Cuba's Economy After Raúl Castro: a Tale of Three

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Slum Clearance in Havana in an Age of Revolution, 1930-65

SLEEPING ON THE ASHES: SLUM CLEARANCE IN HAVANA IN AN AGE OF REVOLUTION, 1930-65 by Jesse Lewis Horst Bachelor of Arts, St. Olaf College, 2006 Master of Arts, University of Pittsburgh, 2012 Submitted to the Graduate Faculty of The Kenneth P. Dietrich School of Arts and Sciences in partial fulfillment of the requirements for the degree of Doctor of Philosophy University of Pittsburgh 2016 UNIVERSITY OF PITTSBURGH DIETRICH SCHOOL OF ARTS & SCIENCES This dissertation was presented by Jesse Horst It was defended on July 28, 2016 and approved by Scott Morgenstern, Associate Professor, Department of Political Science Edward Muller, Professor, Department of History Lara Putnam, Professor and Chair, Department of History Co-Chair: George Reid Andrews, Distinguished Professor, Department of History Co-Chair: Alejandro de la Fuente, Robert Woods Bliss Professor of Latin American History and Economics, Department of History, Harvard University ii Copyright © by Jesse Horst 2016 iii SLEEPING ON THE ASHES: SLUM CLEARANCE IN HAVANA IN AN AGE OF REVOLUTION, 1930-65 Jesse Horst, M.A., PhD University of Pittsburgh, 2016 This dissertation examines the relationship between poor, informally housed communities and the state in Havana, Cuba, from 1930 to 1965, before and after the first socialist revolution in the Western Hemisphere. It challenges the notion of a “great divide” between Republic and Revolution by tracing contentious interactions between technocrats, politicians, and financial elites on one hand, and mobilized, mostly-Afro-descended tenants and shantytown residents on the other hand. The dynamics of housing inequality in Havana not only reflected existing socio- racial hierarchies but also produced and reconfigured them in ways that have not been systematically researched. -

Ernesto 'Che' Guevara: the Existing Literature

Ernesto ‘Che’ Guevara: socialist political economy and economic management in Cuba, 1959-1965 Helen Yaffe London School of Economics and Political Science Doctor of Philosophy 1 UMI Number: U615258 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a complete manuscript and there are missing pages, these will be noted. Also, if material had to be removed, a note will indicate the deletion. Dissertation Publishing UMI U615258 Published by ProQuest LLC 2014. Copyright in the Dissertation held by the Author. Microform Edition © ProQuest LLC. All rights reserved. This work is protected against unauthorized copying under Title 17, United States Code. ProQuest LLC 789 East Eisenhower Parkway P.O. Box 1346 Ann Arbor, Ml 48106-1346 I, Helen Yaffe, assert that the work presented in this thesis is my own. Helen Yaffe Date: 2 Iritish Library of Political nrjPr v . # ^pc £ i ! Abstract The problem facing the Cuban Revolution after 1959 was how to increase productive capacity and labour productivity, in conditions of underdevelopment and in transition to socialism, without relying on capitalist mechanisms that would undermine the formation of new consciousness and social relations integral to communism. Locating Guevara’s economic analysis at the heart of the research, the thesis examines policies and development strategies formulated to meet this challenge, thereby refuting the mainstream view that his emphasis on consciousness was idealist. Rather, it was intrinsic and instrumental to the economic philosophy and strategy for social change advocated. -

Cuban Leadership Overview, Apr 2009

16 April 2009 OpenȱSourceȱCenter Report Cuban Leadership Overview, Apr 2009 Raul Castro has overhauled the leadership of top government bodies, especially those dealing with the economy, since he formally succeeded his brother Fidel as president of the Councils of State and Ministers on 24 February 2008. Since then, almost all of the Council of Ministers vice presidents have been replaced, and more than half of all current ministers have been appointed. The changes have been relatively low-key, but the recent ousting of two prominent figures generated a rare public acknowledgement of official misconduct. Fidel Castro retains the position of Communist Party first secretary, and the party leadership has undergone less turnover. This may change, however, as the Sixth Party Congress is scheduled to be held at the end of this year. Cuba's top military leadership also has experienced significant turnover since Raul -- the former defense minister -- became president. Names and photos of key officials are provided in the graphic below; the accompanying text gives details of the changes since February 2008 and current listings of government and party officeholders. To view an enlarged, printable version of the chart, double-click on the following icon (.pdf): This OSC product is based exclusively on the content and behavior of selected media and has not been coordinated with other US Government components. This report is based on OSC's review of official Cuban websites, including those of the Cuban Government (www.cubagob.cu), the Communist Party (www.pcc.cu), the National Assembly (www.asanac.gov.cu), and the Constitution (www.cuba.cu/gobierno/cuba.htm). -

Islenos and Malaguenos of Louisiana Part 1

Islenos and Malaguenos of Louisiana Part 1 Louisiana Historical Background 1761 – 1763 1761 – 1763 1761 – 1763 •Spain sides with France in the now expanded Seven Years War •The Treaty of Fontainebleau was a secret agreement of 1762 in which France ceded Louisiana (New France) to Spain. •Spain acquires Louisiana Territory from France 1763 •No troops or officials for several years •The colonists in western Louisiana did not accept the transition, and expelled the first Spanish governor in the Rebellion of 1768. Alejandro O'Reilly suppressed the rebellion and formally raised the Spanish flag in 1769. Antonio de Ulloa Alejandro O'Reilly 1763 – 1770 1763 – 1770 •France’s secret treaty contained provisions to acquire the western Louisiana from Spain in the future. •Spain didn’t really have much interest since there wasn’t any precious metal compared to the rest of the South America and Louisiana was a financial burden to the French for so long. •British obtains all of Florida, including areas north of Lake Pontchartrain, Lake Maurepas and Bayou Manchac. •British built star-shaped sixgun fort, built in 1764, to guard the northern side of Bayou Manchac. •Bayou Manchac was an alternate route to Baton Rouge from the Gulf bypassing French controlled New Orleans. •After Britain acquired eastern Louisiana, by 1770, Spain became weary of the British encroaching upon it’s new territory west of the Mississippi. •Spain needed a way to populate it’s new territory and defend it. •Since Spain was allied with France, and because of the Treaty of Allegiance in 1778, Spain found itself allied with the Americans during their independence. -

Racism in Cuba Ronald Jones

University of Chicago Law School Chicago Unbound International Immersion Program Papers Student Papers 2015 A Revolution Deferred: Racism in Cuba Ronald Jones Follow this and additional works at: http://chicagounbound.uchicago.edu/ international_immersion_program_papers Part of the Law Commons Recommended Citation Ronald Jones, "A Revolution Deferred: Racism in Cuba," Law School International Immersion Program Papers, No. 9 (2015). This Working Paper is brought to you for free and open access by the Student Papers at Chicago Unbound. It has been accepted for inclusion in International Immersion Program Papers by an authorized administrator of Chicago Unbound. For more information, please contact [email protected]. qwertyuiopasdfghjklzxcvbnmqw ertyuiopasdfghjklzxcvbnmqwert yuiopasdfghjklzxcvbnmqwertyui opasdfghjklzxcvbnmqwertyuiopaA Revolution Deferred sdfghjklzxcvbnmqwertyuiopasdfRacism in Cuba 4/25/2015 ghjklzxcvbnmqwertyuiopasdfghj Ron Jones klzxcvbnmqwertyuiopasdfghjklz xcvbnmqwertyuiopasdfghjklzxcv bnmqwertyuiopasdfghjklzxcvbn mqwertyuiopasdfghjklzxcvbnmq wertyuiopasdfghjklzxcvbnmqwe rtyuiopasdfghjklzxcvbnmqwerty uiopasdfghjklzxcvbnmqwertyuio pasdfghjklzxcvbnmqwertyuiopas dfghjklzxcvbnmqwertyuiopasdfg hjklzxcvbnmqwertyuiopasdfghjk Contents Introduction .............................................................................................................................................. 2 Slavery in Cuba ....................................................................................................................................... -

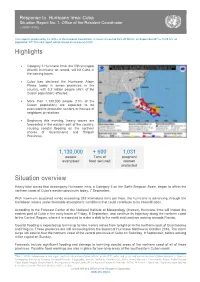

Highlights Situation Overview

Response to Hurricane Irma: Cuba Situation Report No. 1. Office of the Resident Coordinator ( 07/09/ 20176) This report is produced by the Office of the Resident Coordinator. It covers the period from 20:00 hrs. on September 06th to 14:00 hrs. on September 07th.The next report will be issued on or around 08/09. Highlights Category 5 Hurricane Irma, the fifth strongest Atlantic hurricane on record, will hit Cuba in the coming hours. Cuba has declared the Hurricane Alarm Phase today in seven provinces in the country, with 5.2 million people (46% of the Cuban population) affected. More than 1,130,000 people (10% of the Cuban population) are expected to be evacuated to protection centers or houses of neighbors or relatives. Beginning this evening, heavy waves are forecasted in the eastern part of the country, causing coastal flooding on the northern shores of Guantánamo and Holguín Provinces. 1,130,000 + 600 1,031 people Tons of pregnant evacuated food secured women protected Situation overview Heavy tidal waves that accompany Hurricane Irma, a Category 5 on the Saffir-Simpson Scale, began to affect the northern coast of Cuba’s eastern provinces today, 7 September. With maximum sustained winds exceeding 252 kilometers (km) per hour, the hurricane is advancing through the Caribbean waters under favorable atmospheric conditions that could contribute to its intensification. According to the Forecast Center of the National Institute of Meteorology (Insmet), Hurricane Irma will impact the eastern part of Cuba in the early hours of Friday, 8 September, and continue its trajectory along the northern coast to the Central Region, where it is expected to make a shift to the north and continue moving towards Florida. -

América Latina Enfrentando Encrucijadas

LA HABANA, LUNES 15 DE NOVIEMBRE DEL 2010 AÑO 46 / NÚMERO 271 AÑO 52 DE LA REVOLUCIÓN EDICIÓN ÚNICA CIERRE: 1:30 A.M. / 20 CTVS. (Tomado de CubaDebate) Páginas 2 y 3 Hoy en la Mesa Redonda En este proceso quien decide es el pueblo No es que nos volvamos economistas, dijo Raúl en el América Latina enfrentando encrucijadas primer Seminario Nacional sobre el Proyecto de Los efectos de la crisis económica en la región, la epidemia de cólera en Lineamientos de la Política Económica y Social del Haití, el proceso de destitución de la senadora colombiana Piedad Córdoba y Partido y la Revolución, pero para que el Partido ejerza otros temas de interés serán analizados hoy, en la Mesa Redonda Informativa el control que le corresponde debe tener conocimientos América Latina enfrentando encrucijadas, que será transmitida por Cubavisión, Cubavisión Internacional, Radio Rebelde y Radio Habana Cuba a de la economía. Para comprobar cómo se está las 6:30 p.m. cumpliendo lo establecido hay que prepararse. El Canal Educativo retransmitirá este programa al final de su emisión del día. Páginas 4 y 5 Se reunirán en el Capitolio de Washington golpistas y terroristas de toda América Latina JEAN-GUY ALLARD latinoamericanas de los republicanos. nos radicados en Miami y el entonces Según la nota de Telam, también partici- Igualmente, asistirá Otto Reich, quien embajador CIA de Venezuela en El parán Jaime Daremblum, del Instituto Una singular reunión tendrá lugar este fuera embajador de Estados Unidos en Salvador, Leopoldo Castillo. Hudson y ex embajador de Estados -

Cuba Myths and Facts

Myths And Facts About The U.S. Embargo On Medicine And Medical Supplies A report prepared by Oxfam America and the Washington Office on Latin America BASIC FACTS: The Cuban health care system functioned effectively up through the 1980s. Life expectancy increased, infant mortality declined, and access to medical care expanded. Cuba began to resemble the developed nations in health care figures. While the U.S. embargo prevented Cuba from buying medicines and medical supplies directly from the United States, many U.S. products were available from foreign subsidiaries. Cuba may have paid higher prices, and heavier shipping costs, but it was able to do so. The Cuban health care system has been weakened in the last seven years, as the end of Soviet bloc aid and preferential trade terms damaged the economy overall. The economy contracted some 40%, and there was simply less money to spend on a health care system, or on anything else. And because the weakened Cuban economy generated less income from foreign exports, there was less hard currency available to import foreign goods. This made it more difficult to purchase those medicines and medical equipment that had traditionally come from abroad, and contributed to shortages in the Cuban health care system. In the context of the weakened Cuban economy, the U.S. embargo exacerbated the problems in the health care system. The embargo forced Cuba to use more of its now much more limited resources on medical imports, both because equipment and drugs from foreign subsidiaries of U.S. firms or from non-U.S. -

What Should US Policy Be Towards Cuba?

What Should U.S. Policy be Towards Cuba? Megan Orosz At this very moment, Cuba is an island in the world spotlight. With its changing and ambiguous leadership, political system, economy, and relations with Venezuela, Cuba could not be more of a topic of interest. Its current regime leadership is led by Fidel Castro’s brother Raul, who in his old age, will be stepping down within the upcoming decade. The regime’s socialist economy has incurred new policies of questionable basis and sustainability, as the government seems to be opening up to allow entrepreneur activity, within reason that is. All the while, the indistinct direction of Cuba is further muddled by the recent death of Venezuela’s late Hugo Chavez. Oil-rich and supportive Chavez had excellent relations with Cuba and the Castro regime. As Cuba’s crony country moves into its new presidential election, the world and the Cuban people wonder how this change will affect Cuba. With so much change and uncertainty occurring with such a close United States neighbor, this moves Americans to focus in on Cuba. The U.S. relations with Cuba in the past fifty years have been centered on the embargo. The embargo has always been debated and questioned, and now more than ever, we here in the U.S. ask ourselves: “What should U.S. policy be towards Cuba, given these new developments?". In this paper I argue that the United States should keep its embargo against Cuba, while seriously assessing the embargo’s current prohibitions. This policy position is in the best United States interest, since our country is not looking to change its policy to merely benefit another nation, specifically a Communist nation. -

The Cuban Government Approves Guidelines to Reform Cuba's Economic Model and Develops an Implementation Strategy

Law and Business Review of the Americas Volume 17 Number 4 Article 7 2011 The Cuban Government Approves Guidelines to Reform Cuba's Economic Model and Develops an Implementation Strategy Lina Forero-Nino Follow this and additional works at: https://scholar.smu.edu/lbra Recommended Citation Lina Forero-Nino, The Cuban Government Approves Guidelines to Reform Cuba's Economic Model and Develops an Implementation Strategy, 17 LAW & BUS. REV. AM. 761 (2011) https://scholar.smu.edu/lbra/vol17/iss4/7 This Update is brought to you for free and open access by the Law Journals at SMU Scholar. It has been accepted for inclusion in Law and Business Review of the Americas by an authorized administrator of SMU Scholar. For more information, please visit http://digitalrepository.smu.edu. THE CUBAN GOVERNMENT APPROVES GUIDELINES TO REFORM CUBA'S ECONOMIC MODEL AND DEVELOPS AN IMPLEMENTATION STRATEGY Lina Forero-Nifio* 1. BACKGROUND IN April 2011, Cuba's Communist Party ("the Party") held a congress for the first time since 1997 to discuss reforms to Cuba's economic model.' During this congress, the Party approved 313 economic and social policy guidelines (the "guidelines") proposed by President Ratil Castro to stimulate Cuba's economy. 2 In a resolution following the con- gress, the Party said it would guide the government in creating the Imple- mentation and Development Permanent Commission (the "Commission"). 3 The Commission is described as an independent gov- ernment body charged with "the important task of developing and pro- posing the conceptualization of Cuba's economic model." 4 The Commission will oversee the implementation of the guidelines, propose new guidelines when necessary, and ensure that new laws are created to implement the guidelines.5 In May 2011, Cuban authorities published the guidelines and sold them to Cubans eager to learn more details about the guidelines. -

Havana Springfall Cuba Academicspring Year

API ABROAD PROGRAMS OFFERED TO MARIST COLLEGE STUDENTS FALL HAVANA SPRINGFALL CUBA ACADEMICSPRING YEAR WHY CUBA? • Colonial charm • Friendly people • Safe city • International art and music festivals • One of the oldest universities in the hemisphere • Amazing cuisine CUBANDIRECT ENROLLMENT AND CARIBBEAN PROGRAM STUDIES PROGRAM UNIVERSIDADUNIVERSITY COLLEGE DE LA HABANA DUBLIN CLASSES TAUGHT IN SPANISH • TRANSCRIPT FROM U.S. ACCREDITED INSTITUTION (MARIST COLLEGE) ROUND-TRIP AIRFARE (MIAMI-HAVANA) INCLUDED REQUIREMENTS ACADEMIC PROGRAM • 3.0 G.P.A. TOTAL CREDIT HOURS • Open to sophomores, juniors, and seniors SEMESTER 12-16 CREDITS • Must be enrolled as a degree-seeking Students who study abroad in Cuba with API on the Cuban and Caribbean Studies undergraduate student and under the Program will take a required Spanish language course throughout the term. This age of 25 course uses the Cuban experience as a backdrop for language practice, discussion, • Open to advanced level Spanish speakers and writing assignments. Students will select a “track” course covering either Cuban (with a minimum of 4-5 semesters of studies or Caribbean studies. Students choose their remaining courses from a college-level Spanish or the equivalent) selection of offerings in art history, communication, literature, and cultural/regional • Completed API application studies with local Cuban students. Courses are offered Monday through Friday, in • University contact information form both the mornings and afternoons. Course work will be supplemented by numerous cultural activities and excursions. • One letter of recommendation • One official transcript TRANSCRIPTS Students may receive transcripts from either the Universidad de la Habana or Marist • Completion of an oral interview College for courses taken at the Universidad de la Habana*. -

Environmental Law in Cuba

ENVIRONMENTAL LAW IN CUBA OLIVER A. HOUCK*1 Table of Contents Prologue .................................................................................................1 I. A View of the Problem ...................................................................3 II. Institutions and the Law..................................................................8 III. The Environmental Awakening .....................................................13 IV. The Agency, The Strategy and Law 81...........................................18 A. CITMA ..................................................................................19 B. The National Environmental Strategy .......................................21 C. Law 81, the Law of the Environment ........................................23 V. Environmental Impact Analysis .....................................................25 A. What and When......................................................................27 B. Who .......................................................................................31 C. Alternatives ............................................................................34 D. Review...................................................................................35 VI. Coastal Zone Management............................................................38 VII. Biological Diversity ......................................................................47 VIII. Implementation ............................................................................57 IX. The Economy