Media Nations 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

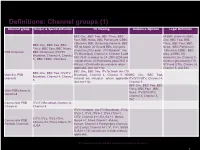

PSB Report Definitions

Definitions: Channel groups (1) Channel group Output & Spend definition TV Viewing Audience Opinion Legal Definition BBC One, BBC Two, BBC Three, BBC All BBC channels (BBC Four, BBC News, BBC Parliament, CBBC, One, BBC Two, BBC CBeebies, BBC streaming channels, BBC Three, BBC Four, BBC BBC One, BBC Two, BBC HD (to March 2013) and BBC Olympics News , BBC Parliament Three, BBC Four, BBC News, channels (2012 only). ITV Network* (inc ,CBeebies, CBBC, BBC PSB Channels BBC Parliament, ITV/ITV ITV Breakfast), Channel 4, Channel 5 and Alba, all BBC HD Breakfast, Channel 4, Channel S4C (S4C is added to C4 2008-2009 and channels), the Channel 3 5,, BBC CBBC, CBeebies excluded from 2010 onwards post-DSO in services (provided by ITV, Wales). HD variants are included where STV and UTV), Channel 4, applicable (but not +1s). Channel 5, and S4C. BBC One, BBC Two, ITV Network (inc ITV BBC One, BBC Two, ITV/ITV Main five PSB Breakfast), Channel 4, Channel 5. HD BBC One, BBC Two, Breakfast, Channel 4, Channel channels variants are included where applicable ITV/STV/UTV, Channel 4, 5 (but not +1s). Channel 5 BBC One, BBC Two, BBC Three, BBC Four , BBC Main PSB channels News, ITV/STV/UTV, combined Channel 4, Channel 5, S4C Commercial PSB ITV/ITV Breakfast, Channel 4, Channels Channel 5 ITV+1 Network (inc ITV Breakfast) , ITV2, ITV2+1, ITV3, ITV3+1, ITV4, ITV4+1, CITV, Channel 4+1, E4, E4 +1, More4, CITV, ITV2, ITV3, ITV4, Commercial PSB More4 +1, Film4, Film4+1, 4Music, 4Seven, E4, Film4, More4, 5*, Portfolio Channels 4seven, Channel 4 Paralympics channels 5USA (2012 only), Channel 5+1, 5*, 5*+1, 5USA, 5USA+1. -

Media Nations 2019

Media nations: UK 2019 Published 7 August 2019 Overview This is Ofcom’s second annual Media Nations report. It reviews key trends in the television and online video sectors as well as the radio and other audio sectors. Accompanying this narrative report is an interactive report which includes an extensive range of data. There are also separate reports for Northern Ireland, Scotland and Wales. The Media Nations report is a reference publication for industry, policy makers, academics and consumers. This year’s publication is particularly important as it provides evidence to inform discussions around the future of public service broadcasting, supporting the nationwide forum which Ofcom launched in July 2019: Small Screen: Big Debate. We publish this report to support our regulatory goal to research markets and to remain at the forefront of technological understanding. It addresses the requirement to undertake and make public our consumer research (as set out in Sections 14 and 15 of the Communications Act 2003). It also meets the requirements on Ofcom under Section 358 of the Communications Act 2003 to publish an annual factual and statistical report on the TV and radio sector. This year we have structured the findings into four chapters. • The total video chapter looks at trends across all types of video including traditional broadcast TV, video-on-demand services and online video. • In the second chapter, we take a deeper look at public service broadcasting and some wider aspects of broadcast TV. • The third chapter is about online video. This is where we examine in greater depth subscription video on demand and YouTube. -

INDUSTRY REPORT (AN ARTICLE of ITV ) After My Graduation, My

INDUSTRY REPORT (AN ARTICLE OF ITV ) After my graduation, my ambition is to work in ITV channel, for creating movies for children and applying 3d graphics in news channels is my passion in my life. In this report I would like to study about Itv’s News channel functions and nature of works in ITV’s graphics hub etc. ITV is a 24-hour television news channel in the United Kingdom which Launched in 1955 as Independent Television. It started broadcasting from 1 August 2000 to 23 December 2005. Latterly only between 6:00 am and 6:00 pm when ITV4 cut its hours to half day in 2005 and analogue cable, presenting national and international news plus regular business, sport, entertainment and weather summaries. Priority was usually given to breaking news stories. There was also an added focus on British stories, drawing on the resources of the ITV network's regional newsrooms. As a public service broadcaster, the ITV network is obliged to broadcast programming of public importance, including news, current affairs, children's and religious programming as well as party election broadcasts on behalf of the major political parties and political events. Current ITV Channels: • 1.1ITV • 1.2ITV2 • 1.3ITV3 • 1.4ITV4 • 1.5ITVBe • 1.6ITV Box Office • 1.7ITV Encore • 1.8ITV HD • 1.9CITV Uses of Graphics : 3D Graphics have been used to greatest effect in within news. In what can be a chaotic world where footage isn’t always the best quality news graphics play an important role in striping stories down to the bare essentials. -

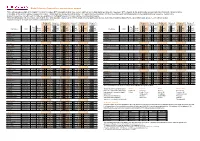

RAJAR DATA RELEASE Quarter 1, 2020 – May 14 Th 2020

RAJAR DATA RELEASE Quarter 1, 2020 – May 14 th 2020 COMPARATIVE CHARTS 1. National Stations 2. Scottish Stations 3. London Stations 4. Breakfast Shows – National and London stations "Please note that the information contained within this quarterly data release has yet to be announced or otherwise made public and as such could constitute relevant information for the purposes of section 118 of FSMA and non-public price sensitive information for the purposes of the Criminal Justice Act 1993. Failure to comply with this embargo could result in prosecution’’. Source RAJAR / Ipsos MORI / RSMB RAJAR DATA RELEASE Quarter 1, 2020 – May 14 th 2020 NATIONAL STATIONS STATIONS SURVEY REACH REACH REACH % CHANGE % CHANGE SHARE SHARE SHARE PERIOD '000 '000 '000 REACH Y/Y REACH Q/Q % % % Q1 19 Q4 19 Q1 20 Q1 20 vs. Q1 19 Q1 20 vs. Q4 19 Q1 19 Q4 19 Q1 20 ALL RADIO Q 48945 48136 48894 -0.1% 1.6% 100.0 100.0 100.0 ALL BBC Q 34436 33584 33535 -2.6% -0.1% 51.4 51.0 49.7 15-44 Q 13295 13048 13180 -0.9% 1.0% 35.2 35.5 34.4 45+ Q 21142 20535 20355 -3.7% -0.9% 60.2 59.4 57.9 ALL BBC NETWORK RADIO Q 31846 31081 30835 -3.2% -0.8% 44.8 45.0 43.4 BBC RADIO 1 Q 9303 8790 8915 -4.2% 1.4% 5.7 5.6 5.6 BBC RADIO 2 Q 15356 14438 14362 -6.5% -0.5% 17.4 17.0 16.3 BBC RADIO 3 Q 2040 2126 1980 -2.9% -6.9% 1.2 1.4 1.3 BBC RADIO 4 (INCLUDING 4 EXTRA) Q 11459 11416 11105 -3.1% -2.7% 13.1 13.4 12.9 BBC RADIO 4 Q 11010 10977 10754 -2.3% -2.0% 11.9 12.0 11.7 BBC RADIO 4 EXTRA Q 2238 2271 1983 -11.4% -12.7% 1.3 1.4 1.2 BBC RADIO 5 LIVE (INC. -

Statement: Ofcom's Plan of Work 2021/22

Ofcom’s plan of work 2021/22 Making communications work for everyone Ofcom’s plan of work 2021/22 – Welsh translation STATEMENT: Publication Date: 26 March 2021 Contents Section 1. Chief Executive’s foreword 1 2. Overview 3 3. Our goals and priorities for 2021/22 9 4. Delivering good outcomes for consumers across the UK 31 Annex A1. What we do 37 A2. Project work for 2021/2022 39 Plan of Work 2021/22 1. Chief Executive’s foreword Ofcom is the UK’s communications regulator, with a mission to make communications work for everyone. We serve the interests of consumers and businesses across the UK’s nations and regions, through our work in mobile and fixed telecoms, broadcasting, spectrum, post and online services. Over the past year we have learned that being connected is everything. High-quality, reliable communications services have never mattered more to people’s lives. But as consumers shift their habits increasingly online, our communications sectors are transforming fast. It is an exciting moment for our industries and for Ofcom as a regulator - it requires long-term focus alongside speed and agility in response to change. Against this backdrop our statement sets out our detailed goals for the coming financial year, and how we plan to achieve them. On telecoms, Ofcom has just confirmed a new long-term framework for investment in gigabit- capable fixed networks. In the coming year, we will shift our focus to support delivery against this programme, alongside investment and innovation in 5G and new mobile infrastructure. Following legislation in Parliament, we will put in place new rules to hold operators to account for the security and resilience of their networks. -

DJ Tiiny, Capital XTRA, Various Dates, 1900

v Issue 424 12 April 2021 DJ Tiiny Type of case Broadcast Standards Outcome Resolved Service Capital XTRA Date & time Various dates, 19:00 Category Commercial communications on radio Summary The presenter played music tracks in return for payment. The Broadcasting Code prohibits any payment that may influence the selection or rotation of music for broadcast. In view of the action taken by the Licensee when it became aware of the presenter’s actions, we considered the matter resolved. Introduction Capital XTRA is a local radio station providing an urban contemporary black music service for African and Afro-Caribbean communities in North London. It is simulcast nationally on DAB, satellite and cable services. Capital XTRA’s licence is held by Capital Xtra Limited, which is owned by Global Media & Entertainment Limited (“Global”). DJ Tiiny was a show broadcast weekly on Friday evenings. A complainant alleged that the presenter played some artists’ music tracks in return for payment. Global contacted Ofcom and confirmed the allegation, saying that it had been alerted to the matter on 27 January 2021 and that the presenter’s contract of employment had been terminated the following day. Ofcom considered the matter raised potential issues under the following Code rule: Rule 10.5: “No commercial arrangement that involves payment, or the provision of some other valuable consideration, to the broadcaster may influence the selection or rotation of music for broadcast”. Issue 424 of Ofcom’s Broadcast and On Demand Bulletin 12 April 2021 1 We therefore requested comments from Global on how programmes in which the presenter had played music tracks in return for payment complied with this rule. -

BBC World Service Report by the Comptroller and Auditor General Presented to the BBC Trust Value for Money Committee, 14 June 2016

BBC World Service Report by the Comptroller and Auditor General presented to the BBC Trust Value for Money Committee, 14 June 2016 BRITISH BROADCASTING CORPORATION BBC World Service Report by the Comptroller and Auditor General presented to the BBC Trust Value for Money Committee, 14 June 2016 Presented to Parliament by the Secretary of State for Culture, Media & Sport by Command of Her Majesty June 2016 © BBC 2016 The text of this document may be reproduced free of charge in any format or medium providing that it is reproduced accurately and not in a misleading context. The material must be acknowledged as BBC copyright and the document title specified. Where third party material has been identified, permission from the respective copyright holder must be sought. BBC Trust response to the National Audit Office value for money review: BBC World Service In the four years to 2014-15 the government BBC Trust response cut core funding to the World Service by As the governing body of the BBC, the around 8% and, in response, the World Trust is responsible for ensuring that the Service reduced its annual expenditure by licence fee is spent efficiently and effectively. £46.8 million. Two thirds of these savings Value-for-money reviews like this one (almost £31 million) have been achieved are an integral part of the governance through greater efficiency and without framework through which the Trust fulfils an impact on audiences. For example, this responsibility. better integration with the BBC newsroom at Broadcasting House has created a The BBC Trust welcomes richer experience for both domestic and the National Audit Office’s international audiences while also saving conclusion that, through its money. -

The BBC's Use of Spectrum

The BBC’s Efficient and Effective use of Spectrum Review by Deloitte & Touche LLP commissioned by the BBC Trust’s Finance and Strategy Committee BBC’s Trust Response to the Deloitte & Touche LLPValue for Money study It is the responsibility of the BBC Trust,under the As the report acknowledges the BBC’s focus since Royal Charter,to ensure that Value for Money is the launch of Freeview on maximising the reach achieved by the BBC through its spending of the of the service, the robustness of the signal and licence fee. the picture quality has supported the development In order to fulfil this responsibility,the Trust and success of the digital terrestrial television commissions and publishes a series of independent (DTT) platform. Freeview is now established as the Value for Money reviews each year after discussing most popular digital TV platform. its programme with the Comptroller and Auditor This has led to increased demand for capacity General – the head of the National Audit Office as the BBC and other broadcasters develop (NAO).The reviews are undertaken by the NAO aspirations for new services such as high definition or other external agencies. television. Since capacity on the platform is finite, This study,commissioned by the Trust’s Finance the opportunity costs of spectrum use are high. and Strategy Committee on behalf of the Trust and The BBC must now change its focus from building undertaken by Deloitte & Touche LLP (“Deloitte”), the DTT platform to ensuring that it uses its looks at how efficiently and effectively the BBC spectrum capacity as efficiently as possible and uses the spectrum available to it, and provides provides maximum Value for Money to licence insight into the future challenges and opportunities payers.The BBC Executive affirms this position facing the BBC in the use of the spectrum. -

Digital Television Transmitters: Pre-Switchover Network

Digital Television Transmitters: pre-switchover network This leaflet provides details of the Digital Terrestrial Television (DTT) transmitters which have not yet switched over to fully-digital operation (the 'low power' DTT network). Detailed information on post-switchover transmitter characteristics is available on the Ofcom website at www.ofcom.org.uk. Transmitters are grouped according to the ITV1 region that they broadcast, which will determine each transmitter's place in the digital switchover sequence. Details of the programme services carried in each multiplex are available on the Digital Television Group's website, www.dtg.org.uk/retailer. While this information is believed to be correct at the time of preparation, changes to the DTT network will occur, particularly as more transmitters switch to digital. For the latest information, please see the Ofcom website, www.ofcom.org.uk, or Digital UK's website, www.digitaluk.co.uk. Multiplex 1 Multiplex 2 Multiplex A Multiplex B Multiplex C Multiplex D Multiplex 1 Multiplex 2 Multiplex A Multiplex B Multiplex C Multiplex D BBC Digital 3&4 SDN BBC Arqiva Arqiva BBC Digital 3&4 SDN BBC Arqiva Arqiva Avg. Avg. Aerial ERP ERP ERP ERP ERP ERP Aerial ERP ERP ERP ERP ERP ERP Site Name NGR Aerial Site Name NGR Aerial Group (kW) (kW) (kW) (kW) (kW) (kW) Group (kW) (kW) (kW) (kW) (kW) (kW) Offset Offset Offset Offset Offset Offset Offset Offset Offset Offset Offset Height Offset Height Channel Channel Channel Channel Channel Channel Channel Channel Channel Channel Channel Channel Anglia Tyne Tees -

SUBMISSION by CHANNEL 5 BROADCASTING LTD to OFCOM CALL for INPUTS on MANAGING the EFFECTS of 700 Mhz CLEARANCE

SUBMISSION BY CHANNEL 5 BROADCASTING LTD TO OFCOM CALL FOR INPUTS ON MANAGING THE EFFECTS OF 700 MHz CLEARANCE Channel 5 welcomes the opportunity to respond to this call for inputs. As we are not a multiplex operator we do not have access to technical data that would enable us to answer all of Ofcom’s questions. But we do have strong views on the importance of the DTT platform and how the clearance programme should be managed. We are confident the 700 MHz clearance programme can be sensibly managed, especially in light of the experience gained during digital switchover (DSO) and the 800 MHz clearance programme. In planning the clearance programme, the greatest priority should be maintenance of confidence in the platform for the tens of millions of viewers who depend on it for viewing on both primary and secondary television sets. The DTT platform is of critical importance for public service broadcasting. For example, Channel 5 has eight channels1 broadcasting on DTT; it is the platform on which our channels are watched most and which is of greatest commercial benefit to us. We believe it is important for there to be a coherent and well resourced support and communications plan. Digital UK has proved itself an effective platform management body, as well as having past experience of DSO and 800 MHz clearance, so we would expect it to have the lead role in managing the programme. The programme itself needs to be properly resourced by government; the clearance programme is taking place to facilitate long-term economic benefits that will accrue to the mobile operators and the wider economy, not to DTT viewers, so the costs of it should be met from the public purse. -

Diamond Technical Account and Methodology

Diamond Technical Account and Methodology What is Diamond? Diamond is designed to answer two questions: - Does the workforce on UK productions, both on and off-screen, reflect the diversity of the UK population? - Are audiences seeing themselves reflected on-screen. With the support of production companies, Diamond collects diversity data directly from cast and crew working on TV programmes (actual data), as well as information about how those on-screen might be perceived by viewing audiences (perceived data). Diamond data collection Scope Diamond is collecting data from: UK original productions commissioned by BBC, ITV, Channel 4, C5/ViacomCBS and Sky. All genres (although we do not currently report on film, sport and news) A large number of on and off-screen TV production roles (see Appendix 2) Programmes broadcast across the following channels BBC One, BBC Two, BBC Scotland, CBBC, CBEEBIES, CITV, GMTV1, GMTV2, ITV Encore, ITV1, ITV2, ITV3, ITV4, ITVBe, 4seven, Channel4, E4, Film Four, More 4, 5 Star, Channel5, Challenge TV, Paramount Network, Pick TV, Real Lives, Sky Arts, Sky Atlantic, Sky One, Sky Two, Sky Witness1 Data about 6 diversity characteristics: gender, gender identity, age, ethnicity, disability and sexual orientation. Diamond is not collecting data about: Programmes which have not been commissioned by the five Diamond broadcasters People working across broadcasting more generally, outside of production (our data are not overall workforce statistics). People who are not making a significant contribution to a programme (for example part of a crowd scene) More information about what is and isn’t collected can be found in the guidance notes issued to producers. -

Channel 5, Playground and MASTERPIECE on PBS Announce Cast for All Creatures Great and Small

EMBARGOED UNTIL 7:01PM ET TUESDAY SEPTEMBER 24TH Channel 5, Playground And MASTERPIECE On PBS Announce Cast For All Creatures Great And Small Newcomer Nicholas Ralph to play beloved vet James Herriot opposite Samuel West, Anna Madeley, Callum Woodhouse and Rachel Shenton Channel 5, BAFTA and Golden Globe-winning production company Playground (Howards End, Wolf Hall) and MASTERPIECE on PBS today announced the casting of key roles for their upcoming adaptation of best-selling author James Herriot’s cherished collection of stories, written by Ben Vanstone (The Last Kingdom) and directed by Brian Percival (Downton Abbey). Exciting newcomer Nicholas Ralph will make his television debut as the iconic vet who became renowned for his inspiring compassion, humour and love of life. Samuel West (Mr. Selfridge, On Chesil Beach) joins as Siegfried Farnon, the wonderfully eccentric veteri- nary surgeon and proprietor of Skeldale House who reluctantly hires the recently qualified Herriot into his rural practice. Mrs Hall, the resident housekeeper and matriarch of Skeldale House will be played by Anna Madeley (The Child in Time, Patrick Melrose). Siegfried’s errant and charismatic younger brother, Tristan, will be played by Callum Woodhouse (The Durrells in Corfu). Rachel Shenton (Switched at Birth, White Gold) takes the role of Helen Alderson, an independent local farmer’s daughter who helps her father manage the family farm and care for her younger sister. “This is an exceptional cast made up of a wonderful mix of exciting new and established talent,” says executive producer Colin Callender. “Re-visiting the world of All Creatures Great and Small is like going home and re-discovering old friends whom we haven’t seen in years.