Workforce and Impact Assessment

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Stags.Co.Uk 01823 256625 | [email protected]

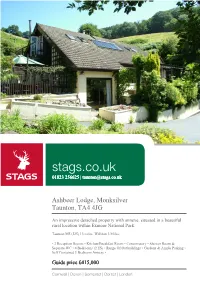

stags.co.uk 01823 256625 | [email protected] Ashbeer Lodge, Monksilver Taunton, TA4 4JG An impressive detached property with annexe, situated in a beautiful rural location within Exmoor National Park. Taunton/M5 (J25) 13 miles. Williton 3 Miles. • 2 Reception Rooms • Kitchen/Breakfast Room • Conservatory • Shower Room & Separate WC • 4 Bedrooms (2 ES) • Range Of Outbuildings • Gardens & Ample Parking • Self Contained 1 Bedroom Annexe • Guide price £415,000 Cornwall | Devon | Somerset | Dorset | London Ashbeer Lodge, Monksilver, Taunton, TA4 4JG Situation appointed family home. The accommodation is Ashbeer Lodge occupies a beautiful rural location flexible and gives the ability to utilise rooms for a within the Exmoor National Park. There are variety of uses. It is currently arranged to provide superb views from the property and the a sitting room, dining room, kitchen/breakfast surrounding countryside. The popular village of room, two ground floor bedrooms and two further Monksilver is considered by many to be one of bedrooms on the first floor. the most attractive villages in West Somerset and Accommodation has an ancient church and popular inn. A sitting room with an open fireplace and door Monksilver is located at the foot of the Brendon leads through to the dining room which inturn Hills, just within the Exmoor National Park leads through to the kitchen/breakfast room, boundary. A large range of facilities are available which is fitted with a range of modern units and in the rural town of Williton, which is about three LPG fired Rayburn providing cooking, central miles, and includes stores, supermarkets and heating and hot water. -

Wivey and the Hills Churches

Wivey and the Hills Magazine June 2019 Price 50p Contents and about the magazine Wivey and the Hills magazine is published 10 times a year by the Benefice of the seven parishes of Wiveliscombe, Brompton Ralph, Clatworthy, Chipstable, Huish Champflower, Raddington and Tolland. Its purpose is to promote the life of all the Christian churches in this area and that of the wider communities which they serve. Contents Contents and magazine information 2 Letter from the Rector 3 What’s Been Happening 4-10 (including On the allotment/ Cuttings from the Garden Wildlife - what to look out for/ Monthly Recipe) Looking ahead - Wivey and the Hills 11-24 Regular Events 25 Quick view - Events for June 26-27 Growing in Faith 28-29 Ways to help your community 30 Adverts for local businesses 31-49, 52 Useful Contacts 50-51 Welcome to your June edition of the Wivey and the Hills magazine! As ever, there is masses going on in our beautiful area. New Subscribers: Would you like to The next issue will be for two months, July and August, so if you have any receive regular copies of the magazine? If contributions then please send them to us before 16th June. so please email [email protected] Lorna Thorne, Peter Pearson, Acting editorial team with your name, address, contact number and email, along with your BACs payment A year’s subscription is £5 (50p / copy) and Articles and events, comments and feedback: [email protected] runs from January to December. Advertising: Lorna Thorne [email protected] 01984 629423 BACS details are Magazine Distribution: Janet Hughes, 12 Lion d’Angers, 01984 624213 ‘WHOF’ 09-01-29 20101213 Or ring 01984 629423 for more details. -

Deer Hunting with Dogs on the Quantock Hills in Somerset 2018/19 a Report by Somerset Wildlife Crime and Hounds Off

Deer Hunting With Dogs On The Quantock Hills In Somerset 2018/19 A Report by Somerset Wildlife Crime and Hounds Off HOUNDS OFF Protecting You From Hunt Trespass 1. Introduction 2 2. Background 3-4 3. Quantock Stag Hounds Fixture List 2018/19 5-6 4. National Trust 7-10 5. Forestry Commission 11-12 6. Other Landowners 13-14 7. Firearms 15-18 8. Biosecurity 19-20 9. Policing 21-24 10. Anti Social Behaviour, Threats & Assaults 25-26 11. Tracks & Rights Of Way 27-28 12. Road Safety 29-30 13. Cruelty Of Deer Hunting With Dogs 31-34 14. Public Outreach 35-36 15. How You Can Help This Campaign 37 16. Conclusions 38 17. From the Heart 39-40 Deer Hunting With Dogs On The Quantock Hills In Somerset 2018/19 A Report by Somerset Wildlife Crime and Hounds Off Closing in for the kill, 11/04/19. 1 Deer Hunting With Dogs On The Quantock Hills In Somerset 2018/19 A Report by Somerset Wildlife Crime and Hounds Off 1. Introduction 1.1 In response to requests from local residents, in August 2018 we (Somerset Wildlife Crime and Hounds Off) began a focused campaign to shine a light on modern day deer hunting with dogs. (1) 1.2 Throughout the 2018/19 hunting season the Quantock Stag Hounds (QSH) chased red deer with pairs of dogs plus the eyes, ears, binoculars, mobile phones and two-way radios of their supporters on horseback, motorbikes, quadbikes, four-wheel drives and on foot. 1.3 Deer were killed by running them to exhaustion and then shooting from close range. -

Exmoor Bars & Pubs

22 23 21 28 26 24 27 Bus: 309/310 25 13 15 Bus: 28/198/WSR 10 Lynton 6 36 14 11 20 2 18 1 38 Porlock 12 Bus: 309/310 Bus: 10 34 35 33 Minehead 32 47 Dunster Watchet Blackmoor Gate Bus: 28/198/WSR 5 44 41 Wheddon Cross 39 Simonsbath 19 Exford 29 16 Bratton Fleming 17 Bus: 198 46 48 45 37 Exmoor Brayford 4 40 42 Bars & 3 43 8 9 30 31 Dulverton Pubs 7 Bus: 25/198/398 49 Design: Edible Exmoor | www.edibleexmoor.co.uk 1. Barbrook Exmoor Manor Hotel & 14. Dunster Stags Head Inn 27. Lynton The Sandrock 43. Upton Lowtrow Cross Inn Beggars Roost Inn 15. Dunster Yarn Market Hotel 28. Lynton Bay Valley Of Rocks Hotel 44. Wheddon Cross Rest & Be Thankful Inn 2. Brendon The Staghunters Inn 16. Exford Crown Hotel 29. Monksilver Notley Arms Inn 45. Winsford The Royal Oak 30. Molland The London Inn 46. Withypool Royal Oak 3. Brompton Regis The George Inn 17. Exford Exmoor White Horse Inn 31. Molland Blackcock 47. Wooton Courtenay Dunkery Beacon Country Badgers Holt 18. Heddons Mouth The Hunters Inn 4. Bridgetown 32. Parracombe The Fox & Goose House Hotel. 5. Challacombe The Black Venus Inn 19. Luxborough Royal Oak Inn 33. Porlock The Castle 48. Yarde Down The Poltimore Arms 6. Countisbury The Blue Ball Inn 20. Lynbridge Cottage Inn Nartnapa Thai 34. Porlock The Royal Oak 49. Yeo Mill Jubilee Inn 7. Dulverton The Bridge Inn Kitchen, Thai Restaurant 35. Porlock The Ship Inn (Top Ship) Buses pass locations in Red. -

West Somerset Railway

How to find us As the Longest Heritage Railway in England Special Events & Days Out 2017 Bridgwater Bay WE ARE MILE FOR MILE BETTER VALUE Burnham- Festive Specials on-Sea J22 With lots of special trains through the festive period, there is something A39 Minehead Steam & Cream Special for everyone - but please pre-book your tickets as these will sell out fast! Porlock A38 WEST SOMERSET Railway Galas Combine your return journey with our Steam and CAROL TRAINS Williton J23 A39 Spring Steam Gala 27th -30th April 2017 Cream Special, where a cream tea will be served Warm up those vocal chords and join us on the 16:30 Minehead to Bishops Lydeard. A396 Diesel Gala & Rail Ale Trail 9th – 11th June 2017 for a special journey of carol singing at Bridgwater 26th March 2017 • 2nd June 2017 • 16th June 2017 Brendon Hills J24 the stations along the way. You will be Exmoor Quantock Late Summer Weekend 2nd – 3rd September 2017 7th July 2017 • 21st July 2017 • 1st September 2017 provided with a carols song book so if you Hills M5 Autumn Steam Gala 5th – 8th October 2017 15th September 2017 Bishops Special Price offered for those combining with don’t know all the words already it doesn’t Dulverton Prices Lydeard A358 TIMETABLE,RAILWAY SPECIAL EVENTS & DAYS OUT GUIDE 2017 Winter Steam Festival 29th – 30th December 2017 matter! Our carol trains are hauled by a Cheese & Cider Special. Taunton heritage steam locomotives to recreate start from J25 the era of Christmas gone by. A38 A358 £245.00 Wellington Dates: 11th and 12th December 2017 J26 Prices: Adult/Senior -

Scoping Opinion

SCOPING OPINION: Proposed A358 Taunton to Southfields Dualling Scheme Case Reference: TR010061 Adopted by the Planning Inspectorate (on behalf of the Secretary of State) pursuant to Regulation 10 of The Infrastructure Planning (Environmental Impact Assessment) Regulations 2017 May 2021 [This page has been intentionally left blank] ii Scoping Opinion for Proposed A358 Taunton to Southfields Dualling Scheme CONTENTS 1. INTRODUCTION ............................................................................ 1 1.1 Background .................................................................................... 1 1.2 The Planning Inspectorate’s Consultation............................................. 2 2. THE PROPOSED DEVELOPMENT ..................................................... 4 2.1 Introduction ................................................................................... 4 2.2 Description of the Proposed Development ............................................ 4 2.3 The Planning Inspectorate’s Comments ............................................... 6 3. ES APPROACH............................................................................... 9 3.1 Introduction ................................................................................... 9 3.2 Relevant National Policy Statements (NPSs)....................................... 10 3.3 Scope of Assessment ..................................................................... 10 3.4 Coronavirus (COVID-19) Environmental Information and Data Collection 14 3.5 Confidential and Sensitive -

5 Surveillance of the Antibiotic Susceptibility of Bacteria Found in the Urinary Tract in the West Midlands Over a Four Year Period

An investigation into the relationship between antimicrobial prescribing and antimicrobial resistance in urinary tract infections at a population level By Dean Ironmonger A thesis submitted to The University of Birmingham for the degree of DOCTOR OF PHILOSOPHY Institute of Microbiology and Infection College of Medical and Dental Sciences University of Birmingham December 2017 University of Birmingham Research Archive e-theses repository This unpublished thesis/dissertation is copyright of the author and/or third parties. The intellectual property rights of the author or third parties in respect of this work are as defined by The Copyright Designs and Patents Act 1988 or as modified by any successor legislation. Any use made of information contained in this thesis/dissertation must be in accordance with that legislation and must be properly acknowledged. Further distribution or reproduction in any format is prohibited without the permission of the copyright holder. Abstract Inappropriate use of antibiotics is a key factor in the development of antimicrobial resistance (AMR). UK national guidance has been ineffective in standardising the management of infections in the community. Many community prescribers are sceptical that their actions have an effect on AMR in their locality. As part of this study, routine surveillance of AMR in a large regional population was established. To help interpret surveillance data, two surveys were undertaken: a survey of laboratory methods, and a survey of GP sampling and prescribing protocols. Using these survey results, surveillance tools were developed to provide hospital and community prescribers with data on antibiotic resistance in bacteria within their locality; and enable laboratories to compare methods for determining antibiotic susceptibility. -

Septoct 2017

EXMOOR NEWS Bringing community news across southern Exmoor since 1985 FREE Sept/Oct 2017 Bampton Dulverton Luxborough Wheddon Cross Bridgetown East Anstey Molland Winsford Brompton Regis Exebridge Simonsbath Withel Florey Brushford Exford Skilgate Withypool Bury Exton Upton Wiveliscombe Cutcombe Hawkridge West Anstey 1 Delicious Local Food and Drink. Confectionery, Gifts and Cards. Wines, Spirits, Ales and Ciders - Exmoor Gin. Celebrating 75 years And Much More! Traditional Shop Open 7 days a week Fore Street, Dulverton T: 01398 323465 Café & Deli www.tantivyexmoor.co.uk EXMOOR NEWS COVERING SOUTHERN EXMOOR As summer comes to an end, there are still many events happening. We have tried to include as many as possible, so please continue to send us your items. In this issue, read about Terry the Ram, Icarus Adventures and our regular ‘Buster, A Dog’s Day Out’ report. At Exmoor News we appreciate the very kind people who deliver our magazine alongside Parish Magazines, and we are extremely grateful. A huge thank you to everyone who makes this possible. You may notice a bit of a difference in the magazine this issue. We continue to improve the quality and now run more colour. Do you like our magazine and would you like to receive it through the post? Some people have asked about this and we are considering a subscription service, (a small fee of £1.50 per magazine to cover postage and packing, minimum 6 issues, less than £10 a year) so get in touch by email or post if you’re interested. Remember to include your address if you contact us by email. -

The Old Post Office the Old Post Office Stogumber, Taunton, TA4 3TA Taunton - 14 Miles, Minehead - 12 Miles

The Old Post Office The Old Post Office Stogumber, Taunton, TA4 3TA Taunton - 14 miles, Minehead - 12 miles • Large Open Plan Sitting Room • Separate Fitted Kitchen • 3 Good Sized Bedrooms • Gardens With Wonderful Views • Many Period Features • Fitted Bathroom Suite • Downstairs WC • Popular Village Location Guide price £299,950 Description The Old Post Office is a fine example of a 17th Century, Grade II Listed, village house, which has been through an interesting history and is believed to have once been two cottages. During the 20th Century the cottage was made into one premises and used as the village Post Office. The King George post box is still in the wall of the cottage with post being collected twice a day. The cottage was then turned into a private residence in 1970 A beautifully presented Grade II listed 17th Century, thatched and had one owner for over 30 years. The current owners have fully refurbished the property but have been mindful to retain cottage situated in this highly sought after village. many of the period features, which include two deep inglenook fireplaces, one with a woodburning stove, heavy beamed ceilings and pretty glazed sash windows. Accommodation The accommodation includes an entrance porch, which opens through to a large open plan sitting/dining room. The sitting room area has an inglenook fireplace with inset woodburning stove, beam over and tiled hearth. There are two front aspect sash windows, an arched display recess, fitted cupboard, further storage cupboard, part of the original spiral wooden staircase that used to lead to the first floor and a door to the rear hallway. -

Somerset Parish Reg Sters

S om e rs e t Pa ris h m r a riages. E DITE D BY . PH IL LIM OR E . W P W , M A , A N D W . A . BELL , R ector o Charl nch f y , A ND C . W . WH ISTLER , M . R . C . S Vicar ofS tockland . VOL VI 1 011 0011 m) T E UBS C R IBER S BY P ss u o TH H ILLIM OR E C o . I S , 1 2 H A NCER Y A NE 4 , C L , P R E F A C E . A sixth volu me of Somer set Marriage Regi sters is now s completed , making the total number of parishe dealt - with to be forty nine . 1 379239 A s s u se of before , contraction have been made w - o r i o — h . o . o . i o s of wid wer w d w di c the di ce e . — - b . a e o c o in h . t e ou of b ch l r c nty . — m — s s i e o a . i m a e l e . s e s Z a . pin t r, ngl w n arri g ic nce d — — m au e . e o a . d ght r . y y n . — — . oi th e a is of c a e n e . p p r h . c rp t r The reader mu st remember that the printed volumes “ ! fi are not evidence in the legal sen se . Certi cate s must l of be obtained from the ocal clergy in charge the Regi sters. -

Königreichs Zur Abgrenzung Der Der Kommission in Übereinstimmung

19 . 5 . 75 Amtsblatt der Europäischen Gemeinschaften Nr . L 128/23 1 RICHTLINIE DES RATES vom 28 . April 1975 betreffend das Gemeinschaftsverzeichnis der benachteiligten landwirtschaftlichen Gebiete im Sinne der Richtlinie 75/268/EWG (Vereinigtes Königreich ) (75/276/EWG ) DER RAT DER EUROPAISCHEN 1973 nach Abzug der direkten Beihilfen, der hill GEMEINSCHAFTEN — production grants). gestützt auf den Vertrag zur Gründung der Euro Als Merkmal für die in Artikel 3 Absatz 4 Buch päischen Wirtschaftsgemeinschaft, stabe c ) der Richtlinie 75/268/EWG genannte ge ringe Bevölkerungsdichte wird eine Bevölkerungs gestützt auf die Richtlinie 75/268/EWG des Rates ziffer von höchstens 36 Einwohnern je km2 zugrunde vom 28 . April 1975 über die Landwirtschaft in Berg gelegt ( nationaler Mittelwert 228 , Mittelwert in der gebieten und in bestimmten benachteiligten Gebie Gemeinschaft 168 Einwohner je km2 ). Der Mindest ten (*), insbesondere auf Artikel 2 Absatz 2, anteil der landwirtschaftlichen Erwerbspersonen an der gesamten Erwerbsbevölkerung beträgt 19 % auf Vorschlag der Kommission, ( nationaler Mittelwert 3,08 % , Mittelwert in der Gemeinschaft 9,58 % ). nach Stellungnahme des Europäischen Parlaments , Eigenart und Niveau der vorstehend genannten nach Stellungnahme des Wirtschafts- und Sozialaus Merkmale, die von der Regierung des Vereinigten schusses (2 ), Königreichs zur Abgrenzung der der Kommission mitgeteilten Gebiete herangezogen wurden, ent sprechen den Merkmalen der in Artikel 3 Absatz 4 in Erwägung nachstehender Gründe : der Richtlinie -

SAMPFORD BRETT PARISH COUNCIL Minutes of the Meeting Held on 2Nd December 2015 in the Village Hall Present: Mrs J

SAMPFORD BRETT PARISH COUNCIL Minutes of the meeting held on 2nd December 2015 in the Village Hall Present: Mrs J. Swan (in the chair), Mr D. Drabble, Mr M. Blazey, Mrs D. Saunders, Mr G. Day, Mr I. Armstrong, Mr B. Doyle, County Councillor Mr Hugh Davies and District Councillor Mr Stuart Dowding, Ms Debbie Dennis Village Agent and members of the public. Apologies : PCSO but sent report. Declarations of Interest: None. Public Input: None. Minutes of the meeting on 2 nd September, were approved and signed as a correct record. Matters Arising from the Minutes. Minute 519 Croft Meadow parking. Clerk had received a reply from Highways who visited the site and at the time there were no vehicles parked there. There was not much that could be done other than a polite word with anyone who causes a problem by parking in a way which causes difficulty for other drivers in the road. 525 . Chairman reported completion of painting of telephone box and thanks were expressed to Roger Biss and Geoff Day. Councillor Blazey proposed a letter be written to Roger Biss expressing PCs thanks. 526. DISTRICT COUNCIL. Councillor Dowding reported :- a. A final investment decision for Hinkley Point is imminent. b. Roundabout at Washford Cross completed on time. c) Hinkley Point community impact management (CIM) fund application form has been redrafted – Liza Redstone is the contact. d) Watchet Paper Mill is to close before Christmas; c. 50% of the Mill’s employees live in the WSD area. e) Scrutiny Committee have spoken to South West Ambulance about an alleged problem in Taunton f) Faster broadband now available in Sampford Brett.