PT Summarecon Agung Tbk (SMRA

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Skripsi Yunda

CHAPTER 1 INTRODUCTION 1.1 General Overview of Research Object 1.1.1 Light Rail Transit Figure 1.1 LRT Source : www.kabar3.com The Palembang Light Rail Transit (Palembang LRT) is an operational light rail transit system in Palembang, Indonesia which connects Sultan Mahmud Badaruddin II International Airport and Jakabaring Sports City. Starting construction in 2015, the project was built to facilitate the 2018 Asian Games and was completed in mid-2018, just a few months before the event. Costing Rp 10.9 trillion for construction, the system is the first operational light rail transit system in Indonesia, and utilizes trains made by local manufacturer PT.INKA. The system's only line has a total of 13 stations (6 operational). As Palembang was to host the 2018 Asian Games, the project was pushed to be completed before the event began. Groundbreaking for the project occurred on 1 November 2015, with state-owned company Waskita Karya being appointed as the primary contractor following the issuance of Presidential Regulation 116 of 2015 on Acceleration of Railway Train Operation in South Sumatera Province. The contract, which was signed in February 2017, was initially valued at Rp 12.5 trillion. Construction was scheduled for completion in February 2018, with commercial service beginning in May 2018. However, the completion date was moved to June 2018 with operations beginning in July, only one month before the Asian Games. A test run was done on 22 May 2018 and was inaugurated by President Joko Widodo on 15 July 2018. Operations for the LRT started on 1 August, several days before the Jakarta LRT began running, making it the first operational LRT system in the country. -

Trams Der Welt / Trams of the World 2021 Daten / Data © 2021 Peter Sohns Seite / Page 1

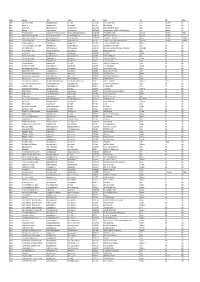

www.blickpunktstrab.net – Trams der Welt / Trams of the World 2021 Daten / Data © 2021 Peter Sohns Seite / Page 1 Algeria ... Alger (Algier) ... Metro ... 1435 mm Algeria ... Alger (Algier) ... Tram (Electric) ... 1435 mm Algeria ... Constantine ... Tram (Electric) ... 1435 mm Algeria ... Oran ... Tram (Electric) ... 1435 mm Algeria ... Ouragla ... Tram (Electric) ... 1435 mm Algeria ... Sétif ... Tram (Electric) ... 1435 mm Algeria ... Sidi Bel Abbès ... Tram (Electric) ... 1435 mm Argentina ... Buenos Aires, DF ... Metro ... 1435 mm Argentina ... Buenos Aires, DF - Caballito ... Heritage-Tram (Electric) ... 1435 mm Argentina ... Buenos Aires, DF - Lacroze (General Urquiza) ... Interurban (Electric) ... 1435 mm Argentina ... Buenos Aires, DF - Premetro E ... Tram (Electric) ... 1435 mm Argentina ... Buenos Aires, DF - Tren de la Costa ... Tram (Electric) ... 1435 mm Argentina ... Córdoba, Córdoba ... Trolleybus Argentina ... Mar del Plata, BA ... Heritage-Tram (Electric) ... 900 mm Argentina ... Mendoza, Mendoza ... Tram (Electric) ... 1435 mm Argentina ... Mendoza, Mendoza ... Trolleybus Argentina ... Rosario, Santa Fé ... Heritage-Tram (Electric) ... 1435 mm Argentina ... Rosario, Santa Fé ... Trolleybus Argentina ... Valle Hermoso, Córdoba ... Tram-Museum (Electric) ... 600 mm Armenia ... Yerevan ... Metro ... 1524 mm Armenia ... Yerevan ... Trolleybus Australia ... Adelaide, SA - Glenelg ... Tram (Electric) ... 1435 mm Australia ... Ballarat, VIC ... Heritage-Tram (Electric) ... 1435 mm Australia ... Bendigo, VIC ... Heritage-Tram -

ECC News, April - June 2017 1 I Hope to Live up to the Confidence That You Have Put in Place with Me

ECC News, April - June 2017 1 I HOPE TO LIVE UP TO THE CONFIDENCE THAT YOU HAVE PUT IN PLACE WITH ME amazing qualities of making use of It’s fortunate today for me that out of forward in digital, smart world, defence, special company. It has been a leader in and unimaginable. All I can say is thank every working minute to make every day others you have chosen me to step into etc. It’s a very special company and you technologies. It has done unique projects you very much for having reposed your meaningful towards the organisation’s the new role as CEO & MD of L&T. It is have correctly coined the statement that & makes unique products. trust and faith on me. I have absolutely no growth is a superb way towards creating not only inheriting the great set of assets, “We make things that make India doubt that your active mentorship across We been in existence for over 79 years. value. many of which have been created by you, proud”. the last decade and more has resulted in Since the time we have gone public, but a great brand and a terrific feeling me being what I am today and many of You have taken Larsen & Toubro from a The value systems that have been we have paid dividends every year. Each that I will be working with a fantastic set your facets, habits and positivity, to the good engineering company to one of the continuously stressed and laid great year’s dividend amount being higher of colleagues, peers and stakeholders. -

Creating Youthquake 4.0 Through Social Media for Optimizing the Use of Mass Rapid Transportation in Urban Areas

http://ejournal.stipjakarta.ac.id/index.php/pcsa Creating Youthquake 4.0 Through Social Media for Optimizing The Use of Mass Rapid Transportation in Urban Areas Melkisedek N. A. Kamagie1, Miftahul Rahma2, Syarifah Salsabi3, Purnama N.F. Lumban Batu4 1, 2, 3 Prodi Ketatalaksanaan Angkutan Laut dan Kepelabuhanan 1, 2, 3 Sekolah Tinggi Ilmu Pelayaran, Jakarta Jl. Marunda Makmur No. 1 Cilincing, Jakarta Utara. Jakarta 14150 Abstract This paper aimed to find out way millennials could optimize the use of Mass Rapid Transportation in urban areas through social media. It was focused on a social change that could be generated by millennials. Thus, it adopted qualitative method by using survey results from other researchers work related to Mass Rapid Transportation, millennials and social media use. The survey results were analyzed to see the relationship between millennials and social media for optimizing the use Mass Rapid Transportation by urban society. The result showed that the use of Mass Rapid Transportation could be optimized by creating Youthquake 4.0. It is a social change resulted from millennials’ action in changing people perception through social media. This could be done through the most use social media platforms, such as Facebook and Instagram. They have features, such as, captions, pictures, and hashtags that are proven could influence people’s perceptions. Copyright © 2019, Prosiding Seminar Hasil Penelitian Dosen Key words: youthquake 4.0, millennials, social media, Mass Rapid Transportation Permalink/ DOI : https://doi.org/10.36101/pcsa.v1i1.87 1. INTRODUCTION This problem can be improved by changing the Transportation development is a vital condition. -

THE ROLE of HISTORICAL SCIENCES on the DEVELOPMENT of URBAN PUBLIC TRANSPORTATION in 21St CENTURY INDONESIA

THE ROLE OF HISTORICAL SCIENCES ON THE DEVELOPMENT OF URBAN PUBLIC TRANSPORTATION IN 21st CENTURY INDONESIA 1 Muhammad Luthfi Lazuardi, 2 Moses Glorino Rumambo Pandin 1 2 Faculty of Humanities, Airlangga University [email protected]; [email protected] ABSTRACT Public transportation is one of the most critical needs for a city, including in Indonesia. The fast and dynamic movement of society makes public transportation expected to accommodate the needs of city residents to move more quickly and efficiently. Available public transport can also reduce congestion because many city residents are switching from their private vehicles. Many cities in Indonesia are competing to develop their public transportation to modernize the life of the town. Problems will arise if the city government does not learn from history in planning the development of public transport in the city. This study aims to examine the role of historical science in the development of urban public transportation in Indonesia. The method used in this research is descriptive-qualitative through literature review by analyzing data and information according to the topic of the research topic. The data and information are sourced from 20 journal articles and five credible online portal sites with published years between 2019-2021. The result of this study is the role of historical science in the development of urban public transportation in Indonesia as a reference for city governments to reorganize their transportation systems in the future. This research has research limitations on the development of urban public transport in Indonesia in the 21st century. -

Copy of 20191114 DEAKIN COLLEGE AGENT LIST.Xlsx

Country Agent name Email Website Phone Address City State Postcode Albania Bridge Blue Pty Ltd ‐ Albania [email protected] Not Provided 377 45 255 988 K2‐No.6 Rruga Naim Frashëri Tiranë Not Provided 1001 Albania Study Care ‐ Tirana [email protected] www.studycate.al Not Provided Abdyl Frasheri Street Tirana Not Provided 1000 Algeria MasterWise Algeria algiers@master‐wise.com www.master‐wise.com 213 021 27 4999 116 Boulevard Des Martyrs el Madania Algiers Not Provided 16075 Argentina ACE Australia info@ace‐australia.com www.ace‐australia.com 54 911 38195291 Av Sargento Cayetano Beliera 3025 Edificio M3 2P Parque Austral Pilar Buenos Aires 1629 Argentina CW International Education [email protected] http://www.cwinternationaleducation.com 54 11 4801 0867 J.F. Segui 3967 Piso 6 A (1425) Buenos Aires Not Provided C1057AAG Argentina Latino Australia Education ‐ Buenos Aires [email protected] http://www.latinoAustralia.com 54 11 4811 8633 Riobamba 972 4‐C / Capital Federal Buenos Aires Not Provided 1618 Argentina Latino Australia Education ‐ Mendoza [email protected] www.latinoAustralia.com 54 261 439 0478 R. Obligado 37 ‐ Oficina S3 Godoy Cruz Mendoza Not Provided Not Provided Argentina TEDUCAustralia ‐ Buenos Aires [email protected] www.teducAustralia.com Not Provided 25 de Mayo 252 2‐B Vicente Lopez Provincia de Buenos Aires Buenos Aires Not Provided Not Provided Australia 1st Education Australia Pty Ltd [email protected] www.1stedu.com.au 08 7225 8699 Unit 4, Level 12, -

LRT (Light Rail Transit / Lintas Rel Terpadu) Adalah Salah Satu

CHAPTER I INTRODUCTION 1.1 Background “LRT (Light Rail Transit / Lintas Rel Terpadu) adalah salah satu transportasi umum jenisnya kereta yang merupakan bagian prasarana dan sarana dalam sistem transportasi umum,” (Setijowarno, 2019). It means LRT is one of the public transportations that is similar with train and it is the part of infrastructure and facilities in the public transportation system. LRT consists of three carriages that capable to carry more than 600 passengers. In Indonesia, LRT is only available in two cities, Jakarta and Palembang. Nevertheless, until now the LRT only operates in Palembang. LRT is the public transportation that is useful for Palembang people. Initially, the construction of Light Rail Transit (LRT) in Palembang, South Sumatra was carried out not only to support the biggest sport event in Asia, the 18th Asian Games but also LRT is intended as the alternative transportation for people in their daily activity so that it can reduce the congestion and pollution due to the large number of motorized vehicles on the highway (Suryanti, 2018). It means that the construction of LRT is not only as the supporter of 18th Asian Games but also as the alternative to reduce the increase of traffic density in Palembang city. In Palembang, LRT starts operating on August 2018. When the first operating, LRT only has 6 stations. In the line with the expansion in public interest of LRT, this time LRT station is getting into 13 stations. LRT has 13 stations in some strategic points. Those stations are Sultan Mahmud Badaruddin II International Airport, Asrama Haji, Punti Kayu, RSUD, Garuda Dempo, Demang, Bumi Sriwijaya, Dishub, Cinde, Ampera, Polresta, Jakabaring and DJKA Station. -

Asia Urban Transport & Railway Engineering

ASIA URBAN TRANSPORT & RAILWAY ENGINEERING KOREA Osong (HSL): Independent verification Osong depot EGISMORE THAN 50 YEARS SERVING access signalling design THE URBAN TRANSPORT AND RAILWAY ENGINEERING SECTOR CHINA Macao (LRT): EPCM and technical assistance for the implementation of the 1st phase of Macao LRT system Wuhan-Guangzhou (HSL): Supervision of construction works on the Wuhan-Guangzhou high-speed line China (LRT Lines): Study of whole life cycle safe operation control & management system for modern tramway China (LRT lines): Consultancy services for tramway INDIA express design URBAN PROJECTS Chennai (MRT): General consultant, phase I Kolkata (MRT): General consultant Mumbai (MRT): General consultant on line 3 Nagpur (MRT): General consultant PHILIPPINES Pune (MRT): General consultant Kochi (MRT): Detail design consultant (viaducts and stations) Manila (LRT): Extension, independent consultant Delhi (MRT): Detail design consultant RAILWAY PROJECTS New Delhi (Freight Corridor): EMP4 contract - Design consultant SINGAPORE Delhi-Meerut (Rapid Rail Transit System): Detail design consultant Tuas (MRT): Trackwork design for Tuas-West depot extension Singapore (MRT): Trackbed and fastener system condition DELIVERED LOCALLY assessment - SMRT THAILAND Singapore (MRT): Consultancy services for catenary system - LTA Pink Line (monorail): Project consultant Orange Line (MRT): Project implementation consultant for east section Blue Line (MRT): Mechanical & electrical supervision consultant INDONESIA Green Line (MRT): Detailed design of viaduct -

Chapter 3. Highlighted Projects and Their Progress by Country

Chapter 3 Highlighted Projects and Their Progress by Country June 2019 This chapter should be cited as ERIA (2019), ‘Highlighted Projects and Their Progress by Country’, in Fujisawa, T., J. Wada and M. LoCastro (eds.), 2018 Progress Survey Report of Infrastructure Projects in CADP 2. ERIA Research Project Report 2018-02, Jakarta: ERIA, pp.15-66. Chapter 3 Highlighted Projects and Their Progress by Country The following eight sections will provide a high-level overview of development progress in selected Association of Southeast Asian Nations (ASEAN) member states since 2017. Each country will be evaluated based on the consideration of individual projects as well as each country’s master plan(s), if extant. The following country overview highlights projects according to their tier classification, when applicable. 1. Cambodia 1.1 Policy Trend(s): Industrial, Transportation, and Economic Master Plans The Government of Cambodia has established a plan to maintain sustainable, inclusive, and high economic growth through economic diversification, strengthened competitiveness, and the promotion of productivity. The government’s vision consists of three goals: (i) Increase the gross domestic product (GDP) share of the industrial sector from 24.1% in 2013 to 30.0% by 2025, and that of the manufacturing sector from 15.5% in 2013 to 20% in 2025. (ii) Diversify goods exports by increasing the export of non-textile goods to 15% of all exports and that of processed agricultural products to 12% of all exports by 2025. (iii) Encourage the formal registration of 80% of small enterprises and 95% of medium-sized enterprises, and ensure that 50% of small enterprises and 70% of medium-sized enterprises have proper accounts and balance sheets. -

Palembang City, Indonesia–

Assessment of Urban Mobility using the Sustainable Urban Transport Index – PALEMBANG CITY, INDONESIA– Dr. Melawaty Agustien, S.Si., M.T. 2020 SUSTAINABLE URBAN TRANSPORT INDEX | ESCAP 2020 i TABLE OF CONTENTS I.1 General description ................................................................................................ 2 I.2 Demography .......................................................................................................... 3 I.2.1 Population and Employment ..................................................................... 3 I.2.2 Household Expenditure ............................................................................ 5 I.2.3 System of Regional Account .................................................................... 6 I.3 Road Network Data ............................................................................................... 7 II.1 Number of vehicles .............................................................................................. 12 II.2 Transportation Network in Palembang City ........................................................ 14 II.2.1 Public Transportation Infrastructure ....................................................... 17 II.3 Master plan of transportation in Palembang ........................................................ 21 II.3.1 Construction of the passenger terminal .................................................. 21 II.3.2 Improvement of Public Transportation Services .................................... 22 II.3.3 Railway Network System ...................................................................... -

1-11 Contents, Director's Note, Overview-2012Ver Rev.Indd

UNCRD Annual Repo r t 2012 UNCRD Annual Report United Nations Centre for Regional Development (UNCRD) 2012 Nagono 1-47-1, Nakamura-ku, Nagoya 450-0001, JAPAN Tel : (+81-52) 561-9377 Fax: (+81-52) 561-9374/9375 E-mail: [email protected] Homepage: http://www.uncrd.or.jp/ UNCRD Africa Office UN Complex, Gigiri, Block M, Middle Level P.O. Box 30218, 00100 Nairobi, KENYA Tel : (+254-20) 7624374/7624375 Fax: (+254-20) 7624480 E-mail: [email protected] UNCRD Latin America and the Caribbean Office Calle 113 No. 7-45, Edificio Teleport Business Park, Torre B, Of. 606 Bogotá, COLOMBIA Tel : (+57-1) 629-2808/2819 Fax: (+57-1) 629-2785 E-mail: [email protected] Printed on recycled paper UNCRD Annual Report 2012 © United Nations Centre for Regional Development ISSN - Mission Statement of UN DESA The Department of Economic and Social Aff airs of the United Nations Secretariat is a vital interface between glob- al policies in the economic, social, and environmental spheres and national action. The Department works in three main interlinked areas: (a) it compiles, generates, and analyses a wide range of economic, social, and environmen- tal data and information on which States Members of the United Nations draw to review common problems and to take stock of policy options; (b) it facilitates the negotiations of Member States in many intergovernmental bodies on joint courses of action to address ongoing or emerging global challenges; and (c) it advises interested Governments on the ways and means of translating policy frameworks developed in United Nations conferences and summits into programmes at the country level and, through technical assistance, helps build national capacities. -

KPPIP 2015 15-March 2016 Report

Table of Contents Table of Contents i Acknowledgement ii Chapter 1 Committee for Acceleration of Priority Infrastructure Delivery 1 Chapter 2 Progress of Infrastructure Development in Indonesia 7 Chapter 3 Achievement of KPPIP 19 Chapter 4 Latest Updates on KPPIP Priority Projects 30 Chapter 5 KPPIP’s Plan for the Future 101 Glossary 108 List of Figures 111 KPPIP’s Report of August 2015 – December 2015 KPPIP’s Report of August 2015 – December 2015 i FOREWORD As a country grows, the growth is inevitably reflected in its peoples’ changing needs, and such a change following the issuance of Presidential Regulation and Presidential Instruction on national strategic projects, correlates with demand for infrastructure, ranging from fundamental infrastructure such as the availability KPPIP was given additional responsibility to safeguard the delivery of 225 projects and construction of the of clean water to construction of hub ports that play a vital role in improving the country’s domestic and selected power plants of 35,000 MW, and conducted evaluation on the proposal for future national strategic international connectivity. projects. Aside from such a change, a nation’s economic growth is also closely related to the development of To ensure an effective project monitoring, KPPIP built a monitoring system using integrated information infrastructure. Building appropriate and effective infrastructure offers significant multiplier effects ranging technology for the use of KPPIP and other relevant parties in the second semester of 2015. The system from employment of manpower for construction process until operation, an increase in investment by both provides a dashboard for decision-making and may be used to monitor the progress of a project, reduce domestic and foreign investors to an improved competitiveness.