2013 Annual Report and Financial Statements

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Public Notice

PUBLIC NOTICE PROVISIONAL LIST OF TAXPAYERS EXEMPTED FROM 6% WITHHOLDING TAX FOR JANUARY – JUNE 2016 Section 119 (5) (f) (ii) of the Income Tax Act, Cap. 340 Uganda Revenue Authority hereby notifies the public that the list of taxpayers below, having satisfactorily fulfilled the requirements for this facility; will be exempted from 6% withholding tax for the period 1st January 2016 to 30th June 2016 PROVISIONAL WITHHOLDING TAX LIST FOR THE PERIOD JANUARY - JUNE 2016 SN TIN TAXPAYER NAME 1 1000380928 3R AGRO INDUSTRIES LIMITED 2 1000049868 3-Z FOUNDATION (U) LTD 3 1000024265 ABC CAPITAL BANK LIMITED 4 1000033223 AFRICA POLYSACK INDUSTRIES LIMITED 5 1000482081 AFRICAN FIELD EPIDEMIOLOGY NETWORK LTD 6 1000134272 AFRICAN FINE COFFEES ASSOCIATION 7 1000034607 AFRICAN QUEEN LIMITED 8 1000025846 APPLIANCE WORLD LIMITED 9 1000317043 BALYA STINT HARDWARE LIMITED 10 1000025663 BANK OF AFRICA - UGANDA LTD 11 1000025701 BANK OF BARODA (U) LIMITED 12 1000028435 BANK OF UGANDA 13 1000027755 BARCLAYS BANK (U) LTD. BAYLOR COLLEGE OF MEDICINE CHILDRENS FOUNDATION 14 1000098610 UGANDA 15 1000026105 BIDCO UGANDA LIMITED 16 1000026050 BOLLORE AFRICA LOGISTICS UGANDA LIMITED 17 1000038228 BRITISH AIRWAYS 18 1000124037 BYANSI FISHERIES LTD 19 1000024548 CENTENARY RURAL DEVELOPMENT BANK LIMITED 20 1000024303 CENTURY BOTTLING CO. LTD. 21 1001017514 CHILDREN AT RISK ACTION NETWORK 22 1000691587 CHIMPANZEE SANCTUARY & WILDLIFE 23 1000028566 CITIBANK UGANDA LIMITED 24 1000026312 CITY OIL (U) LIMITED 25 1000024410 CIVICON LIMITED 26 1000023516 CIVIL AVIATION AUTHORITY -

Africa Beyond Covid-19: President George Weah, US Senator Chris

Africa Beyond Covid-19: President George Weah, US Senator Chris Coons, Tony Elumelu and Other Global Leaders at the 2nd UBA Africa Day Conversations Urge Government and Private Sector Collaboration . Demand a new deal in and for Africa . Advocate speedy implementation of AFCFTA . Call for Increased Investment in Digital Connectivity United Bank for Africa (UBA) celebrated Africa Day 2020, by bringing together global leaders at the 2nd UBA Africa Day Conversations, screened live across the continent. UBA helps set the debate around African economic development through its series of “Africa Conversations”. This year, the focus was on the Sustainable Development Goals (SDGs) and the Covid-19 pandemic. Leaders emphasised the need for meaningful collaboration between governments and the private sector, as a requirement for the quick recovery of the economy of the African continent post Covid-19. The panel included the President of Liberia, H.E George Weah; United States Senator Chris Coons; the President & Chairman of the Board of Directors of the African Export–Import Bank (AFREXIMBANK), Professor Benedict Okey Oramah; President, International Committee of the Red Cross (ICRC), Peter Maurer; and was moderated by the Group Chairman, UBA Plc, Tony O. Elumelu. Other leading voices contributing were the Founder, Africa CEO Forum, Amir Ben Yahmed; the Secretary-General of the African Caribbean and Pacific Group of States (ACP), H.E George Chikoti; Administrator, United Nations Development Program (UNDP), Achim Steiner and Donald Kaberuka, the former President of the African Union. Elumelu spoke on the need to mobilise quickly and explained the necessity to identify a more fundamental solution to Africa’s challenges. -

Digital Access: the Future of Financial Inclusion in Africa Acronyms

DIGITAL ACCESS: THE FUTURE OF FINANCIAL INCLUSION IN AFRICA ACRONYMS ADC Alternative Delivery Channel ISO International Organization for Standardization AFSD African Financial Sector Database IT Information Technology ARPU Average Revenue Per User KES Kenyan Shilling API Application Programming Interface KPI Key Performance Indicator ATM Automated Teller Machine KYC Know Your Customer B2P Business to Person LAPO MfB Lift Above Poverty Organization BCEAO Central Bank of West Africa (Banque Centrale Microfinance Bank des Etats de l’Afrique de l’Ouest) M-banking Mobile Banking BOI Banking Operations Intermediary M-wallet Mobile Wallet BVN Bank Verification Number MFI Microfinance Institution CEO Chief Executive Officer MM Mobile Money CBA Commercial Bank of Africa MSME Micro, Small and Medium Enterprise CBN Central Bank of Nigeria MTN Mobile Telephone Network CFA West African Franc, or Central African Franc MNO Mobile Network Operator CGAP Consultative Group to Assist the Poor MVNO Mobile Virtual Network Operator CRM Customer Relationship Management NFC Near Field Communication DFS Digital Financial Services OTC Over the Counter DJ Disc Jockey P2B Person to Business DVD Digital Versatile Disc P2P Person to Person E-banking Electronic Banking PC Personal Computer EFT Electronic Funds Transfer PIN Personal Identification Number EMI e-Money Issuer POS Point of Sale E-money Electronic Money PSP Payment Service Provider E-wallet Electronic Wallet E-warehousing Electronic Warehousing QR Quick Response FCMB First City Monument Bank RCT Randomized -

Banking Sector Liberalisation in Uganda Process, Results and Policy Options

Banking Sector Liberalisation in Uganda Process, Results and Policy Options Research report Editors: Madhyam & SOMO December 2010 Banking Sector Liberalisation in Uganda Process, Results and Policy Options Research report By: Lawrence Bategeka & Luka Jovita Okumu (Economic Policy Research Centre, Uganda) Editors: Kavaljit Singh (Madhyam), Myriam Vander Stichele (SOMO) December 2010 SOMO is an independent research organisation. In 1973, SOMO was founded to provide civil society organizations with knowledge on the structure and organisation of multinationals by conducting independent research. SOMO has built up considerable expertise in among others the following areas: corporate accountability, financial and trade regulation and the position of developing countries regarding the financial industry and trade agreements. Furthermore, SOMO has built up knowledge of many different business fields by conducting sector studies. 2 Banking Sector Liberalisation in Uganda Process, Results and Policy Options Colophon Banking Sector Liberalisation in Uganda: Process, Results and Policy Options Research report December 2010 Authors: Lawrence Bategeka and Luka Jovita Okumu (EPRC) Editors: Kavaljit Singh (Madhyam) and Myriam Vander Stichele (SOMO) Layout design: Annelies Vlasblom ISBN: 978-90-71284-76-2 Financed by: This publication has been produced with the financial assistance of the Dutch Ministry of Foreign Affairs. The contents of this publication are the sole responsibility of SOMO and the authors, and can under no circumstances be regarded as reflecting the position of the Dutch Ministry of Foreign Affairs. Published by: Stichting Onderzoek Multinationale Ondernemingen Centre for Research on Multinational Corporations Sarphatistraat 30 1018 GL Amsterdam The Netherlands Tel: + 31 (20) 6391291 Fax: + 31 (20) 6391321 E-mail: [email protected] Website: www.somo.nl Madhyam 142 Maitri Apartments, Plot No. -

Societe Generale Ghana 2019 Annual Report

ANNUAL REPORT 2019 2019 ANNUAL REPORT AND FINANCIAL STATEMENTS 2019 Major Events WE INTRODUCED NEW INNOVATIONS Electronic billboard to communicate Our 24/7 drive-in ATM to the public about our product offers at Achimota branch & Our solar project. A cleaner, more effective energy source at our head office WE LAUNCHED NEW SERVICES 2019 Major Events WE LAUNCHED EXCITING COMMERCIAL PROMOTIONS & CAMPAIGNS Loans Promotion Deposit and Win Promotion WE OPENEDM ORE OUTLETS Achimota Branch Osu Branch TABLE OF CONTENTS Overview 02 Notice and agenda for annual general meeting Corporate Governance 03 Corporate information 04 Profile of the board of directors 07 Key management personnel Strategic report 10 Chairman's statement 13 Managing director’s review Financial statements 16 Report of the directors 31 Statement of directors responsibilities 32 Independent report of the auditors 36 Financial highlights 38 Statement of profit or loss and other comprehensive income 39 Statement of financial position 40 Statement of changes in equity 41 Statement of cash flows 42 Notes to financial statement 94 Proxy form 95 Resolutions 97 Branch network 2019 ANNUAL REPORT & FINANCIAL STATEMENTS 1 Notice and Agenda NOTICE AND AGENDA FOR ANNUAL GENERAL MEETING NOTICE IS HEREBY GIVEN THAT the 40th Annual General Meeting of Societe Generale Ghana Limited (the “Company”) will be held on Thursday, 26 March 2020 at 11am at the Alisa Hotel, Ridge Arena, Accra Ghana for the following purpose:- Ordinary Business: Ordinary Resolutions 1. To elect Directors, the following directors appointed 5. To approve Directors’ fees. during the year and retiring in accordance with Section 72(1) of the Company’s Regulations: 6. -

United Bank of Africa Customer Success Story

CUSTOMER SUCCESS STORY United Bank for Africa Invests in Polycom® RealPresence® Platform to Drive Polycom UC Solution Across its Global Network Industry Overview Finance United Bank for Africa (UBA) Group is one of Africa’s leading financial institutions offering banking services to more than seven million customers via Daily use 750 branches in 18 African countries. With further offices in New York, London • Executive briefings and Paris, UBA is connecting people and businesses across the world through retail and corporate banking, innovative cross-border payments, trade finance • Board meetings and investment banking. • Quarterly business reviews • Corporate training Over the past three years, UBA had undergone a period of rapid expansion that had seen affiliate banks in 16 African countries come on board. This expansion Solution has naturally put the group’s communication infrastructure under pressure. A flexible unified communications platform In order for the Group to improve and extend its communication network at the that delivered an integrated telephony same time as alleviating the increasing pressure on travelling executives it sought and video conferencing solution to an integrated communications platform to deliver the flexibility and dynamic accommodate the growing number of resource allocation they needed for unified communications (UC). disparate and geographically-dispersed end-points. The Group stated “We required a platform to deliver an integrated telephony and video conferencing solution with the flexibility to accommodate the growing Results and benefits number of disparate and geographically-dispersed end-points.” • Increased productivity meetings The IT team was asked to lead an investigation on the best solutions • Savings in travel costs available. -

World Bank Document

THE GAMBIA: Policies to Foster Growth Public Disclosure Authorized Volume II. Macroeconomy, Finance, Trade and Energy May 19, 2015 Trade and Competitiveness Practice Cape Verde, Gambia, Guinea-Bissau, Mauritania and Senegal Country Department Africa Region Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized Document of the World Bank REPUBLIC OF GAMBIA –FISCAL YEAR January 1 st - December 31 st MONETARY EQUIVALENT (Exchange rate as of May 15, 2015) Currency Unit = Gambian Dalasi (GMD) 1,00 US$ = 42.6000 GMD WEIGHTS AND MEASUREMENTS Metric System ABBREVIATIONS AND ACRONYMS ABTA Association of British Travel Agents IPC Investment Promotion Center TEU Twenty-foot equivalent Unit ADR Average Daily Rate JIC Joint Industrial Council Agreement TFP Total Factor Productivity Agribusiness Services and Producers’ Trade Intensity Index ASPA LDCs Least Developed countries TII Association Association of Small Enterprises in Tourism Master Plan ASSET LFO Liquid Pilot Fuel TMP Tourism C.Pct Column Percentage LIC Low Income Countries ULC Unit Labor Cost CAR Capital Adequacy ratio LMIC Low Middle Income Countries UNDP United Nations Development Program CBG Central Bank of The Gambia MFI Microfinance institution UREP Upland Rice Expansion Program Ministry of Finance and Economic United Nations World Tourism CET Common external tariff MOFEA UNWTO Affairs Organization DB 2015 Doing business 2015 Report MTC Ministry of Tourism and Culture VFR Visiting Friends and Relatives Economic Community of West Ministry of Trade, Industry -

Liberia's 9 Commercial Banks

Public Disclosure Authorized IFC Mobile Money Scoping Country Report: Liberia Public Disclosure Authorized June, 2012 Public Disclosure Authorized Public Disclosure Authorized About The MasterCard Foundation Program IFC and the MasterCard Foundation (MCF) entered into a partnership focused on accelerating the growth and outreach of microfinance and mobile financial services in Sub-Saharan Africa. The partnership aims to leverage IFC’s expanding microfinance client network in the region and its emerging expertise in mobile financial services to catalyze innovative and low-cost approaches for expanding financial services to low- income populations. The Partnership has three Primary Components Mobile Financial Service IFC and The MasterCard Foundation see tremendous opportunity with Microfinance mobile banking, particularly for those living in rural areas. Mobile phones Through this partnership, IFC will result in lower transactions costs and implement a scaling program for reduce the cost of information. This Knowledge & Learning microfinance in Africa. The primary partnership will (i) identify nascent This partnership will include a major purpose of the Program is to markets to accelerate the uptake of knowledge sharing component to accelerate delivery of financial branchless banking services, (ii) work ensure broader dissemination of services in sub-Saharan Africa (SSA) with private sector players to build results, impacts and lessons learned through the significant scaling up of expertise and infrastructure to from both the microfinance and between eight and ten of IFC‘s sustainably offer financial services to mobile financial services. These strongest microfinance partners in the unbanked using mobile knowledge products will include Africa. Interventions will include technology and agent networks and product and channel diversification (iii) build robust business models that into underserved areas. -

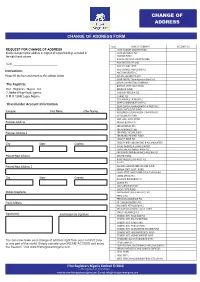

Backup of Change of Address

CHANGE OF ADDRESS CHANGE OF ADDRESS FORM TICK NAME OF COMPANY ACCOUNT NO. REQUEST FOR CHANGE OF ADDRESS ACAP CANARY GROWTH FUND Kindly change my/our address in respect of my/ourholdings as ticked in AFRICAN PAINTS PLC the right hand column ANCHOR FUND ARM AGGRESSIVE GROWTH FUND Date: _____________________________ ARM DISCOVERY FUND ARM ETHICAL FUND ASO-SAVINGS AND LOANS PLC Instructions ABC TRANSPORT PLC Please fill the form and return to the address below AUSTIN LAZ AND CO. PLC BANK PHB PLC (Now Keystone Bank Ltd) The Registrar, BCN PLC-MARKETING COMPANY BAYELSA STATE GOVT BOND First Registrars Nigeria Ltd. BEDROCK FUND 2, Abebe Village Road, Iganmu CADBURY NIGERIA PLC P. M. B. 12692 Lagos. Nigeria. CHAMS PLC COSTAIN WEST AFRICA PLC Shareholder Account Information DAAR COMMUNICATIONS PLC DEAP CAPITAL MANAGEMENT & TRUST PLC DELTA STATE GOVT BOND Surname First Name Other Names REDEEMED GLOBAL MEDIA COMPANY LTD DV BALANCED FUND EDO STATE GOVT. BOND Previous Address FAMAD NIGERIA PLC FBN HOLDINGS PLC FBN HERITAGE FUND Previous Address 2 FBN FIXED INCOME FUND FBN MONEY MARKET FUND FIDELITY BANK PLC City State Country FIDELITY NIGFUND (INCOME & ACCUMULATED) FOKAS SAVINGS & LOANS LIMITED FORTIS MICROFINANCE BANK PLC FRIESLANDCAMPINA WAMCO NIGERIA PLC Present\New Address GTBANK BOND HONEYWELL FLOUR MILLS PLC JULI PLC Present\New Address 2 KAKAWA GUARANTEED INCOME FUND KWARA STATE GOVT. BOND LAGOS STATE GOVT. BOND (1st & 2nd tranche) LEARN AFRICA PLC City State Country NIGERIAN BREWERIES PLC OANDO PLC OASIS INSURANCE PLC ONDO STATE BOND Mobile -

Participant List

Participant List 10/20/2019 8:45:44 AM Category First Name Last Name Position Organization Nationality CSO Jillian Abballe UN Advocacy Officer and Anglican Communion United States Head of Office Ramil Abbasov Chariman of the Managing Spektr Socio-Economic Azerbaijan Board Researches and Development Public Union Babak Abbaszadeh President and Chief Toronto Centre for Global Canada Executive Officer Leadership in Financial Supervision Amr Abdallah Director, Gulf Programs Educaiton for Employment - United States EFE HAGAR ABDELRAHM African affairs & SDGs Unit Maat for Peace, Development Egypt AN Manager and Human Rights Abukar Abdi CEO Juba Foundation Kenya Nabil Abdo MENA Senior Policy Oxfam International Lebanon Advisor Mala Abdulaziz Executive director Swift Relief Foundation Nigeria Maryati Abdullah Director/National Publish What You Pay Indonesia Coordinator Indonesia Yussuf Abdullahi Regional Team Lead Pact Kenya Abdulahi Abdulraheem Executive Director Initiative for Sound Education Nigeria Relationship & Health Muttaqa Abdulra'uf Research Fellow International Trade Union Nigeria Confederation (ITUC) Kehinde Abdulsalam Interfaith Minister Strength in Diversity Nigeria Development Centre, Nigeria Kassim Abdulsalam Zonal Coordinator/Field Strength in Diversity Nigeria Executive Development Centre, Nigeria and Farmers Advocacy and Support Initiative in Nig Shahlo Abdunabizoda Director Jahon Tajikistan Shontaye Abegaz Executive Director International Insitute for Human United States Security Subhashini Abeysinghe Research Director Verite -

Sierra Leone - Mobile Money Transfer Market Study

Sierra Leone - Mobile Money Transfer Market Study FINAL REPORT, March 2013 March 2013 Report prepared by PHB Development, with the support of Disclaimer The contents of this report are the responsibility of PHB Development and do not necessarily reflect the views of Cordaid. The information contained in this report and any errors or mistakes that occurred are the sole responsibility of PHB Development. 2 Contents Introduction………………………………………………………………………………3 Executive Summary and Recommendations………………………………............... 9 I. Module 1 Regulation and Partnerships (Supply side)……………………………….23 II. Module 2 Markets and products (Demand side )……………………………………..56 III. Module 3 Distribution Networks………………………………………………………..74 IV. Module 4 MFI Internal Capacity………………………………………………………..95 V. Module 5 Scenario's for Mobile Money Transfers and the MFIs in Sierra Leone...99 3 Introduction Cordaid has invited PHB Development to execute a market study on Mobile Money Transfers (MMT) in Sierra Leone and on the opportunities this market offers for Microfinance Institutions (MFIs). This study follows on the MITAF1 programme that Cordaid co-financed in the period 2004-2011. The results of the market study were shared in an interactive workshop in Sierra Leone on 26 February 2013. 27 persons attended, representing MFIs, MMT providers, the Bank of Sierra Leone and the donor. This final report represents an overview of the information collected, on which the workshop has been based. Moreover, information obtained during the workshop is reflected in this document. In addition, the MFIs have received individual assessment reports on their readiness for MMT. This report starts with an executive summary followed by recommendations for the MFIs and Cordaid. Chapters 1-5 provide detailed information on the regulation and the supply side of market players and MMT partnerships (module 1), on the demand for financial products (module 2) and the agent networks in Sierra Leone (module 3). -

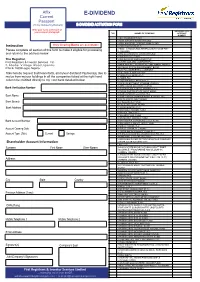

E-Dividend Mandate Activation Form of First Registrars

Affix E-DIVIDEND Current Passport (To be stamped by Bankers) E-DIVIDEND ACTIVATION FORM Write your name at the back of your passport photograph SHAREHOLER’S TICK NAMES OF COMPANY ACCOUNT NUMBER ABC TRANSPORT PLC ACAP CANARY GROWTH FUND AFRICAN DEVELOPMENT BANK BOND Instruction Only Clearing Banks are acceptable AFRICAN PAINTS PLC ASSET & RESOURCE MANAGEMENT COMPANY Please complete all section of this form to make it eligible for processing LTD(FUND) and return to the address below ARM AGGRESSIVE GROWTH FUND ARM ETHICAL FUND The Registrar, ASO-SAVINGS AND LOANS PLC First Registrars & Investor Services Ltd. AUSTIN LAZ AND COMPANY PLC 2 , A b e b e V i l l a g e R o a d , I g a n m u BANK PHB PLC (NOW KEYSTONE BANK LIMITED) P. M. B. 12692 Lagos. Nigeria. BAYELSA STATE GOVERNMENT BOND BCN PLC-MARKETING COMPANY I\We hereby request that henceforth, all my\our dividend Payment(s) due to BOC GASES NIGERIA PLC CADBURY NIGERIA PLC me\us from my\our holdings in all the companies ticked at the right hand CHAMS PLC column be credited directly to my \ our bank detailed below: COSTAIN WEST AFRICA PLC CORE INVESTMENT SCHEME (COINS) CORE VALUE ACCOUNT (COVA) Bank Verification Number CR SERVICES (CREDIT BUREAU) PLC CROSS RIVERS STATE GOVT BOND DAAR COMMUNICATIONS PLC Bank Name DEAP CAPITAL MANAGEMENT & TRUST PLC DELTA STATE GOVT BOND Bank Branch DV BALANCED FUND EDO STATE GOVT BOND Bank Address FAMAD NIGERIA PLC FBN FIXED INCOME FUND FBN HOLDINGS PLC FBN HERITAGE FUND FBN MONEY MARKET FUND Bank Account Number FBN NIGERIA EUROBOND (USD) FUND FBN NIGERIA