NIGERIAN NAIRA EXCHANGE RATES SARIMA MODELLING Ette

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Modelling Naira/Pounds Exchange Rate Volatility: Application of Arima and Garch Models

International Journal of Engineering Applied Sciences and Technology, 2019 Vol. 4, Issue 8, ISSN No. 2455-2143, Pages 238-242 Published Online December 2019 in IJEAST (http://www.ijeast.com) MODELLING NAIRA/POUNDS EXCHANGE RATE VOLATILITY: APPLICATION OF ARIMA AND GARCH MODELS Saminu Umar Shehu Sidi Abubakar Department of Mathematics and Statistics Department of Mathematics and Statistics Umaru Ali Shinkafi Polytechnic, Sokoto, Nigeria Umaru Ali Shinkafi Polytechnic, Sokoto, Nigeria Abdulrashid M. Salihu Zayyanu Umar Department of Mathematics and Statistics Department of Agricultural Science Umaru Ali Shinkafi Polytechnic, Sokoto, Nigeria Shehu Shagari Collage of Education, Sokoto, Nigeria Abstract—This study aimed at modelling the daily determined by market forces of demand and supply but rather Naira/Pound exchange rate volatility with ARIMA and the prevailing system is the managed float whereby the GARCH type models with daily exchange rate ranging from monetary authorities intervene periodically in the foreign June 2016 to July 2019 is obtained from Central Bank of exchange market of a country in order to attain some strategic Nigeria. The stationarity of the data series was checked objectives. using graphical analysis, Augmented Dickey Fuller (ADF) Time series is the record of outcomes of a variable according and Phillips-Perron (PP) tests, it was found out that the to time, the outcomes may be recorded daily, weekly, monthly, exchange rate series is not stationary, the return of the quarterly, yearly or at any other specified interval of time. It is series was obtained and found out to be stationary. It was known that time series data are volatile. Undoubtedly, daily observed that ARIMA (2, 1, 1) and GARCH (1,1) are the exchange rate of one currency for another currency forms a time optimal with the highest log-likelihood and lowest AIC and series. -

Country Codes and Currency Codes in Research Datasets Technical Report 2020-01

Country codes and currency codes in research datasets Technical Report 2020-01 Technical Report: version 1 Deutsche Bundesbank, Research Data and Service Centre Harald Stahl Deutsche Bundesbank Research Data and Service Centre 2 Abstract We describe the country and currency codes provided in research datasets. Keywords: country, currency, iso-3166, iso-4217 Technical Report: version 1 DOI: 10.12757/BBk.CountryCodes.01.01 Citation: Stahl, H. (2020). Country codes and currency codes in research datasets: Technical Report 2020-01 – Deutsche Bundesbank, Research Data and Service Centre. 3 Contents Special cases ......................................... 4 1 Appendix: Alpha code .................................. 6 1.1 Countries sorted by code . 6 1.2 Countries sorted by description . 11 1.3 Currencies sorted by code . 17 1.4 Currencies sorted by descriptio . 23 2 Appendix: previous numeric code ............................ 30 2.1 Countries numeric by code . 30 2.2 Countries by description . 35 Deutsche Bundesbank Research Data and Service Centre 4 Special cases From 2020 on research datasets shall provide ISO-3166 two-letter code. However, there are addi- tional codes beginning with ‘X’ that are requested by the European Commission for some statistics and the breakdown of countries may vary between datasets. For bank related data it is import- ant to have separate data for Guernsey, Jersey and Isle of Man, whereas researchers of the real economy have an interest in small territories like Ceuta and Melilla that are not always covered by ISO-3166. Countries that are treated differently in different statistics are described below. These are – United Kingdom of Great Britain and Northern Ireland – France – Spain – Former Yugoslavia – Serbia United Kingdom of Great Britain and Northern Ireland. -

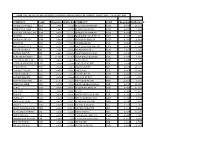

ZIMRA Rates of Exchange for Customs Purposes for Period 24 Dec 2020 To

ZIMRA RATES OF EXCHANGE FOR CUSTOMS PURPOSES FOR THE PERIOD 24 DEC 2020 - 13 JAN 2021 ZWL CURRENCY CODE CROSS RATEZIMRA RATECURRENCY CODE CROSS RATEZIMRA RATE ANGOLA KWANZA AOA 7.9981 0.1250 MALAYSIAN RINGGIT MYR 0.0497 20.1410 ARGENTINE PESO ARS 1.0092 0.9909 MAURITIAN RUPEE MUR 0.4819 2.0753 AUSTRALIAN DOLLAR AUD 0.0162 61.7367 MOROCCAN DIRHAM MAD 0.8994 1.1119 AUSTRIA EUR 0.0100 99.6612 MOZAMBICAN METICAL MZN 0.9115 1.0972 BAHRAINI DINAR BHD 0.0046 217.5176 NAMIBIAN DOLLAR NAD 0.1792 5.5819 BELGIUM EUR 0.0100 99.6612 NETHERLANDS EUR 0.0100 99.6612 BOTSWANA PULA BWP 0.1322 7.5356 NEW ZEALAND DOLLAR NZD 0.0173 57.6680 BRAZILIAN REAL BRL 0.0631 15.8604 NIGERIAN NAIRA NGN 4.7885 0.2088 BRITISH POUND GBP 0.0091 109.5983 NORTH KOREAN WON KPW 11.0048 0.0909 BURUNDIAN FRANC BIF 23.8027 0.0420 NORWEGIAN KRONER NOK 0.1068 9.3633 CANADIAN DOLLAR CAD 0.0158 63.4921 OMANI RIAL OMR 0.0047 212.7090 CHINESE RENMINBI YUANCNY 0.0800 12.5000 PAKISTANI RUPEE PKR 1.9648 0.5090 CUBAN PESO CUP 0.3240 3.0863 POLISH ZLOTY PLN 0.0452 22.1111 CYPRIOT POUND EUR 0.0100 99.6612 PORTUGAL EUR 0.0100 99.6612 CZECH KORUNA CZK 0.2641 3.7860 QATARI RIYAL QAR 0.0445 22.4688 DANISH KRONER DKK 0.0746 13.4048 RUSSIAN RUBLE RUB 0.9287 1.0768 EGYPTIAN POUND EGP 0.1916 5.2192 RWANDAN FRANC RWF 12.0004 0.0833 ETHOPIAN BIRR ETB 0.4792 2.0868 SAUDI ARABIAN RIYAL SAR 0.0459 21.8098 EURO EUR 0.0100 99.6612 SINGAPORE DOLLAR SGD 0.0163 61.2728 FINLAND EUR 0.0100 99.6612 SPAIN EUR 0.0100 99.6612 FRANCE EUR 0.0100 99.6612 SOUTH AFRICAN RAND ZAR 0.1792 5.5819 GERMANY EUR 0.0100 99.6612 -

Leadership Strategies for Managing Change in the Nigerian Banking Industry Jude Ememe Walden University

Walden University ScholarWorks Walden Dissertations and Doctoral Studies Walden Dissertations and Doctoral Studies Collection 2017 Leadership Strategies for Managing Change in the Nigerian Banking Industry Jude Ememe Walden University Follow this and additional works at: https://scholarworks.waldenu.edu/dissertations Part of the Business Administration, Management, and Operations Commons, International Business Commons, and the Management Sciences and Quantitative Methods Commons This Dissertation is brought to you for free and open access by the Walden Dissertations and Doctoral Studies Collection at ScholarWorks. It has been accepted for inclusion in Walden Dissertations and Doctoral Studies by an authorized administrator of ScholarWorks. For more information, please contact [email protected]. Walden University College of Management and Technology This is to certify that the doctoral dissertation by Jude Ememe has been found to be complete and satisfactory in all respects, and that any and all revisions required by the review committee have been made. Review Committee Dr. David Banner, Committee Chairperson, Management Faculty Dr. Steven Tippins, Committee Member, Management Faculty Dr. David Cavazos, University Reviewer, Management Faculty Chief Academic Officer Eric Riedel, Ph.D. Walden University 2017 Abstract Leadership Strategies for Managing Change in the Nigerian Banking Industry by Jude Ememe M. Sc. University of Lagos, 1981 B. Sc. University of Benin, 1978 Dissertation Submitted in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy Management Walden University August 2017 Abstract The Nigerian banking system is experiencing changes brought about by globalization. Operating in a changing business environment requires that bank leaders evolve strategies to manage and adapt to change. There are direct and indirect costs associated when banks are unable to adapt to change such as bank closures, and loss of economic and business opportunities. -

WM/Refinitiv Closing Spot Rates

The WM/Refinitiv Closing Spot Rates The WM/Refinitiv Closing Exchange Rates are available on Eikon via monitor pages or RICs. To access the index page, type WMRSPOT01 and <Return> For access to the RICs, please use the following generic codes :- USDxxxFIXz=WM Use M for mid rate or omit for bid / ask rates Use USD, EUR, GBP or CHF xxx can be any of the following currencies :- Albania Lek ALL Austrian Schilling ATS Belarus Ruble BYN Belgian Franc BEF Bosnia Herzegovina Mark BAM Bulgarian Lev BGN Croatian Kuna HRK Cyprus Pound CYP Czech Koruna CZK Danish Krone DKK Estonian Kroon EEK Ecu XEU Euro EUR Finnish Markka FIM French Franc FRF Deutsche Mark DEM Greek Drachma GRD Hungarian Forint HUF Iceland Krona ISK Irish Punt IEP Italian Lira ITL Latvian Lat LVL Lithuanian Litas LTL Luxembourg Franc LUF Macedonia Denar MKD Maltese Lira MTL Moldova Leu MDL Dutch Guilder NLG Norwegian Krone NOK Polish Zloty PLN Portugese Escudo PTE Romanian Leu RON Russian Rouble RUB Slovakian Koruna SKK Slovenian Tolar SIT Spanish Peseta ESP Sterling GBP Swedish Krona SEK Swiss Franc CHF New Turkish Lira TRY Ukraine Hryvnia UAH Serbian Dinar RSD Special Drawing Rights XDR Algerian Dinar DZD Angola Kwanza AOA Bahrain Dinar BHD Botswana Pula BWP Burundi Franc BIF Central African Franc XAF Comoros Franc KMF Congo Democratic Rep. Franc CDF Cote D’Ivorie Franc XOF Egyptian Pound EGP Ethiopia Birr ETB Gambian Dalasi GMD Ghana Cedi GHS Guinea Franc GNF Israeli Shekel ILS Jordanian Dinar JOD Kenyan Schilling KES Kuwaiti Dinar KWD Lebanese Pound LBP Lesotho Loti LSL Malagasy -

Nigeria – China Bilateral Currency Swap Agreement: a Cost-Benefit Analysis of the Policy

Nigeria – China Bilateral Currency Swap Agreement: A Cost-Benefit Analysis of the Policy. October 28th, 2019. Nigeria – China Bilateral Currency Swap Agreement: A Cost-Benefit Analysis of the Policy Ejiro U. Osiobe Founder/CFO of the Ane Osiobe International Foundation Plot 114 Lugbe, Federal Capital Territory NG, 900001, Nigeria. Odezi M. Oseghe Research Associate at the Ane Osiobe International Foundation Delta State Liaison Branch, Delta State, Nigeria. Abstract This study probes the effects of the currency swap agreement between the Nigerian government through the Central Bank of Nigeria (CBN) and the Chinese government through the People’s Bank of China (PBC). The objectives of this paper are to define the concepts of currency swap, review relevant literature, and analyze its policy implication on the Nigerian economy. The Bilateral Currency Swap Agreement (BLCSA) between the CBN and the PBC, aims to achieve foreign exchange stability and hedge the naira from volatility both in the short and long run of each business cycle. The literature reviewed suggests the BLCSA would eliminate the unnecessary rigors involved in trade between Nigeria and China businesses and reduce the demand of the United States (US) dollar. Although a step in the right direction, this solution is a temporary fix when a permanent solution is needed. The study’s recommendations will elicit the necessary responses from the CBN, PBC, stakeholders, China, and Nigeria government on the benefits of the BLCSA* Keywords: Currency Swap, Nigeria, China, Naira, transactions’ have been made using the US dollar (CBN, 2017). Nevertheless, the CBN in 2011 decided to hold a BLCSA. part of its foreign exchange reserves in the CNY. -

Globalization, Imperialism and Christianity: the Nigerian Perspective (Pp 75-89)

An International Multi-Disciplinary Journal, Ethiopia Vol. 4 (3a) July, 2010 ISSN 1994-9057 (Print) ISSN 2070-0083 (Online) Globalization, Imperialism and Christianity: The Nigerian Perspective (Pp 75-89) Obiefuna, B. A. C. - Department of Religion and Human Relations, Nnamdi Azikiwe University, Awka. E-mail: [email protected] GSM: +2348033920835 Ezeoba, A. C. - Department of Religion and Human Relations, Nnamdi Azikiwe University, Awka. E-mail: [email protected] GSM: 08036724554 Abstract There appears to be very close link between globalization and imperialism. Both seem to have domineering character. Globalization could be likened to a new wave of imperialism as it could be adjudged the process by which the so called superior powers of the West dominate and influence developing countries like Nigeria. They are expansionist in nature. Christianity has the same expansionist features as globalization and imperialism. The imperialist nature of globalization could be assessed from the expansionist activities of Christianity that equally originates from the West. This paper is an attempt to discuss globalization, imperialism and Christianity as expansionist realities from the Nigerian perspective. Information is gathered from content analyses of the concepts of globalization, imperialism and Christianity and simple observation of what Nigeria experiences with regard to Christianity. It is Copyright © IAARR, 2010: www.afrrevjo.com 75 Indexed African Journals Online: www.ajol.info African Research Review Vol. 4(3a) July, 2010 . Pp. 75 -89 observed that much of what Christianity favours are materials from the West. The paper concludes that Christianity more than ever before rides on the crest of globalization to further imperialism. It suggests that Christianity in the twenty-first century should be more inculturated than hanging on the apron strings of the West especially with regard to religious wares. -

Exchange Rate Behaviour in the West Africa Monetary Zone: a GARCH Approach

Munich Personal RePEc Archive Exchange Rate Behaviour in the West Africa Monetary Zone: A GARCH Approach Oshinloye, Micheal and Onanuga, Olaronke and Onanuga, Abayomi Olabisi Onabanjo University, University of South Africa, Olabisi Onabanjo University 4 January 2015 Online at https://mpra.ub.uni-muenchen.de/83324/ MPRA Paper No. 83324, posted 20 Dec 2017 16:37 UTC Exchange Rate Behaviour in the West African Monetary Zone: A GARCH Approach Oshinloye Michael Olufemi B. Department of Accounting Banking and Finance, Olabisi Onabanjo University Ago-Iwoye, Ogun state, Nigeria. Onanuga Olaronke Toyin Doctoral student in Economics, School of Economic Sciences College of Economic and Management Sciences, University of South Africa (UNISA) Pretoria, South Africa. Onanuga Abayomi Toyin (Corresponding Author) Department of Accounting Banking and Finance, Olabisi Onabanjo University Ago-Iwoye, Ogun state, Nigeria. Tel: +234-803-351-9370 E-mail: [email protected] 1 Exchange Rate Behavior in the West African Monetary Zone –A GARCH Approach Abstract This study employs Generalized Autoregressive Conditional Heteroscedasticity (GARCH) to explore the level of exchange rate volatility in West African Monetary Zone for the period 1980-2014. Our empirical findings reveal that the Gambian dalasi experiences the least volatile official exchange rate while the Liberia dollar is the most volatile in the Zone. There is need for government of Gambia and Nigeria to control overshooting dynamics experienced by dalasi and naira. All the countries should exercise monetary and fiscal measures on time to put their exchange rate volatility under check. Key words: Exchange rate Volatility, GARCH, West African Monetary Zone JEL Classification: C10, F02, F31 1.0 Introduction Exchange rates and their rates of change, in the course of time, are often as reported in the literature to be inconsistent with equilibrium. -

Foreign Exchange Rate

EDUCATION IN ECONOMICS SERIES NO. 4 FOREIGN EXCHANGE RATE BANK OF RAL NIG NT ER CE IA CENTRAL BANK OF NIGERIA BANK OF RAL NIG NT ER CE IA CENTRAL BANK OF NIGERIA RESEARCH DEPARTMENT 2016 2016 EDUCATION IN ECONOMICS SERIES No. 4 FOREIGN EXCHANGE RATE BANK OF RAL NIG NT ER CE IA CENTRAL BANK OF NIGERIA RESEARCH DEPARTMENT 2016 Copyright © 2016 Central Bank of Nigeria 33 Tafawa Balewa Way Central Business District P.M.B. 0187, Garki Abuja, Nigeria. Studies on topical issues affecting the Nigerian economy are published in order to communicate the results of empirical research carried out by the Bank to the public. In this regard, the findings, interpretation, and conclusions expressed in the papers are entirely those of the authors and should not be attributed in any manner to the Central Bank of Nigeria or institutions to which they are affiliated. The Central Bank of Nigeria encourages dissemination of its work. However, the materials in this publication are copyrighted. Request for permission to reproduce portions of it should be sent to the Director of Research, Research Department, Central Bank of Nigeria, Abuja. ISBN: 978-978-8714-03-3 Table of Contents 1.0 Introduction……………………………………………………....…………1 2.0 Conceptual Issues…………………………….……………………………1 2.1 Exchange Rate……………………………………….…………………….1 2.2 Cross Exchange Rate …………………………………………...………..3 2.3 End-Period Exchange Rate…………………………………...………....4 2.4 Average Exchange Rate………………………………..………….…….4 2.5 The Appreciation / Depreciation of the Exchange Rate…….……4 2.6 Exchange Rate Premium…………………………..……………………..5 -

A Model for the Forecasting of Daily South African Rand and Nigerian Naira Exchange Rates

Etuk and Amadi /International Journal of Modern Sciences and Engineering Technology (IJMSET) ISSN 2349-3755; Available at https://www.ijmset.com Volume 1, Issue 6, 2014, pp.89-97 A Model for the Forecasting of Daily South African Rand and Nigerian Naira Exchange Rates 2 Ette Harrison Etuk1 Eberechi Humphrey Amadi Department of Mathematics / Department of Mathematics / Computer Science, Rivers State Computer Science, Rivers State University of Science and University of Science and Technology, P. Harcourt, Nigeria Technology, P. Harcourt, Nigeria [email protected] [email protected] Abstract Daily South African Rand / Nigerian Naira exchange rates are analyzed by seasonal autoregressive integrated moving average (SARIMA) methods. The actual realization considered herein and called ZNER spans from 20th March 2014 to 15th September, 2014, a 180-day interval. Its time plot shows a generally negative secular trend which depicts the relative depreciation of the rand within the time interval. A seven-point differencing of the series yields a series SDZNER with a very slightly negative trend and an autocorrelation structure of a seasonal series of period 7 days. A non-seasonal differencing of the differences yields the series DSDZNER with a horizontal trend and a correlogram showing a seasonal nature of period 7days and the involvement of a seasonal moving average component of order one. There is also an indication of a seasonal autoregressive component of order two. It is noteworthy that Augmented Dickey Fuller (ADF) tests consider ZNER as non- stationary (p < .01). SDZNER is also considered non-stationary (p < .05). Only DSDZNER is considered stationary. A close look reveals the involvement of a SARIMA(0, 1, 1)X(0, 1, 1)7 component. -

Religious Freedom I

Written Statement Submitted to the United States Commission on International Religious Freedom Hearing on “Religious Freedom in Nigeria: Extremism and Government Inaction” Statement of Mike Jobbins, Search for Common Ground Wednesday, June 9, 2021 - 10:30 AM - 12:00pm Held via Zoom Chairwoman Bhargava, Vice Chair Perkins, Members of the U.S. Commission on International Religious Freedom, I thank you for holding this hearing to draw urgent attention to the terrible violence affecting rural Nigeria, and for your work and the work of this Commission in ensuring a focus on human rights around the world. My name is Mike Jobbins, Vice President of Global Affairs and Partnerships at Search for Common Ground. Search for Common Ground (Search) has worked in Nigeria since 2004 and currently has six offices across the country. Search works to advance religious tolerance, transform violent extremism, promote reconciliation across dividing lines, strengthening community-led security, and strengthening democratic governance. We often work in close cooperation with, and with support from, USAID and the State Department as well as many others.1 While this testimony is informed by my work with Search for Common Ground, the opinions and recommendations expressed are my own. 1. DYNAMICS OF VIOLENT CONFLICT Violence and insecurity have had a profound impact on the Nigerian people. Most Nigerians do not feel the country is secure – this percentage jumps to more than four in five when only considering residents of northern Nigeria.2 There is significant public support for political, religious, and ethnic tolerance in Nigeria. 86% of Nigerians say they “would not care” if their neighbors were from a different religious group, and by a ratio of 2-to-1, citizens think that there is more that unite Nigerians as a people (62%) than divides them (36%). -

List of Currencies of All Countries

The CSS Point List Of Currencies Of All Countries Country Currency ISO-4217 A Afghanistan Afghan afghani AFN Albania Albanian lek ALL Algeria Algerian dinar DZD Andorra European euro EUR Angola Angolan kwanza AOA Anguilla East Caribbean dollar XCD Antigua and Barbuda East Caribbean dollar XCD Argentina Argentine peso ARS Armenia Armenian dram AMD Aruba Aruban florin AWG Australia Australian dollar AUD Austria European euro EUR Azerbaijan Azerbaijani manat AZN B Bahamas Bahamian dollar BSD Bahrain Bahraini dinar BHD Bangladesh Bangladeshi taka BDT Barbados Barbadian dollar BBD Belarus Belarusian ruble BYR Belgium European euro EUR Belize Belize dollar BZD Benin West African CFA franc XOF Bhutan Bhutanese ngultrum BTN Bolivia Bolivian boliviano BOB Bosnia-Herzegovina Bosnia and Herzegovina konvertibilna marka BAM Botswana Botswana pula BWP 1 www.thecsspoint.com www.facebook.com/thecsspointOfficial The CSS Point Brazil Brazilian real BRL Brunei Brunei dollar BND Bulgaria Bulgarian lev BGN Burkina Faso West African CFA franc XOF Burundi Burundi franc BIF C Cambodia Cambodian riel KHR Cameroon Central African CFA franc XAF Canada Canadian dollar CAD Cape Verde Cape Verdean escudo CVE Cayman Islands Cayman Islands dollar KYD Central African Republic Central African CFA franc XAF Chad Central African CFA franc XAF Chile Chilean peso CLP China Chinese renminbi CNY Colombia Colombian peso COP Comoros Comorian franc KMF Congo Central African CFA franc XAF Congo, Democratic Republic Congolese franc CDF Costa Rica Costa Rican colon CRC Côte d'Ivoire West African CFA franc XOF Croatia Croatian kuna HRK Cuba Cuban peso CUC Cyprus European euro EUR Czech Republic Czech koruna CZK D Denmark Danish krone DKK Djibouti Djiboutian franc DJF Dominica East Caribbean dollar XCD 2 www.thecsspoint.com www.facebook.com/thecsspointOfficial The CSS Point Dominican Republic Dominican peso DOP E East Timor uses the U.S.