2004 ANNUAL REPORT Dover Motorsports, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Event Track Location Date Box Number Collection Auto Races 16Th Street Speedway Indianapolis, in 1950 Sep 15 CR-2-D Box 2 F26 9

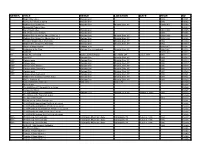

Programs by Venue Event Track Location Date Box Number Collection Auto Races 16th Street Speedway Indianapolis, IN 1950 Sep 15 CR-2-D Box 2 f26 99A104 Eastern States Midget Racing Assoc 1986 Official Program Various Tracks 1986 Annual Mezz Box 19A TQ Midgets/Carts-Baltimore Indoor Racing 1st Mariner Arena Baltimore, MD 2012 Dec 8 Mezz Box 33 98A13 Accord Speedway Souvenir Magazine Accord Speedway Accord, NY 1982 Mezz Box 19A The Buckeye Sports Car Races Akron Airport Akron, OH 1957 Sep 1 Mezz Box 84 19A27 The Buckeye Sports Car Races Akron Airport Akron, OH 1958 Aug 3 Mezz Box 1 Auto Races Akron Motor Speedway Akron, NY 1935 Jul 14 CR-2-E Box 4 f10 99A104 Auto and Motorcycle Races Akron Motor Speedway Akron, NY 1935 May 30 CR-2-E Box 4 f8 99A104 Auto Races Akron Motor Speedway Akron, NY 1935 Sep 22 CR-2-E Box 4 f12 99A104 Midget Auto Races Akron Motor Speedway Akron, NY 1936 Jul 26 CR-2-E Box 4 f19 99A104 Auto Races Akron Motor Speedway Akron, NY 1936 May 30 CR-2-E Box 4 f16 99A104 Auto Races Akron Motor Speedway Akron, NY 1937 May 30 CR-2-E Box 4 f21 99A104 Auto Races Akron Motor Speedway Akron, NY 1937 Sep 6 CR-2-E Box 4 f23 99A104 Talladega 500 Alabama International Motor Speedway Talladega, AL 1972 Aug 6 Mezz Box 28A Talladega 500 Alabama International Motor Speedway Talladega, AL 1973 Aug 12 Mezz Box 28A Winston 500 Alabama International Motor Speedway Talladega, AL 1973 May 6 Mezz Box 28A Talladega 500 Alabama International Motor Speedway Talladega, AL 1975 Aug 10 Mezz Box 28A Talladega 500 Alabama International Motor Speedway Talladega, -

Feb 04 Nonmem

The official newsletter of the Motorsport Emergency Turnworkers Association M.E.T.A. c/o 10952 McAdam Road, Delta, B.C., Canada, V4C 3E8 Newsletter c/o 3809 St Thomas St, Port Coquitlam, BC V3B 2Z2 Newsletter E-Mail: [email protected] META Website: www.meta.bc.ca March 2004 Volume 29 Issue 3 Speed reading Mar 10 SCCBC Meeting – Best Western, North Road Coquitlam, BC CLUB EXECUTIVE Mar 13&14 Group Practice – CARTBC WKA/CKR Chilliwack BC Mar 20&21 Alternate Practice – CARTBC WKA/CKR Chilliwack BC PRESIDENT: Mar 20&21 Driver Training – MRP SCCBC Mission, BC Lynn Yeo Mar 24 META Meeting – Century House 7:30 New West, BC 604-864-0459 Mar 27 Ice Race AGM – Sundance Inn 6:00 Ladner, BC [email protected] Mar 27 Season Opener – Evergreen NASCAR Monroe, Wa VICE PRESIDENT: Mar 27&28 Coastal Club Race #1 CKR Chilliwack BC Irene Chambers Apr 3&4 Westwood Club Race #1 WKA Chilliwack BC 604-944-7759 Apr 3&4 CACC Race # 1 – MRP SCCBC Mission, BC [email protected] Apr 14 SCCBC Meeting – Best Western, North Road Coquitlam, BC SECRETARY: Mike Zosiak Apr 16&17 Defrost Kickoff – PR SOVREN Seattle, Wa 604-591-7213 Apr 17&18 Coastal Club Race #2 CKR Chilliwack BC [email protected] Apr 17&18 ICSCC Race # 1 – MRP SCCBC Mission, BC TREASURER: Apr 24&25 Westwood Club Race #2 WKA Chilliwack BC Max Thompson Apr 28 META Meeting – Century House 7:30 New West, BC 604-936-2452 [email protected] DIRECTOR AT LARGE: George Chambers 604-944-7759 [email protected] It is with great sadness I must announce the passing NEWSLETTER STAFF of Hilda Randall EDITOR: Our deepest condolences go out to Bob Andrew Clouston 604-942-4974 and the rest of the Randall Family [email protected] fax:604-882-9783 Hilda passed away peacefully in her sleep (attention Andrew) Saturday March 6. -

8/14/2006 Monsports2c7

commercialappeal.com M o n d ay , August 14 , 2006 ★★★ C7 Carson Blue Devils’ cupboard isn’t bare Knowlton (right) drags down an Dauksch is trying to do it all over newly formed Class 6A with West Memphis has only been opposing Dauksch’s team aims again with many fresh faces, neighboring Marion in its con- practicing for a couple of weeks, ba l l - c a r r i e r to make noise in 6A thanks to heavy graduation loss- f e re n c e . so the race to replace departed last year. es. Among the top returnees, se- quarterback Tyler Allen is still Knowlton, NO. 9 WEST MEMPHIS “We had a very good senior nior Teddy Stackhouse is a three- wide open. who had 17 class (last year),” Dauksch said. year starter and certainly figures Seniors Holden Bell and Do- sacks as a By Craig Wack “Last year’s juniors are talented, into the Blue Devils plans. minique Hamelin are battling sophomore in wack@commercialappeal .com but they just don’t have a lot of He’ll be expected to help fill with junior Barrett Oswalt for 2005, is one experience playing on Friday the void at running back created the starting job. of several nights.” by the departures of tailback Dauksch said he’s not afraid if talented It’s become a tough act to fol- Luckily Dauksch has some Marquette Williams and fullback the Blue Devils start a little slow. p l ay e r s l ow. time to figure out who is going to Xavier Murry. -

4-17-09 Grand Prix Racers – Consolation With

www.MySpace.com/racerswhocare M E D I A A L E R T TOYOTA GRAND PRIX OF LONG BEACH RACERS’ PLANNED PLAY DATE AT MILLER CHILDREN’S HOPITAL, MAY INCLUDE CONSOLATION FOR IMMEDIATE RELEASE © 1997 RACERS WHO CARE, INC. HOLLYWOOD, CA SCBA # 725708-692 PU WHO : Racers still plan to visit young patients at Miller Children’s Hospital (a part of Long Beach Memorial Hospital) today, in spite of shootings and deaths, that occurred there yesterday. Racer Who Cares spokesracer Tim Nickel [Fresno, CA], accompanied by fellow racers Robb Holland [Denver, CO], Brandon Davis [Denver, CO], and Drew Staveley [Walnut, CA], who will be in the Long Beach area to work at, or compete in, the Toyota Grand Prix of Long Beach (April 16 – 19, 2009), had a play date planned, that they fully intend to keep, with Long Beach’s Miller Children’s Hospital patients. Nickel, Holland, Davis and Stavely, who now believe it is even more important for them to visit the young patients, sharing cheer, encouragement and sage insights. WHEN : 2:00 P.M. BE FLEXIBLE WITH DREAMS & FRIDAY, APRIL 17, 2009 GOALS! WHERE : MILLER CHILREN’S HOSPITAL AT LONG BEACH MEMORIAL 2801 ATLANTIC AVE. LONG BEACH, CA 90806 7095 HOLLYWOOD BLVD . , # 769 HOLLYWOOD , CA 90028 PHONE : 323/375-9225 E-MAIL : RACERSCARE @AOL.COM Federal Tax I.D.: 95-4417337 California Tax I.D.: 1911416 M E D I A A L E R T TOYOTA GRAND PRIX OF LONG BEACH RACERS’ PLAY DATE AT MILLER CHILDREN’S HOPITAL PAGE TWO CONTACT : RITA GOSHERT CHILD LIFE DEPARTMENT 562/933-8029 [email protected] TOYOTA GRAND PRIX OF LONG BEACH The Toyota Grand Prix of Long Beach is an open-wheel race annually held on a temporary road course in Long Beach, California. -

The Business Entertainment

THE BUSINESS OF SPORTS AND ENTERTAINMENT Teacher Edition For the 2014-15 School Year THE BUSINESS OF SPORTS & ENTERTAINMENT 2014-15 EDITION 2014-15 Membership Edition This digital publication is an updated and enhanced version of the free textbook available online and is available only to SCC members. The information contained in this version of the publication contains information current as of August, 2014. The 2014-15 edition marks the third version containing interactive elements. Please remember that the interactive links will take you to content that SCC does not control so it may be possible that some links are broken or no longer exist. Copyright © 2014 by Sports Career Consulting, LLC. All rights reserved. Reproduction or use of any portion of this publication by any mechanical, electronic, or other means is prohibited without written permission of Sports Career Consulting, LLC. PAGE 2 OF 360 INTRODUCTION THE BUSINESS OF SPORTS & ENTERTAINMENT 2014-15 EDITION PREFACE One of the greatest values of an “elective” course like sports and entertainment marketing is its ability to transform the classroom into a dynamic atmosphere where progressive “new age” learning can take place while reinforcing the same academic standards students learn within the confines of a generic business or marketing class. The examples used to support each lesson resonate on a different level for students thanks to course content that most students take a genuine interest in. Unfortunately, many instructors today wishing to integrate elective studies into the classroom face the inevitable challenge of being handcuffed by severe budget constraints. Sports Career Consulting, LLC (SCC) understands the current budget crises and is empathetic to the needs of the school system. -

Managing Travel for Planned Special Events

MANAGING TRAVEL FOR PLANNED SPECIAL EVENTS FINAL REPORT SEPTEMBER 2003 NOTICE This document is disseminated under the sponsorship of the Department of Transportation in the interest of information exchange. The United States Government assumes no liability for its contents or use thereof. This report does not constitute a standard, specification, or regulation. The United States Government does not endorse products or manufacturers. Trade and manufacturers’ names appear in this report only because they are considered essential to the object of the document. i Technical Report Documentation Page 1. Report No. 2. Government Accession No. 3. Recipient’s Catalog No. FHWA-OP-04-010 4. Title and Subtitle 5. Report Date September 2003 Managing Travel for Planned Special Events 6. Performing Organization Code 7. Author(s) 8. Performing Organization Report No. Steven P. Latoski, Walter M. Dunn, Jr., Bernie Wagenblast, Jeffrey Randall, Matthew D. Walker 9. Performing Organization Name and Address 10. Work Unit No. (TRAIS) Dunn Engineering Associates, P.C. 66 Main Street 11. Contract or Grant No. Westhampton Beach, NY 11978 DTFH61-01-C-00180 12. Sponsoring Agency Name and Address 13. Type of Report and Period Covered Office of Transportation Management Final Report Federal Highway Administration April 2002 – September 2003 400 Seventh Street, S.W. 14. Sponsoring Agency Code Washington, D.C. 20590 HOTM 15. Supplementary Notes Jon Obenberger, FHWA Operations Office of Transportation Management, Contracting Officer’s Technical Representative (COTR). Technical report was performed under contract to Science Applications International Corporation. 16. Abstract This handbook presents and recommends policies, regulations, planning and operations processes, impact mitigation strategies, equipment and personnel resources, and technology applications used in the advance planning, management, and monitoring of travel for planned special events. -

2 0 0 5 C H a M P I O

7108 Cad 2/28/06 11:36 AM Page 1 DESIGN • DEVELOP • BUILD • RACE • WIN 2004 2005 CHAMPIONS 7108 Cad 2/28/06 11:37 AM Page 2 PRATT & MILLER ENGINEERING 2005 THE PRODUCTION TEAM THANKS TO Robin Pratt OUR SPONSORS editor Richard Prince production coordinator General Motors John Machaqueiro Cadillac art direction, design XM Satellite Radio Dan Kelly Mobil 1 Colortech Graphics, Inc. Motorola printing OnStar Alleyne Kelly proofreading Bose THE PHOTOGRAPHERS with thanks also to Rick Dole Dave Friedman Katech Gregory P Johnson John Machaqueiro O-Z Wheels Darren Maybury Tremec Robert Mochernuk Robin Pratt Getrag Richard Prince Steve Robertson Borla Ray Smith Competition Graphics Denis Tanney John Thawley SCCA Pro Racing Copyright © 2006 Pratt www.teamcadillac.com & Miller Engineering & Fabrication, Inc. All rights reserved. Pratt & Miller Engineering & Fabrication, Inc. 29600 William K Smith Dr. New Hudson, MI 48165 Phone: 248-446-9800 Fax: 248-446-9020 Winners every one! www.prattmiller.com 2 7108 Cad 2/28/06 11:37 AM Page 3 PRATT & MILLER ENGINEERING 2005 SUCCESS ON ALL FRONTS Contents Winning championships with one major racing program is difficult indeed, but Success on All Fronts . 3 winning titles with multiple programs operating simultaneously is a truly remark- able accomplishment. The many successes we enjoyed this year demonstrate SEBRING: On the Podium . 4 your unwavering commitment to excellence in everything Pratt & Miller does. ST. PETERSBURG: Taking it to the Streets . 5 ROAD ATLANTA: A Clean Sweep . 6 The Cadillac program faced increased competition from factory supported MID-OHIO: Piling Up Points . 7 Porsche and Dodge teams, and struggled mightily to overcome “competition CLEVELAND: Flying High . -

Series Title Venue Location Date Year V

SERIES TITLE VENUE LOCATION DATE YEAR V# Ralph Miller video Watkins Glen 1949 V-0001 Twenty Five Years at Speed Watkins Glen 1972 V-0002 Watkins Glen Grand Prix Watkins Glen Watkins Glen, NY 1948-1953 V-0003 Graham Hill Tribute Video V-0004 Darrell Dean video Watkins Glen 1954-1980 V-0005 MG, Allard, Lister Banquet Watkins Glen 1998 V-0006 Watkins Glen Grand Prix (Muzzy film) vol 1 Watkins Glen Watkins Glen, NY 1948-1949 V-0007 Watkins Glen Grand Prix (Muzzy film) vol 2 Watkins Glen Watkins Glen, NY 1948-1949 V-0008 Racing in Watkins Glen (Dominick) Watkins Glen Watkins Glen, NY 1952 V-0009 Watkins Glen Grand Prix Weekend Watkins Glen Watkins Glen, NY 1952 V-0010 History of Motor Racing LeMans; et al 1934-1957 V-0011 NWC Budweiser at the Glen Watkins Glen International Watkins Glen, NY 1986-1987 V-0012 NASCAR 1987-1988 V-0013 TA Trans Am, Cleveland Burke Lakefront Airport Cleveland, OH July 2, 1988 1988 V-0014 Camel GT Watkins Glen Watkins Glen, NY 1989 V-0015 HIST Vintage races Watkins Glen Watkins Glen, NY 1995 V-0016 HIST Vintage races Watkins Glen Watkins Glen, NY 1996 V-0017 HIST Vintage races (Master) Watkins Glen Watkins Glen, NY 1996 V-0018 HIST Vintage races (Camera 2) Watkins Glen Watkins Glen, NY 1996 V-0019 HIST Vintage races Watkins Glen Watkins Glen, NY 1997 V-0020 HIST Vintage races (Camera 2) Watkins Glen Watkins Glen, NY 1996 V-0021 Watkins Glen International 50th Anniv. Watkins Glen Watkins Glen, NY 1998 V-0022 WATV Classics 30 Watkins Glen Watkins Glen, NY 1998 V-0023 Collier Automotive Museum Naples FL Naples FL V-0024 -

Toyota a Tlantic

TOYOTA ATLANTIC TOYOTA 2005 Toyota Atlantic Championship Presented by Yokohama Sponsors Report® Published by Joyce Julius and Associates, Inc. Year-End Report www.joycejulius.com Series Coordinator: Stephanie Fordyce 2005 Toyota Atlantic Championship Year-End Report This report documents the amount of exposure Running order (3:51:03/$878,700) and series title time, mentions and comparable value earned by (1:10:04/$266,600) graphics, as well as vehicle sponsors during the 12-event 2005 TOYOTA identity in view of an on-board camera (OBC) Atlantic Championship Presented by YOKOHAMA (1:14:50/$247,800), mentions ($171,000) and car season, beginning with the TOYOTA Grand Prix of identity (25:23/$99,400), supplied the bulk of the Long Beach and ending with the Grand Prix of the exposure for TOYOTA. Montreal. Yokohama In all, a total of 19 telecasts--airing on Speed Channel--chronicled the series when taking replays Runner-up year-end AS&E sponsor chart accolades into consideration. During each telecast, all clear, were bestowed upon YOKOHAMA, which nabbed in-focus exposure was monitored and tabulated by 4:47:25, 100 mentions and $1,089,900 of compara- the Sponsors Report. In addition, mentions of a ble value. sponsor’s name or product(s) were counted and valued at :10 each. Running order graphics (2:12:41/$475,600), vehicle identity in view of an OBC (1:29:48/$304,900), To determine a dollar value for each sponsor’s driver uniforms (21:23/$79,800), verbal references exposure, on-screen time and mentions were ($65,000) and presented by graphics (17:15/ compared to Speed Channel’s non-discounted $60,800) led the exposure source contingent for cost per :30 commercial rate of $3,000 for each tele- YOKOHAMA. -

Annual General Meeting

The official newsletter of the Motorsport Emergency Turnworkers Association M.E.T.A. c/o 10952 McAdam Road, Delta, B.C., Canada, V4C 3E8 Newsletter c/o 3809 St Thomas St, Port Coquitlam, BC V3B 2Z2 Newsletter E-Mail: [email protected] META Website: www.meta.bc.ca November 2001 Volume 26 Issue 11 SPEED READING CLUB EXECUTIVE Nov 10 SCCBC Banquet Executive Inn Burnaby, BC PRESIDENT: Nov 13 Ice Race Meeting 7:00pm WCIRABC New West, BC Bernice Zosiak Douglas College Room 1807 604-591-7213 [email protected] Nov 14 SCCBC Meeting – Executive Inn, North Road Coquitlam, BC VICE PRESIDENT: Nov 28 AGM META Meeting – Century House 7:30 New West, BC Gerry Lomas Dec 12 SCCBC Meeting – Executive Inn, North Road Coquitlam, BC 604-882-1246 Jan 5 & 6 Ice Races Barnes Lake Cache Creek, BC [email protected] Jan 19 & 20 Ice Races Barnes Lake Cache Creek, BC SECRETARY: Jan 26 META Banquet Krystyna Mitchell Feb 2 & 3 30 th Anniversary Ice Races Barnes Lake Cache Creek, BC 604-944-7759 Feb 16 & 17 Ice Races Barnes Lake Cache Creek, BC [email protected] TREASURER: Angus Glass 604-264-1641 ANNUAL GENERAL MEETING [email protected] PAST PRESIDENT: Ann Peters META’S ANNUAL GENERAL MEETING WILL BE HELD ON 604-581-7189 WEDNESDAY NOVEMBER 28 TH [email protected] TH CENTURY HOUSE-620 8 ST NEW WESTMINSTER AT 7:30PM NEWSLETTER STAFF PLEASE PLAN ON ATTENDING THIS MEETING AS OUR ANNUAL ELECTIONS WILL BE HELD AT THIS TIME. THE POSITIONS AVAILABLE EDITOR: ARE: Andrew Clouston 604-942-4974 [email protected] PRESIDENT, VICE PRESIDENT, TREASURER, SECRETARY fax:604-882-9783 (attention Andrew) From SCCBC website MEMBERSHIP SCCBC 50th ANNIVERSARY BANQUET Thomas Liesner 604-501-1503 NOVEMBER 10, 2001 [email protected] TICKETS ON SALE NOW All opinions expressed in the Mayday CALL TINA AT 604-824-7277 OR CHERYL AT 604-941-5347 are those of the individual authors DON'T MISS THE FUNNY ANTICS AND GREAT MUSIC OF and do not necessarily reflect the opinions of the Mayday staff, Club SPECIAL ENTERTAINER Executive, or the members of META. -

SEC Form 13D/A No.21 with Exhibits: April 26, 2010 Letter to The

d1094528_13d-a.htm SC 13D/A 1 d1094528_13d-a.htm SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 SCHEDULE 13D/A (Rule 13d-101) INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO RULE 13d-2(a) Amendment No. 21 Dover Motorsports, Inc. (Name of Issuer) Common Stock, Par Value $0.10 per share (Title of Class of Securities) 260174107 (CUSIP Number) Mario Cibelli, c/o Cibelli Capital Management, L.L.C. 110 East 42nd Street, Suite 1100, New York, NY 10017 (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications) April 26, 2010 (Date of Event which Requires Filing of This Statement) If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box [_]. Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent. ____________ (1) The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes). -

Final Race Results

FINAL RACE RESULTS SPEED GT Championship Round One Mobil 1 12 Hours of Sebring Weekend Sanction # [PRWC-01-06] processing by MONITOR Systems at Sebring International Raceway on March 15-17 2006 Track Length: 3.7 as licensed to: SCCA CLUB RACING PS. ST. CAR --DURING-RACE-- FN. PS. NO DRIVER/HOMETOWN/STATE SPONSOR/CAR PTS PURSE LAPS STATUS FAST LAP SPEED 1 2 82 Mike McCann/N. Canton/OH McCann Plastics/K&N Filters/Dodge Viper 35 15000 20 2:10.670 101.936 2 5 1 Andy Pilgrim/Boca Raton/FL XM/Mobil 1/Motorola/On Star/Cadillac CTS-V 28 4000 20 -11.571 2:11.841 101.030 3 9 13 Bob Woodhouse/Blair/NE Woodhouse Auto Family/Dodge Viper 25 5500 20 -19.381 2:12.073 100.853 4 8 14 James Sofronas/Newport Beach/CA Global Motorsports Group/Porsche 911 GT3 23 1800 20 -22.464 2:12.310 100.672 5 7 66 Lawson AXA Financial/Porsche 911 GT3 21 1700 20 -22.865 2:12.181 100.771 Aschenbach(R)/Gaithersburg/MD 6 15 87 Doug Peterson(R)/Bonita Springs/FL LG ProLong Tube Headers/Chevrolet Corvette C6 20 1400 20 -47.170 2:12.653 100.412 7 11 31 Sonny Whelen/Old Saybrook/CT Whelen Engineering/Chevrolet Corvette Z06 19 1300 20 -59.145 2:13.299 99.925 8 12 64 Ricardo Imery(R)/Caracas VEN/ AXAFinancial/Cavenas Elevators/Porsche 911 GT3 18 1200 20 -1:00.005 2:14.093 99.334 9 14 17 Rob Foster(R)/Phoenix/AZ LTI Contracting/Race Craft/Dodge Viper 17 2100 20 -1:01.517 2:13.410 99.842 10 22 96 Skip Sauls(R)/Longmont/CO 3R Racing/Dodge Viper 16 2000 20 -1:09.168 2:13.754 99.585 11 13 26 Claudio Burtin/Atlanta/GA LG ProLong Tube Headers/Chevrolet Corvette C6 15 800 20 -1:18.147 2:14.339