Interim Results for the Six Months Ended 30 June 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Earl's Court and West Kensington Opportunity Area

Earl’s Court and West Kensington Opportunity Area - Ecological Aspirations September 2010 www.rbkc.gov.uk www.lbhf.gov.uk Contents Site Description..................................................................................................................... 1 Holland Park (M131).......................................................................................................... 1 West London and District Line (BI 2) ................................................................................. 4 Brompton Cemetery (BI 3)................................................................................................. 4 Kings College (L8)............................................................................................................. 5 The River Thames and tidal tributaries (M031) .................................................................. 5 St Paul's Open Space (H&FL08) ....................................................................................... 5 Hammersmith Cemetery (H&FL09) ................................................................................... 6 Normand Park (H&FL11)................................................................................................... 6 Eel Brook Common (H&FL13) ........................................................................................... 7 British Gas Pond (H&FBI05).............................................................................................. 7 District line north of Fulham Broadway (H&FBI07G)......................................................... -

Lillie Enclave” Fulham

Draft London Plan Consultation: ref. Chapter 7 Heritage - Neglect & Destruction February 2018 The “Lillie Enclave” Fulham Within a quarter mile radius of Lillie Bridge, by West Brompton station is A microcosm of the Industrial Revolution - A part of London’s forgotten heritage The enclave runs from Lillie Bridge along Lillie Road to North End Road and includes Empress (formerly Richmond) Place to the north and Seagrave Road, SW6 to the south. The roads were named by the Fulham Board of Works in 1867 Between the Grade 1 Listed Brompton Cemetery in RBKC and its Conservation area in Earl’s Court and the Grade 2 Listed Hermitage Cottages in H&F lies an astonishing industrial and vernacular area of heritage that English Heritage deems ripe for obliteration. See for example, COIL: https://historicengland.org.uk/listing/the-list/list-entry/1439963. (Former HQ of Piccadilly Line) The area has significantly contributed to: o Rail and motor Transport o Building crafts o Engineering o Rail, automotive and aero industries o Brewing and distilling o Art o Sport, Trade exhibitions and mass entertainment o Health services o Green corridor © Lillie Road Residents Association, February1 2018 Draft London Plan Consultation: ref. Chapter 7 Heritage - Neglect & Destruction February 2018 Stanford’s 1864 Library map: The Lillie Enclave is south and west of point “47” © Lillie Road Residents Association, February2 2018 Draft London Plan Consultation: ref. Chapter 7 Heritage - Neglect & Destruction February 2018 Movers and Shakers Here are some of the people and companies who left their mark on just three streets laid out by Sir John Lillie in the old County of Middlesex on the border of Fulham and Kensington parishes Samuel Foote (1722-1777), Cornishman dramatist, actor, theatre manager lived in ‘The Hermitage’. -

Lillie Road, West Brompton, SW6 £645 Per Week

Fulham 843 Fulham Road London SW6 5HJ Tel: 020 7731 7788 [email protected] lillie Road, West Brompton, SW6 £645 per week (£2,803 pcm) 4 bedrooms, 2 Bathrooms Preliminary Details A large four bedroom maisonette boasting high ceilings, period features and two bathrooms in West Brompton. This split level property is currently being decorated throughout. The flat is also conveniently located for the shops and bars of Fulham and Parsons Green, and minutes from the ever popular The Prince. The property is located within minutes of West Brompton Station which has access to both the Underground and National Rail services providing ample transport links in and out of London. It is also within easy reach Earls Court Underground Station which has access to the District and Piccadilly Lines. The property would be perfectly suited for professional or student sharers. Key Features • Spacious period conversion • Four large double bedrooms • Two Bathrooms • Dining room/reception room • Separate Kitchen • Close to West Brompton station Fulham | 843 Fulham Road, London, SW6 5HJ | Tel: 020 7731 7788 | [email protected] 1 Area Overview The area of West Brompton is served by both the tube and rail which offer direct access to Earls Court Exhibition Centre. Home to The Empress State Building, a skyscraper 328 ft tall built in tribute to the Empire State Building, the area has a lot to offer and is an enviable place to live. © Collins Bartholomew Ltd., 2013 Nearest Stations West Brompton (0.2M) West Brompton (0.2M) West Kensington (0.4M) Fulham | 843 Fulham -

Thames Wharf Studios Rainville Road, Hammersmith, London W6 9Ha

THAMES WHARF STUDIOS RAINVILLE ROAD, HAMMERSMITH, LONDON W6 9HA 500sq ft - 11,500 sq ft THAMES WHARF STUDIOS RAINVILLE ROAD, HAMMERSMITH, LONDON W6 9HA LOCATION A219 STAMFORD Situated on the bank of the River Thames at Hammersmith, ThamesBROOK Wharf Studios on Rainville Road is accessed from the A219 Fulham Palace Road. It is also a short walk from Hammersmith Bridge and RAVENSCOURT TURNHAM PARK Hammersmith Embankment along the Thames Path. Hammersmith GREEN A315 Broadway (Piccadilly, District, Hammersmith and City and Circle Lines) is a 10 minute walk. The A219 Fulham Palace Road also links with the A4/M4 at Hammersmith Broadway for connections to the west end, HAMMERSMITH Heathrow and the west. The renowned River Café Restaurant which KING STREET HAMMERSMITH RD opened in 1987 occupies the ground floor ofCHISWICK the scheme. HIGH RD A315 RE:CENTRE HAMMERSMITH at A4 6 A316 THAMES WHARF STUDIOS A219 a sanctuary providing: • Rest Areas 5 1 • Treatment Rooms D A306 • Yoga G C THAMES FULHAM • Events & Exhibtions • Cafe & Restaurant E PALACE ROAD B CHARING Chiswick CROSS Eyot 1 HOSPITAL A316 CASTLENAU A 2 4 2 DIRECTORY LOCAL BUSINESSES 3 1 The Blue Boat & A Betfair, Odigeo Harris + Hoole (Coffee shop) & Cambian Group THAMES WHARF STUDIOS LILLIE ROAD 2 River Café & RE:Centre B Chivas Brothers 3 Little Waitrose C British Rowing A219 4 The Crabtree D The Manser Practice (Architect) 4 5 Hammersmith Apollo E Tinopolis Group 6 The Broadway F British Safety Council WETLAND CENTRE MUNST E THAMES WHARF STUDIOS RAINVILLE ROAD, HAMMERSMITH, LONDON W6 9HA SITE PLAN BLOCK 5 BLOCK 1 River Café (ground floor) BLOCK 4 car park BLOCK 6 BLOCK 2 BLOCK 3 Thames DESCRIPTION BLOCK Description size sq ft size sq m Office accommodation at Thames Wharf Studios is arranged in 4 separate buildings that surroundRiv theer mainThames courtyard. -

Palace Wharf

PALACE WHARF FULHAM PALACE WHARF FULHAM LONDON Computer generated image is indicative only. Welcome To PALACE WHARF RAINVILLE ROAD VEHICLE & PEDESTRIAN ACCESS THE C RABTREE BUILDING A TAV ERN BUILDING B CAR PARK Computer generated image is indicative only. An outstanding development of just 22 apartments and 5 townhouses located in one of Fulham’s premier roads, immediately adjacent to the River Thames. A select number of just six 1 and 2 bedroom Discount Market Sale Apartments are available at our Palace Wharf development, to assist first time buyers on to the property ladder which offers them a discount on the open market value. TOWNHOUSES Equidistant to Fulham Broadway and Hammersmith Underground Stations, and a five minute walk to Fulham Palace Road, the development is well served by public transport, bringing central London within easy reach. Closer to home, what could be more liberating than living BUILDING C next door to the River Thames. GATE ALK NEW RIVER W THAMES PATH RIVER THAMES Computer generated images are indicative only. PALACE WHARF LOCATION Lying on the north bank of the River Thames, situated in the London Borough of Hammersmith and Fulham, our development at Palace Wharf breathes new life into this historic site. The wharf was originally used for importing marble and by the 1980s was used as a plaster works. The original industrial use of the site has long gone, which left a disfigurement of buildings along the riverside that contributed nothing. The proposed development has had a highly positive effect both on the site itself and its surrounding community – bringing new and vibrant life into a redundant group of buildings. -

LBD Rights Agreement (Agreed Form)

DATED 20[ ] (1) [EARLS COURT PARTNERSHIP LIMITED] (2) EC PROPERTIES LP (3) LONDON UNDERGROUND LIMITED LILLIE BRIDGE DEPOT RIGHTS AGREEMENT COMMERCIAL IN CONFIDENCE CONTENTS Clause Page 1 DEFINITIONS AND INTERPRETATION 4 2 DESIGN TRIAL 14 3 S278 AGREEMENT AND CARRYING OUT OF BEAUMONT AVENUE WORKS 15 4 ACCEPTANCE OF BEAUMONT AVENUE WORKS 15 5 DISPUTES IN RESPECT OF A BAW ADVERSE EFFECT 17 6 LUL OBLIGATION TO CARRY OUT LBD ON SITE WORKS 18 7 ALTERNATIVE ACCESS ROAD 20 8 SECONDARY ACCESS 20 9 LUL VOID 24 10 PEDESTRIAN ACCESS 24 11 EXISTING SERVICES 26 12 DISPUTES 26 13 SUMS UNDER THIS AGREEMENT 26 14 CONFIDENTIAL INFORMATION AND FREEDOM OF INFORMATION 26 15 NOTICES 26 16 THIRD PARTY RIGHTS 27 17 AMENDMENTS 27 18 GOVERNING LAW AND JURISDICTION 27 19 COUNTERPARTS 27 SCHEDULE 1 - APPOINTMENT AND POWERS OF AN INDEPENDENT PERSON 28 SCHEDULE 2 - SECONDARY ACCESS PERFORMANCE CRITERIA 29 SCHEDULE 3 - FORM OF EMAIL NOTICE 30 APPENDIX 1 - FORM OF DEED OF EASEMENT 4 APPENDIX 2 - BAW DETAILED SPECIFICATION AND PLANS 6 APPENDIX 3 - DESIGN TRIAL DRAWINGS 7 APPENDIX 4 – DESIGN TRIAL REPORT 8 APPENDIX 5 – LBD ON SITE WORKS 9 APPENDIX 6 - PLANS 10 THIS AGREEMENT is made by Deed on day of 20[ ] BETWEEN:- (1) [EARLS COURT PARTNERSHIP LIMITED a private limited company registered in England, (Company Number 8872070) whose registered office is at 15 Grosvenor Street, London, W1K 4QZ] ("JVCo") (2) EC PROPERTIES LP a limited partnership registered in England and Wales under number LP14695 whose registered office is at 15 Grosvenor Street, London, W1K 4QZ acting by its general partner EC PROPERTIES GP LIMITED (Company Number 7696161) whose registered office is at 15 Grosvenor Street, London, W1K 4QZ ("ECP"); (3) LONDON UNDERGROUND LIMITED of 42-50 Windsor House, Victoria Street, London SW1H 0TL ("LUL"); together, the "Parties", and each, a "Party". -

BUSINESS MASTERY Lead Your Business Effectively, Efficiently & Profitably to Thrive in Any Economic Time

TONY ROBBINS FACT SHEET BUSINESS MASTERY Lead Your Business Effectively, Efficiently & Profitably To Thrive in Any Economic Time Business Mastery London 2015 June 6-10, 2015 REGISTRATION ACCOMMODATIONS Friday, June 5, 2015: 5:00pm - 7:00pm Mercure Kensington Hotel Saturday, June 6, 2015: 7:30am - 8:45am 1a Lexham Gardens, London W8 5JJ Tel: +44 20 7244 2400 http://tonyr.co/BMMercureKensington EVENT SCHEDULE Distance from venue: 1.3 miles Reservations: The times below for the seminar are approximate times only. Room rate for single occupancy: £154 (includes VAT) Arrive: June 5 Room rate for twin occupancy: £169 (includes VAT) Start: June 6, 9:00am Reserve by: Friday, May 15, 2015 End: June 10, 11:00pm When calling, ask for in house reservations and mention you are with Depart: June 11 the Anthony Robbins Business Mastery 2015 group. EVENT LOCATION Marriott London Kensington 147 Cromwell Road, SW5 0TH Ibis London Earls Court | ILEC Conference Centre Tel: +44 20 7973 1000 http://tonyr.co/BMLondonMarriottKensington 47 Lillie Road Distance from venue: 1.3 miles SW6 1UD London Reservations: United Kingdom Room rate for single occupancy: £170 (includes VAT) Room rate for twin occupancy: £185 (includes VAT) AIRPORTS Reserve by: Monday, May 11, 2015 Reserve Online: http://tonyr.co/BMLondonMarriottReservations Heathrow Click here to complete your booking form. Tel: +44 844 3351 801 http://www.heathrowairport.com/ ADDITIONAL ACCOMMODATIONS Distance from Conference Centre = 22.53 km / 14 miles Ibis London Earls Court Gatwick 47 Lillie Road, SW6 1UD Tel: +44 844 8920 322 Tel: +44 20 7610 0880 http://www.gatwickairport.com http://tonyr.co/BMIBISLondonEarlsCourt Distance from Conference Centre = 54.23 km / 33.7 miles Kensington Close Hotel London City Airport Wrights Lane, Kensington, London W8 5SP Tel: +44 20 7646 0088 Tel: +44 207 368 4041 www.londoncityairport.com Email: [email protected] Distance from Conference Centre = 19.79 km / 12.3 miles http://tonyr.co/BMKensingtonCloseHotel TONY ROBBINS | ©2015 Robbins Research International, Inc. -

H&F 2020-21 Draft Statement of Accounts

STATEMENT OF ACCOUNTS 2020/21 Draft unaudited version Hammersmith & Fulham Council [THIS PAGE IS INTENTIONALLY BLANK] London Borough of Hammersmith and Fulham 2 CONTENTS The Director of Finance’s Narrative Report, the Council's Statement of Accounts for the Year Ended 31 March 2021 and the Council's Annual Governance Statement are set out on the following pages. Independent auditor’s report to the members of the London Borough of Hammersmith and Fulham ........... 5 CERTIFICATION BY CHAIR OF THE AUDIT COMMITTEE ......................................................................... 6 THE DIRECTOR OF FINANCE’S NARRATIVE REPORT ...................................................................... 7 STATEMENT OF RESPONSIBILITIES FOR THE STATEMENT OF ACCOUNTS ............................................. 18 CORE FINANCIAL STATEMENTS ....................................................................................................... 19 Movement in Reserves Statement .................................................................................................... 20 Comprehensive Income and Expenditure Statement ........................................................................... 21 Balance Sheet ............................................................................................................................... 22 Cash Flow Statement ...................................................................................................................... 23 NOTES TO THE CORE FINANCIAL STATEMENTS ................................................................................ -

Earls Court Project London Borough of Hammersmith & Fulham Application 2

Earls Court Project London Borough of Hammersmith & Fulham Application 2 Development Specification Prepared for EC Properties Ltd by DP9 February 2012 Properties DEVELOPMENT SPECIFICATION CONTENTS 1. Introduction and Purpose of Document 1.1 Introduction 1.2 The Purpose of the Development Specification 1.3 The Structure of the Development Specification 2. The Planning Applications 2.1 Nature and Type of Planning Applications 2.2 Parallel Applications under the Planning (Listed Building and Conservation Areas) Act 1990 2.3 Highway Proposals 2.4 Application Documents 3. Development Options 4. Site Description 4.1 Summary Site Description 4.2 Existing Floorspace 5. Description of Development: Application 1 5.1 Description of Development 5.2 Proposed Floorspace by Land Use 5.3 Proposed Floorspace by Development Plot 5.4 Development Plot Land Use Description 5.5 Residential 5.6 Business 5.7 Retail 5.8 Hotel and Serviced Apartments 5.9 Leisure 5.10 Education, Health, Community and Culture 5.11 Works to Earls Court Station 5.12 Ancillary Uses 5.13 Proposed Amount and Distribution of Car and Cycle Parking 5.14 Open Space 6. Description of Development: Application 2 6.1 Description of Development 6.2 Proposed Floorspace by Land Use 6.3 Proposed Floorspace by Development Plot 6.4 Development Plot Land Use Description 6.5 Residential 6.6 Business 6.7 Retail 6.8 Hotel and Serviced Apartments 6.9 Leisure 6.10 Private Hospital 2 DEVELOPMENT SPECIFICATION 6.11 Education, Health, Community and Culture 6.12 Ancillary Uses 6.13 Stabling Area 6.14 Proposed Amount and Distribution of Car and Cycle Parking 6.15 Open Space 7. -

Newsletter 34-Sum 16

Issue No. 34 Spring 2016 elcome to the latest edition of the HBG We also report on campaigns for two new conservation newsletter. Since our last number two new areas (one in the Old Oak Park Royal area in the north of W structures in the borough have been statutorily the borough and the other in the east around Earl’s listed: the war memorial at the former St John’s Church, Court/Lillie Road) and for a D-Day information panel in now part of Godolphin & Latymer School and the St Paul’s Gardens. Caroline Walker writes about her great- Reclining Woman sculpture beside the Great West Road, uncle Max Gill, brother of Eric Gill who featured in the close to St Peter’s Church. We have details of these, plus last number. And historical and archaeological the fascinating background to another listed structure in investigations are telling us more about St Peter’s Square the borough, currently on Historic England’s Heritage at and Ravenscourt Park, both at one time owned and Risk Register, but about which there may be some good developed by George Scott. news in the not too distant future. This is the mausoleum Andrew Duncan, editor, Historic Buildings Group in St Mary’s Cemetery containing the remains of a prominent 19th century Spanish sherry maker who left his Below: detail of Max Gill’s splendid Wonderground Map of London home to the Spanish government for use as an London Town, produced for the underground network in 1914 embassy, a function it still fulfils today. -

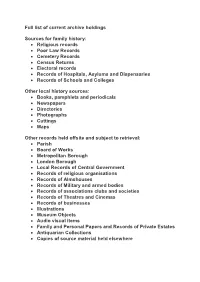

Full List of Current Archive Holdings

Full list of current archive holdings Sources for family history: Religious records Poor Law Records Cemetery Records Census Returns Electoral records Records of Hospitals, Asylums and Dispensaries Records of Schools and Colleges Other local history sources: Books, pamphlets and periodicals Newspapers Directories Photographs Cuttings Maps Other records held offsite and subject to retrieval: Parish Board of Works Metropolitan Borough London Borough Local Records of Central Government Records of religious organisations Records of Almshouses Records of Military and armed bodies Records of associations clubs and societies Records of Theatres and Cinemas Records of businesses Illustrations Museum Objects Audio visual items Family and Personal Papers and Records of Private Estates Antiquarian Collections Copies of source material held elsewhere Sources for Family History Religious records Anglican churches Registers and records of most of the Anglican parishes in the borough are held at the London Metropolitan Archives www.cityoflondon.gov.uk/lma All Saints Fulham Registers of baptisms (1675-1969), marriages (1664-1905), burials (1675-1863) - microfilm only Vestry minute book 1877-1891. Churchwardens’ rates and accounts 1826-1886. Christ Church Fulham Accounts 1977-1987. St Andrew Fulham Fields Plan of seating layout 1884. St Barnabas Kensington Unity experiment with Munster Park Methodist Church, Fulham. Register of baptisms 1969-1975. St Dionis Parsons Green Church rolls 1920-1930. Pew rents 1905-1931. Clothing -

Housing Trajectory 2016/2017

Total units Address permitted 2013/2012 2013/2014 2014/2015 2015/2016 2016/2017 2017/2018 2018/2019 2019/2020 2020/2021 2021/2022 2022/2023 2023/2024 2024/2025 2025/2026 2026/2027 2027/2028 2028/2029 2029/2030 2030/2031 2031/2032 2032/2033 2033/2034 2034/2035 (Net) 2012/2011 Table 1 W hite City Regenaration Area/ Opportunity Area Phase 1 (Years 1 to 5) Phase 2 (Years 6 to 10) Phase 3 (Years 11 to 15) Phase 4 (Years 16 to 20) London Borough of Hammersmith and Fulham - Housing Trajectory 2016/2017 146 73 73 TA centre 3000 Imperial College, 80 Wood Lane, 288 96 96 96 147 W12 0TT Shepherd's Bush Market, Peabody And Broadway Centre, Nos.1 - 14 Market Lane, Former Laundry Site 197 197 Rear Of Nos.9 - 61 Pennard Road, 2500 Land Adjoining Former Shepherd's Bush Library And Nos.30 - 52 Goldhawk Road W12 QPR Football Ground 380 190 190 Former BBC Television Centre 943 235 235 235 238 Wood Lane London W12 Former Dairy Crest Site Land 2000 Beneath And Bounded By Westway 1648 1,150 115 115 230 460 230 1826 And West London Railway Line 1577 1701 And Adjoining 58 Wood Lane 1637 1635 LandLondon North W12 Of Westfield Shopping 1567 1,347 449 449 449 Centre Ariel Way London 1500 1193 M&S White City Site 54 Wood 1,465 488 733 244 1112 1102 Lane London W12 7RQ 1052 Unit 2H Woodstock Studios 36 Woodstock Grove London W12 1 1 914 899 851 835 8LE W hite City RA Total (Net Units of Number 0 0 0 0 0 97 96 96 685 1,297 1,043 914 695 658 190 0 0 0 0 73 0 0 73 73 1000 1031 without windfall- By Year) 5,917 635 649 W hite City RA Total (Net 2,271 3,500 73 146 without