Quarterly Commentary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Executive Branch Personnel Public Financial Disclosure Report (OGE Form 278E)

Nominee Report | U.S. Office of Government Ethics; 5 C.F.R. part 2634 | Form Approved: OMB No. (3209-0001) (March 2014) Executive Branch Personnel Public Financial Disclosure Report (OGE Form 278e) Filer's Information Shanahan, Patrick Michael Deputy Secretary of Defense, Department of Defense Other Federal Government Positions Held During the Preceding 12 Months: None Names of Congressional Committees Considering Nomination: ● Committee on Armed Services Electronic Signature - I certify that the statements I have made in this form are true, complete and correct to the best of my knowledge. /s/ Shanahan, Patrick Michael [electronically signed on 04/08/2017 by Shanahan, Patrick Michael in Integrity.gov] Agency Ethics Official's Opinion - On the basis of information contained in this report, I conclude that the filer is in compliance with applicable laws and regulations (subject to any comments below). /s/ Vetter, Ruth, Certifying Official [electronically signed on 06/08/2017 by Vetter, Ruth in Integrity.gov] Other review conducted by /s/ Vetter, Ruth, Ethics Official [electronically signed on 06/08/2017 by Vetter, Ruth in Integrity.gov] U.S. Office of Government Ethics Certification /s/ Apol, David, Certifying Official [electronically signed on 06/08/2017 by Apol, David in Integrity.gov] 1. Filer's Positions Held Outside United States Government # ORGANIZATION NAME CITY, STATE ORGANIZATION POSITION HELD FROM TO TYPE 1 The Boeing Company Chicago, Illinois Corporation Senior Vice 3/1986 Present President 2 The University of Washington Seattle, -

Business Analytics

NICK, ’20 Business Analytics Business Analytics Experiential Learning SAMPLE COURSES: Throughout their undergraduate careers, students work in small teams to solve real-world problems from local companies. • BALT 3330: Database Structures and Queries Students get a briefing from company executives on the problem • BALT 4320: Data and Text Mining and work all semester on the project scope and deliverables. At • FINA 4330: Predictive Analytics the end of the semester, the student teams present the results to the company. • BALT 4350: Web Intelligence and Analytics Hackathon Benedictine hosts an annual Hackathon for current BenU students SIMILAR MAJORS: along with students from local community colleges. The event Finance, Marketing, Data Science offers students a chance to work collaboratively in small teams on an analytics and Big Data project. A more recent Hackathon was sponsored by IBM and teams explored Chicago crime data for their project. BUSINESS ANALYTICS ALUMNI Communication Skills Our alumni have built successful careers at Zurich All business analytics students have project-based classes which Insurance, Northwestern, Conversant, CDW, allow them to gain practical and valuable experience as well as Morningstar, UniFirst Corporation, Nicor Gas, learn how to communicate their findings effectively. Students Invesco, Ace Hardware, Dial America, Kraft Heinz learn how to present technical results through written and oral Company, FedEx, Crowe, First Midwest Bank, presentations. These skills are essential in a dynamic business and Chamberlain Group – just to name a few. world and are highly sought-after by employers. WHY STUDY BUSINESS ANALYTICS AT BENEDICTINE? The growing field of analytics is transforming the way companies do business. Analytics can help improve managerial and organizational decision making by transforming data into actions and business insights. -

2019 SEC Form 10-K (PDF File)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001-14905 BERKSHIRE HATHAWAY INC. (Exact name of Registrant as specified in its charter) Delaware 47-0813844 State or other jurisdiction of (I.R.S. Employer incorporation or organization Identification No.) 3555 Farnam Street, Omaha, Nebraska 68131 (Address of principal executive office) (Zip Code) Registrant’s telephone number, including area code (402) 346-1400 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbols Name of each exchange on which registered Class A Common Stock BRK.A New York Stock Exchange Class B Common Stock BRK.B New York Stock Exchange 0.750% Senior Notes due 2023 BRK23 New York Stock Exchange 1.125% Senior Notes due 2027 BRK27 New York Stock Exchange 1.625% Senior Notes due 2035 BRK35 New York Stock Exchange 0.500% Senior Notes due 2020 BRK20 New York Stock Exchange 1.300% Senior Notes due 2024 BRK24 New York Stock Exchange 2.150% Senior Notes due 2028 BRK28 New York Stock Exchange 0.250% Senior Notes due 2021 BRK21 New York Stock Exchange 0.625% Senior Notes due 2023 BRK23A New York Stock Exchange 2.375% Senior Notes due 2039 BRK39 New York Stock Exchange 2.625% Senior Notes due 2059 BRK59 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: NONE Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

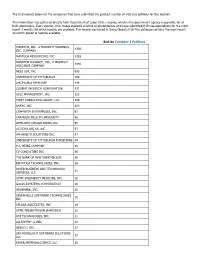

The H1B Records Below List the Companies That Have Submitted the Greatest Number of H1B Visa Petitions for This Location

The H1B records below list the companies that have submitted the greatest number of H1B visa petitions for this location. This information was gathered directly from Department of Labor (DOL) records, which is the government agency responsible for all H1B submissions. Every quarter, DOL makes available a listing of all companies who have submitted H1B visa applications for the most recent 3 months for which records are available. The records contained in Going Global's H1B Plus database contains the most recent 12-month period of records available. Sort by Company | Petitions MASTECH, INC., A MASTECH HOLDINGS, 4339 INC. COMPANY MASTECH RESOURCING, INC. 1393 MASTECH ALLIANCE, INC., A MASTECH 1040 HOLDINGS COMPANY NESS USA, INC. 693 UNIVERSITY OF PITTSBURGH 169 UHCP D/B/A UPMC MEP 144 COGENT INFOTECH CORPORATION 131 SDLC MANAGEMENT, INC. 123 FIRST CONSULTING GROUP, LLC 104 ANSYS, INC. 100 COMPUTER ENTERPRISES, INC. 97 CARNEGIE MELLON UNIVERSITY 96 INTELLECT DESIGN ARENA INC. 95 ACCION LABS US, INC. 63 HM HEALTH SOLUTIONS INC. 57 UNIVERSITY OF PITTSBURGH PHYSICIANS 44 H.J. HEINZ COMPANY 40 CV CONSULTING INC 36 THE BANK OF NEW YORK MELLON 36 INFOYUGA TECHNOLOGIES, INC. 36 BAYER BUSINESS AND TECHNOLOGY 31 SERVICES, LLC UPMC EMERGENCY MEDICINE, INC. 28 GALAX-ESYSTEMS CORPORATION 26 HIGHMARK, INC. 25 SEVEN HILLS SOFTWARE TECHNOLOGIES 25 INC VELAGA ASSOCIATES, INC 24 UPMC PRESBYTERIAN SHADYSIDE 22 DVI TECHNOLOGES, INC. 21 ALLEGHENY CLINIC 20 GENCO I. INC. 17 SRI MOONLIGHT SOFTWARE SOLUTIONS 17 LLC BAYER MATERIALSCIENCE, LLC 16 BAYER HEALTHCARE PHARMACEUTICALS, 16 INC. VISVERO, INC. 16 CYBYTE, INC. 15 BOMBARDIER TRANSPORTATION 15 (HOLDINGS) USA, INC. -

Chicago's Largest Publicly Traded Companies | Crain's Book of Lists

Chicago’s Largest Publicly Traded Companies | Crain’s Book of Lists 2018 Company Website Location Walgreens Boots Alliance Inc. www.walgreensbootsalliance.com Deerfield, IL Boeing Co. www.boeing.com Chicago, IL Archer Daniels Midland Co. www.adm.com Chicago, IL Caterpillar Inc. www.caterpillar.com Peoria, IL United Continental Holdings Inc. www.unitedcontinental-holdings.com Chicago, IL Allstate Corp. www.allstate.com Northbrook, IL Exelon Corp. www.exeloncorp.com Chicago, IL Deere & Co. www.deere.com Moline, IL Kraft Heinz Co. www.kraftheinz-company.com Chicago, IL Mondelez International Inc. www.mondelez-international.com Deerfield, IL Abbvie Inc. www.abbvie.com North Chicago, IL McDonald’s Corp. www.aboutmcdonalds.com Oak Brook, IL US Foods Holding Corp. www.USfoods.com Rosemont, IL Sears Holdings Corp. www.searsholdings.com Hoffman Estates, IL Abbott Laboratories www.abbott.com North Chicago, IL CDW Corp. www.cdw.com Lincolnshire, IL Illinois Tool Works Inc. www.itw.com Glenview, IL Conagra Brands Inc. www.conagrabrands.com Chicago, IL Discover Financial Services Inc. www.discover.com Riverwoods, IL Baxter International Inc. www.baxter.com Deerfield, IL W.W. Grainger Inc. www.grainger.com Lake Forest, IL CNA Financial Corp. www.cna.com Chicago, IL Tenneco Inc. www.tenneco.com Lake Forest, IL LKQ Corp. www.lkqcorp.com Chicago, IL Navistar International Corp. www.navistar.com Lisle, IL Univar Inc. www.univar.com Downers Grove, IL Anixter International Inc. www.anixter.com Glenview, IL R.R. Donnelly & Sons Co. www.rrdonnelly.com Chicago, IL Jones Lang LaSalle Inc. www.jll.com Chicago, IL Dover Corp. www.dovercorporation.com Downers Grove, IL Treehouse Foods Inc. -

Ctpf Illinois Economic Opportunity Report

CTPF ILLINOIS ECONOMIC OPPORTUNITY REPORT As Required by Public Act 096-0753 for the period ending June 30, 2021 202 1 TABLE OF CONTENTS TABLE I 1 Illinois-based Investment Manager Firms Investing on Behalf of CTPF TABLE II Illinois-based Private Equity Partnerships, Portfolio Companies, 2 Infrastructure, and Real Estate Properties in the CTPF Portfolio TABLE III 14 Illinois-based Public Equity Market Value of Shares Held in CTPF’s Portfolio TABLE IV 18 Illinois-based Fixed Income Market Value of Shares Held in CTPF’s Portfolio TABLE V Domestic Equity Brokerage Commissions Paid to Illinois-based 19 Brokers/Dealers TABLE VI 20 International Equity Brokerage Commissions Paid to Illinois-based Brokers/Dealers TABLE VII Fixed Income Volume Traded through Illinois-based Brokers/Dealers 21 (par value) 2021 CTPF ILLINOIS ECONOMIC OPPORTUNITY REPORT REQUIRED BY PUBLIC ACT 096-0753 FOR THE PERIOD ENDING JUNE 30, 2021 TABLE I Illinois-based Investment Manager Firms Investing on Behalf of CTPF Table I identifies the economic opportunity investments made by CTPF with Illinois-based investment management companies. As of June 30, 2021, Total Market/Fair Value of Illinois-based investment managers was $3,121,157,662.18 (23.74%) of the total CTPF investment portfolio of $13,145,258,889.14. Market/Fair Value % of Total Fund Investment Manager Firms Location As of 6/30/2021 (reported in millions) Adams Street Chicago $ 319.69 2.43% Ariel Capital Management Chicago 83.44 0.63% Attucks Asset Management Chicago 274.06 2.08% Ativo Capital Management1 Chicago -

ACVR NT High Income

American Century Investments® Quarterly Portfolio Holdings NT High Income Fund June 30, 2021 NT High Income - Schedule of Investments JUNE 30, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) CORPORATE BONDS — 94.0% Aerospace and Defense — 1.9% Bombardier, Inc., 6.00%, 10/15/22(1) 1,287,000 1,291,240 Bombardier, Inc., 7.50%, 12/1/24(1) 1,450,000 1,517,070 Bombardier, Inc., 7.50%, 3/15/25(1) 676,000 696,702 Bombardier, Inc., 7.875%, 4/15/27(1) 1,100,000 1,142,636 BWX Technologies, Inc., 4.125%, 4/15/29(1) 525,000 535,521 F-Brasile SpA / F-Brasile US LLC, 7.375%, 8/15/26(1) 600,000 620,250 Howmet Aerospace, Inc., 5.125%, 10/1/24 1,925,000 2,129,493 Howmet Aerospace, Inc., 5.90%, 2/1/27 125,000 146,349 Howmet Aerospace, Inc., 5.95%, 2/1/37 1,975,000 2,392,574 Rolls-Royce plc, 5.75%, 10/15/27(1) 600,000 661,668 Spirit AeroSystems, Inc., 5.50%, 1/15/25(1) 400,000 426,220 Spirit AeroSystems, Inc., 7.50%, 4/15/25(1) 875,000 936,587 Spirit AeroSystems, Inc., 4.60%, 6/15/28 600,000 589,515 TransDigm, Inc., 7.50%, 3/15/27 675,000 718,942 TransDigm, Inc., 5.50%, 11/15/27 6,000,000 6,262,500 TransDigm, Inc., 4.625%, 1/15/29(1) 1,275,000 1,279,195 TransDigm, Inc., 4.875%, 5/1/29(1) 1,425,000 1,440,319 Triumph Group, Inc., 8.875%, 6/1/24(1) 315,000 350,833 Triumph Group, Inc., 6.25%, 9/15/24(1) 275,000 280,159 Triumph Group, Inc., 7.75%, 8/15/25 375,000 386,250 23,804,023 Air Freight and Logistics — 0.3% Cargo Aircraft Management, Inc., 4.75%, 2/1/28(1) 850,000 869,584 Western Global Airlines LLC, 10.375%, 8/15/25(1) 875,000 1,003,520 XPO Logistics, Inc., 6.125%, 9/1/23(1) 1,100,000 1,111,820 XPO Logistics, Inc., 6.75%, 8/15/24(1) 475,000 494,000 3,478,924 Airlines — 1.1% American Airlines Group, Inc., 5.00%, 6/1/22(1) 750,000 751,890 American Airlines, Inc., 11.75%, 7/15/25(1) 2,475,000 3,109,219 American Airlines, Inc. -

Kraft Heinz Merger

Kraft Heinz Merger Mohd Sakib Agenda n Overview of Merger Companies n Deal Terms and Merger Structure n Synergies and Risks n Effects on Investors – 3G Capital and Berkshire Hathaway n Future of Kraft Heinz 4/22/15 Wall Street Club 2 Overview of Kraft n Kraft Foods Group, Inc. is a consumer packaged food and beverage company founded in 1903 – Operates in six segments; portfolio of >70 major brands – Primarily serves supermarket chains, club stores, retail food outlets, etc n Kraft split into Kraft Foods, focusing on grocery products in North America, and Mondelez International Inc., focused on snacks – Stable financial performance – $18 Billion in annual sales – 9 brands with more than $500 Million in annual sales 4/22/15 Wall Street Club 3 Overview of Heinz n H.J. Heinz Company is a global food player that was established in 1869 – Three core categories: Ketchup and Sauces, Meals and Snacks, and Infant/Nutrition – Products have #1 or #2 market share in 50+ countries n Acquired by Warren Buffett and 3G Capital for $28 Billion in 2013 – Appealing due to strong, durable brands and global presence – Strong international presence with emerging market sales consisting of 25% of total revenue 4/22/15 Wall Street Club 4 Deal Terms and Merger Structure n Stock for stock merger possibly valued at $46.6 Billion and orchestrated by Berkshire Hathaway and 3G Capital – Heinz will control 51% whereas Kraft will own remaining 49% n $10 Billion special cash dividend to be paid out by 3G and Berkshire – Kraft shareholders will receive $16.50 a share, representing -

The Kraft Heinz Company (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): January 30, 2018 The Kraft Heinz Company (Exact name of registrant as specified in its charter) Commission File Number: 001-37482 Delaware 46-2078182 (State or other jurisdiction (IRS Employer of incorporation) Identification No.) One PPG Place, Pittsburgh, Pennsylvania 15222 (Address of principal executive offices, including zip code) (412) 456-5700 (Registrant’s telephone number, including area code) Not Applicable (Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (§230.405 of this chapter) or Rule 12b-2 of the Exchange Act (§240.12b-2 of this chapter). Emerging growth company ☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. -

1:19-Cv-02394 Document #: 109 Filed: 11/15/19 Page 1 of 24 Pageid #:2414

Case: 1:19-cv-02394 Document #: 109 Filed: 11/15/19 Page 1 of 24 PageID #:2414 IN THE UNITED STATES DISTRICT COURT FOR THE NORTHERN DISTRICT OF ILLINOIS EASTERN DIVISION IN RE THE BOEING COMPANY ) No. 19 CV 2394 AIRCRAFT SECURITIES ) LITIGATION ) Judge John J. Tharp, Jr. MEMORANDUM OPINION AND ORDER In this putative class action, five plaintiffs are vying for appointment as Lead Plaintiff and to approve their selection of counsel to represent the class. For the reasons set forth below, the Court appoints the Public Employees Retirement System of Mississippi as Lead Plaintiff and approves its selection of the law firm of Bernstein Litowitz Berger & Grossman LLP as Lead Counsel. I. BACKGROUND This matter involves securities fraud claims predicated on statements issued by The Boeing Company regarding the safety of its 737 MAX aircraft. In a nutshell, the complaints filed to date allege that during the first part of 2019, Boeing misled investors about the financial prospects for its commercial airplanes business by misstating and concealing information about safety problems with the 737 MAX in the wake of investigations of the crashes of Lion Air Flight 610 in October 2018 and of Ethiopian Airlines Flight 302 in March 2019. Two class action complaints have been filed. The initial complaint (Case No. 19 CV 2394; the “Seeks” action) was filed on April 9, 2019, by plaintiff Richard Seeks on behalf of a class comprising purchasers of Boeing securities between January 8, 2019 and March 21, 2019. A subsequent complaint was filed by plaintiff Mercer Busch (Case No. 19 CV 3548; the “Busch” action) on May 28, 2019 on behalf of a class of persons who acquired Boeing securities between Case: 1:19-cv-02394 Document #: 109 Filed: 11/15/19 Page 2 of 24 PageID #:2414 January 8, 2019 and May 8, 2019. -

Of DISTINGUISHED GENERAL COUNSEL

WORLD RECOGNITION of DISTINGUISHED GENERAL COUNSEL GUEST OF HONOR: James Savina Senior Vice President, General Counsel & Corporate Secretary, The Kraft Heinz Company Copyright © 2016 Directors Roundtable WORLD RECOGNITION of DISTINGUISHED GENERAL COUNSEL THE SPEAKERS James Savina Jonathan Katz Gary Kushner Senior Vice President, General Partner, Cravath, Swaine Partner, Hogan Lovells LLP Counsel & Corporate Secretary, & Moore LLP The Kraft Heinz Company Dean Panos Brian Jorgensen Jamie Cain Partner, Jenner & Block LLP Partner, Jones Day Partner, Sutherland Asbill & Brennan LLP (The biographies of the speakers are presented at the end of this transcript. Further information about the Directors Roundtable can be found at our website, www.directorsroundtable.com.) TO THE READER General Counsel are more important than ever in history. Boards of Directors look increasingly to them to enhance financial and business strategy, compliance, and integrity of corporate operations. In recognition of our distinguished Guest of Honor’s personal accomplishments in his career and his leadership in the profession, we are honoring James Savina, General Counsel of Kraft Heinz, with the leading global honor for General Counsel. His address focuses on key issues facing the General Counsel of an international food corporation. The panelists’ additional topics include labor and employment; food industry regulation; M&A; managing risk with derivatives; and complex business litigation. The Directors Roundtable is a civic group which organizes the preeminent worldwide programming for Directors and their advisors, including General Counsel. Jack Friedman Directors Roundtable Chairman & Moderator Spring 2016 2 Copyright © 2016 Directors Roundtable WORLD RECOGNITION of DISTINGUISHED GENERAL COUNSEL Jim Savina is General Counsel and provided legal judgment to conducting inves- Corporate Secretary for The Kraft Heinz tigations and developed investigation-related Company. -

Usaa Fund Holdings Usaa Nasdaq-100 Index Fund

USAA FUND HOLDINGS As of June 30, 2021 USAA NASDAQ-100 INDEX FUND CUSIP TICKER SECURITY NAME SHARES/PAR/CONTRACTS MARKET VALUE 00507V109 ATVI ACTIVISION BLIZZARD INC 229,531.00 21,906,438.64 00724F101 ADBE ADOBE INC 141,201.00 82,692,953.64 007903107 AMD ADVANCED MICRO DEVICES 358,915.00 33,712,885.95 015351109 ALXN ALEXION PHARMACEUTICALS 65,289.00 11,994,242.19 016255101 ALGN ALIGN TECHNOLOGY INC 23,377.00 14,283,347.00 02079K107 GOOG ALPHABET INC - CLASS C 62,814.00 157,431,984.48 02079K305 GOOGL ALPHABET INC - CLASS A 58,382.00 142,556,583.78 023135106 AMZN AMAZON.COM, INC. 97,900.00 336,791,664.00 025537101 AEP AEP CO., INC. 147,626.00 12,487,683.34 031162100 AMGN AMGEN, INC. 169,722.00 41,369,737.50 032654105 ADI ANALOG DEVICES, INC. 108,951.00 18,757,004.16 03662Q105 ANSS ANSYS INC 25,745.00 8,935,059.70 037833100 AAPL APPLE, INC. 3,239,420.00 443,670,963.20 038222105 AMAT APPLIED MATERIALS, INC. 269,988.00 38,446,291.20 052769106 ADSK AUTODESK, INC. 65,007.00 18,975,543.30 053015103 ADP AUTOMATIC DATA PROCESSING 125,698.00 24,966,136.76 056752108 BIDU BAIDU INC 76,539.00 15,606,302.10 09062X103 BIIB BIOGEN INC 44,474.00 15,400,011.98 09857L108 BKNG BOOKING HOLDINGS INC 12,127.00 26,534,967.43 11135F101 AVGO BROADCOM INC 120,612.00 57,512,626.08 12514G108 CDW CDW CORP OF DELAWARE 41,416.00 7,233,304.40 126408103 CSX CSX CORP.