Weekly Economic Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Executive Branch Personnel Public Financial Disclosure Report (OGE Form 278E)

Nominee Report | U.S. Office of Government Ethics; 5 C.F.R. part 2634 | Form Approved: OMB No. (3209-0001) (March 2014) Executive Branch Personnel Public Financial Disclosure Report (OGE Form 278e) Filer's Information Shanahan, Patrick Michael Deputy Secretary of Defense, Department of Defense Other Federal Government Positions Held During the Preceding 12 Months: None Names of Congressional Committees Considering Nomination: ● Committee on Armed Services Electronic Signature - I certify that the statements I have made in this form are true, complete and correct to the best of my knowledge. /s/ Shanahan, Patrick Michael [electronically signed on 04/08/2017 by Shanahan, Patrick Michael in Integrity.gov] Agency Ethics Official's Opinion - On the basis of information contained in this report, I conclude that the filer is in compliance with applicable laws and regulations (subject to any comments below). /s/ Vetter, Ruth, Certifying Official [electronically signed on 06/08/2017 by Vetter, Ruth in Integrity.gov] Other review conducted by /s/ Vetter, Ruth, Ethics Official [electronically signed on 06/08/2017 by Vetter, Ruth in Integrity.gov] U.S. Office of Government Ethics Certification /s/ Apol, David, Certifying Official [electronically signed on 06/08/2017 by Apol, David in Integrity.gov] 1. Filer's Positions Held Outside United States Government # ORGANIZATION NAME CITY, STATE ORGANIZATION POSITION HELD FROM TO TYPE 1 The Boeing Company Chicago, Illinois Corporation Senior Vice 3/1986 Present President 2 The University of Washington Seattle, -

Partner Resumes

John L. Gronski Major General, USA (Ret.) [email protected] 610-463-5492 PROFESSIONAL EXPERIENCE • Served for over 40 years in the United States Army on active duty and in the Pennsylvania National Guard retiring at the rank of Major General. Currently a Senior Mentor – Highly Qualified Expert for the U.S. Army Mission Command Training Program, an adjunct fellow with the Center for European Policy Analysis (CEPA), president of Leader Grove Consulting, LLC, and an independent national security analyst focusing on transatlantic issues. Holds a top secret security clearance. • Key military operational leadership experience includes from 2016 to 2019 served on active duty as United States Army Europe, Deputy Commanding General, Army National Guard assisting the Commanding General in leading over 30,000 Soldiers. Commanded the 28th Infantry Division, leading 15,000 Soldiers from 2012 to 2016. Deployed to Ramadi, Iraq in 2005 and 2006 as a brigade commander leading a force of over 5,400 U.S. service members and 5,000 Iraqi Soldiers during combat operations. Deployed to the central region of Europe between 2002 and 2003 as a brigade commander leading a force of approximately 2,000 Soldiers. In 2000 was assigned for one year as the Military Liaison Team Chief in the Republic of Lithuania. Commanded National Guard infantry units at every level from company to division. • In the civilian sector, led diverse teams as a management consultant for over 13 years. Provided oversight and leadership to implementation teams responsible for planning and executing large complex projects in Fortune 500 companies. Served as an executive coach for senior business leaders. -

Business Analytics

NICK, ’20 Business Analytics Business Analytics Experiential Learning SAMPLE COURSES: Throughout their undergraduate careers, students work in small teams to solve real-world problems from local companies. • BALT 3330: Database Structures and Queries Students get a briefing from company executives on the problem • BALT 4320: Data and Text Mining and work all semester on the project scope and deliverables. At • FINA 4330: Predictive Analytics the end of the semester, the student teams present the results to the company. • BALT 4350: Web Intelligence and Analytics Hackathon Benedictine hosts an annual Hackathon for current BenU students SIMILAR MAJORS: along with students from local community colleges. The event Finance, Marketing, Data Science offers students a chance to work collaboratively in small teams on an analytics and Big Data project. A more recent Hackathon was sponsored by IBM and teams explored Chicago crime data for their project. BUSINESS ANALYTICS ALUMNI Communication Skills Our alumni have built successful careers at Zurich All business analytics students have project-based classes which Insurance, Northwestern, Conversant, CDW, allow them to gain practical and valuable experience as well as Morningstar, UniFirst Corporation, Nicor Gas, learn how to communicate their findings effectively. Students Invesco, Ace Hardware, Dial America, Kraft Heinz learn how to present technical results through written and oral Company, FedEx, Crowe, First Midwest Bank, presentations. These skills are essential in a dynamic business and Chamberlain Group – just to name a few. world and are highly sought-after by employers. WHY STUDY BUSINESS ANALYTICS AT BENEDICTINE? The growing field of analytics is transforming the way companies do business. Analytics can help improve managerial and organizational decision making by transforming data into actions and business insights. -

2019 SEC Form 10-K (PDF File)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001-14905 BERKSHIRE HATHAWAY INC. (Exact name of Registrant as specified in its charter) Delaware 47-0813844 State or other jurisdiction of (I.R.S. Employer incorporation or organization Identification No.) 3555 Farnam Street, Omaha, Nebraska 68131 (Address of principal executive office) (Zip Code) Registrant’s telephone number, including area code (402) 346-1400 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbols Name of each exchange on which registered Class A Common Stock BRK.A New York Stock Exchange Class B Common Stock BRK.B New York Stock Exchange 0.750% Senior Notes due 2023 BRK23 New York Stock Exchange 1.125% Senior Notes due 2027 BRK27 New York Stock Exchange 1.625% Senior Notes due 2035 BRK35 New York Stock Exchange 0.500% Senior Notes due 2020 BRK20 New York Stock Exchange 1.300% Senior Notes due 2024 BRK24 New York Stock Exchange 2.150% Senior Notes due 2028 BRK28 New York Stock Exchange 0.250% Senior Notes due 2021 BRK21 New York Stock Exchange 0.625% Senior Notes due 2023 BRK23A New York Stock Exchange 2.375% Senior Notes due 2039 BRK39 New York Stock Exchange 2.625% Senior Notes due 2059 BRK59 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: NONE Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

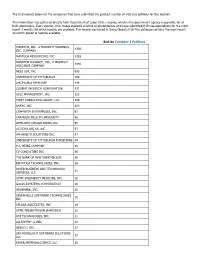

The H1B Records Below List the Companies That Have Submitted the Greatest Number of H1B Visa Petitions for This Location

The H1B records below list the companies that have submitted the greatest number of H1B visa petitions for this location. This information was gathered directly from Department of Labor (DOL) records, which is the government agency responsible for all H1B submissions. Every quarter, DOL makes available a listing of all companies who have submitted H1B visa applications for the most recent 3 months for which records are available. The records contained in Going Global's H1B Plus database contains the most recent 12-month period of records available. Sort by Company | Petitions MASTECH, INC., A MASTECH HOLDINGS, 4339 INC. COMPANY MASTECH RESOURCING, INC. 1393 MASTECH ALLIANCE, INC., A MASTECH 1040 HOLDINGS COMPANY NESS USA, INC. 693 UNIVERSITY OF PITTSBURGH 169 UHCP D/B/A UPMC MEP 144 COGENT INFOTECH CORPORATION 131 SDLC MANAGEMENT, INC. 123 FIRST CONSULTING GROUP, LLC 104 ANSYS, INC. 100 COMPUTER ENTERPRISES, INC. 97 CARNEGIE MELLON UNIVERSITY 96 INTELLECT DESIGN ARENA INC. 95 ACCION LABS US, INC. 63 HM HEALTH SOLUTIONS INC. 57 UNIVERSITY OF PITTSBURGH PHYSICIANS 44 H.J. HEINZ COMPANY 40 CV CONSULTING INC 36 THE BANK OF NEW YORK MELLON 36 INFOYUGA TECHNOLOGIES, INC. 36 BAYER BUSINESS AND TECHNOLOGY 31 SERVICES, LLC UPMC EMERGENCY MEDICINE, INC. 28 GALAX-ESYSTEMS CORPORATION 26 HIGHMARK, INC. 25 SEVEN HILLS SOFTWARE TECHNOLOGIES 25 INC VELAGA ASSOCIATES, INC 24 UPMC PRESBYTERIAN SHADYSIDE 22 DVI TECHNOLOGES, INC. 21 ALLEGHENY CLINIC 20 GENCO I. INC. 17 SRI MOONLIGHT SOFTWARE SOLUTIONS 17 LLC BAYER MATERIALSCIENCE, LLC 16 BAYER HEALTHCARE PHARMACEUTICALS, 16 INC. VISVERO, INC. 16 CYBYTE, INC. 15 BOMBARDIER TRANSPORTATION 15 (HOLDINGS) USA, INC. -

Exelon Illinois Nuclear Fleet Audit

Redacted Version Exelon Illinois Nuclear Fleet Audit Findings and Recommendations Prepared for Illinois Environmental Protection Agency April 14, 2021 AUTHORS Divita Bhandari Max Chang Philip Eash-Gates Jason Frost Steve Letendre, PhD Jackie Litynski Cheryl Roberto Andrew Takasugi Jon Tabernero Rachel Wilson 485 Massachusetts Avenue, Suite 3 Cambridge, Massachusetts 02139 617.661.3248 | www.synapse-energy.com Redacted Version This page left intentionally blank Synapse Energy Economics, Inc. Exelon Illinois Nuclear Fleet Audit 1 Redacted Version CONTENTS EXECUTIVE SUMMARY ......................................................................................... I 1. BACKGROUND ........................................................................................... 1 1.1. Summary of Illinois Plants ......................................................................................... 1 1.2. Historical Revenues .................................................................................................. 2 1.3. Separation of Exelon................................................................................................. 8 2. METHODOLOGY......................................................................................... 8 2.1. Monte Carlo Analysis ................................................................................................ 9 2.2. EnCompass Modeling ..............................................................................................14 3. RESULTS: BYRON AND DRESDEN................................................................... -

04/26/2016 Summary of Meeting Held with Exelon Generation Company

~~\\ B£Gui ~(_,\... -1)'. .,. 01>,_ p '• '6 UNITED STATES i ;: NUCLEAR REGULATORY COMMISSION "'c;, ~. Jlllll' ;),,ff WASHINGTON, D.C. 20555-0001 "'/41") ... v-0 * ** • ._ May 1 0 , 2 0 1 6 LICENSEE: Exelon Generation Company, LLC FACILITY: Peach Bottom Atomic Power Station, Units 2 and 3 SUBJECT: SUMMARY OF APRIL 26, 2016, MEETING WITH EXELON GENERATION COMPANY, LLC TO DISCUSS A POTENTIAL FUTURE MEASUREMENT UNCERTAINTY RECAPTURE POWER UPRATE LICENSE AMENDMENT REQUEST FOR PEACH BOTTOM ATOMIC POWER STATION, UNITS 2 AND 3 (CAC NOS. MF7532 AND MF7533} On April 26, 2016, a Category 1 public meeting was held between the U.S. Nuclear Regulatory Commission (NRC) and representatives of Exelon Generation Company, LLC (Exelon, the licensee) at NRC Headquarters, One White Flint North, 11555 Rockville Pike, Rockville, Maryland. The purpose of the meeting was to discuss a potential future measurement uncertainty recapture (MUR) power uprate license amendment request (LAA) for the Peach Bottom Atomic Power Station (PBAPS), Units 2 and 3. The meeting notice and agenda, dated April 11, 2016, are available in the Agencywide Documents Access and Management System (ADAMS) at Accession No. ML 16102A 104. A list of attendees is enclosed. Background Nuclear power plants are licensed to operate at a specified maximum core thermal power, often called rated thermal power (RTP). Title 1O of the Code of Federal Regulations (1 O CFR) Part 50, Appendix K, "ECCS [Emergency Core Cooling System] Evaluation Models," formerly required licensees to assume that the reactor had been operating continuously at a power level at least 1.02 times the RTP level when performing loss-of-coolant accident (LOCA) and ECCS analyses. -

Exelon Nuclear Fact Sheet Exelon Nuclear, a Division of Exelon Generation, Is Headquartered in Kennett Square, Pa

Exelon Nuclear Fact Sheet Exelon Nuclear, a division of Exelon Generation, is headquartered in Kennett Square, Pa. and operates the largest U.S. fleet of carbon-free nuclear plants with more than 17,800 megawatts of capacity from 21 reactors at 12 facilities in Illinois, Maryland, New York and Pennsylvania. Dave Rhoades is President and Chief Nuclear Officer, Exelon Nuclear. There are more than 10,000 nuclear professionals working in Exelon Generation’s nuclear division. These professionals implement industry best practices to ensure safe, reliable operation throughout Exelon’s nuclear fleet. Exelon believes that clean, affordable energy is the key to a brighter, more sustainable future. Exelon’s nuclear power plants account for approximately 60 percent of Exelon’s power generation portfolio. Nuclear power plants are critical to the stability of the U.S. electrical grid because they can produce an uninterrupted flow of electricity for extended periods. This uninterrupted flow supplies the necessary level of baseload electricity for the grid to operate around-the-clock. Exelon’s nuclear stations Braidwood Generating Station Braceville, Illinois Byron Generating Station Byron, Illinois Calvert Cliffs Nuclear Power Plant Lusby, Maryland Clinton Power Station Clinton, Illinois Dresden Generating Station Morris, Illinois FitzPatrick Nuclear Power Plant Scriba, New York Ginna Nuclear Power Plant Ontario, New York LaSalle County Generating Station Marseilles, Illinois Limerick Generating Station Pottstown, Pennsylvania Nine Mile Point Nuclear Station Scriba, New York Peach Bottom Atomic Power Station Delta, Pennsylvania Quad Cities Generating Station Cordova, Illinois Updated: January 2021 . -

Will Exelon Cut the Cord with Comed?

REAL ESTATE: The “Crayola House” on Wisconsin’s shoreline is for sale. PAGE 27 BOOZE: Spirit Hub aims to get craft spirits to the masses. PAGE 3 CHICAGOBUSINESS.COM | OCTOBER 5, 2020 | $3.50 Will Exelon cut the cord with ComEd? estimated earnings, Exelon’s It’s a move Wall Street has applauded elsewhere in the power industry stock price is at a multiple that But ComEd’s admissions in for nancial success. badly trails its utility peers, which BY STEVE DANIELS July that it engaged in a bribery Now Wall Street is wondering average about 16 times. Exelon’s More and more, Exelon looks scheme over nearly a decade to why Exelon, unlike virtually ev- stock has fallen 21 percent this like the last man standing in its win lucrative legislation in the ery major electricity company in year, while the Standard & Poor’s industry—and not in a good way. Illinois Capitol—coupled with the U.S., isn’t uncoupling its - Utilities Index is down 7 percent. e Chicago-based nuclear repeated requests for ratepayer nancially struggling power plants e valuation implies that inves- power giant and parent of Com- bailouts from Exelon’s unregu- from its healthy utilities, which tors ascribe essentially no value monwealth Edison long has lated arm that once pledged fe- along with ComEd include mo- to Exelon’s merchant arm even maintained that owning regulat- alty to market forces—make this nopoly power-delivery compa- Exelon CEO Chris Crane though the company projects it ed utilities like ComEd alongside marriage look rocky at best. -

EXELON CORPORATION EMPLOYEE SAVINGS PLAN (Full Title of the Plan)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 11-K ☒ ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended December 31, 2007 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File Number 1-16169 EXELON CORPORATION EMPLOYEE SAVINGS PLAN (Full title of the Plan) EXELON CORPORATION (a Pennsylvania Corporation) 10 South Dearborn Street P.O. Box 805379 Chicago, Illinois 60680-5379 (312) 394-7398 (Name of the issuer of the securities held pursuant to the Plan and the address of its principal executive offices) Table of Contents EXELON CORPORATION EMPLOYEE SAVINGS PLAN INDEX TO FORM 11-K Page No. Report of Independent Registered Public Accounting Firm 1 Financial Statements: Statements of Net Assets Available for Benefits as of December 31, 2007 and 2006 2 Statement of Changes in Net Assets Available for Benefits for the Year Ended December 31, 2007 3 Notes to Financial Statements 4 - 13 Supplemental Schedule: Schedule of Assets (Held at End of Year) as of December 31, 2007, Schedule H, Part IV, Item 4i of Form 5500 14 Note: All other schedules of additional information required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under ERISA have been omitted because they are not applicable. Exhibit Index 15 Signatures 16 Exhibits 17 Table of Contents REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Participants and the Administrator of the Exelon Corporation Employee Savings Plan: We have audited the accompanying statements of net assets available for benefits of the Exelon Corporation Employee Savings Plan (the “Plan”) as of December 31, 2007 and 2006, and the related statement of changes in net assets available for benefits for the year ended December 31, 2007. -

Chicago's Largest Publicly Traded Companies | Crain's Book of Lists

Chicago’s Largest Publicly Traded Companies | Crain’s Book of Lists 2018 Company Website Location Walgreens Boots Alliance Inc. www.walgreensbootsalliance.com Deerfield, IL Boeing Co. www.boeing.com Chicago, IL Archer Daniels Midland Co. www.adm.com Chicago, IL Caterpillar Inc. www.caterpillar.com Peoria, IL United Continental Holdings Inc. www.unitedcontinental-holdings.com Chicago, IL Allstate Corp. www.allstate.com Northbrook, IL Exelon Corp. www.exeloncorp.com Chicago, IL Deere & Co. www.deere.com Moline, IL Kraft Heinz Co. www.kraftheinz-company.com Chicago, IL Mondelez International Inc. www.mondelez-international.com Deerfield, IL Abbvie Inc. www.abbvie.com North Chicago, IL McDonald’s Corp. www.aboutmcdonalds.com Oak Brook, IL US Foods Holding Corp. www.USfoods.com Rosemont, IL Sears Holdings Corp. www.searsholdings.com Hoffman Estates, IL Abbott Laboratories www.abbott.com North Chicago, IL CDW Corp. www.cdw.com Lincolnshire, IL Illinois Tool Works Inc. www.itw.com Glenview, IL Conagra Brands Inc. www.conagrabrands.com Chicago, IL Discover Financial Services Inc. www.discover.com Riverwoods, IL Baxter International Inc. www.baxter.com Deerfield, IL W.W. Grainger Inc. www.grainger.com Lake Forest, IL CNA Financial Corp. www.cna.com Chicago, IL Tenneco Inc. www.tenneco.com Lake Forest, IL LKQ Corp. www.lkqcorp.com Chicago, IL Navistar International Corp. www.navistar.com Lisle, IL Univar Inc. www.univar.com Downers Grove, IL Anixter International Inc. www.anixter.com Glenview, IL R.R. Donnelly & Sons Co. www.rrdonnelly.com Chicago, IL Jones Lang LaSalle Inc. www.jll.com Chicago, IL Dover Corp. www.dovercorporation.com Downers Grove, IL Treehouse Foods Inc. -

Ctpf Illinois Economic Opportunity Report

CTPF ILLINOIS ECONOMIC OPPORTUNITY REPORT As Required by Public Act 096-0753 for the period ending June 30, 2021 202 1 TABLE OF CONTENTS TABLE I 1 Illinois-based Investment Manager Firms Investing on Behalf of CTPF TABLE II Illinois-based Private Equity Partnerships, Portfolio Companies, 2 Infrastructure, and Real Estate Properties in the CTPF Portfolio TABLE III 14 Illinois-based Public Equity Market Value of Shares Held in CTPF’s Portfolio TABLE IV 18 Illinois-based Fixed Income Market Value of Shares Held in CTPF’s Portfolio TABLE V Domestic Equity Brokerage Commissions Paid to Illinois-based 19 Brokers/Dealers TABLE VI 20 International Equity Brokerage Commissions Paid to Illinois-based Brokers/Dealers TABLE VII Fixed Income Volume Traded through Illinois-based Brokers/Dealers 21 (par value) 2021 CTPF ILLINOIS ECONOMIC OPPORTUNITY REPORT REQUIRED BY PUBLIC ACT 096-0753 FOR THE PERIOD ENDING JUNE 30, 2021 TABLE I Illinois-based Investment Manager Firms Investing on Behalf of CTPF Table I identifies the economic opportunity investments made by CTPF with Illinois-based investment management companies. As of June 30, 2021, Total Market/Fair Value of Illinois-based investment managers was $3,121,157,662.18 (23.74%) of the total CTPF investment portfolio of $13,145,258,889.14. Market/Fair Value % of Total Fund Investment Manager Firms Location As of 6/30/2021 (reported in millions) Adams Street Chicago $ 319.69 2.43% Ariel Capital Management Chicago 83.44 0.63% Attucks Asset Management Chicago 274.06 2.08% Ativo Capital Management1 Chicago