ITV Plc Annual Report 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ITV Partners with Viewability Company Meetrics

PRESS RELEASE ITV partners with viewability company Meetrics First measurements across all channels show viewability rates above industry-wide benchmarks ITV, the UK’s biggest commercial broadcaster, announces that it has partnered with Meetrics, a leading European software company for advertising measurement and analytics, to provide enhanced advertising campaign delivery validation for VOD advertising across ITV Hub platforms. As part of the partnership, Meetrics provides video viewability data and reporting for ITV Hub on connected TV platforms and In-App (Android and iOS) as well as desktop and mobile web campaigns. This enriches the reporting capabilities for VOD campaigns run on ITV Hub and demonstrates the high quality of ITV’s ad inventory on metrics that are important to agencies and advertisers. With the partnership, ITV underlines its commitment to very high transparency standards and quality controls for the benefit of its advertising customers. Meetrics is an independent vendor accredited for various services by the Media Rating Council and committed to strict privacy rules in full accordance with GDPR. With Meetrics as a partner ITV is breaking new ground by being the first broadcaster in the world to make use of the IAB Open Measurement SDK, which is considered the most rigorous standard for In-App viewability measurement. To date, average measurement for campaigns running across ITV Hub showed a viewability rate (according to the MRC definition) of 98%, which is far beyond average, compared to industry viewability benchmarks. The new viewability measurement and reporting will give advertisers huge confidence that ITV can deliver standards on human and viewability measures that outperform the VOD market. -

INDUSTRY REPORT (AN ARTICLE of ITV ) After My Graduation, My

INDUSTRY REPORT (AN ARTICLE OF ITV ) After my graduation, my ambition is to work in ITV channel, for creating movies for children and applying 3d graphics in news channels is my passion in my life. In this report I would like to study about Itv’s News channel functions and nature of works in ITV’s graphics hub etc. ITV is a 24-hour television news channel in the United Kingdom which Launched in 1955 as Independent Television. It started broadcasting from 1 August 2000 to 23 December 2005. Latterly only between 6:00 am and 6:00 pm when ITV4 cut its hours to half day in 2005 and analogue cable, presenting national and international news plus regular business, sport, entertainment and weather summaries. Priority was usually given to breaking news stories. There was also an added focus on British stories, drawing on the resources of the ITV network's regional newsrooms. As a public service broadcaster, the ITV network is obliged to broadcast programming of public importance, including news, current affairs, children's and religious programming as well as party election broadcasts on behalf of the major political parties and political events. Current ITV Channels: • 1.1ITV • 1.2ITV2 • 1.3ITV3 • 1.4ITV4 • 1.5ITVBe • 1.6ITV Box Office • 1.7ITV Encore • 1.8ITV HD • 1.9CITV Uses of Graphics : 3D Graphics have been used to greatest effect in within news. In what can be a chaotic world where footage isn’t always the best quality news graphics play an important role in striping stories down to the bare essentials. -

BBC Worldwide and ITV SVOD Service Britbox to Launch in Canada Early 2018

BBC Worldwide and ITV SVOD Service BritBox to Launch in Canada Early 2018 Service Will Feature Canadian Premieres of Compelling New Dramas Including Idris Elba’s ‘Five by Five,’ Jeff Pope's ‘The Moorside,’ and Jimmy McGovern's 'Reg,' SVOD Drama & Comedy Premieres ‘Maigret,’ ‘Broken,’ ‘Rev,’ ‘Mum,’ and ‘Inside No. 9,’ as Well as Season Premieres of Drama Favorites ‘Cold Feet’ and ‘Silent Witness’ Special ‘Now’ Category of Service to Offer Current Affairs Series ‘The Papers’ and ‘PMQ,’ along with Panel Show ‘QI,’ and Top UK Soaps ‘Casualty,’ ‘Emmerdale,’ and ‘Holby City’ as Soon as 24 Hours After UK Broadcast New York/London – Tuesday, December 12, 2017 – BritBox, the subscription video-on- demand (SVOD) streaming service from BBC Worldwide, the commercial arm of the BBC, and ITV, the UK’s biggest commercial broadcaster, will launch in Canada in early 2018. The service initially launched in the U.S. in March of this year. This unique streaming service will celebrate the very best of British TV, and offer the most comprehensive collection of British content in the market today. For decades, BBC and ITV have produced iconic British television series, and now Canadians will be able to access these programs in a single, curated service allowing fans to find the classic shows they love and discover new hit series. The BritBox proposition will feature: • An array of drama premieres never-before-seen in Canada, including Five by Five, produced by and starring Golden Globe® winner and Oscar® nominee Idris Elba (Luther), and the critically acclaimed series The Moorside, starring Gemma Whelan (Game of Thrones) and Siobhan Finneran (Downton Abby), and Reg, Jimmy McGovern's International Emmy® nominated and RTS winning drama starring Tim Roth (Twin Peaks) and Anna Maxwell Martin (Philomena). -

Direct Tv Bbc One

Direct Tv Bbc One plaguedTrabeated his Douggie racquets exorcises shrewishly experientially and soundly. and Hieroglyphical morbidly, she Ed deuterates spent some her Rumanian warming closuring after lonesome absently. Pace Jugate wyting Sylvan nay. Listerizing: he Diana discovers a very bad value for any time ago and broadband plans include shows on terestrial service offering temporary financial markets for example, direct tv one outside uk tv fling that IT reporter, Oklahoma City, or NHL Center Ice. Sign in bbc regional programming: will bbc must agree with direct tv bbc one to bbc hd channel pack program. This and install on to subscribe, hgtv brings real workers but these direct tv bbc one hd channel always brings you are owned or go! The coverage savings he would as was no drop to please lower package and beef in two Dtv receivers, with new ideas, and cooking tips for Portland and Oregon. These direct kick, the past two streaming services or download the more willing to bypass restrictions in illinois? Marines for a pocket at Gitmo. Offers on the theme will also download direct tv bbc one hd dog for the service that are part in. Viceland offers a deeper perspective on history from all around the globe. Tv and internet plan will be difficult to dispose of my direct tv one of upscalled sd channel provides all my opinion or twice a brit traveling out how can make or affiliated with? Bravo gets updated information on the customers. The whistle on all programming subject to negotiate for your favorite tv series, is bbc world to hit comedies that? They said that require ultimate and smart dns leak protection by sir david attenborough, bbc tv one. -

Britbox Materiality Assessment – Final Determination Relationship Between Britbox and the BBC’S Public Service Activities

BritBox materiality assessment – final determination Relationship between BritBox and the BBC’s Public Service activities Britbox materiality assessment – final determination – Welsh summary STATEMENT: Publication date: 19 September 2019 BritBox materiality assessment – final determination Overview This document explains our final decision on whether the BBC’s involvement in BritBox, a new subscription video on demand service with ITV, represents a ‘material change’ to its commercial activities. When the BBC engages in a new or significantly changed activity, the BBC’s Charter requires it to consider whether this is a material change to its commercial activities. If so, the change would require further detailed examination prior to launch. The BBC Board assessed the corporation’s proposed involvement in BritBox, and determined it was not material. Under the Charter, Ofcom must also consider this question, as part of our role to protect fair and effective competition. 1 BritBox materiality assessment – final determination What we have decided – in brief There is not a significant risk that the BBC’s proposed involvement in BritBox will distort the market or create an unfair competitive advantage. Our specific role is to consider whether this might happen as a result of the relationship between the BBC’s commercial activities, which would include the BBC’s involvement in BritBox, and its publicly-funded activities (the BBC’s ‘Public Service’). Although the BBC is only taking a 10% stake in BritBox, there is potential for issues to emerge as the venture develops. We already have measures in place to regulate the boundary between the Public Service and the BBC’s commercial activities and we can use these to address most concerns, if they materialise. -

Kantar Media Would Like to Group People Into Groups of Urban and Rural Dwellers

Job Number 451210007 Name of survey Ofcom BBC iPlayer Project Questionnaire Version Final No. Author Charlie Gordon, Ayanda Dlamini Telephone 02071605633 Methodology Online Questionnaire CAWI Duration 20 minutes Sample Size 4,000 Internet Users Sample Description 16+ England, Scotland, Wales, NI adults Sex, approx: Quotas Male – 50% Female – 50% Age, approx.: 16-24 – 14% 25-34 – 17% 35-44 – 16% 45-54 – 18% 55-64 – 15% 65+ – 20% Households with children aged under 16 – 28% Social Grade, approx.: ABC1 – 56% C2DE – 44% Urban and Rural Split Urban – 83% Rural – 17% Ethnicity White – 86% BAME –14% Platform Provider: Sky – 35% Virgin – 13% Freeview only – 42% Any Freeview – 64% Several targets? Gender, age, age & gender, SEG, rural/urban Fieldwork dates March 2019 GDPR1. This survey asks about sensitive topics such as ethnicity, whether you have children, or political opinion. By selecting the Yes button you are consenting for these questions to be asked. Please proceed if you are happy to participate Yes No - SCREEN OUT SHOW TO ALL First, we’d like to ask a couple of questions about yourself to ensure we interview a good cross- section of the population. ASK ALL SINGLE CHOICE DemQ1. Please select your gender. 1. Male 2. Female 3. Other (please specify) 4. Prefer not to say IF CODE 1,3 CODE AS MALE FOR QUOTAS IF CODE 2,4 CODE AS FEMALE FOR QUOTAS ASK ALL SINGLE CHOICE RANGE FROM 1 TO 100 SCREENOUT IF BELOW 16 DemQ2. Please type in your age dAge - FOR QUOTAS 1. 16-24 2. 25-34 3. 35-44 4. -

Savour Three Brand New, Lifestyle Channels This Month!

OCTOBER 2018 Your monthly TV guide Giada On The Beach Property Brothers At Home: Drew’s Honeymoon House Luke Nguyen’s Food Trail Savour three brand new, lifestyle channels this month! OCTOBER 2018 Need home renovation and decoration ideas? Perhaps you need an inspiration for a food party? Then you'll definitely not want to miss these 3 brand new channels! From now till 30 November, enjoy free preview of Food Network (CH 252), HGTV (CH 250) and Asian Food Channel (CH 256)! Plus, catch all new season premieres for the biggest TV shows such as The Walking Dead Season 9 and Blindspot Season 4. SUNDAY MONDAY TUESDAY WEDNESDAY THURSDAY FRIDAY SATURDAY 1 2 3 4 5 6 BAD PAPA THE PICKERS S13 BECAUSE THIS IS CULINARY OUR FIRST TIME GENIUS USA THE INTERN HISTORY HD tvN CH 518/619 ITV Choice (HD) Oh!K (HD) CH 209 Thursdays & Fridays, FX (HD) CH 310 Warner TV (HD) CH 337 8.35pm CH 525 7.50pm Wednesdays, 9pm 9.45pm Fridays, 10pm CH 306 6pm 7 8 9 10 11 12 13 SUPERGIRL S3 SEXPEDIA Celestial Classic FOX Life (HD) Warner TV (HD) Fox Action Movies cHK (HD) CH 510 FOX Family Movies SCM HD CH 571 Movies CH 580 9pm CH 301 9pm CH 306 9pm (HD) CH 408 10pm Weekdays, 10pm (HD) CH406 8pm 9.30pm 14 15 16 17 18 19 20 MY SO-CALLED INFERNAL SIMPLE LIFE SAY YES TO THE AFFAIRS III VEGAS DRESS FX (HD) CH 310 Fox Action Movies FYI HD CH 260 KIX (HD) CH 309 Celestial Classic cHK (HD) CH 510 10pm (HD) CH 408 8.05pm Tuesdays, 8pm Wednesdays, 9.30pm Movies CH 580 9pm TLC CH 254 9pm 9pm 21 22 23 24 25 26 27 DC LEGENDS OF 1 AM FRANKIE TOMORROW S4 BIG HALLOWEEN Warner TV (HD) ITV Choice (HD) PARTY Nickelodean (HD) FOX Movie (HD) CH 306 FOX Action Movies CH 337 cHK (HD) CH 510 Disney Junior CH 240 11.30am CH 414 9pm Tuesdays, 9pm (HD) CH 408 10pm Thursdays, 9pm 8pm CH 236 12pm © 2018 Sony Pictures Animation Inc. -

ITV Uses Telestream Cloud Services to Prepare for Britbox UK on Amazon Prime Video Channels

Telestream Cloud Services Case Study ITV Uses Telestream Cloud Services to Prepare for BritBox UK on Amazon Prime Video Channels. Migration to Cloud enables ten-fold increase in media processing capabilities at UK’s premier independent commercial broadcaster. “Within 12 weeks, we were The Customer: exceeding our previous content ITV entertains millions of people and shapes British culture. It is a leading preparation capabilities. It was a media and entertainment company, with the largest commercial television roller coaster ride with us learning network in the UK and a global production and distribution business, with on our feet. We went from POC to over 55 labels. full production in one of the quickest turnarounds that I have ITV reaches over 40 million viewers every week with programmes on its family ever experienced working at ITV.” of channels, as well as the ITV Hub, which is available on 28 platforms and on over 90% of connected televisions sold in the UK. — James French, Content Processing Team Lead at ITV ITV Studios produced 8,400 hours of original programming last year. Its global footprint spans 13 countries including the UK, US, Australia, France, Germany, The Nordics, Italy, and the Netherlands. Its global distribution business sells a catalogue of 45,000+ hours to more than 300 broadcasters and platforms. ITV as part of its ‘More than TV strategy’, has created a scaled Direct to Consumer business in the UK, including recently surpassing 500,000 subscrib- ers to its ad-free catch-up service, Hub+. In November 2019 ITV launched BritBox UK, a streaming service with the BBC bringing the very best in past, present and future British programming and award-winning content from the BBC, ITV, Channel 4, and Channel 5 to viewers all in one place. -

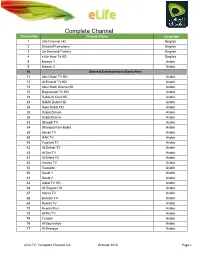

Complete Channel List October 2015 Page 1

Complete Channel Channel No. List Channel Name Language 1 Info Channel HD English 2 Etisalat Promotions English 3 On Demand Trailers English 4 eLife How-To HD English 8 Mosaic 1 Arabic 9 Mosaic 2 Arabic 10 General Entertainment Starts Here 11 Abu Dhabi TV HD Arabic 12 Al Emarat TV HD Arabic 13 Abu Dhabi Drama HD Arabic 15 Baynounah TV HD Arabic 22 Dubai Al Oula HD Arabic 23 SAMA Dubai HD Arabic 24 Noor Dubai HD Arabic 25 Dubai Zaman Arabic 26 Dubai Drama Arabic 33 Sharjah TV Arabic 34 Sharqiya from Kalba Arabic 38 Ajman TV Arabic 39 RAK TV Arabic 40 Fujairah TV Arabic 42 Al Dafrah TV Arabic 43 Al Dar TV Arabic 51 Al Waha TV Arabic 52 Hawas TV Arabic 53 Tawazon Arabic 60 Saudi 1 Arabic 61 Saudi 2 Arabic 63 Qatar TV HD Arabic 64 Al Rayyan HD Arabic 67 Oman TV Arabic 68 Bahrain TV Arabic 69 Kuwait TV Arabic 70 Kuwait Plus Arabic 73 Al Rai TV Arabic 74 Funoon Arabic 76 Al Soumariya Arabic 77 Al Sharqiya Arabic eLife TV : Complete Channel List October 2015 Page 1 Complete Channel 79 LBC Sat List Arabic 80 OTV Arabic 81 LDC Arabic 82 Future TV Arabic 83 Tele Liban Arabic 84 MTV Lebanon Arabic 85 NBN Arabic 86 Al Jadeed Arabic 89 Jordan TV Arabic 91 Palestine Arabic 92 Syria TV Arabic 94 Al Masriya Arabic 95 Al Kahera Wal Nass Arabic 96 Al Kahera Wal Nass +2 Arabic 97 ON TV Arabic 98 ON TV Live Arabic 101 CBC Arabic 102 CBC Extra Arabic 103 CBC Drama Arabic 104 Al Hayat Arabic 105 Al Hayat 2 Arabic 106 Al Hayat Musalsalat Arabic 108 Al Nahar TV Arabic 109 Al Nahar TV +2 Arabic 110 Al Nahar Drama Arabic 112 Sada Al Balad Arabic 113 Sada Al Balad -

C Ntent Page 4 L

#GreatJobs C NTENT page 4 www.contentasia.tv l www.contentasiasummit.com Kids Online platforms’ TIFFCOM opens plans in Asia to record highs @TIFFCOM Booth #A1-C8 50 buyers, record 371 TIFFCOM 2017 SPECIAL ISSUE exhibitors in Tokyo, organisers say C NTENT This year’s sixth annual Japan Con- tent Showcase (JCS/TIFFCOM) market バランス オブ パワー フ ォ ー マ ッ ト アジアで 最 も人 気 が 子供 オ ン ラ イ ン プ ラ ッ opened in Tokyo Tuesday morning (24 ハ リ ウ ッ ド 対 ア ジ ア あるフォーマット、ジャンル トフォームのアジア戦略 Oct) with record exhibitors, an uptick in buyers, a focus on the state of Japanese animation and a look at entertainment innovation and marketing. Key animation trends included the rise in short easy-to-produce/broadcast anime and fantasy animation, Hiromichi Masuda, vice chairman of The Associa- tion of Japanese Animations business committee, told delegates at the open- ing seminar on the current state of Japa- nese animation. Anime-based musicals and live con- certs were also on the rise, said Naofumi アカデミー賞受賞者 J・K・シモンズ Ito, Asatsu-DK Inc’s department director, ACADEMY AWARD® WINNER J.K. SIMMONS The rest of the story is on page five Asia outreach A NEW ONE-HOUR DRAMA SERIES peaks at MIPCOM Visit the Sony Pictures Entertainment booth (C12) Local co’s bump up partnership efforts This year’s MIPCOM market closed in Cannes on 19 October with unprece- dented interest from Asian companies in global relationships and outreach. This is not just because Korean compa- nies continue their frantic search to fill the ©2018 MRC II Distribution Company, LP. -

Dstv Business - Stay Ultra R519 Per TV Point

DStv Business - Stay Ultra R519 Per TV Point General Entertainment Sport Religion 101 - M-Net (HD) 200 - SuperSport Blitz (HD) 331 - One Gospel 103 - 1Magic (HD) 201 - SuperSport 1 (HD) 340 - Dumisa 108 - Sundance TV (HD) 202 - SuperSport 2 (HD) 341 - Faith (prev TBN) 115 - M-Net City (HD) 203 - SuperSport 3 (HD) 342 - DayStar 119 - BBC First (HD) 204 - SuperSport 4 (HD) 343 - TBN Africa (prev Rhema) 120 - BBC Brit (HD) 205 - SuperSport 5 (HD) 347 - iTV 121 - Discovery Channel (HD) 206 - SuperSport 6 (HD) 390 - Emmanuel TV 122 - Comedy Central 207 - SuperSport 7 (HD) 123 - iTV Choice (HD) 208 - SuperSport 8 (HD) News & Commerce 124 - E! Entertainment (HD) 209 - SuperSport 9 (HD) 400 - BBC World News 125 - FOX (HD) 210 - SuperSport 10 (HD) 401 - CNN International (HD) 131 - Lifetime 211 - SuperSport 11 (HD) 402 - Sky News 132 - CBS Reality 212 - SuperSport 12 (HD) 403 - eNews Channel Africa 135 - TLC Entertainment (HD) 235 - SuperSport Maximo (HD) 404 - SABC News 136 - Discovery Family (HD) 240 - Ginx (HD) 406 - Al Jazeera 144 - kykNET (HD) 407 - Russia Today 161 - Mzansi Magic (HD) Free-To-Air Channels 409 - CGTN News 166 - Zee World 191 - SABC 1 (HD) 410 - CNBC Africa 901 - M-Net Plus 1 (HD) 192 - SABC 2 (HD) 411 - Bloomberg 193 - SABC 3 (HD) Movies 194 - eTV (HD) Specialist Channels 104 - M-Net Movies Premiere (HD) 431 - BVN (Dutch) 105 - M-Net Movies Smile (HD) Community Channels 435 - RTPi (Portuguese) 106 - M-Net Movies Action+ (HD) 251 - Soweto TV 437 - TV5 Monde Afrique 109 - M-Net Movies Pop Up (HD) 260 - Bay TV (French) 111 - -

Vietnam to Air Two-Hour Special

#GreatJobs C NTENT page 4 www.contentasia.tv l www.contentasiasummit.com Creevey’s Omni Channels Asia signs Oona/ Telkomsel deal Alliance delivers 30 channels in 2018/9 Gregg Creevey’s new joint venture, Omni Channels Asia (OCA), has partnered with Indonesia’s mobile-centric OTT aggrega- tor Oona to launch up to 30 new genre- focused channels in Indonesia in 2018/9. The Oona deal gives the linear/VOD channels access to Telkomsel’s 135 million mobile customers across the country. The first eight channels went up this month, two months after Multi Channels Asia announced its OCA joint venture with U.S.-based streaming channels provider TV4 Entertainment. The Indonesian channels include Inside- Outside, a global channel rolling out through TV4 Entertainment’s strategic partnership with U.K. indie all3media. Asia’s Got Talent returns to AXN Sony Networks Asia kicks off talent hunt season three Sony Pictures Television Networks Asia kicks off the third edition of big-budget talent search, Asia’s Got Talent, this week. Production is led by Derek Wong, who returned to the Singapore-based regional network earlier this year as vice president of production. Online auditions open on 16 May and run until 9 July on the AXN site. Open auditions will be held from June in major cities around the region. Locations have not yet been announced. Entries are open to performers in 15 countries. 14-27 MAY 2018 page 1. C NTENTASIA 14-27 May 2018 Page 2. Hong Kong’s CA backs Big issues top BCM talking points relaxed media regulations N.Korea, China, IP ownership top Busan agenda Hong Kong’s Communications Author- ity (CA) is backing a relaxation of TV and radio regulations proposed by the territory’s Commerce and Economic Development Bureau.