Complaint for Temporary Restraining Order and Preliminary Injunction

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PPC-Infographic.Pdf

Celebrating our 15th anniversary, Partnership for Patient Care (PPC) is the region’s premier patient safety and quality program driving health equity and high quality outcomes. 115th5th Anniversary 2006 – 2021 WHAT IS PARTNERSHIP FOR PATIENT CARE? Partnership for Patient Care (PPC) is a collaboration between Independence Blue Cross, Health Care Improvement Foundation and the region’s leading healthcare organizations and stakeholders to accelerate the adoption of evidence-based clinical best practices. PPC’s improvement efforts have enabled the region to foster partnerships among organizations that share a common desire for providing the safest and highest quality care to patients. PPC serves as an umbrella, under which several programs have been established during the past 15 years to support ongoing regional improvement. PPC PROGRAMS Health Equity Data Strategy (HEDS) NEW New in 2021, HEDS is a regional collaborative aimed at decreasing disparities in health outcomes with a focus on establishing recommendations for the implementation of a health equity data strategy. This program will support organizations in the accurate and reliable collection of REaL (ethnicity, and language) data, utilization of the data to evaluate health outcomes, identification of disparities across populations and health conditions; and implementation of targeted quality improvement strategies that promote health equity. Safety Forum 100% A forum of front-line patient safety leaders from hospitals across Southeastern PA that of participants rated promotes interactive discussions about safety hazards and vulnerabilities and a peer- the program as very good or excellent to-peer exchange of patient safety approaches, processes, and best practices. Pennsylvania Urologic Regional Collaborative (PURC) 142 PURC is a quality improvement initiative that brings urology practices together in a physician- participating physicians led, data-sharing and improvement collaborative aimed at advancing the quality of diagnosis 17,000+ and care for men with prostate cancer. -

HMO Proactive Tiered Network Hospital List

Save with Keystone HMO Proactive, our most popular plans Keystone HMO Proactive health plans are our most popular for good reason: You get access to high-quality care and save money. Not only do you pay less for your monthly premiums, but you can save even more by choosing doctors and hospitals in Tier 1 – Preferred. Save with Tier 1 – Preferred Tier 1 – Preferred includes more than 50 percent of the network. Keystone HMO Proactive offers the same essential health benefits as our other health plans, including doctor visits, Tier 1 – Preferred hospital stays, prescription drug coverage, blood tests, and X-rays. The difference is its tiered provider network, which gives you the option to pay less for care by choosing Tier 1 –Preferred providers. Here are the most important things to know about Keystone HMO Proactive: • You can visit any doctor or hospital in the Independence Blue Cross network once you have a referral. Tier 2 – Enhanced Tier 3 – Standard • You will select a PCP to coordinate your care and refer you to specialists. • Some services cost the same no matter what provider you Save even more choose — like preventive care, emergency room visits, and Keystone HMO Silver Proactive Select and Keystone HMO Silver urgent care. Proactive Value: These lower-premium options are only available • When you use doctors and hospitals in Tier 1 – Preferred, when you purchase directly from Independence Blue Cross. you pay the lowest out-of-pocket costs. Keystone HMO Silver Proactive Value includes a deductible for • The choice is always yours. You can choose Tier 1 providers Tiers 1 – 3 for some services. -

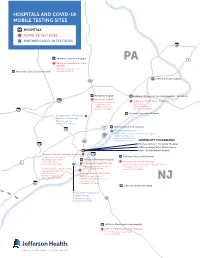

COVID Testing Sites

HOSPITALS AND COVID-19 MOBILE TESTING SITES HOSPITALS COVID-19 TEST SITES PARTNER COVID-19 TEST SITES 95 Abington–Lansdale Hospital PA 1 Abington–Lansdale Hospital PAT Site 100 Medical Campus Drive Physicians Care Surgical Hospital Lansdale, PA 19446 Jeerson Bucks Hospital 611 Abington Hospital Rothman Orthopedic Specialty Hospital – Bensalem Abington Hospital 276 Jeerson Urgent Care – Bensalem (Corner of Horace and Highland Avenues) (Parking lot) 1200 Old York Road 2966 Street Road Bensalem, PA 19020 76 Abington, PA 19001 Jeerson Torresdale Hospital St. Raymond’s of Penefort Church in Mount Airy 7940 Williams Ave. Philadelphia, PA 19150 1 Jeerson Frankford Hospital 76 Ampersand (City Life) (at the Jeerson Northeast Frankford campus) 95 5000 Frankford Avenue Medical Oce Building 611 Philadelphia, PA 19124 CENTER CITY PHILADELPHIA 476 Thomas Jeerson University Hospital Jeerson Hospital for Neuroscience Magee Rehabilitation Hospital Thomas Jeerson University Hospital 676 (Located at the Emergency Jeerson Cherry Hill Hospital Department entry ramp) Jeerson Methodist Hospital 132. S 10th Street Jeerson Cherry Hill Hospital 1 Methodist Hospital PAT Site Philadelphia, PA 19107 (Rear of hospital, near Behavioral Health entrance) 2301 S. Broad Street, 2nd Floor 2201 Chapel Avenue West For Pre-surgical or Pre-procedural Philadelphia, PA 19148 Cherry Hill, NJ 08002 (asymptomatic) patients: 925 Chestnut St. Jeerson Health – Navy Yard 4th Floor, Patient Testing (Entrance to garage site o Philadelphia, PA 19107 13th Street and Intrepid Avenue) NJ 3 Crescent Drive 95 Philadelphia, PA 19112 Jeerson Stratford Hospital Richard Allen Preparatory Charter School 5701 Lindbergh Blvd. 42 Philadelphia, PA 19143 DE 95 Jeerson Washington Twp Hospital Jeerson Washington Twp Hospital 367 Hurfville-Cross Keys Road Sewell, NJ 08080 PLEASE NOTE: Physician referral is required for testing at these sites. -

PA Ehealth Partnership P3N ADT Operations Facilities in Production Exchange ER Name Type of Facility Subtype - ED, Inpatient, Etc

PA eHealth Partnership P3N ADT Operations Facilities in Production Exchange ER Name Type of Facility Subtype - ED, Inpatient, etc. Consent Model Address HSX Mainline Health Bryn Mawr Hospital hospital ED Opt Out 130 South Bryn Mawr Avenue, Bryn Mawr, PA 19010 HSX Mainline Health Lankenau Hospital hospital ED Opt Out 100 Lancaster Avenue, Wynnewood, PA 19096 HSX Mainline Health Paoli Hospital hospital ED Opt Out 255 W. Lancaster Avenue, Paoli, PA 19301 HSX Mainline Health Riddle Hospital hospital ED Opt Out 1068 West Baltimore Pike, Media, PA 19063 HSX Temple University Hospital hospital ED Opt Out 3401 N.Broad Street,Philadelphia, PA 19140 HSX Temple Jeanes Hospital hospital ED Opt Out 7600 Central Avenue, Philadelphia,PA 19111 HSX Crozer-Chester Medical Center hospital ED Opt out 1 Medical Center Blvd, Chester, PA 19013 HSX Crozer Delaware County Memorial Hospital hospital ED Opt out 501 N Lansdowne Ave, Drexel Hill, PA 19026 HSX Crozer Springfield Hospital hospital ED Opt out 190 W Sproul Rd, Springfield, PA 19064 HSX Crozer Taylor Hospital hospital ED Opt out 175 E Chester Pike, Ridley Park, PA 19078 HSX Doylestown Hospital hospital ED,INPATIENT Opt out 595 West State Street, Doylestown, PA 18901 HSX Einstein Medical Center Elkins Park hospital ED,INPATIENT Opt out 60 Township Line Rd, Elkins Park, PA 19027 HSX Einstein Medical Center Montgomery hospital ED,INPATIENT Opt out 559 W Germantown Pike, East Norriton, PA 19403 HSX Einstein Medical Center Philadelphia hospital ED,INPATIENT Opt out 5501 Old York Rd, Philadelphia, PA 19141 HSX Holy Redeemer Hospital hospital ED,INPATIENT Opt Out 1648 Huntingdon Pike, Meadowbrook, PA 19046 HSX Mercy Fitzgerald Hospital hospital ED Opt Out 1500 Lansdowne Avenue, Darby, PA 19023 HSX Mercy Nazareth Hospital hospital ED Opt Out 2601 Holme Avenue, Philadelphia, PA 19152 HSX Mercy Philadelphia Hospital hospital ED Opt Out 501 South 54th Street, Philadelphia, PA 19143 HSX St. -

Community 2019

Southeastern Pennsylvania Community 2019 SOUTHEASTERN PENNSYLVANIA SOUTHEASTERN PENNSYLVANIA HEALTH NEEDS ASSESSMENT Partnering Hospitals • Abington Hospital • Abington Lansdale Hospital • Chester County Hospital • Children’s Hospital of Philadelphia • Einstein Medical Center Montgomery NEEDS ASSESSMENT HEALTH COMMUNITY • Einstein Medical Center Philadelphia • Einstein Medical Center Elkins Park • Grand View Hospital • Holy Redeemer Hospital • Jefferson Bucks Hospital • Jefferson Frankford Hospital • Jefferson Torresdale Hospital • Thomas Jefferson University Hospital • Jefferson Hospital for Neuroscience • Jefferson Methodist Hospital • Hospital of the University of Pennsylvania • Pennsylvania Hospital • Penn Presbyterian Medical Center TABLE OF CONTENTS Executive Summary ........................................2 Philadelphia County, PA ..................................127 1. Center City .........................................................128 Partners ....................................................13 2. Far North Philadelphia ......................................130 1. Introduction .......................................................13 3. Far Northeast Philadelphia ...............................134 2. Participating Hospitals and Health Systems ....14 4. Lower Northeast Philadelphia ...........................138 a. Hospital Profiles 5. North Philadelphia – East .................................142 i. Overview of Hospital 6. North Philadelphia – West ................................146 ii. Past CHNA and Community 7. Northwest -

Table of Contents

Gift of Life Donor Program SRTR OPO-Specific Report OPO Code: PADV Feedback?: [email protected] Public Report Release: July 08, 2019 1.877.970.SRTR (7787) Based on Data as of: April 30, 2019 http://www.srtr.org Table of Contents User Guide 2 A. Description of the Donation Service Area (DSA) Served by PADV 6 B. US Population Density, Deaths, Death Rates, and Donations 7 C. Organ Utilization 14 D. Description of Donors Recovered by PADV 19 E. Programs Transplanting Organs Procured by PADV 20 F. Transplants Facilitated by PADV 30 G. Counties Served by PADV 40 The data reported here were prepared by the Scientific Registry of Transplant Recipients (SRTR) under contract with the Health Resources and Services Administration (HRSA). Page: 1 Gift of Life Donor Program SRTR OPO-Specific Report OPO Code: PADV Feedback?: [email protected] Public Report Release: July 08, 2019 1.877.970.SRTR (7787) Based on Data as of: April 30, 2019 http://www.srtr.org User Guide This report contains a wide range of useful information about the operations and performance of the Organ Procurement Organization (OPO). The report is divided into seven main sections: A. Description of the Donation Service Area (DSA) Served by PADV B. US Population Density, Deaths, Death Rates, and Donations C. Organ Utilization D. Description of Donors Recovered by PADV E. Programs Transplanting Organs Procured by PADV F. Transplants Facilitated by PADV G. Counties Served by PADV Some common abbreviations are used throughout the report: Organ Designators: HR: Heart IN: Intestine KI: Kidney LI: Liver LU: Lung PA: Pancreas Other Abbreviations: DSA: Donation Service Area DBD: Donation after Brain Death DCD: Donation after Circulatory Death Section A: Description of the Donation Service Area Served by PADV Section A provides a broad geographic overview of the area of the United States served by the OPO. -

PA Ehealth Partnership P3N ADT Operations Facilities in Production Exchange ER Name Type of Facility Subtype - ED, Inpatient, Etc

PA eHealth Partnership P3N ADT Operations Facilities in Production Exchange ER Name Type of Facility Subtype - ED, Inpatient, etc. Consent Model Address HSX Mainline Health Bryn Mawr Hospital hospital ED,INPATIENT Opt Out 130 South Bryn Mawr Avenue, Bryn Mawr, PA 19010 HSX Mainline Health Lankenau Hospital hospital ED,INPATIENT Opt Out 100 Lancaster Avenue, Wynnewood, PA 19096 HSX Mainline Health Paoli Hospital hospital ED,INPATIENT Opt Out 255 W. Lancaster Avenue, Paoli, PA 19301 HSX Mainline Health Riddle Hospital hospital ED,INPATIENT Opt Out 1068 West Baltimore Pike, Media, PA 19063 HSX Temple University Hospital hospital ED,INPATIENT Opt Out 3401 N.Broad Street,Philadelphia, PA 19140 HSX Temple Jeanes Hospital hospital ED,INPATIENT Opt Out 7600 Central Avenue, Philadelphia,PA 19111 HSX Children's Hospital of Philadelphia hospital ED,INPATIENT Opt out 3401 Civic Center Blvd. Philadelphia,PA 19104 HSX Crozer-Chester Medical Center hospital ED,INPATIENT Opt out 1 Medical Center Blvd, Chester, PA 19013 HSX Crozer Delaware County Memorial Hospital hospital ED,INPATIENT Opt out 501 N Lansdowne Ave, Drexel Hill, PA 19026 HSX Crozer Springfield Hospital hospital ED,INPATIENT Opt out 190 W Sproul Rd, Springfield, PA 19064 HSX Crozer Taylor Hospital hospital ED,INPATIENT Opt out 175 E Chester Pike, Ridley Park, PA 19078 HSX Doylestown Hospital hospital ED,INPATIENT Opt out 595 West State Street, Doylestown, PA 18901 HSX Einstein Medical Center Elkins Park hospital ED,INPATIENT Opt out 60 Township Line Rd, Elkins Park, PA 19027 HSX Fox Chase -

Transforming Marketing Via a Growth Strategy for a Competitive Market

Transforming Marketing via a Growth Strategy for a Competitive Market Today’s Presenters Chuck Lewis Barbara Giletto-Patterson Alison McDonough Executive VP, Chief Growth & VP, Enterprise Marketing & VP, Client Development Marketing Officer Advertising Who we are WHY WE EXIST To build meaningful connections between healthcare consumers and healthcare providers by providing trusted information for all WHAT WE BELIEVE IN WHO WE WORK WITH Meeting healthcare consumers where they are. 600+ client partners Providing access everywhere without friction. 1,000+ hospitals Data preceding insight. Accountability through measurement. Earning loyalty repeatedly. Consumer Marketing Access Services Consumer Access Healthgrades.com Analytics & Insights Online Appointment Segmentation/Targeting Scheduling Campaign Management Call Center Services Digital & Print Services Consumer Patient Intelligence Engagement & Consumer Retention Intelligence CRM Marketing Automation 360 Profile Consumer Data Platform Real-Time Marketing Performance Reporting Patient Predictive Modeling Marketing Engagement & Onmi-channel Services Retention Attribution Understanding Today’s Environment Today’s Healthcare Consumers Are: Consumers view up to eight health Informed 8 information sites and rely on them to make care decisions. Source: STAX web survey and analysis, March 2017 65% of consumers are frequently shopping Choosy 65% for a new physician. Source: STAX web survey and analysis, March 2017 80% of consumers will choose a physician Impatient with online self scheduling over an identical 80% one who does not. Source: Deloitte 2014 Consumer Health Study Only 9% of consumers would definitely follow Fickle 9% their PCP to another practice or clinic. Source: Deloitte 2014 Consumer Health Study and They Expect: Consumers are demanding access to cost, Information quality, availability, experience and Transparency outcomes data. -

Regional-Profiles-All-March2021.Pdf

State Region: Northern Tier Hospitals* Staffed Beds Employees 19 2,176 11,183 © 2021 Mapbox © OpenStreetMap Hospital Types Hospital Characteristics Non-Profit 16 General Acute Care 16 Rural County 13 12 Long-Term Acute Care 1 340B OB/GYN Units 10 Psychiatric 1 Teaching Hospitals 7 Critical Access Hospitals 4 Rehab 1 Trauma Centers 1 Payor Mix Fiscal Year 2019 - Economic Impact Commercial Medicare Medicaid Other Payor Total Spending Total Employees Total Salary $3.1B 18,888 $1.0B 36% 45% 14% 4% $1.9B 11,183 7,705 $0.7B $1.2B $0.3B Direct Ripple Direct Ripple Direct Ripple Impact Impact Impact Impact Impact Impact Methodology *Hospitals reported exclude federal VA and state psychiatric hospitals Definitions: Direct impact is what hospitals spend for operations. It is the wages they pay to employees and everything purchased—from supplies, equipment, and technology to services provided through contracts with third parties (like contracts for laundry services or parking operations, for example). Indirect impact is the spending generated by third-party suppliers as a result of their contracts and financial arrangements with hospitals. That includes the wages that pay the parking attendant, who works for the local business to which the hospital outsources parking services. Induced impact is the spending generated by all workers whose earnings are affected by a hospital’s direct and indirect impacts. Induced impact takes into account spending by hospital employees as well as employees of the third-party suppliers that serve hospitals. Examples of induced impact include what a doctor, nurse, lab technician, or the contracted parking attendant spends in the hospital’s neighborhood for coffee, lunch out, groceries, dry cleaning, etc. -

UPMC Inside Advantage Network Listing

UPMC Inside Advantage Network listing of UPMC Health Plan participating Effective March 2021 hospitals for commercial employer group plans Level 1 Hospitals and Facilities Lycoming Level 2 Hospitals and Facilities UPMC Muncy Allegheny Allegheny UPMC Williamsport Curahealth Pittsburgh Heritage Valley Health System – UPMC Williamsport Divine Select Specialty Hospital – McKeesport Heritage Valley Kennedy Providence Campus Select Specialty Hospital – Heritage Valley Health System – Pittsburgh UPMC McKean Heritage Valley Sewickley UPMC Children’s Hospital of Pittsburgh Bradford Regional Medical Center Jefferson Hospital UPMC East UPMC Kane LifeCare Behavioral Health Hospital of UPMC Hillman Cancer Center Pittsburgh Mercer UPMC Magee-Womens Hospital Grove City Medical Center LifeCare Hospitals of Pittsburgh at UPMC McKeesport UPMC Horizon – Greenville Main Campus UPMC Mercy UPMC Horizon – Shenango Valley St. Clair Hospital UPMC Montefiore The Children’s Home of Pittsburgh UPMC Passavant – McCandless Potter The Children’s Institute UPMC Presbyterian UPMC Cole Armstrong UPMC St. Margaret Somerset Armstrong County Memorial UPMC Shadyside UPMC Somerset Hospital UPMC Western Psychiatric Hospital Tioga Beaver Bedford UPMC Wellsboro Curahealth Hospital Heritage Valley UPMC Bedford Memorial Venango Heritage Valley Health System – Blair UPMC Northwest Heritage Valley Beaver UPMC Altoona Warren Berks Butler Warren General Hospital Penn State Health St. Joseph UPMC Passavant – Cranberry Reading Hospital Westmoreland Surgical Institute of Reading Cambria -

Save with Keystone HMO Proactive

Save with Keystone HMO Proactive Keystone HMO Proactive health plans use a tiered network, so you save on monthly premiums. Plus, you have the option to save even more on your out-of-pocket costs each time you receive covered services. How you’ll save Tier 1 – Preferred Like a typical HMO, you select a primary care physician who can refer you to specialists. You can visit any doctor or hospital in the Keystone Health Plan East network. We grouped our network into three tiers based on cost and, in many cases, quality measures. While all of the doctors and hospitals in our network must meet high quality standards, many offer services at a lower cost. You’ll pay the lowest out-of-pocket costs when you visit doctors Tier 2 – Enhanced Tier 3 – Standard and hospitals in Tier 1 – Preferred, which includes more than 50 percent of doctors and hospitals in the Keystone Health Plan East network. But the choice is always yours, and you can choose Tier 1 – Preferred for some services, and Tiers 2 or 3 for others. Also keep in mind: 50% of doctors and hospitals are • For some services, your out-of-pocket costs are the same in Tier 1 – Preferred. no matter what doctor or hospital you use, including preventive care, emergency room visits, and urgent care. Visit ibx.com/providerfinder, and select • For some services, like surgery, you pay out-of-pocket Keystone HMO Proactive under Your costs for both the facility and the performing doctor. To save the most money, you’ll want to make sure both Plan to find Tier 1 providers and save. -

2020 Hospital Campaign for Organ Donation Recognition for Outreach

2020 Hospital Campaign for Organ Donation Recognition for Outreach The following hospitals and community partners earned recognition for educating their communities about organ, eye, and tissue donation during the 2020 Hospital Campaign. Partners worked closely with organ procurement organizations (OPOs), Donate Life America (DLA) state teams, and state hospital associations to generate more than 59,600 donor registrations between October 1, 2019 and April 30, 2020. OPO, DLA, and hospital association participation is indicated in the title line for each state. The number of partners recognized in each OPO service area is listed beginning on page 45. SEARCH BY STATE: A C D F G I K L M N O P R S T U V W OPO RECOGNITION ALABAMA Legacy of Hope, Donate Life Alabama, Alabama Hospital Association Andalusia Health SR Athens–Limestone Hospital SR Atmore Community Hospital SR Baptist Medical Center East Baptist Medical Center South Beacon Children’s Hospital SR Bibb Medical Center SR Birmingham VA Medical Center TC Brookwood Baptist Medical Center Bryce Hospital Bullock County Hospital SR Central Alabama Veterans Health Care System – East Campus Central Alabama Veterans Health Care System – West Campus Children’s of Alabama TC Choctaw General Hospital SR Citizens Baptist Medical Center SR Clay County Hospital (Clay County Healthcare Authority) SR Community Hospital, Inc. SR Coosa Valley Medical Center SR Crenshaw Community Hospital SR Crestwood Medical Center Cullman Regional Medical Center SR D.W. McMillan Memorial Hospital SR Dale Medical Center