Notice of Annual Shareholders' Meeting

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Matching Gifts the Companies Listed Below Will Match Donations Their Employees Make to the Boy Scouts of America, Allowing Your

Matching Gifts The companies listed below will match donations their employees make to the Boy Scouts of America, allowing your gift to have twice the impact! Abbott Corn Products International ACCO CPC International Corp. ADM Discover Financial Services ADP, Inc. Eaton Vance Mgnt., Inc. Albertson's Ethicon, Inc. Allied Corp. Exxon/Mobil Altria Group, Inc. First Bank System, Inc. American Brands, Inc. FMC Corp. American Express Fort Dearborn Paper Co. American Gasket & Rubber Co. Fortune Brands American National Bank & Trust Co. of Chicago Gannett Inc. Arthur D. Raybin Assoc., Inc. Gary Williams Oil Product/The Piton Fdn. Astellas Pharma GATX Corporation AT&T General Electric Atlantic Richfield Gilman Paper Co. Avon Products GlaxoSmithKline B.F. Goodrich Co. Grainger, Inc. (3:1) Bank of America Gulf Western Industries, Inc. Barber-Coleman Co. H.J. Heinz Co. Fdn. Barnes & Roche, Inc. Haggerty Consulting Boeing North America Henry Crown & Co. BP Amoco Hewitt Associates, LLC Burlington Northern Hoffman-LaRoche, Inc. Burroughs Wellcome Co. HSBC-North America, Inc. Campbell Soup Co. IBM CAN Insurance IDS Cargill Illinois Tool Works, Inc. (3:1) CDW Corporation ING Equitable Life Chicago Tribune Foundation Investors Diversified Svcs., Inc. Citigroup John D. & Catherine T. MacArthur Fdn. Cigna Corp. John Hancock Mutual Life Ins. Co. Citicorp & Citibank Johnson & Higgins Colgate-Palmolive Co. Johnson & Johnson Corning Glass Works Jones Lang LaSalle Matching Gifts Continued Kemper Pittway Corp. Kids R Us Pizza Hut Kimberly-Clark Corp. PPG Industries, Inc. Kirkland & Ellis PQ Corp. Kraft Foods, Inc. Quaker Oats Leo Burnett Co., Inc. Quantum Chemical Corp. Lever Bros. Co. Ralston Purina Co. Life Iris Assn. -

Proxy Voting Guidelines Benchmark Policy Recommendations TITLE

UNITED STATES Proxy Voting Guidelines Benchmark Policy Recommendations TITLE Effective for Meetings on or after February 1, 2021 Published November 19, 2020 ISS GOVERNANCE .COM © 2020 | Institutional Shareholder Services and/or its affiliates UNITED STATES PROXY VOTING GUIDELINES TABLE OF CONTENTS Coverage ................................................................................................................................................................ 7 1. Board of Directors ......................................................................................................................................... 8 Voting on Director Nominees in Uncontested Elections ........................................................................................... 8 Independence ....................................................................................................................................................... 8 ISS Classification of Directors – U.S. ................................................................................................................. 9 Composition ........................................................................................................................................................ 11 Responsiveness ................................................................................................................................................... 12 Accountability .................................................................................................................................................... -

Executive Branch Personnel Public Financial Disclosure Report (OGE Form 278E)

Nominee Report | U.S. Office of Government Ethics; 5 C.F.R. part 2634 | Form Approved: OMB No. (3209-0001) (March 2014) Executive Branch Personnel Public Financial Disclosure Report (OGE Form 278e) Filer's Information Shanahan, Patrick Michael Deputy Secretary of Defense, Department of Defense Other Federal Government Positions Held During the Preceding 12 Months: None Names of Congressional Committees Considering Nomination: ● Committee on Armed Services Electronic Signature - I certify that the statements I have made in this form are true, complete and correct to the best of my knowledge. /s/ Shanahan, Patrick Michael [electronically signed on 04/08/2017 by Shanahan, Patrick Michael in Integrity.gov] Agency Ethics Official's Opinion - On the basis of information contained in this report, I conclude that the filer is in compliance with applicable laws and regulations (subject to any comments below). /s/ Vetter, Ruth, Certifying Official [electronically signed on 06/08/2017 by Vetter, Ruth in Integrity.gov] Other review conducted by /s/ Vetter, Ruth, Ethics Official [electronically signed on 06/08/2017 by Vetter, Ruth in Integrity.gov] U.S. Office of Government Ethics Certification /s/ Apol, David, Certifying Official [electronically signed on 06/08/2017 by Apol, David in Integrity.gov] 1. Filer's Positions Held Outside United States Government # ORGANIZATION NAME CITY, STATE ORGANIZATION POSITION HELD FROM TO TYPE 1 The Boeing Company Chicago, Illinois Corporation Senior Vice 3/1986 Present President 2 The University of Washington Seattle, -

Women Owned Small Business (Wosb) Program

WOMEN-OWNED SMALL BUSINESS (WOSB) PROGRAM Small Entity Compliance Guide to the WOSB Program December 2010 U.S. Small Business Administration A handbook for small businesses interested in learning about the WOSB Program, including eligibility requirements, Federal contracting opportunities, and how the program works in general. This document is published by the U.S. Small Business Who Should Read this Guide? Administration as the official All small businesses that believe they may be eligible to qualify compliance guide for small entities, as required by the as a woman owned small business or economically Small Business Regulatory disadvantaged woman owned small business should read this Enforcement Fairness Act of guide. 1996 (SBREFA). What is the purpose of this Guide? SBREFA requires that The purpose of the guide is to provide an easy to use summary agencies publish compliance of the purpose and requirements of the WOSB Program. guides for all rules with a However, to ensure compliance with the program requirements, significant small business you should also read the complete rule on which the program is impact. These guides must based. While SBA has summarized the provisions of the rule in explain in plain language this guide, the legal requirements that apply to the program are how the firms can comply governed by 13 C.F.R. part 127, ―The Women-Owned Small with the regulations. Business Federal Contract Assistance Procedures.‖ A copy of the rule is available on the U.S. Small Business Administration‘s (SBA‘s) website at www.sba.gov/wosb. This guide has no legal effect and does not create any legal A companion guide will be prepared for distribution to rights. -

Science Chicago Sep 2008—Aug 2009 FINAL REPORT

The world’s largesT science celeBraTion. science chicago sep 2008—aug 2009 Final REPORT Spearheaded by the Museum of Science and Science is essential for our Industry and in partnership with Chicago’s leading civic, academic, scientific, corporate collective health and well-being, and nonprofit institutions, Science Chicago began as a year-long collaborative initiative to: economic viability and our > Highlight science and technology achievements > Increase access to science learning future. As Chicagoans, we each experiences > Promote dialogue about the importance of have a stake in ensuring that science and technology in the Chicago region. our region continues to respect, From September 2008 — August 2009, citizens enjoyed unparalleled access to more than 1,200 support and value science. dynamic in-person science experiences and countless ways to explore and share science on the web. This report presents highlights of the Science Chicago initiative; for more detailed highlights please refer to the website. We are grateful to the following donors for their generous support of The John D. and Catherine Abbott Science Chicago: T. MacArthur Foundation The Boeing Company The Searle Funds at The Chicago Illinois Tool Works Inc. Community Trust Motorola Table of Contents > 1 About Science Chicago 3 Letters 4 Executive Director letter Board of Advisor Co-Chair letters Board of Advisors Vice-Chair letter Science Council Chair letter Leadership and Staff 8 Board of Advisors Science Council Leadership Committee Honorary Committee Staff Project -

Business Analytics

NICK, ’20 Business Analytics Business Analytics Experiential Learning SAMPLE COURSES: Throughout their undergraduate careers, students work in small teams to solve real-world problems from local companies. • BALT 3330: Database Structures and Queries Students get a briefing from company executives on the problem • BALT 4320: Data and Text Mining and work all semester on the project scope and deliverables. At • FINA 4330: Predictive Analytics the end of the semester, the student teams present the results to the company. • BALT 4350: Web Intelligence and Analytics Hackathon Benedictine hosts an annual Hackathon for current BenU students SIMILAR MAJORS: along with students from local community colleges. The event Finance, Marketing, Data Science offers students a chance to work collaboratively in small teams on an analytics and Big Data project. A more recent Hackathon was sponsored by IBM and teams explored Chicago crime data for their project. BUSINESS ANALYTICS ALUMNI Communication Skills Our alumni have built successful careers at Zurich All business analytics students have project-based classes which Insurance, Northwestern, Conversant, CDW, allow them to gain practical and valuable experience as well as Morningstar, UniFirst Corporation, Nicor Gas, learn how to communicate their findings effectively. Students Invesco, Ace Hardware, Dial America, Kraft Heinz learn how to present technical results through written and oral Company, FedEx, Crowe, First Midwest Bank, presentations. These skills are essential in a dynamic business and Chamberlain Group – just to name a few. world and are highly sought-after by employers. WHY STUDY BUSINESS ANALYTICS AT BENEDICTINE? The growing field of analytics is transforming the way companies do business. Analytics can help improve managerial and organizational decision making by transforming data into actions and business insights. -

2019 SEC Form 10-K (PDF File)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001-14905 BERKSHIRE HATHAWAY INC. (Exact name of Registrant as specified in its charter) Delaware 47-0813844 State or other jurisdiction of (I.R.S. Employer incorporation or organization Identification No.) 3555 Farnam Street, Omaha, Nebraska 68131 (Address of principal executive office) (Zip Code) Registrant’s telephone number, including area code (402) 346-1400 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbols Name of each exchange on which registered Class A Common Stock BRK.A New York Stock Exchange Class B Common Stock BRK.B New York Stock Exchange 0.750% Senior Notes due 2023 BRK23 New York Stock Exchange 1.125% Senior Notes due 2027 BRK27 New York Stock Exchange 1.625% Senior Notes due 2035 BRK35 New York Stock Exchange 0.500% Senior Notes due 2020 BRK20 New York Stock Exchange 1.300% Senior Notes due 2024 BRK24 New York Stock Exchange 2.150% Senior Notes due 2028 BRK28 New York Stock Exchange 0.250% Senior Notes due 2021 BRK21 New York Stock Exchange 0.625% Senior Notes due 2023 BRK23A New York Stock Exchange 2.375% Senior Notes due 2039 BRK39 New York Stock Exchange 2.625% Senior Notes due 2059 BRK59 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: NONE Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

2015 FACT BOOK Grainger Worldwide

Our Strengths at Work 2015 FACT BOOK Grainger Worldwide (AS OF 12/31/14) MRO MARKET MARKET BRANCHES DISTRIBUTION APPROXIMATE NUMBER SIZE* SHARE CENTERS OF CUSTOMERS SERVED IN 2014 United States > $126 billion 6 percent 377 19 1,400,000 Includes: Grainger Industrial Supply, E&R Industrial, Imperial Supplies, Techni-Tool, Zoro** Canada > $13 billion 8 percent 181 6 40,000 Includes: Acklands–Grainger Inc., WFS Enterprises Inc. Latin America > $18 billion 1 percent 34 3 54,000 Colombia, Costa Rica, Dominican Republic, Mexico, Panama, Peru, Puerto Rico*** Japan > $43 billion 1 percent 02 627,000 MonotaRO Co., Ltd. Asia > $109 billion < 1 percent 01 14,000 China, India Europe > $73 billion < 1 percent 89 2100,000 Fabory: Belgium, Czech Republic, France, Hungary, The Netherlands, Poland, Portugal, Romania, Slovakia Zoro Europe: Germany TOTAL > $380 billion 3 percent 681 33 More than 2,000,000 * Estimated MRO market size where Grainger has operations. The worldwide MRO market is approximately $595 billion. ** For segment reporting, Zoro is included in Other Businesses. *** Although Puerto Rico is a U.S. territory, the company manages this business as a part of Latin America. Contents FORWARD-LOOKING STATEMENTS The 2015 Fact Book contains statements that are not historical in AtaGlance.......................................... 1 nature but concern future results and business plans, strategies Strategy:Overview .................................... 2 and objectives, and other matters that may be deemed to be Strategy: Shareholder Value. 4 “forward-looking statements” under federal securities laws. Grainger Growth and Scale: Growth Drivers. 6 cannot guarantee that any forward-looking statement will be realized, GrowthandScale:Scale................................ 8 although Grainger does believe that its assumptions underlying its Multichannel: United States . -

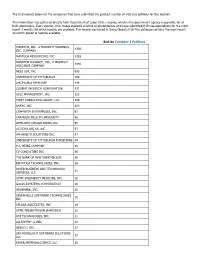

The H1B Records Below List the Companies That Have Submitted the Greatest Number of H1B Visa Petitions for This Location

The H1B records below list the companies that have submitted the greatest number of H1B visa petitions for this location. This information was gathered directly from Department of Labor (DOL) records, which is the government agency responsible for all H1B submissions. Every quarter, DOL makes available a listing of all companies who have submitted H1B visa applications for the most recent 3 months for which records are available. The records contained in Going Global's H1B Plus database contains the most recent 12-month period of records available. Sort by Company | Petitions MASTECH, INC., A MASTECH HOLDINGS, 4339 INC. COMPANY MASTECH RESOURCING, INC. 1393 MASTECH ALLIANCE, INC., A MASTECH 1040 HOLDINGS COMPANY NESS USA, INC. 693 UNIVERSITY OF PITTSBURGH 169 UHCP D/B/A UPMC MEP 144 COGENT INFOTECH CORPORATION 131 SDLC MANAGEMENT, INC. 123 FIRST CONSULTING GROUP, LLC 104 ANSYS, INC. 100 COMPUTER ENTERPRISES, INC. 97 CARNEGIE MELLON UNIVERSITY 96 INTELLECT DESIGN ARENA INC. 95 ACCION LABS US, INC. 63 HM HEALTH SOLUTIONS INC. 57 UNIVERSITY OF PITTSBURGH PHYSICIANS 44 H.J. HEINZ COMPANY 40 CV CONSULTING INC 36 THE BANK OF NEW YORK MELLON 36 INFOYUGA TECHNOLOGIES, INC. 36 BAYER BUSINESS AND TECHNOLOGY 31 SERVICES, LLC UPMC EMERGENCY MEDICINE, INC. 28 GALAX-ESYSTEMS CORPORATION 26 HIGHMARK, INC. 25 SEVEN HILLS SOFTWARE TECHNOLOGIES 25 INC VELAGA ASSOCIATES, INC 24 UPMC PRESBYTERIAN SHADYSIDE 22 DVI TECHNOLOGES, INC. 21 ALLEGHENY CLINIC 20 GENCO I. INC. 17 SRI MOONLIGHT SOFTWARE SOLUTIONS 17 LLC BAYER MATERIALSCIENCE, LLC 16 BAYER HEALTHCARE PHARMACEUTICALS, 16 INC. VISVERO, INC. 16 CYBYTE, INC. 15 BOMBARDIER TRANSPORTATION 15 (HOLDINGS) USA, INC. -

Annual Report & Accounts 2019

ANNUAL REPORT & ACCOUNTS 2019 WHO WE ARE WPP IS A CREATIVE TRANSFORMATION COMPANY. WE USE THE POWER OF CREATIVITY TO BUILD BETTER FUTURES FOR OUR PEOPLE, CLIENTS AND COMMUNITIES. STRATEGIC REPORT Covid-19 2 Chief Executive’s statement 3 At a glance 8 Our business model 9 Investment case 10 Where we are 12 The market 14 Our strategy 16 Delivering on our strategy 18 Jeremy Bullmore’s essay 48 Remembering two industry greats 50 Financial review 52 Sustainability 58 Assessing and managing our risks 80 CORPORATE GOVERNANCE Chairman’s letter 94 Our Board 96 Our Executive Committee 98 Corporate governance report 100 Sustainability Committee report 107 Nomination and Governance Committee report 108 Audit Committee report 109 Compliance with the Code 112 Compensation Committee report 114 FINANCIAL STATEMENTS Accounting policies 140 Consolidated financial statements 147 Notes to the consolidated financial statements 152 Company financial statements 182 Notes to the Company financial statements 185 Independent auditor’s report 187 ADDITIONAL INFORMATION Taskforce on Climate-related Financial Disclosures 196 Other statutory information 198 Five-year summary 201 Information for shareholders 202 To learn more see Financial glossary 204 wpp.com Where to find us 206 WPP ANNUAL REPORT 2019 1 STRATEGIC REPORT COVID-19 The coronavirus pandemic has touched all our lives. At WPP our first priority is the wellbeing of our people and doing what we can to limit the impact of the virus on society. Our second is continuity of service for our clients. We have thrown ourselves into achieving both objectives. To ensure the safety of employees and We have also modelled a range of revenue When we come through the current to help reduce transmission, we moved declines resulting from the pandemic and, situation, the world will have been changed to a global policy of managed remote in the most extreme scenarios tested, in ways that we cannot fully anticipate yet. -

Company Law of China, There Were a Great Deal of Companies

THE COMPANY LAW OF CHINA Zhao Youg Qing" INTRODUCTION The Standing Committee of the Eighth National People's Congress approved the Company Law of the People's Republic of China (Company Law) in its Fifth Session on December 29, 1993. On the same day, the President of the People's Republic of China promulgated it, and the Company Law of China came into force on July 1, 1994. The Company Law is important because for the first time in mainland China the organization and activity of business entities are regulated. For this reason, the Company Law is the foundation of modem socialist enterprises and the market economic system. Many new companies are expected to be established pursuant to the Company Law, and many existing enterprises such as state-owned enterprises, enterprises with foreign investment, and privately owned enterprises will be reorganized under the Company Law. This will allow for the establishment of modem enterprises with clearly defined ownership rights, with articulated boundaries regarding rights and duties between government and enterprises, and with the use of scientific management techniques. The promulgation of the Company Law is also a significant step toward China's compliance with international practices, especially in the field of Company Law. I. LEGISLATION GOVERNING COMPANIES BEFORE ENACTMENT OF THE COMPANY LAW Before the birth of the Company Law, China did have some laws and regulations with respect to companies.' These laws govern only certain * Zhao Yong Qing practices law in the PRC as an attorney with the Ningbo Municipal External Lawyer Office. He is also the Vice-Director of the Ningbo Conciliation Centre of CCPIT and a member of the Zhejiang Bar Association's Foreign Law Committee. -

Palmiter Judicial Schizophrenia in Shareholder Voting Cases.Pdf

+(,121/,1( Citation: 79 Iowa L. Rev. 485 1993-1994 Content downloaded/printed from HeinOnline (http://heinonline.org) Wed Jun 16 23:31:46 2010 -- Your use of this HeinOnline PDF indicates your acceptance of HeinOnline's Terms and Conditions of the license agreement available at http://heinonline.org/HOL/License -- The search text of this PDF is generated from uncorrected OCR text. -- To obtain permission to use this article beyond the scope of your HeinOnline license, please use: https://www.copyright.com/ccc/basicSearch.do? &operation=go&searchType=0 &lastSearch=simple&all=on&titleOrStdNo=0021-0552 Judicial Schizophrenia in Shareholder Voting Cases Dale A. Oesterle* and Alan R. Palmiter** TABLE OF CONTENTS 1. Shareholder Voting in Public Corporations: The Statutory Framework ............................ 495 A. W ho Votes? ..................................... 497 B. On W hat? ...................................... 501 C. How? ................................ ....... 507 D. A Glimpse at Recent Shareholder Voting ............... 512 II. A Theory of Shareholder Voting ....................... 514 A. The Relative Value of Voting Rights to Various Corporate Constituencies .................... 516 B. The Value of Voting as a Control or Monitoring Device ... 519 C. Mandatory Voting Rules: A Contradiction of the Contract Model? ............................ 521 D. The Role of State Courts: Enforcing the Basic Agreement . 523 III. Judicial Schizophrenia Toward Shareholder Voting ......... 526 A. Strict Judicial Scrutiny When the Board Interferes with the Voting Process: Schnell Review ................ 528 1. The Schnell Standard of Review .................. 529 2. The Definition of "Ministerial" Action ............. 537 3. The "Compelling Justifications" Exception for "Extreme Action"......................... 540 B. Board Action Beyond Schnell Review .................. 542 1. The Action/Inaction Distinction .................. 542 2. The Requirement of a Pending Voting Contest .....