Company Presentation July 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Blackham Resources Ltd. the Giant Wiluna Gold District – Breaking Free

30th January 2020 Blackham Resources Ltd. The Giant Wiluna Gold District – Breaking Free. The Wiluna gold mine, smack bang in the middle of West Australia, has produced over 4.0 million ounces of gold and has approximately 6.4 Blackham Resources Ltd. million ounces remaining in resources and reserves. The company is Ticker: BLK:ASX ‘cheap’ because it has often disappointed. Blackham Resources and its Share price: A$0.011 Wiluna mine may be about to awaken from a multi-decade slumber and Market cap: A$51.1m join its richly clothed Australian peers including Kirkland Lake’s Cash: A$5.7m Fosterville mine, Northern Star’s Jundee and Bellevue Gold. Debt: A$6.7m (Exc. WCF) Working Cap. Facility: e. A$13.5m Enterprise Value: A$65.6m Shares Outstanding: 4,716m Options: 864m Executive Chair: M. Jerkovic Director Operations: N. Meadows CFO: A. Rechichi IR: J. Malone Blackham consolidated the concessions around Wiluna into one giant tenement package covering over 1,600km2. In January 2014, they acquired the strategically-important Wiluna Gold Plant from Apex Minerals which went bust in 2013 as the gold price fell from US$1,700 to US$1,200 an ounce and Apex’s under-capitalised balance sheet imploded. The Wiluna plant was recommissioned and produced first gold in Prices as of the close of business October 2016. Blackham have invested approximately A$150 million 30th January 2020 since 2016 refurbishing the mine, plant and growing the reserve and resource. March and June quarters of 2019 proved operationally Contact details: challenging but the new Blackham management turned around operations Roger Breuer (Analyst) and have since delivered two consecutive quarters of increasing gold +44 (0)20 7389 5010 production. -

Subjects Index 2000Pag

1 INDEX TO SUBJECTS ABORIGINES See also “Health” and “Native Title” Assembly Aboriginal Commission of Elders - Funding 3422 Indigenous Land Use Agreements 1814 Minister for Aboriginal Affairs - Visit to the Kimberley 1464 Wunngagatu Patrol - Funding 1089 Council Aboriginal Affairs - Budget - Operating Expenses 605 Aboriginal Affairs Planning Authority - Disbursement of Funds 2526 Aboriginal Corporations - Corporations Law 2529 Communities - Water Supplies 22, 3151 Djidi Djidi Aboriginal School, Carey Park, Bunbury 51, 174 Education Funding 1995, 2246 Remote Communities - Urgency Motion 243; Rulings by President 243, 244 Health Cardio-Respiratory Services 3765 Dental Services - Kimberley Communities 1153 Ninga Mia Village - Relocation 1627 Northern Goldfields - Aboriginal Approval for Mining 1609, 3417 Reconciliation Walk 1112 Roebuck Plains Station - Adjournment Debate Royal Commission into Aboriginal Deaths in Custody - Recommendations 2731 Sobering-up Centre, Newman 1479 Swimming Pools - Remote Centres 2388 Westrail - Aboriginal Liaison Officers 2140 ABORTION Council Legality - Education Budget 2404 ACTS AMENDMENT AND REPEAL (COMPETITION POLICY) BILL 2000 Assembly Restoration to Notice Paper 87 ACTS AMENDMENT (AUSTRALIAN DATUM) BILL 2000 Assembly Restoration to Notice Paper 87 Second Reading 670 Consideration in Detail 671 Third Reading 768 Returned 2808 Council’s Amendments 3210 2 [INDEX TO SUBJECTS] ACTS AMENDMENT (AUSTRALIAN DATUM) BILL 2000 (continued) Council Receipt and First Reading 750 Second Reading 750, 2706 Committee 2707 -

Consolidated Gold Fields in Australia the Rise and Decline of a British Mining House, 1926–1998

CONSOLIDATED GOLD FIELDS IN AUSTRALIA THE RISE AND DECLINE OF A BRITISH MINING HOUSE, 1926–1998 CONSOLIDATED GOLD FIELDS IN AUSTRALIA THE RISE AND DECLINE OF A BRITISH MINING HOUSE, 1926–1998 ROBERT PORTER Published by ANU Press The Australian National University Acton ACT 2601, Australia Email: [email protected] Available to download for free at press.anu.edu.au ISBN (print): 9781760463496 ISBN (online): 9781760463502 WorldCat (print): 1149151564 WorldCat (online): 1149151633 DOI: 10.22459/CGFA.2020 This title is published under a Creative Commons Attribution-NonCommercial- NoDerivatives 4.0 International (CC BY-NC-ND 4.0). The full licence terms are available at creativecommons.org/licenses/by-nc-nd/4.0/legalcode Cover design and layout by ANU Press. Cover photograph John Agnew (left) at a mining operation managed by Bewick Moreing, Western Australia. Source: Herbert Hoover Presidential Library. This edition © 2020 ANU Press CONTENTS List of Figures, Tables, Charts and Boxes ...................... vii Preface ................................................xiii Acknowledgements ....................................... xv Notes and Abbreviations ................................. xvii Part One: Context—Consolidated Gold Fields 1. The Consolidated Gold Fields of South Africa ...............5 2. New Horizons for a British Mining House .................15 Part Two: Early Investments in Australia 3. Western Australian Gold ..............................25 4. Broader Associations .................................57 5. Lake George and New Guinea ..........................71 Part Three: A New Force in Australian Mining 1960–1966 6. A New Approach to Australia ...........................97 7. New Men and a New Model ..........................107 8. A Range of Investments. .115 Part Four: Expansion, Consolidation and Restructuring 1966–1981 9. Move to an Australian Shareholding .....................151 10. Expansion and Consolidation 1966–1976 ................155 11. -

Preparing for High-Grade Zinc Production in Italy

Preparing for high-grade zinc production in Italy Kim Robinson, Managing Director – Diggers & Dealers 2015 Disclaimer The following disclaimer applies to this presentation and any information provided regarding the information contained in this presentation. You are advised to read this disclaimer carefully before reading or making any other use of this presentation or any information contained in this presentation. In accepting this presentation, you agree to be bound by the following terms and conditions, including any modifications to them. This presentation has been prepared by Energia Minerals Limited (“Energia Minerals”). The information contained in this presentation is a professional opinion only and is given in good faith. Certain information in this document has been derived from third parties and though Energia has no reason to believe that it is not accurate, reliable or complete, it has not been independently audited or verified by Energia. The information contained in this presentation is for information only and does not constitute an offer to sell, issue or arrange to sell securities or other financial products. Any forward-looking statements included in this document involve subjective judgement and analysis and are subject to uncertainties, risks and contingencies, many of which are outside the control of, and maybe unknown to Energia Minerals. In particular, they speak only as of the date of this document, they assume the success of Energia’s strategies, and they are subject to significant regulatory, business, competitive and economic uncertainties and risks. Actual future events may vary materially from the forward looking statements and the assumptions on which the forward-looking statements are based. -

METS Global Experience Projects and Technical Papers

METS Global Experience Projects and Technical Papers METS Engineering Group Pty Ltd Level 3 44 Parliament Place West Perth WA 6005 PO Box 1699 West Perth WA 6872 P: (+61 8) 9421 9000 ABN 92 625 467 674 W: www.metsengineering.com E: [email protected] > DISCLAIMER With respect to all the information contained herein, neither METS Engineering Group Pty Ltd, nor any officer, servant, employee, agent or consultant thereof make any representations or give any warranties, expressed or implied, as to the accuracy, reliability or completeness of the information contained herein, including but not limited to opinions, information or advice which may be provided to users of the document. No responsibility is accepted to users of this document for any consequence of relying on the contents hereof. > COPYRIGHT © Passing of this document to a third party, duplication or re-use of this document, in whole or part, electronically or otherwise, is not permitted without the expressed written consent of METS Engineering Group Pty Ltd. > ACKNOWLEDGEMENTS This document is a dynamic record of the knowledge and experience of personnel at METS Engineering Group Pty Ltd. As such it has been built upon over the years and is a collaborative effort by all those involved. We are thankful for the material supplied by and referenced from various equipment manufacturers, vendors, industry research and project partners. PROCESSING PROCESS CONTROL PRODUCT INNOVATION TESTWORK MANAGEMENT ENGINEERING STUDIES OPERATIONS TRAINING Key Attributes “Provide engineering and -

Wiluna Gold Project

For personal use only March 2012 ASX: BLK SENIOR MANAGEMENT Brett Smith – Chairman Greg Miles – Executive Director With a wealth of experience in all facets of To date, Greg’s career in mineral exploration and geology, as well as the search for and development in numerous commodities and development of gold and nickel assets, Brett has mineral provinces spans more than 18 years. He been involved in mineral exploration, project has broad technical expertise as both a geologist development and mining (in a range of and an exploration manager directing a small but commodities) for more than 20 years. He dynamic team, as well as board-level experience is also managing director of Corazon Mining Ltd. as a non-executive director with Cove Resources Limited. Highlights of Greg’s professional life include the discovery and development of the 40 Bryan Dixon – Managing Director Mt Mount Caudan Iron Ore Deposit, the Parker Bryan, a chartered accountant, contributes project Range Project (Cazaly Resources) and the acquisition, development, financing and corporate exploration and development of gold resources at skills to the Company. Having previously worked West Kalgoorlie (now owned by Phoenix with KPMG, Resolute Samantha Limited, Société Resources). Générale and Archipelago Resources Plc, he has substantial experience in the mining sector and Alan Thom – Non-executive Director the management of listed public companies. Bryan is also a non-executive director of Hodges Alan, a mining engineer, has extensive experience Resources Limited and Midwinter Resources NL, as a senior manager and executive in the United and chairman of the Scaddan Energy JV Kingdom, Africa and Bangladesh, as well as Committee. -

PROSPECTUS 2021 for an Initial Public Offer of 30,000,000 Shares to Be Issued at a Price of $0.20 Per Share to Raise $6,000,000 (Before Costs)

PROSPECTUS 2021 For an initial public offer of 30,000,000 Shares to be issued at a price of $0.20 per Share to raise $6,000,000 (before costs) LEGAL ADVISER CORPORATE ADVISER MIDAS MINERALS LIMITED ACN 625 128 770 2 Prospectus For an initial public offer of 30,000,000 Shares to be issued at a price of $0.20 per Share to raise $6,000,000 (before costs) This Prospectus has been issued to provide information on the offer of 30,000,000 Shares to be issued at a price of $0.20 per Share to raise $6,000,000 (before costs) (Public Offer). This Prospectus also incorporates the offer of 3,000,000 Options to be issued to the Lead Manager (or its nominees) as part consideration for capital raising services provided to the Company (Lead Manager Offer). It is proposed that the Public Offer and the Lead Manager Offer (together, the Offer) will close at 5.00pm (WST) on 10 August 2021. The Directors reserve the right to close the Offer earlier or to extend this date without notice. Applications must be received before that time. The Offer pursuant to this Prospectus is subject to a number of conditions precedent as outlined in Section 1.2 of this Prospectus. This is an important document and requires your immediate attention. It should be read in its entirety. Please consult your professional adviser(s) if you have any questions about this Prospectus. Investment in the Securities offered pursuant to this Prospectus should be regarded as highly speculative in nature, and investors should be aware that they may lose some or all of their investment. -

Wiluna Expansion PFS Confirms Robust Economics for +200Kozpa

ASX Announcement 30 August 2017 BOARD OF DIRECTORS Wiluna Expansion PFS confirms robust economics for Bryan Dixon +200kozpa long mine life operation (Managing Director) Milan Jerkovic Blackham Resources Ltd ("Blackham” or “the Company") (ASX: BLK) has pleasure in (Non-Executive Chairman) announcing the successful results of the Expansion Preliminary Feasibility Study Greg Miles (PFS) on its 100% owned Matilda & Wiluna Gold Operation (“Operation”). The PFS (Non-Executive Director) demonstrates robust economics and improved economies of scale supporting the Peter Rozenauers Operation’s expansion. Historically, over the last 20 years, the Operation has relied (Non-Executive Director) predominately on underground feed. Blackham’s comparative advantage to previous operators is the 15Mt @ 2.3g/t Au (85% at Reserve classification) in open pit feed, which is included in the Expansion PFS Mine Plan. ASX CODE BLK Blackham’s principal success to date has been identifying, consolidating and defining orebodies all within 20kms of the existing Wiluna Gold Plant. From the large existing Resource base of 61Mt @3.1g/t for 6.2Moz Au, the Expansion PFS CORPORATE brings into Reserves 1.2Moz (15Mt @ 2.5g/t) – an increase of 116% in 1 year. INFORMATION 339.3M Ordinary Shares Expansion PFS Highlights 29.2M Unlisted Options Initial Gold Production over initial 9 years 3.8M Performance Rights 1.47Moz Au Open Pit Mining Inventory 15Mt @ 2.3g/t for 1.1Moz ABN: 18 119 887 606 Underground Mining Inventory 4Mt @ 4.7g/t for 608koz Expanded processing capacity PRINCIPAL -

Origin of Manganese and Base Metal Anomalies in Paleozoic Cover Rocks Overlying 1 Al-Saleh the Eastern Margin of the Arabian Shield

The 20th International Geochemical Exploration Symposium (IGES) “Geochemistry and Exploration : 2001 and Beyond” Hyatt Regency Hotel Santiago de Chile - May 6th ANGLO to May 10th, 2001 AMERICAN Conference Program Guide The Association of Exploration Geochemists The Santiago Exploration and Mining Association Sociedad Geologica de Chile The 20th International Geochemical Exploration Symposium (IGES), “Geochemistry and Exploration 2001 and Beyond”, Santiago de Chile - May 6th to May 10th, 2001 INDICE-INDEX (ABSTRACTS-RESUMENES) Nº AUTHOR-AUTOR TITLE-TITULO Origin of Manganese and base metal anomalies in Paleozoic cover rocks overlying 1 Al-Saleh the eastern margin of the Arabian Shield 2 Bonham et al Statistical analysis of hydrogeochemical data from a survey in Nova Scotia, Canada 3 Boni et al Environmental geochemical Atlas of Southern Sardinia 4 Bonotto and Caprioglio Radon in groundwaters from Guarany Aquifer, South America: Environmental and exploration implications 5 Bowell and Freyssinet A systematic classification of regolith gold 6 Bowell and Parshley Wasterock characterization and management: A case study from New Mexico A Mass Balance Approach to estimate the dilution and removal of pollutants in the 7 Bowell et al Lago Junin drainage, Central Highlands, Peru Three-dimensional investigations of gold dispersion and regolith at the Argo and 8 Britt and Gray Apollo deposits, Kambalda, Western Australia 9 Burlinson Fluid Inclusions for exploration - the acoustic decrepitation method Groundwater flow in playa lake environments: Impact -

Equities Research

EQUITIES BW RESEARCH 27 FEBRUARY 2015 Blackham Resources Ltd (BLK) | Initiation Coverage Rating: Matilda Gold Project , a re-emerging BUY mining district 1 Target Price : $0.40 Investment Summary Projected Return: Blackham Resources has commenced drilling at the Matilda mine as 300% initiation of a 13 month plan to establish a free milling gold Reserve and 1 recommence production at the Wiluna Processing Facility. Underpinned by 12 month target a large tenement position and sizeable gold resources Blackham has the ability to emerge in 2016 as a producer of over 100,000 ozs of gold per year with a mine life in excess of ten years. Company Statistics Investment Highlights Share Price (AUD$) 0.135 Market Cap (AUD$) 24.0 Enterprise Value (AUD$) 21.0 Purchase of the Wiluna Mine and processing facility allowed Issued Shares (mil) 177.9 consolidation of the region under single ownership Options (mil) Tenements of 780km2 surrounding the Wiluna Processing Facility (unlisted) 20.3 with a total gold resource of 4.7million oz Cash 3.0 13 month time line to re-establish >100,000ozpa gold production Debt nil All proposed mining operations within 20km of the Wiluna Processing Facility. Low capital requirement to re-start gold EV/Resource ounce $4.45 production Drilling underway to confirm 5 year Reserve with Initial focus on Earnings Summary free milling gold ore at the Matilda Mine FY Yr. End 2015e 2016e 2017e 2018e High grade underground quartz reef deposits will provide Revenue ($AU) 0 0 132 167 additional low cost ounces EBITDA ($AU) N/A N/A 57 70 Potential to quickly expand gold Reserves for mine life of more Net Income than ten years N/A N/A 36.7 45.0 ($AU) EV/EBITDA 0.37 0.30 Investment Recommendation Initiate with a BUY Rating and a $0.40 price target. -

For Personal Use Only

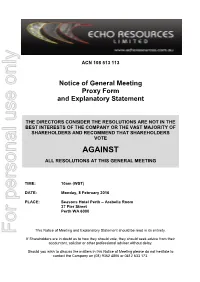

ACN 108 513 113 Notice of General Meeting Proxy Form and Explanatory Statement THE DIRECTORS CONSIDER THE RESOLUTIONS ARE NOT IN THE BEST INTERESTS OF THE COMPANY OR THE VAST MAJORITY OF SHAREHOLDERS AND RECOMMEND THAT SHAREHOLDERS VOTE AGAINST ALL RESOLUTIONS AT THIS GENERAL MEETING TIME: 10am (WST) DATE: Monday, 8 February 2016 PLACE: Seasons Hotel Perth – Arabella Room 37 Pier Street Perth WA 6000 This Notice of Meeting and Explanatory Statement should be read in its entirety. For personal use only If Shareholders are in doubt as to how they should vote, they should seek advice from their accountant, solicitor or other professional adviser without delay. Should you wish to discuss the matters in this Notice of Meeting please do not hesitate to contact the Company on (08) 9362 4806 or 0412 633 173. LETTER TO SHAREHOLDERS Dear Shareholder, This is to notify you of a General Meeting that is scheduled for Monday, 8 February 2016 at the Seasons Hotel Perth, Arabella Room, 37 Pier Street, Perth, commencing at 10.00am (WST). The Meeting is being held as one of the Company’s Shareholders, Kesli Chemicals Pty Ltd (Kesli), a company controlled by Michael Ruane, is seeking to replace the two existing Directors of the Company with two of its nominees. On 4 November 2015, Michael Ruane gave notice that Kesli was the registered holder of 13,885,487 Echo shares (with a voting power of 9.96 percent). Michael Ruane is Managing Director and the largest shareholder of Metaliko Resources Limited (Metaliko; ASX Code: MKO) which owns the dormant Bronzewing Gold Mine. -

WMC in Expansion Mode WMC Ltd, the World’S Third Largest Lion

Personal copy; not for onward transmission WMC in expansion mode WMC Ltd, the world’s third largest lion. Proven and probable reserves at nickel producer, said this Tuesday that that time amounted to 342 Mt at an it is considering a major capacity average grade of 0.65% Ni. The expansion at its Mount Keith open-pit expanded operation would have a mini- Georgian House nickel mine in Western Australia that mum mine life of 25 years. Mr Johnson Loeb Aron &63, Company Coleman Ltd. Street would raise output from the current said the expected capital cost for the London EC2R 5BB Tel :+44 (0)20 7628-1128 45,000 t/y to 70,000 t/y of metal. It is expansion represented US$4.50/lb of REGULATED BY THE SFA only a week ago that the Australian annual nickel capacity and he estimates producer announced that it is expand- that the equivalent for Western ing capacity at its Kwinana nickel Australia’s new generation of lateritic refinery near Perth, by 10% to 67,000 nickel mines is nearer US$10.00/lb. t/y by July next year, and that a further The new nickel laterite mines have Inside expansion to 70,000 t/y is planned been beset with technical problems eventually. Built in 1970, Kwinana was causing significant production delays, • Uranium missing an upgraded to a nameplate capacity of and WMC, which retains its faith in opportunity? (p.186) 42,000 t/y in 1994, and over the past mining conventional sulphide ore, has, • Miners die in mystery four years output has risen by 35% at a from the outset, been sceptical about capital cost of just US$0.20/lb of annu- some of the more extravagant claims aircrash (p.190) al nickel capacity.