Henry Boot Plc Unaudited Results for the Year Ended

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

COVID-19 Proxy Governance Update

COVID-19 Proxy Governance Update 2020 AGM mid-season review FROM EQUINITI 01 Looking back and planning ahead It is incredible to note that it has been over 12 weeks since the official announcement on 23 March of the UK Government’s Stay at Home Measures, and nearly seven months since the severity of the pandemic became apparent in China. Over the said period, PLC boards, company secretaries and investor relations officers have kept their corporate calendars going thanks to rapid adoption of modified regulatory guidelines and inventive modes of engagement with investors. With annual general meetings being an obvious highlight in the corporate calendar, we take stock of the progress made so far over the 2020 AGM season, as well as using what we learned to plan ahead. Now that we are over the first ‘hump’ with the busy period of May AGMs out of the way, we are readying for the second ‘peak’ of June and July AGMs, and then an ‘easing’ until the second ‘mini’ season in the early autumn. As such, in this update, we look at: • 2020 AGM season statistics…so far • Proxy adviser engagement and ISS recommendations review • High-level assumptions for Q3 and Q4 • Relevant updates from the regulators, industry bodies and proxy advisers • Communications in the COVID-19 world – special commentary by leading financial PR firm,Camarco • How has COVID-19 impacted activism – special commentary by international law firm,White & Case 02 2020 AGM Season Statistics…so far Scope of data To assess progress and forecast what is to come, we look at the key statistics for the UK AGM season 2020 thus far. -

Taylor Woodrow Plc Report and Accounts 2006 Our Aim Is to Be the Homebuilder of Choice

Taylor Woodrow plc Report and Accounts 2006 Our aim is to be the homebuilder of choice. Our primary business is the development of sustainable communities of high-quality homes in selected markets in the UK, North America, Spain and Gibraltar. We seek to add shareholder value through the achievement of profitable growth and effective capital management. Contents 01 Group Financial Highlights 54 Consolidated Cash Flow 02 Chairman’s Statement Statement 05 Chief Executive’s Review 55 Notes to the Consolidated 28 Board of Directors Financial Statements 30 Report of the Directors 79 Independent Auditors’ Report 33 Corporate Governance Statement 80 Accounting Policies 37 Directors’ Remuneration Report 81 Company Balance Sheet 46 Directors’ Responsibilities 82 Notes to the Company Financial Statement Statements 47 Independent Auditors’ Report 87 Particulars of Principal Subsidiary 48 Accounting Policies Undertakings 51 Consolidated Income Statement 88 Five Year Review 52 Consolidated Statement of 90 Shareholder Facilities Recognised Income and Expense 92 Principal Taylor Woodrow Offices 53 Consolidated Balance Sheet Group Financial Highlights • Group revenues £3.68bn (2005: £3.56bn) • Housing profit from operations* £469m (2005: £456m) • Profit before tax £406m (2005: £411m) • Basic earnings per share 50.5 pence (2005: 50.6 pence) • Full year dividend 14.75 pence (2005: 13.4 pence) • Net gearing 18.6 per cent (2005: 23.7 per cent) • Equity shareholders’ funds per share 364.7 pence (2005: 338.4 pence) Profit before tax £m 2006 405.6 2005 411.0 2004 403.9 Full year dividend pence (Represents interim dividends declared and paid and final dividend for the year as declared by the Board) 2006 14.75 2005 13.4 2004 11.1 Equity shareholders’ funds per share pence 2006 364.7 2005 338.4 2004 303.8 * Profit from operations is before joint ventures’ interest and tax (see Note 3, page 56). -

Disclaimer Strictly Not to Be Forwarded to Any

DISCLAIMER STRICTLY NOT TO BE FORWARDED TO ANY OTHER PERSONS IMPORTANT: You must read the following disclaimer before reading, accessing or making any other use of the attached document relating to SEGRO plc (the “Company”) dated 10 March 2017. In accessing the attached document, you agree to be bound by the following terms and conditions, including any modifications to them from time to time, each time you receive any information from us as a result of such access. You acknowledge that this electronic transmission and the delivery of the attached document is confidential and intended for you only and you agree you will not forward, reproduce, copy, download or publish this electronic transmission or the attached document (electronically or otherwise) to any other person. The attached document has been prepared solely in connection with the proposed rights issue and offering of nil paid rights, fully paid rights and new ordinary shares (the “Securities”) of the Company (the “Transaction”). The Prospectus has been published in connection with the admission of the Securities to the Official List of the UK Financial Conduct Authority (the ‘‘Financial Conduct Authority’’) and to trading on the London Stock Exchange plc’s main market for listed securities (together, ‘‘Admission’’). The Prospectus has been approved by the Financial Conduct Authority as a prospectus prepared in accordance with the Prospectus Rules made under section 73A of the Financial Services and Markets Act 2000, as amended. NOTHING IN THIS ELECTRONIC TRANSMISSION AND THE ATTACHED DOCUMENT CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. -

The Taylor Wimpey Difference

Annual Report and Accounts 2019 Difference The Taylor Wimpey Taylor Wimpey plc Annual Report and Accounts 2019 www.taylorwimpey.co.uk Taylor Wimpey plc is a customer-focused residential developer building and delivering homes and communities across the UK and in Spain. Our Company purpose is to deliver new homes within thriving communities, in a safe and environmentally responsible manner, with customers at the heart of our decision making and consideration of the potential impact on wider stakeholders. Contents Strategic report Financial statements Connect with us 1 The Taylor Wimpey difference 140 Independent auditor’s report There are several ways you can get in 12 Investment case 148 Consolidated income statement touch with us or follow our news. 14 Chair’s statement 149 Consolidated statement of www.taylorwimpey.co.uk/corporate 17 Group Management Team Q&A comprehensive income 18 UK market review 150 Consolidated balance sheet www.twitter.com/taylorwimpeyplc 22 Chief Executive’s letter 151 Consolidated statement of changes in equity 24 Our strategy and www.linkedin.com/company/taylor-wimpey key performance indicators 152 Consolidated cash flow statement 30 Our business model 153 Notes to the consolidated financial statements 32 Making a difference for our stakeholders Navigating this report 183 Company balance sheet 44 Non-financial information statement The icons below help to signpost where you 184 Company statement of changes 45 Our approach to identifying and can find more information. in equity managing risk 185 Notes to the -

Fidelity® Low-Priced Stock K6 Fund

Quarterly Holdings Report for Fidelity® Low-Priced Stock K6 Fund April 30, 2021 LPSK6-QTLY-0621 1.9883997.103 Schedule of Investments April 30, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 91.1% Shares Value COMMUNICATION SERVICES – 1.6% Diversified Telecommunication Services – 0.0% Verizon Communications, Inc. 2,636 $ 152,334 Interactive Media & Services – 0.1% Dip Corp. 24,518 677,504 QuinStreet, Inc. (a) 25,997 526,959 XLMedia PLC (a) 268,040 190,641 ZIGExN Co. Ltd. 54,118 197,576 1,592,680 Media – 1.5% AMC Networks, Inc. Class A (a) (b) 33,496 1,684,179 Comcast Corp. Class A 130,298 7,316,233 Corus Entertainment, Inc. Class B (non‑vtg.) 49,446 236,539 Discovery Communications, Inc.: Class A (a) (b) 145,589 5,482,882 Class C (non‑vtg.) (a) 310,153 10,021,043 Gray Television, Inc. 28,620 581,558 Hyundai HCN 211,755 859,684 Intage Holdings, Inc. 244,992 2,992,628 Legs Co. Ltd. 1,400 29,325 MSG Network, Inc. Class A (a) 45,058 715,070 Nexstar Broadcasting Group, Inc. Class A 2,261 333,294 Nordic Entertainment Group AB (B Shares) 56 2,600 Pico Far East Holdings Ltd. 1,820,216 321,032 Proto Corp. 14,723 156,539 Reach PLC 503 1,528 RKB Mainichi Broadcasting Corp. 2,889 161,513 Saga Communications, Inc. Class A 35,206 793,191 Sky Network Television Ltd. (a) 1,984,879 241,465 TechTarget, Inc. (a) 12,227 937,811 Tegna, Inc. 85,733 1,719,804 The New York Times Co. -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

The Vale of Glamorgan Council Joint Housing Land

THE VALE OF GLAMORGAN COUNCIL JOINT HOUSING LAND AVAILABILITY STUDY 2014 BETWEEN THE VALE OF GLAMORGAN COUNCIL AND, THE HOME BUILDERS FEDERATION, BARRATT HOMES, HAFOD, NEWYDD HOUSING ASSOCIATION, PERSIMMON HOMES, REDROW HOMES & TAYLOR WIMPEY. July 2014 CONTENTS 1 Summary 2 Housing Land Supply 3 Commentary 4 Monitoring data Appendix 1 - Site Schedules Appendix 2 - Past Completions Data Appendix 3 - Previous Land Supply Data 1.0 SUMMARY 1.1 This is the Vale of Glamorgan Joint Housing Land Availability Study for 2014 which presents the housing land supply for the area at the base date of 1st April 2014. It replaces the report for the previous base date of 1st April 2013. 1.2 The JHLAS has been prepared in accordance with the requirements of Planning Policy Wales, Technical Advice Note 1 (TAN 1) and the Guidance Note on the JHLAS process (September 2012), and Welsh Government Clarification Letter (November 2013). Please refer to these documents for details of the requirements for the maintenance of a five year housing land supply in each Local Planning Authority area and the process for undertaking the JHLAS. This document can be accessed on the Welsh Government web site using the following link: http://wales.gov.uk/topics/planning/planningstats/housing-land- availability- in-wales/?lang=en 1.3 Section 2 sets out details of the housing land supply and how it has been calculated. It shows that based on the past building rates method set out in TAN 1; this indicates that the Vale of Glamorgan has a 7.3 year housing land supply. -

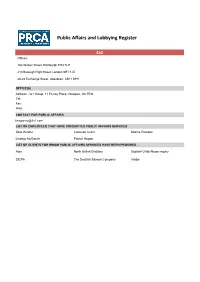

Public Affairs and Lobbying Register

Public Affairs and Lobbying Register 3x1 Offices: 16a Walker Street, Edinburgh EH3 7LP 210 Borough High Street, London SE1 1JX 26-28 Exchange Street, Aberdeen, AB11 6PH OFFICE(S) Address: 3x1 Group, 11 Fitzroy Place, Glasgow, G3 7RW Tel: Fax: Web: CONTACT FOR PUBLIC AFFAIRS [email protected] LIST OF EMPLOYEES THAT HAVE CONDUCTED PUBLIC AFFAIRS SERVICES Ailsa Pender Cameron Grant Katrine Pearson Lindsay McGarvie Patrick Hogan LIST OF CLIENTS FOR WHOM PUBLIC AFFAIRS SERVICES HAVE BEEN PROVIDED Atos North British Distillery Scottish Child Abuse Inquiry SICPA The Scottish Salmon Company Viridor Public Affairs and Lobbying Register Aiken PR OFFICE(S) Address: 418 Lisburn Road, Belfast, BT9 6GN Tel: 028 9066 3000 Fax: 028 9068 3030 Web: www.aikenpr.com CONTACT FOR PUBLIC AFFAIRS [email protected] LIST OF EMPLOYEES THAT HAVE CONDUCTED PUBLIC AFFAIRS SERVICES Claire Aiken Lyn Sheridan Shane Finnegan Simon Tiernan LIST OF CLIENTS FOR WHOM PUBLIC AFFAIRS SERVICES HAVE BEEN PROVIDED McDonald’s Diageo Public Affairs and Lobbying Register Airport Operators Associaon OFFICE(S) Address: Airport Operators Association, 3 Birdcage Walk, London, SW1H 9JJ Tel: 020 7799 3171 Fax: 020 7340 0999 Web: www.aoa.org.uk CONTACT FOR PUBLIC AFFAIRS [email protected] LIST OF EMPLOYEES THAT HAVE CONDUCTED PUBLIC AFFAIRS SERVICES Ed Anderson Henk van Klaveren Karen Dee Michael Burrell - external public affairs Peter O'Broin Roger Koukkoullis advisor LIST OF CLIENTS FOR WHOM PUBLIC AFFAIRS SERVICES HAVE BEEN PROVIDED N/A Public Affairs and Lobbying Register Al -

Woodcote Grove • Epsom • Kt18 5Bw

WOODCOTE GROVE • EPSOM • KT18 5BW PRIME SOUTH EAST PRE-LET FORWARD FUNDING OPPORTUNITY INVESTMENT SUMMARY • Located 500 metres south of Epsom town centre within easy walking distance of Epsom Station and The Ashley Centre • Attractive low density landscaped site totalling circa 2.89 hectares (7.14 acres) • A state of the art Grade A headquarters style office building anticipated to provide a NIA of 8,604 sq m (92,613 sq ft) over ground and two upper floors • Exceptional car parking ratio of 1:21.51 sq m (1:232 sq ft) • A highly specified building which will have a BREEAM rating of ‘Excellent’ and EPC rating of A • To be let to the secure covenant of Atkins Limited on an unbroken 25 year full repairing and insuring lease from practical completion and guaranteed by the tenant’s global parent company WS Atkins plc • Income protection through restrictions on assignment • A low anticipated annual rent from lease completion of £1,950,000 per annum, equating to only £227 per sq m (£21.06 per sq ft), over 30% below achieved rents within other comparable South East office markets, offering excellent long term value protection • Five yearly upwards only rent reviews linked to the “All Items” Retail Prices Index, capped at 4% per annum • Freehold • Practical completion targeted for September 2017, with site works set to begin in January 2016 • Cushman & Wakefield are instructed to seek a full forward funding proposal for the development based upon a price in excess of £41,600,000, subject to contract and exclusive of VAT. -

Segmental Review Land Promotion

Henry Boot PLC Annual Report and Financial Statements for the year ended 31 December 2020 Segmental Review Land Promotion Nick Duckworth Hallam Land Management Limited HLM performed well, achieving a Significant strides forward were achieved at Didcot with Oxfordshire County Council securing an important infrastructure funding package £14.2m operating profit (2019: £31.0m) which enabled it to reaffirm its support for our 2,170-plot scheme. We from selling 2,000 plots (2019: 3,427 are hopeful that the final planning consent will be secured in 2021. plots), at an average of £6,456 per plot Furthermore, we continued to make good progress at Eastern Green, (2019: £10,000 per plot). Coventry where in November a resolution to permit planning permission was secured for 2,400 plots, 37 acres of commercial development, plus During 2020, UK greenfield land values remained relatively stable a primary school and community centre. This scheme requires a grade with a decline of 0.6% in the year according to Savills Research. separated junction on the A45 to effect access, and a loan from the After suspending land buying in H1, the majority of the major national Homes and Infrastructure Fund (HIF) has been secured, with delivery and regional housebuilders re-entered the market in H2 with land expected during 2021/22. values increasing by 0.3% in Q4. This followed a strong recovery in HLM secured further opportunities in its land bank during the year, new housing sales, leading to continued demand for our land, where increasing it to 16,607 acres (2019: 14,898) with just under 60% encouragingly we received bids at pre-CV-19 prices. -

CDP Climate Change Report 2015 United Kingdom Edition

CDP Climate Change Report 2015 United Kingdom Edition Written on behalf of 822 investors with US$95 trillion in assets CDP Report | October 2015 1 Contents Foreword 3 Global overview 4 2015 Leadership criteria 8 The Climate A List 2015 10 2015 FTSE 350 Climate Disclosure Leadership Index (CDLI) 12 Investor engagement in the UK 13 Profile: BT Group 14 United Kingdom snapshot 16 Profile: SSE 18 Natural Capital 20 Appendix I 24 Investor signatories and members Appendix II 25 FTSE 350 scores Appendix III 30 Responding FTSE SmallCap climate change companies Please note: The selection of analyzed companies in this report is based on market capitalization of regional stock indices whose constituents change over time. Therefore the analyzed companies are not the same in 2010 and 2015 and any trends shown are indicative of the progress of the largest companies in that region as defined by market capitalization. Large emitters may be present in one year and not the other if they dropped out of or entered a stock index. ‘Like for like’ analysis on emissions for sub-set of companies that reported in both 2010 and 2015 is included for clarity. Some dual listed companies are present in more than one regional stock index. Companies referring to a parent company response, those responding after the deadline and self-selected voluntary responding companies are not included in the analysis. For more information about the companies requested to respond to CDP’s climate change program in 2015 please visit: https://www.cdp.net/Documents/disclosure/2015/Companies-requested-to-respond-CDP-climate-change.pdf Important Notice The contents of this report may be used by anyone providing acknowledgement is given to CDP Worldwide (CDP). -

Berkeley Group Holdings Plc (BKG:LN)

Berkeley Group Holdings Plc (BKG:LN) Consumer Discretionary/Home Construction Price: 4,751.00 GBX Report Date: September 3, 2021 Business Description and Key Statistics Berkeley Group Holdings is a holding company. Through its Current YTY % Chg subsidiaries, Co. is engaged in residential-led mixed use development and ancillary activities. Co. builds homes and Revenue LFY (M) 2,202 14.7 communities across London, Birmingham and the EPS Diluted LFY 0.72 6.1 South-East of England. Market Value (M) 26,684 Shares Outstanding LFY (000) 561,659 Book Value Per Share 5.65 EBITDA Margin % 23.10 Net Margin % 19.6 Website: www.berkeleygroup.co.uk Long-Term Debt / Capital % 8.6 ICB Industry: Consumer Discretionary Dividends and Yield TTM 1.16 - 2.44% ICB Subsector: Home Construction Payout Ratio TTM % 100.0 Address: Berkeley House;19 Portsmouth Road Cobham 60-Day Average Volume (000) 455 GBR 52-Week High & Low 4,943.00 - 4,001.00 Employees: 2,627 Price / 52-Week High & Low 0.96 - 1.19 Price, Moving Averages & Volume 4,990.1 4,990.1 Berkeley Group Holdings Plc is currently trading at 4,751.00 which is 1.1% below its 50 day 4,860.6 4,860.6 moving average price of 4,804.42 and 3.2% above its 4,731.0 4,731.0 200 day moving average price of 4,603.30. 4,601.5 4,601.5 BKG:LN is currently 3.9% below its 52-week high price of 4,943.00 and is 18.7% above 4,472.0 4,472.0 its 52-week low price of 4,001.00.