Merger Between Cable Companies UPC and Ziggo Should Be

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Broadband Services and Local Loop Unbundling in the Netherlands Nico Van Eijk, Institute for Information Law

Broadband Services and Local Loop Unbundling in the Netherlands Nico van Eijk, Institute for Information Law This article describes the availability of broadband services in the ABSTRACT Netherlands. This particularly concerns broadband services for the consumer/end user such as access to the Internet. We will first discuss the new telecommunications act before dealing with current market relations and regulation of the (until 15 December 2000). This means telecommunications sector. This is followed by a description of the most significant deci- that — in accordance with the Euro- sions of the independent supervisory body, the Independent Post and Telecommunications pean directives — KPN has special obli- Authority, as related to broadband services. gations concerning interconnection and other forms of special access to its net- work. KPN is also responsible for pro- viding universal service (primarily he Netherlands has always been keen to take the traditional voice telephony service). On the expiration of the T lead in liberalizing the telecommunications sector. statutorily prescribed period of two years, whether KPN is still Nevertheless, it was not until the end of 1998 that Dutch leg- in the same position will again need to be established. It is islation satisfied all the underlying principles of European implicitly assumed that the operators of broadcasting networks telecommunications regulations. (the legal term for cable television networks) have significant This does not diminish the fact that, in the previous peri- market power regarding the transmission of programming. od, important liberalizations had occurred. In 1996–1997 all The market position of KPN is thus also at issue in regard to restrictions to offering telecommunications services — with the question of whether local differences in rates for public voice the exception of voice telephony — were discontinued. -

TV Channel Distribution in Europe: Table of Contents

TV Channel Distribution in Europe: Table of Contents This report covers 238 international channels/networks across 152 major operators in 34 EMEA countries. From the total, 67 channels (28%) transmit in high definition (HD). The report shows the reader which international channels are carried by which operator – and which tier or package the channel appears on. The report allows for easy comparison between operators, revealing the gaps and showing the different tiers on different operators that a channel appears on. Published in September 2012, this 168-page electronically-delivered report comes in two parts: A 128-page PDF giving an executive summary, comparison tables and country-by-country detail. A 40-page excel workbook allowing you to manipulate the data between countries and by channel. Countries and operators covered: Country Operator Albania Digitalb DTT; Digitalb Satellite; Tring TV DTT; Tring TV Satellite Austria A1/Telekom Austria; Austriasat; Liwest; Salzburg; UPC; Sky Belgium Belgacom; Numericable; Telenet; VOO; Telesat; TV Vlaanderen Bulgaria Blizoo; Bulsatcom; Satellite BG; Vivacom Croatia Bnet Cable; Bnet Satellite Total TV; Digi TV; Max TV/T-HT Czech Rep CS Link; Digi TV; freeSAT (formerly UPC Direct); O2; Skylink; UPC Cable Denmark Boxer; Canal Digital; Stofa; TDC; Viasat; You See Estonia Elion nutitv; Starman; ZUUMtv; Viasat Finland Canal Digital; DNA Welho; Elisa; Plus TV; Sonera; Viasat Satellite France Bouygues Telecom; CanalSat; Numericable; Orange DSL & fiber; SFR; TNT Sat Germany Deutsche Telekom; HD+; Kabel -

Global Pay TV Operator Forecasts

Global Pay TV Operator Forecasts Table of Contents Published in October 2016, this 190-page electronically-delivered report comes in two parts: A 190-page PDF giving a global executive summary and forecasts. An excel workbook giving comparison tables and country-by-country forecasts in detail for 400 operators with 585 platforms [125 digital cable, 112 analog cable, 208 satellite, 109 IPTV and 31 DTT] across 100 territories for every year from 2010 to 2021. Forecasts (2010-2021) contain the following detail for each country: By country: TV households Digital cable subs Analog cable subs Pay IPTV subscribers Pay digital satellite TV subs Pay DTT homes Total pay TV subscribers Pay TV revenues By operator (and by platform by operator): Pay TV subscribers Share of pay TV subscribers by operator Subscription & VOD revenues Share of pay TV revenues by operator ARPU Countries and operators covered: Country No of ops Operators Algeria 4 beIN, OSN, ART, Algerie Telecom Angola 5 ZAP TV, DStv, Canal Plus, Angola Telecom, TV Cabo Argentina 3 Cablevision; Supercanal; DirecTV Australia 1 Foxtel Austria 3 Telekom Austria; UPC; Sky Bahrain 4 beIN, OSN, ART, Batelco Belarus 2 MTIS, Zala Belgium 5 Belgacom; Numericable; Telenet; VOO; Telesat/TV Vlaanderen Bolivia 3 DirecTV, Tigo, Entel Bosnia 3 Telemach, M:Tel; Total TV Brazil 5 Claro; GVT; Vivo; Sky; Oi Bulgaria 5 Blizoo, Bulsatcom, Vivacom, M:Tel, Mobitel Canada 9 Rogers Cable; Videotron; Cogeco; Shaw Communications; Shaw Direct; Bell TV; Telus TV; MTS; Max TV Chile 6 VTR; Telefonica; Claro; DirecTV; -

Master Working Paper 2018/1 Eline Vancraybex

Maastricht Centre for European Law Master Working Paper 2018/1 Eline Vancraybex Innovation in the EU Merger Control Battlefield: In Search for Best Practices All rights reserved No part of this paper may be reproduced in any form Without the permission of the author(s) The MCEL Master Working Paper series seeks to give excellent Master students the opportunity to publish their final theses and to make their work accessible to a wide audience. Those wishing to submit papers for consideration are invited to send work to: [email protected] Our submission guidelines and further information are available at: http://www.maastrichtuniversity.nl/web/Institutes/MCEL/Publications1/MasterWorkingPapers.htm © ELINE VANCRAYBEX Published in Maastricht, February 2018 Faculty of Law Maastricht University Postbox 616 6200 MD Maastricht The Netherlands This paper is to be cited as MCEL Master Working Paper 2018/1 2 Table of Contents Maastricht Centre for European Law 1 2018/1 1 1. Introduction 4 2. The Innovation Concept 6 2.1. Types of Innovation 6 2.1.1. A General Definition 6 2.1.2. Sustaining vs Disruptive Innovation 6 2.2. Legal Perspective: Innovation in the EU (Non-)Horizontal Merger Guidelines 8 2.3. Economic Perspective: The Link between Innovation and Competition 9 2.4. Different Markets 11 2.5. Determinants of Innovation 11 2.5.1. Research and Development 12 2.5.2. Patents 12 2.5.3. Market Share 13 2.6. Complexity of Assessing Innovation Effects 13 3. The EU Approach 14 3.1. Assessment of Negative Effects 14 3.1.1. Framework 14 3.1.2. -

Internal Memorandum

Non-confidential version text which has been removed from the confidential version is marked [business secrets] or [XXX] as the case may be Case handlers: Tormod S. Johansen, Brussels, 11 July 2007 Runa Monstad Tel: (+32)(0)2 286 1841/1842 Case No: 13114 e-mail: [email protected] Event No: 436086 By fax (+47 22 83 07 95) and courier Viasat AS Care of: BA-HR Advokatfirma Att: Mr. Helge Stemshaug Postboks 1524 Vika N-0117 Oslo Norway Dear Mr. Stemshaug, Case COM 13114 (former case COM 020.0173) - Viasat/TV2/Canal Digital Norge (please quote this reference in all correspondence) I refer to the application of Viasat AS dated 30 July 2001, pursuant to Article 3 of Chapter II of Protocol 41 to the Agreement between the EFTA States on the Establishment of a Surveillance Authority and a Court of Justice (hereinafter “Surveillance and Court Agreement”), regarding alleged infringements of Articles 53 and 54 of the Agreement on the European Economic Area (hereinafter “EEA Agreement” or “EEA”) by TV2 Gruppen AS and Canal Digital Norge AS. By this letter I inform you that, pursuant to Article 7(1) of Chapter III of Protocol 4 to the Surveillance and Court Agreement,2 the Authority considers that, for the reasons set out below and on the basis of the information in its possession, there are insufficient grounds for acting on your complaint. 1 As applicable before the entry into force of the Agreement amending Protocol 4 of 24 September 2004 (e.i.f. 20.5.2005). 2 As applicable after the entry into force of the Agreement amending Protocol 4 of 3 December 2004 (e.i.f. -

Analysys Mason Report on Developments in Cable for Superfast Broadband

Final report for Ofcom Future capability of cable networks for superfast broadband 23 April 2014 Rod Parker, Alex Slinger, Malcolm Taylor, Matt Yardley Ref: 39065-174-B . Future capability of cable networks for superfast broadband | i Contents 1 Executive summary 1 2 Introduction 5 3 Cable network origins and development 6 3.1 History of cable networks and their move into broadband provision 6 3.2 The development of DOCSIS and EuroDOCSIS 8 4 Cable network elements and architecture 10 4.1 Introduction 10 4.2 Transmission elements 10 4.3 Description of key cable network elements 13 4.4 Cable access network architecture 19 5 HFC network implementation, including DOCSIS 3.0 specification 21 5.1 Introduction 21 5.2 HFC performance considerations 21 5.3 Delivery of broadband services using DOCSIS 3.0 24 5.4 Limitations of DOCSIS 3.0 specification 27 5.5 Implications for current broadband performance under DOCSIS 3.0 30 6 DOCSIS 3.1 specification 33 6.1 Introduction 33 6.2 Reference architecture 34 6.3 PHY layer frequency plan 35 6.4 PHY layer data encoding options 37 6.5 MAC and upper layer protocol interface (MULPI) features of DOCSIS 3.1 39 6.6 Development roadmap 40 6.7 Backwards compatibility 42 6.8 Implications for broadband service bandwidth of introducing DOCSIS 3.1 43 6.9 Flexibility of DOCSIS 3.1 to meet evolving service demands from customers 47 6.10 Beyond DOCSIS 3.1 47 7 Addressing future broadband growth with HFC systems – expanding DOCSIS 3.0 and migration to DOCSIS 3.1 49 7.1 Considerations of future broadband growth 49 7.2 Key levers for increasing HFC data capacity 52 7.3 DOCSIS 3.0 upgrades 53 7.4 DOCSIS 3.1 upgrades 64 7.5 Summary 69 Ref: 39065-174-B . -

12/FINAL Working Party on Telecommunication And

Unclassified DSTI/ICCP/TISP(2005)12/FINAL Organisation de Coopération et de Développement Economiques Organisation for Economic Co-operation and Development 07-Apr-2006 ___________________________________________________________________________________________ English - Or. English DIRECTORATE FOR SCIENCE, TECHNOLOGY AND INDUSTRY COMMITTEE FOR INFORMATION, COMPUTER AND COMMUNICATIONS POLICY Unclassified DSTI/ICCP/TISP(2005)12/FINAL Working Party on Telecommunication and Information Services Policies MULTIPLE PLAY: PRICING AND POLICY TRENDS English - Or. English JT03207142 Document complet disponible sur OLIS dans son format d'origine Complete document available on OLIS in its original format DSTI/ICCP/TISP(2005)12/FINAL FOREWORD This report was presented to the Working Party on Telecommunication and Information Services Policies in December 2005 and was declassified by the Committee for Information, Computer and Communications Policy in March 2006. The report was prepared by Mr. Yoshikazu Okamoto and Mr. Taylor Reynolds of the OECD’s Directorate for Science, Technology and Industry. It is published under the responsibility of the Secretary- General of the OECD. © OECD/OCDE 2006 2 DSTI/ICCP/TISP(2005)12/FINAL TABLE OF CONTENTS MAIN POINTS.............................................................................................................................................. 6 Regulatory issues........................................................................................................................................ 7 INTRODUCTION -

NGN in the Netherlands: the Market and Regulation Geneva, 8 September 2008

NGN in The Netherlands: the market and regulation Geneva, 8 September 2008 Jilles van den Beukel Chief Regulatory Officer KPN +31653420780 [email protected] Business case of NGN is not proven yet; Legacy regulation has high impact on business case It should not be automatically extended to NGN 2 Market developments 3 Dynamic market situation 18% Mobile-only households 75% Broadband penetration High VoIP penetration The Netherlands is ‘competition champion’ of Europe Existing operators are consolidating On top of existing service providers, Fibre to the home operators are emerging new entrants with other business models Amsterdam 4 Marketshares The NL TV Internet Voice Cable Cable Cable VOIP Kabel 83% 40% 19% 6% 0% 44% 16% 60% ADSL DVB-T IP TV VOIP POTS KPN Internet 11% 16% 5% Other TV Other Internet Other VOIP Other (a.o. satellite) (ADSL) (DSL-Providers) Market Shares Consumer Market in % (indicative/management estimates) 5 Tariffs in the Multiplay market Telfort Casema UPC € 19,95 € 69,95 € 60,00 tot 20 Mb/s 20 Mb/s 24 Mb/s € 9,95 voice incl Voice include voice Tele2 Compleet Tele2 Compleet BelGratisAltijd Internetsnelheid Tot 20Mb/s Tot 20Mb/s Bellen Bellen tegen voordelige Tele2 tarieven. GRATIS naar vaste nummers in Nederland Actie € 14,95 p/mnd € 24,95 p/mnd eerste 6 maanden Abonnement € 29,95 p/mnd € 39,95 p/mnd 6 Next steps: FttC and FttH? 7 Change of mindshift KPN • Market developments: – High churn to cable; – Television is crucial for Multiplay; – IP-technology Lead to Upgrade of the network: Business Model: – VDSL -

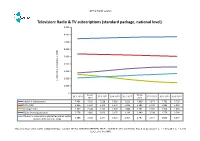

Television: Radio & TV Subscriptions (Standard Package, National Level) 9.000

OPTA Public version Television: Radio & TV subscriptions (standard package, national level) 9.000 8.000 7.000 6.000 5.000 4.000 3.000 2.000 number of subscriptionsof number x 1,000 1.000 0 31-12- 31-12- 30-9-2010 31-3-2011 30-6-2011 30-9-2011 31-3-2012 30-6-2012 30-9-2012 2010 2011 Total RTV subscriptions 7.454 7.500 7.538 7.590 7.623 7.669 7.677 7.702 7.730 Total cable 5.366 5.334 5.291 5.271 5.226 5.182 5.129 5.083 5.033 Analogue cable 2.587 2.448 2.265 2.095 1.888 1.741 1.592 1.504 1.434 Digital (+ analogue) cable 2.778 2.886 3.026 3.176 3.338 3.440 3.538 3.579 3.599 Other RTV subscriptions (digital terrestrial, digital 2.088 2.166 2.247 2.319 2.397 2.487 2.547 2.620 2.697 satellite, IPTV over DSL, FttH) Based on figures from CAIW, CANALDIGITAAL, COGAS, DELTA, KPN, REGGEFIBER, TELE2, T-MOBILE, UPC and ZIGGO. Based on questions 5_A_1_1 through 5_A_1_5 and 5_A_1_8 of the SMM. OPTA Public version Television: Churn based on radio & TV subscriptions (standard package, national level) 5% 4% 3% 2% % of number%of subscriptions 1% 0% 30-9-2010 31-12-2010 31-3-2011 30-6-2011 30-9-2011 31-12-2011 31-3-2012 30-6-2012 30-9-2012 Adds 3,1% 3,2% 3,1% 3,0% 3,3% 3,9% 3,8% 3,3% 3,2% Disconnects 2,7% 2,5% 2,8% 2,7% 2,9% 3,3% 3,4% 3,1% 3,0% Based on figures from CAIW, CANALDIGITAAL, COGAS, DELTA, KPN, REGGEFIBER, TELE2, UPC and ZIGGO. -

Rikstv Test Specification

RiksTV Test Specification for Integrated Receiver Decoders - 2 - RiksTV Test specification ver. 2.0 1 Document History......................................................................................................................................... 4 2 References.................................................................................................................................................... 4 3 Signing of test report ................................................................................................................................... 5 3.1 Test item ................................................................................................................................................ 6 4 Test Specification for RiksTV tests .............................................................................................................. 7 4.1 Task 4: IRD interfaces and hardware requirements .............................................................................. 7 Task 4:1 Terrestrial tuner and demodulator – NorDig requirements ........................................................ 7 Task 4:2 Extended frequency range and 7/8MHz raster .......................................................................... 7 Task 4:3 Support for 7 and 8MHz signal Bandwidth .............................................................................. 8 Task 4:4 RF output power source (5V 50mA) ........................................................................................ 8 Task 4:5 HDMI output.......................................................................................................................... -

Opmaak 1 01-05-19 17:11 Pagina 1

Evolve_2_QSG_UK_URC7125_711733_RDN1010519.qxp_Opmaak 1 01-05-19 17:11 Pagina 1 ESPAÑOL ENGLISH HOW TO SET UP YOUR REMOTE HOW TO SET UP YOUR REMOTE A – SIMPLESET A – SIMPLESET KEY TABLE SimpleSet is a quick and easy way of setting up the remote to control the most popular brands of To set up your device ENGLISH each device type with only a few key presses, typically in under a minute per device. The first step is to select which device you are going to set up. The following is a list of Device Modes on the 1. Turn on your device (not on standby) and point the OFA remote towards it. remote control, and the Device types that can be set up on that mode: MAGIC: Used to set up POWER: 2. Hold down MAGIC until the LED under the device blinks twice. The LED your remote Power on/off under the current device will stay lit. 3. Press the MODE key repeatedly until the LED for the device you want to WATCH TV: Combines TV and URC7125 STB into one mode set up is lit. for TV viewing Device Mode Type of device 4. Hold down the digit for your brand and device as listed above (e.g. 6 for SIMPLE SET UP GUIDE MODE: Scroll through TV TV, HDTV, LED, LCD, Plasma, Projector Samsung TV). the devices your remote is set up to control STB Set Top Box, Satellite Receiver, Cable Converter, 5. The remote will send Power every 3 seconds until your device switches off. Freeview, DVB-T, IPTV, Media, Streamer 6. -

European Pay TV Operator Forecasts: Table of Contents

European Pay TV Operator Forecasts: Table of Contents Published in September 2012, this 140-page electronically-delivered report comes in two parts: A 110-page PDF giving a global executive summary, country/operator analysis and forecasts. An 30-page excel workbook giving comparison tables and country-by- country forecasts in detail for 95 operators across 25 territories from 2007 to 2017. Countries and operators covered: Country No of ops Operators Austria 3 Telekom Austria; UPC; Sky Belgium 4 Belgacom; Numericable; Telenet; VOO Croatia 2 Digi TV; Max TV/T-HT Czech 4 Digi TV; Telefonica; Skylink; UPC Denmark 6 Canal Digital; Viasat; You See; Stofa; Boxer; TDC Finland 6 Digita; Elisa; Teliasonera; DNA; Canal Digital; Viasat France 6 Orange; SFR; CanalSat; Numericable; Free; TNT Germany 5 KBW; KDG; DT; Sky; Unitymedia Greece 1 Nova Hungary 3 T-Home; Digi TV; UPC (cable & DTH) Ireland 2 UPC; Sky Italy 3 Mediaset; Sky; Telecom Italia Netherlands 5 UPC; Canal Digitaal; Tele 2; Ziggo; KPN/Digitenne Norway 5 Canal Digital; Viasat; Riks TV; Telenor; Get Poland 8 N; TNK; TP/Orange; Vectra; Multimedia Polska; Cyfra Polsat; Cyfra+; UPC Portugal 3 PT; Zon; Cabovisao Romania 3 Romtelecom; RCS-RDS/Digi TV; UPC Russia 7 NTV Plus; Tricolor; Akado; MTS; ER Telecom; Rostelecom; Beeline Serbia 1 SBB Slovakia 4 UPC; RCS-RDS; Skylink; Slovak Telekom Spain 3 Ono; Canal Plus; Telefonica Sweden 5 Canal Digital; Viasat; Com Hem; Telia; Boxer Switzerland 2 Swisscom; UPC/Cablecom Ukraine 1 Volia UK 3 Sky; Virgin; BT Forecasts (2007-2017) contain the following detail for each country: By country: TV households Digital cable subs Analog cable subs Pay IPTV subscribers Pay digital DTH subs Pay DTT homes By operator (and by platform by operator): Subscribers Subscription & VOD revenues ARPU Liberty Global and BSkyB to continue European pay TV dominance Pay TV subscriptions for the 95 operators across 25 countries covered in a new report from Digital TV Research will increase from a collective 96.2 million in 2007 to 140.9 million by 2017.