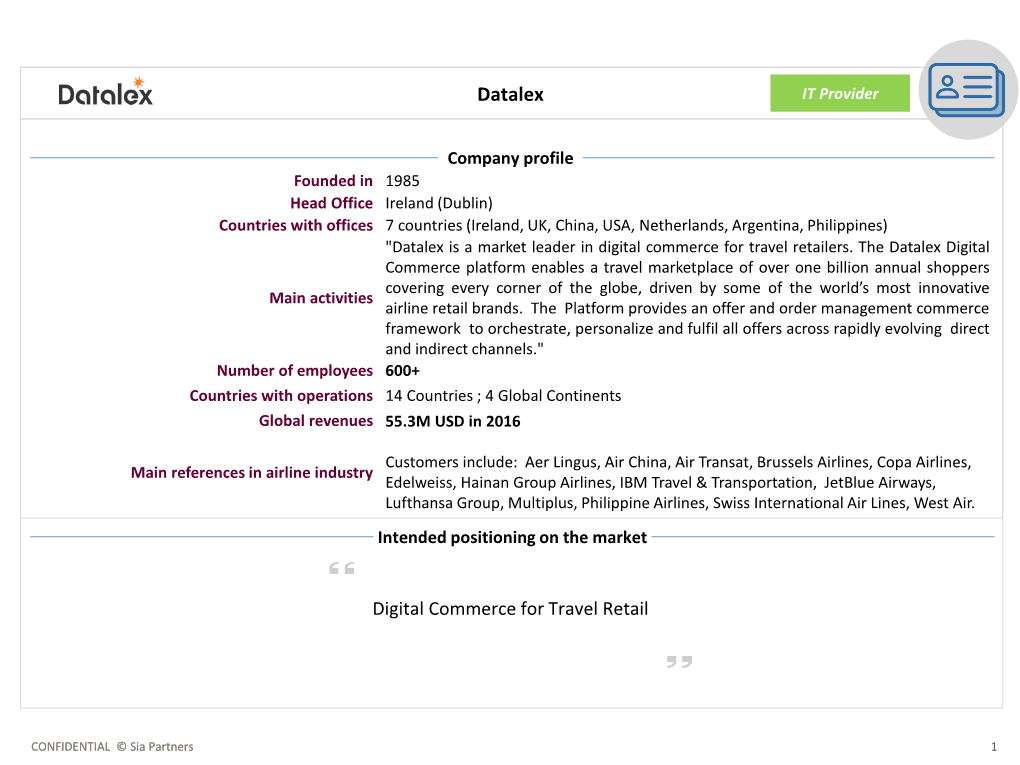

Datalex IT Provider

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 Datalex Big Book of Airline Data Page 0

2021 Datalex Big Book of Airline Data Page 0 2021 Datalex Big Book of Airline Data by IdeaWorksCompany Table of Contents Updates to the 2021 Datalex Big Book of Airline Data .................................................................................... 3 A. Welcome Message from Datalex .................................................................................................................. 5 B. Introduction to the Data ................................................................................................................................. 6 About Special Reporting Periods ....................................................................................................................... 7 Year over Year Comparisons are Introduced this Year............................................................................... 8 2020 Was Bad – But There Were a Few Bright Spots ................................................................................. 9 C. Airline Traffic for the 2020 Period .............................................................................................................. 12 Primary Airlines in Alphabetical Order .......................................................................................................... 12 Subsidiary Airlines in Alphabetical Order ...................................................................................................... 18 Primary Airlines by Traffic ................................................................................................................................ -

Annual Report 2016 2 Datalex Annual Report 2016 Datalex

ANNUAL REPORT 2016 2 DATALEX ANNUAL REPORT 2016 DATALEX. YOU GET A BETTER VIEW OF PEOPLE FROM HERE. 2016 HIGHLIGHTS In 2016, we continued to successfully deliver on our strategy for growth and the creation of shareholder value, with double digit growth across all key metrics of revenue, Adjusted EBITDA and cash and short term investments, while undertaking significant investment to drive future growth. Platform Revenue Profit after Tax Growth 15% 29% 2016 2016 2015 2015 15 $22.8m $26.4m $4.2mgraph $5.4m Adjusted EBITDA Cash and Short Term Investments 18% 12% 2016 2016 2015 2015 15 $10.4m $12.2m $21.8m $24.3m 4 DATALEX ANNUAL REPORT 2016 CONTENTS STRATEGY REVIEW At a Glance 2 Market Review 4 Our Digital Commerce Portfolio 6 Investment Case 8 Business Model 10 Chairman's Statement 12 Our Strategy 14 Chief Executive Review 18 Key Performance Indicators 24 Financial and Operational Review 26 Risk Report 31 GOVERNANCE Directors and Other Information 35 Directors’ Report 40 Directors' Responsibilities Statement 46 Corporate Governance Statement 48 Remuneration Report 64 Independent Auditors’ Report 68 FINANCIAL STATEMENTS Consolidated Balance Sheet 80 Consolidated Income Statement 81 Consolidated Statement of Comprehensive Income 82 Consolidated Statement of Changes in Equity 83 Consolidated Statement of Cash Flows 84 Company Balance Sheet 85 Company Statement of Changes in Equity 86 Company Statement of Cash Flows 87 Notes to the Financial Statements 88 See all investor information online at www.datalex.com/investors WWW.DATALEX.COM 1 AT A GLANCE Our software enables airlines to adapt faster and better to the ever changing needs of customers. -

Datalex Annual Report 2018

ANNUAL REPORT 2018 Datalex plc Global Headquarters Block U ANNUAL REPORT 2018 EastPoint Dublin D03 H704 Ireland Call: +353 1 806 3500 Fax: +353 1 806 3501 Email: [email protected] www.datalex.com ANNUAL REPORT 2018 STRATEGY REVIEW Acting Chairman and Interim Chief Executive Officer (“CEO”) Statement 2 Datalex at a Glance 4 Airline Retail Expansion and Shift 4 Our People 5 Our Business Model 6 Financial and Operational Review 8 Risk Report 14 GOVERNANCE Directors and Other Information 16 Board of Directors 17 Directors’ Report 18 Directors’ Responsibilities Statement 26 Corporate Governance Statement 27 Remuneration Report 39 Independent Auditor’s Report to the Members of Datalex plc 43 FINANCIAL STATEMENTS Consolidated Statement of Financial Position 52 Consolidated Statement of Profit or Loss 53 Consolidated Statement of Comprehensive Income 54 Consolidated Statement of Changes in Equity 55 Consolidated Statement of Cash Flows 56 Company Statement of Financial Position 57 Company Statement of Changes in Equity 58 Company Statement of Cash Flows 59 Notes to the Financial Statements 60 See all investor information online at www.datalex.com/investors ACTING CHAIRMAN AND INTERIM CHIEF EXECUTIVE OFFICER (“CEO”) STATEMENT This Annual Report sets out to summarise 2018 as transparently is required as a short-term measure which is in the best interests and methodically as possible in what has been the most difficult of shareholders. The Board is currently undertaking a formal year in the history of the Group. Events uncovered in early 2019, process for segregating these roles in the immediate future with including the breakdown in internal controls which failed to the expectation that the positions of CEO and Chairman will be detect accounting irregularities, were unprecedented. -

The Future of Airline Distribution, 2016 - 2021

The Future of Airline Distribution, 2016 - 2021 By Henry H. Harteveldt, Atmosphere Research Group CONTENTS 3 INTRODUCTION 5 RESEARCH METHODOLOGY 7 EXECUTIVE SUMMARY 9 HOW SHOULD AIRLINES PREPARE TO SERVE THE AIRLINE TRAVELER OF 2021? 26 TECHNOLOGY INNOVATION AND THE EVOLVING TECHNOLOGY LANDSCAPE 29 AIRLINE DISTRIBUTION IN 2021 70 CONCLUSION 72 ENDNOTES © 2016 International Air Transport Association. All rights reserved. 2 INTRODUCTION Introduction from Atmosphere Research Atmosphere Research Group is honored to have Airlines that want to become true retailers are once again been selected by IATA to prepare this well-positioned to do so. Carriers have an abun- report on the future of airline distribution. We dance of technologies, including cloud comput- believe that the five-year timeframe this report ing, artificial intelligence, and mobility, that they covers – 2016 to 2021 – will see the successful can use to help them bring their products to mar- introduction of true retailing among the world’s ket in more meaningful ways. IATA’s NDC, One airlines and their distribution partners. Order, and NGISS initiatives are being brought to market to help airlines be more successful busi- This report reflects Atmosphere Research’s in- nesses. As each airline independently contem- dependent and objective analysis based on our plates its distribution strategies and tactics, we extensive industry and consumer research (for hope this report will serve as a helpful resource. more information about how the research was conducted, please refer to the “Research Method- ology” section). © 2016 International Air Transport Association. All rights reserved. 3 Future of Distribution Report 2016-2021 Introduction from IATA In 2012 IATA commissioned Atmosphere Research Game changes are prompted by consumer needs, to conduct a survey on the Future of Airline Dis- or by the ability to offer new solutions. -

Ferry Service to Shenzhen

IEEE 802.16 WG Session # 31 at Shenzhen Access to Crowne Plaza Shenzhen from Hong Kong International Airport via High-Speed Ferry Service High speed ferry service is also available between Hong Kong International Airport (HKIA) and Shekou Harbor. Ferry services are operated by HKIA Ferry Terminal Services Ltd and operated between Hong Kong International Airport and major cities in the Pearl River Delta. At the SkyPier, located inside the Hong Kong International Airport, passengers can take the Ferry Services to the Shenzhen Shekou Harbor. With ferry services, you avoid the hassle of going through the immigration procedures at the Airport and the the baggage is delivered straight at the Shenzhen Shekou Harbor. It is about 30 minutes ride between the HKIA and Shekou Harbor. From Shekou harbour to Crowne Plaza Shenzhen, it’s about 20km . You would need to take a taxi from the harbor to the hotel. The taxi charge is about RMB50. (Please pay according to the taxi charge meter.) Ferry Sailing schedule: Hong Kong International Airport fl‡ Shenzhen Shekou Harbour From HK International Airport From Shenzhen Shekou Harbour to Shenzhen Shekou Harbour to HK International Airport 900 745 1015 845 1100 1000 1215 1115 1430 1330 1520 1440 1715 1610 1900 1800 l The time table on the web page may not be updated. The information above is more current. l If the airlines you want to take are not listed below, you CAN’T take the ferry from Shenzhen Shekou Harbour to HKIA due to the customs regulation. Airlines participating in Skypier Operation (as of February -

PAL” Means Philippine Airlines, Inc

PHILIPPINE AIRLINES, INC. GENERAL CONDITIONS OF CARRIAGE (GCC) (Passenger and Baggage) Article 1 DEFINITIONS “PAL” means Philippine Airlines, Inc. “YOU,” “YOUR,” and “YOURSELF” means any person, except members of the crew, carried or to be carried in an aircraft pursuant to a Ticket. (See also definition of Passenger) "AGREED STOPPING PLACES" means those places, except the place of departure and the place of destination, set forth in the Ticket or shown in PAL’s timetables as scheduled stopping places on your route. “AIRLINE DESIGNATOR CODE” means two or three characters or letters which identify a particular air carrier. “AUTHORIZED AGENT” a passenger sales agent who has been appointed by PAL to represent it in the sale of air passengers’ transportation services of PAL. "BAGGAGE" means your personal property accompanying you in connection with your travel. Unless otherwise specified, it includes both your Checked and Unchecked Baggage. "BAGGAGE TAG" means a document issued by PAL solely for identification of Checked Baggage. "CHECKED BAGGAGE" means your Baggage which PAL takes custody of and for which PAL has issued a Baggage Tag. “CHECK-IN DEADLINE” means the time limit specified by PAL within which you must have completed check-in formalities and received your boarding pass. “CONNECTING FLIGHT” means a subsequent flight providing onward travel on the same Ticket, on a separate Ticket or on a Conjunction Ticket. "CONJUNCTION TICKET" means a Ticket issued to you in conjunction with another Ticket, both of which constitute a single contract of carriage. “CONVENTION” means whichever of the following instruments is or are applicable: the Convention for the Unification of Certain Rules for International Carriage by Air, signed at Montreal, 28 May 1999 (referred to as the Montreal Convention; The Convention for the Unification of Certain Rules Relating to International Carriage by Air, signed at Warsaw, 12 October 1929 (referred to as the Warsaw Convention; 1 the Warsaw Convention as amended at The Hague on 28 September 1955. -

Transitioning to a Future of Intelligent Dynamic Offers Continuous Pricing, Dynamic Offer Generation and Customer-Centric Airline Retail

Transitioning to a Future of Intelligent Dynamic Offers Continuous Pricing, Dynamic Offer Generation and Customer-Centric Airline Retail White Paper by The COVID-19 pandemic has caused havoc for traditional revenue management models. The Introduction typical patterns of peak and low seasons, estimated booking windows, look to book ratios as well as the A Datalex white paper on the important developments expected patterns of boom-and-bust economies no longer apply. Dealing with this major disruption in Continuous Pricing and Dynamic Offer Generation in revenue management requires innovative thinking, a great deal of flexibility and importantly, more for a future of rich airline retailing. Featuring exclusive agile and intelligence driven pricing and offers than ever before. insights from a Datalex interview with leading international authority on Dynamic Offer Generation Airlines are showing an appetite for innovation and experimentation to leap-frog competitors during and Continuous Pricing – Dr. Peter Belobaba, Principal recovery – including an acceleration of pace in Dynamic Offer & Continuous Pricing, powered by Research Scientist at the MIT International Centre of smarter decision-making and artificial intelligence. The future of airline retailing will look different Air Transportation and Director of the PODS Revenue than it did pre-COVID, and it is evident that the ability to respond to rapidly changing market and Management Research Consortium. customer demands instantaneously is key. Moreover, airlines need to explore new retailing opportunities to better distinguish themselves from their competitors. While dynamic offer © Datalex generation (the top right corner of the IATA Dynamic Maturity Matrix (1)) is still in its infancy, airlines can invest in moving towards this in a strategic manner with dynamic product determination and dynamic price adjustments today, while preparing for a future move to full dynamic offers without the restrictions of filed fares and RBD’s. -

Airlines Continue Move Into New International Terminal More Than Half of All Daily International Flights Switched Over

NEWS December 7, 2000 MEDIA ADVISORY: Contact: Ron V. Wilson FOR IMMEDIATE RELEASE Director, Bureau of Community Affairs (650) 821-4000 SF-00-74 Airlines Continue Move Into New International Terminal More than half of all daily international flights switched over SAN FRANCISCO -- The move-in process to San Francisco International Airport’s new International Terminal continues to go smoothly as airlines switch over their operations. Four of the Airport’s 24 international carriers – British Airways, EVA Airways, KLM Royal Dutch, and Philippine Airlines -- will move its operations from the existing terminal to the new terminal overnight. The move is scheduled to happen between each airline’s final flight today and first flight tomorrow morning. All British Airways, EVA, KLM and Philippine Airlines flights will operate out of the new International Terminal as of midnight tonight. Travelers should confirm all flight times and locations with their airlines before coming to the Airport. United Airlines, the Airport’s largest international carrier, successfully moved its operations over on Wednesday, doubling the number of passengers in the new terminal. “As the world’s largest airline, and with SFO representing our largest international hub, we’re delighted to bring our 18 daily non-stop international departures to this wonderful, new, state-of-the-art facility,” said Frank Kent, Northern California Managing Director for United Airlines. “Our customers will be better served and will experience dramatically improved convenience as a result.” An estimated 8,554 passengers are scheduled to depart from the new Terminal tomorrow and 8,035 are expected to arrive in the new International Terminal, totaling 16,589. -

ANA HOLDINGS Purchases Stake in PAL Holdings

ANA HOLDINGS Purchases Stake in PAL Holdings TOKYO and MANILA, JAN. 29, 2019 – ANA HOLDINGS INC. (hereinafter "ANA HD"), parent of All Nippon Airways (ANA), Japan's largest and 5-star airline for six consecutive years, will invest $95 million US dollars in PAL Holdings Inc. (hereinafter “PAL Holdings”) and acquire 9.5% of PAL Holding’s outstanding shares. PAL Holdings is the parent of Philippine Airlines Inc. (PAL), the Philippine flag carrier and the largest airline in the Philippines. ANA HD will acquire the shares from Trustmark Holdings Corporation, which is owned by the Lucio Tan family and is the largest shareholder of PAL Holdings. In line with the Mid-Term Corporate Strategy for FY2018-2022, the ANA Group is expanding its international group network, which is considered its main growth pillar, and strengthening its partnerships with foreign airlines to provide further convenience to its passengers. This purchase underscores ANA HD’s belief in the dynamism of the Asian region and the great potential of the Philippines’ multi-awarded flag carrier and its confidence that the Philippine air travel market will continue to serve as an economic leader for the ASEAN region. Additionally, the investment by ANA HD heralds the dawn of a new era of growth for PAL, which has embarked on a full-scale expansion program that has seen its fleet and network grow to almost 100 aircraft and 80 destinations in four continents. This campaign has coincided with an emphasis on product transformation that saw PAL recognized recently as the World’s Most Improved Airline for 2019. -

Morning Wrap

Morning Wrap Today ’s Newsflow Equity Research 04 Jun 2021 08:40 BST Upcoming Events Select headline to navigate to article European Airlines Anger, frustration and a delayed Company Events 04-Jun Derwent London; Interim Ex Div recovery 08-Jun Paragon Banking Group; Q221 Results Smurfit Kappa Entering the Peruvian corrugated market 09-Jun SSP Group; Q221 Results Datalex Intention to raise €25m Irish Banks An Post mortgage timeline might be mid-2022 Irish Banks BOE governor on climate change at Green Swan conference Economic Events Ireland 04-Jun GDP Q1 08-Jun Industrial Production Apr21 10-Jun CPU May21 United Kingdom 04-Jun CIPS Construction PMI May21 11-Jun Construction Output Apr21 GDP Apr21 Trade Balance Apr21 Industrial Production Apr21 Manufacturing Production Apr21 United States Europe This document is intended for the sole use of Goodbody Stockbrokers and its affiliates Goodbody Capital Markets Equity Research +353 1 6419221 Equity Sales +353 1 6670222 Bloomberg GDSE<GO> Goodbody Stockbrokers UC, trading as “Goodbody”, is regulated by the Central Bank of Ireland. In the UK, Goodbody is authorised and subject to limited regulation by the Financial Conduct Authority. Goodbody is a member of Euronext Dublin and the London Stock Exchange. Goodbody is a member of the FEXCO group of companies. For the attention of US clients of Goodbody Securities Inc, this third-party research report has been produced by our affiliate, Goodbody Stockbrokers Goodbody Morning Wrap European Airlines Anger, frustration and a delayed recovery The UK Government’s decision to shorten rather than lengthen its travel destination green Mark Simpson list saw a sharp decline in share prices as the market will need to adjust down forecasts for +353-1-641 0478 this year and raise cash needs for the industry. -

DATALEX PLC Notice of Annual General Meeting 2021

Page 1 of 1 DATALEX PLC Notice of Annual General Meeting 2021 Dublin, Ireland – 30 August 2021: Datalex plc (the “Company” or the “Group”) (Euronext Dublin: DLE), a market leader in digital retail technology focused on the airline market, announces that the Annual General Meeting (“AGM”) of the Company will be held at Block U, Eastpoint Business Park, Clontarf, Dublin D03 H704, Ireland on 23 September 2021 at 12.00 noon Dublin time. The Company plans to conduct the AGM in accordance with the Irish Government’s COVID-19 related public health measures and public health advice. As stated in the Notice of AGM all shareholders are strongly encouraged to vote by proxy on this occasion so they can be represented at the AGM without having to physically attend the meeting. To facilitate shareholder communication, the AGM will also be broadcast by conference call. Details of the conference call will be posted on our website www.datalex.com. The Notice of AGM is available from today on the Company's website, and may be viewed and downloaded online at: www.datalex.com Hard copies of the notice have been posted to shareholders who have elected to receive them. Copies of the notice will be submitted to Euronext Dublin where they will be available for inspection. About Datalex Investor Enquiries Neil McLoughlin Datalex is a market leader in transformative airline retail products and solutions. The Datalex plc Datalex Digital Commerce Platform provides airlines with a unique solution to drive +353 1 806 3500 revenue and profit as digital retailers. Today the platform enables a travel marketplace of over one billion shoppers covering every corner of the globe, driven [email protected] by some of the world’s most innovative airline retail brands. -

Leaps and Bounds a Conversation with Pham Ngoc Minh, President and Chief Executive O Cer, Vietnam Airlines, Pg 18

A MAGAZINE FOR AIRLINE EXECUTIVES 2008 Issue No. 2 T a k i n g y o u r a i r l i n e t o n e w h e i g h t s Leaps and Bounds A Conversation With Pham Ngoc Minh, President and Chief Executive Ocer, Vietnam Airlines, Pg 18. Special Section Airline Mergers and Consolidation American Airlines’ fuel program saves 10 more than US$200 million a year Integrated systems significantly 31 enhance revenue Caribbean Nations rely on air 38 72 transportation © 2009 Sabre Inc. All rights reserved. [email protected] profile profile Photos courtesy of Vietnam Airlines A Conversation With … Pham Ngoc Minh, President and Chief Executive Officer, Vietnam Airlines ore than five decades ago, Vietnam Despite the airline’s many accomplish- tourism industries. What are some of the key Airlines began service with a mere five ments and continued evolution, it faces daily chal- changes the airline has undergone during Maircraft, which, based on its steady lenges such as out-of-control fuel costs, a possible the last several decades that has led to such growth and success, was all the foundation it shortage of pilots, government-regulated domes- success? needed. Since then, the thriving Vietnamese tic fares, aircraft delays and steep competition. Answer: Several key initiatives that carrier, once known as Vietnam Civil Aviation, has But these issues won’t keep Vietnam contributed to the success of Vietnam Airlines grown significantly and continues to do so. Today, Airlines President and Chief Executive Officer include adopting the latest technology in fleet it operates 49 aircraft — with plans to expand to Pham Ngoc Minh from pushing ahead to brighter expansion to have a young and modern fleet, 104 aircraft by 2015 — and serves 20 domestic days for his airline.