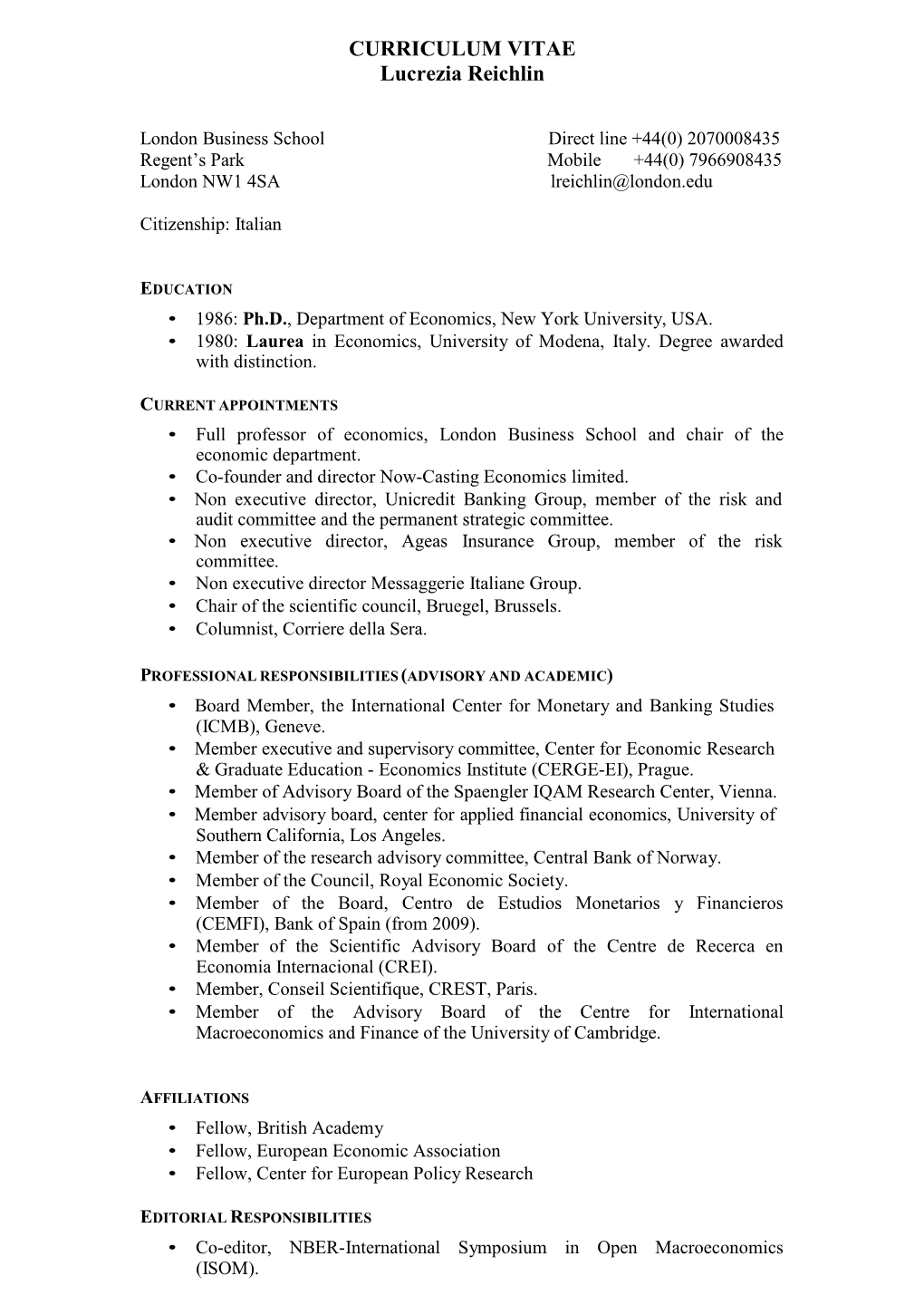

CURRICULUM VITAE Lucrezia Reichlin

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Econometric Society European Region Aide Mémoire

The Econometric Society European Region Aide M´emoire March 22, 2021 1 European Standing Committee 2 1.1 Responsibilities . .2 1.2 Membership . .2 1.3 Procedures . .4 2 Econometric Society European Meeting (ESEM) 5 2.1 Timing and Format . .5 2.2 Invited Sessions . .6 2.3 Contributed Sessions . .7 2.4 Other Events . .8 3 European Winter Meeting (EWMES) 9 3.1 Scope of the Meeting . .9 3.2 Timing and Format . 10 3.3 Selection Process . 10 4 Appendices 11 4.1 Appendix A: Members of the Standing Committee . 11 4.2 Appendix B: Winter Meetings (since 2014) and Regional Consultants (2009-2013) . 27 4.3 Appendix C: ESEM Locations . 37 4.4 Appendix D: Programme Chairs ESEM & EEA . 38 4.5 Appendix E: Invited Speakers ESEM . 39 4.6 Appendix F: Winners of the ESEM Awards . 43 4.7 Appendix G: Countries in the Region Europe and Other Areas ........... 44 This Aide M´emoire contains a detailed description of the organisation and procedures of the Econometric Society within the European Region. It complements the Rules and Procedures of the Econometric Society. It is maintained and regularly updated by the Secretary of the European Standing Committee in accordance with the policies and decisions of the Committee. The Econometric Society { European Region { Aide Memoire´ 1 European Standing Committee 1.1 Responsibilities 1. The European Standing Committee is responsible for the organisation of the activities of the Econometric Society within the Region Europe and Other Areas.1 It should undertake the consideration of any activities in the Region that promote interaction among those interested in the objectives of the Society, as they are stated in its Constitution. -

Download PDF (673.5

PEOPLE IN ECONOMICS Jeremy Clift profi les Lucrezia Reichlin, a pioneer in real-time short-term forecasting The QUEEN of Numbers URO area growth may be on the Business School, she is also a non-executive mend, but the risks are far from over director of UniCredit—an Italian commercial and the region is still in for a bumpy bank active in central and eastern Europe—a ride, reckons Lucrezia Reichlin, a former director of research at the ECB under Eprofessor at the London Business School who then-President Jean-Claude Trichet, and a for- was the fi rst female head of research at the mer consultant to the U.S. Federal Reserve. European Central Bank (ECB). “I think we’re not out of the crisis, and it’s Ringside seat going to take a while before we find the way,” “Sitting on the board of a commercial bank says Reichlin, an expert in business cycle gives you a ringside perspective of Europe’s analysis. “We have a technical recovery in banking problems,” says Reichlin, who lives terms of GDP showing positive growth, but in north London with her daughter but visits it doesn’t mean the risks to Europe are over,” Italy regularly. she says in her cramped office overlooking She sees a banking union and implementa- London’s Regent’s Park. tion of a planned process for reorganizing or She is a pioneer in real-time short-term winding up failed banks as crucial next steps economic forecasting that harnesses large for a more stable euro area. The outcome amounts of data, and her expertise intersects of European Parliament elections in May the commercial and academic worlds. -

Uncorrected Transcript

1 EUROZONE-2015/01/16 THE BROOKINGS INSTITUTION THE EUROZONE: NOW WHAT? A CONVERSATION WITH LUCREZIA REICHLIN Washington, D.C. Friday, January 16, 2015 PARTICIPANTS: Welcome and Moderator: DAVID WESSEL Director, The Hutchins Center on Fiscal and Monetary Policy, and Senior Fellow, Economic Studies The Brookings Institution Featured Speaker: LUCREZIA REICHLIN Professor of Economics, London Business School Research Director, Centre for Economic Policy Research * * * * * ANDERSON COURT REPORTING 706 Duke Street, Suite 100 Alexandria, VA 22314 Phone (703) 519-7180 Fax (703) 519-7190 2 EUROZONE-2015/01/16 P R O C E E D I N G S MR. WESSEL: I am David Wessel from the Hutchins Center on Fiscal and Monetary Policy here at Brookings and is an example of just how perfect our timing is. I can't think of a better moment to have someone who actually knows something about the European Central Bank and the European economy, especially someone who has such great foresight that her last day as a Research Director at the ECB was the day that Lehman Brothers failed. Lucrezia Reichlin really is a wonderful example of globalization. She was born in Italy, educated at NYU, has worked in Frankfurt for the ECB, taught in Brussels, and she's now Professor of Economics at the London Business School, a columnist for Italy's Il Corriere della Serra, a Director of Unicredit and at AGEAS Insurance Group, and she's involved in pretty much every European think tank I ever heard of. And on the side she has started a company called Now-Casting, a firm that specializes in real time economic data and near-term forecasting. -

Reinforcing the Eurozone and Protecting an Open Society

MEZ 2 2016 Reinforcing the Eurozone and Protecting an Open Society GIANCARLO CORSETTI, LARS FELD, RALPH KOIJEN, LUCREZIA REICHLIN, RICARDO REIS, HÉLÈNE REY, BEATRICE WEDER DI MAURO WITH THE HELP OF FERDINANDO GIUGLIANO Acknowledgements We would like thank Aurelio Maccario, Jasper McMahon, Richard PorteS and Jeromin Zettelmeyer for excellent comments all along thiS project. We are extremely grateful to the Tommaso Padoa-Schioppa Chair at the EUI for financial Support and for organiSing SeamleSSly the February 5th Conference at which the draft report was diScuSSed. We benefitted immenSely from the inSightful comments of participants at the Conference. Furthermore we thank thank participants at SeminarS and workShopS at the ECB, the German MiniStry of Finance and the London BuSineSS School. We thank Ferdinando Giugliano for hiS excellent editing and making uS clarify Some obScure SentenceS. We are alSo grateful to CEPR for hoSting Some of our diScuSSionS and Anil Shamdasani for the final editing of thiS e-book. Reinforcing the Eurozone and Protecting an Open Society Monitoring the Eurozone 2 April 2016 “Il nous faut de l'audace, encore de l'audace, toujours de l'audace ». Danton, 2 Septembre 1792. Introduction: A critical juncture for the Euro area and the European Union The Sovereign debt and the refugee criSes prove that Europe has failed to deSign inStitutionS robuSt enough to weather difficult timeS. The StakeS are high: when economic ShockS and political crises coincide, the riSk of diSintegration riSeS to alarming levelS. Coordinated actionS are needed, but theSe are difficult to implement becauSe of the political climate. In Short, we may be contemplating the end of Europe as we know it. -

The Ecb and Its Watchers Xvi

Frankfurt am Main March 11, 2015 1999since THE ECB AND ITS WATCHERS XVI The Conference: The ECB and Its The ECB and Its Four Questions, Selected Topics About the Past, Presence, Watchers XVI: Watchers XVI: Four Economic and Speakers: Organizing and Future The Program The Speakers Answers Indicators 1999 – 2014 Institutions 1 2 3 4 6 7 8 Editorial This year’s “The ECB and Its Watchers” conference takes place against the background of an economic situation in the euro area that has unfortunately not significantly improved compared to the previous year. As the economic indicators presented on pages 6-7 show, the unemployment rate has only slightly decreased and still exhibits a level well above that of other major advanced economies. GDP growth has not picked up and inflation has further declined and has even fallen below zero in December 2014. In light of these disconcerting economic developments, the Governing Council decided in its January meeting to launch an “extended asset purchase programme” involving monthly purchases of public and private sector securities totaling €60 billion until September 2016 or, alternatively, until a “sustained adjustment in the path of inflation” consistent with the ECB’s inflation aim is achieved. While large-scale asset- purchase programs have been undertaken by other major central banks in recent years (see Figure 2) and The ECB and Its Watchers Conference – the economies of these countries have been successful in substantially reducing their unemployment rates, Past, Presence, and Future there is considerable disagreement regarding the benefit-risk analysis of the ECB’s planned measures Otmar Issing (continue on page 4 to read the comments of ECB Watchers we asked about this topic). -

Curriculum Vitae – Lucrezia Reichlin

Lucrezia Reichlin London Business School, Regent's Park, London NW1 4SA +44 7966 908435; [email protected] www.lucreziareichlin.eu PRINCIPAL APPOINTMENTS London Business School (London) 2008 - present Full Professor, Economics Now-Casting Economics Ltd (London) 2011 - present Chairman & co-founder IFRS [International Financial Reporting Standards] Foundation 2018 - present Trustee UniCredit Banking Group (Milan) 2009 - present Non-executive Director • Internal Control & Risk Committee - member 2009 - present • Correlated Parties Committee - member 2015 - present • Permanent Strategic Committee - member 2012 - 2015 Ageas Insurance Group (Bruxelles) 2014 - present Non-executive Director • Risk Committee – member 2014 - present Eurobank Ergasias SA (Athens) 2016 - present Non-executive Director • Nomination Committee - chair 2016 - present • Remuneration Committee – chair 2016 - present Messagerie Italiane Group (Milan) 2012 - present Non-executive Director European Central Bank (Frankfurt) 2005 - 2008 Director-General Research Université Libre de Bruxelles (Bruxelles) 1994 - 2005 Full Professor, Economics On leave 2005 - 2008 Graduate School of Business, Columbia University (New York) 1993 - 1994 Visiting Associate Professor Observatoire Français des Conjunctures Economiques (OFCE) 1988 - 1993 Fondation Nationale des Sciences Politiques (Paris) Deputy Director, Research Department European University Institute (Florence) 1986 - 1988 Fellow Barnard College, Columbia University (New York) 1985 - 1986 Adjunct Professor EDUCATION New York -

Progress Note of the G20 High-Level Independent Panel on Financing the Global Commons for Pandemic Preparedness and Response

Progress Note of the G20 High-Level Independent Panel on Financing the Global Commons for Pandemic Preparedness and Response 1. This Note provides an update on the work of the High-Level Independent Panel (HLIP) on Financing the Global Commons for Pandemic Preparedness and Response.1 I. HLIP’s Approach 2. The G20 established the HLIP on 26 Jan 20212, with the task of: a. Identifying the gaps in the financing system for the global commons for pandemic prevention, surveillance, preparedness and response; and b. Proposing actionable solutions to meet these gaps on a systematic and sustainable basis, and to optimally leverage resource from the public, private and philanthropic sectors and the international financial institutions (IFIs). 3. The HLIP’s members, predominantly economic and finance experts, serve in their individual and independent capacities. The Panel is supported by two independent economic think tanks, Bruegel and the Center for Global Development. The Panel recognizes that the coordinated effort of the global health and financial community is necessary to achieve coherent and impactful solutions for strengthening pandemic prevention, preparedness and response (PPR). The HLIP is taking into account the work done by other key reviews, including that of the Independent Panel for Pandemic Preparedness and Response (IPPR) established by the World Health Organization. It is also consulting closely with the Global Preparedness Monitoring Board (GPMB) on the standards and performance required for effective PPR, based on expert global health opinion. 4. The Panel is also interacting with key international institutions, including the UN, WHO, the IFIs and OECD, as well as with a range of experts and other stakeholders comprising NGOs, development aid agencies, philanthropies, and key private sector actors such as pharmaceutical companies and insurers. -

The EURO at TEN – LESSONS and CHALLENGES FRAN B ED FRANK G 13-14 Nov13-14 Conf C ECB Fifth ARTO ILL ITOR ES CESC E E SZ S R Ntral Bankin Ntral S NO E M Nce MA O E B E

GES THE EURO AT TEN – N E LESSONS AND CHALLENGES HALL D C AN S ON ESS L – N E T AT URO E E TH FIFTH ECB CENTRAL BANKING CONFERENCE 13-14 NOVEMBER 2008 EDITORS NTRAL BANK E BARTOSZ MAĆKOWIAK AN C FRANCESCO PAOLO MONGELLI E GILLES NOBLET EUROP FRANK SMETS THE EURO AT TEN – LESSONS AND CHALLENGES FIFTH ECB CENTRAL BANKING CONFERENCE 13-14 NOVEMBER 2008 EDITORS BARTOSZ MAĆKOWIAK FRANCESCO PAOLO MONGELLI GILLES NOBLET FRANK SMETS © European Central Bank, 2009 Address Kaiserstrasse 29 D-60311 Frankfurt am Main Germany Postal address Postfach 16 03 19 D-60066 Frankfurt am Main Germany Telephone +49 69 1344 0 Internet http://www.ecb.europa.eu Fax +49 69 1344 6000 The views expressed in this publication do not necessarily ref lect those of the European Central Bank, the Eurosystem or any of the other institutions with which the authors are affiliated. All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged. ISBN 978-92-899-0375-2 (print) ISBN 978-92-899-0376-9 (online) CONTENTS INTRODUCTION by Bartosz Maćkowiak, Francesco Paolo Mongelli, Gilles Noblet and Frank Smets .................................................................... 6 OPENING ADDRESS by Lucas Papademos ................................................................................... 16 SESSION 1 EUROPEAN MONETARY UNION (EMU) AFTER TEN YEARS – WHAT HAS EMU BROUGHT TO CONSUMERS AND THE CORPORATE SECTOR? PRICES AND QUANTITIES The euro at ten – unfulfilled threats and unexpected challenges by Francesco -

Report “A Global Deal for Our Pandemic Age”

A GLOBAL DEAL FOR OUR PANDEMIC AGE REPORT OF THE G20 HIGH LEVEL INDEPENDENT PANEL A GLOBAL DEAL FOR OUR PANDEMIC AGE Report of the G20 High Level Independent Panel on Financing the Global Commons for Pandemic Preparedness and Response June 2021 www.pandemic-financing.org A Global Deal for Our Pandemic Age: Foreword The High Level Independent Panel was asked by to ensure that large swathes of the world’s the G20 in January 2021 to propose how finance population are not left ill-equipped to respond can be organized, systematically and sustainably, to when a pandemic strikes, is in the mutual interests reduce the world’s vulnerability to future pandemics1. of all nations, not only a humanitarian imperative in its own right. Our report sets out critical and actionable solutions and investments to meet the challenge of an age of In short, we need a global deal for our pandemic pandemics, and to avoid a repeat of the catastrophic age. We must strengthen global governance and damage that COVID-19 has brought. The Panel mobilize greater and sustained investments in arrived at its recommendations after intensive global public goods, which have been dangerously deliberations and consultations with a wide range underfunded. Both are critical to building resilience of stakeholders and experts around the globe against future pandemics. over a period of four months. We urge that our proposals be discussed, developed further, and It requires establishing a global governance and implemented as a matter of urgency. financing mechanism, fitted to the scale and complexity of the challenge, besides bolstering Scaling up pandemic preparedness cannot wait the existing individual institutions, including the until COVID-19 is over. -

View Full Festival Program

updated 12 May THE RETURN OF THE STATE Businesses, communities and institutions TRENTO 2021 3-6 June PROVINCIA AUTONOMA DI TRENTO The relationship between the state and the economy has always been something of a seesaw. As a general rule, in times of crisis – and here we need only think of the Wall Street crash in 1929, but also the 2008 international financial crisis – public authorit- ies have had to intervene to sort out the disasters caused by a market without rules, or with rules that are too ineffective. In contrast, in times of expansion, the “invisible hand” of the market is usually left free to act, creating and redistributing wealth. Hence the state is invited to take one or several steps back, limiting itself to “regulating the traffic”, creating the most fa- vourable conditions for economic forces to free all their energy, and their aggression, ultimately considered to be beneficial. The pandemic undoubtedly took us back to the first of the two scenarios, but this time in a particular context: on this occasion the state entered the fray not to deal with the negative effects of a recession, but rather to combat a deadly serious health emer- gency, of the kind not faced by the world for around a century. Inevitably, however, the health emergency has also led to a devastating economic crisis. Consequently, the state has been called on to act in two contexts: in the field of health, but also in rela- tion to economic recovery, which must be brought about, encouraged and stimulated at all costs. -

Members of G20 High Level Independent Panel on Financing the Global Commons for Pandemic Preparedness and Response

Members of G20 High Level Independent Panel on Financing the Global Commons for Pandemic Preparedness and Response 1 Tharman Senior Minister, Singapore; Former Deputy Prime Minister Shanmugaratnam * and Minister for Finance Chair, G20 Eminent Persons Group on Global Financial Governance (2017/18) 2 Lawrence Summers * Charles W. Eliot University Professor, Harvard Kennedy School Former United States Treasury Secretary 3 Ngozi Okonjo-Iweala * Former Finance and Foreign Minister, Nigeria Former MD, World Bank Former Chair, GAVI The Vaccine Alliance Special Envoy of the World Health Organization for the Access to COVID-19 Tools (ACT) Accelerator Special Envoy of the African Union to Mobilise International Economic Support for Continental Fight Against COVID-19 4 Ana Botin Executive Chairman, Santander Group 5 Mohamed El-Erian Chief Economic Adviser, Allianz President, Queens’ College, Cambridge University 6 Jacob Frenkel Former Chairman, JPMorgan Chase International Former Governor, Bank of Israel Former Economic Counsellor, IMF 7 Rebeca Grynspan Secretary General, Ibero-American General Secretariat Former UN Under-Secretary General and Associate Administrator, UNDP Former Vice-President of Costa Rica 8 Naoko Ishii Professor and Director, Center for Global Commons, University of Tokyo Former CEO and Chairperson, Global Environment Facility Former Deputy Vice Minister of Finance, Japan 9 Michael Kremer University Professor and Director, Development Innovation Lab, The University of Chicago 2019 Nobel Laureate 10 Kiran Mazumdar-Shaw Founder -

Money and Monetary Policy in the Twenty-First Century -First Century

THE ROLE OF MONEY – MONEY AND MONETARY POLICY IN THE TWENTY-FIRST CENTURY -FIRST CENTURY FOURTH THE ROLE OF MONEY – MONEY AND MONETARY POLICY IN THE TWENTY THE POLICY IN AND MONETARY OF MONEY – MONEY THE ROLE ECB CENTRAL BANKING CONFERENCE 9-10 NOVEMBER 2006 ISBN 978-928990207-6 EDITORS ANDREAS BEYER 9 789289 902076 EUROPEAN CENTRAL BANK EUROPEAN LUCREZIA REICHLIN THE ROLE OF MONEY – MONEY AND MONETARY POLICY IN THE TWENTY-FIRST CENTURY FOURTH ECB CENTRAL BANKING CONFERENCE 9-10 NOVEMBER 2006 EDITORS ANDREAS BEYER LUCREZIA REICHLIN © European Central Bank, 2008 Address Kaiserstrasse 29 60311 Frankfurt am Main Germany Postal address Postfach 16 03 19 60066 Frankfurt am Main Germany Telephone +49 69 1344 0 Website http://www.ecb.int Fax +49 69 1344 6000 The views expressed in this volume do not necessarily reflect those of the European Central Bank and the Eurosystem. All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged. ISBN 978-92-899-0207-6 (print version) ISBN 978-92-899-0208-3 (online version) CONTENTS INTRODUCTION by Lucrezia Reichlin ................................................................................... 5 OPENING ADDRESS The role of money by Jürgen Stark ........................................................................................... 16 SESSION 1 HOW IMPORTANT IS THE ROLE OF MONEY IN THE MONETARY TRANSMISSION MECHANISM? Two reasons why money and credit may be useful in monetary policy by Lawrence J. Christiano, Roberto Motto and