The Influence of Consumer Protection on the Satisfaction of Airline Passengers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

Attachment F – Participants in the Agreement

Revenue Accounting Manual B16 ATTACHMENT F – PARTICIPANTS IN THE AGREEMENT 1. TABULATION OF PARTICIPANTS 0B 475 BLUE AIR AIRLINE MANAGEMENT SOLUTIONS S.R.L. 1A A79 AMADEUS IT GROUP SA 1B A76 SABRE ASIA PACIFIC PTE. LTD. 1G A73 Travelport International Operations Limited 1S A01 SABRE INC. 2D 54 EASTERN AIRLINES, LLC 2I 156 STAR UP S.A. 2I 681 21 AIR LLC 2J 226 AIR BURKINA 2K 547 AEROLINEAS GALAPAGOS S.A. AEROGAL 2T 212 TIMBIS AIR SERVICES 2V 554 AMTRAK 3B 383 Transportes Interilhas de Cabo Verde, Sociedade Unipessoal, SA 3E 122 MULTI-AERO, INC. DBA AIR CHOICE ONE 3J 535 Jubba Airways Limited 3K 375 JETSTAR ASIA AIRWAYS PTE LTD 3L 049 AIR ARABIA ABDU DHABI 3M 449 SILVER AIRWAYS CORP. 3S 875 CAIRE DBA AIR ANTILLES EXPRESS 3U 876 SICHUAN AIRLINES CO. LTD. 3V 756 TNT AIRWAYS S.A. 3X 435 PREMIER TRANS AIRE INC. 4B 184 BOUTIQUE AIR, INC. 4C 035 AEROVIAS DE INTEGRACION REGIONAL 4L 174 LINEAS AEREAS SURAMERICANAS S.A. 4M 469 LAN ARGENTINA S.A. 4N 287 AIR NORTH CHARTER AND TRAINING LTD. 4O 837 ABC AEROLINEAS S.A. DE C.V. 4S 644 SOLAR CARGO, C.A. 4U 051 GERMANWINGS GMBH 4X 805 MERCURY AIR CARGO, INC. 4Z 749 SA AIRLINK 5C 700 C.A.L. CARGO AIRLINES LTD. 5J 203 CEBU PACIFIC AIR 5N 316 JOINT-STOCK COMPANY NORDAVIA - REGIONAL AIRLINES 5O 558 ASL AIRLINES FRANCE 5T 518 CANADIAN NORTH INC. 5U 911 TRANSPORTES AEREOS GUATEMALTECOS S.A. 5X 406 UPS 5Y 369 ATLAS AIR, INC. 50 Standard Agreement For SIS Participation – B16 5Z 225 CEMAIR (PTY) LTD. -

Annual Report 2007

EU_ENTWURF_08:00_ENTWURF_01 01.04.2026 13:07 Uhr Seite 1 Analyses of the European air transport market Annual Report 2007 EUROPEAN COMMISSION EU_ENTWURF_08:00_ENTWURF_01 01.04.2026 13:07 Uhr Seite 2 Air Transport and Airport Research Annual analyses of the European air transport market Annual Report 2007 German Aerospace Center Deutsches Zentrum German Aerospace für Luft- und Raumfahrt e.V. Center in the Helmholtz-Association Air Transport and Airport Research December 2008 Linder Hoehe 51147 Cologne Germany Head: Prof. Dr. Johannes Reichmuth Authors: Erik Grunewald, Amir Ayazkhani, Dr. Peter Berster, Gregor Bischoff, Prof. Dr. Hansjochen Ehmer, Dr. Marc Gelhausen, Wolfgang Grimme, Michael Hepting, Hermann Keimel, Petra Kokus, Dr. Peter Meincke, Holger Pabst, Dr. Janina Scheelhaase web: http://www.dlr.de/fw Annual Report 2007 2008-12-02 Release: 2.2 Page 1 Annual analyses of the European air transport market Annual Report 2007 Document Control Information Responsible project manager: DG Energy and Transport Project task: Annual analyses of the European air transport market 2007 EC contract number: TREN/05/MD/S07.74176 Release: 2.2 Save date: 2008-12-02 Total pages: 222 Change Log Release Date Changed Pages or Chapters Comments 1.2 2008-06-20 Final Report 2.0 2008-10-10 chapters 1,2,3 Final Report - full year 2007 draft 2.1 2008-11-20 chapters 1,2,3,5 Final updated Report 2.2 2008-12-02 all Layout items Disclaimer and copyright: This report has been carried out for the Directorate-General for Energy and Transport in the European Commission and expresses the opinion of the organisation undertaking the contract TREN/05/MD/S07.74176. -

EWF Scientific Seminar

EWF Scientific Seminar GENERAL INFORMATION DATES Arrival: Frebruary 08th 2013 Departure: February 11th 2013 LOCATION The 2013 European Scientific Seminar will take place in Lignano Sabbiadoro (UD) a famous tourist location in the north of Adriatic Sea. ACCOMMODATION All Participants will be accommodated: Hotel Columbus **** Lungomare Trieste 22 33054 Lignano Sabbiadoro (Udine) www.doimohotels.it [email protected] Tel +39 0431 71516 – Fax +39 0431 720114 The Hotel consists of a modern and comfortable rooms, congress hall, traditional restaurant and self-service restaurant, swimming-pools, fitness gym and a parking area: EWF Scientific Seminar ARRIVAL INFORMATION By Car - Take the motorway A4 Venice-Trieste or A23 Tarvisio -Venice and exit Latisana. Continue on highway 354 for about 18 km to Lignano. By Bus - Numerous bus services link Lignano Sabbiadoro with the main Italian and foreign cities. Some examples from the nearest town in Lignano: From Udine Direct link with Lignano. From Latisana Direct link with Lignano. From Venezia Link Venice - Portogruaro - Lignano. By Train - The nearest stations to Lignano dispose of bus services with frequent trips. Station of Latisana Km. 23 Bus connection with Lignano Station of Udine Km. 60 Bus connection with Lignano Station of Portogruaro km. 35 Bus connection with Lignano For further information, consult the website of http://www.ferroviedellostato.it/ By Plane - Lignano is about an hour's drive from the international airports of Venice - Marco Polo located 80 KM from Lignano. The following Companies offer Flights to Venice: British Airways, Iberia, KLM, Lufthansa, Air Dolomiti, Alitalia, Air France, EasyJet, Brussels Airlines, Aerlingus, SAS, Norvegian, CSA, Swiss, Finnair, Austrian, Carpatair, Turkish Airline, Air Berlin, Aegean, Aerolflot, BelleAir, Vueling, Meridiana, Luxair. -

356 Partners Found. Check If Available in Your Market

367 partners found. Check if available in your market. Please always use Quick Check on www.hahnair.com/quickcheck prior to ticketing P4 Air Peace BG Biman Bangladesh Airl… T3 Eastern Airways 7C Jeju Air HR-169 HC Air Senegal NT Binter Canarias MS Egypt Air JQ Jetstar Airways A3 Aegean Airlines JU Air Serbia 0B Blue Air LY EL AL Israel Airlines 3K Jetstar Asia EI Aer Lingus HM Air Seychelles BV Blue Panorama Airlines EK Emirates GK Jetstar Japan AR Aerolineas Argentinas VT Air Tahiti OB Boliviana de Aviación E7 Equaflight BL Jetstar Pacific Airlines VW Aeromar TN Air Tahiti Nui TF Braathens Regional Av… ET Ethiopian Airlines 3J Jubba Airways AM Aeromexico NF Air Vanuatu 1X Branson AirExpress EY Etihad Airways HO Juneyao Airlines AW Africa World Airlines UM Air Zimbabwe SN Brussels Airlines 9F Eurostar RQ Kam Air 8U Afriqiyah Airways SB Aircalin FB Bulgaria Air BR EVA Air KQ Kenya Airways AH Air Algerie TL Airnorth VR Cabo Verde Airlines FN fastjet KE Korean Air 3S Air Antilles AS Alaska Airlines MO Calm Air FJ Fiji Airways KU Kuwait Airways KC Air Astana AZ Alitalia QC Camair-Co AY Finnair B0 La Compagnie UU Air Austral NH All Nippon Airways KR Cambodia Airways FZ flydubai LQ Lanmei Airlines BT Air Baltic Corporation Z8 Amaszonas K6 Cambodia Angkor Air XY flynas QV Lao Airlines KF Air Belgium Z7 Amaszonas Uruguay 9K Cape Air 5F FlyOne LA LATAM Airlines BP Air Botswana IZ Arkia Israel Airlines BW Caribbean Airlines FA FlySafair JJ LATAM Airlines Brasil 2J Air Burkina OZ Asiana Airlines KA Cathay Dragon GA Garuda Indonesia XL LATAM Airlines -

State and Airline Response to COVID-19. 04 May 2020 Airline Announcement Share Flights 2019 2/5/20 Aer Lingus See IAG

State and Airline Response to COVID-19. 04 May 2020 Airline Announcement Share Flights 2019 2/5/20 Aer Lingus See IAG. Plan to cut workforce by 20% [1/5]. 0.8% -91% Air Dolomiti Suspended flights (18/3–17/5). Some repatriation flights [2/4]. 0.2% Air France Flight capacity cut by 90% from 23/3 until end May [10/4]. State aid granted with commitment to reduce CO2 3.2% -97% emissions of domestic flights by 50% by 2024 [24/4]. All A380 grounded [16/3]. A ‘best case’ could be 30% of 2019 during July, but social distancing challenges [20/4]. Progressive pax domestic flights restart from 11 May [26/4]. Air Malta Suspended flights from 25/3 (until further notice) with exceptions [18/3]. Will lay off 80% of pilots (21/4). 0.2% Air Moldova Suspended flights (25/3–15/5) [26/3]. 0.1% Air Serbia Suspended passenger transport (19/3–30/4 or later) (see Serbia). State aid granted [27/4] 0.3% airBaltic Suspended flights (17/3–12/5). Flight capacity reduced by 50% 15/4-30/10 [3/4] (see Latvia). Accelerated fleet 0.6% transformation (A220-only) [22/4]. Some pax flights may resume 13/5 [28/4] Alitalia Nationalised [17/3] to resume ops with ~80% of current fleet [23/4]. Reimbursement or exchange of tickets booked 1.9% -89% until 31 May proposed [20/3]. Cargo flights to/from China extended until 11/5 [30/4]. Austrian Airlines Suspended flights (19/3–31/5) [29/4]. Expects 25%-50% of demand for Summer (vs S19). -

IATA Agents in BSP Italy Date: 20 Maggio 2008 Subject: Carpatair

BULLETIN 22/2008 For: All IATA Agents in BSP Italy Date: 20 Maggio 2008 Subject: Carpatair – ET Policy Egregi Agenti, Si prega voler prendere giusta nota che IATA non-è in alcun modo responsabile del contenuto della comunicazione. Per qualsiasi dubbio o chiarimento vi preghiamo voler contattare direttamente la Compagnia Aerea Distinti Saluti, Service Centre Europe International Air Transport Association Service Centre Europe Torre Europa Paseo de la Castellana, 95 28046 Madrid, Spain www.iata.org/europe/cs S.C. Carpatair S.A. TO: AGENTS IN IATA BSPs & INTERLINE PARTNERS ISSUED: 15 MAY 2008 CARPATAIR E-TICKETING POLICY STARTING 01 JUNE 2008 (IATA DEADLINE FOR PAPER TICKETS) Dear Partners, Carpatair (V3) would like to inform all travel agents and interline partners that effective 01 June 2008 V3 will have 100% electronic ticketing eligibility on its own routes for the issuance of V3 plated E-tickets (prefixed 021) across all of V3 sales channels. 1. V3 Electronic Ticket Issue Policy Carpatair may be selected as ticketing carrier by travel agents when issuing e-tickets to cover journeys entirely on V3 flights with V3 flight designator code including marketing flights. 2. V3 Interline Electronic Tickets Agreements (IETs) Carpatair has completed IET agreements with the following carriers. This means that providing Carpatair flights are part of an interline journey with the following carriers, Carpatair tickets may be issued in accordance with the V3 ticket issue policy. Note – list subject to change 2M Moldavian Airlines A3 Aegean Airlines AB Air Berlin AY Finnair HR Hahn Air LT LTU International LX Swiss International Air Lines MA Malev Hungarian Airlines OS Austrian Airlines RO Tarom SN SN Brussels 3. -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010. -

Monthly OTP November 2019

Monthly OTP November 2019 ON-TIME PERFORMANCE AIRLINES Contents On-Time is percentage of flights that depart or arrive within 15 minutes of schedule. Global OTP rankings are only assigned to all Airlines/Airports where OAG has status coverage for at least 80% of the scheduled flights. Regional Airlines Status coverage will only be based on actual gate times rather than estimated times. This may result in some airlines / airports being excluded from this report. If you would like to review your flight status feed with OAG, please email [email protected] MAKE SMARTER MOVES Airline Monthly OTP – November 2019 Page 1 of 1 Home GLOBAL AIRLINES – TOP 50 AND BOTTOM 50 TOP AIRLINE ON-TIME FLIGHTS On-time performance BOTTOM AIRLINE ON-TIME FLIGHTS On-time performance Airline Arrivals Rank No. flights Size Airline Arrivals Rank No. flights Size JH Fuji Dream Airlines 96.5% 1 2,340 155 3H Air Inuit 37.2% 162 1,465 196 GA Garuda Indonesia 95.8% 2 12,736 48 AI Air India 40.1% 161 16,509 38 RC Atlantic Airways Faroe Islands 95.0% 3 210 295 WG Sunwing Airlines Inc. 50.3% 160 905 225 7G Star Flyer 94.0% 4 2,160 164 WO Swoop 53.4% 159 919 222 EW Eurowings 93.4% 5 15,608 40 SG SpiceJet 54.3% 158 18,288 33 SATA International-Azores 6J Solaseed 93.3% 6 2,226 161 S4 54.5% 157 448 260 Airlines S.A. XQ SunExpress 93.3% 7 3,115 135 IW Wings Air 54.7% 156 11,242 55 TA TACA International Airlines 92.8% 8 374 272 JY Intercaribbean Airways Ltd 56.1% 155 1,760 184 FA Safair 92.6% 9 2,250 159 JT Lion Air 58.0% 154 17,320 34 B7 Uni Airways 92.5% 10 4,132 123 BJ Nouvelair -

EMPIRICAL VALIDATION of BLUE OCEAN STRATEGY SUSTAINABILITY in an INTERNATIONAL ENVIRONMENT Jiri DVORAK*, Ilona RAZOVA

Foundations of Management, Vol. 10 (2018), ISSN 2080-7279 DOI: 10.2478/fman-2018-0012 143 EMPIRICAL VALIDATION OF BLUE OCEAN STRATEGY SUSTAINABILITY IN AN INTERNATIONAL ENVIRONMENT Jiri DVORAK*, Ilona RAZOVA** University of Economics, Prague, Jindrichuv Hradec, CZECH REPUBLIC * e-mail: [email protected] ** e-mail: [email protected] Abstract: This article investigates the applicability of blue ocean strategy in regard to low-cost airlines in the civil airline industry. To do so, the commercial offers of selected airlines were compared to vali- date any attempts to apply the blue ocean strategy concept. This is followed by examining the time lim- itation of the concept in a competitive environment and is illustrated by the changes in the industry for the past 30 years and a comparison of offers from similar companies. The third issue is the evalua- tion of the further contribution of blue ocean strategy when it is recognized as time-limited. The im- portance of first-mover advantage, which could be based on the ability to capture an economy of scale and advantageously shape the market, is also discussed. Keywords: blue ocean strategy, civil airliners, competitiveness, low-cost strategy, first-mover ad- vantage, Ryanair, customer value, value curve. JEL: M16, L10, L21. 1 Introduction Bonsor, 2001; Doganis, 2006). In Europe, the situa- tion began to change with the emergence of Ryanair Air transport experienced dynamic growth in the in 1985 when it entered the European market with second half of the twentieth century, which contin- a low-cost airline concept (Barrett, 2004; Thomas, ued into the early twenty-first century and still re- 2013; Ryanair, 2015a). -

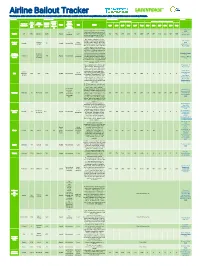

European Airline Bailout Tracker Reflects the Most up to Date Public Information Available at the Time It Was Published on June 9, 2021

Airline Bailout Tracker This European airline bailout tracker reflects the most up to date public information available at the time it was published on June 9, 2021. Financial data based on research by Profundo. Company Bailout amount Financial results Sources Amount Binding Net profits (mln €) Dividends + share buybacks (mln €) 2018 Airline/ Amount (mln €) - climate Country of Passen subsidiarie (mln €) - Under Status conditions Type Details registration gers 2019 2018 2017 2016 2015 Total 2019 2018 2017 2016 2015 Total (mln) s Agreed discussi Private on dividend ban Guardian, 6 April An initial government loan of GBP 2020 600m (ca €670m) was provided at No Reuters, 11 EasyJet UK 88.5 EasyJet 2240 Agreed Loan the start of the crisis, followed with a 393 402 246 505 742 2288 214 281 195 272 421 1383 dividends January 2021 government backed loan of GBP 1,4 bn (ca €1,570m) in January 2021. One-quarter of Norway’s rescue package for airlines (loan guarantee e24, 20 April Regional Regional Loan of NOK 6 billion ($549 million)) will 2020 Norway 121 Agreed No condition - - - - - - - - - - - - carriers carriers guarantee be divided between Widerøe, which Aeronautics, 20 offers key regional service, and other March 2020 small regional airline operators. Total pot of €455m has been made available to all airlines registered in Sweden. SAS has been loaned €137m and that has been deducted Euractiv, 13 April All airlines All airlines Loan from this amount and included in the 2020 operating in Sweden operating 318 Agreed No condition - - - - - - - - - - - - guarantee overall support provided to SAS by Finans, 17 March Sweden in Sweden Sweden and other countries, detailed 2020 the row below. -

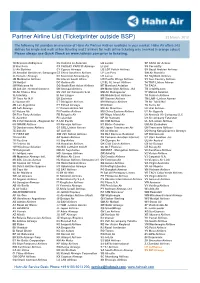

Airlines List in Outside

Partner Airline List (Ticketprinter outside BSP) 23 March, 2012 The following list provides an overview of Hahn Air Partner Airlines available in your market. Hahn Air offers 243 airlines for single and multi airline ticketing and 2 airlines for multi airline ticketing only (marked in orange colour). Please always use Quick Check on www.hahnair.com prior to ticketing. 1X Branson AirExpress CU Cubana de Aviacion LG Luxair SP SATA Air Acores 2I Star Perú CX CATHAY PACIFIC Airways LI Liat SS Corsairfly 2J Air Burkina CY Cyprus Airways LO LOT Polish Airlines SV Saudi Arabian Airlines 2K AeroGal Aerolineas Galapagos CZ China Southern Airlines LP Lan Peru SW Air Namibia 2L Helvetic Airways D2 Severstal Aircompany LR Lacsa SX SkyWork Airlines 2M Moldavian Airlines D6 Interair South Africa LW Pacific Wings Airlines SY Sun Country Airlines 2N Nextjet DC Golden Air LY EL AL Israel Airlines T4 TRIP Linhas Aéreas 2W Welcome Air DG South East Asian Airlines M7 Marsland Aviation TA TACA 3B Job Air - Central Connect DN Senegal Airlines M9 Motor Sich Airlines JSC TB Jetairfly.com 3E Air Choice One DV JSC Air Company Scat MD Air Madagascar TF Malmö Aviation 3L InterSky EI Aer Lingus ME Middle East Airlines TK Turkish Airlines 3P Tiara Air N.V. EK Emirates MF Xiamen Airlines TM LAM - Linhas Aereas 4J Somon Air ET Ethiopian Airlines MH Malaysia Airlines TN Air Tahiti Nui 4M Lan Argentina EY Etihad Airways MI SilkAir TU Tunis Air 4Q Safi Airways F7 Darwin Airline SA MK Air Mauritius U6 Ural Airlines 5C Nature Air F9 Frontier Airlines MU China Eastern Airlines