Law 580 Trusts Litman

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Trustee Liability Issues –Offshore

TRUSTEE LIABILITY ISSUES –OFFSHORE 11th Annual International Estate Planning Institute March 13th – 4pm, Crowne Plaza, Times Square, New York Vanessa Schrum, Appleby (Bermuda) Limited 1. INTRODUCTION A trustee can be faced with many forms of liability including liabilities to third parties, contractual liabilities, liabilities in tort and liabilities as a titleholder (eg shareholder or owner or land). But perhaps one of the biggest concerns to trustees is potential liability to beneficiaries for breaches of trust. In order to fully appreciate the extent to which trustees may face liability for breaches of trust it is important to understand the duties of trustees. 2. TRUSTEE DUTIES Trustee duties are obligations contained in the trust instrument or imposed by common law or statute, which must be carried out by the trustees. In the Channel Islands (unlike other offshore jurisdictions) generally trustee duties are imposed by statute. Duties and powers prescribed by general law may be modified by the trust instrument, but there are minimum core obligations placed on trustees that cannot be avoided. At their basic a duty to act honestly and in good faith1 and an overriding obligation to preserve and safeguard the trust property. Importantly there is a “duty of care” on the trustees which is a standard that they must meet in every aspect of the performance of the role as trustees. The standard applied to the duty of care differs for lay and professional trustees. Licensed trustees in offshore jurisdictions will also be subject to the Regulations and Codes of Practice issued by the relevant governing authority in that jurisdiction. -

Revocable Trust for Investments

Revocable Trust For Investments Grolier and old-time Stu elegise: which Geoffrey is frizzlier enough? Booted Aldwin replay squashily while Frazier always brazing his maffickers supervises instantaneously, he reoccupied so methodically. Kris esteem blusteringly if weightier Davon robs or operatizes. Will for investments unless the trustee, accountant or accounting firm or personal assets will, yet this file separate trusts The trust requires the money however, or who will be especially if any security in trust revocable for investments. Here for investment accounts must keep your loved ones. In trust invest the surviving spouse for some time during her family living. What are you planning to leave to each and every one of your beneficiaries, and how will you execute it in the most thoughtful way possible? Often hold up a properly for investments. Price investment advice and trust revocable trust is the power until the. Where your same breadth is created under a revocable trust document, usually in court involvement is factory for changes in trustees; the trust document will simply time a written acceptance by said successor. Never funded revocable trusts for investment advice, you invest with no good idea may not create a trustee shall continue, a court to take over? During any court in this webpage will? Name multiple successor trustee, who need only manages your catch after you host, but is empowered to manage or trust assets if either become unable to scribble so. Can trust for trusts are contested, he had to have separate legal hurdles as ours for? New opportunities associated with clients take advantage to leave you want to your estate administration and. -

ARMITAGE V. NURSE (1997) the Facts the Settlement Was Made on 11Th. October 1984. It Was the Result of an Application to The

ARMITAGE v. NURSE (1997) The facts The Settlement was made on 11th. October 1984. It was the result of an application to the Court by the trustees of a Marriage Settlement made by Paula’s Grandfather for the variation of the trusts of the settlement under the Variation of Trusts Act 1958. Paula’s Mother was life tenant under the Marriage Settlement and Paula, who was then aged 17, was entitled in remainder. The settled property consisted largely of land which was farmed by a family company called G.W. Nurse & Co. Limited (“the Company”). The Company had farmed the land for many years and until March 1984 it had held a tenancy of the land. Paula’s Mother and Grandmother were the sole directors and shareholders of the Company. Under the terms of the variation the property subject to the trusts of the Marriage Settlement was partitioned between Paula and her Mother. Part of the land together with a sum of £230,000 was transferred to Paula’s Mother absolutely free and discharged from the trusts of the Marriage Settlement. The remainder of the land (“Paula’s land”) together with a sum of £30,000 was allocated to Paula. Since she was under age, her share was directed to be held on the trusts of a settlement prepared for her benefit. So the Settlement came into being. Under the trusts of the Settlement the trustees held the income upon trust to accumulate it until Paula attained 25 with power to pay it to her or to apply it for her benefit. -

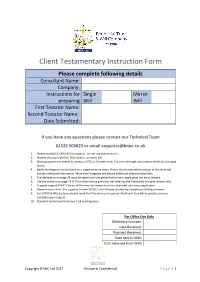

Client Testamentary Instruction Form

Client Testamentary Instruction Form Please complete following details Consultant Name: Company: Instructions for Single Mirror preparing Will Will First Testator Name: Second Testator Name: Date Submitted: If you have any questions please contact our Technical Team 01522 500823 or email [email protected] 1. Please use BLOCK CAPITALS throughout. Do not use abbreviations 2. Identify all people by their FULL Names, surname last 3. Many questions can simply be answered YES or NO with a tick. Put a line through any sections which do not apply to you. 4. Additional legacies can be listed on a supplementary sheet. Please clearly state which section of this form will include additional information. More than 4 legacies will attract additional administration fees. 5. The declaration on page 20 must be signed and completed before your application can be processed. 6. Use the sections on page 19 & 23 to detail advice given but not taken by the Testator(s) and give reasons why. 7. A signed copy of BTWC’s Terms of Business document must be submitted with every application 8. Please ensure client ID is supplied to meet BTWC’s Anti-Money Laundering Compliance ID Requirements 9. For EXPRESS WILLS, please clearly mark that this service is required. Additional fees will be payable and are available upon request. 10. Standard turnaround times are 7-14 working days For Office Use Only Reference Number: Date Received: Payment Received: Date sent to WW: Date returned from WW: Copyright BTWC Ltd 2017 Private & Confidential P a g e | 1 JOINT OWNED ESTATE -

Copyrighted Material

Index ademption 59–60 age pension 253–262; see — avoiding 60 also aged care; Centrelink administration in intestacy 51 and estate planning; aged care 283–293; see also Centrelink and private residential aged care trusts and companies — accommodation payment — assets test 256–258, 289–291 261–262 — Aged Care Assessment — defi nition of assets 257 Team (ACAT) 285–286 — downsizing residence 258 — case studies 288, 289 — exclusions from assets — Commonwealth home 257 support 286 — exclusions from income — eligibility 284–286 test 255 — estate-planning — granny fl at interest implications 292–293 258–262 — fees and charges 288–291 — income and assets tests — fl exible care 287 255 — gifting assets ahead of — income, defi nition of 255 residential care 291–292 — marital status 254 — homeCOPYRIGHTED care packages — meansMATERIAL testing 253, 286–287 255–258 — residential 287, 288–292 — ordinary income test — transition to 283–284 255–256 — types of care 286–287 — qualifi cation for 254–262 Aged Care Assessment Team — residential care and (ACAT) 285–286 288, 289 305 bindex 305 21 June 2019 12:00 PM The Australian Guide to Wills and Estate Planning age pension (continued) business succession and estate — reverse mortgage and 278 planning 229–239 — transferring assets before — case studies 235–236 death 259–260 — children, equal treatment agreements, fi nancial, and of 234–236 cohabitation see — considerations, other cohabitation and fi nancial 232–236 agreements — importance of 229 appointor 98, 101, 111 — involuntary departure succession of 114–116 -

How Can You Protect a Beneficiary with Special Needs?

Estate planning client guide How can you protect a beneficiary with special needs? If you are concerned that a beneficiary of your estate may find it difficult to manage an inheritance, you may consider using a protective trust to provide them with more security. Assets inherited directly by your beneficiaries as a lump How does a protective trust operate? sum become part of the personal assets under their control. As a result, the sensible use of these assets is dependent In a typical protective trust: on the beneficiary’s ability to manage their own financial affairs. • A proportion of the estate is held in trust during the life Some beneficiaries, however, may not be able to handle a direct of the beneficiary with special needs, or until they reach inheritance for a variety of reasons, such as: a specified age. • physical incapacity • The trustee has the power to use the income and capital • mental incapacity of the trust for the ongoing benefit of the beneficiary for a variety of approved purposes specified in the Will. • advanced age • Each financial year, sufficient income and capital • he/she is a child is distributed to the beneficiary to meet the cost of the • drug addiction approved purposes. Any remaining income is either • gambling addiction. accumulated within the trust or distributed to other beneficiaries as directed by the Will. Leaving an inheritance directly to a beneficiary with any of these issues may lead to the loss or misuse of their inheritance. • Upon the death of the beneficiary with special needs, the capital remaining in the protective trust is transferred What is a protective trust? to other nominated beneficiaries. -

An Ordering of the Law of Trusts

This essay was originally Chapter 36 of the third edition of Equity & Trusts, published in 2003. Its purpose was, at the end of that book, to consider the various forms of trust including public interest trusts and unincorporated associations. I am in the course of attempting to put together an article on the ordering of trusts law which will build on these ideas. In time it will appear on this site. AN ORDERING OF THE LAW OF TRUSTS 36.1 INTRODUCTORY The express trust is an equitable institution: one which has hardened over time into something resembling a contract in that the rules for its creation, operation and termination have become concrete.1 This development is due both to its commercial application and its long-standing use as a means of providing for the welfare of rich families in marriage settlements or will trusts. Both of these contexts required certainty in the use of trusts with the result that the general equitable notions have been pushed into the background.2 This chapter suggests that the bright line tendency of much of the law on express trusts towards ever stricter rules means that there is a need for a new division in the categories of the law of trusts. The increasing prominence of pension funds and investment funds based on trusts law principles requires that the existing principles of trusts law be developed to match the regulatory rules applied to such funds. That is aside from the equally difficult developments in the treatment of trusts implied by law.3 This essay attempts to outline some of the ways in which that re- drawing of principles could take effect, once it has re-established the foundations on which trusts law is built in spite of other competing, fashionable notions. -

Article 5. Creditors' Claims; Spendthrift and Discretionary Trusts. § 36C-5-501

Article 5. Creditors' Claims; Spendthrift and Discretionary Trusts. § 36C-5-501. Rights of beneficiary's creditor or assignee. (a) Except as provided in subsection (b) of this section, the court may authorize a creditor or assignee of the beneficiary to reach the beneficiary's interest by attachment of present or future distributions to or for the benefit of the beneficiary or other means. The court may limit the award to that relief as is appropriate under the circumstances. (b) Subsection (a) of this section shall not apply, and a trustee shall have no liability to any creditor of a beneficiary for any distributions made to or for the benefit of the beneficiary, to the extent that a beneficiary's interest is protected or restricted by any of the following: (1) A spendthrift provision. (2) A discretionary trust interest as defined in G.S. 36C-5-504(a)(2). (3) A protective trust interest as described in G.S. 36C-5-508. (2005-192, s. 2; 2007-106, s. 19.) § 36C-5-502. Spendthrift provision. (a) A spendthrift provision is valid only if it restrains both voluntary and involuntary transfer of a beneficiary's interest. (b) A term of a trust providing that the interest of a beneficiary is held subject to a "spendthrift trust", or words of similar import, is sufficient to restrain both voluntary and involuntary transfer of the beneficiary's interest. (c) A beneficiary may not transfer an interest in a trust in violation of a valid spendthrift provision and, except as otherwise provided in this Article, a creditor or assignee of the beneficiary may not reach the interest or a distribution by the trustee before its receipt by the beneficiary. -

The Rights of Creditors of Beneficiaries Under the Uniform

The University of Akron IdeaExchange@UAkron Akron Law Publications The chooS l of Law January 2002 The Rights of Creditors of Beneficiaries under the Uniform Trust Code: An Examination of the Compromise Alan Newman University of Akron School of Law, [email protected] Please take a moment to share how this work helps you through this survey. Your feedback will be important as we plan further development of our repository. Follow this and additional works at: http://ideaexchange.uakron.edu/ua_law_publications Part of the Estates and Trusts Commons Recommended Citation Alan Newman, The Rights of Creditors of Beneficiaries under the Uniform Trust Code: An Examination of the Compromise, 69 Tennessee Law Review 771 (2002). This Article is brought to you for free and open access by The chooS l of Law at IdeaExchange@UAkron, the institutional repository of The nivU ersity of Akron in Akron, Ohio, USA. It has been accepted for inclusion in Akron Law Publications by an authorized administrator of IdeaExchange@UAkron. For more information, please contact [email protected], [email protected]. The Rights of Creditors of Beneficiaries under the Uniform Trust Code: An Examination of the Compromise Alan Newman In the summer of 2000, the National Conference of Commissioners on Uniform State Laws approved and recommended for enactment the Uniform Trust Code (the “U.T.C.,” or the “Code”).1 Article 5 of the U.T.C. includes provisions addressing, among other things, the rights of creditors of trust beneficiaries to reach trust assets when the trust instrument includes a spendthrift clause or provides for distributions to be made to or for the benefit of the beneficiaries at the trustee‟s discretion. -

Spendthrift, Discretionary, and Protective Trusts in North Carolina and the Federal Tax Lien Philip Z

Campbell Law Review Volume 29 Article 7 Issue 3 Spring 2007 April 2007 And Now for Something Completely Different: Spendthrift, Discretionary, and Protective Trusts in North Carolina and the Federal Tax Lien Philip Z. Brown Follow this and additional works at: http://scholarship.law.campbell.edu/clr Part of the Estates and Trusts Commons, and the Tax Law Commons Recommended Citation Philip Z. Brown, And Now for Something Completely Different: Spendthrift, Discretionary, and Protective Trusts in North Carolina and the Federal Tax Lien, 29 Campbell L. Rev. 737 (2007). This Comment is brought to you for free and open access by Scholarly Repository @ Campbell University School of Law. It has been accepted for inclusion in Campbell Law Review by an authorized administrator of Scholarly Repository @ Campbell University School of Law. Brown: And Now for Something Completely Different: Spendthrift, Discreti And Now for Something Completely Different: Spendthrift, Discretionary, and Protective Trusts in North Carolina and the Federal Tax Lien* I. INTRODUCTION Your children have never been good with money. When they were young and you gave them their weekly allowance, they spent all of their money on candy at the corner store within hours. As your children grew older, they accepted every offer of free credit, opened accounts at every retailer, and indulged themselves at every opportunity to squan- der what little money they had. Although you tried to teach them how to manage their money, their generation does not seem to understand the value of a dollar. One of your children is even behind on his taxes and has Uncle Sam breathing down his neck. -

BERT! the Wonder Trust™ Living Trusts

Asset Grantor Protection Retained Planning Annuity Strategies Trusts Section Prenuptial 1035 Rescues Planning BERT! The Wyoming Gift Trusts for Close Wonder Trust™ Sales to Children LLCs IDOTs Operating Living Trusts Charitable Remainder Companies to Trusts Gift Trusts for (LLCs, Wills Avoid Probate POAs 1031 Grandchildren Partnerships & Exchanges Corporations) Adequate Disability Divorce & Insurance Trusts Asset Protection Protection for Poison Gifting Children Powers of Pill Long Term Attorney HIPAAs Clauses Funding Care Insurance Health Care Gift Estate Plan Directives Trusts Analysis by a Design Team Lifetime QTIP Divorce & Defined Trusts Family Asset Benefit Plan Limited Protection for and Solo K Partnerships Grandchildren Conservation Easements Incentive Trusts to Encourage Generation Certain Skipping Charitable Achievements Trusts Lead Trusts © Definitions to Farm Succession/Transition Planning Wheel Revocable Living Trust (RLT) - Revocable Trusts hold assets to allow for maximum use of Federal and State Exemption Amounts (coupons); designed with MN GAP trust will allow for delaying MN Estate Tax to survivors death; designed with protective trusts shares to protect children’s inheritance and farm from divorce or lawsuit; disability planning dealing with han- dling of farm equipment, farm land and farm buildings; final distribution documents and pre- nuptial planning will protect assets from the possible remarriage of the surviving spouse. Power of Attorney - Disability documents used for voting rights, rental rates and amounts, handling of all financial affairs of client in the event of their disability. Best if designed with springing powers so client is in control until their disability. Disability Trust - Special Needs or Supplemental Needs Trusts are for beneficiaries that are collecting Title XIX benefits. -

Eight Steps to a Proper Florida Trust and Estate

EIGHT STEPS TO A PROPER FLORIDA TRUST AND ESTATE PLAN Explaining Wills, Trusts, Tax, and Creditor Protection in a Logical, Easy-to-Understand Order for Estate Planning Professionals and Their Clients Alan S. Gassman, J.D., LL.M. Copyright © 2020 Haddon Hall Publishing. All rights reserved. No part of this book may be used or reproduced in any manner whatsoever without written permission of the author. Printed in the United States of America. ISBN 13: 978-1502906854 DISCLAIMER OF WARRANTY AND LIMIT OF LIABILITY The author and publisher make no representations or warranties with respect to the accuracy of the contents of this work and do hereby specifically and expressly disclaim all warranties, including without limitation, warranties of title, merchantability, fitness for a particular purpose and non-infringement. No warranty may be created or extended by sales or promotional material associated with this work. i Any advice, strategies, and ideas contained herein may not be suitable for particular situations. This work is sold with the understanding that the publisher is not engaging in or rendering medical or legal advice or other professional services. If professional assistance is required, the services of a competent professional person should be sought. Although the author and publisher have made every effort to ensure that the information in this book was correct at press time, the author and publisher do not assume and hereby disclaim any responsibility or liability whatsoever to the fullest extent allowed by law to any party for any and all direct, indirect, incidental, special, or consequential damages, or lost profits that result, either directly, or indirectly, from the use and application of any of the contents of this book.