Energy Company and Environmental Services Provider September 2021 2 Agenda

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Flexible Storage

Underground Sun Conversion – Flexible Storage RAG Austria AG Sustainable storage for the renewable energy system of Consortium Partners RAG Austria AG is Austria’s largest energy storage company and one of Europe’s leading gas storage the future facility operators. Our focus is on storage, conversi- on and demand based conditioning of energy in the form of gaseous energy carriers. With storage capacity of more than 6.2 billion cubic metres of natural gas RAG Austria AG has already converted large parts of its natural gas reservoirs into storages facilities. These can supply the stored energy at any time and at high capacity. RAG is living the vision of „sustainable energy mining“ and makes a major contribution to security of supply of Austria and Europe. The company develops innovative and pioneering energy technologies around „green gas“ that act as partners to renewables. RAG Austria AG is playing a vital role in achieving Austria’s ambitious climate goals, and in the sustainable stewardship of the country’s raw material and energy supplies. RAG’s goal is to provide its customers with safe, efficient, environmentally friendly and affordable energy and gas storage services – sustainably and responsibly. Schwarzenbergplatz 16, 1015 Vienna, Austria www.rag-austria.at, [email protected] Underground Sun Conversion – Sustainable carbon cycle Flexible Storage Renewable natural gas From December 2020, the “Underground Sun Conver- Electricity Elektrolysis CO2 CH4 sion – Flexible Storage” (USC-FlexStore) project will investigate seasonal storage of large quantities of H renewable energy to be made available year round. 2 Water utilization This innovative international project is aimed at developing a seasonal, high-volume transformation Energetic utilization Electricity generated by solar and storage solution for erratic renewable generation. -

Top 500 Beschäftigten Stabil

TRENDTHEMA Die 500 größten UNTERNEHMEN INHALT COMEBACK » Erstaunlich gutes Jahr 2020 trotz Coronakrise. TENDENZ » Große Unternehmen weniger betroffen als kleine. UMSATZ » Rund 40 % mit Zuwächsen gegenüber 2019. MITARBEITER » Zahl der bei den Top 500 Beschäftigten stabil. TREND-TABELLE » Die Ränge 1 bis 500 im Überblick. Tren21_TOP500_für-online-PDF_Deckblatt.indd 1 11.06.21 13:09 Programmierung: RJ Partner GmbH TOP 500: die größten Unternehmen Österreichs RANKING. Das Coronajahr 2020 stellte für viele Unternehmen eine absolute Ausnahmesituation dar. In Summe kamen die TOP 500 Gastronomie oder Events, konnten viele aber überraschend gut durch die Krise. Die gesamte Liste von österreichische Firmen die herben Rück- gänge vor allem im zweiten Quartal 2020 der Nummer ein bis Rang 500 sehen Sie hier auf trend.at. teilweise oder ganz aufholen. Gar nicht so wenige haben in der Pandemie sogar MGEKEHRTE VORZEICHEN: Im wiegend bei den Unternehmen direkt er- massiv zugelegt: die Münze Österreich, vergangenen Jahr, als das TOP- folgt, diesmal ein bisschen schwieriger. die Spar-Gruppe, der Pistolenhersteller U 500-Ranking die Geschäftszahlen Manche wollten – nicht ganz unverständ- Glock oder die cargo-partner Group – um von 2019 repräsentierte, wies der trend an lich – die Werte für ein völlig untypisches nur ein paar Beispiele zu nennen. dieser Stelle darauf hin, dass das außeror- Geschäftsjahr nur ungern melden. Bei 284 Unternehmen der TOP 500 dentlich gute Bild, das sich offenbarte, mit manchen sorgten krisenbedingte Sonder- mussten 2020 gegenüber dem Jahr davor der Lage zum Erscheinungszeitpunkt – effekte für Verzögerungen oder sie hat- Umsatzeinbußen hinnehmen, immerhin Mitte Juni 2020 – längst nichts mehr zu ten – ebenfalls nachvollziehbar – schlicht 211 konnten jedoch Umsatzsteigerungen tun hatte. -

Corporate Governance Report

Corporate governance report EVN AG is a listed stock corporation under Austrian law whose Deviations from C-Rules shares are traded on the Vienna Stock Exchange. Corporate gov- EVN does not fully comply with the following C-Rules of the ACGC: ernance is therefore based on Austrian law – in particular stock corporation and capital market laws, legal regulations govern- Rule 16: The Supervisory Board did not appoint a member of the ing co-determination by employees and the company by-laws – Executive Board to serve as chairman because the Executive Board as well as the Austrian Corporate Governance Code (ACGC, see consists of only two members in line with its assigned duties and www.corporate-governance.at – and the rules of procedure for the structure of the company. In cases where the Executive Board the company’s corporate bodies. consists of only two members, voting is based on the following rules: meetings must be announced in the approved manner and both Executive Board members must be present. Resolutions must be passed unanimously and abstention from voting is not permitted. If a unanimous decision is not reached, the Executive Board must Commitment to the Austrian review and vote again on the respective point of the agenda within Corporate Governance Code ten days. The Executive Board must report to the Supervisory Board if the second round of voting does not bring a unanimous decision. Introduction A spokesman is appointed for the Executive Board even when there The Executive Board and the Supervisory Board of EVN are com- are only two members, and the rules for the direction of the meet- mitted to the principles of good corporate governance and, in this ings and the representation also apply in this case. -

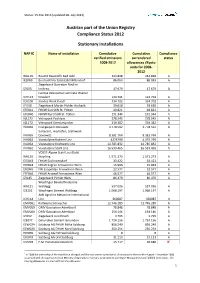

Austrian Part of the Union Registry Compliance Status 2012 Stationary

Status: 15 Mai 2013 (updated 28. July 2014) Austrian part of the Union Registry Compliance Status 2012 Stationary installations NAP ID Name of installation Cumulative Cumulative Compliance verified emissions surrendered status 2008-2012 allowances /Kyoto units for 2008- 2012 IKA119 Baumit Baustoffe Bad Ischl 244.848 244.848 A IES069 Breitenfelder Edelstahl Mitterdorf 86.063 86.063 A Ziegelwerk Danreiter Ried im IZI155 Innkreis 17.679 17.679 A Isomax Dekorative Laminate Wiener ICH113 Neudorf 124.701 124.701 A ICH106 Sandoz Werk Kundl 334.702 334.702 A IZI150 Ziegelwerk Martin Pichler Aschach 39.650 39.650 A EFE041 FHKW Süd StW St. Pölten 40.821 40.821 A EFE040 FHKW Nord StW St. Pölten 191.344 191.344 A IGL173 Vetropack Pöchlarn 278.545 278.545 A IGL172 Vetropack Kremsmünster 339.382 339.382 A IVA066 Energiepark Donawitz 4.778.592 4.778.592 A Sinteranl., Hochöfen, Stahlwerk IVA065 Donawitz 8.381.769 8.381.769 A IVA063 Voestalpine Kokerei Linz 4325299 4.325.299 A IVA064 Voestalpine Kraftwerk Linz 14.785.832 14.785.832 A IVA062 Voestalpine Stahl Linz 16.533.465 16.533.465 A VOEST-Alpine Stahl Linz (Kalk) IKA120 Steyrling 1.571.273 1.571.273 A EFE043 FHKW Süd Inzersdorf 33.422 33.422 A EFE044 FHKW Kagran Fernwärme Wien 15.993 15.993 A EFE045 FW Leopoldau Fernwärme Wien 22.577 22.577 A EFE046 FHKW Arsenal Fernwärme Wien 46.577 46.577 A IZI145 Ziegelwerk Pichler Wels 86.470 86.470 A Wopfinger Baustoffindustrie IKA121 Waldegg 537.026 537.026 A IZE202 Wopfinger Zement Waldegg 1.068.197 1.068.197 A AMI Agrolinz Melamine International ICH114 Linz 360087 360087 A EMV061 Raffinerie Schwechat 12.746.289 12.746.289 A EMV059 OMV Gasstation Aderklaa II 78.848 78.848 A EMV060 OMV Gasstation Aderklaa I 154.146 154.146 A IZI152 Ziegelwerk Lizzi Erlach 3.795 3.795 A IZE077 Gmundner Zement Gmunden 1.724.156 1.724.156 A EEW024 SalzBurg AG FHKW Mitte SalzBurg 856.240 856.240 A EEW025 SalzBurg AG FHKW Nord SalzBurg 250.254 250.254 A EFE035 SalzBurg AG HW Süd SalzBurg 0 0 A EFE049 SalzBurg AG LKH SalzBurg 31.113 31.113 A ICH203 F.M. -

Sustainable Storage for the Renewable Energy System of the Future

Press Release 22 January 2021 “Underground Sun Conversion – Flexible Storage”: sustainable storage for the renewable energy system of the future From December 2020, the “Underground Sun Conversion – Flexible Storage” (USC- FlexStore) project will investigate seasonal storage of large quantities of renewable energy to be made available year round. This innovative international project is aimed at developing a seasonal, high-volume transformation and storage solution for erratic renewable generation. Energy will be stored safely in gaseous form in underground facilities at depths of over 1,000m. The aim of the project is to take RAG Austria AG’s patented “Underground Sun Conversion” (USC) technology (which involves methanation of CO2 and green H2) to the next level, and to design services based on it. Field tests will be carried out at RAG’s research facility in Pilsbach (Upper Austria). In collaboration with Swiss energy supplier Energie 360° and research partners (Wiva, BOKU Vienna, Empa, University of Bern, OST) working on this multi-disciplinary, transnational project, know-how and specific capabilities will be bundled. The research will focus on devising solutions to one of the biggest challenges facing the energy system of tomorrow: how to expand fluctuating generation of renewables such as wind and solar power while at the same time maintaining high levels of security of supply, especially in winter, when the possibility of generating power is low and demand is high? Investigations will centre on the technological, commercial, energy-sector and legal requirements for a cross-sector approach that can reduce the current need for substantial imports and use of fossil energy in winter, when demand is stronger. -

DIVIDENDEN.REPORT.2020 Geplante Ausschüttungspolitik Der ATX Konzerne Mit Stand 2

DIVIDENDEN.REPORT.2020 Geplante Ausschüttungspolitik der ATX Konzerne mit Stand 2. April 2020 Ein erster Blick in die Dividendensaison 2020 Im Rahmen dieser Schnelluntersuchung analysiert die Abteilung Betriebswirtschaft der AK-Wien die Dividenden- politik der großen, im Austrian Trade Index notierten, Konzerne. Zum Untersuchungszeitpunkt waren folgende Unternehmen im ATX notiert: Andritz AG, AT&S Austria Technologie & Systemtechnik AG, BAWAG Group AG, CA Immobilien Anlagen AG, DO&CO AG, Erste Group Bank AG, Immofinanz AG, Lenzing AG, Mayr-Melnhof Karton AG, Österreichische Post AG, OMV AG, Raiffeisen Bank International AG, Schoeller-Bleckmann Oilfield Equipment AG, S Immo AG, Telekom Austria AG, Uniqa Insurance Group AG, Verbund AG, Vienna Insurance Group AG, Voestalpine AG und Wiener- berger AG Zum Auswertungszeitpunkt, mit Stand 2. April 2020, lagen von 13 Unternehmen die vollständigen Konzernab- schlüsse (Andritz AG, BAWAG Group AG, Erste Group Bank AG, CA Immobilien Anlagen AG, Lenzing AG, OMV AG, Österreichische Post AG, Raiffeisen Bank International AG, Schoeller-Bleckmann Oilfield Equipment AG, S-Immo AG, Telekom Austria AG, Verbund AG Wienerberger AG) vor. Von weiteren 3 Unternehmen lagen die vorläufigen Zahlen (Mayr-Melnhof Karton AG, Uniqa Insurance Group AG und Vienna Insurance Group AG) vor. Es können daher mit Stand 2. April 2020 verlässliche Aussagen zu 80 % der ATX Konzerne getätigt werden. Rekordgewinne – zwei Drittel der Unternehmen konnten ihre Ergebnisse verbessern Das abgelaufene Wirtschaftsjahr 2019 bescherte den ATX-Unternehmen nach dem Vorjahr erneut Rekordge- winne. Konkret stieg das kumulierte, den AktionärInnen zurechenbare Ergebnis der 16 ATX Konzerne um 3,9 % auf 7,75 Milliarden Euro. Das zweite Jahr in Folge fuhren alle untersuchten Unternehmen einen Konzernüber- schuss ein. -

Company Presentation March 2019

EVN – energy company and environmental services provider March 2019 2 Agenda EVN at a glance Business development FY 2017/18) Back-up information Company presentation, March 2019 , Integrated .usiness model as .asis for our value chain 0eneration Networks 1rade and Customers 2) Environment 1hermal 1,771 M2) 3enewa.le 591 Electricity supply Electricity ,.4m) Drinking water M2) 1) 142,105 km) supply Electricity Natural gas 0.,m) Natural gas 2astewater Natural gas 7eating 0.1m) 14,012 km) treatment Storage 7eat 7eat Drinking water 0.5m) 1hermal waste Natural gas 875 km) utilisation 1) 1hereof ,,5 M2 wind power as of Decem.er 2018) 2) Num.er of customers in .rackets Foreign markets in the energy .usiness : Bulgaria: Electricity distri.ution networks, electricity supply, generation and heat : Macedonia: Electricity distri.ution networks, electricity supply and generation : Selected activities in 0ermany, Croatia and Al.ania Company presentation, March 2019 4 7igh share of regulated and sta.le .usiness EU3 571.8m 73% of EBITDA from regulated and stable business in FY 2017/18) Regulated business in Lower Austria Electricity distri.ution networks Natural gas distri.ution networks ,8% Stable business in Lower Austria 2ind generation 2ater supply 2.,%) 7eat 5.9%) 2aste incineration 4.0%) 19% Ca.le 1V and telecommunication 4.5%) Earnings contri.ution from Burgenland 7olding 1.7%) Regulated business in SEE 15% Electricity distri.ution networks Unregulated business Electricity supply 0eneration 7eat Energy trade and supply 27% International environmental projects Storage of natural gas as well as E&A of oil and natural gas EBI1DA share in 2017/18 Company presentation, March 2019 5 Sustaining high share of sta.le income from regulated network .usiness Investments in electricity networks : New construction or eBpansion of transformer stations : EBpansion of 110 kV power lines : Smart meter Investments in gas networks : 3eplacement of AVC gas pipelines C future 3AB growth ,-4% p.a. -

Branchenreport Mineralöl 2019

BRANCHENREPORT MINERALÖL 2019 Kontakt: Abteilung Betriebswirtschaft, AK Wien, +43 1 501 65 DW 12650 Bei Verwendung von Textteilen wird um Quellenangabe und Zusendung Eines Belegexemplares an die AK Wien, Abteilung Betriebswirtschaft, ersucht. Impressum Medieninhaber: Kammer für Arbeiter und Angestellte für Wien, Prinz Eugen Straße 20-22, 1040 Wien, Telefon: (01) 501 65 0 Offenlegung gem. § 25 MedienG: siehe wien.arbeiterkammer.at/impressum Zulassungsnummer: AK Wien 02Z34648 M AuftraggeberInnen: AK Wien, Betriebswirtschaft AutorInnen: Simon Schumich [email protected] +43 1 50165 DW 12682 Kathrin Schragl [email protected] +43 1 50165 DW 12792 Bilanzdatenbank: Elisabeth Lugger, Kristina Mijatovic-Simon Beiträge: Sandra Matzinger, Michael Soder (Das energiepolitische Umfeld) Kai Biehl, Michael Ertl, Markus Marterbauer, Reinhold Russinger (Wirtschaftslage Österreichs) Foto: Rido - Fotolia Grafik Umschlag und Druck: AK Wien Verlags- und Herstellungsort: Wien © 2019 bei AK Wien Stand November 2019 Im Auftrag der Kammer für Arbeiter und Angestellte für Wien Branchenreport.2019 │ 2 INHALT 1 Kurzfassung ............................................................................................................. 4 2 Wirtschaftslage Österreichs...................................................................................... 6 WIFO-Prognose Oktober 2019 für Österreich ................................................................................................................ 6 Aktuelle WIFO-Prognose im Vergleich .......................................................................................................................... -

GREEN FINANCING FRAMEWORK Green Financing Framework

March 2021 GREEN FINANCING FRAMEWORK Green Financing Framework Table of contents Introduction 2 Strategy and Rationale 3 Commitment to the Sustainable Development Goals 6 Environmental and Social Risk Management 7 Alignment with Voluntary Market Standards 9 Green Bond Principles 9 Use of Proceeds 9 Process for Project Evaluation and Selection 10 Management of Proceeds 11 Reporting 11 External Review 12 Sustainability-Linked Bond Principles 12 Selection of Key Performance Indicators (KPIs) 13 Calibration of Sustainability Performance Targets (SPTs) 16 Bond characteristics 20 Reporting 21 Verification 21 Annex I – Impact Reporting 23 Disclaimer 25 1 Green Financing Framework Introduction VERBUND’s mission is to energise the future with clean electricity from our renewable energy plants and innovative solutions. VERBUND is Austria’s largest utility company. VERBUND’s value chain comprises the generation, transportation, trading and sale of electrical energy and other energy sources as well as the provision of energy services. In 2020, the Group generated annual revenue of around €3.2bn with approximately 2,870 employees. VERBUND has been listed on the Vienna Stock Exchange since 1988, with 51% of the share capital held by the Republic of Austria. 2 Green Financing Framework Strategy and Rationale VERBUND’s 2030 strategy is based on five strategic pillars: efficient generation of electricity from hydropower; expansion of electricity generation from renewable energy sources such as wind and solar power; sustainable expansion and safe operation of the Austrian high-voltage grid; use of the flexible power plants to maintain security of supply in Austria; and the Sales segment, with provision of customer-centric, innovative products and services. -

Hydro News Issue 33

№33 INTELLIGENT NEWS MONITORING Cover Story Page 16 Grand Coulee USA Page 12 Country Report New Zealand Page 24 Magazine of ANDRITZ Hydro // №33 / 12-2019 №33 ANDRITZ Hydro Magazine of // Reventazón Costa Rica ENGLISH Page 34 HYDRO PASSION FOR HYDRO All employees at ANDRITZ share the same core values that define how we act and what we stand for. We love what we do. Our ability to get the best out of ourselves and our technology is what makes us stand out. Times and technologies change, but our passion is always there. №33 / 2019 HYDRONEWS 3 Solving the challenges of the hydropower market Dear Business Friends, The energy market – and the hydropower indus- try especially – is facing many challenges with the growing demand for “base load renewables” and aging of much of the existing hydropower fleet. As a result, new strategies are needed for success- ful hydro asset management and operation. One solution to reduce costs and improve operations is maintenance optimization to increase revenues. The new Metris DiOMera Platform, developed by ANDRITZ, is addressing these topics. Among recent Wolfgang Semper Harald Heber project successes are the latest orders for Metris DiOMera, coming from the PresAGHO project in South America and Cerro del Águila in Peru. At a time when baseload power generation from fossil resources has to be replaced by a carbon-free renewable energy-based alternative, large-scale energy hybrid solutions offer a vital approach for the future. Hybrid solutions combine two or more power generation technologies with at least one renewable energy source, as well as a power and energy storage system. -

Energy. Water. Life. Full Report 2018 /19 Report 2018 EVN Full Dear Ladies and Gentlemen, Dear Shareholders

/ 19 Energy. Water. Life. Full Report 2018 /19 EVN Full Report 2018 EVN Full Dear Ladies and Gentlemen, Dear Shareholders, The future of the global climate has domi- investments towards Lower Austria’s network nated public discussions in recent months. infrastructure. We see these investments as a EVN’s activities during the 2018/19 financial central step on the road to a climate-friendly year included the early termination of energy system because they are an indispen- coal-generated electricity production in sable requirement for protecting network Lower Austria – also against the backdrop stability in view of a further increase in volatile of the substantial increase in the price of renewable generation. CO2 emission certificates – as well as the accelerated expansion of wind power. We are also making a substantial contribution Our wind power generation capacity has in support of renewable generation: EVN, increased by roughly 100 MW to 367 MW currently the leading wind power producer in in only two financial years, which means Lower Austria, set an ambitious goal several we have reached our interim goal one year years ago to increase this capacity to 500 MW. earlier than planned. These two examples While our work is directed to meeting this alone show that we are committed to sup- goal, we are also evaluating projects for porting the future-oriented transformation large-scale photovoltaic facilities, especially at of our energy system towards renewable our own power plant locations. Here we see generation. a potential of up to 100 MW in our markets over the medium term, subject to appropriate Our long-term strategy as a listed company framework conditions. -

Sustainability Report RAG Austria AG

Sustainability report RAG Austria AG The future interests me far more than the past, as I intend living in it. Albert Einstein ENGLISH RAG Austria AG Foreword at a glance Total number of employees 225 Dear Reader, (incl. temporary workers) total We are pleased to present our company‘s first Sustainability Report to all stakeholders. 171 | 76 % men 54 | 24 % women RAG Austria AG has been operating in Austria since the 1930s and in recent years has become the fourth largest energy storage company in Europe. We use our many years of Maternity / know-how to store natural gas in depleted natural underground gas reservoirs. In this way, Paternity leave we ensure that these depleted gas reservoirs are used sustainably and with significant economic benefits for Austria. After all, securing energy supplies for the future with sustai- 7 | 3,1 % 11 | 4,9 % maternity leave paternity leave nable and affordable energy while simultaneously reducing greenhouse gas emissions and improving energy efficiency is one of the greatest challenges facing the world today. This report is intended to give you an overview of the concrete measures we are taking to million euros Research million Euro and development Total invest- kg LNG sale positively support the achievement of the defined climate and energy goals. We see our per month 6.9 expenses 49.8 ments 40.000 role in particular in working with innovative research projects on the production of renewa- ble gas - projects that are also funded by the Austrian Climate and Energy Fund. RAG‘s sustainability strategy relates not only to our energy services themselves, but also to AFFORDABLE AND Training costs CLEAN ENERGY how we provide these services and deal with our business partners, neighbours and employees.