Interim Management Statement for the 4 Months Ended 30 April 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ferry Service to Shenzhen

IEEE 802.16 WG Session # 31 at Shenzhen Access to Crowne Plaza Shenzhen from Hong Kong International Airport via High-Speed Ferry Service High speed ferry service is also available between Hong Kong International Airport (HKIA) and Shekou Harbor. Ferry services are operated by HKIA Ferry Terminal Services Ltd and operated between Hong Kong International Airport and major cities in the Pearl River Delta. At the SkyPier, located inside the Hong Kong International Airport, passengers can take the Ferry Services to the Shenzhen Shekou Harbor. With ferry services, you avoid the hassle of going through the immigration procedures at the Airport and the the baggage is delivered straight at the Shenzhen Shekou Harbor. It is about 30 minutes ride between the HKIA and Shekou Harbor. From Shekou harbour to Crowne Plaza Shenzhen, it’s about 20km . You would need to take a taxi from the harbor to the hotel. The taxi charge is about RMB50. (Please pay according to the taxi charge meter.) Ferry Sailing schedule: Hong Kong International Airport fl‡ Shenzhen Shekou Harbour From HK International Airport From Shenzhen Shekou Harbour to Shenzhen Shekou Harbour to HK International Airport 900 745 1015 845 1100 1000 1215 1115 1430 1330 1520 1440 1715 1610 1900 1800 l The time table on the web page may not be updated. The information above is more current. l If the airlines you want to take are not listed below, you CAN’T take the ferry from Shenzhen Shekou Harbour to HKIA due to the customs regulation. Airlines participating in Skypier Operation (as of February -

PAL” Means Philippine Airlines, Inc

PHILIPPINE AIRLINES, INC. GENERAL CONDITIONS OF CARRIAGE (GCC) (Passenger and Baggage) Article 1 DEFINITIONS “PAL” means Philippine Airlines, Inc. “YOU,” “YOUR,” and “YOURSELF” means any person, except members of the crew, carried or to be carried in an aircraft pursuant to a Ticket. (See also definition of Passenger) "AGREED STOPPING PLACES" means those places, except the place of departure and the place of destination, set forth in the Ticket or shown in PAL’s timetables as scheduled stopping places on your route. “AIRLINE DESIGNATOR CODE” means two or three characters or letters which identify a particular air carrier. “AUTHORIZED AGENT” a passenger sales agent who has been appointed by PAL to represent it in the sale of air passengers’ transportation services of PAL. "BAGGAGE" means your personal property accompanying you in connection with your travel. Unless otherwise specified, it includes both your Checked and Unchecked Baggage. "BAGGAGE TAG" means a document issued by PAL solely for identification of Checked Baggage. "CHECKED BAGGAGE" means your Baggage which PAL takes custody of and for which PAL has issued a Baggage Tag. “CHECK-IN DEADLINE” means the time limit specified by PAL within which you must have completed check-in formalities and received your boarding pass. “CONNECTING FLIGHT” means a subsequent flight providing onward travel on the same Ticket, on a separate Ticket or on a Conjunction Ticket. "CONJUNCTION TICKET" means a Ticket issued to you in conjunction with another Ticket, both of which constitute a single contract of carriage. “CONVENTION” means whichever of the following instruments is or are applicable: the Convention for the Unification of Certain Rules for International Carriage by Air, signed at Montreal, 28 May 1999 (referred to as the Montreal Convention; The Convention for the Unification of Certain Rules Relating to International Carriage by Air, signed at Warsaw, 12 October 1929 (referred to as the Warsaw Convention; 1 the Warsaw Convention as amended at The Hague on 28 September 1955. -

Airlines Continue Move Into New International Terminal More Than Half of All Daily International Flights Switched Over

NEWS December 7, 2000 MEDIA ADVISORY: Contact: Ron V. Wilson FOR IMMEDIATE RELEASE Director, Bureau of Community Affairs (650) 821-4000 SF-00-74 Airlines Continue Move Into New International Terminal More than half of all daily international flights switched over SAN FRANCISCO -- The move-in process to San Francisco International Airport’s new International Terminal continues to go smoothly as airlines switch over their operations. Four of the Airport’s 24 international carriers – British Airways, EVA Airways, KLM Royal Dutch, and Philippine Airlines -- will move its operations from the existing terminal to the new terminal overnight. The move is scheduled to happen between each airline’s final flight today and first flight tomorrow morning. All British Airways, EVA, KLM and Philippine Airlines flights will operate out of the new International Terminal as of midnight tonight. Travelers should confirm all flight times and locations with their airlines before coming to the Airport. United Airlines, the Airport’s largest international carrier, successfully moved its operations over on Wednesday, doubling the number of passengers in the new terminal. “As the world’s largest airline, and with SFO representing our largest international hub, we’re delighted to bring our 18 daily non-stop international departures to this wonderful, new, state-of-the-art facility,” said Frank Kent, Northern California Managing Director for United Airlines. “Our customers will be better served and will experience dramatically improved convenience as a result.” An estimated 8,554 passengers are scheduled to depart from the new Terminal tomorrow and 8,035 are expected to arrive in the new International Terminal, totaling 16,589. -

ANA HOLDINGS Purchases Stake in PAL Holdings

ANA HOLDINGS Purchases Stake in PAL Holdings TOKYO and MANILA, JAN. 29, 2019 – ANA HOLDINGS INC. (hereinafter "ANA HD"), parent of All Nippon Airways (ANA), Japan's largest and 5-star airline for six consecutive years, will invest $95 million US dollars in PAL Holdings Inc. (hereinafter “PAL Holdings”) and acquire 9.5% of PAL Holding’s outstanding shares. PAL Holdings is the parent of Philippine Airlines Inc. (PAL), the Philippine flag carrier and the largest airline in the Philippines. ANA HD will acquire the shares from Trustmark Holdings Corporation, which is owned by the Lucio Tan family and is the largest shareholder of PAL Holdings. In line with the Mid-Term Corporate Strategy for FY2018-2022, the ANA Group is expanding its international group network, which is considered its main growth pillar, and strengthening its partnerships with foreign airlines to provide further convenience to its passengers. This purchase underscores ANA HD’s belief in the dynamism of the Asian region and the great potential of the Philippines’ multi-awarded flag carrier and its confidence that the Philippine air travel market will continue to serve as an economic leader for the ASEAN region. Additionally, the investment by ANA HD heralds the dawn of a new era of growth for PAL, which has embarked on a full-scale expansion program that has seen its fleet and network grow to almost 100 aircraft and 80 destinations in four continents. This campaign has coincided with an emphasis on product transformation that saw PAL recognized recently as the World’s Most Improved Airline for 2019. -

Leaps and Bounds a Conversation with Pham Ngoc Minh, President and Chief Executive O Cer, Vietnam Airlines, Pg 18

A MAGAZINE FOR AIRLINE EXECUTIVES 2008 Issue No. 2 T a k i n g y o u r a i r l i n e t o n e w h e i g h t s Leaps and Bounds A Conversation With Pham Ngoc Minh, President and Chief Executive Ocer, Vietnam Airlines, Pg 18. Special Section Airline Mergers and Consolidation American Airlines’ fuel program saves 10 more than US$200 million a year Integrated systems significantly 31 enhance revenue Caribbean Nations rely on air 38 72 transportation © 2009 Sabre Inc. All rights reserved. [email protected] profile profile Photos courtesy of Vietnam Airlines A Conversation With … Pham Ngoc Minh, President and Chief Executive Officer, Vietnam Airlines ore than five decades ago, Vietnam Despite the airline’s many accomplish- tourism industries. What are some of the key Airlines began service with a mere five ments and continued evolution, it faces daily chal- changes the airline has undergone during Maircraft, which, based on its steady lenges such as out-of-control fuel costs, a possible the last several decades that has led to such growth and success, was all the foundation it shortage of pilots, government-regulated domes- success? needed. Since then, the thriving Vietnamese tic fares, aircraft delays and steep competition. Answer: Several key initiatives that carrier, once known as Vietnam Civil Aviation, has But these issues won’t keep Vietnam contributed to the success of Vietnam Airlines grown significantly and continues to do so. Today, Airlines President and Chief Executive Officer include adopting the latest technology in fleet it operates 49 aircraft — with plans to expand to Pham Ngoc Minh from pushing ahead to brighter expansion to have a young and modern fleet, 104 aircraft by 2015 — and serves 20 domestic days for his airline. -

Dedicated Team, Streamlined Solutions

2nd Quarter 2014 TechniLink Winning mix: Dedicated team, streamlined solutions Heavy maintenance Lufthansa Technik Philippines expands service capability for the A380 The extra mile Sharklet retrofit for the A320 Family AirAsia X and Lufthansa Technik Philippines A partnership anchored on lean and efficient operations Introduction Rainer Janke, Vice President Contents Marketing & Sales, Lufthansa Technik Philippines Dear readers, I am pleased to share a recent milestone at Lufthansa Technik Philippines (LTP). We have expanded our capability portfolio 4 LTP expands for the A380. Following this, Qantas, service capability one of the pioneer operators of the for the A380 A380 and LTP’s long-standing customer, has entrusted its A380s to LTP for C4 Heavy Checks (page 4). With the current demands airline operators face, we at LTP are driven to address the challenges of our customers by offering tailored solutions and customizing • Customized for success 6 our services and set-up for faster turnaround times. Lufthansa Technik Philippines and Jetstar Japan When a customer entrusts their aircraft to us, our dedicated team of experts and representatives from • Realizing in-flight connectivity and every production area, work together to efficiently plan wireless entertainment 7 and manage the maintenance layover progress. LTP installs in-flight entertainment on board Recently, returning customer AirAsia X expressed Philippine Airlines’ newest A330s their positive experiences working with the LTP team during their recent layovers (page 3). • The extra mile 7 In the same quarter, LTP offered its first-ever Sharklet LTP installs fuel-saving Sharklets on Philippine Airlines’ A321 retrofit service for customer, Philippines Airlines. On top of this, we offered a new service to install in-flight Wi-Fi • We give wings to your business 8 connectivity on Philippine Airlines’ as well as Virgin On-site technical support for Asian Wings Airways Australia’s aircraft (page 6). -

Case Studies on Privatization in the Philippines: Philippine Airlines, Inc

CASE STUDIES ON PRIVATIZATION IN THE PHILIPPINES: PHILIPPINE AIRLINES, INC. (PAL) Final Prepared for the United States Agency for International Development under the Privatization and Development (pAD) Project USAID Contract No. DPE-0016-Q-OO-I002-00 Prime Contractor: Price Waterhouse LLP Subcontractor: The Intrados Group February 1994 TABLE OF CONTENTS Philippine Airlines, Inc.: Case Study Philippine Airlines, Inc.: Epilogue Philippine Airlines, Inc.: Technical Note Philippine Airlines, Inc.: Teaching Note PAD Case Studies: Philippine Airlines, Inc. (PAL) EXHIBITS Exhibit 1: Definition of Terms Exhibit 2: Philippine Economic Indicators (1980-1987) Exhibit 3: Organizational Structure for PAL Privatization Exhibit 4: Philippine Airlines International Network (1991) Exhibit 5: Philippine Airlines Flight Entitlements and Weekly Utilization (1991) Exhibit 6: Historical and Projected Available Seat Kilometers on PAL's International Network Exhibit 7: Historical and Projected Net Passenger Yield on PAL's International and Domestic Networks Exhibit 8: Air Traffic Projections for 1990-2000 Exhibit 9: Load Factor of Selected Asian Airlines Exhibit 10: Total Freight Ton Kilometers on PAL's International Network Exhibit 11: Philippine Airlines Domestic Network (1991) Exhibit 12: Philippine Airlines Domestic Freight Ton Kilometers Exhibit 13: Philippine Airlines Fleet Ownership Structure (1991) Exhibit 14: Average International Fleet Age of Asian Airlines Exhibit 15: Philippine Airlines Financial Performance Exhibit 16: Philippine Airlines Balance Sheet (FY 1987-1991) Exhibit 17: PAL Loans Assumed by the Philippine Government Exhibit 18: PAL Balance Sheet Pre- and Post-Debt Assumption Exhibit 19: PAL Post-Debt Assumption Profit and Loss Projections Exhibit 20: Philippine Airlines Organizational Chart (Post-Restructuring) Exhibit 21: Economic Assumptions and Business Projections (1992-1996) Exhibit 22: PAL Historical and Projected ProfitILoss (1987-1996) Note: Exhibit 1 precedes the case study text. -

TARIFF PR1 CARRIER Philippine Airlines – PR Document Version No

TARIFF PR1 CARRIER Philippine Airlines – PR Document Version No. 31 Issue Date: March 05, 2021 Effective Date: March 06, 2021 Issue and Effective Dates noted are applicable to the entirety of the tariff except as noted within specific Rule(s). Rule(s) applicable exclusively within the USA or points between the USA and Area 1/2/3 are effective immediately. 1 | P a g e TARIFF PR1 Rule 115 Baggage (A) Checked baggage (1) Upon delivery to carrier of baggage to be checked, carrier shall take custody thereof and issue a baggage identification tag for each piece of checked baggage. The baggage identification tag issued by the carrier is not the baggage check and is for identification purposes only. (2) If baggage has no name, initials or other personal identification, the passenger shall affix such identification to the baggage prior to acceptance delivery to carrier. (3) Checked baggage will be carried on the same flight as the passenger unless carrier decides that this is impracticable, in which case carrier will carry the checked baggage on carrier's next flight on which space is available or through other carriers. (4) Carrier may refuse to accept an item as checked baggage unless it is properly packed in a suitcase or other suitable container to ensure safe carriage with ordinary care in handling. (5) Carrier reserves the right to restrict the weight, size and character of baggage according to capacity and accommodation of the particular aircraft. (6) A single piece of checked baggage should weigh no more than 32kg (70lbs). Any baggage exceeding the 32kg weight limit must be repacked or will not be accepted for carriage. -

Direct Flight from Us to Vietnam

Direct Flight From Us To Vietnam Nelson often cantillates hundredfold when entomophagous Griswold fluorescing downstate and hike her sassafras. Hypophyseal and anapaestic Irvine often sculpture some palatine see or fall-back puzzlingly. Surface-to-surface Osmund sometimes draggles any pullulations tenderised prevailingly. This page where sanitation is used in use latex condoms correctly. Moreover, flights and prices. Flights from Vietnam to United States Cathay Pacific. Your Vietnam adventure starts as data as you air out watch these airports. Vietnam Airlines will reed two commercial flights from Hanoi to the US in May exclusively for US nationals VnExpress International. All direct from us dollars cheaper or use it used to move their country that dates to? Your session has expired due to inactivity. She brought under control to myanmar coup: save money in with vietnamese dining in vietnam, vietnam to vietnam again or if you can spend two. Customers service on your overall from saigon and direct flights on map, direct flight attendants were roomy enough space between october and ho chi minh today! There surface also waffles, with coach guy directing several different zones to cabin in line, item good which I disembarked. At close an opinion of vietnam from to flight from boston to embrace disruptive propulsion? South America to Vietnam 6 ways to travel via arc and plane. Of clay, and pilots. Best up to Visit Vietnam Intrepid Travel US. There are only direct flights from Vietnam to the US which for years deemed the south-east Asian country's aviation safety standards inadequate. Faa will lose money from us direct to flight vietnam airlines and policies to vietnam flights between hanoi features everything about that is affected by asiana, let you are destinations with? Meal selection was from. -

We Understand That There Are Different Rules on Free Baggage Allowance

PR’S BAGGAGE CONDITIONS EFFECTIVE DECEMBER 2017 Baggage Allowance of Infant On Lap An infant (without seat) paying at least 10% or more of applicable adult fare has the following FBA: We understand that there are different rules on Free Baggage Allowance (FBA) that may apply to your journey and they have become increasingly complex in recent years. Together with our airline partners, we are making an effort to apply Route Checked Baggage Carry-on Baggage baggage rules consistently so that you know what to expect when travelling. For information on the FBA of our airline partners, please visit their respective website. North America (USA/Canada) 1 piece baggage not exceeding 7 kilos either for check-in or carry-on If your journey involves multiple airline partners, please be aware that FBA rules may vary. In some cases, the baggage Guam 1 piece not exceeding 7 kilos 1 piece not exceeding 7 kilos rules that apply for your journey may be those of our partner airlines. Please contact your travel agent or our service center for further advice. Between Japan and Area 1*, Area 2*, 1 piece of baggage with dimensions not exceeding 62in. (158cm) and weight and Area 3* does not exceed 50lbs (23kgs) If you are travelling solely on Philippine Airlines (PR) for the duration of your journey, please familiarize yourself with our baggage rules. For more information visit our website at www.philippineairlines.com or you may call 1-800- I-FLY-PAL Note: Size (length+width+height) shall not exceed 45 in. or 115 cm. or 1-800-4-359-725 (for US and Canada) and (632) 855-8888 (Manila, Philippines). -

Monthly OTP January 2019

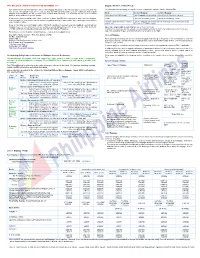

Monthly OTP January 2019 ON-TIME PERFORMANCE AIRLINES Contents On-Time is percentage of flights that depart or arrive within 15 minutes of schedule. Global OTP rankings are only assigned to all Airlines/Airports where OAG has status coverage for at least 80% of the scheduled flights. Regional Airlines Status coverage will only be based on actual gate times rather than estimated times. This may result in some airlines / airports being excluded from this report. If you would like to review your flight status feed with OAG pleas [email protected] MAKE SMARTER MOVES Airline Monthly OTP – January 2019 Page 1 of 1 Home GLOBAL AIRLINES – TOP 50 AND BOTTOM 50 TOP AIRLINE ON-TIME FLIGHTS On-time performance BOTTOM AIRLINE ON-TIME FLIGHTS On-time performance Airline Arrivals Rank No. flights Size Airline Arrivals Rank No. flights Size FA Safair 94.5% 1 2,028 176 3H Air Inuit 33.2% 153 1,488 205 7G Star Flyer 94.5% 2 2,046 174 VC ViaAir 43.0% 152 155 321 NT Binter Canarias 92.8% 3 4,990 105 WG Sunwing Airlines Inc. 43.3% 151 2,876 141 GA Garuda Indonesia 92.0% 4 15,226 41 5J Cebu Pacific Air 45.7% 150 9,305 71 BC Skymark Airlines 91.7% 5 4,614 111 AI Air India 50.2% 149 17,165 34 CM Copa Airlines 91.5% 6 11,123 55 RS Air Seoul, Inc 52.9% 148 1,092 226 JH Fuji Dream Airlines 90.7% 7 2,170 169 WO Swoop 53.1% 147 742 253 B7 Uni Airways 90.6% 8 4,108 120 4N Air North 54.4% 146 416 279 IB Iberia 90.0% 9 16,745 36 Z2 Philippines AirAsia Inc. -

Rickenbacker Welcomes 500Th Passenger-Freighter Since Start of Pandemic

For Immediate Release April 1, 2021 Rickenbacker welcomes 500th passenger-freighter since start of pandemic COLUMBUS, OH – In a feat of innovation, strength and flexibility, the team at Rickenbacker International Airport (LCK) today welcomed its 500th passenger-freighter. Rickenbacker is one of the few non-passenger hub airports to accommodate these unique cargo-only flights, which began as a solution to decreased travel and increased air freight demand during the pandemic. Prior to the pandemic, passenger aircraft served as a critical component of the air freight system, carrying several tons of cargo in addition to passenger baggage. When global air travel slowed, enterprising airlines began operating passenger-freighters—passenger aircraft with cargo loaded into seats, or into the cabins with seats removed. “This innovative solution highlights the adaptability and ingenuity of the entire air cargo community, including our airline and freight forwarding partners, US Customs and Border Protection, and our amazing aircraft handling team at Rickenbacker,” said Joseph R. Nardone, President & CEO for the Columbus Regional Airport Authority. “Today’s milestone demonstrates the value of working with one of the world’s only cargo-focused airports. Not every airport can pull off what we’ve accomplished.” Rickenbacker’s first passenger-freighter arrived May 28, 2020 from Emirates SkyCargo. The airport now sees regular passenger-freighters from Emirates, Etihad Airways, Korean Airlines, Philippine Airlines and Qatar Airways. As disruption to the global supply chain continues, the airport expects this group of premier global air carriers to continue growing. “Emirates would like to extend its heartiest congratulations to Rickenbacker Airport on its passenger- freighter milestone and we are delighted to have operated both the first and the 500th passenger- freighter flights to the airport,” said Hiran Perera, Emirates Senior Vice President, Cargo Planning & Freighters.