenance and, where they are underdeveloped, for their built-up and expansion. “Paying” for the usage of public goods is taken care of by taxes and excise, and, more recently, by duties like those levied on emission. However, the magnitude of public goods usage is rarely measured on either national or regional or local levels1, let alone in monetary terms. -

Can Ideas Be Capital: Can Capital Be Anything Else?

Working Paper 83 Can Ideas be Capital: Can Capital be Anything Else? * HOWARD BAETJER AND PETER LEWIN The ideas presented in this research are the authors' and do not represent official positions of the Mercatus Center at George Mason University. Introduction There is no concept in the corpus of economics, or in the realm of political economy, that is more fraught with controversy and ambiguity than the concept of “capital” (for a surveyand analysis see Lewin, 2005). It seems as if each generation of economists has invented its own notion of capital and its own “capital controversy.”1 The Classical economists thought of capital in the context of a surplus fund for the sustaining of labor in the process of production. Ricardo and Marxprovide frameworks that encourage us to think of capital as a social class—the class of owners of productive facilities and equipment. The Austrians emphasized the role of time in the production process. In Neoclassical economic theorywe think of capital as a quantifiable factor of production. In financial contexts we think of it as a sum of money. Different views of capital have, in large part, mirrored different approaches to the study of economics. To be sure capital theory is difficult. But difficulty alone is insufficient to explain the elusive nature of its central concepts and the disagreements that have emerged from this lack of clarity. We shall argue that this ambiguityis a direct result of the chosen methods of analysis, and that these methods, because of their restrictive nature, have necessarily limited the scope of economics and, by extension, have threatened to limit the scope and insights of management theories drawing insights from economics. -

Capital Goods Trade and Economic Development

Capital Goods Trade and Economic Development Piyusha Mutreja∗ B. Ravikumary Michael Sposiz Preliminary Draft, Incomplete, Please do not circulate May 2013 Abstract Almost 80 percent of capital goods production in the world is concentrated in 8 countries. Poor countries import most of their capital goods. We argue that interna- tional trade in capital goods is crucial to understand economic development through two channels: (i) capital formation and (ii) aggregate TFP. We embed a multi-country, multi-sector Ricardian model of trade into a neoclassical growth framework. Barriers to trade result in a misallocation of factors both within and across countries. We cal- ibrate the model to bilateral trade flows, prices, and income per worker. Our model matches the world distribution of capital goods production and accounts for almost all of the log variance in capital per worker across countries. Trade barriers in our model imply a substantial misallocation of resources relative to the optimal allocation: poor countries produce too much capital goods, while rich countries produce too little. Autarky in capital goods is costly: poor countries suffer a welfare loss of 11 percent, with all of the loss stemming from decreased capital accumulation. ∗Department of Economics, Syracuse University. Email: [email protected] yFederal Reserve Bank of Saint Louis. Email: [email protected] zFederal Reserve Bank of Dallas. Email: [email protected] 1 1 Introduction Cross-country differences in income per worker are large: the income per worker in the top decile is more than 40 times the income per worker in the bottom decile (Penn World Tables version 6.3, see Heston, Summers, and Aten, 2009). -

Measuring Capital -- OECD Manual

« STATISTICS ON E LIN BL E A IL A V A E www.SourceOECD.org N G I D L I N SP E ONIBLE Measuring Capital OECD Manual MEASUREMENT OF CAPITAL STOCKS, CONSUMPTION OF FIXED CAPITAL AND CAPITAL SERVICES © OECD, 2001. © Software: 1987-1996, Acrobat is a trademark of ADOBE. All rights reserved. OECD grants you the right to use one copy of this Program for your personal use only. Unauthorised reproduction, lending, hiring, transmission or distribution of any data or software is prohibited. You must treat the Program and associated materials and any elements thereof like any other copyrighted material. All requests should be made to: Head of Publications Service, OECD Publications Service, 2, rue André-Pascal, 75775 Paris Cedex 16, France. « STATISTICS Measuring Capital OECD Manual MEASUREMENT OF CAPITAL STOCKS, CONSUMPTION OF FIXED CAPITAL AND CAPITAL SERVICES 2001 ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT Pursuant to Article 1 of the Convention signed in Paris on 14th December 1960, and which came into force on 30th September 1961, the Organisation for Economic Co-operation and Development (OECD) shall promote policies designed: – to achieve the highest sustainable economic growth and employment and a rising standard of living in Member countries, while maintaining financial stability, and thus to contribute to the development of the world economy; – to contribute to sound economic expansion in Member as well as non-member countries in the process of economic development; and – to contribute to the expansion of world trade on a multilateral, non-discriminatory basis in accordance with international obligations. The original Member countries of the OECD are Austria, Belgium, Canada, Denmark, France, Germany, Greece, Iceland, Ireland, Italy, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, Turkey, the United Kingdom and the United States. -

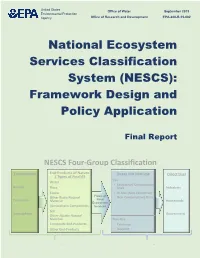

National Ecosystem Services Classification System (NESCS): Framework Design and Policy Application

United States Office of Water September 2015 Environmental Protection Agency Office of Research and Development EPA-800-R-15-002 National Ecosystem Services Classification System (NESCS): Framework Design and Policy Application Final Report NESCS Four-Group Classification Environment End-Products of Nature Direct Use Non-Use Direct User Structure / Types of Final ES Use Water • Extractive/ Consumptive Aquatic Flora Uses Industries Fauna • In-Situ (Non-Extractive/ Flows of Non-Consumptive) Uses Other Biotic Natural Final Terrestrial Material Households Ecosystem Atmospheric Components Services Soil Atmospheric Government Other Abiotic Natural Material Non-Use Composite End-Products • Existence Other End-Products • Bequest (Supply) (Demand) ACKNOWLEDGEMENTS The authors thank Jennifer Richkus, Jennifer Phelan, Robert Truesdale, Mary Barber, David Bellard, and others from RTI International for providing feedback and research support during the development of this report. The early leadership of former EPA employee John Powers proved instrumental in launching this effort. The authors thank Amanda Nahlik, Tony Olsen, Kevin Summers, Kathryn Saterson, Randy Bruins, Christine Davis, Bryan Hubbell, Julie Hewitt, Ashley Allen, Todd Doley, Karen Milam, David Simpson, and others at EPA for their discussion and feedback on earlier versions of this document. In addition, the authors thank V. Kerry Smith, Neville D. Crossman, and Brendan Fisher for review comments. Finally, the authors would like to thank participants of the two NESCS Workshops held in 2012 and 2013, as well as participants of an ACES session in 2014. Any factual or attribution errors are the responsibility of the authors alone. ADDITIONAL INFORMATION This document was developed under U.S. EPA Contract EP-W-11-029 with RTI International (Paramita Sinha and George Van Houtven), in collaboration with the ORISE Participant Program between U.S.