1310 Landsec AR2011 P01-28.Indd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Greater London Authority

Consumer Expenditure and Comparison Goods Retail Floorspace Need in London March 2009 Consumer Expenditure and Comparison Goods Retail Floorspace Need in London A report by Experian for the Greater London Authority March 2009 copyright Greater London Authority March 2009 Published by Greater London Authority City Hall The Queen’s Walk London SE1 2AA www.london.gov.uk enquiries 020 7983 4100 minicom 020 7983 4458 ISBN 978 1 84781 227 8 This publication is printed on recycled paper Experian - Business Strategies Cardinal Place 6th Floor 80 Victoria Street London SW1E 5JL T: +44 (0) 207 746 8255 F: +44 (0) 207 746 8277 This project was funded by the Greater London Authority and the London Development Agency. The views expressed in this report are those of Experian Business Strategies and do not necessarily represent those of the Greater London Authority or the London Development Agency. 1 EXECUTIVE SUMMARY.................................................................................................... 5 BACKGROUND ........................................................................................................................... 5 CONSUMER EXPENDITURE PROJECTIONS .................................................................................... 6 CURRENT COMPARISON FLOORSPACE PROVISION ....................................................................... 9 RETAIL CENTRE TURNOVER........................................................................................................ 9 COMPARISON GOODS FLOORSPACE REQUIREMENTS -

Area Guide Brochure

GALLIONS POINT AT ROYAL ALBERT WHARF | E16 AREA GUIDE Photography of show home at Gallions point. SITUATED IN EAST LONDON’S ROYAL DOCKS. Gallions Point is perfectly positioned to take advantage of living in one of the world’s greatest cities. With its rich history and culture, unparalleled shopping opportunities, world-class restaurants, award-winning green spaces, and some of the world’s most iconic buildings and landmarks, the capital has it all in abundance. In this guide you’ll find just a few of the places that make London such an incredible place to live, with a list of amenities and services that we think you’ll find useful as well. Computer generated image of Gallions Point are indicative only. BLACKWELL TUNNEL START YOUR The Blackwall Tunnel is a pair of road tunnels underneath the River Thames in east ADVENTURE AT London, England linking the London Borough of Tower Hamlets with the Royal GALLIONS POINT Borough of Greenwich. EMIRATES AIR LINE Emirates Air Line crosses the River Thames between Greenwich Peninsula and the Royal Docks, just five minutes from the O2 by North Greenwich Tube station. Cabins arrive every 30 seconds and flights are approximately 10 minutes each way. SANTANDER CYCLES DLR – LONDON BIKE HIRE GALLIONS REACH BOROUGH BUSES You can hire a bike from as With the station literally London’s iconic double- little as £2. Simply download at your doorstep, your decker buses are a quick, the Santander Cycles app destination in London is convenient and cheap way or go to any docking station easily in reach. -

71 Fenchurch Street London EC3

71 Fenchurch Street London EC3 73,891 sq ft savills.co.uk Location 71 Fenchurch Street is one of the iconic buildings within the insurance district of the City of London. Accessed via a private courtyard on Fenchurch Street, the building is adjacent to Fenchurch Street mainline station and a few minute walk from Lloyd’s. In addition to Fenchurch Street, numerous other transport hubs are within a short walk; Tower Hill (Docklands Light Railway, District and Circle lines), Aldgate (Circle, Metropolitan and Hammersmith & City lines) and Liverpool Street (mainline, Elizabeth. Central, Circle, Metropolitan and Hammersmith & City lines). Description This landmark 12 storey, Richard Rogers designed building comprises 245,000 sq ft of office space with additional ground floor retail on the Fenchurch Street and Fenchurch Place frontages. The floors are available in a range of conditions from partially fitted-out to full ‘plug-and-play’ options. Specification • Grade A office accommodation VAT • Chilled beam air conditioning • Enhanced raised floors The property has been elected for VAT. • Superb natural light and City skyline views • Cycle spaces, showers and lockers Lease • Reception café • Potential for self-contained entrance off Lloyd’s Avenue A new lease direct from the landlord. • EPC – C (68) Accommodation Quoting rent Floor Area (sq ft) Availability £62.50 per sq ft on Pt 8th floor 11th 4,732 Q3 2021 10th 4,732 Q1 2022 Rates Pt 8th 4,789 Immediate 7th 11,198 Q4 2021 £19.97 per sq ft 6th 11,185 Q3 2021 4th 20,942 Q2 2021 Service Charge LG 16,313 Q3 2021 TBC - strictly by appointment through:- Viewing Josh Lamb Jade Dedman Savills Savills 020 7409 8891 020 7330 8617 [email protected] [email protected] Important Notice: Savills, their clients and any joint agents give notice that: 1.They are not authorised to make or give any representations or warranties in relation to the property either here or elsewhere, either on their own behalf or on behalf of their client or otherwise. -

One Blackfriars in the London Borough of Southwark Planning Application No.12/AP/1784

planning report PDU/2894/01 18 July 2012 One Blackfriars in the London Borough of Southwark planning application no.12/AP/1784 Strategic planning application stage 1 referral (new powers) Town & Country Planning Act 1990 (as amended); Greater London Authority Acts 1999 and 2007; Town & Country Planning (Mayor of London) Order 2008 The proposal The erection of three buildings a tower of 50 storey (containing 274 residential units) plus basement levels, of a maximum height of 170 metres above ordnance datum (AOD), a low rise building of 6 storey “the Rennie Street building”, a low rise 4 storey building “the podium building” which together provide a mixed use development totalling 74,925 sq.m. gross external area comprising: class C1 hotel use, class C3 residential use , Class A1to A5 retail use; and 9,648 sq.m. of basement, ancillary plant, servicing and car parking with associated public open space and landscaping. The applicant The applicant is St George South London Ltd, the architect is Ian Simpson Architects and the agent is CBRE. Strategic issues Strategic issues for consideration are the principle of the proposed development; housing, affordable housing; London’s visitor infrastructure; urban design and inclusive design tall buildings and strategic views; access; Children’s and young people’s play; transport; climate change mitigation and energy; Transport and Community Infrastructure Levy. Recommendation That Southwark Council be advised that while the application is generally acceptable in strategic planning terms the application does not comply with the London Plan, for the reasons set out in paragraph 130 of this report; but that the possible remedies set out in paragraph 132 of this report could address these deficiencies. -

Consultation Statement

Maidstone Borough Council Affordable and Local Needs Housing Supplementary Planning Document Consultation Statement 21st August 2019 1 Maidstone Borough Council - Consultation Statement 1.1 Maidstone Borough Council (MBC) has recently adopted its Local Plan (October 2017) and this includes a commitment to produce an Affordable and Local Needs Housing Supplementary Planning Document (the SPD). 1.2 Adams Integra have been instructed to compile an SPD which is intended to facilitate negotiations and provide certainty for landowners, lenders, housebuilders and Registered Providers regarding MBC’s expectations for affordable and local needs housing provision in specific schemes. 1.3 The purpose of this Supplementary Planning Document (SPD) is to provide advice on how the Council’s Local Plan housing policies are to be implemented. 1.4 In order to facilitate the preparation of the SPD we (Adams Integra) consulted with the following persons and organisations: David Banfield Redrow Homes Barry Chamberlain Wealden Homes Tim Daniels Millwood Designer Homes Paul Dawson Fernham Homes Rosa Etherington Countryside Properties PLC Chris Lilley Redrow Homes Chris Loughead Crest Nicholson Iain McPherson Countryside Properties PLC Stuart Mitchell Chartway Group Chris Moore Bellway Guy Osborne Country House Developments Kathy Putnam Chartway Group James Stevens Home Builders Federation Julian Wilkinson BDW Homes Kerry Kyriacou Optivo Adetokunbo Adeyeloja Golding Homes Sarah Paxton Maidstone Housing Trust Joe Scullion Gravesend Churches Housing Association Gareth Crawford Homes Group Mike Finch Hyde HA Russell Drury Moat HA Keiran O'Leary Orbit HA Chris Cheesman Clarion Housing Micheal Neeh Sanctuary HA Colin Lissenden Town and Country West Kent HA Guy Osbourne Country House Homes Katherine Putnam Chartway Group Annabel McKie Golding Homes Councillors at Maidstone Maidstone Borough Council Borough Council 2 Maidstone Borough Council - Consultation Statement 1.5 We sent out separate questionnaires to Housing Associations and Developers which have been appended to this statement. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

One New Change for Shopping Near St Paul's London Hotels

Oct 29, 2010 12:05 IST One New Change for Shopping near St Paul’s London Hotels The newest shopping destination in London right next to the St. Paul’s Cathedral is ready to open its doors on 28th October 2010. If you are one the travellers and have plans to book hotels near St. Paul’s tube station, the search of an ideal shopping place in London ends right here at ‘One New Change’. For all those aficionados, this structure designed by Jean Nouvel is an ideal destination to explore in the core of the City of London. This development by Land Securities is complete with wide range of cuisines served through restaurants and cafes and well equipped with brands like Topshop, Banana Republic, H&M, Hugo Boss and a lot more. There is something for every taste. From apparels to accessories, for men and women, anything can be picked from the various brand stores. The building is of a contemporary style comprising of 8 floors. There are office spaces on the top and the shops at Lower Ground and ground level. With an attractive terrace on sixth floor, the mall will be the largest shopping centre in central London. The exciting views of the famous church can be access through the panoramic lift in the middle. The designer of this iconic building is the Pritzker Prize-winner and architect, Jean Nouvel. Around 6500 floor to ceiling glass panes in varying colours of grey, red and beige have been used to construct the structure. Thus, the best of shopping experiences can be relished whether you are staying in cheap or luxury hotels in St. -

22 Bishopsgate London EC2N 4BQ Construction of A

Committee: Date: Planning and Transportation 28 February 2017 Subject: Public 22 Bishopsgate London EC2N 4BQ Construction of a building arranged on three basement floors, ground and 58 upper floors plus mezzanines and plant comprising floorspace for use within Classes A and B1 of the Use Classes Order and a publicly accessible viewing gallery and facilities (sui generis); hard and soft landscaping works; the provision of ancillary servicing and other works incidental to the development. (201,449sq.m. GEA) Ward: Lime Street For Decision Registered No: 16/01150/FULEIA Registered on: 24 November 2016 Conservation Area: St Helen's Place Listed Building: No Summary The planning application relates to the site of the 62 storey tower (294.94m AOD) granted planning permission in June 2016 and which is presently being constructed. The current scheme is for a tower comprising 59 storeys at ground and above (272.32m AOD) with an amended design to the top. The tapering of the upper storeys previously approved has been omitted and replaced by a flat topped lower tower. In other respects the design of the elevations remains as before. The applicants advise that the lowering of the tower in the new proposal is in response to construction management constraints in relation to aviation safeguarding issues. The planning application also incorporates amendments to the base of the building, the public realm and to cycle space provision which were proposed in a S73 amendment application and which your Committee resolved to grant on 28 November 2016, subject to a legal agreement but not yet issued. The building would provide offices, retail at ground level, a viewing gallery with free public access at levels 55 and 56 and a public restaurant and bar at levels 57 and 58. -

Units 1 & 2 Hampstead Gate

UNITS 1 & 2 HAMPSTEAD GATE FROGNAL | HAMPSTEAD | LONDON | NW3 FREEHOLD OFFICE BUILDING FOR SALE AVAILABLE WITH FULL VACANT POSSESSION & 4 CAR SPACES 3,354 SQFT / 312 SQM (CAPABLE OF SUB DIVISION TO CREATE TWO SELF CONTAINED BUILDINGS) OF INTEREST TO OWNER OCCUPIERS AND/OR INVESTORS www.rib.co.uk INVESTMENT SUMMARY www.rib.co.uk • 2 INTERCONNECTING OFFICE BUILDINGS CAPABLE OF SUB DIVISION (TWO MAIN ENTRANCES) • 4 CAR PARKING SPACES • CLOSE PROXIMITY TO FINCHLEY ROAD UNDERGROUND STATION AND THE O² CENTRE • FREEHOLD • AVAILABLE WITH FULL VACANT POSSESSION SUMMARY www.rib.co.uk F IN C H LE Y HAMPSTEAD R F O I A GATE T EST D Z J HAMPSTEAD O Belsie Park H N H ’ A S V E A R V S Finchle Rd & Fronall T E O N CK U H E IL West Hampstead 2 L W O2 Centre E S ESIE PA T Finchle Rd E N D SUTH Swiss Cottae Chalk Farm L A D K HAMPSTEAD E ROA IL N AID BURN DEL E A HI OAD G E R H SIZ RO L E B F A I D N C H L E Y A B R A O V PIMSE HI B E E A Y N D D A R U RO E RT O E A R LB D O A A CE St ohns Wood D IN PR M IUN A W ID E A L L V I A N L G E T O EGENTS PA N R O A D LOCATION DESCRIPTION Hampstead Gate is situated close to the junction with Frognal and Comprise two interconnecting office buildings within a purpose-built Finchley Road (A41) which is one of the major commuter routes development. -

LAND SECURITIES Report and Financial Statements 31 March 1999

LAND SECURITIES Report and Financial Statements 31 March 1999 Home Contents Search Next Back Home Contents Contents Corporate Statement 1 Corporate Governance 33 Financial Highlights 2 Report of the Remuneration Committee 35 Search Valuation 4 Directors’ Report 38 Chairman’s Statement 6 Directors and Advisers 40 Operating and Financial Review Senior Management 41 Next Chief Executive‘s Review 8 Directors’ Responsibilities 42 The Group’s Developments 10 Auditors’ Report 42 Offices 12 Valuers’ Report 43 Back Shops and Shopping Centres 16 Consolidated Profit and Loss Account 44 Retail Warehouses and Balance Sheets 45 Food Superstores 20 Consolidated Cash Flow Statement 46 Hotels, Leisure and Residential 23 Other Primary Statements 47 Warehouses and Industrial 24 Notes to the Financial Statements 48 Financial Review 27 Ten Year Record 62 Environment and Health & Safety 32 Major Property Holdings 63 Investor Information (Inside Back Cover) FINANCIAL CALENDAR 1999 2000 26 May Preliminary Announcement January Interim dividend payable 7 June Ex-dividend date 11 June Registration qualifying date for final dividend 14 July Annual General Meeting 26 July Final dividend payable November Announcement of interim results (unaudited) LAND SECURITIES PLC Corporate Statement Home Contents We are committed to providing our shareholders Search with sustainable and growing returns underpinned by secure and increasing income, together with Next capital appreciation. Back We deliver these returns by developing and investing for the long term to create and enhance -

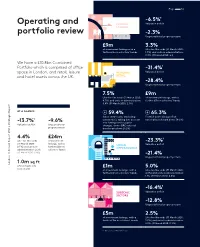

Download Our Operating and Portfolio Review

Page 36 -6.5%1 Operating and CENTRAL Valuation deficit LONDON portfolio review -2.3% Ungeared total property return £9m 3.3% of investment lettings with a Like-for-like voids (31 March 2020: further £1m in solicitors’ hands 1.3%) and units in administration: 0.3% (31 March 2020: nil) We have a £10.8bn Combined Portfolio which is comprised of office -31.4%1 space in London, and retail, leisure REGIONAL Valuation deficit and hotel assets across the UK. RETAIL -28.4% Ungeared total property return 7.5% £9m Like-for-like voids (31 March 2020: of investment lettings, with a 4.7%) and units in administration: further £7m in solicitors’ hands 5.8% (31 March 2020: 2.1%) AT A GLANCE 59.4% 65.3% Same centre sales (excluding Footfall down (ShopperTrak ¹ automotive), taking into account national benchmark down 58.2%) -13.7% -9.6% new lettings and occupier Valuation deficit Ungeared total changes, down (BRC national » Strategic Report property return benchmark down 29.2%) 4.4% £24m Like-for-like voids of investment -23.3%1 (31 March 2020: lettings, with a URBAN Valuation deficit 2.5%) and units in further £12m in OPPORTUNITIES administration: 2.2% solicitors’ hands (31 March 2020: 0.8%) -21.4% Ungeared total property return 1.0m sq ft Landsec // AnnualLandsec Report // 2021 of developments £1m 5.0% now on site of investment lettings, with a Like-for-like voids (31 March 2020: further £1m in solicitors’ hands 4.8%) and units in administration: 1.1% (31 March 2020: 0.4%) -16.4%1 SUBSCALE Valuation deficit SECTORS -12.8% Ungeared total property return £5m 2.5% of investment lettings, with a Like-for-like voids (31 March 2020: further £3m in solicitors’ hands 2.0%) and units in administration: 2.9% (31 March 2020: 0.9%) 1. -

Lewisham Town Centre Local Plan Submission Version

Lewisham local plan Lewisham town centre local plan Submission version September 2012 PLEASE NOTE: The maps and figures within this document will be professionally altered for the final publication version. Contents 1 The plan and context 3 1.1 Lewisham town centre and the Local Plan 4 1.2 Key characteristics of Lewisham town centre 6 1.3 Summary of issues and challenges for the town centre 11 1.4 How does the LTC Local Plan relate to other policy? 12 1.5 Sustainability Appraisal and Equalities Analysis Assessment 15 2 Vision and objectives 16 2.1 The vision 17 2.2 The objectives 18 2.3 From issues to objectives 20 3 Presumption in favour of sustainable development 22 4 The spatial strategy 24 4.1 The plan boundaries 25 4.2 Introducing policy areas and sites 27 4.3 Creating a cohesive and complete town centre experience 32 5 Policy Areas and sites 37 5.1 Lewisham Gateway Policy Area 37 5.2 Loampit Vale Policy Area 41 5.3 Conington Road Policy Area 46 5.4 Lee High Road Policy Area 51 5.5 Ladywell Policy Area 55 5.6 Central Policy Area 60 6 Area-wide policies 66 6.1 Growing the local economy 67 6.1.1 Employment 69 6.1.2 Housing 73 6.1.3 Shopping 76 6.2 Building a sustainable community 84 6.2.1 Urban design 85 Lewisham TCLP Adoption Version Contents 6.2.2 Sustainable movement 89 6.2.3 Community 95 6.3 Environmental management 100 7 Implementation, monitoring and risk 106 7.1 Implementation 107 7.2 Monitoring 111 7.3 Risk 113 8 Appendix 1 - Policy, guidance and evidence base linkages 115 9 Appendix 2 - Heritage assets 122 10 Appendix 3 - Delivery strategy and monitoring framework 125 11 Appendix 4 - Lewisham town centre infrastructure schedule 134 12 Appendix 5 - UDP proposals replaced by the LTCLP 143 13 Glossary 144 Lewisham TCLP Adoption Version The plan and context 1 Section 1 of the Lewisham Town Centre Local Plan (LTCLP) firstly introduces Lewisham town centre, its strengths, weaknesses and the opportunities for it to develop and improve in the next five to ten years.