Press Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

National Retailer & Restaurant Expansion Guide Spring 2016

National Retailer & Restaurant Expansion Guide Spring 2016 Retailer Expansion Guide Spring 2016 National Retailer & Restaurant Expansion Guide Spring 2016 >> CLICK BELOW TO JUMP TO SECTION DISCOUNTER/ APPAREL BEAUTY SUPPLIES DOLLAR STORE OFFICE SUPPLIES SPORTING GOODS SUPERMARKET/ ACTIVE BEVERAGES DRUGSTORE PET/FARM GROCERY/ SPORTSWEAR HYPERMARKET CHILDREN’S BOOKS ENTERTAINMENT RESTAURANT BAKERY/BAGELS/ FINANCIAL FAMILY CARDS/GIFTS BREAKFAST/CAFE/ SERVICES DONUTS MEN’S CELLULAR HEALTH/ COFFEE/TEA FITNESS/NUTRITION SHOES CONSIGNMENT/ HOME RELATED FAST FOOD PAWN/THRIFT SPECIALTY CONSUMER FURNITURE/ FOOD/BEVERAGE ELECTRONICS FURNISHINGS SPECIALTY CONVENIENCE STORE/ FAMILY WOMEN’S GAS STATIONS HARDWARE CRAFTS/HOBBIES/ AUTOMOTIVE JEWELRY WITH LIQUOR TOYS BEAUTY SALONS/ DEPARTMENT MISCELLANEOUS SPAS STORE RETAIL 2 Retailer Expansion Guide Spring 2016 APPAREL: ACTIVE SPORTSWEAR 2016 2017 CURRENT PROJECTED PROJECTED MINMUM MAXIMUM RETAILER STORES STORES IN STORES IN SQUARE SQUARE SUMMARY OF EXPANSION 12 MONTHS 12 MONTHS FEET FEET Athleta 46 23 46 4,000 5,000 Nationally Bikini Village 51 2 4 1,400 1,600 Nationally Billabong 29 5 10 2,500 3,500 West Body & beach 10 1 2 1,300 1,800 Nationally Champs Sports 536 1 2 2,500 5,400 Nationally Change of Scandinavia 15 1 2 1,200 1,800 Nationally City Gear 130 15 15 4,000 5,000 Midwest, South D-TOX.com 7 2 4 1,200 1,700 Nationally Empire 8 2 4 8,000 10,000 Nationally Everything But Water 72 2 4 1,000 5,000 Nationally Free People 86 1 2 2,500 3,000 Nationally Fresh Produce Sportswear 37 5 10 2,000 3,000 CA -

Fuel Retail Ready for Ev's 11 Technology 12 Mobile Commerce for Fuel Retail 14 Edgepetrol's New Technology

WWW.PETROLWORLD.COM Issue 1 2019 TECHNOLOGYWORLD SHOPWORLD FRANCHISEWORLD FOODSERVICESWORLD FUEL RETAIL READY FOR EV’S Mobile Commerce for Fuel Retail New Technology EdgePetrol The Customer Service Station Experience Evolves Byco Petroleum Pakistan INFORMING AND SERVING THE FUEL INDUSTRY GLOBALLY DESIGNED FOR YOU Wayne HelixTM fuel dispenser www.wayne.com ©2018. Wayne, the Wayne logo, Helix, Dover Fueling Solutions logo and combinations thereof are trademarks or registered trademarks of Wayne Fueling Systems, in the United States and other countries. Other names are for informational purposes and may be trademarks of their respective owners. TRANSFORM your forecourt DESIGNED FOR YOU Wayne HelixTM fuel dispenser www.wayne.com Tokheim QuantiumTM 510 fuel dispenser ©2018. Wayne, the Wayne logo, Helix, Dover Fueling Solutions logo and combinations thereof are trademarks or registered trademarks of Wayne Fueling Systems, in the United States and other countries. Other names are for informational purposes and may be trademarks of their respective owners. © 2018 Dover Fueling Solutions. All rights reserved. DOVER, the DOVER D Design, DOVER FUELING SOLUTIONS, and other trademarks referenced herein are trademarks of Delaware Capital Formation. Inc./Dover Corporation, Dover Fueling Solutions UK Ltd. and their aflliated entities. 092018v2 2 + CONTENTS 08 FUEL RETAIL READY SECTION 1: FEATURES FOR EV'S 04 WORLD VIEW Key stories from around the world 08 FUEL RETAIL READY FOR EV'S 11 TECHNOLOGY 12 MOBILE COMMERCE FOR FUEL RETAIL 14 EDGEPETROL'S NEW -

City of Lakeland, Florida City Manager Recruitment Portfolio

City of Lakeland, Florida City Manager Recruitment Portfolio September 25, 2020 The Honorable William “Bill” Mutz, Mayor and Members of the City Commission City of Lakeland 228 S. Massachusetts Ave. Lakeland, FL 33801 Dear Mayor Mutz and Commission Members: Thank you for the opportunity to assist the City of Lakeland in the recruitment and selection process for the City Manager position. The City Manager search yielded 126 resumes from 28 states, including 59 applications from Florida. Enclosed are the recommendations for this position. Candidates listed under (Recommended for Further Consideration) are the candidates I believe are most suited to the position. (Additional Candidates Interviewed) candidates are candidates who are generally qualified, but not as strongly recommended. I look forward to reviewing the credentials for these candidates with you on September 29th. Again, thank you for the opportunity to assist you in this important recruitment! Best wishes, Heidi J. Voorhees President GovHR USA, LLC City of Lakeland, Florida City Manager Presented in Alphabetical Order Candidates Recommended for Further Consideration Candidate 1..……………………………………………. Marc Antonie-Cooper Interim City Manager City of Deltona, Florida Candidate 2……………………………………………… Carmen Y. Davis County Administrator (former) Hinds County, Mississippi Candidate 3..……………………………………. ……… Natasha S. Hampton Assistant City Manager City of Rocky Mount, North Carolina Candidate 4...…………………………………………… Thomas J. Hutka Director of Public Works (former) Broward County, Florida Candidate 5……………………………………………… Alex “Ty” Kovach Executive Director Lake County Forest Preserve District Libertyville, Illinois Candidate 6……………………………………………… Ronda E. Perez Assistant City Manager City of Lancaster, California Candidate 7……………………………………………… Richard Reade Village Manager/Palm Springs CRA Executive Director Village of Palm Springs, Florida Candidate 8……………………………………………… Michael “Shawn” Sherrouse Deputy City Manager City of Lakeland, Florida Additional Candidates Interviewed Candidate 9…………………………………………..…. -

17GEC Attendee Listing W Emails

First Name Last Name Company City St Email Address Steve Adams Kleinfelder Mount Dora FL [email protected] Amy Addison AMA Environmental Services, LLC Leesburg GA [email protected] Ryan Adolphson University of Georgia Athens GA [email protected] Patrick Ahlm Wenck & Associates Minneapolis MN [email protected] Anthony Ahmed Raven Engineered Films Sioux Falls SD [email protected] Garrow Alberson City of Brunswick Brunswick GA [email protected] Sergie Albino ecoSPEARS Winter Park FL [email protected] Ruth Albright SynTerra Corporation Greenville SC [email protected] Shanna Alexander GA Environmental Protection Division Atlanta GA [email protected] Constance Alexander US Environmental Protection Agency Atlanta GA [email protected] Meredith Allen GeoAdvisers, L.L.C. Savannah GA [email protected] Jerry Allen ALS Houston TX [email protected] Sheridan Alonso American Env. & Construction Services Alpharetta GA Jon Ambrose Nongame Conservation Division, GA DNR Atlanta GA [email protected] Justin Amiro ILS Salley SC [email protected] Barry Amos City of Atlanta Atlanta GA [email protected] Kristofor Anderson Georgia Environmental Finance Authority Atlanta GA [email protected] Scott Anderson HRP Associates, Inc Greenville SC [email protected] Michelle Andotra USDOT/FHWA Atlanta GA [email protected] Titus Andrews Fort Valley State University Dublin GA [email protected] Jill Andrews GADNR Coastal Resources Division Brunswick GA [email protected] David Anthony Pace Analytical Services, LLC Peachtree Corners GA [email protected] Shan Arora Southface Atlanta GA Rod Arters EnviroWorkshops.com Davidson NC [email protected] Joseph Baggett Stantec Nashville TN [email protected] Katrina Bagwell EPS, Inc. -

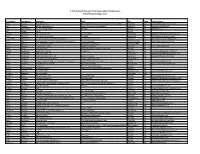

AI Permit No. Facility Name Activity Type Activity No. Issued Media

AI Permit No. Facility Name Activity Type Activity No. Issued Media 131434 LAJ650100 Environmental Processing Inc GNP GEN20100001 09/27/2013 Biosolids 2218 LA0097161 Praxair Inc - Geismar Plant RAP PER20120001 07/09/2013 Water 18394 LA0084557 Baton Rouge Recreation & Park Commission - Greater Baton Rouge Zoo RAP PER20120001 07/09/2013 Water 19975 LA0046639 Arnaudville Town of - Arnaudville Wastewater Treatment Plant RAP PER20120001 07/09/2013 Water 43876 LA0122505 Ascension Wastewater Treatment Inc - Seven Oaks Flea Market RAP PER20120001 07/09/2013 Water 96034 LA0126462 Ship Shoal 43 RAP PER20120001 07/09/2013 Water 85341 LA0115592 Jefferson Davis Parish - Water & Sewer Commission #1 RAP PER20120002 07/19/2013 Water 2644 LA0005231 Pioneer Americas LLC dba Olin Chlor Alkali Products - St Gabriel Facility RAP PER20130001 07/26/2013 Water 2617 LA0005258 Georgia-Pacific Consumer Operations LLC - Port Hudson Operations RAP PER20120008 08/05/2013 Water 2082 LA0006181 Honeywell International Inc - Geismar Plant RAP PER20120003 08/05/2013 Water 161761 LA0124478 Baker Hughes INTEQ Supercenter - Baker Hughes Oilfield Operations RAP PER20120003 08/13/2013 Water 13058 LA0054399 Pelican Refining Co LLC - Lake Charles Facility RAP PER20120001 08/13/2013 Water 17061 LA0104884 Enterprise Marine Services LLC - Houma Shipyard RAP PER20120001 08/13/2013 Water 40011 LA0097811 Ocean Harvest Wholesale Inc RAP PER20120001 08/13/2013 Water 19884 LA0081965 LD Commodities Port Allen Export Elevator LLC RAP PER20130002 08/14/2013 Water 19449 LA0020486 Lake Providence -

Catalog of Data

Catalog of Data Volume 5, Issue 10 October 2013 AggData LLC - 1 1570 Wilmington Dr, Suite 240, Dupont, WA 98327 253-617-1400 Table of Contents Table of Contents ................................................................................................... 2 I. Explanation and Information ............................................................................ 3 II. New AggData September 2013 ........................................................................ 4 III. AggData by Category ........................................................................................ 5 Arts & Entertainment .......................................................................................... 5 Automotive ......................................................................................................... 5 Business & Professional Services ......................................................................... 8 Clothing & Accessories ........................................................................................ 9 Community & Government ............................................................................... 13 Computers & Electronics ................................................................................... 13 Food & Dining ................................................................................................... 14 Health & Medicine ............................................................................................ 23 Home & Garden ............................................................................................... -

Top Employers 2018 Master Updated FINAL.Xlsx

METRO ATLANTA TOP EMPLOYERS (2018-2019) (includes employers with minimum FTE Headcount of 500 in metro Atlanta) The Metro Atlanta Chamber's Economic Research Team conducted a top employers survey from October 2018-January 2019 to determine which employers have the largest total full-time equivalent (FTE) headcounts of all locations across the 29-county metro Atlanta area (Barrow, Bartow, Butts, Carroll, Cherokee, Clayton, Cobb, Coweta, Dawson, DeKalb, Douglas, Fayette, Forsyth, Fulton, Gwinnett, Haralson, Heard, Henry, Jasper, Lamar, Meriwether, Morgan, Newton, Paulding, Pickens, Pike, Rockdale, Spalding, Walton counties). The research included direct outreach to organizations with a survey from the Metro Atlanta Chamber's President & CEO as well as data from third party sources. Final results totaled 233 organizations that qualify as metro Atlanta's top employers. 46 percent of organizations provided direct survey responses with their full-time equivalent (FTE) headcounts. Headcounts for the remaining 54 percent of organizations listed, who did not respond, were sourced primarily through BusinessWise, a database of companies in the area. Additional sources included the Atlanta Business Chronicle and Carroll County Chamber. Federal, state and local government and public school systems were not included in the research. Full-Time Equivalent Rank Employer Primary Facility Type (FTE) Headcount* 1 Delta Air Lines 34,500 Corporate HQ/Airport (FORTUNE #75) 2 Emory University & Emory Healthcare 32,091 Educational Institution/Healthcare 3 The Home Depot 16,510 Corporate HQ (FORTUNE #23) 4 Northside Hospital 16,000+ Healthcare 5 Piedmont Healthcare 15,900 Healthcare 6 Publix Super Markets 15,591 Division HQ 7 WellStar Health System 15,353 Healthcare 8 The Kroger Co. -

Offering Memorandum RACETRAC

Offering775 NE ALSBURYMemorandum BLVD | BURLESON, TX RACETRAC 775 NE ALSBURY BLVD BURLESON, TX 76028 REPRESENTATIVE PROPERTY EXCLUSIVELY LISTED BY : 1 STEVEN J. SIEGEL | SENIOR MANAGING DIRECTOR Executive Director - Institutional Property Advisors (IPA) Senior Managing Director - Investments Office: (212) 430-5166 National Retail Group Cell: (646) 996-3709 E-mail: [email protected] ThisNet information Leased Properties has been securedGroup from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the informationLicense: and NYbears: 30SI0857139 all risk for any NJ:inaccuracies. 0015107 Any CT: projections,REB.0754170 opinions, assumptions or estimates used herein are for example purposes only and do not represent RACETRAC the current or future performance of the property. Marcus & Millichap Real Estate Investment Services is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2018 Marcus & Millichap 1 STEVEN J. SIEGEL Associate DirectorSJS & Partners LLC Office: (212) 430-5293 Cell: (914) 525-7735 E-mail: [email protected] License: NY: 10401253283 775 NE ALSBURY BLVD | BURLESON, TX 775 NE ALSBURY BLVD | BURLESON, TX Investment Contacts STEVEN J. SIEGEL PHIL BIANCAVILLA Executive Director Associate DirectorSJS & Partners LLC Institutional Property Advisors (IPA) Senior Managing Director - Investments Office: (212) 430-5293 Cell: (914) 525-7735 -

16GEC Reg List

11th Annual Georgia Environmental Conference Final Registration List First Name Last Name Company Title City State Email Address Paula Adams Republic Services Manufacturing & environmental services executive Mableton GA [email protected] Amy Addison Golder Associates Inc. Senior Environmental Scientist Leesburg GA [email protected] Ryan Adolphson The University of GA Director Athens GA [email protected] Karl Albach FLETC Glynco GA Garrow Alberson City of BrunswicK City Engineer Brunswick GA [email protected] Ruth Albright SynTerra Corporation Principal Greenville SC [email protected] Constance Alexander U.S. Environmental Protection Agency Watershed Coordinator Atlanta GA [email protected] Guy Allard Environmental Products and Services of Vermont Project Manager Stone Mountain GA [email protected] Scott Allison City of Richmond Hill Assistant City Manager Richmond Hill GA Sherri Altman VA Medical Center GEMS Coordinator Asheville NC [email protected] Barry Amos City of Atlanta Environmental Compliance Manager Atlanta GA Neville Anderson Basha Services, LLC President Snellville GA [email protected] Scott Anderson HRP Associates, Inc Greenville SC [email protected] Bill Anderson Terracon Consultants, Inc Senior Principal Savannah GA [email protected] Titus Andrews Fort Valley State University County Extension Agent Union Point GA Josh Andrews University of GA, Dept. of Crop and Soil Sciences Graduate Research Assistant Athens GA [email protected] David Anthony -

This List Is Current As of 10/11/10

This company listing is current as of 10/11/10 | All duplicate companies have been removed 22squared AlphaStaff Atlanta Journal Constitution 542 Consulting ALPLA Atlanta Leadership Consulting, LLC AAA Auto Club South ALPLA, Inc. Atlanta Regional Commission AARP AMEC Atlanta Spirit LLC AARP - GA State Office American Cancer Society Atlanta Spirit, LLC Abatement Technologies, Inc. Amerigroup Community Care Atlanta West Carpets, Inc. Adam M. Goodman, Standing Chapter 13 Ameriprise Financial Avery Partners, LLC Bankruptcy T AOS USA, Inc BDO Seidman, LLP Adams Keegan Aquilex Corporation Bed Bath & Beyond Administaff Aramark Uniform Services Benefitfocus ADP Archdiocese of Atlanta Bernard HODES Group AFLAC Argosy University Berry Appleman & Leiden LLP Air2Web, Inc. Armstrong World Industries BestWork DATA ajcjobs Arthritis Foundation BGAC LLC AkzoNobel ASAP Staffing, LLC BIS Benefits, Inc. Alabama Power Ashford University BPI group Aldebaran Associates International, LLC Asset Control, Inc. BPI group US Allconnect Astron Solutions Brand Velocity Alliant Insurance Services, Inc. AT&T Brasfield & Gorrie Allstate Insurance Company Atlanta Business Chronicle Bruel & Kjaer North America Inc. This company listing is current as of 10/11/10 | All duplicate companies have been removed Bryant & Associates, LLC Ceridian Colonial Pipeline Company BSI CharterBank Columbia Southern University Byrd Professional Resources Chartis Aerospace Insurance Services, Inc. Combined Worksite Solutions C.R. BARD, INC Cherokee County Board of Commissioners Commdex Consulting C.R. Bard, Inc. Children's Healthcare of Atlanta Communities In Schools of Georgia CanAm Care, LLC Chipotle Mexican Grill Compass Group Canvas Systems, LLC Cisco Compass Group, NA Capital Access Network, Inc. City of Atlanta Competitive Solutions, Inc. CARE City of Atlanta, Department of Watershed Concept Hub Management Career Education Corporation Consultant City of Decatur Careers In Transition, Inc Convergent ERS City of East Point Careers In Transition, Inc. -

View the List of Dismissed Plaintiffs

Case 1:05-md-01720-MKB-JO Document 7257-2 Filed 09/18/18 Page 98 of 284 PageID #: 106699 APPENDIX B – Dismissed Plaintiffs BI-LO, LLC; and Bruno’s Supermarkets, Inc. Hy ‑Vee, Inc. The Kroger Co. Albertson’s Inc. Safeway, Inc. Ahold U.S.A., Inc. Walgreen Co. Maxi Drug, Inc. (and doing business as Brooks Pharmacy) Eckerd Corporation Delhaize America, Inc. The Great Atlantic & Pacific Tea Company H.E. Butt Grocery Company Meijer, Inc.; and Meijer Stores Limited Partnership Publix Supermarkets, Inc. QVC, Inc. Raley’s Rite Aid Corporation; and Pathmark Stores, Inc. Supervalu Inc. Wakefern Food Corporation Delta Air Lines, Inc. (and as successor in interest to Northwest Airlines Corp.); Delta Private Jets, Inc.; and MLT, Inc. Fiesta Restaurant Group, Inc. Alfred H. Siegel as Trustee of the Circuit City Stores, Inc. Liquidating Trust Curtis R. Smith as Trustee of the BGI Creditors’ Liquidating Trust B-1 Case 1:05-md-01720-MKB-JO Document 7257-2 Filed 09/18/18 Page 99 of 284 PageID #: 106700 Performance Food Group, Inc. META Advisors LLC (f/k/a KDW Restructuring and Liquidation Services, LLC) as Trustee of the Deel Liquidating Trust Dots, LLC Hewlett-Packard Company Manheim, Inc.; AutoTrader Group, Inc.; Cox Media Group, LLC; Cox Communications, Inc.; and Cox Enterprises, Inc. G6 Hospitality, LLC (and as successor in interest to Accor North America, Inc.); and Motel 6 Operating LP Live Nation Entertainment, Inc. Air Canada Air New Zealand Limited Amway Corp. (f/k/a Quixtar, Inc.); and Alticor Inc. Blue Nile, LLC Callaway Golf Company; Callaway Golf Interactive, Inc.; Callaway Golf Sales Company; and uPlay, Inc. -

COMPANY FACTS: (As of October 31, 2018)

COMPANY FACTS: (As of October 31, 2018) Financial Services: Full-service financial institution offering commercial loans; commercial deposit accounts; consumer and small business savings, checking and money market accounts; certificates of deposit; IRAs; health savings accounts; credit cards; Assets: consumer loans; mortgages; retirement, investment and insurance services $5,753,445,000 Branches: 28, including 25 in metro Atlanta and three out-of-state in Cincinnati/Northern Kentucky, Dallas and Salt Lake City, plus members have access to more than 5,000 shared branch locations nationwide Deposits: Administrative Office: 3250 Riverwood Parkway, Atlanta, GA 30339 $5,001,567,000 ATMs: 56 Delta Community-owned ATMs, plus members have access to thousands of surcharge-free ATMs in the United States and 10 other countries through the CO-OP ATM network Loans: $4,633,847,000 Ranking: Largest credit union in Georgia and among the 25 largest in the United States Online Services: DeltaCommunityCU.com Equity: 12.51% Department of Banking and Finance established minimum to be well Executive Management: Hank Halter, CEO capitalized is 7.00% History: Delta Community was founded in 1940 by eight employees of Delta Air Lines and has become Georgia’s largest credit union with more than $5.7 billion in assets and 28 branch locations. In addition to proudly serving Delta Air Lines’ employees, the Credit Union now welcomes people who live or work in the Members: 11-county metro Atlanta area, and employees of more than 140 businesses including Chick-fil-A, RaceTrac and UPS. 383,611 Media Contacts: John Kennedy, Assistant Vice President, Corporate Communications 404-677-4763 Sharon Renaud, Manager, Public Relations Employees: 770-401-5546 1,052 .