Mitsui Fudosan Co., Ltd. Representative

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Alma Eikoh Japan Large Cap Equity Fund a Sub-Fund of Alma Capital Investment Funds SICAV

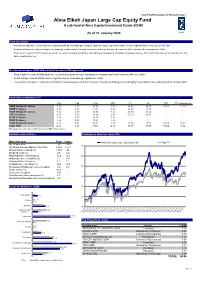

FOR PROFESSIONAL INVESTORS ONLY Alma Eikoh Japan Large Cap Equity Fund A sub-fund of Alma Capital Investment Funds SICAV As of 31 January 2020 Eikoh Fund description • Investment objective: seek long-term capital growth by investing generally in Japanese large cap stocks (with market capitalisation in excess of US$ 1bn) • Investment process: analyse long term company fundamentals through extensive in-house bottom up research with a strong risk management ethos • Portfolio of around 25-30 companies which are well managed, profitable and with good prospects. Portfolio managers believe that Cash Flow Return on Investment and value creation are key Investment manager: ACIM (Alma Capital Investment Management) • Alma Capital Investment Management is a Luxembourg based asset management company and holds a branch office in London • ACIM manages assets of $4bn and is regulated by the Luxembourg regulator the CSSF • The portfolio managers, led by James Pulsford, worked together at Eikoh Research Investment Management managing the portfolio before joining ACIM in January 2020 Cumulative performance (%) 1 M 3 M 6 M YTD 1Y 3Y ITD ITD (annualized) I GBP Hedged C shares -0.29 4.47 12.94 -0.29 24.54 26.44 86.03 11.36 I GBP C shares -0.58 2.63 4.95 -0.58 23.80 24.93 - - I EUR Hedged C shares -0.43 4.29 12.94 -0.43 23.69 23.44 - - I JPY C shares -0.35 4.53 13.85 -0.35 25.10 26.48 - - I EUR C shares 1.36 5.60 14.74 1.36 - - - - I EUR D shares 1.36 5.58 14.67 1.36 - - - - I USD Hedged C shares -0.20 5.06 14.81 -0.20 27.84 33.92 94.05 12.47 Topix (TR) -2.14 1.21 8.88 -2.14 10.17 18.46 53.20 7.86 Fund launched on 12 June 2014 (I USD Hedged C and I GBP Hedged C shares) Portfolio characteristics Performance (Indexed - Base 100) Main indicators Fund Index Alma Eikoh Japan Large Cap Equity Fund Topix TR No. -

The Popular Culture Studies Journal

THE POPULAR CULTURE STUDIES JOURNAL VOLUME 6 NUMBER 1 2018 Editor NORMA JONES Liquid Flicks Media, Inc./IXMachine Managing Editor JULIA LARGENT McPherson College Assistant Editor GARRET L. CASTLEBERRY Mid-America Christian University Copy Editor Kevin Calcamp Queens University of Charlotte Reviews Editor MALYNNDA JOHNSON Indiana State University Assistant Reviews Editor JESSICA BENHAM University of Pittsburgh Please visit the PCSJ at: http://mpcaaca.org/the-popular-culture- studies-journal/ The Popular Culture Studies Journal is the official journal of the Midwest Popular and American Culture Association. Copyright © 2018 Midwest Popular and American Culture Association. All rights reserved. MPCA/ACA, 421 W. Huron St Unit 1304, Chicago, IL 60654 Cover credit: Cover Artwork: “Wrestling” by Brent Jones © 2018 Courtesy of https://openclipart.org EDITORIAL ADVISORY BOARD ANTHONY ADAH FALON DEIMLER Minnesota State University, Moorhead University of Wisconsin-Madison JESSICA AUSTIN HANNAH DODD Anglia Ruskin University The Ohio State University AARON BARLOW ASHLEY M. DONNELLY New York City College of Technology (CUNY) Ball State University Faculty Editor, Academe, the magazine of the AAUP JOSEF BENSON LEIGH H. EDWARDS University of Wisconsin Parkside Florida State University PAUL BOOTH VICTOR EVANS DePaul University Seattle University GARY BURNS JUSTIN GARCIA Northern Illinois University Millersville University KELLI S. BURNS ALEXANDRA GARNER University of South Florida Bowling Green State University ANNE M. CANAVAN MATTHEW HALE Salt Lake Community College Indiana University, Bloomington ERIN MAE CLARK NICOLE HAMMOND Saint Mary’s University of Minnesota University of California, Santa Cruz BRIAN COGAN ART HERBIG Molloy College Indiana University - Purdue University, Fort Wayne JARED JOHNSON ANDREW F. HERRMANN Thiel College East Tennessee State University JESSE KAVADLO MATTHEW NICOSIA Maryville University of St. -

US$2098.00 Tour Start Dates: 2013 – 12/1, 12/8, 12/15, 12/22 2014 – 2/2, 12/7, 12/14, 12/21

The Golden Route Japan Tour Winter 7 days 6 nights US$2098.00 Tour Start Dates: 2013 – 12/1, 12/8, 12/15, 12/22 2014 – 2/2, 12/7, 12/14, 12/21 TOUR COST INCLUDES: 5 nights Western style and 1 night Japanese style accommodation Meet and greet upon arrival at Narita Airport Airport transfers on arrival and departure Private luxury coach transfers between destinations in Japan Comprehensive escorted with AJT professional English speaking tour guide Gratuities Meals Breakfast everyday 4 lunches and 2 dinners Admission fees and activities Entry fees to sites, gardens, and museums listed in the itinerary Sumida River Cruise Bullet Train Ride Nishijin Kimono Show Green Tea Ceremony All prices are per person, based on double or triple occupancy. International flights are not included on our tours -this allows you the flexibility to choose your own departure and get the best value for your money! We can arrange international flights for US customers if needed, please ask for details. All Japan Tours 646 W. California St., Ontario, CA 91762, USA Toll Free (US/CANADA): 1-855-325-2726 <1-855-32JAPAN> TEL: 1-909-988-8885 FAX: 1-909-349-1736 E-mail: [email protected] www.alljapantours.com 2 ITINERARY Day 01: Narita Airport Welcome to Tokyo! Our tour guide will greet you and escort you to the hotel. Overnight: Narita Excel Hotel Tokyu or similar class Overnight: Tokyo Dome Hotel or similar class (NOTE 1 & 2) NOTE 1: If you wish to stay in the center of Tokyo for the first night, we can arrange for you to stay at Tokyo Dome Hotel instead of Narita Excel Hotel Tokyu for an additional $50 per person. -

Inside and Outside Powerbrokers

Inside and Outside Powerbrokers By Jochen Legewie Published by CNC Japan K.K. First edition June 2007 All rights reserved Printed in Japan Contents Japanese media: Superlatives and criticism........................... 1 Media in figures .............................................................. 1 Criticism ........................................................................ 3 The press club system ........................................................ 4 The inside media: Significance of national dailies and NHK...... 7 Relationship between inside media and news sources .......... 8 Group self-censorship within the inside media .................. 10 Specialization and sectionalism within the inside media...... 12 Business factors stabilizing the inside media system.......... 13 The outside media: Complementarities and role as watchdog 14 Recent trends and issues .................................................. 19 Political influence on media ............................................ 19 Media ownership and news diversity................................ 21 The internationalization of media .................................... 25 The rise of internet and new media ................................. 26 The future of media in Japan ............................................. 28 About the author About CNC Japanese media: Superlatives and criticism Media in figures Figures show that Japan is one of the most media-saturated societies in the world (FPCJ 2004, World Association of Newspapers 2005, NSK 2006): In 2005 the number of daily newspapers printed exceeded 70 million, the equivalent of 644 newspapers per 1000 adults. This diffusion rate easily dwarfs any other G-7 country, including Germany (313), the United Kingdom (352) and the U.S. (233). 45 out of the 120 different newspapers available carry a morning and evening edition. The five largest newspapers each sell more than four million copies daily, more than any of their largest Western counterparts such as Bild in Germany (3.9 mil.), The Sun in the U.K. (2.4 mil.) or USA Today in the U.S. -

Yomiuri, Shimbun Mike Mansfield 1903-2001

University of Montana ScholarWorks at University of Montana Mike Mansfield Speeches Mike Mansfield Papers 4-1981 Yomiuri, Shimbun Mike Mansfield 1903-2001 Let us know how access to this document benefits ouy . Follow this and additional works at: https://scholarworks.umt.edu/mansfield_speeches Recommended Citation Mansfield, Mike 1903-2001, "Yomiuri, Shimbun" (1981). Mike Mansfield Speeches. 1522. https://scholarworks.umt.edu/mansfield_speeches/1522 This Speech is brought to you for free and open access by the Mike Mansfield Papers at ScholarWorks at University of Montana. It has been accepted for inclusion in Mike Mansfield Speeches by an authorized administrator of ScholarWorks at University of Montana. For more information, please contact [email protected]. \ ( YOMIURI (Page 2) (Full) April 19, 1981 fiiJ Foreign Minister Easily Succumbs to Ambassador MANSFIELD's Fervent Speech; Becomes Weak-Kneed, with Efforts to Seek Early Reply Taken Advantage Of ITO's style of "naniwa-bushi" was completely defeated (?), with its being taken advantage of. It seems that the Foreign Minister ITO-US Ambassador MANSFIELD talks, which were held on the 18th, in connection with the US nuclear-powered submarine's ''hit-and-run" accident, started with and ended in the Ambassador's remarkably fervent speech, covering a range of problems from his view on life and political philosophy to an argument concerning the US as a law-governed country. The Ambassador's stand may be briefly summed up as follows: "Investigations into the accident will be conducted -

Yahoo Japan Corporation

Yahoo Japan Corporation Annual Review Year ended March 31,2001 Profile Yahoo Japan Corporation (Yahoo! Japan) provides Internet users with a wide range of services, including directory search, information, community, commerce, and mobile services. Our Web site is the overwhelming leader in Japan in number of users and page views. Our primary business is Internet advertising. We place advertising banners on our Web pages that target Yahoo! Japan site users and for which we receive fees from advertisers. We also utilize our substantial Internet know-how to launch and develop such other businesses as Internet commerce and Internet technology support services. Contents Financial Highlights 1 To Our Shareholders 2 Review of Operations 6 Services 9 Financial Review 11 Balance Sheets 16 Statements of Income 18 Statements of Cash Flows 19 Risk Factors 20 Corporate Data/Directors and Auditors 37 Forward-Looking Statements Statements included in this Annual Review that are not historical facts are forward-looking statements about the future performance of Yahoo! Japan. The Company cautions you that a number of important factors could cause actual results to differ materially from those discussed in the forward-looking statements. Such factors include, but are not limited to, the items mentioned in the “Risk Factors.” Financial Highlights (Millions of Yen) FY2001/3 FY2000/3 FY1999/3 FY1998/3 FY1997/3 FOR THE YEAR Net Sales: Advertising Services 12,187 5,136 1,432 908 345 Other Services 851 559 482 360 67 Total 13,039 5,695 1,914 1,269 413 Operating Income 5,308 2,110 399 165 56 Ordinary Income 5,208 2,031 391 151 56 Net Income 2,972 1,153 183 64 23 Net Income per Share (Yen) 39,328 63,515 27,068 11,895 5,986 Number of Shares Outstanding (Number of Shares) 75,586 18,163 6,785 5,416 4,000 AT YEAR-END Total Assets 27,972 10,475 3,919 1,247 375 Shareholders' Equity 18,673 8,106 3,263 1,018 218 Notes: 1. -

United Japan Growth Fund

United Japan Growth Fund Semi Annual Report for the half year ended 30 June 2021 United Japan Growth Fund (Constituted under a Trust Deed in the Republic of Singapore) MANAGER UOB Asset Management Ltd Registered Address: 80 Raffles Place UOB Plaza Singapore 048624 Company Registration No. : 198600120Z Tel: 1800 22 22 228 DIRECTORS OF UOB ASSET MANAGEMENT LTD Lee Wai Fai Eric Tham Kah Jin PehKianHeng Thio Boon Kiat TRUSTEE State Street Trust (SG) Limited 168 Robinson Road #33-01, Capital Tower Singapore 068912 CUSTODIAN / ADMINISTRATOR / REGISTRAR State Street Bank and Trust Company, acting through its Singapore Branch 168 Robinson Road #33-01, Capital Tower Singapore 068912 AUDITOR PricewaterhouseCoopers LLP 7 Straits View, Marina One East Tower, Level 12 Singapore 018936 SUB-MANAGER Fukoku Capital Management, Inc. 1-3-1 Uchisaiwaicho Chiyoda-Ku Saiwai Building 3rd Floor Tokyo 100-0011, Japan -1- United Japan Growth Fund (Constituted under a Trust Deed in the Republic of Singapore) A) Fund Performance Since Inception 18 August 3yr 5yr 10 yr 1995 3mth 6mth 1yr Ann Ann Ann Ann Fund Performance/ % % % Comp Comp Comp Comp Benchmark Returns Growth Growth Growth Ret Ret Ret Ret United Japan Growth Fund -2.42 -2.27 16.23 3.68 5.17 4.75 2.57 Benchmark -0.24 3.01 20.29 6.73 10.16 8.13 0.60 Source: Morningstar. Note: The performance returns of the Fund are in Singapore Dollar based on a NAV-to-NAV basis with dividends and distributions reinvested, if any. The benchmark of the Fund: Aug 95 – Dec 04: Nikkei 225 Stock Average; Jan 05 – Dec 10: Topix; Jan 11 to Present: MSCI Japan Index. -

Significance of Rainwater and Reclaimed Water As Urban Water Resource for Sustainable Use

Significance of rainwater and reclaimed water as urban water resource for sustainable use Hiroaki FURUMAI Professor, Research Center for Water Environment Technology University of Tokyo Japan-China-Korea Green Technology Forum @ Tokyo, March 14, 2012 1 Outline Introduction - Climate change and fluctuation of annual rainfall in Japan - Water resource and water supply system in Tokyo - Concern about the sustainability of urban water use - Facility installation for rainwater and reclaimed water use Urban water resources for sustainable use - Rainwater harvesting and use Representative cases and new movement of rainwater use - Reclaimed water use and treatment technology Current state of reclaimed water use and new projects Japan-China-Korea Green Technology Forum @ Tokyo, March 14, 2012 2 Fluctuation of annual rainfall and occurrence of drought in Japan (mm) 2,100 Average annual rainfall decreases by about 7% in 100 years 2,000 1,900 1,800 1,700 1,600 1,500 B Annual rainfall 1,400 C H Annual rainfall J 年降水量 D 1,300 Moving average A G K for5年移動平均 5 years 1,200 E Tendencyトレンド F I 1,100 1900 1905 1910 1915 1920 1925 1930 1935 1940 1945 1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 Fluctuation becomes larger A: Lake Biwa drought(1939), B: Tokyo Olympic drought(1964), C: Nagasaki drought(1967), D: Takamatsu drought(1973), E: Fukuoka drought(1978), F: Nationwide winter drought(1984), G: West Japan winter drought(1986), H: Metropolitan area drought(1987), I: Japan Islands drought(1994), J: Matsuyama drought(2002), K: Chubu and Shikoku area drought(2005) 3 Surface water dependent Water resource and Dam storage type Water supply system in Tokyo One-through water use Drinking water treatment plant Wastewater Treatment Plant 80% 20% <1% Japan-China-Korea Green Technology Forum @ Tokyo, March 14, 2012 4 Concern about the sustainability of urban water use Increased water demand had led to the dam construction at the upstream and the extensive water withdrawal from rivers in Japan. -

News Pdf 311.Pdf

2013 World Baseball Classic- The Nominated Players of Team Japan(Dec.3,2012) *ICC-Intercontinental Cup,BWC-World Cup,BAC-Asian Championship Year&Status( A-Amateur,P-Professional) *CL-NPB Central League,PL-NPB Pacific League World(IBAF,Olympic,WBC) Asia(BFA,Asian Games) Other(FISU.Haarlem) 12 Pos. Name Team Alma mater in Amateur Baseball TB D.O.B Asian Note Haarlem 18U ICC BWC Olympic WBC 18U BAC Games FISU CUB- JPN P 杉内 俊哉 Toshiya Sugiuchi Yomiuri Giants JABA Mitsubishi H.I. Nagasaki LL 1980.10.30 00A,08P 06P,09P 98A 01A 12 Most SO in CL P 内海 哲也 Tetsuya Utsumi Yomiuri Giants JABA Tokyo Gas LL 1982.4.29 02A 09P 12 Most Win in CL P 山口 鉄也 Tetsuya Yamaguchi Yomiuri Giants JHBF Yokohama Commercial H.S LL 1983.11.11 09P ○ 12 Best Holder in CL P 澤村 拓一 Takuichi Sawamura Yomiuri Giants JUBF Chuo University RR 1988.4.3 10A ○ P 山井 大介 Daisuke Yamai Chunichi Dragons JABA Kawai Musical Instruments RR 1978.5.10 P 吉見 一起 Kazuki Yoshimi Chunichi Dragons JABA TOYOTA RR 1984.9.19 P 浅尾 拓也 Takuya Asao Chunichi Dragons JUBF Nihon Fukushi Univ. RR 1984.10.22 P 前田 健太 Kenta Maeda Hiroshima Toyo Carp JHBF PL Gakuen High School RR 1988.4.11 12 Best ERA in CL P 今村 猛 Takeshi Imamura Hiroshima Toyo Carp JHBF Seihou High School RR 1991.4.17 ○ P 能見 篤史 Atsushi Nomi Hanshin Tigers JABA Osaka Gas LL 1979.5.28 04A 12 Most SO in CL P 牧田 和久 Kazuhisa Makita Seibu Lions JABA Nippon Express RR 1984.11.10 P 涌井 秀章 Hideaki Wakui Seibu Lions JHBF Yokohama High School RR 1986.6.21 04A 08P 09P 07P ○ P 攝津 正 Tadashi Settu Fukuoka Softbank Hawks JABA Japan Railway East-Sendai RR 1982.6.1 07A 07BWC Best RHP,12 NPB Pitcher of the Year,Most Win in PL P 大隣 憲司 Kenji Otonari Fukuoka Softbank Hawks JUBF Kinki University LL 1984.11.19 06A ○ P 森福 允彦 Mitsuhiko Morifuku Fukuoka Softbank Hawks JABA Shidax LL 1986.7.29 06A 06A ○ P 田中 将大 Masahiro Tanaka Tohoku Rakuten Golden Eagles JHBF Tomakomai H.S.of Komazawa Univ. -

Sports Quiz When Were the First Tokyo Olympic Games Held?

Sports Quiz When were the first Tokyo Olympic Games held? ① 1956 ② 1964 ③ 1972 ④ 1988 When were the first Tokyo Olympic Games held? ① 1956 ② 1964 ③ 1972 ④ 1988 What is the city in which the Winter Olympic Games were held in 1998? ① Nagano ② Sapporo ③ Iwate ④ Niigata What is the city in which the Winter Olympic Games were held in 1998? ① Nagano ② Sapporo ③ Iwate ④ Niigata Where do sumo wrestlers have their matches? ① sunaba ② dodai ③ doma ④ dohyō Where do sumo wrestlers have their matches? ① sunaba ② dodai ③ doma ④ dohyō What do sumo wrestlers sprinkle before a match? ① salt ② soil ③ sand ④ sugar What do sumo wrestlers sprinkle before a match? ① salt ② soil ③ sand ④ sugar What is the action wrestlers take before a match? ① shiko ② ashiage ③ kusshin ④ tsuppari What is the action wrestlers take before a match? ① shiko ② ashiage ③ kusshin ④ tsuppari What do wrestlers wear for a match? ① dōgi ② obi ③ mawashi ④ hakama What do wrestlers wear for a match? ① dōgi ② obi ③ mawashi ④ hakama What is the second highest ranking in sumo following yokozuna? ① sekiwake ② ōzeki ③ komusubi ④ jonidan What is the second highest ranking in sumo following yokozuna? ① sekiwake ② ōzeki ③ komusubi ④ jonidan On what do judo wrestlers have matches? ① sand ② board ③ tatami ④ mat On what do judo wrestlers have matches? ① sand ② board ③ tatami ④ mat What is the decision of the match in judo called? ① ippon ② koka ③ yuko ④ waza-ari What is the decision of the match in judo called? ① ippon ② koka ③ yuko ④ waza-ari Which of these is not included in the waza techniques of -

Baseball in Japan and the US History, Culture, and Future Prospects by Daniel A

Sports, Culture, and Asia Baseball in Japan and the US History, Culture, and Future Prospects By Daniel A. Métraux A 1927 photo of Kenichi Zenimura, the father of Japanese-American baseball, standing between Lou Gehrig and Babe Ruth. Source: Japanese BallPlayers.com at http://tinyurl.com/zzydv3v. he essay that follows, with a primary focus on professional baseball, is intended as an in- troductory comparative overview of a game long played in the US and Japan. I hope it will provide readers with some context to learn more about a complex, evolving, and, most of all, Tfascinating topic, especially for lovers of baseball on both sides of the Pacific. Baseball, although seriously challenged by the popularity of other sports, has traditionally been considered America’s pastime and was for a long time the nation’s most popular sport. The game is an original American sport, but has sunk deep roots into other regions, including Latin America and East Asia. Baseball was introduced to Japan in the late nineteenth century and became the national sport there during the early post-World War II period. The game as it is played and organized in both countries, however, is considerably different. The basic rules are mostly the same, but cultural differences between Americans and Japanese are clearly reflected in how both nations approach their versions of baseball. Although players from both countries have flourished in both American and Japanese leagues, at times the cultural differences are substantial, and some attempts to bridge the gaps have ended in failure. Still, while doubtful the Japanese version has changed the American game, there is some evidence that the American version has exerted some changes in the Japanese game. -

Scenery Baseball Postmarks of Japan

JOURNAL OF SPORTS PHILATELY Volume 51 Spring 2013 Number 3 TABLE OF CONTENTS President's Message Mark Maestrone 1 Cricket & Philately: Cricket on the Peter Street 3 Subcontinent – Bangladesh Hungary Salutes London Olympics Mark Maestrone 10 and Hungarian Olympic Team & Zoltan Klein 1928 Olympic Fencing Postcards from Italy Mark Maestrone 12 Scenery Baseball Postmarks Norman Rushefsky 15 of Japan & Masaoki Ichimura 100th Grey Cup Game – A Post Game Addendum Kon Sokolyk 22 The next Olympic Games are J.L. Emmenegger 24 just around the corner! Book Review: Titanic: The Tennis Story Norman Jacobs, Jr. 28 The Sports Arena Mark Maestrone 29 Reviews of Periodicals Mark Maestrone 30 News of our Members Mark Maestrone 32 New Stamp Issues John La Porta 34 www.sportstamps.org Commemorative Stamp Cancels Mark Maestrone 36 SPORTS PHILATELISTS INTERNATIONAL CRICKET President: Mark C. Maestrone, 2824 Curie Place, San Diego, CA 92122 Vice-President: Charles V. Covell, Jr., 207 NE 9th Ave., Gainesville, FL 32601 3 Secretary-Treasurer: Andrew Urushima, 1510 Los Altos Dr., Burlingame, CA 94010 Directors: Norman F. Jacobs, Jr., 2712 N. Decatur Rd., Decatur, GA 30033 John La Porta, P.O. Box 98, Orland Park, IL 60462 Dale Lilljedahl, 4044 Williamsburg Rd., Dallas, TX 75220 Patricia Ann Loehr, 2603 Wauwatosa Ave., Apt 2, Wauwatosa, WI 53213 Norman Rushefsky, 9215 Colesville Road, Silver Spring, MD 20910 Robert J. Wilcock, 24 Hamilton Cres., Brentwood, Essex, CM14 5ES, England Store Front Manager: (Vacant) Membership (Temporary): Mark C. Maestrone, 2824 Curie Place, San Diego, CA 92122 Sales Department: John La Porta, P.O. Box 98, Orland Park, IL 60462 OLYMPIC Webmaster: Mark C.