A Publication of WWD

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

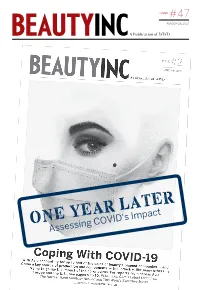

Assessing COVID's Impact

ISSUE #47 MARCH 26, 2021 A Publication of WWD ONEAssessing YEAR COVID's LATER Impact THE BUZZ 2 MARCH 26, 2021 Beauty Bulletin SK-II will release as “leftover” in Chinese culture. eight original The company's #ChangeDestiny films through its newly formed campaigns over the years also include By the SK-II Studio. “The Expiry Date,” “Meet Me Halfway” and its “Timelines” docuseries, Numbers: created in partnership with Katie Couric. Trendalytics' “All of these stories have been about the limitations that society has placed Top 10 on women, forcing them to make choices that they don't necessarily Beauty want to make,” Seth said. “We felt the need to make this brand purpose Trends much more integral. Over the last year, Data from Trendalytics across the world, a lot of unfortunate points to a return to things have been said and done. We normalcy by summer. felt that SK-II needs to take a stronger stance and have a point of view and be BY JAMES MANSO that force for good.” CONSUMERS ARE getting ready Along with its studio, SK-II has set to show their faces to the outside up a #ChangeDestiny fund, to which it world — masked or otherwise. will contribute $1 per view of its films. Trendalytics' top March trends Total contributions will be capped at point to the masses anticipating $500,000, with proceeds benefiting a return to normalcy, perhaps organizations with which SK-II has a by this summer. relationship. “People are trying to prepare Asked for the company's stance themselves for the fact that on the rise in global anti-Asian hate they’ll have to be appropriate for SK-II to Release Original Films crimes since the onset of COVID-19, human consumption sometime YoeGin Chang, SK-II Global's senior soon,” said Cece Lee Arnold, chief executive officer of Trendalytics. -

Real Scientists Answer Your Beauty Questions

Real Scientists Answer Your Beauty Questions Real Scientists Answer Your Beauty Questions edited by Sarah Bellum brains publishing Brains Publishing – New York, Chicago Copyright © 2008 by Brains Publishing All rights reserved. Published in the United States by Brains Publishing. www.brainspublishing.com The authors have attempted to make this book as accurate and up to date as possible, but it may contain errors, omissions, or material that is out of date at the time you read it. Neither the author nor publisher has any legal responsibility or liability for errors, omissions, out-of-date material, or the reader’s application of the advice contained in this book ISBN: 978-0-9802173-4-6 Printed in the United States of America First Edition For Beauty Brainiacs everywhere ... Real Scientists Answer Your Beauty Questions Table of Contents Who are the Beauty Brains viii What’s the Purpose of The Beauty Brains? ix Section I Hair Chapter 1 Hair Products and how they work The shampoo secret companies don’t want you to know 1 Is Paul Mitchell making your hair break 3 Is Ojon Restorative Treatment any good 5 Two natural oils that make your hair shiny and strong 7 Is Pantene good or bad for my hair 8 Are salon products in stores the same as those in salons 10 Do curling shampoos really work 11 Chapter 2 Tips on Caring for Your Hair Drying dilemma – What’s the best way to dry your hair 14 Three simple secrets to save your scalp 16 Want shiny hair? Avoid the dirty dozen 17 How to tell if a dandruff shampoo will really work 19 You don’t have to use -

When I Lived in England, I Was Surprised to Find That the Only Place in Town to Buy High-End Cosmetics— from Chanel to Clarins

all made up HOW WHITE COATS AND WHITE LIES CHANGED THE DISCOURSE OF BEAUTY hen I lived in England, I was surprised to find Wthat the only place in town to buy high-end cosmetics— from Chanel to Clarins to Clinique—was at Boots, the local chain pharmacy where I picked up my prescriptions. “Of course it makes sense to buy your makeup from a pharmacy!” a Boots customer assistant told me the first time I walked in, searching for a violet lipstick. “Your well-being is your beauty.” by Noël Duan 48 | bitch FEMINIST RESPONSE TO POP CULTURE Bitch Media is a non-profit, independent media organization. This wasn’t the first time I’d heard beauty equated to well - consume beauty products, convincing women that beauty ness and self-care. More and more brands are using clinical self-care is a medical and moral responsibility. Rubinstein, language to stand out in the market. Luxury-skincare brand a self-made multimillionaire and daughter of immigrants, Perricone MD calls itself the “global leader in the world of said anyone can be “made” beautiful. She created the idea of prestige skincare led by innovation, research, and science,” the beauty nerd, the glamorous pseudoscientist who studies with products ranging from antiaging eye creams to vitamin the proper techniques, routines, and products. supplements. Drugstore brand Physicians Formula, which Other beauticians took note of Rubinstein’s success. In sells itself as “Rx for Glamour,” was created by a Hollywood 1968, Evelyn Lauder—daughter-in-law of cosmetics mogul allergist, Frank Crandall. And RéVive Skincare, which sells and entrepreneur Estée Lauder—helped establish New creams and serums that cost anywhere from $60 to $1,950 at York–based Clinique and also donned a white lab coat at Neiman Marcus, markets itself as different from other luxury training sessions with her salespeople. -

Peptides, Proteins and Peeling Active Ingredients: Exploring 'Scientific' Language in English and French Cosmetics Advertisi

Études de stylistique anglaise 7 | 2014 Traversées Peptides, proteins and peeling active ingredients: exploring ‘scientific’ language in English and French cosmetics advertising Helen Ringrow Electronic version URL: http://journals.openedition.org/esa/1322 DOI: 10.4000/esa.1322 ISSN: 2650-2623 Publisher Société de stylistique anglaise Printed version Date of publication: 31 December 2014 Number of pages: 183-210 ISBN: 978-2-36442-055-7 ISSN: 2116-1747 Electronic reference Helen Ringrow, « Peptides, proteins and peeling active ingredients: exploring ‘scientific’ language in English and French cosmetics advertising », Études de stylistique anglaise [Online], 7 | 2014, Online since 19 February 2019, connection on 21 April 2019. URL : http://journals.openedition.org/esa/1322 ; DOI : 10.4000/esa.1322 Études de Stylistique Anglaise Peptides, proteins and peeling active ingredients: exploring ‘scientific’ language in English 1 and French cosmetics advertising Dr Helen RINGROW University of Portsmouth – United Kingdom 1. Cosmetics, science and pseudo-science The discourse of current beauty advertising can be characterised by the construction of ‘consumer femininity’ or ‘commodified femininity’ (Talbot 2010; Benwell and Stokoe 2006) in which femininity is a bodily characteristic which requires products for its upkeep and continual improved appearance (Gill 2007: 91). In much contemporary advertising, consumers are bombarded with various ‘scientific’ claims, lexis and imagery on product marketing materials for beauty products. Perhaps in an attempt to differentiate their product in an ever-growing market, brands are turning to science to help authenticate various cosmetics. Contemporary Western advertising copy is often saturated with references to DNA, cell coding, systems and formulas, in addition to scientific- sounding ingredients such as hyaluronic acid, bioactive glycoproteins, and biotechnological peptides. -

1001 Everyday Makeup Tips?

TABLE OF CONTENTS INTRODUCTION ............................................................................................................. 5 What In The World Am I Talking About, And Why Should You Invest Your Time To Keep Reading?..... 5 Have You Ever Experienced This? (I Like To Call It The ‘Beauty Bummer’!) ........................................... 6 Why Failure Is NOT Your Fault 90% Of The Time!................................................................................... 6 NO! Of Course Not! ................................................................................................................................... 7 And Now, “The Rest of The Story”…......................................................................................................... 7 You Are Left With 3 Options:..................................................................................................................... 8 The Beauty Bummer In Hiding…............................................................................................................... 9 You Are Being Given An Incomplete System!........................................................................................... 9 Here Is The Life of A Typical Online Product In The beauty Marketplace. ............................................... 9 But Let’s Get Real…................................................................................................................................10 THE PURPOSE OF THIS REPORT… ......................................................................... -

Effective Pigmentation Resolution That's Kind on Skin

Book your ticket to The Aesthetics Awards 2014 Today VOLUME 1/ISSUE 10 - SEPTEMBER 2014 IRESOLVEI EFFECTIVE PIGMENTATION RESOLUTION THAT’S KIND ON SKIN Advanced evidence-based dermatological medical devices, pharmaceuticals & medigrade cosmetics Treating Hair Aesthetics Collagen Radiofrequency Loss Awards supplements Leading figures share The finalists for the Practitioners discuss CPD article their methods for prestigious Aesthetics the benefits and Lee Brine explores the science behind RF hair loss treatment in Awards 2014 are limitations of orally in medical aesthetic procedures patients announced ingested collagen Aesthetics Journal Neoretin FC.indd 1 11/08/2014 17:07 Syneron Candela Launches Breakthrough Technology. Again. Introducing PicoWay. PicoWay is a remarkably innovative dual wavelength picosecond laser from Syneron Candela, the most trusted brand in lasers. With both 532nm and 1064nm wavelengths, PicoWay can treat a very broad range of tattoo types and colors and pigmented lesions on any skin type. PicoWay has the highest peak power and the shortest pulse duration of any picosecond laser for superior efficacy, safety and comfort. Proprietary PicoWay technology creates the purest photo-mechanical interaction available to most effectively impact tattoo ink and pigmented lesions, without the negative thermal effects of other lasers. And PicoWay has the reliability and low cost of ownership physicians want. PicoWay Launch @ CCR Expo, Olympia London October 10th & 11th, 2014 STAND #E10 www.syneron-candela.co.uk | [email protected] | Tel. 0845 5210698 ©2014. All rights reserved. Syneron and the Syneron logo are registered trademarks of Syneron Medical Ltd. and may be registered in certain jurisdictions. PicoWay and Candela are registered trademarks of the Candela Corporation. -

Ttabvue-91184456-OPP-48.Pdf

Trademark Trial and Appeal Board Electronic Filing System. http://estta.uspto.gov ESTTA Tracking number: ESTTA352075 Filing date: 06/10/2010 IN THE UNITED STATES PATENT AND TRADEMARK OFFICE BEFORE THE TRADEMARK TRIAL AND APPEAL BOARD Proceeding 91184456 Party Plaintiff L'Oreal USA, Inc. Correspondence Robert L. Sherman Address Paul, Hastings, Janofsky & Walker LLP 75 East 55th Street New York, NY 10022 UNITED STATES [email protected] Submission Plaintiff's Notice of Reliance Filer's Name Natalie G. Furman Filer's e-mail [email protected] Signature /NGF/ Date 06/10/2010 Attachments Pages from Exhibit I-1 - Part 11 Lexis Search Results 1985-2009-8.pdf ( 216 pages )(466633 bytes ) IN THE UNITED STATES PATENT AND TRADEMARK OFFICE BEFORE THE TRADEMARK TRIAL AND APPEAL BOARD In the Matter of Application Serial No. 76/596,736 Published in the Official Gazette on May 6, 2008 Mark: L'OREAL PARIS L’ORÉAL S.A. and L'ORÉAL USA, INC., Opposer, v. Opposition No. 91184456 ROBERT VICTOR MARCON, ORAL ARGUMENT REQUESTED Applicant. EXHIBIT I-1 Part 11 TO OPPOSER’S NOTICE OF RELIANCE Page 67 ... SAVINGS & LOAN ASSN L'OREAL SA (54%); US ... 436. Drug Store News, January 17, 1994, Pg. p16(1), 14747428, 967 words, Artificial nails biggest chip in cosmetic sales.; Product Forecast '94 ... L'Oreal ... ... L'Oreal ... ... L'Oreal's ... L'OREAL SA (82%); PAY ... 437. Sun-Sentinel (Fort Lauderdale, FL), January 14, 1994 FRIDAY,, ALL EDITION, Pg. 1E, 746 words, CYBILL SHEPHERD READY FOR ANOTHER TV SERIES, TOM JICHA; TV/Radio Writer, LOS ANGELES ... commercial spokeswoman for L'Oreal beauty products. -

Beauty at Any Age

Beauty At Any Age The best skin care, hair care, and makeup tricks to have in your image arsenal By Diana Pemberton-Sikes Please Note: You Do NOT Have the Right to Reprint or Resell this Ebook! You Also MAY NOT Give Away, Sell or Share the Content Herein If you purchased this ebook from anywhere other than http://www.fashionforrealwomen.com, you have a pirated copy. Please help stop Internet crime by reporting this to: mailto:[email protected] DISCLAIMER AND TERMS OF USE AGREEMENT The author, Diana Pemberton-Sikes, and the publisher, Top Drawer Publications, LLC, have made their best effort to produce a high quality, informative, and helpful book. But they make no representation or warranties of any kind for the completeness or accuracy of its contents. The information contained in this ebook is strictly for educational purposes. The author and publisher accept no liability of any kind for any losses or damages caused or alleged to be caused, directly or indirectly, from using the information contained in this book. Beauty at Any Age is © 2007 by Diana Pemberton-Sikes. All rights reserved worldwide. Other than a single printed copy for your personal use, no part of this publication may be reproduced or transmitted in any form whatsoever, electronic, or mechanical, including photocopying, recording, or by any informational storage or retrieval system without express written, dated, and signed permission from the author. Top Drawer Publications, LLC 256 S. College Avenue Newark, DE 19711 (302) 266-0156 http://www.topdrawerpublications.com/ © 2007 Diana Pemberton-Sikes Beauty At Any Age 2 ABOUT THE AUTHOR A former model and unrepentant clotheshorse, Diana Pemberton-Sikes is a certified color and image consultant who has been helping women reach their image goals since 1994. -

A STUDY of the FACTORS IMPACTING WOMEN's PURCHASES of ANTI-AGING SKINCARE PRODUCTS by 5 LESLIE BAILEY (Under the Direction Of

A STUDY OF THE FACTORS IMPACTING WOMEN’S PURCHASES OF ANTI-AGING SKINCARE PRODUCTS by R. LESLIE BAILEY (Under the direction of Jan M. Hathcote) ABSTRACT The purpose of this study was to discover if information sources, product attributes, and shopping orientation influence which cosmetic and skincare brand is favored by a consumer. Women who were thirty-five years or older were asked to participate in the online questionnaire. A multiple regression analysis was conducted and indicated that all three independent variables influence brand attitude. Shopping orientation had the most influence with Reputation being the most significant factor. This means women tend to buy products from the brands they believe are the highest quality and are therefore more credible. Many women also decide to purchase an anti-aging skincare product during a consultation at a cosmetics counter after the salesperson explains the benefits of using the product. With the high percentage of women receiving consultations at the department store, it is no surprise women choose to buy the luxury brands. The more expensive products are perceived to be better quality and also tend to have the more attractive containers which women are pleased to display on their bathroom counters. Limitations and implications of the study are discussed. INDEX WORDS: Cosmetics, Skincare, Anti-Aging, Marketing, Merchandising, Information Sources, Product Attributes, Shopping Orientation, Brand Attitude, Purchase Intention A STUDY OF THE FACTORS IMPACTING WOMEN’S PURCHASES OF ANTI-AGING SKINCARE PRODUCTS by R. LESLIE BAILEY B.A., Rhodes College, 2009 A Thesis Submitted to the Graduate Faculty of The University of Georgia in Partial Fulfillment of the Requirements for the Degree MASTER OF SCIENCE ATHENS, GEORGIA 2011 ©2011 Leslie Bailey All Rights Reserved A STUDY OF THE FACTORS IMPACTING WOMEN’S PURCHASES OF ANTI-AGING SKINCARE PRODUCTS by R. -

The Original Beauty Bible Unparalleled Information for Beautiful and Younger Skin at Any Age

The Original Beauty Bible Unparalleled Information for Beautiful and Younger Skin at Any Age PAULA BEGOUN BEAUTYPEDIA.COM YOUR ULTIMATE SOURCE FOR CO S METIC PRODUCT REVIEW S The Best of the Best Free Email Updates Subscribe Today Access Paula’s lists of the best Keep up with what’s new on Subscribers have exclusive access to over products or quickly find the Beautypedia.com by signing up for 40,000 skin-care and makeup reviews from product you’re searching for Paula’s FREE Beautypedia Bulletin more than 250 lines plus complete ingredient lists for every skin-care product reviewed Beautypedia.com Real Time Updates FREE Special Reports Thousands of precise, researched, New full line and individual On a wide range of cosmetic topics, and controversial reviews—all online in product reviews added from the best inexpensive products an easily searchable product database! often, so you’ll be better to cosmetics myth-busting informed than ever before! CO S METIC S COP .COM SUPERIOR SKIN-CARE & EXPERT INFORMATION FREE email Beauty Bulletins Shop Sign up for Paula’s Beauty Bulletins and stay Take a look at Paula’s state-of-the-art informed about what’s happening in the cosmetics skin-care line. There are products designed industry. Free product reviews, intriguing special for a broad range of needs and concerns, reports, “Dear Paula” Q&As, and more from acne to wrinkled, sun-damaged skin Learn Best & Worst Products Dear Paula Find extensive information on how Every month, Paula reviews new products Check out the current “Dear Paula” to determine and manage your skin and awards a “best” and “worst” product. -

Tophow the World’S100 Largest Beauty Companies Fared During COVID-19

A SPECIAL EDITION OF THE 2020 BEAUTY TOPHow the World’s100 Largest Beauty Companies Fared During COVID-19 LEAD TIME NICOLAS HIERONIMUS TAKES THE REINS THE BRAINS AT L’O R É A L BEHIND SKIN CARE’S HOTTEST BRAND SHEENA YAITANES FINE-TUNES HER CREATIVITY PREDICTING THE FUTURE OF WELLNESS April BINC Cover.indd 1 4/13/21 12:02 PM B:10.25" T:10" S:9.5" B:12.25" S:11.5" T:12" ©2021 L’Oréal USA, Inc. Untitled-22 1 4/14/21 8:36 AM Cyan, Magenta, Yellow, Black PR27687_M21CS002_02.indd | Page 1/1 Project # PR27687 Client L'Oreal Headline BECAU5E YOU'RE W0RTH IT Bleed 10.25" x 12.25" AQR CopyWriter Job # None Product 50 Anniversary Visual Viola Trim 10" x 12" Studio QA Acct Exec PP Eileen Kaufman / Frances Safety 9.5" x 11.5" Espinal Gutter None Proofreader Release QA User Brian Ng Art Director Print Prod Document Path CWWNYC:Craft Production:L’Oreal:Production:Magazine:PR27687_NYC-CWW - Beauty Inc Print 50th Anniv ft Viola:PR27687_M21CS002_02.indd | Saved 4-13-2021 7:49 PM | Print/ Export 4-13-2021 7:49 PM | Print Scale None FONTS Gotham (Book; OpenType) | IMAGES CNY_PR27687_02_462_v3_QC_G300_SWOP.tif (CMYK; 810 ppi; Up to Date; 37.01%), logo_loreal_paris_n100_rich_black.eps (Up to Date; 88.94%), CNY_PR27687_LOREAL-50-LOGO-BIWI-BLACK- FONT_SWOP.psd (CMYK; 635 ppi; Up to Date; 113.22%) SWATCHES IN DOC Black, DoNotPrint NOTES TABLE OF CONTENTS DEPARTMENTS 6 A NOVICE NO MORE Charles Rosier may have been new to beauty when he cofounded Augustinus Bader, but its meteoric success is proof positive he’s a fast learner. -

WWD-Beautyinc-Newsle

ISSUE #43 FEBRUARY 19, 2021 A Publication of WWD Hitting Refresh Virtual or no, as awards season approaches, Tinseltown derms and plastic surgeons report they're busier than ever with clients clamoring to look like Gigi Hadid and other A-listers. For more, see pages 10 and 11. PLUS: Nicolas Hieronimus, L’Oréal’s incoming CEO, on his strategic vision for Day One. COLLAGE BY JILLIAN SOLLAZZO THE BUZZ 2 FEBRUARY 19, 2021 By The Numbers: Skin Care Trends in AR/AI Tools Data from Revieve’s AI Skin Advisory Solutions show exploding adoption rates — and heightened consumer concern around aging. BY JAMES MANSO AS CONSUMERS increasingly rely on the internet to help solve their skin care concerns, artificial intelligence providers stand to gain a plethora of consumer insights. Revieve, an artificial intelligence company that offers selfie- and questionnaire-based skin care diagnostics to the consumers of over 100 brand and retailers, has noticed a serious uptick in adoption, and therefore, of what consumers are shopping for. Skin concerns that showed The Thread: the most growth in January include redness (up 38 percent), Gold Face Masks Drive Buzz — and Sales hyperpigmentation (up 37 Gold face masks are driving organic social media content, percent) and dullness (up 34 percent). However, concerns resulting in a sales boost for brands. BY ALEXA TIETJEN AND JAMES MANSO around aging, like wrinkles, fine lines and undereye bags, showed Skin care enthusiasts are lighting Dr. Maryam Zamani, a London- customers’ interest in at-home, self- the highest overall volume. up social media with gold face masks.