Interbrand-Best-Retail-Brands-2014-3

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Developing Employees As Organisational Assets

Developing Employees as Organisational Assets INTRODUCTION The Kingfisher Recruitment • The Person Specification How KMDS is evolving commercial and afterwards in key functions The Group requires from prospec- Kingfisher plc is one of Europe’s leading retailers based Management Development Scheme Investing in a trainee over ten years tive KMDS trainees: The KMDS was launched in 1995 and • a post-graduate certificate in man- around three main sectors - DIY, electrical and general involves significant cost as well as today has 172 individuals on the scheme agement studies from Templeton • excellent interpersonal skills merchandise. The company employs over 130,000 people in invest- risk. The risk includes choosing the working across the Group. All individu- College, Oxford The KMDS represents a key • enthusiasm and drive to become ment by the organisation in its human wrong type of person and equally als following the KMDS route joined in • a ‘skills tool-box’ consisting of 2,900 stores across 15 countries and has some of the best senior managers within 7-10 years assets. The scheme takes high-poten- importantly losing the person to anoth- their early 20s. Recently Kingfisher has day-release training to develop per- known retail brands in Europe, including B&Q, Castorama, • innovative approach to challenges tial graduates who want to make a er organisation during the training recognised that there are benefits in sonal skills Comet, Darty, BUT, Woolworths and Superdrug among opening up the process to existing high- career in retail, and provides them with process. For this reason, Kingfisher • the ability to analyse and make • a ‘buddy’ who is already on the others. -

Fuel Forecourt Retail Market

Fuel Forecourt Retail Market Grow non-fuel Are you set to be the mobility offerings — both products and Capitalise on the value-added mobility mega services trends (EVs, AVs and MaaS)1 retailer of tomorrow? Continue to focus on fossil Innovative Our report on Fuel Forecourt Retail Market focusses In light of this, w e have imagined how forecourts w ill fuel in short run, concepts and on the future of forecourt retailing. In the follow ing look like in the future. We believe that the in-city but start to pivot strategic Continuously pages w e delve into how the trends today are petrol stations w hich have a location advantage, w ill tow ards partnerships contemporary evolve shaping forecourt retailing now and tomorrow . We become suited for convenience retailing; urban fuel business start by looking at the current state of the Global forecourts w ould become prominent transport Relentless focus on models Forecourt Retail Market, both in terms of geographic exchanges; and highw ay sites w ill cater to long customer size and the top players dominating this space. distance travellers. How ever the level and speed of Explore Enhance experience Innovation new such transformation w ill vary by economy, as operational Next, w e explore the trends that are re-shaping the for income evolutionary trends in fuel retailing observed in industry; these are centred around the increase in efficiency tomorrow streams developed markets are yet to fully shape-up in importance of the Retail proposition, Adjacent developing ones. Services and Mobility. As you go along, you w ill find examples of how leading organisations are investing Further, as the pace of disruption accelerates, fuel their time and resources, in technology and and forecourt retailers need to reimagine innovative concepts to become more future-ready. -

4Q Toronto G Guichard

EL Puerto de Liverpool S.A.B. de C.V March, 2017 Safe Harbor Statement This presentation has been prepared by El Puerto de Liverpool, S.A.B. de C.V. (together with its subsidiaries, “Liverpool”), is strictly confidential, is not intended for general distribution and may only be used for informational purposes. This presentation may contain proprietary, trade-secret, and commercially sensitive information and neither this presentation nor the information contained herein may be copied, disclosed or provided, in whole or in part, to third parties for any purpose. By receiving this presentation, you become bound by the above referred confidentiality obligation and agree that you will, and will cause your representatives and advisors to, use the information contained herein only to evaluate a credit rating for Liverpool and for no other purpose. Failure to comply with such confidentiality obligation may result in civil, administrative or criminal liabilities. The distribution of this presentation in other jurisdictions may also be restricted by law and persons into whose possession this presentation comes should inform themselves about and observe any such restrictions. Although the information presented in this document has been obtained from sources that Liverpool believes to be reliable, Liverpool does not make any representation as to its accuracy, validity, timeliness or completeness for any purpose. The information set forth herein does not purport to be complete and Liverpool is not responsible for errors and/or omissions with respect to the information contained herein. Certain of the information contained in this presentation represents or is based upon forward-looking statements or information. -

Décision N° 18-DCC-65 Du 27 Avril 2018 Relative À La Prise De Contrôle

RÉPUBLIQUE FRANÇAISE Décision n° 18-DCC-65 du 27 avril 2018 relative à la prise de contrôle exclusif des sociétés Zormat, Les Chênes et Puech Eco par la société Carrefour Supermarchés France L’Autorité de la concurrence, Vu le dossier de notification adressé complet au service des concentrations le 15 mars 2018, relatif à la prise de contrôle exclusif des sociétés Zormat, Les Chênes et Puech Eco par la société Carrefour Supermarchés France, et formalisée par un protocole de cession en date du 1er février 2018 ; Vu le livre IV du code de commerce relatif à la liberté des prix et de la concurrence, et notamment ses articles L. 430-1 à L. 430-7 ; Vu les engagements présentés les 15 mars et 18 avril 2018 par la partie notifiante ; Vu les éléments complémentaires transmis par la partie notifiante au cours de l’instruction ; Adopte la décision suivante : I. Les entreprises concernées et l’opération 1. La société Carrefour Supermarchés France SAS (ci-après « CSF ») est une filiale à 100 % du groupe Carrefour, lequel est actif dans le secteur du commerce de détail à dominante alimentaire, ainsi que dans la distribution en gros à dominante alimentaire. En France, le groupe Carrefour exploite des hypermarchés, supermarchés, commerces de proximité, cash and carry, sous les enseignes Carrefour, Carrefour Market, Carrefour City, Carrefour Contact, Carrefour Express, Carrefour Montagne, Huit à 8, Marché Plus, Proxi et Promocash. Le groupe Carrefour dispose par ailleurs d’une activité de drive et exploite plusieurs sites marchands sur internet : www.carrefour.fr, www.ooshop.carrefour.fr et www.rueducommerce.fr. -

537 the Impact of Foreign Retail and Wholesale Stores on Traditional

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by AMH International (E-Journals) Information Management and Business Review Vol. 4, No. 10, pp. 537-544, Oct 2012 (ISSN 2220-3796) The Impact of Foreign Retail and Wholesale Stores on Traditional Wholesale Stores in Nonthaburi Province, Thailand Supitcha Cheevapruk, John Walsh* School of Management, Shinawatra University, Thailand *[email protected] Abstract: The entrance of foreign retail and wholesale businesses in Thailand started some ten years ago and led to the closure of many Thai wholesale stores. The objective of this study is to determine the needs of Thai wholesalers in the Nonthaburi area and to identify suitable strategies for relevant managers to be able to compete with contemporary commercial strategies of the foreign enterprises. A total of 114 of the 120 Thai traditional wholesale stores in Nonthaburi were surveyed by questionnaire and results were analyzed by statistical means. It was found that low price strategy, location of store and full cycle service strategies were the principal approaches employed by the managers of the foreign wholesale and retail stores. Tesco Lotus was the foreign venture with the greatest impact on the Thai environment. With respect to managerial approach, it was found that Thai traditional wholesale stores should try to build stronger relationships with customers and regularly search for new markets. Employee performance should also be taken into consideration to some extent. Other issues of importance included the presentation of the store and visual merchandising, as well as transparency in management systems and the need for well–organized financial and accounting systems and their proper control. -

Finance Project

MASTER OF SCIENCE IN FINANCE MASTERS FINAL WORK PROJECT EQUITY RESEARCH: HORNBACH BAUMARKT AG JOÃO MARIA GONÇALVES PAIVA DÓRDIO RODRIGUES SUPERVISOR: ANA ISABEL ORTEGA VENÂNCIO OCTOBER 2020 Acknowledgements This paper represents the end of a journey started in 2018 and I would like to express my sincerest gratitude to all persons involved in these 2 years of the Masters. Firstly, to Professor Ana Venâncio for the guidance, time and patience, not only during this project, but also during classes. Secondly, to my family, parents, sister and grandmother, for supporting and believing in me. And last but not least, to my friends, new and old, for the moments shared in these past 2 years. i Abstract The following project is a valuation of the company Hornbach Baumarkt AG, based on publicly available information until the 6th November 2020. It follows the format recommended by the CFA Institute. Hornbach Baumarkt AG was chosen due to the interest in wanting to explore and learn about the DIY sector and by it being the only publicly traded German company. Hornbach Baumarkt AG is a Top 10 player in the DIY Home Improvement sector in Europe. It was created in 1993 after an IPO that saw Hornbach AG being subdivided in Hornbach Holding AG (Parent Company) and Hornbach Baumarkt AG, having the original company being founded in 1877, in Landau, Germany, but only making their first IPO in 1987. Today, Hornbach Baumarkt AG is a Child company of Hornbach Holding AG. The valuation was derived from an intrinsic valuation, based on a Discounted Cash Flow (DFC) method, more specifically, through a Free Cash Flow to the Firm (FCFF) perspective. -

Merger Control 2018 Seventh Edition

Merger Control 2018 Seventh Edition Contributing Editors: Nigel Parr & Ross Mackenzie GLOBAL LEGAL INSIGHTS – MERGER CONTROL 2018, SEVENTH EDITION Editors Nigel Parr & Ross Mackenzie, Ashurst LLP Production Editor Andrew Schofi eld Senior Editors Suzie Levy Caroline Collingwood Group Consulting Editor Alan Falach Publisher Rory Smith We are extremely grateful for all contributions to this edition. Special thanks are reserved for Nigel Parr & Ross Mackenzie for all their assistance. Published by Global Legal Group Ltd. 59 Tanner Street, London SE1 3PL, United Kingdom Tel: +44 207 367 0720 / URL: www.glgroup.co.uk Copyright © 2018 Global Legal Group Ltd. All rights reserved No photocopying ISBN 978-1-912509-17-1 ISSN 2048-1292 This publication is for general information purposes only. It does not purport to provide comprehensive full legal or other advice. Global Legal Group Ltd. and the contributors accept no responsibility for losses that may arise from reliance upon information contained in this publication. This publication is intended to give an indication of legal issues upon which you may need advice. Full legal advice should be taken from a qualifi ed professional when dealing with specifi c situations. The information contained herein is accurate as of the date of publication. Printed and bound by CPI Group (UK) Ltd, Croydon, CR0 4YY June 2018 CONTENTS Preface Nigel Parr & Ross Mackenzie, Ashurst LLP General chapter Anti-competitive buyer power under UK and EC merger control – too much of a good thing? Burak Darbaz, Ben Forbes & Mat Hughes, AlixPartners UK LLP 1 Country chapters Albania Anisa Rrumbullaku, CR PARTNERS 19 Australia Sharon Henrick & Wayne Leach, King & Wood Mallesons 24 Austria Astrid Ablasser-Neuhuber & Gerhard Fussenegger, bpv Hügel Rechtsanwälte GmbH 39 Canada Micah Wood & Kevin H. -

Nombre De La Tienda Direccion Liverpool Centro Venustiano Carranza No

NOMBRE DE LA TIENDA DIRECCION LIVERPOOL CENTRO VENUSTIANO CARRANZA NO. 92 COL.CENTRO DEL. CUAUHTEMOC ATRÁS ESPLANADA DEL ZOCALO SALIENDO METRO ZOCALO LIVERPOOL INSURGENTES INSURGENTES SUR 1310 COL. DEL VALLE DEL BENITO JUAREZ A LADO DE PLAZA GALERIA INSURGENTES METRO INSURGENTES SUR LIVERPOOL POLANCO MARIANO ESCOBEDO 425 ENTRE HOMERO Y HORACIO COL. POLANCO. 11560 LIVERPOOL SATELITE CIRCUITO CENTRO COMERCIAL NO. 2551 PLAZA SATELITE 53100. NAUCALPAN DE JUAREZ EDO DE MEXICO LIVERPOOL COAPA CALZ DEL HUESO NO. 519 COL. RESIDENCIAL ACOXPA CP.14300 DEL. TLALPAN LIVERPOOL SANTA FE AV. GASCA DE QUIROGA NO. 3800 COL. SANTA FE CUAJIMALPA. C.P 05109 LIVERPOOL METEPEC BLV TOLUCA METEPEC N.-400 NORTE BARRIO DE XUSTENCO CP 51141 LIVERPOOL LINDA VISTA CALLE COLECTOR 13 NO. 280 COL. MAGDALENA DE LAS SALINAS DEL. GUSTAVO AMADERO LIVERPOOL TEZONTLE AV. CANAL DE TEZONTLE C.P.09020 ENTE COL.DR. ALFONSO TIRADO DEL. IZTAPALAPA PLAZA ORIENTE METRO BUS ROJO GOMEZ LIVERPOOL INTERLOMAS CALLE VIALIDAD DE LA BARRANCA NO. 6 COL. EXHACIENDA JESUS DEL MONTE MPO. HUIXQUILUCAN FRENTE HOSPITAL ANGELES. PLAZA PASEO INTERLOMAS LIVERPOOL ATIZAPAN AV. RUIZ CORTINES NO. 255 COL. LAS MARGARITAS ATIZAPAN DE ZARAGOZA. LIVERPOOL TOLUCA AV PRIMERO DE MAYO N.-1700 COL SANTANA TLAPANTITLAN TOLUCA LIVERPOOL CIUDAD JARDIN AV BORDE DE AXOCHIAPAN NO. 3 COL. CIUDAD JARDIN BICENTENARIO DEL NETZAHUALCOYOTL FABRICAS PLAZA CENTRAL AV. CANAL RIOS CHURUBUSCO NO. 1635 COL. CENTRAL DE ABASTOS DEL. IZTAPALAPA LIVERPOOL TLALNEPANTLA AV. SOR JUANA INES DE LA CRUZ NO. 280 COL. SAN LORENZO TLALNEPANTLA DE BAR C.P 54030 ESQ. MARIO COLIN PLAZA TLALNEPANTLA FABRICA CHIMALHUACAN AV. NETZAHUALCOYOTL LT 1 COL. -

Allegato a Largo Consumo 7/2011

PL Documento in versione interattiva: www.largoconsumo.info/072011/CitatiPia2011.pdf SOMMARIO INTERATTIVO DI PIANETA DISTRIBUZIONE 2011 Per l'acquisto del fascicolo, o di sue singole parti, rivolgersi al servizio Diffusione e Abbonamenti [email protected] Tel. 02.3271.646 Fax. 02.3271840 LE FONTI DI QUESTO PERCORSO DI LETTURA E SUGGERIMENTI PER L'APPROFONDIMENTO DEI TEMI: Pianeta Distribuzione Osservatorio D'Impresa Rapporto annuale sul grande dettaglio internazionale Leggi le case history di comunicazioni d'impresa Un’analisi ragionata delle politiche e delle strategie di sviluppo dei grandi gruppi di Aziende e organismi distributivi internazionali, food e non food e di come competono con la attivi distribuzione locale a livello di singolo Paese. Tabelle, grafici, commenti nei mercati considerati in giornalistici, interviste ai più accreditati esponenti del retail nazionale e questo internazionale, la rappresentazione fotografica delle più importanti e recenti Percorso di lettura strutture commerciali in Italia e all’estero su Pianeta Distribuzione. selezionati da Largo Consumo http://www.intranet.largoconsumo.info/intranet/Articoli/PL/VisualizzaPL.asp (1 di 16)09/11/2009 11.46.44 PL Pianeta Distribuzione, fascicolo 7/2011, n°pagina 3, lunghezza 1 pagine Tipologia: Articolo I retailer puntano verso nuovi mercati I mercati emergenti stanno beneficiando dell’attuale crisi globale visto che i Proposte editoriali sugli retailer internazionali hanno indicato come mercati target dove espandersi nel .... stessi argomenti: proprio quei Paesi dove le prospettive di crescita sono maggiori e quelli dove è minore la probabilità di essere colpiti dalle misure di austerità approvate dai governi. Ciò è quanto emerge dall’ultimo rapporto pubblicato da CB Richard Ellis (CBRE) “How Global is the Business of Retail?", ormai giunto alla sua quarta edizione. -

Retail Food Sector Retail Foods France

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 9/13/2012 GAIN Report Number: FR9608 France Retail Foods Retail Food Sector Approved By: Lashonda McLeod Agricultural Attaché Prepared By: Laurent J. Journo Ag Marketing Specialist Report Highlights: In 2011, consumers spent approximately 13 percent of their budget on food and beverage purchases. Approximately 70 percent of household food purchases were made in hyper/supermarkets, and hard discounters. As a result of the economic situation in France, consumers are now paying more attention to prices. This situation is likely to continue in 2012 and 2013. Post: Paris Author Defined: Average exchange rate used in this report, unless otherwise specified: Calendar Year 2009: US Dollar 1 = 0.72 Euros Calendar Year 2010: US Dollar 1 = 0.75 Euros Calendar Year 2011: US Dollar 1 = 0.72 Euros (Source: The Federal Bank of New York and/or the International Monetary Fund) SECTION I. MARKET SUMMARY France’s retail distribution network is diverse and sophisticated. The food retail sector is generally comprised of six types of establishments: hypermarkets, supermarkets, hard discounters, convenience, gourmet centers in department stores, and traditional outlets. (See definition Section C of this report). In 2011, sales within the first five categories represented 75 percent of the country’s retail food market, and traditional outlets, which include neighborhood and specialized food stores, represented 25 percent of the market. In 2011, the overall retail food sales in France were valued at $323.6 billion, a 3 percent increase over 2010, due to price increases. -

Foodservice Underserviced: Unlocking Growth Opportunities for Grocery Retailers in Southeast Asia

Executive Insights Volume XVIII, Issue 49 Foodservice Underserviced: Unlocking Growth Opportunities for Grocery Retailers in Southeast Asia Khun Pimolpa runs a fusion Thai-Italian cuisine At the same time, the Big C hypermarket that she visits is also restaurant in the Sukhumvit district of Bangkok. struggling. Like-for-like sales at Big C have been under pressure in the past few years due to intense competition from new stores Business has been good for her over the past and new variations of store formats, combined with a sluggish decade, as she has been able to increase sales economy overall. by 4-5% annually, an upward trend that has Khun Pimolpa’s story is not the only one of its kind. Across been benefiting the rest of the Thai food service Southeast Asia, similar stories can be heard in various parts of the region, where grocery retailers are experiencing slowing industry. Despite the surge in income, Khun sales growth. However, a key customer segment — small and Pimolpa is tired — she starts the day at 5 a.m. medium-sized foodservice operators — remains underserved. and does not finish till 11 p.m. Aside from Growth in the foodservice industry the everyday operation of her outlet, she also Favorable trends such as rising income levels and urbanization spends a significant amount of time and effort are supporting the growth of “eating out” across Southeast Asia. In countries like Malaysia, Indonesia, the Philippines and sourcing inputs — fresh meats and vegetables Vietnam, growing populations and demographics (the young at the wet market, dry groceries at the Big C are more likely to dine out than older individuals) are further hypermarket — and purchasing emergency boosting demand. -

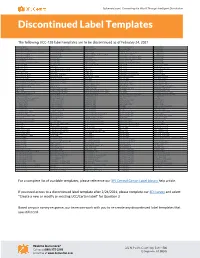

Discontinued Label Templates

3plcentral.com | Connecting the World Through Intelligent Distribution Discontinued Label Templates The following UCC-128 label templates are to be discontinued as of February 24, 2021. AC Moore 10913 Department of Defense 13318 Jet.com 14230 Office Max Retail 6912 Sears RIM 3016 Ace Hardware 1805 Department of Defense 13319 Joann Stores 13117 Officeworks 13521 Sears RIM 3017 Adorama Camera 14525 Designer Eyes 14126 Journeys 11812 Olly Shoes 4515 Sears RIM 3018 Advance Stores Company Incorporated 15231 Dick Smith 13624 Journeys 11813 New York and Company 13114 Sears RIM 3019 Amazon Europe 15225 Dick Smith 13625 Kids R Us 13518 Harris Teeter 13519 Olympia Sports 3305 Sears RIM 3020 Amazon Europe 15226 Disney Parks 2806 Kids R Us 6412 Orchard Brands All Divisions 13651 Sears RIM 3105 Amazon Warehouse 13648 Do It Best 1905 Kmart 5713 Orchard Brands All Divisions 13652 Sears RIM 3206 Anaconda 13626 Do It Best 1906 Kmart Australia 15627 Orchard Supply 1705 Sears RIM 3306 Associated Hygienic Products 12812 Dot Foods 15125 Lamps Plus 13650 Orchard Supply Hardware 13115 Sears RIM 3308 ATTMobility 10012 Dress Barn 13215 Leslies Poolmart 3205 Orgill 12214 Shoe Sensation 13316 ATTMobility 10212 DSW 12912 Lids 12612 Orgill 12215 ShopKo 9916 ATTMobility 10213 Eastern Mountain Sports 13219 Lids 12614 Orgill 12216 Shoppers Drug Mart 4912 Auto Zone 1703 Eastern Mountain Sports 13220 LL Bean 1702 Orgill 12217 Spencers 6513 B and H Photo 5812 eBags 9612 Loblaw 4511 Overwaitea Foods Group 6712 Spencers 7112 Backcountry.com 10712 ELLETT BROTHERS 13514 Loblaw