Annual Report 2006

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Siemens Company Presentation

Siemens AG August 2021 Unrestricted | © Siemens 2021 | August 2021 Disclaimer This document contains statements related to our future business and financial Siemens neither intends, nor assumes any obligation, to update or revise these performance and future events or developments involving Siemens that may forward-looking statements in light of developments which differ from those constitute forward-looking statements. These statements may be identified by anticipated. words such as “expect,” “look forward to,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” “will,” “project” or words of similar meaning. We may also make forward-looking statements in other reports, in prospectuses, in This document includes – in the applicable financial reporting framework not presentations, in material delivered to shareholders and in press releases. In clearly defined – supplemental financial measures that are or may be alternative addition, our representatives may from time to time make oral forward-looking performance measures (non-GAAP-measures). These supplemental financial statements. Such statements are based on the current expectations and certain measures should not be viewed in isolation or as alternatives to measures of assumptions of Siemens’ management, of which many are beyond Siemens’ Siemens’ net assets and financial positions or results of operations as presented control. These are subject to a number of risks, uncertainties and factors, in accordance with the applicable financial reporting framework in its including, but not limited to, those described in disclosures, in particular in the Consolidated Financial Statements. Other companies that report or describe chapter Report on expected developments and associated material opportunities similarly titled alternative performance measures may calculate them differently. and risks of the Annual Report, and in the Half-year Financial Report, which should be read in conjunction with the Annual Report. -

Siemens Share Price

Siemens share price Stock market trend (XETRA closing prices, Frankfurt, in euros) indexed Low: 32.05 High*: 68.60 200 Siemens 180 DAX Dow Jones Stoxx 160 140 120 100 80 Nov. Jan. March May July Sept. Nov. Jan. 2003 2004 *as of January 19, 2004 Key figures – Fiscal 2003 in billions of euros Percentage 2003 2002 change Net income 2.445 1.661* + 47 Group profit 4.295 3.756 + 14 New orders 75.056 86.214 -5** Sales 74.233 84.016 -4** Net cash provided by operating activities 5.712 5.564 + 3 * excl. €936 million from sales of Infineon shares ** Adjusted for currency effects and portfolio activities Employees (I) 2003* 2002* Change Worldwide 417,000 426,000 - 9,000 Germany 170,000 175,000 - 5,000 Outside 247,000 251,000 - 4,000 Germany * September 30 Employees (II) 2% reduction worldwide Success in training and placement 5,000 new hires in Germany 12,000 in training programs Operation 2003 (I) 8 of 9 Groups Margin targets achieved targets Q4 03 FY 03 Target PG Power Generation 11.3 16.8 10 – 13 Med Medical Solutions 14.0 15.1 11 – 13 A&D Automation & Drives 10.5 9.6 11 – 13 Osram 10.3 9.8 10 – 11 PTD Power Transmission and Distr. 7.4 6.1 5 – 7 TS Transportation Systems 5.5 6.0 5 – 7 SV Siemens VDO Automotive 5.8 5.0 5 – 6 SFS* Siemens Financial Services 20.5 24.9 18 – 22 SBT Siemens Building Technologies 2.7 2.0 7 – 9 *) Return on shareholders' equity before income taxes Operation 2003 (II) Power Generation Demag Delaval successfully integrated Alstom industrial turbines round out product range Offerings for oil & gas industry expanded Operation -

Qualitative and Quantitative Analysis of Siemens Ag

QUALITATIVE AND QUANTITATIVE ANALYSIS OF SIEMENS AG Authors (Universitat de Barcelona): Patrícia Amor Agut Clara Valls Moreno Gemma Casserras EDITOR: Jordi Marti Pidelaserra (Dpt. Comptabilitat, Universitat Barcelona) 1 Patrícia Amor 14961785 Clara Valls 14959906 Gemma Casserras 14965090 Alessandra Cortegiani (Bloc 3) 14991480 2 BLOC 1: SIEMENS AG BLOC 2: Risk Analysis BLOC 3: Profitability Analysis 3 BLOC 1 SIEMENS AG BASIC INFORMATION 4 Index 1. Introduction 2. Company History 3. Vision, Mission and Strategy 3.1. Vision 3.2. Mission 3.3. Strategy 4. Company Structure 4.1. Board of directors 4.2. Management by sector 5. Company Sectors 5.1. Energy Sector 5.2. Industry Sector 5.3. Healthcare Sector 5.4. Infrastructure and cities Sector 5.5. Financial Services 5.6. Other activities 5.7. Revenues importance 6. Shareholders 7. Stakeholders 8. Competitors 5 1. Introduction: Siemens AG is a German multinational engineering and electronics conglomerate company headquartered in Munich, Germany. It is the largest based in Europe. Founded to manufacture and install telegraphic systems, Germany-based Siemens AG has prospered and grown over 165 years to become a multifaceted electronics and electrical engineering enterprise, and one of the most international corporations in the world. Founded to manufacture and install telegraphic systems, Germany-based Siemens AG has prospered and grown over 165 years to become a multifaceted electronics and electrical engineering enterprise, and one of the most international corporations in the world. The Siemens name has been synonymous with cutting-edge technologies and continuous growth in profitability. With their wide array of products, systems and services, they are world leaders in information and communications, automation and control, power, medical solutions, transportation and lighting. -

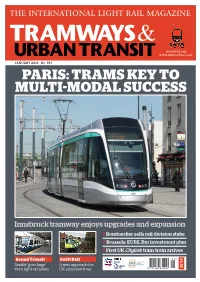

Paris: Trams Key to Multi-Modal Success

THE INTERNATIONAL LIGHT RAIL MAGAZINE www.lrta.org www.tautonline.com JANUARY 2016 NO. 937 PARIS: TRAMS KEY TO MULTI-MODAL SUCCESS Innsbruck tramway enjoys upgrades and expansion Bombardier sells rail division stake Brussels: EUR5.2bn investment plan First UK Citylink tram-train arrives ISSN 1460-8324 £4.25 Sound Transit Swift Rail 01 Seattle ‘goes large’ A new approach for with light rail plans UK suburban lines 9 771460 832043 For booking and sponsorship opportunities please call +44 (0) 1733 367600 or visit www.mainspring.co.uk 27-28 July 2016 Conference Aston, Birmingham, UK The 11th Annual UK Light Rail Conference and exhibition brings together over 250 decision-makers for two days of open debate covering all aspects of light rail operations and development. Delegates can explore the latest industry innovation within the event’s exhibition area and examine LRT’s role in alleviating congestion in our towns and cities and its potential for driving economic growth. VVoices from the industry… “On behalf of UKTram specifically “We are really pleased to have and the industry as a whole I send “Thank you for a brilliant welcomed the conference to the my sincere thanks for such a great conference. The dinner was really city and to help to grow it over the event. Everything about it oozed enjoyable and I just wanted to thank last two years. It’s been a pleasure quality. I think that such an event you and your team for all your hard to partner with you and the team, shows any doubters that light rail work in making the event a success. -

Technology Study on Consumer Energy Devices

Department of Trade and Industry Technology Study on Consumer Energy Devices Tender Ref # DTI/RSP/RMU 10/12-13 This document contains 1. The project’s Inception Report 2. The findings from Stage 1: International Best Practice Analysis 3. The findings from Stage 2: International EE Technology Scan 4. The findings from Stage 3: Local Manufacturing Capability Scan 5. The findings from Stage 4: Local Manufacturing Transition Analysis 6. The findings from Stage 5: Recommendations and Implementation Assistance 7. Addendum TABLE OF CONTENTS Inception Report ................................................................................................................................................... 4 1.1 Project Introduction ............................................................................................................................. 5 1.2 Project Objectives ................................................................................................................................ 5 1.3 Project Scope........................................................................................................................................ 6 1.4 Sources of the Literary Review ............................................................................................................. 6 1.5 High Level Project Approach to Project Analysis ................................................................................. 7 1.6 Detailed Methodology of the Primary Data Collection ....................................................................... -

2013 Customer Success Stories

Customer Success Stories 2013 Edition Stories Success Customer Customer Success Stories Proven Solutions for Every Industry ICONICS World Headquarters 100 Foxborough Blvd. Foxborough, MA 02035 Tel: 508 543 8600 Email: [email protected] ICONICS Europe ICONICS Asia Czech Republic Australia Tel: 420 377 183 420 Tel: 61 2 9727 3411 Email: [email protected] Email: [email protected] France China Tel: 33 4 50 19 11 80 Tel: 86 10 8494 2570 Email: [email protected] Email: [email protected] Germany India Tel: 49 2241 16 508 0 Tel: 91 22 67291029 Email: [email protected] Email: [email protected] Italy Tel: 39 010 46 0626 ICONICS UK Email: [email protected] United Kingdom Tel: 44 1384 246 700 Netherlands Email: [email protected] Tel: 31 252 228 588 Email: [email protected] WWW.ICONICS.COM Visualize YourYour Enterprise™Enterprise™ Customers & Partners Featured ICONICS Thanks Our Loyal Customers from Around the World ICONICS is a leading provider of award-winning real-time visualization, SCADA and operational management software for manufacturing intelligence and building automation. ICONICS software delivers significant cost reductions in design, building, deployment and maintenance for a wide variety of manufacturing companies, building owners and government organizations. ICONICS solutions have helped our users to be more agile and productive and to achieve sustained profitability. Our products are installed in over 250,000 applications worldwide, continuously delivering value to more than 70% of the Fortune 1000. © 2013 ICONICS, Inc. All rights reserved. Specifications are subject to change without notice. AnalytiX and its respective modules are registered trademarks of ICONICS, Inc. -

Siemens Annual Report 2011

D.7.2 Managing Board Peter Löscher Roland Busch, Dr. rer. nat. Brigitte Ederer Joe Kaeser President and Chief Executive Officer, Date of birth: November 22, 1964 Date of birth: February 27, 1956 Date of birth: June 23, 1957 Siemens AG First appointed: April 1, 2011 First appointed: July 1, 2010 First appointed: May 1, 2006 Date of birth: September 17, 1957 Term expires: March 31, 2016 Term expires: June 30, 2015 Term expires: March 31, 2016 First appointed: July 1, 2007 External positions External positions External positions Term expires: March 31, 2017 Positions outside Germany: Positions outside Germany: German supervisory board positions: External positions Atos S.A., France Boehringer Ingelheim RCV GmbH, Allianz Deutschland AG, Munich German supervisory board positions: Company positions Austria Positions outside Germany: Münchener Rückversicherungs- Österreichische Industrieholding AG NXP Semiconductors B.V., Netherlands German supervisory board positions: (ÖIAG), Austria Gesellschaft Aktiengesellschaft OSRAM AG, Munich Company positions in München, Munich Company positions Positions outside Germany: German supervisory board positions: Positions outside Germany: Siemens Industry, Inc., USA Positions outside Germany: BSH Bosch und Siemens Hausgeräte TBG Limited, Malta Siemens Ltd., China Siemens Aktiengesellschaft GmbH, Munich (Chairman) Österreich, Austria (Chairman) Siemens Ltd., India (Chairwoman) OSRAM AG, Munich Siemens Pte. Ltd., Singapore Siemens France Holding S.A.S., France Siemens Holding S.p.A., Italy Positions outside -

Annual Report 2004 2

s Annual Report 2004 2 Contents 4 let t er to our shareholders 13 at a glance 18 business areas 28 siemens one 32 report of the supervisory board 40 Corporate Governance Report 48 Compensation Report 54 information for shareholders * 56 Management’s discussion and analysis 96 Consolidated financial statements 174 Statement of the Managing Board 175 Independent auditors’ report 178 Supervisory Board 180 Managing Board 186 Siemens financial calendar corporat e structure ** * With separate table of contents ** See foldou2004t inside back cover. 3 Siemens – a global network of innovation comprising more than 400,000 people – offers innovative products, solutions and services spanning the entire field of electronics and electrical engineering. Our innovations are shaping tomorrow’s world, giving our cus- tomers a competitive edge and improving the lives of people every- where. We aim to capture leading market positions in all our busi- nesses and to achieve profitable growth now and in the future. Our success is based on a well-focused business portfolio, a truly global presence and an international workforce of highly qualified and highly motivated managers and employees. key figures in millions of euros 2004 (1) 2003 (1) New orders 80,830 75,056 Sales 75,167 74,233 Net income 3,405 2,445 Effects related to Infineon share sale and a goodwill impairment(2) 403 3,002 Net cash from operating and investing activities 3,262 1,773 Research and development expenses 5,063 5,067 Shareholders’ equity (September 30) 26,855 23,715 Employees (September 30, in thousands) 430 417 (1) Fiscal year: October 1 to September 30 (2) Pretax gain of €590 million on sale of Infineon shares plus related €246 million reversal of deferred tax liability, less a goodwill impairment of €433 million. -

BSH 2010 English.Indd

1 Corporate Social Responsibility Report 2010 BSH IKIAKES SYSKEVES A.B.E CONTENTS 3 1. Introduction Page 4 2. Managing Directors’ Message Page 5 The Company 3. BSH IKIAKES SYSKEVES A.B.E.: The Company Page 6 3.1. History Page 6 3.2. Plants in Athens Page 7 3.3. History of Pitsos Page 7 Corporate Social 4. BSH Ikiakes Syskeves A.B.E” and Corporate Social Responsibility (CSR) Page 8 Responsibility 4.1. The Company’s Philosophy and Sustainability Page 8 4.2 Corporate Governance Page 9 4.3. Code of Business Conduct Page 10 4.4. Mapping our Stakeholders Page 10 4.5. Memberships in Associations and Business Organisations Page 11 Human Resources 5. Acting Responsibly: Our People Page 12 5.1. Policy Page 12 5.2. Equal Opportunities at the Workplace Page 12 5.3. Health & Safety Policy Page 13 5.4. Employee Development and Training Page 14 5.5. Volunteer Work Page 15 5.6. Communicating with our Employees Page 15 The Market 6. Acting Responsibly: the Market Page 16 6.1. Policy Page 16 6.2. Products and Services Page 16 6.3. Supply Chain & Partners & Contribution to Community Page 18 6.4. Customer and Partner Satisfaction Page 18 Environment 7. Acting Responsibly: The Environment and Society Page 20 and Society 7.1. Policy Page 20 7.2. Environmental Management Page 20 7.3. Raw Material Consumption Page 21 7.4. Paper Consumption Page 21 7.5. Energy Consumption Page 21 7.6. Greenhouse Gas Emissions Reduction Page 22 7.7. Water Management and Consumption Page 23 7.8. -

Siemens Annual Report 2018

Annual Report 2018 siemens.com Table of contents . A B C Combined Management Report Consolidated Financial Statements Additional Information A.1 p 2 B.1 p 62 C.1 p 132 Organization of the Siemens Group Consolidated Statements Responsibility Statement and basis of presentation of Income C.2 p 133 A.2 p 3 B.2 p 63 Independent Auditor ʼs Report Financial performance system Consolidated Statements of Comprehensive Income C.3 p 139 A.3 p 6 Report of the Supervisory Board Segment information B.3 p 64 Consolidated Statements C.4 p 144 A.4 p 18 of Financial Position Corporate Governance Results of operations B.4 p 65 C.5 p 157 A.5 p 21 Consolidated Statements Notes and forward- looking Net assets position of Cash Flows statements B.5 p 66 A.6 p 22 Financial position Consolidated Statements of Changes in Equity A.7 p 26 B.6 p 68 Overall assessment of the economic position Notes to Consolidated Financial Statements A.8 p 28 Report on expected developments and associated material opportunities and risks A.9 p 40 Siemens AG A.10 p 43 Compensation Report A.11 p 57 Takeover-relevant information A. Combined Management Report A.1 Organization of the Siemens Group and basis of pr esentation Siemens is a technology company with core activities in the fields Non-financial matters of the Group of electrification, automation and digitalization and activities and Siemens AG in nearly all countries of the world. We are a leading supplier of Siemens has policies for environmental, employee and social power generation, power transmission and infrastructure solu- matters, for the respect of human rights, and anti-corruption and tions as well as automation, drive and software solutions for in- bribery matters, among others. -

We Are on the Right Track for Ensuring Our Success

s »We have made great progress in »We are on the right track for networking our internal value ensuring our success as the chain electronically and in linking it to our customers, suppliers and Global network of innovation.« partners. This is enabling us to accelerate processes and cut costs.« Annual Report 2001 Annual s Annual Report 2001 Siemens Aktiengesellschaft Order No. A19100-F-V055-X-7600 Siemens Siemens is a network encompassing well over 400,000 people in 190 countries. information on contents for external orders We take pride in possessing in-depth knowledge of customers' requirements, the Telephone +49 89 636-33032 (Press Office) e-mail [email protected] expertise to create innovative solutions in electrical engineering and electronics, and +49 89 636-32474 (Investor Relations) Internet http://www.siemens.de/geschaeftsbericht_2001/order Fax +49 89 636-32825 (Press Office) Telephone +49 89 636-32910 the experience to successfully navigate even rough economic waters. But our greatest +49 89 636-32830 (Investor Relations) Fax +49 89 636-32908 e-mail [email protected] asset is undoubtedly our people, with their unparalleled motivation and their passion [email protected] for outperforming our competitors. Linked via a global network that enables them address for internal orders to exchange ideas with colleagues around the world, Siemens employees strive Siemens AG Wittelsbacherplatz 2 LZF, Fürth-Bislohe continuously to increase company value. D-80333 Munich Intranet http://c4bs.spls.de/ We at Siemens do not measure value solely in terms of short-term profitability. For Federal Republic of Germany Fax +49 911 654-4271 Internet http://www.siemens.com German Order no. -

Siemens Annual Report 2019

Annual Report 2019 siemens.com Table of contents A B C Combined Consolidated Additional Information Management Report Financial Statements A.1 p 2 B.1 p 76 C.1 p 150 Organization of the Siemens Group Consolidated Statements Responsibility Statement and basis of presentation of Income C.2 p 151 A.2 p 3 B.2 p 77 Independent Auditor ʼs Report Financial performance system Consolidated Statements of Comprehensive Income C.3 p 157 A.3 p 5 Report of the Supervisory Board Segment information B.3 p 78 Consolidated Statements C.4 p 162 A.4 p 16 of Financial Position Corporate Governance Results of operations B.4 p 79 C.5 p 174 A.5 p 19 Consolidated Statements Notes and forward- looking Net assets position of Cash Flows statements B.5 p 80 A.6 p 20 Financial position Consolidated Statements of Changes in Equity A.7 p 24 B.6 p 82 Overall assessment of the economic position Notes to Consolidated Financial Statements A.8 p 26 Report on expected developments and associated material opportunities and risks A.9 p 38 Siemens AG A.10 p 40 Compensation Report A.11 p 71 Takeover-relevant information Combined Management Report Pages 1 – 74 A.1 Organization of the Siemens Group and basis of pr esentation Siemens is a technology company that is active in nearly all coun- Non-financial matters of the Group tries of the world, focusing on the areas of automation and digi- and Siemens AG talization in the process and manufacturing industries, intelligent Siemens has policies for environmental, employee and social infrastructure for buildings and distributed energy systems, con- matters, for the respect of human rights, and anti-corruption and ventional and renewable power generation and power distribu- bribery matters, among others.