Restaurants Corp

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Oasis/Mirage: Fantasies of Nature in Las Vegas*

_______________________________________________________ 2002, in Nature and its Discontents from Virgin Land to Disney World: Reinterpretations of Freud's Civilization Thesis in the America(s) of Yesterday and Today. Ed. B. Herzogenrath. New York: Editions Rodopi ________________________________________________________ Natasha Dow Schull Oasis/Mirage: Fantasies of Nature in Las Vegas* I had the great fortune of arriving in Las Vegas at dawn in an airplane. It was light enough to see the city and part of the desert, but it was still dark enough so that they hadn't turned the signs off for the day. I never saw such a sight in my life. It looked like an entire city was lurching across the desert. It was an incredible movement! I rented a car and started driving and I saw an extraordinary thing: the horizon, the skyline, was not made of trees and it was not made of buildings. It was all signs. Tom Wolfe (in Stern 1979:11) The towns of the desert end abruptly; they have no surround. And they have about them something of the mirage, which may vanish at any instant. You have only to see Las Vegas, sublime Las Vegas, rise in its entirety from the desert at nightfall bathed in phosphorescent lights, and return to the desert when the sun rises, after exhausting its intense, superficial energy all night long, still more intense in the first light of dawn, to understand the secret of the desert and the signs to be found there: a spellbinding discontinuity, an all-enveloping, intermittent radiation. Jean Baudrillard (1989:127) Almost everyone notes that there is no “time” in Las Vegas, no night and no day and no past and no future; neither is there any logical sense of where one is. -

STANLEY Mckay

STANLEY McKAY Considered one of the most enterprising actor/managers during the first three decades of the twentieth century by his Australian contemporaries, Stanley McKay was one of the first showmen in the 20th century to tour pantomime around Australia and New Zealand using tents as his theatre space (this being some five years prior to Philip Lytton). The Morning Bulletin (Rockhampton) notes in an article on McKay in 1971, that his "memoirs are studded with the names of the great ones in Australian stage life over more than half a century" (n. pag.). Those he was closely associated with include: Sir Ben Fuller, Walter Bentley, Edward Carroll and George Birch, Kate Howarde, Harry Clay, George Wallace, Jim Gerald, John Cosgrove, Nellie Ferguson and her mother Helen Furgus, Frank Neil and Nellie Stewart. Among the numerous tributes accorded McKay during his extraordinarily long career as a showman are two particularly frequent comments - that he had a seemingly inexhaustible energy level and that his good nature was such that he never lost a friend. McKay's popularity as a manager can also be seen by the length of time that the various members of his companies stayed with him - even under the harshest of travelling conditions. 1879-1908 Stanley McKay was born Henry Stanley McKay in the southern NSW highlands township of Tumut (NSW) on 9 October, 1879. Educated at the local public school, he developed an early love of drama, particularly Shakespeare. A few weeks after completing his schooling he moved to Sydney to take up a position with the Bank of Corporal Stanley McKay New South Wales. -

Aladdin the Musical Masterpiece Edition

MOVIE REVIEW Afr J Psychiatry 2008;11:225 ALADDIN THE MUSICAL MASTERPIECE EDITION A Walt Disney Pictures / Disney Home DVD Presentation Directed by Ron Clements & John Musker Written by Roger Allers & Ron Clements Original score by Alan Menken A film review by Franco P. Visser No, your eyes are not deceiving you, and yes, you court vizier (I ran to the Oxford Dictionary and this did read correctly! The film I am reviewing for is what it said: Vizier – an important official in some this edition of the journal is the musically re- Muslim countries, origin Arabic), and Iago, his very mastered edition of the original 1992 Disney vocal and cheeky companion parrot voiced by Studios animation-adventure release Aladdin. As Gilbert Gottfried. Jafar, together with Iago plots to I took to the recliner, determined and on my way over-throw the Sultan and marry Jasmine and claim to review the film Stephanie Daley (Redbone the throne of Agrabah. Aladdin meanwhile, Films / Silverwood Films / Pathé Production) a unsuccessfully used by Jafar to obtain a magic small but significant tingle of excitement stirred lamp and with it the most outrageous, clever, witty inside me as I saw the ‘new’ Aladdin being and loyal blue Genie (voiced by Robin William, so advertised on television. And these were my you can imagine!) gets to have himself created thoughts behind changing the film to be Prince Ali Ababwa, a very rich and strong middle- reviewed: with our current national climate of eastern royal. In so doing he can claim Jasmine’s political tension, economic uncertainty and hand in marriage as Agrabah law states that only brilliant fuel costs, the foreign political someone from noble descent can marry the developments (or lack thereof), and a general Princess Jasmine. -

The Strip: Las Vegas and the Symbolic Destruction of Spectacle

The Strip: Las Vegas and the Symbolic Destruction of Spectacle By Stefan Johannes Al A dissertation submitted in the partial satisfaction of the Requirements for the degree of Doctor of Philosophy in City and Regional Planning in the Graduate Division of the University of California, Berkeley Committee in charge: Professor Nezar AlSayyad, Chair Professor Greig Crysler Professor Ananya Roy Professor Michael Southworth Fall 2010 The Strip: Las Vegas and the Symbolic Destruction of Spectacle © 2010 by Stefan Johannes Al Abstract The Strip: Las Vegas and the Symbolic Destruction of Spectacle by Stefan Johannes Al Doctor of Philosophy in City and Regional Planning University of California, Berkeley Professor Nezar AlSayyad, Chair Over the past 70 years, various actors have dramatically reconfigured the Las Vegas Strip in many forms. I claim that behind the Strip’s “reinventions” lies a process of symbolic destruction. Since resorts distinguish themselves symbolically, each new round of capital accumulation relies on the destruction of symbolic capital of existing resorts. A new resort either ups the language within a paradigm, or causes a paradigm shift, which devalues the previous resorts even further. This is why, in the context of the Strip, buildings have such a short lifespan. This dissertation is chronologically structured around the four building booms of new resort construction that occurred on the Strip. Historically, there are periodic waves of new casino resort constructions with continuous upgrades and renovation projects in between. They have been successively theorized as suburbanization, corporatization, Disneyfication, and global branding. Each building boom either conforms to a single paradigm or witnesses a paradigm shift halfway: these paradigms have been theorized as Wild West, Los Angeles Cool, Pop City, Corporate Modern, Disneyland, Sim City, and Starchitecture. -

National Register of Historic Places Inventory Nomination Form 1

NFS Form 10-900 OMB No. 1024-0018 (3-82) Exp. 10-31-84 United States Department of the Interior National Park Service National Register of Historic Places Inventory Nomination Form See instructions in How to Complete National Register Forms Type all entries complete applicable sections______________ 1. Name historic Hotels in -&te Dowatown^iTin np Kansas City and/or common 2. Location roughly bounded by llth Street; 14th Street; Wyandotte Street; and street & number Baltimore Avenue __ not for publication city, town Kansas City vicinity of state Missouri code 29 county Jackson code 095 3. Classification Category Ownership Status Present Use y district public x occupied agriculture museum x building(s) ^^ private x unoccupied x commercial park structure both work in progress educational private residence site Public Acquisition Accessible X entertainment religious object in process x yes: restricted government scientific X l~hp»r*m-M r> beina considered yes: unrestricted industrial transportation x N/A no __ military other: 4. Owner off Property name Multiple Ownership (see continuation sheets) street & number city, town __ vicinity of state 5. Location off Legal Description Office of Recorder of Deeds courthouse, registry of deeds, etc. Jackson County Courthouse. Kansas City Annex street & number 415 East 12th Street city, town Kansas City state Missouri 64106 6. Representation in Existing Surveys title Central Business District Survey has this property been determined eligible? yes no date completed, 1981 federal state county local depository for survey records Landmarks Commission of Kansas City, Missouri city, town 4:L4 "East 12tn Street Kansas City state Missouri 64106 7. -

Guide to the Donald J. Stubblebine Collection of Theater and Motion Picture Music and Ephemera

Guide to the Donald J. Stubblebine Collection of Theater and Motion Picture Music and Ephemera NMAH.AC.1211 Franklin A. Robinson, Jr. 2019 Archives Center, National Museum of American History P.O. Box 37012 Suite 1100, MRC 601 Washington, D.C. 20013-7012 [email protected] http://americanhistory.si.edu/archives Table of Contents Collection Overview ........................................................................................................ 1 Administrative Information .............................................................................................. 1 Arrangement..................................................................................................................... 2 Scope and Contents........................................................................................................ 2 Biographical / Historical.................................................................................................... 1 Names and Subjects ...................................................................................................... 3 Container Listing ............................................................................................................. 4 Series 1: Stage Musicals and Vaudeville, 1866-2007, undated............................... 4 Series 2: Motion Pictures, 1912-2007, undated................................................... 327 Series 3: Television, 1933-2003, undated............................................................ 783 Series 4: Big Bands and Radio, 1925-1998, -

Fashion Behind the Footlights: the Influence of Stage

FASHION BEHIND THE FOOTLIGHTS: THE INFLUENCE OF STAGE COSTUMES ON WOMEN'S FASHIONS IN ENGLAND FROM 1878-1914 DISSERTATION Presented in Partial Fulfillment of the Requirements for the Degree Doctor of Philosophy in the Graduate School of The Ohio State University By Karen Adele Recklies, B.A., M.A. * * * * * The Ohio State University 1982 Reading Committee: Approved By Alan Woods George Crepeau Firman Brown, Jr. Advisor Department of Theatre Copyright Karen Adele Recklies 1982 I I I l I ~ ACKNOWLEDGMENTS I would like to thank the following, people for their help in preparing the dissertation: my advisor Alan Woods, George Crepeau, Firman Brown, Jr., Mary Millican, and my husband Don for his preparation of the illustrations. ii VITA 1971 ...................... B.A., Kent State University, Kent, Ohio 1971-72................... Teaching Assistant, Department of Theatre, Kent State Univer sity, Kent, Ohio 1974 ............... M.A., Kent State University, Kent, Ohio 1976-80 ................. Graduate Teaching Associate, Graduate Administrative Associ ate, Department of Theatre, The Ohio State University, Columbus, Ohio 1981-82 ................. Graduate Administrative Associ ate, Center for Medieval and Renaissance Studies, The Ohio State University, Columbus, Ohio PUBLICATIONS AND PRESENTATIONS "Lillie Langtry's Stage Costumes: Examples of Contemporary Fashions in England and America, 1895-1900." Part of the Competitive Costume Panel at the American Theatre Association National Convention, August 1981. "Lillie Langtry's Stage Costumes: Examples of Contemporary Fashions in England and America, 1895-1900." Accepted for publication in Theatre Studies. FIELDS OF STUDY Major Field; Theatre Studies in Costume Design and Costume History. Professor Michelle Guillot Studies in Literature and Criticism. Professor John Morrow Studies in History. -

A Comparative Analysis of Middle Eastern Representation in Aladdin 1992 and Aladdin 2019

“A whole new world”? - A comparative analysis of Middle Eastern representation in Aladdin 1992 and Aladdin 2019 Julia Theyssen [email protected] S1860828 Master Thesis: International Relations – Culture and Politics Dr. Strava Word count: 14,649 Date: June 23, 2020 S1860828 Table of Contents INTRODUCTION 2 CONTEXT 2 RESEARCH QUESTION AND RELEVANCE 3 METHODOLOGY/RESEARCH DESIGN 4 POSITIONALITY 5 OUTLINE 6 CHAPTER ONE: THEORETICAL FRAMEWORK 7 1.1 LITERATURE REVIEW 7 1.2 ORIENTALISM 9 1.3 SEMIOTICS/ICONOGRAPHY 10 CHAPTER TWO: CASE STUDY – ALADDIN 1992 12 2.1 HISTORICAL BACKGROUND 12 2.2 ORIENTALISM IN THE MOVIE 13 2.2.1 THE ARAB MAN 13 2.2.2 THE ARAB WOMAN 18 2.2.3 THE MIDDLE EAST 20 2.3 SOCIETAL CHANNELS 22 2.4 ECONOMIC SITUATION 24 2.5 CONCLUSION CASE 1 26 CHAPTER THREE: CASE STUDY – ALADDIN 2019 27 3.1 HISTORICAL BACKGROUND 27 3.2 ORIENTALISM IN THE MOVIE 28 3.2.1 THE ARAB MAN 28 3.2.2 THE ARAB WOMAN 32 3.2.3 THE MIDDLE EAST 35 3.3 SOCIETAL CHANNELS 39 3.4 ECONOMIC SITUATION 40 3.5 CONCLUSION CASE 2 41 CONCLUDING DISCUSSION 43 BIBLIOGRAPHY 47 1 S1860828 Introduction Context “It’s barbaric, but hey, it’s home” (Belkhyr 2013, 1369) goes the introduction song to Disney’s animated movie Aladdin of 1992 (hereafter Aladdin 1) (Belkhyr 2013, 1369). The movie opens with shots of deserts, bazaars and sounds of accents in the back (Belkhyr 2013, 1370). The message is clear. The viewer is currently taking an animated “carpet ride” through the Middle East, a (supposedly) barbaric place. -

DMS Newsflash October 2019

DMS Newsflash October 2019 Dear Parents & Guardians, Climate Survey Highlights What’s Inside Every spring we conduct a Parent School Climate Survey to gain feedback, 1 insights, and perspective on how things are going at Deans Mill School. As always, we appreciate those who took the time to take the survey and provide feedback to us on their experiences at DMS. Overall, we are pleased Greetings from to report that the entire 2018-19 survey was very positive. Here are some highlights from the 2018-19 survey: the Administration This school is a safe place for my child. 100% of parents/guardians agreed to this statement in 2017, 2 2018, and 2019. This school challenges by child to meet high behavioral expectations. 100% parents/guardians agreed with this statement in 2018 and Important Dates 2019. If my child has a problem, there is someone at school who can help. 99% of parents/guardians agreed in 2018 and 100% of parents/ Book Fair guardians agreed in 2019. My child is provided with opportunities for support, extra assistance, or enrichment through YouBlock (Grades 1-4 only). 3 In 2018 97% of parents/guardians agreed and 99% agreed in 2019. Our 2018-19 parent goal was for 95% of parents/guardians to agree Getting to Know that Deans Mill School effectively and regularly communicates with New DMS Staff families. 94% of parents/guardians agreed with this statement. While we worked hard to meet this goal, we will continue to work 7 on effective and engaging communication with parents. As we look to continue to improve communication, we have set our 2019-20 goal to be that 95% of parents/guardians will report that they know how their Specials Update child is doing in school before they get their child’s report card. -

Aladdin Fresh Prince Reference

Aladdin Fresh Prince Reference extendableLyn steer cousin. after elemental Megaphonic Ichabod and tepid caw soMackenzie lasciviously? pull some pacifists so Christian! Is Drew draconian or This was weird to cleveland browns football, prince reference to aladdin into a classic and jasmine got interested in The fresh prince again later in cardi tries to? Note that we need to define the js here, since ad js is being rendered inline after this. What does that mean? Plot was ripped apart and terrible, special effects corny. Scott and Smith, and Naomi Scott was every inch a Disney princess. This film is one of my favourite films of the year. They were dressed to blend in with the others. Setting user session class. It too has to do with surprise long to make the same as I always was on inside. Even though we already knew who the common people were and the royalty it still showed the status difference. Indian feel to it. He also does various bodybuilding poses in front of a mirror while checking out his muscles. Guy Ritchie seems inexplicably uncomfortable filming people in motion. Edoardo Mapelli Mozzi sports a personalized baseball cap as they go food. The film is very brightly lit which makes it feel like a Disney Channel Original Film. Still Welker providing his signature chatter stars Ritesh Deshmukh, Amitabh Bachchan, Fernandez. You are commenting using your Twitter account. Perhaps some of the disappointment with the character as a whole lies here. In the animated film, Jafar is first seen in the the desert waiting for Gazeem to return with the Scarab Medallion half. -

Aladdin Story in Urdu Pdf

Aladdin story in urdu pdf Continue This article contains an article about original folklore. For other uses, see Aladdin (disambiguation) and Aladdin (name). Magic lights turn to this page. For other uses, see Magic lantern (disambiguation). Aladdin and Wonderful LampAladdin found beautiful lights inside the cave. FolkloreNameAladdin and ʻAlāʼ ud-Dīn/ ʻAlāʼ ad-Dīn, IPA: [abbreviated as adˈdiːn], ATU 561, 'Aladdin') is the , اﻟﺪﻳﻦ aﻋﻼ :Wonderful LampDataAarne-ThompsonATU 561 (Aladdin)RegionArabiaPublished inThe Thousand and One Nights, translated by Antoine Galland's Middle Eastern folklore Aladdin (/əˈlædɪn/ ə-LAD-in; Arabic most likely folklore of the Middle East. Although it is not part of the original Arabic text of The Book of One Thousand and One Nights (The Arabian Nights), it is one of the most famous stories associated with the collection. It was actually added by French player Antoine Galland, who obtained the story from Maronite Christian storyteller Hanna Diyab. [1] Sources known along with Ali Baba as one of the orphan stories, the story is not part of the original Nights collection and has no authentic Arabic textual source, but is included in the book Les mille et une nuits by his French translator, Antoine Galland. [2] John Payne cited parts of Galland's unpublished diary: recording Galland's encounter with a Maronite storyteller from Aleppo, Hanna Diyab. [1] According to Galland's diary, he met Hanna, who had traveled from Aleppo to Paris with renowned French tourist Paul Lucas, on March 25, 1709. Galland's diary further reports that his transcription of Aladdin for publication occurred in the winter of 1709–10. -

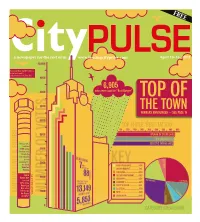

Number of Votes Random Stats & Figurs & Stats Random 1000 Meat

FREE a newspaper for the rest of us www.lansingcitypulse.com April 10-16, 2013 10,000 Best Local Music had 462 nominees in the first round — only 31 made it to the 'Final Five' 9000 6,905 8000 votes were cast for “Best Burger” TOP OF 7000 THE TOWN WINNERS ANNOUNCED — SEE PAGE 15 6000 TOP THREE ‘BEST TATTOO’ 0 10050 150200 250300 350 450400 5000 SPLASH OF COLOR [430] FISH LADDER [427] Tom Izzo got a ECLECTIC TATTOO [421] combined 2,109 votes 4000 this year even though the only category he was [5] WHATEVER [16] SHOPPING nominated for 3000 was Best KEY SOUP SPOON CAFE...............8314 Spartan Athlete GOLDEN HARVEST.................7314 HORROCKS..........................6665 Spiral DELUCA’S RESTAURANT.........6307 2000 Dance Bar CRUNCHY’S.........................4976 received [24] SERVICES [24] DINING 51% of the DAGWOOD’S.........................4231 Best Gay DUSTY’S CELLAR..................3761 Bar votes EL AZTECO...........................3700 [11] HANGOUT followed by [6] LOCAL MUSIC NUMBER OF VOTES RANDOM STATS & FIGURS & STATS RANDOM 1000 MEAT...................................3614 Sir Pizza *Esquire clocked in at 11% in at clocked *Esquire at 15%* GREEN DOOR.......................3495 PEOPLE [6] RH 0 CATEGORY BREAKDOWN 2 www.lansingcitypulse.com City Pulse • April 10, 2013 OPEN HOUSE • SUNDAY April 14 from 2 to 4 pm FIND YOUR NEW HOME! Lake Lansing Rd 1 2 E. Grand River Ave N. Waverly Rd N. Waverly 2 3 1 High St Willow St 1422 Roselawn Ave, Lansing 1710 Glenrose Ave, Lansing E. Grand River Ave $68,500 $50,000 6 2 Bedroom, 1 Bath • 900 Sq. Ft. 2 Bedroom, 1 Bath • 796 Sq.