Sun TV Network Ltd. Customer Success Story Collateral Layout

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Who Owns the Broadcasting Television Network Business in Indonesia?

Network Intelligence Studies Volume VI, Issue 11 (1/2018) Rendra WIDYATAMA Károly Ihrig Doctoral School of Management and Business University of Debrecen, Hungary Communication Department University of Ahmad Dahlan, Indonesia Case WHO OWNS THE BROADCASTING Study TELEVISION NETWORK BUSINESS IN INDONESIA? Keywords Regulation, Parent TV Station, Private TV station, Business orientation, TV broadcasting network JEL Classification D22; L21; L51; L82 Abstract Broadcasting TV occupies a significant position in the community. Therefore, all the countries in the world give attention to TV broadcasting business. In Indonesia, the government requires TV stations to broadcast locally, except through networking. In this state, there are 763 private TV companies broadcasting free to air. Of these, some companies have many TV stations and build various broadcasting networks. In this article, the author reveals the substantial TV stations that control the market, based on literature studies. From the data analysis, there are 14 substantial free to network broadcast private TV broadcasters but owns by eight companies; these include the MNC Group, EMTEK, Viva Media Asia, CTCorp, Media Indonesia, Rajawali Corpora, and Indigo Multimedia. All TV stations are from Jakarta, which broadcasts in 22 to 32 Indonesian provinces. 11 Network Intelligence Studies Volume VI, Issue 11 (1/2018) METHODOLOGY INTRODUCTION The author uses the Broadcasting Act 32 of 2002 on In modern society, TV occupies a significant broadcasting and the Government Decree 50 of 2005 position. All shareholders have an interest in this on the implementation of free to air private TV as a medium. Governments have an interest in TV parameter of substantial TV network. According to because it has political effects (Sakr, 2012), while the regulation, the government requires local TV business people have an interest because they can stations to broadcast locally, except through the benefit from the TV business (Baumann and broadcasting network. -

Cinema of the Social: Stars, Fans and the Standardization of Genre in Tamil Cinema

Western University Scholarship@Western Digitized Theses Digitized Special Collections 2011 CINEMA OF THE SOCIAL: STARS, FANS AND THE STANDARDIZATION OF GENRE IN TAMIL CINEMA Ganga Rudraiah Follow this and additional works at: https://ir.lib.uwo.ca/digitizedtheses Recommended Citation Rudraiah, Ganga, "CINEMA OF THE SOCIAL: STARS, FANS AND THE STANDARDIZATION OF GENRE IN TAMIL CINEMA" (2011). Digitized Theses. 3315. https://ir.lib.uwo.ca/digitizedtheses/3315 This Thesis is brought to you for free and open access by the Digitized Special Collections at Scholarship@Western. It has been accepted for inclusion in Digitized Theses by an authorized administrator of Scholarship@Western. For more information, please contact [email protected]. CINEMA OF THE SOCIAL: STARS, FANS AND THE STANDARDIZATION OF GENRE IN TAMIL CINEMA r , ' (Spine title: CINEMA OF THE SOCIAL) (Thesis Format: Monograph) by : Ganga Rudraiah Graduate Program in Film Studies A thesis submitted in partial fulfillment of the requirements for the degree of Master of Arts The School of Graduate and Postdoctoral Studies The University of Western Ontario London, Ontario, Canada © Ganga Rudraiah 2011 THE UNIVERSITY OF WESTERN ONTARIO SCHOOL OF GRADUATE AND POSTDOCTORAL STUDIES CERTIFICATE OF EXAMINATION r Supervisor Examiners Dr. Christopher E. Glttings Dr. James Prakash Younger Supervisory Committee Dr. Constanza Burucúa Dr. Chris Holmlund The thesis by Ganga Rudraiah entitled: Cinema of the Social: Stars, Fans and the Standardization of Genre in Tamil Cinema is accepted in partial fulfillment of the requirements for the degree of Master of Arts Date Chair of the Thesis Examination Board Abstract The star machinery of Tamil cinema presents itself as a nearly unfathomable system that produces stars and politicians out of actors and fans out of audiences in an organized fashion. -

Frankenstein's Avatars: Posthuman Monstrosity in Enthiran/Robot

Rupkatha Journal on Interdisciplinary Studies in Humanities (ISSN 0975-2935), Vol. 10, No. 2, 2018 [Indexed by Web of Science, Scopus & approved by UGC] DOI: https://dx.doi.org/10.21659/rupkatha.v10n2.23 Full Text: http://rupkatha.com/V10/n2/v10n223.pdf Frankenstein’s Avatars: Posthuman Monstrosity in Enthiran/Robot Abhishek V. Lakkad Doctoral Research Candidate, Centre for Studies in Science, Technology and Innovation Policy (CSSTIP), School of Social Sciences, Central University of Gujarat, Gujarat. ORCID ID: 0000-0002-0330-0661. Email: [email protected] Received January 31, 2018; Revised April 22, 2018; Accepted May 19, 2018; Published May 26, 2018. Abstract This paper engages with ‘Frankenstein’ as a narrative structure in Indian popular cinema, in the context of posthumanism. Scholarship pertaining to monsters/monstrosity in Indian films has generally been addressed within the horror genre. However, the present paper aspires to understand monstrosity/monsters as a repercussion of science and technology (S&T) through the cinematic depiction of Frankenstein-like characters, thus shifting the locus of examining monstrosity from the usual confines of horror to the domain of science fiction. The paper contends Enthiran/Robot (Shankar 2010 Tamil/Hindi) as an emblematic instance of posthuman monstrosity that employs a Frankenstein narrative. The paper hopes to bring out the significance of cinematic imagination concerning posthuman monstrosity, to engage with collective social fears and anxieties about various cutting-edge technologies as well as other socio-cultural concerns and desires at the interface of S&T, embodiment and the society/nation. Keywords: Posthumanism, Monstrosity, Frankenstein, Indian popular cinema, Science Fiction, Enthiran/Robot The Frankenstein narrative and Posthuman Monstrosity It has been argued that in contemporary techno-culture Science Fiction (hereafter SF) performs the role of “modern myth(s)” (Klein, 2010, p.137). -

MARKET LENS 13255 Intraday Pic SUNTV Resistance 13449 Intraday Pick PETRONET 13504 Intraday Pick GODREJPROP

Institutional Equity Research NIFTY 13393 IN FOCUS December 09, 2020 Support 13324 Stock in Focus Kalpataru Power MARKET LENS 13255 Intraday Pic SUNTV Resistance 13449 Intraday Pick PETRONET 13504 Intraday Pick GODREJPROP EQUITY INDICES Indices Absolute Change Percentage Change Domestic Last Trade Change 1-D 1-Mth YTD BSE Sensex 45,609 182 0.4% 5.4% 10.6% CNX Nifty 13,393 37 0.3% 6.0% 10.1% S&P CNX 500 11,089 18 0.2% 8.0% 12.3% SENSEX 50 14,013 42 0.3% 5.9% 10.0% International Last Trade Change 1-D 1-Mth YTD DJIA 30,174 104 0.4% 2.6% 5.7% NASDAQ 12,583 63 0.5% 8.9% 40.2% NIKKEI 26,707 240 0.8% 7.2% 12.8% HANGSENG 26,550 245 0.9% 1.0% (5.8%) ADRs / GDRs Last Trade Change 1-D 1-Mth YTD Dr. Reddy’s Lab (ADR) 67.8 0.2 0.2% 7.6% 67.0% Tata Motors (ADR) 12.5 (0.1) (0.6%) 24.1% (3.7%) STOCK IN FOCUS Infosys (ADR) 16.0 0.4 2.5% 10.1% 55.1% f Kalpataru Power (KPP) and its subsidiary, JMC Projects are the ICICI Bank (ADR) 13.9 (0.1) (0.6%) 4.7% (8.1%) plays on large opportunities in seven key infrastructure segments in HDFC Bank (ADR) 67.4 0.1 0.1% 0.1% 6.3% India and abroad. We expect total opportunities worth ~Rs8 trillion Axis Bank (GDR) 42.6 0.1 0.2% 6.4% (19.9%) over the next 5 years. -

ABSTRACT: in India Till 1991 There Was Only One Television Channel

ABSTRACT: In India till 1991 there was only one television channel –Doordarshan, the public service broadcaster. With the opening up of the Indian economy in early 1990s enabled the entry of private broadcasters in India. The number of television channels has proliferated manifold. By 2005 India had more than 200 digital channels. The number of television channels has grown from around 600 in 2010 to 800 in 2012.This includes more than 400 news and current affairs channel. Technological changes have caused intense competition in news and general entertainment channels, as a result of which there is growth in regional and niche channels. The growth of cable and satellite television and direct to home television services has continued to drive television as the most preferred medium among advertisers. Broadcasters are also tapping into online and mobile media to increase their revenue. This paper seeks to study the impact of privatisation on media policy of the Government of India and how it has evolved various institutional mechanisms to deal with the growth of television as the medium to study the effect of privatisation and convergence on media regulations as television is the most powerful medium. The visual images transmitted by television reach large section of the Indian population irrespective of linguistic and cultural differences. GROWTH OF THE TELEVISION INDUSTRY IN INDIA: Television began in India in 1959 as an educational project supported by the United Nations Educational Scientific and Cultural Organisation (UNESCO) and the Ford Foundation. Television was based on the model of a public broadcasting system prevalent in many countries of Europe. -

Details of Non-News Channels Carrying More Than 12 Minutes

Details of Non-news Channels carrying more than 12 minutes average duration per hour of Advertisements (Commercial & Self promotional) during peak hours ( 7PM - 10 PM) for the period 01 Jan - 25 Mar 2018. Average duration per hour of Name of Channel (Non S. No. Name of the Broadcaster Advertisements News) during peak hours (in minutes) 1 B4U Television Network I Pvt. Ltd. B4U Movies 25.88 2 HHP Broadcasting Services P. Ltd. Dabangg 22.87 3 B4U Television Network I Pvt. Ltd. B4U Music 20.02 4 Brand Value Communications Ltd. Rupashi Bangla 19.65 5 TV VISION LTD Mastiii 19.35 6 Sun TV Network Ltd. SUN LIFE 17.79 7 Sun TV Network Ltd. ADITHYA 16.99 8 Sun TV Network Ltd. UDAYA MOVIES 16.75 9 Sun TV Network Ltd. GEMINI MOVIES 16.73 10 Sun TV Network Ltd. Surya Movies 16.48 11 Sun TV Network Ltd. K TV 16.46 12 Sun TV Network Ltd. K TV HD 16.46 13 Sun TV Network Ltd. SUN TV 16.41 14 Sun TV Network Ltd. SUN TV HD 16.41 15 Asianet Communications Ltd Asianet Plus 16.03 16 Bangla Entertainment Private Ltd AATH 15.93 17 Sony Pictures Networks India Pvt. Ltd. SET MAX (MAX TV) 15.91 18 Sun TV Network Ltd. GEMINI TV 15.85 19 Sun TV Network Ltd. GEMINI TV HD 15.85 20 Asianet Communications Ltd Star Suvarna 15.83 21 Sun TV Network Ltd. UDAYA TV 15.76 22 STAR India Pvt Ltd Movies OK 15.64 23 STAR India Pvt Ltd STAR Movies 15.61 24 STAR India Pvt Ltd STAR Gold 15.58 25 Sony Pictures Networks India Pvt. -

Sun TV Network Limited: Rating Reaffirmed Summary of Rating Action

July 01, 2019 Sun TV Network Limited: Rating Reaffirmed Summary of rating action Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. crore) (Rs. crore) Short term - Non-fund based 12.50 12.50 [ICRA]A1+; reaffirmed Total 12.50 12.50 *Instrument details are provided in Annexure-1 Rationale The rating reaffirmation draws comfort from STNL’s established presence; strong brand equity of ‘Sun TV’; and the company’s strong financial profile. The company witnessed strong revenue growth of 27.7% in FY2019 supported by healthy growth in subscription and advertisement revenues, and its margins remained strong at an OPM of 68.9% and NPM of 37.5%, aided by its scale, high bargaining power and nil debt position. The company has had zero debt every year, with sizeable cash and liquid investments of Rs. 2,686.5 crore as on March 31, 2019 (PY: Rs,1,896.9), facilitated by its strong accruals. By virtue of ‘Sun TV’ being one of the top viewership channels and having consistently high television rating points (TRP’s), the company has significant bargaining power over its content providers. This, in turn, has aided in control over telecasted content and facilitated advertisement revenue growth. As per the new TRAI order, every customer is entitled to a set free to air channels which may or may not include popular channels offered by major broadcasters. In addition, customers can choose channels/packs offered by the broadcasters based on their interest. However, Sun TV is part of the base pack in its viewership locations by virtue of user preference. -

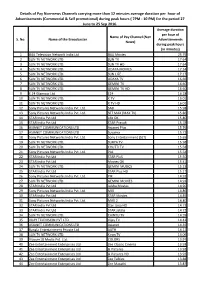

Details of Pay Non-News Channels Carrying More Than 12 Minutes

Details of Pay Non-news Channels carrying more than 12 minutes average duration per hour of Advertisements (Commercial & Self promotional) during peak hours ( 7PM - 10 PM) for the period 27 June to 25 Sep 2016. Average duration per hour of Name of Pay Channel (Non S. No. Name of the Broadcaster Advertisements News) during peak hours (in minutes) 1 B4U Television Network India Ltd B4U Movies 25.79 2 SUN TV NETWORK LTD. SUN TV 17.64 3 SUN TV NETWORK LTD. SUN TV HD 17.64 4 SUN TV NETWORK LTD. UDAYA MOVIES 17.34 5 SUN TV NETWORK LTD. SUN LIFE 17.17 6 SUN TV NETWORK LTD. UDAYA TV 16.66 7 SUN TV NETWORK LTD. GEMINI TV 16.60 8 SUN TV NETWORK LTD. GEMINI TV HD 16.60 9 E 24 Glamour Ltd E24 16.18 10 SUN TV NETWORK LTD. K TV 16.01 11 SUN TV NETWORK LTD. K TV HD 16.01 12 Sony Pictures Networks India Pvt. Ltd. SAB 15.98 13 Sony Pictures Networks India Pvt. Ltd. SET MAX (MAX TV) 15.86 14 STAR India Pvt Ltd Life OK 15.80 15 STAR India Pvt Ltd STAR Pravah 15.78 16 ASIANET COMMUNICATIONS LTD Asianet Plus 15.76 17 ASIANET COMMUNICATIONS LTD Suvarna 15.72 18 Sony Pictures Networks India Pvt. Ltd. Sony Entertainment (SET) 15.65 19 SUN TV NETWORK LTD. SURYA TV 15.58 20 SUN TV NETWORK LTD. CHUTTI TV 15.58 21 Sony Pictures Networks India Pvt. Ltd. PAL 15.54 22 STAR India Pvt Ltd STAR PluS 15.50 23 STAR India Pvt Ltd Movies OK 15.41 24 SUN TV NETWORK LTD. -

Sun TV Network Ltd

Sun TV Network Ltd. BUY Target Price `625 CMP `410 FY15 PE 15.1x Index Details We initiate coverage on Sun TV Network Ltd (Sun TV) as a BUY Sensex 19,242 with a price Objective of `625 representing a potential upside of Nifty 5,848 ~52.4% over a period of 24 months. At a CMP of `410, the stock is BSE 100 5,908 trading at 22.2x and 18.1x its estimated earnings for FY13 and Industry Media FY14 respectively. With ~2 mn households in Chennai (1.3-1.5 mn cable subscribers and 0.5 mn DTH subscribers) and ~11 mn Scrip Details subscribers in five cities of Phase II (Bangalore, Hyderabad, Mysore, Coimbatore and Vishakhapatnam), Sun TV is expected to Mkt Cap (` cr) 16,138 be one of the biggest beneficiaries of impending digitisation in BVPS ( ) 63.7 ` these geographies. Sun TV’s revenues are expected to grow at a O/s Shares (Cr) 39.4 CAGR of 14.6% to `2,778.0 crore with cable subscription revenues Av Vol (Lacs) 2.1 growing at a CAGR of 30.2% while DTH is expected to grow at a 52 Week H/L 431/177 CAGR of 21.6% by FY15. In line with revenues, PAT is expected to Div Yield (%) 2.3 grow at a 15.6% CAGR from `692.9 crore in FY12 to `1,070.6 crore FVPS (`) 5.0 by FY15. Shareholding Pattern Digitisation to provide fillip to Sun TV’s subscription revenues Shareholders % Near term triggers from the implementation of digitisation in Phase I (Chennai) and Promoters 77.0 Phase II cities should help boost Sun TV’s subscription revenues. -

A Study Onbrand Equity of Sun Tv Network with Special

PROJECT REPORT “A STUDY ONBRAND EQUITY OF SUN T.V NETWORK WITH SPECIAL REFERENCE TO ITS CHANNELS, BANGALORE” SUBMITTED BY Mr.S.DILIP KUMAR 15P35G0103 UNDER THE GUIDANCE OF Ms.SREEJA.K NEW HORIZON COLLEGE MASTERS OF BUSINESS ADMINISTRATION BHARATHIAR UNIVERSITY COLLEGE CODE: KA 11 B 131 2016-2017 GUIDE CERTIFICATE This is to certify that the project report entitled“A STUDY ON BRAND EQUITY OF SUN NETWORK” submitted by DILIP KUMAR S bearing registration number 15P35G0103 to Bharathiar University for the partial fulfillment of master degree in business management is an outcome of genuine research work carried under my guidance and it has been submitted for the award of any degree, diploma or prize. DATE Ms. SREEJA K Bangalore ASSISTANT PROFESSOR PRINCIPAL’S CERTIFICATE This is to certify that DILIP KUMAR S bearing registration no 15P35G0103 is a bonafide student of this college. The project entitled “A STUDY ON BRAND EQUITY OF SUN NETWORK” is a work carried out by him in partial fulfillment of the requirements for master degree in Business management of Bharathiar University along the year 2016-17 DATE Dr. R BODHISATVAN Bangalore HOD CERTIFICATE This is to certify that DILIP KUMAR S bearing registration number 15P35G0103 is a bonafide student of this college. The project work entitled “A STUDY ON BRAND EQUITY OF SUN NETWORK” is a work carried out by him for partial fulfillment of the requirements for Master Degree in Business management of Bharathiar University during the year 2016-17. It is certified that all the corrections/suggestions have been incorporated in the project report and a copy is deposited in the department library. -

Factsheet March 2021

FACTSHEET MARCH 2021 Remember this TASK, Always wear a MASK Stay Safe. Stay Healthy *The Bank of Baroda logo belongs to Bank of Baroda and is used under license. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The Bank of Baroda logo belongs to Bank of Baroda CIO LETTER - March 2021 and is used under license Mr. Sanjay Chawla Chief Investment Officer Dear Investors, Warm Greetings! The BSE Sensex and Nifty 50 index ended with minor gains of 0.8% and 1.1% in the month of March. Globally, stock markets rallied sharply with DOW JONES up 5.6% and S&P500 up 3.8%. European markets too rallied by 5-6% for the month of March. In India, the breadth was positive with the BSE Mid-cap and BSE Small-cap indices gaining by 1% and 2.5% respectively. Amongst sector indices, IT, FMCG, Metals outperformed while Oil & Gas, Bank and Auto underperformed during last month. While the month started on a positive note as 3QFY21 GDP grew at 0.4% after two quarters of contraction and expansion of the vaccination drive, a rapid spurt in Covid-19 cases, imposition of lockdowns, night curfews and other restrictions, weak macroeconomic data, elevated crude prices and jump in bond yield weighed on market sentiments. In its policy meeting the US Federal Reserve kept interest rates unchanged; it also mentioned that it does not currently expect to hike interest rates through 2023 and will maintain the current quantum of bond purchases. The policy rates remained at 0%-0.25% band and median estimate for unemployment rates are pegged at 4.5% end 2021 and 3.9% end 2022. -

Media Buzz Large Regional TV Opportunity; Competitive Intensity on the Rise

Asia Pacific | India Media - General (Citi) Industry Focus 5 December 2008 23 pages Media Buzz Large Regional TV Opportunity; Competitive Intensity on the Rise High growth regional entertainment market — The size of the six major regional markets is estimated to be ~Rs 21b, thus contributing about a fourth of the overall Surendra Goyal, CFA1 TV ad revenues in India. Sun TV Network and Zee News are the larger listed players that benefit from the regional entertainment market opportunity. 'Viewership - Revenue' mismatch — The share of advertising revenue for the Aditya Mathur1 regional language channels (~25%) is far less when compared to the viewership share (~37%). Regional advertising is growing at a pace faster than the national Jason Brueschke2 growth. Of the ad revenue pie, ~60% comes from regional ads. Large players enter the regional genre — The market is expanding as the number of corporates with deep pockets enter. Zee News has entered the Tamil, Telugu & Kannada markets while Star has entered the Marathi & Bengali segments and has aggressive plans for South India through its JV with Jupiter Entertainment. Increasing competition results in pressure on content/talent and other costs. Zee News management meeting takeaways — (a) ZEEN expects to grow at least 5% more than overall industry; (b) Zee Telugu broke even in 2QFY09 and mgmt expects Zee Kannada to breakeven by mid CY09; (c) Zee Bangla & Zee Marathi contribute to about half of ZEEN's revenues; (d) In Tamil Nadu, ZEEN targets the No 2 position, after Sun TV, within the next 12-18 months. Noteworthy this month: (1) GEC ratings decline as no fresh content aired...— For ~20 days, Hindi GECs were not airing fresh content, which led to a steep drop in ratings.