Account-To-Account Electronic Money Transfers: Recent Developments in the United States

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FEDERAL RESERVE SYSTEM 12 CFR Part 229 Regulation CC

FEDERAL RESERVE SYSTEM 12 CFR Part 229 Regulation CC [Docket No. R-1637] RIN 7100-AF 28 BUREAU OF CONSUMER FINANCIAL PROTECTION 12 CFR Part 1030 [Docket No. CFPB–2018–0035] RIN 3170–AA31 Availability of Funds and Collection of Checks (Regulation CC) AGENCY: Board of Governors of the Federal Reserve System (Board) and Bureau of Consumer Financial Protection (Bureau) ACTION: Final rule. SUMMARY: The Board and the Bureau (Agencies) are amending Regulation CC, which implements the Expedited Funds Availability Act (EFA Act), to implement a statutory requirement in the EFA Act to adjust the dollar amounts under the EFA Act for inflation. The Agencies are also amending Regulation CC to incorporate the Economic Growth, Regulatory Relief, and Consumer Protection Act (EGRRCPA) amendments to the EFA Act, which include extending coverage to American Samoa, the Commonwealth of the Northern Mariana Islands, and Guam, and making certain other technical amendments. DATES: This rule is effective July 1, 2020, except for the amendments to §§ 12 CFR 229.2(c), (ff), and (jj), 229.12(e), 229.43, and 12 CFR Part 1030 which are effective [INSERT DATE 60 DAYS AFTER DATE OF PUBLICATION IN THE FEDERAL REGISTER]. FOR FURTHER INFORMATION CONTACT: Board: Gavin L. Smith, Senior Counsel (202) 452-3474, Legal Division, or Ian C.B. Spear, Manager (202) 452-3959, Division of Reserve Bank Operations and Payment Systems. Bureau: Joseph Baressi and Marta Tanenhaus, Senior Counsels, Office of Regulations, at (202) 435-7700. If you require this document in an alternative electronic format, please contact [email protected]. SUPPLEMENTARY INFORMATION: I. -

Interpretive Letter #1036 August 2005 12 USC 36

O Comptroller of the Currency Administrator of National Banks Washington, DC 20219 August 10, 2005 Interpretive Letter #1036 August 2005 12 USC 36 Subject: Remote Deposit Capture Terminals Dear [ ]: This is in response to your letter of June 2, 2005 on behalf of [ National Bank ], requesting confirmation of our earlier telephone discussion as to whether a check scanning terminal at a nonbank location, used by a bank customer to transmit electronic images of checks to the bank for deposit, is a branch within the meaning of the McFadden Act, 12 U.S.C. § 36. This will confirm my opinion expressed during that call that such terminals are not branches under federal law regardless of whether they are owned by the customer or the bank. Facts According to your letter, it is now possible for a corporate customer of a bank to use a check scanning terminal, located on the customer’s premises, to make deposits. The customer scans a check and an electronic image of the check is then transmitted to the bank to effect a deposit. This can be done even when the depositary bank is located in another state and does not have a branch in the customer’s state. In some cases the scanning terminal may be owned by the bank, while in other cases the customer or a third party may own the terminal. This process, known as “remote deposit capture,”1 has been made possible by the Check Clearing for the 21st Century Act (“Check 21 Act”),2 which was enacted in 2003 and took effect on October 28, 2004. -

Regulation CC

Consumer Affairs Laws and Regulations Regulation CC Introduction The Expedited Funds Availability Act (EFA) was enacted in August 1987 and became effective in Septem- ber 1988. The Check Clearing for the 21st Century Act (Check 21) was enacted October 28, 2003 with an effective date of October 28, 2004. Regulation CC (12 C.F.R. Part 229) issued by the Board of Governors of the Federal Reserve System implements the EFA act in Subparts A through C and Check 21 in Subpart D. Regulation CC sets forth the requirements that depository institutions make funds deposited into transaction accounts available according to specified time schedules and that they disclose their funds availability poli- cies to their customers. The regulation also establishes rules designed to speed the collection and return of unpaid checks. The Check 21 section of the regulation describes requirements that affect banks that create or receive substitute checks, including consumer disclosures and expedited recredit procedures. Regulation CC contains four subparts: • Subpart A – Defines terms and provides for administrative enforcement. • Subpart B – Specifies availability schedules or time frames within which banks must make funds avail- able for withdrawal. It also includes rules regarding exceptions to the schedules, disclosure of funds availability policies, and payment of interest. • Subpart C – Sets forth rules concerning the expeditious return of checks, the responsibilities of paying and returning banks, authorization of direct returns, notification of nonpayment of large-dollar returns by the paying bank, check-indorsement standards, and other related changes to the check collection system. • Subpart D – Contains provisions concerning requirements a substitute check must meet to be the legal equivalent of an original check; bank duties, warranties, and indemnities associated with substitute checks; expedited recredit procedures for consumers and banks; and consumer disclosures regarding sub- stitute checks. -

Pa Perspectives on Nordic Financial Services

PA PERSPECTIVES ON NORDIC FINANCIAL SERVICES Autumn Edition 2017 CONTENTS The personal banking market 3 Interview with Jesper Nielsen, Head of Personal Banking at Danske bank Platform thinking 8 Why platform business models represent a double-edged sword for big banks What is a Neobank – really? 11 The term 'neobanking' gains increasing attention in the media – but what is a neobank? Is BankID positioned for the 14future? Interview with Jan Bjerved, CEO of the Norwegian identity scheme BankID The dance around the GAFA 16God Quarterly performance development 18 Latest trends in the Nordics Value map for financial institutions 21 Nordic Q2 2017 financial highlights 22 Factsheet 24 Contact us Chief editors and Nordic financial services experts Knut Erlend Vik Thomas Bjørnstad [email protected] [email protected] +47 913 61 525 +47 917 91 052 Nordic financial services experts Göran Engvall Magnus Krusberg [email protected] [email protected] +46 721 936 109 +46 721 936 110 Martin Tillisch Olaf Kjaer [email protected] [email protected] +45 409 94 642 +45 222 02 362 2 PA PERSPECTIVES ON NORDIC FINANCIAL SERVICES The personal BANKING MARKET We sat down with Jesper Nielsen, Head of Personal Banking at Danske Bank to hear his views on how the personal banking market is developing and what he forsees will be happening over the next few years. AUTHOR: REIAR NESS PA: To start with the personal banking market: losses are at an all time low. As interest rates rise, Banking has historically been a traditional industry, loss rates may change, and have to be watched. -

Interbank GIRO Is an Automated Payment Service Which Allows You to Make Monthly Payment to Your ICBC Credit Card Account from Your Designated Bank Account Directly

Interbank GIRO Frequently Asked Questions: 1. What is Interbank GIRO? Interbank GIRO is an automated payment service which allows you to make monthly payment to your ICBC Credit Card account from your designated bank account directly. The amount will be deducted from your designated bank account and paid to ICBC every month. All you need to do is to ensure that the designated bank account has sufficient funds every month. 2. What is the benefit of using Interbank GIRO? Interbank GIRO is a convenient, paperless and cashless payment method. It enables you to make hassle-free monthly payments to ICBC through your designated bank account. There are also no fees charged for the setup. 3. Are there any additional charges for signing up for Interbank GIRO? There are no fees charged for the setup of Interbank GIRO. 4. How can I apply for Interbank GIRO? Simply fill up the Interbank GIRO form, and submit to Credit Card Department. 5. Which banks can I use for Interbank GIRO? You can use any bank that supports Interbank GIRO. 6. How long is the Interbank GIRO application Processing Time? Interbank GIRO applications may take up to 60 days to process, including the processing time required by the deducting bank. We will notify you of your application status as soon as possible. 7. How do I submit the Interbank GIRO form to ICBC Credit Card Department? You can mail the duly signed Original Interbank GIRO form to ICBC Credit Card Department by using the Business Reply Service Envelope attached. Please do not fax the Interbank GIRO form or email the scanned copy of the Interbank GIRO form as the designated bank requires the original signature for verification. -

Building a Customer-Centric Digital Bank in Singapore: It Takes an Ecosystem

White Paper Digital Banking EQUINIX AND KAPRONASIA BUILDING A CUSTOMER-CENTRIC DIGITAL BANK IN SINGAPORE: IT TAKES AN ECOSYSTEM Contents The dawn of digital banking in the Lion City Defining a value proposition . 2 No digital bank, in the purest sense of the term, Digital banking in Singapore amid COVID-19 . 4 currently exists in Singapore. While there are many fintechs, most provide only digital financial services The digital banking opportunity: that do not require a banking license: digital wallet retail and corporate . 5 services, cross-border payments and various virtual- asset-focused services. A digital bank (also known Key success factors for digital banks . 7 as a “neobank” or “virtual bank”) differs in that it is licensed to both accept customer deposits and issue 1. Digital agility to support a better loans, whether to retail customers, corporate customers customer experience. .7 or both. Singapore’s financial regulator, the Monetary 2. Favorable cost structure. .8 Authority of Singapore (MAS) plans to release five digital bank licenses in total and will announce the 3. Optimizing security .............................8 successful licensees in the second half of 2020. The licensed digital banks will likely then launch in mid-2021. Conclusion: The ecosystem opportunity . 10 While many less-developed Southeast Asian economies are leveraging digital banks to focus on financial inclusion, the role of digital banks in Singapore will be slightly different and focused on driving innovation. Bringing together traditional financial services firms, fintechs, other tech companies and even telecoms Singapore will become one of the firms, digital banks could act as a catalyst for financial focal points of Asia’s digital banking innovation in Singapore and help the city-state maintain evolution when the city-state awards its competitive advantage as a regional fintech hub. -

Download This Article

The Fidelity Law Journal published by The Fidelity Law Association Volume XIII, October 2007 Cite as XIII Fid. L.J. ___ (2007) WWW.FIDELITYLAW.ORG The Fidelity Law Journal is published annually. Additional copies may be purchased by writing to: The Fidelity Law Association, c/o Wolff & Samson PC, One Boland Drive, West Orange, New Jersey 07052. The opinions and views expressed in the articles in this Journal are solely of the authors and do not necessarily reflect the views of the Fidelity Law Association or its members, nor of the authors’ firms or companies. Publication should not be deemed an endorsement by the Fidelity Law Association or its members, or the authors’ firms or companies, of any views or positions contained herein. The articles herein are for general informational purposes only. None of the information in the articles constitutes legal advice, nor is it intended to create any attorney-client relationship between the reader and any of the authors. The reader should not act or rely upon the information in this Journal concerning the meaning, interpretation, or effect of any particular contractual language or the resolution of any particular demand, claim, or suit without seeking the advice of your own attorney. The information in this Journal does not amend, or otherwise affect, the terms, conditions or coverages of any insurance policy or bond issued by any of the authors’ companies or any other insurance company. The information in this Journal is not a representation that coverage does or does not exist for any particular claim or loss under any such policy or bond. -

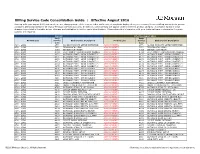

Billing Service Code Consolidation Guide | Effective August 2016

Billing Service Code Consolidation Guide | Effective August 2016 Starting with your August 2016 statement, we are changing some of the service codes and service descriptions displayed on your Treasury Services Billing statement to provide consistent billing standards for all of your Treasury Services accounts. In addition, some services will appear under a different product category. A complete listing of these changes is provided in the table below. Changes are highlighted in red for easier identification. Please share this information with your technical team to determine if system updates are required. Current Effective August 2016 Bank Bank Product Line Service Bank Service Description Product Line Service Bank Service Description Code Code ACH - GIRO 2770 ACHDD MANDATE SETUP(INITIATOR) ACH PAYMENTS 2770 ACHDD MANDATE SETUP(INITIATOR) ACH - GIRO 3971 ZENGIN ACH (LOW) ACH PAYMENTS 3971 ZENGIN ACH (LOW) ACH - GIRO 4093 ZENGIN ACH (HIGH) ACH PAYMENTS 4093 ZENGIN ACH (HIGH) ACH - GIRO 4094 ELECTRONIC TRANSMISSION CHARGE ACH PAYMENTS 4094 ELECTRONIC TRANSMISSION CHARGE ACH - GIRO 4170 OUTWARD PYMT - GIRO (URGENT) 1 ACH PAYMENTS 4170 OUTWARD PYMT - GIRO (URGENT) 1 ACH - GIRO 4171 OUTWARD PYMT - GIRO (URGENT) 2 ACH PAYMENTS 4171 OUTWARD PYMT - GIRO (URGENT) 2 ACH - GIRO 4172 OUTWARD PYMT - GIRO (URGENT) 3 ACH PAYMENTS 4172 OUTWARD PYMT - GIRO (URGENT) 3 ACH - GIRO 4173 OUTWARD PYMT - GIRO (URGENT) 4 ACH PAYMENTS 4173 OUTWARD PYMT - GIRO (URGENT) 4 ACH - GIRO 4174 OUTWARD PYMT - GIRO (URGENT) 5 ACH PAYMENTS 4174 OUTWARD PYMT - GIRO (URGENT) -

Payment Services Guide

CitiDirect® Online Banking Payments Services Guide March 2004 Proprietary and Confidential These materials are proprietary and confidential to Citibank, N.A., and are intended for the exclusive use of CitiDirect ® Online Banking customers. The foregoing statement shall appear on all copies of these materials made by you in whatever form and by whatever means, electronic or mechanical, including photocopying or in any information storage system. In addition, no copy of these materials shall be disclosed to third parties without express written authorization of Citibank, N.A. Table of Contents Overview .......................................................................................................................................1 Payments Services....................................................................................................................1 Creating Service Requests From Transaction Lookup..............................................................2 Creating Service Requests From Transaction Details ..............................................................9 Modifying Service Requests....................................................................................................14 Authorizing or Deleting Service Requests...............................................................................16 Viewing Service Request Transactions...................................................................................18 Disclaimer ...................................................................................................................................20 -

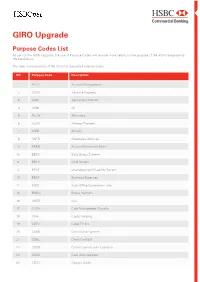

GIRO Upgrade Purpose Codes List

GIRO Upgrade Purpose Codes List As part of the GIRO Upgrade, the use of Purpose Codes will provide more details on the purpose of the ACH transaction to the beneficiary. The table below consists of the full list of supported purpose codes. SN Purpose Code Description 1 ACCT Account Management 2 ADVA Advance Payment 3 AGRT Agricultural Transfer 4 AIRB Air 5 ALLW Allowance 6 ALMY Alimony Payment 7 ANNI Annuity 8 ANTS Anesthesia Services 9 AREN Account Receivable Entry 10 BBSC Baby Bonus Scheme 11 BECH Child Benefit 12 BENE Unemployment Disability Benefit 13 BEXP Business Expenses 14 BOCE Back Office Conversion Entry 15 BONU Bonus Payment 16 BUSB Bus 17 CASH Cash Management Transfer 18 CBFF Capital Building 19 CBTV Cable TV Bill 20 CCRD Credit Card Payment 21 CDBL Credit Card Bill 22 CDCB Credit Payment with Cashback 23 CDCD Cash Disbursement 24 CDOC Original Credit SN Purpose Code Description 25 CDQC Quasi cash 26 CFEE Cancellation Fee 27 CHAR Charity Payment 28 CLPR Car Loan Principal Repayment 29 CMDT Commodity Transfer 30 COLL Collection Payment 31 COMC Commericial Payment 32 COMM Commission 33 COMT Consumer Third Party Consolidate Payment 34 COST Costs 35 CPKC Carpark Charges 36 CPYR Copyright 37 CSDB Cash Disbursement 38 CSLP Company Social Loan Payment To Bank 39 CVCF Convalescent Care facility 40 DBTC Debit Collection Payment 41 DCRD Debit Card Payment 42 DEPT Deposit 43 DERI Derivatives 44 DIVD Dividend 45 DMEQ Durable Medical Equipment 46 DNTS Dental Services 47 EDUC Education 48 ELEC Electricity Bill 49 ENRG Energies 50 ESTX Estate -

Report to the Congress on the Check Clearing for the 21St Century Act of 2003

Board of Governors of the Federal Reserve System Report to the Congress on the Check Clearing for the 21st Century Act of 2003 April 2007 Board of Governors of the Federal Reserve System Report to the Congress on the Check Clearing for the 21st Century Act of 2003 Submitted to the Congress pursuant to section 16 of the Check Clearing for the 21st Century Act of 2003 April 2007 Report to the Congress on Check 21 Contents Contents I. Executive Summary .................................................................................................... 1 II. Introduction ................................................................................................................. 4 III. Background ................................................................................................................. 6 Overview of Check 21................................................................................................. 6 Overview of the EFAA................................................................................................ 7 IV. Check 21 Adoption.................................................................................................... 10 V. Funds-availability Practices ...................................................................................... 13 VI. Returned Checks........................................................................................................ 15 VII. Check Losses............................................................................................................ -

BST TOC (Page 1)

BS&T’S EXECUTIVE SUMMIT 2011: SEE PAGES 20-21 NEW STRATEGIES FOR NEW BUSINESS MODELS Business Innovation Powered By Technology July 2011 Arkadi Pete Kuhlmann Kight Muhammed Steve Yunus Jobs Richard Jack Fairbank Dorsey INNOVATORS OF THE DECADE Who has had the most significant impact on banking technology over the past 10 years? Here are 10 innovators who have helped shape the 21st century banking industry. p.15 David Jeff Walker Bezos Aaron Barney Patzer Frank $8.95 www.banktech.com B:8.375” S:7” Visit star.com/learnmore B:11.125” S:9.4375” In today’s changing debit landscape, choose the STAR® Network to ensure success every step of the way. Regulatory change is coming, and you need to prepare. The STAR® Network adds value beyond the transaction with: • Cutting-edge Security Solutions • Industry-leading Innovation • Coast-to-coast POS/ATM Access • Proven Commitment ©2011 First Data Corporation. All Rights Reserved. 79649_Star_Mag_FP_Size_A.indd 215 Park Av. South, Saved At: 4-11-2011 2:55 PM By: JPavia / mgobel Printed at: None Print #: 1 Round #: 1 2nd Level NY, NY, 10003 212.206.1005 Job Info Specs Fonts, Images & Inks Approvals W/C OK Client: FD Bleed: None Inks: Cyan, Magenta, Yellow, Black Creative Director: Product: First Data Trim: 8.375” x 11.125” Fonts: Simple Sans (Regular, Medium) Art Director: Job #: 79649 Safety: 7” x 9.4375” Images: grey_bg_7x5.tif (Gray; 354 ppi; 169.15%), Copywriter: Star_Logo.eps, FD_3C_4c.eps, FD_Star.eps, FD_Bird.eps, Job Title: Star Program Ads Gutter: None Account: FD_Cloud2.eps, FD_Cloud1.eps, FD_Hat.eps, FD_Man.eps, FD-Beyond-Symbol-4c_ERS.eps, FD-Tagline-4c_ERS.eps Studio: Publications: The Warren Group, Bank News, Bank System & Tech Print Production: Business Innovation Powered By Technology July 2011 banktech.com INNOVATORS OF THE DECADE COVER STORY FEATURE STORY 29 How to Build a 15 Unstoppable Force Secure Mobile App THE INNOVATION JUGGERNAUT Innovation — and the change As banks rush to deploy mobile that comes with it — are inevitable.