Revenue Growth*

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sustainability Report Monster Beverage Corporation

2020 SUSTAINABILITY REPORT MONSTER BEVERAGE CORPORATION FORWARD-LOOKING STATEMENT This Report contains forward-looking statements, within the meaning of the U.S. federal securities laws as amended, regarding the expectations of management with respect to our plans, objectives, outlooks, goals, strategies, future operating results and other future events including revenues and profitability. Forward-look- ing statements are generally identified through the inclusion of words such as “aim,” “anticipate,” “believe,” “drive,” “estimate,” “expect,” “goal,” “intend,” “may,” “plan,” “project,” “strategy,” “target,” “hope,” and “will” or similar statements or variations of such terms and other similar expressions. These forward-looking statements are based on management’s current knowledge and expectations and are subject to certain risks and uncertainties, many of which are outside of the control of the Company, that could cause actual results and events to differ materially from the statements made herein. For additional information about the risks, uncer- tainties and other factors that may affect our business, please see our most recent annual report on Form 10-K and any subsequent reports filed with the Securities and Exchange Commission, including quarterly reports on Form 10-Q. Monster Beverage Corporation assumes no responsibility to update any forward-looking state- ments whether as a result of new information, future events or otherwise. 2020 SUSTAINABILITY REPORT #UNLEASHED TABLE OF CONTENTS LETTER FROM THE CO-CEOS 1 COMPANY AT A GLANCE 3 INTRODUCTION 5 SOCIAL 15 PRODUCT RESPONSIBILITY 37 ENVIRONMENTAL 45 GOVERNANCE 61 CREDITS AND CONTACT 67 INTRODUCTION MONSTER BEVERAGE CORPORATION LETTER FROM THE CO-CEOS As Monster publishes its first Sustainability Report, we cannot ignore the impact of the COVID-19 pandemic. -

I Will Lift My Weary Eyes • SATB • © 2019 HELBLING Grundsätzlich This Copyright AUSTRIA: Kaplanstrasse 9, 6063 Rum/Innsbruck | GERMANY: P.O

2 I Will I WillLift Lift My My WearyWeary Eyes Eyes Lyrics: Kinley Lange, based on Psalm 121 Music: Kinley Lange *) Freely, plaintively S 4 4 A 4 4 mf (solo or section) T 4 4 And I will lift my wear y eyes, I’ll lift them up un to the hills, and the B 4 4 5 (tutti) help that I have need ed will sure ly tum ble down, I will lift my eyes un to the hills. And I will 9 G CG D mf And the mf Hm I’ll lift them up un to the hills, and the lift my wear y eyes, I’ll lift them up un to the hills, and the • The vowels should be very bright and open, a bit nasal in quality, and the singing should be without vibrato. Many of the upward-moving intervals, as well as certain repeated notes, should be embellished with a scoop or slight grace-note glissando from beneath. Take care not to over-do this as it is primarily a soloistic embellishment and could easily become overbearing in choral singing. • The piece can be performed with traditional Blue Grass instruments. If so, it is recommended that a bass not be used as it could be in conflict with the sung bass line. Mandolin, violin and guitar will work nicely, following the indicated chords. *) Optional fiddle drone accompaniment til bar 8 Fotokopieren Photocopying Kinley Lange, I Will Lift My Weary Eyes • SATB • © 2019 HELBLING grundsätzlich this copyright AUSTRIA: Kaplanstrasse 9, 6063 Rum/Innsbruck | GERMANY: P.O. -

Mexico Is the Number One Consumer of Coca-Cola in the World, with an Average of 225 Litres Per Person

Arca. Mexico is the number one Company. consumer of Coca-Cola in the On the whole, the CSD industry in world, with an average of 225 litres Mexico has recently become aware per person; a disproportionate of a consolidation process destined number which has surpassed the not to end, characterised by inventors. The consumption in the mergers and acquisitions amongst USA is “only” 200 litres per person. the main bottlers. The producers WATER & CSD This fizzy drink is considered an have widened their product Embotelladoras Arca essential part of the Mexican portfolio by also offering isotonic Coca-Cola Group people’s diet and can be found even drinks, mineral water, juice-based Monterrey, Mexico where there is no drinking water. drinks and products deriving from >> 4 shrinkwrappers Such trend on the Mexican market milk. Coca Cola Femsa, one of the SMI LSK 35 F is also evident in economical terms main subsidiaries of The Coca-Cola >> conveyor belts as it represents about 11% of Company in the world, operates in the global sales of The Coca Cola this context, as well as important 4 installation. local bottlers such as ARCA, CIMSA, BEPENSA and TIJUANA. The Coca-Cola Company These businesses, in addition to distributes 4 out of the the products from Atlanta, also 5 top beverage brands in produce their own label beverages. the world: Coca-Cola, Diet SMI has, to date, supplied the Coke, Sprite and Fanta. Coca Cola Group with about 300 During 2007, the company secondary packaging machines, a worked with over 400 brands and over 2,600 different third of which is installed in the beverages. -

When in Rome, Beijing Or Brussels

When in Rome, Beijing or Brussels: Cultural Considerations of International Business Communication By Colin Gunn-Graffy A Senior Honors Thesis Submitted to the Department of Communication Boston College May, 2007 Copyright, Colin Gunn-Graffy © 2007 All Rights Reserved Acknowledgements To my family, for their continued support, no matter what continent I’m on TABLE OF CONTENTS Page CHAPTER ONE: Introduction 1 CHAPTER TWO: Things Go Worse for Coke: The Coca-Cola 12 Contamination Crisis in Belgium CHAPTER THREE: The Magic’s Gone: The Marketing Mistake 31 of Euro Disney in France CHAPTER FOUR: Looking Ahead: The Digital Age 55 and the Rising Markets of the East CHAPTER FIVE: Conclusion 69 REFERENCES 74 1 CHAPTER ONE: Introduction Globalization and the Rise of Multinational Corporations Even before the Dutch sailed to the East Indies or Marco Polo traveled to China, people have been interacting with other cultures in numerous ways, many of them for economic reasons. One would imagine it was quite difficult initially for these people to communicate and do business with each other, but even today obstacles in international business still exist. Although our world has certainly become much smaller in the last several centuries, cultural and geographical contexts still play a large part in shaping different societies and their methods of interaction with others. The term “globalization” is one heard of quite often in today’s world, particularly in economic terms, referring to the expansion of free market capitalism. There are many other aspects that fit into the globalization process, ranging from political to social to technological, that are a part of this increasing interconnectivity of people around the world. -

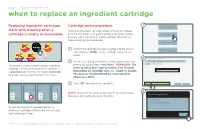

When to Replace an Ingredient Cartridge

page 6 | productOperating replacement System System Configuration Service Menu Language when to replace an ingredient cartridge Dashboard Errors Alerts Notices Replacing ingredient cartridges Cartridge prime procedure. Replace Ingredients startsHFCS with knowingWater when aIce PrimingCarb an Water ingredient cartridgeProduct simply removesSwitches any And trapped Lighting User Interface Agitation Locks cartridge is empty or unavailable. air in the line and ensures guests receive a consistent, quality Prime beverage. After replacing an empty cartridge follow the on- screen messages outlined below: Manual Oerride Coke CokeZero DietCoke CFDietCoke Pibb Barqs Confirm the cartridge has been inserted into10 the / 26 /correct 14 Return To Dashboard 9 / 26 / 14 10 / 26 / 14 10 / 26 / 14slot and press “PRIME”10 / 26 on / 14 the cartridge replacement 10 / 26 / 14 Operating System System Configuration Service Menu Language screen. Please prime/purge all newly inserted packages below: ERR User Mode: Crew Customer View Remove Dasani ingredient appear to be expired. 100% To Empty 100% To Empty 100% To Empty A new screen listing100% all brands/secondaryTo Empty flavors100%Operating Tothat Empty require System System100% To Configuration Empty Service Menu priming will appear. Press “Auto Prime”. REMINDER: The Prime Coke temporarily unavailable - needs agitation. TheSprite example above shows theMMLemonade cherry ingredient SeagramsGingerAle MelloYello HiC Powerade ® prime process lasts approximately 5-10 seconds cartridge is empty, as a result cherry vanilla Hi-C Please wait while the system agitates. 10 / 26 / 14 10 /® 26 / 14 10 / 26 / 14depending on cartridge10 / 26 / 14 size, i.e., single10 / or26 / double.14 10 / 26 / 14 is grayed out and cherry Hi-C shows unavailable Please prime/purge all newly inserted packages below: when the user touches the cherry Hi-C® icon. -

American Fruits and Flavors, Monster Beverage Councilmember Corporation and the City of San Fernando to Hold Official Robert C

COUNCIL MAYOR JOEL FAJARDO CONTACT: Timothy Hou, Deputy City Manager/Director of Community Development VICE MAYOR (818) 898-1202 HECTOR A. PACHECO DATE: February 11, 2020 COUNCILMEMBER SYLVIA BALLIN AMERICAN FRUITS AND FLAVORS, MONSTER BEVERAGE COUNCILMEMBER CORPORATION AND THE CITY OF SAN FERNANDO TO HOLD OFFICIAL ROBERT C. GONZALES GROUNDBREAKING AND SHOVEL CEREMONY FOR THE COUNCILMEMBER NEW MANUFACTURING FACILITY IN SAN FERNANDO MARY MENDOZA WHO/WHAT: American Fruits and Flavors, LLC (AFF), Monster Beverage Corporation and the City of San Fernando will break ground on the future Monster Beverage flavoring manufacturing facility, located at 510 Park Avenue, San Fernando. The 7.6 acre site, which formerly served as a service yard for Frontier Communications, was entitled in October 2018 by its previous owner for redevelopment of a new 168,676 sq. ft. industrial development. AFF was acquired by Monster Beverage Corporation in 2016 and is the primary flavor supplier for flagship Monster Energy drinks, as well as several other key flavors. They will be joined by San Fernando Mayor Joel Fajardo, City Councilmembers, and Alston Construction, the Design Build General Contractor for the project. WHEN: Thursday, February 13, 2020 TIME: 11:00 am – 12:00 pm Media check-in at 10:45 am WHERE: 510 Park Avenue, San Fernando (entrance on Library Street) NOTE: This event will be open to the public. About American Fruits and Flavors, LLC ADMINISTRATION DEPARTMENT American Fruits and Flavors started in 1962 as a flavor company called California Flavor Labs, creating and producing flavors for the bar mix and soda fountain industries. In 1972, American 117 MACNEIL STREET Fruit Processors was formed to address the growing demand for fruit juices and concentrates. -

SPORTS DRINKS TABLE of CONTENTS Sports Drinks Table of Contents

SPORTS DRINKS TABLE OF CONTENTS Sports drinks Table of Contents Sports nutrition market overview 06 Global sports nutrition market 2018-2023 07 Global sports nutrition market volume 2013-2020 08 Global sports food and drink sales in 2013, by category Sports drinks 10 Brand value of the most valuable soft drink brands worldwide 2018 11 Market share of leading sports/energy drinks companies worldwide 2015 12 Market share of the leading non-aseptic sport drink brands in the U.S. 2018 13 Global volume sales of liquid refreshment beverages (LRB) 2017, by category 14 Global volume sales share of liquid refreshment beverages (LRB) 2017, by category 15 U.S. market share of sports drinks 2012-2017, based on retail sales 16 U.S. market share of sports drinks 2012-2017, based on volume sales Retail facts 18 U.S. sports and energy drink retail sales 2009-2014 19 U.S. dollar sales of sports drinks 2012-2017 20 Volume sales of sports drinks in the U.S. 2012-2017 Table of Contents 21 U.S. retail price of sports drinks 2012-2017 22 U.S. supermarkets: sports drink dollar sales 2014-2015 23 U.S. supermarkets: sports drink unit sales 2014-2015 24 Sales of the leading non-aseptic sport drink brands in the U.S. 2017/18 25 Market share of the leading non-aseptic sport drink brands in the U.S. 2018 26 U.S. C-store sales of sports drinks 2017, by brand 27 U.S. C-store unit sales of sports drinks 2017, by brand 28 U.S. -

US Enery Drinks Through 2021

U.S. Energy Drinks through 2021 2017 Edition (Published September 2017. Data through 2016. Market projections through 2021.) More than 150 pages, with extensive text analysis, graphs, charts and more than 40 tables Get the facts and find out what is next for this dynamic For A Full segment where new players strive to grow and hope to take market share from the industry leaders. This research report from Catalog of Beverage Marketing Corporation profiles companies and brands Reports and and examines trends and issues impacting energy drinks and Databases, energy shots. It covers regional markets, quarterly growth, Go To packaging, distribution, demographics and advertising breakouts for 18 media types, a broadened scope of market forecasts, bmcreports.com expanded discussion of small energy drink companies, and more. INSIDE: REPORT OVERVIEW A brief discussion of key AVAILABLE FORMAT & features of this report. 2 PRICING TABLE OF CONTENTS A detailed outline of this Direct report’s contents and data Download tables. 6 $3,995 SAMPLE TEXT AND To learn more, to place an advance order or to inquire about INFOGRAPHICS additional user licenses call: Charlene Harvey +1 212.688.7640 A few examples of this ext. 1962 [email protected] report’s text, data content layout and style. 10 HAVE Contact Charlene Harvey: 212-688-7640 x 1962 ? QUESTIONS? [email protected] Beverage Marketing Corporation 850 Third Avenue, 13th Floor, New York, NY 10022 Tel: 212-688-7640 Fax: 212-826-1255 The answers you need U.S. Energy Drinks through 2021 provides in-depth data and analysis, shedding light on various aspects of the market through reliable data and discussions of what the numbers really mean. -

A Guide to the Soft Drink Industry Acknowledgments

BREAKING DOWN THE CHAIN: A GUIDE TO THE SOFT DRINK INDUSTRY ACKNOWLEDGMENTS This report was developed to provide a detailed understanding of how the soft drink industry works, outlining the steps involved in producing, distributing, and marketing soft drinks and exploring how the industry has responded to recent efforts to impose taxes on sugar-sweetened beverages in particular. The report was prepared by Sierra Services, Inc., in collaboration with the Supply Chain Management Center (SCMC) at Rutgers University – Newark and New Brunswick. The authors wish to thank Kristen Condrat for her outstanding support in all phases of preparing this report, including literature review and identifying source documents, writing, data analysis, editing, and final review. Special thanks also goes to Susanne Viscarra, who provided copyediting services. Christine Fry, Carrie Spector, Kim Arroyo Williamson, and Ayela Mujeeb of ChangeLab Solutions prepared the report for publication. ChangeLab Solutions would like to thank Roberta Friedman of the Yale Rudd Center for Food Policy and Obesity for expert review. For questions or comments regarding this report, please contact the supervising professors: Jerome D. Williams, PhD Prudential Chair in Business and Research Director – The Center for Urban Entrepreneurship & Economic Development (CUEED), Rutgers Business School – Newark and New Brunswick, Management and Global Business Department 1 Washington Park – Room 1040 Newark, NJ 07102 Phone: 973-353-3682 Fax: 973-353-5427 [email protected] www.business.rutgers.edu/CUEED Paul Goldsworthy Senior Industry Project Manager Department of Supply Chain Management & Marketing Sciences Rutgers Business School Phone: 908-798-0908 [email protected] Design: Karen Parry | Black Graphics The National Policy & Legal Analysis Network to Prevent Childhood Obesity (NPLAN) is a project of ChangeLab Solutions. -

Coca-Cola 2020 World Without Waste Report

2020 World Without Waste Report THE COMPANY Introduction Design Collect Partner What’s Next Assurance Statement Design Make 100% of our packaging recyclable globally by 2025—and We have a responsibility to help solve the global use at least 50% recycled material plastic waste crisis. That’s why, in 2018, we in our packaging by 2030. launched World Without Waste—an ambitious, sustainable packaging initiative that is creating systemic change by driving a circular economy Collect for our bottles and cans. Collect and recycle a bottle or can for each one we sell by 2030. The World Without Waste strategy has signaled a renewed focus on our entire packaging lifecycle—from how bottles and cans are Partner designed and produced to how they’re recycled Bring people together to and repurposed—through a focus on three support a healthy, debris-free environment. fundamental goals: Our sustainability priorities are interconnected, so we approach them holistically. Because packaging accounts for approximately 30% of our overall carbon footprint, our World Without Waste strategy is essential to meeting our Science-Based Target for climate. We lower our carbon footprint by using more recycled material; by lightweighting our packaging; by focusing on refillable, dispensed and Coca-Cola Freestyle solutions; by developing alternative packaging materials, such as advanced, plant-based packaging that requires less fossil fuel; and by investing in local recycling programs to collect plastic and glass bottles and cans so they can become new ones. This is our third World Without Waste progress report (read our 2018 and 2019 reports). Three years into this transformational journey, the global conversation about plastic pollution—and calls for urgent, collaborative action—are intensifying. -

Krause Fund Research Spring 2021

Krause Fund Research Spring 2021 National Beverage Corp. (NASDAQ: FIZZ) April 20, 2021 Stock Rating: SELL Consumer Staples – Non-Alcoholic Beverages Analysts Target Price: $35 - $42 Emily Ellinger | [email protected] DCF Model: $41.53 Meghan Maleri | [email protected] Rachel Recker | [email protected] Relative Model: $35.27 Investment Thesis Price Data Current Price: $50.19 National Beverage Corp. is a mid-cap provider of juices, sodas, and sparkling water brands. Its emphasis on meeting ever-changing consumer trends, as well as indulging in their loyal customer 52-Week Range: $23.99-$98.21 base has demonstrated historic stability. However, we do not project strong growth in future performance. Due to the increasingly competitive nature of the beverage industry, especially in Key Statistics the sparkling water segment, we believe the stock is overvalued by 16.3-30.3%; therefore, we are Market Capitalization (B): $4.84 recommending a sell position. Shares Outstanding (T): 94,000 Drivers of Thesis • Avg 1-5 yr weekly beta: 0.494 Lack of innovation: National Beverage Corp. is limited by its majority insider ownership which is hesitant to innovate. This is apparent in its limited delegation of funds for its Fwd Price/Earnings: 39.4 research and development facilities, which are almost exclusively used for regulation and compliance testing. As a result, it is falling behind competition in satisfying Price/Earnings (LTM): 36.0 changing consumer trends in the industry as indicated by LaCroix’s loss of retail market Financial Metrics share in 20198. • Weak global presence: National Beverage Corp. operates only in the United States and 2020 Revenue $1,000,394 exports limited volume of products to Canada. -

2020 CDP Water Response

The Coca-Cola Company - Water Security 2020 W0. Introduction W0.1 (W0.1) Give a general description of and introduction to your organization. The Coca-Cola Company (NYSE: KO) is here to refresh the world and make a difference. We craft the brands and choice of drinks that people love. We do this in ways that create a more sustainable business. It’s about working together to create a better shared future for our people, our communities and our planet. The Coca-Cola Company is a total beverage company that markets, manufactures and sells beverage concentrates and syrups and finished beverages, offering over 500 brands and more than 4,700 products in over 200 countries and territories. In our concentrate operations, The Coca‑Cola Company typically generates net operating revenues ($37.3 billion in 2019) by selling concentrates and syrups to authorized bottling partners. Our bottling partners combine the concentrates and syrups with still or sparkling water and sweeteners (depending on the product), to prepare, package, sell and distribute finished beverages. Our finished product operations consist primarily of company-owned or -controlled bottling, sales and distribution operations. The 37 countries listed under question C0.3 are those countries in which The Coca-Cola Company owns and operates bottling plants. In addition to the company’s Coca-Cola brands, our portfolio includes some of the world’s most valuable beverage brands, such as AdeS soy-based beverages, Ayataka green tea, Dasani waters, Del Valle juices and nectars, Fanta, Georgia coffee, Gold Peak teas and coffees, Honest Tea, innocent smoothies and juices, Minute Maid juices, Powerade sports drinks, Simply juices, smartwater, Sprite, vitaminwater and ZICO coconut water.