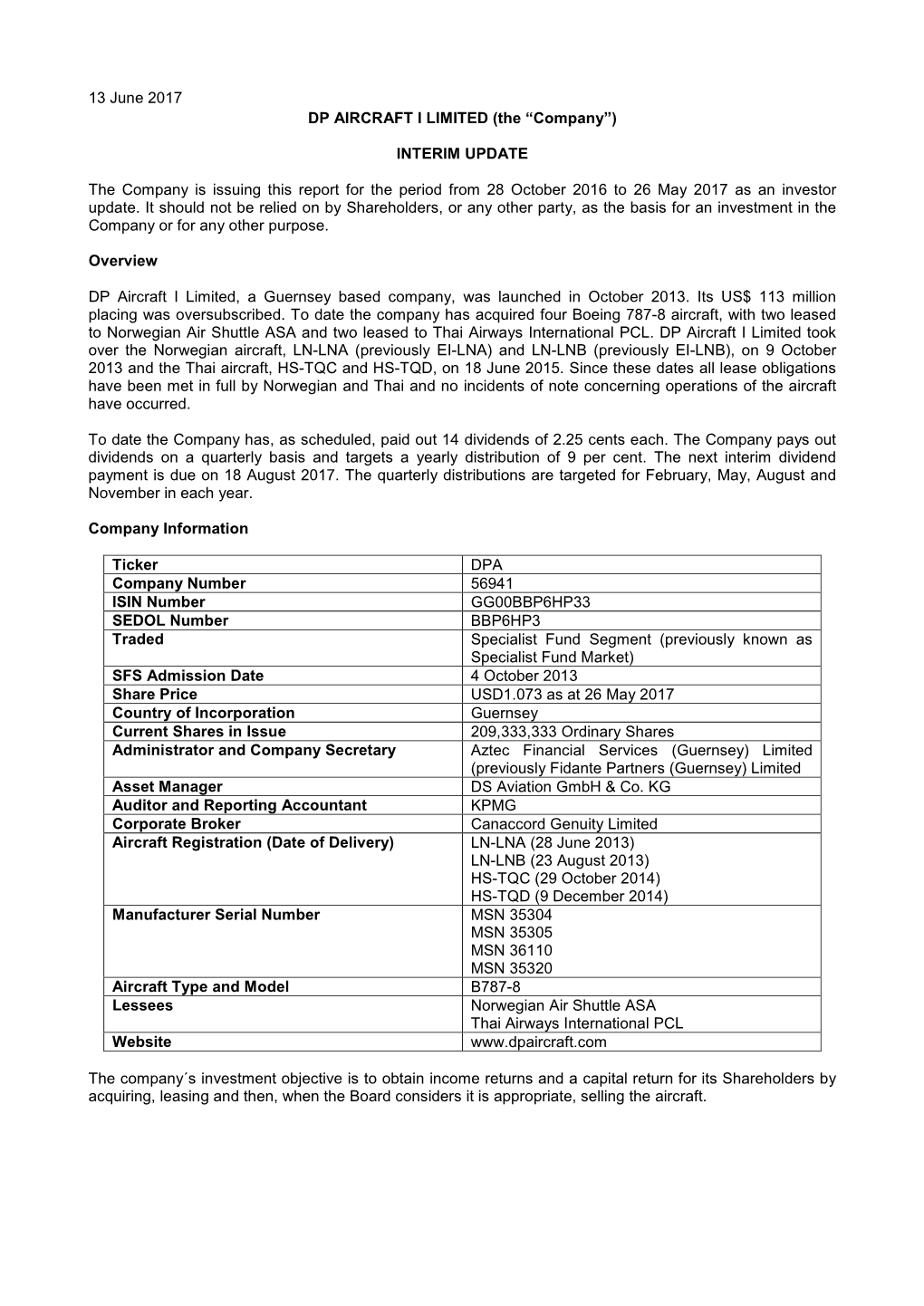

Interim Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2016 Environmental Report

Build Something Cleaner The Boeing Company 2016 Environment Report OUR APPROACH DESIGN AND DEVELOPMENT MANUFACTURING AND OPERATIONS IN SERVICE END OF SERVICE APPENDIX About The Boeing Company Total revenue in For five straight Currently holds 2015: $96.1 billion years, has been 15,600 active named a top global patents around Employs 160,000 innovator among the world people across the aerospace and United States and in defense companies Has customers in more than 65 other 150 countries countries Established 11 research and For more than a 21,500 suppliers development centers, decade, has been and partners 17 consortia and the No.1 exporter around the world 72 joint global in the United States research centers OUR APPROACH DESIGN AND DEVELOPMENT MANUFACTURING AND OPERATIONS IN SERVICE END OF SERVICE APPENDIX At Boeing, we aspire to be the strongest, best and best-integrated aerospace-based company in the world— and a global industrial champion—for today and tomorrow. CONTENTS Our Approach 2 Design and Development 18 Manufacturing and Operations 28 In Service 38 End of Service 46 Jonathon Jorgenson, left, and Cesar Viray adjust drilling equipment on the 737 MAX robotic cell pulse line at Boeing’s fab- rication plant in Auburn, Washington. Automated production is helping improve the efficiency of aircraft manufacturing. (Boeing photo) 1 OUR APPROACH DESIGN AND DEVELOPMENT MANUFACTURING AND OPERATIONS IN SERVICE END OF SERVICE APPENDIX As Boeing celebrates Our Approach its first century, we are looking forward to the innovations of the next 100 years. We are working to be the most environmentally progressive aero- space company and an enduring global industrial champion. -

Qtr 01 15 a Quarterly Publication Brought to You by the Boeing Edge

QTR_01 15 A QUARTERLY PUBLICATION BROUGHT TO YOU BY THE BOEING EDGE Take Our Readership Survey See page 3 Building Better Communication Advanced Ultrasonic Inspection Preventing Loss of Control in Flight Commercial Operations on Runways with Arresting Systems Cover photo: 737-800 Vertical Fin Assembly AERO Contents 03 Building Better Communication: Readership Survey You have an opportunity to provide input that will help shape future issues of AERO. 05 AERO Advanced Ultrasonic Readership Survey Inspection Boeing has introduced advanced Share your opinions, ultrasonic inspection techniques that insights, and ideas at provide operators with significant www.boeing.com/aerosurvey . cost improvements over traditional 05 ultrasonic testing technologies. 09 Preventing Loss of Control in Flight A multiyear industry analysis of loss-of control–in-flight events generated feasible solutions in areas of training, operations, and airplane design. 17 Commercial Operations on Runways with Arresting Systems Airports with joint commercial and military operations are often equipped with runway arresting systems for tactical military air- 09 craft. Airlines working closely with airports can take steps to ensure safe commercial operations in these situations. 17 01 WWW.BOEING.COM/BOEINGEDGE/AEROMAGAZINE Issue 57 _Quarter 01 | 2015 AERO Publisher Design Cover photography Editorial Board Chris Villiers Methodologie Jeff Corwin Don Andersen, Gary Bartz, Richard Breuhaus, David Carbaugh, Laura Chiarenza, Justin Hale, Darrell Hokuf, Al John, Doug Lane, Jill Langer, -

Airbus Develops New A380 Cabin Enablers, Including “New Forward Stairs” Option

Airbus develops new A380 cabin enablers, including “New Forward Stairs” option By Melissa Silva on April, 10 2017 | Inflight Entertainment Airbus is developing a full spectrum of new cabin enablers for customers of its flagship A380 airliner. The latest is the “New Forward Stairs” (NFS) option, which was presented last week at the Aircraft Interiors Expo (AIX) in Hamburg. Together these cabin enhancements will make the already efficient and comfortable airliner even better: Overall cabin optimization is expected to result in the freeing-up of more cabin floor space for around 80 additional passengers, bringing airlines significant additional revenues. “Continuous improvement of our products is our daily work," said Dr. Kiran Rao, EVP of Strategy and Marketing at Airbus Commercial Aircraft. "This new package for our A380 customers is a smart way to meet airline needs while improving the A380 economics with additional revenues and innovating in passenger comfort.” Dr. Rao added: “Only the A380 has the economies of scale and development potential to efficiently solve the problem of increasing congestion at large airports while providing the best comfort for passengers. The aircraft can also serve fast growing markets and airlines' regional airports, so we are adapting the aircraft to meet evolving market needs.” With this latest proposal of the NFS option, the package of new cabin enablers for the A380 now comprises the following: 1 Copyright DutyFree Magazine. All rights reserved. New Forward Stairs — 20 more passengers (Business, Premium Economy and Economy Classes) The NFS involves relocation of the forward stair from door 1 to door 2, and combining the entrance of the NFS to the upper deck (going up), with the adjacent staircase to the lower-deck crew-rest (going down). -

Preventing Crew Fatigue

There’s a long history of crew fatigue as a factor in fatal accidents. All too often, flight crews don’t recognize the risks posed by long flights, extended duty days and sleep loss. For instance, look at the facts surrounding the fatal October 2004 crash of a medevac Learjet 35A into Otay Mountain, just east of San Diego’s Brown Field Municipal Airport (SDM). After flying three legs, the crew planned an FAR Part 91 deadhead IFR flight from SDM back to their base in Albuquerque. It was to be a short 1+15 jaunt. On the previous afternoon, they’d left at 3:20 p.m. from Albuquerque to fly to El Paso, Texas, to pick up a medical technician. The second leg was a 3-hr. mission from El Paso to Manzanillo, Mexico, to board the medevac patient and another passenger. After hours on the ground at Manzanillo, the crew departed at 8:40 p.m. for the 3+24 flight to San Diego, where an ambulance would transport the patient to a local hospital. They landed at Brown shortly after 11:00 p.m. due to the time zone change. The CVR told much about the crew’s fatigue. The dialogue between the captain and first officer reeks of impaired judgment and faulty decision-making. The two pilots might as well have been talking after being over-served in the airport bar. The captain said he intended to depart eastbound on Brown Field’s Runway 8L to avoid noise-sensitive populated areas to the west. The departure plan also would head them for home base at Albuquerque just after midnight. -

Billing Code 4910-13 DEPARTMENT OF

This document is scheduled to be published in the Federal Register on 03/25/2020 and available online at federalregister.gov/d/2020-06025, and on govinfo.gov Billing Code 4910-13 DEPARTMENT OF TRANSPORTATION Federal Aviation Administration 14 CFR Part 25 [Docket No. FAA-2020-0223; Special Conditions No. 25-768-SC] Special Conditions: GDC Technics, Boeing Model 777-300ER Series Airplane; Lower Lobe Crew Rest Compartment AGENCY: Federal Aviation Administration (FAA), DOT. ACTION: Final special conditions; request for comments. SUMMARY: These special conditions are issued for the Boeing Model 777-300ER series airplane. This airplane, as modified by GDC Technics, will have a novel or unusual design feature when compared to the state of technology envisioned in the airworthiness standards for transport category airplanes. This design feature is a lower lobe crew rest (LLCR) compartment located under the passenger cabin floor of the Boeing Model 777-300ER series airplane. The applicable airworthiness regulations do not contain adequate or appropriate safety standards for this design feature. These special conditions contain the additional safety standards that the Administrator considers necessary to establish a level of safety equivalent to that established by the existing airworthiness standards. DATES: This action is effective on GDC Technics on [INSERT DATE OF PUBLICATION IN THE FEDERAL REGISTER]. Send comments on or before [INSERT DATE 45 DAYS AFTER PUBLICATION IN THE FEDERAL REGISTER]. ADDRESSES: Send comments identified by Docket No. FAA-2020-0223 using any of the following methods: Federal eRegulations Portal: Go to http://www.regulations.gov/ and follow the online instructions for sending your comments electronically. -

Aviation Week & Space Technology

$14.95 JULY 27-AUGUST 16, 2020 FLIGHT PATHS FORWARD CLIMBING OUT OF COVID-19 CEO Interviews Airbus, Boeing and L3Harris U.S. Army’s FVL Plan A Heavy Lift for Industry Pandemic Tests Smallsat Industry Digital Edition Copyright Notice The content contained in this digital edition (“Digital Material”), as well as its selection and arrangement, is owned by Informa. and its affiliated companies, licensors, and suppliers, and is protected by their respective copyright, trademark and other proprietary rights. Upon payment of the subscription price, if applicable, you are hereby authorized to view, download, copy, and print Digital Material solely for your own personal, non-commercial use, provided that by doing any of the foregoing, you acknowledge that (i) you do not and will not acquire any ownership rights of any kind in the Digital Material or any portion thereof, (ii) you must preserve all copyright and other proprietary notices included in any downloaded Digital Material, and (iii) you must comply in all respects with the use restrictions set forth below and in the Informa Privacy Policy and the Informa Terms of Use (the “Use Restrictions”), each of which is hereby incorporated by reference. Any use not in accordance with, and any failure to comply fully with, the Use Restrictions is expressly prohibited by law, and may result in severe civil and criminal penalties. Violators will be prosecuted to the maximum possible extent. You may not modify, publish, license, transmit (including by way of email, facsimile or other electronic means), transfer, sell, reproduce (including by copying or posting on any network computer), create derivative works from, display, store, or in any way exploit, broadcast, disseminate or distribute, in any format or media of any kind, any of the Digital Material, in whole or in part, without the express prior written consent of Informa. -

Aviation Week & Space Technology

STARTS AFTER PAGE 38 How AAR Is Solving Singapore Doubles Its Workforce Crisis RICH MEDIA Down on Aviation ™ EXCLUSIVE $14.95 FEBRUARY 10-23, 2020 BRACING FOR Sustainability RICH MEDIA EXCLUSIVE Digital Edition Copyright Notice The content contained in this digital edition (“Digital Material”), as well as its selection and arrangement, is owned by Informa. and its affiliated companies, licensors, and suppliers, and is protected by their respective copyright, trademark and other proprietary rights. Upon payment of the subscription price, if applicable, you are hereby authorized to view, download, copy, and print Digital Material solely for your own personal, non-commercial use, provided that by doing any of the foregoing, you acknowledge that (i) you do not and will not acquire any ownership rights of any kind in the Digital Material or any portion thereof, (ii) you must preserve all copyright and other proprietary notices included in any downloaded Digital Material, and (iii) you must comply in all respects with the use restrictions set forth below and in the Informa Privacy Policy and the Informa Terms of Use (the “Use Restrictions”), each of which is hereby incorporated by reference. Any use not in accordance with, and any failure to comply fully with, the Use Restrictions is expressly prohibited by law, and may result in severe civil and criminal penalties. Violators will be prosecuted to the maximum possible extent. You may not modify, publish, license, transmit (including by way of email, facsimile or other electronic means), transfer, sell, reproduce (including by copying or posting on any network computer), create derivative works from, display, store, or in any way exploit, broadcast, disseminate or distribute, in any format or media of any kind, any of the Digital Material, in whole or in part, without the express prior written consent of Informa. -

Jet Aviation Basel Maintenance Only • 14 Passenger Fwd Galley Confi Guration • All Upgrades Performed • Always Hangared • in Perfect Exterior & Interior Conditions

OPUS TIME MONACO 2018 – 2ND EDITION OPUS TIME Welcome to the second issue of OPUS Time AIRCRAFT LISTING t OPUS, we love private jets and this an aircraft with the help of case studies, and The pre-owned business jets listed in the journal edition will prove it. What is it that introduce the newest Rolls-Royce 4x4 to you – are o ered exclusively by Opus Aeronautics. makes the idea of fl ying so special, and to a beautiful private jet belongs a spectacular A We look forward to providing you with the information why is fl ying in a private jet so desirable? automobile. you might need on any of these prestigious aircraft. In this second edition, we focus on exceptional During this festive season we invite you to pre-owned aircraft from the Boeing explore the world of business aircraft – happy BBJ-1 through the Gulfstream G650ER to the reading and welcome on board! Bombardier Challenger 650. Those aircraft “Once you have tasted fl ight, you will forever o er everything the most discerning traveler walk the earth with your eyes turned skyward, CONTENTS might wish for. We will dive into the world of for there you have been, and there you will business aircraft with the latest industry news, always long to return.” Leonardo da Vinci Boeing BBJ-1, Serial Number 37700 YG124 2 guide you through the process of acquiring Boeing BBJ-1, Serial Number 30751 YG062 3 Boeing BBJ-1, Serial Number 40586 YG 135 4 About Opus Aeronautics Gulfstream G450, Serial Number 4205 5 Gulfstream G650ER, Serial Number 6240 6 Opus Aeronautics was established in 2011 in the Principality of Monaco. -

Download This Article

A compre hensive systems-level approach in cabin design minimizes fire potential and helps ensure passenger safety. 18 AERO QUARTERLY QTR_04 | 11 Fire Protection: Passenger Cabin The cabins on all Boeing airplanes incorporate comprehensive fire-protective features and materials to minimize the potential for a fire and help ensure the safety of passengers. By Arthur L. Tutson, Boeing Organization Designation Authorization, Authorized Representative, Fire Protection; Douglas E. Ferguson, Technical Safety Chief, Fire Protection, Technical Services and modifications; and Mike Madden, Deputy Pressurized Compartment Fire Marshal, Payloads Design This article is the third in a series exploring approach that goes beyond ensuring This article describes how Boeing the implementation of fire protection on individual parts meet fire property require- incorporates fire protection features and transport category airplanes. ments by looking at the integration of all materials into the airplane cabin that meet those parts on the airplane. This approach or exceed fire protection standards defined Two types of fires can affect an airplane uses the principles of material selection, by U.S. Federal Aviation Regulations (FAR). and its occupants: in-flight and post-crash. separation, isolation, detection, and control. an in-flight fire usually occurs as a result of These principles involve separating the a system or component failure or mainte- FIRE-PROTECTIVE MATERIALS three contributory factors to a fire (fuel, nance issue. A post-crash fire usually ignition source, and oxygen), isolating results from ignition of fuel released during Most materials used in the construction potential fires from spreading to other parts a crash landing. Boeing considers both of passenger compartment interiors are of the airplane, and controlling a fire should types of fires when designing for airplane required by the U.S. -

Federal Register/Vol. 71, No. 119/Wednesday, June 21, 2006

Federal Register / Vol. 71, No. 119 / Wednesday, June 21, 2006 / Proposed Rules 35567 a means of ensuring compliance with payment or transmittal orders for funds III. Conclusion the requirement to report suspicious transfers or transmittals of funds With this Advance Notice, the transactions. The requirement on the involving amounts below the current Agencies request comment on the part of money services businesses to threshold of $3,000 differ from the potential effect of lowering or report suspicious transactions may information that your financial eliminating the threshold for the mean that reducing or eliminating the institution includes in payment or requirement in 31 CFR 103.33 to collect, threshold would impose less of an transmittal orders for funds transfers or retain, and transmit information on incremental cost. If this is not the case, transmittals of funds involving amounts funds transfers and transmittals of the Agencies welcome comments from above the threshold? If so, please funds. Comments on all aspects of the money services businesses. describe the differences. In addition, technology has advanced Advance Notice are welcome, and the (5) How would reducing or since the issuance of the recordkeeping Agencies encourage all interested eliminating the threshold affect the and travel rules for funds transfers and parties to provide their views. price and type of the services that your transmittals of funds. Banks and other financial institution provides in IV. Executive Order 12866 financial institutions may use less connection with domestic and cross- The Agencies do not know whether expensive or more efficient means of border funds transfers or transmittals of regulations under the Bank Secrecy Act electronic storage and retrieval. -

Smoke, Fire and Fumes in Transport Aircraft

SMOKE, FIRE AND FUMES IN TRANSPORT AIRCRAFT PAST HISTORY, CURRENT RISKS AND RECOMMENDED MITIGATIONS Part 2: Training Second Edition 2018 A Specialist Paper by the Royal Aeronautical Society www.aerosociety.com About the Royal Aeronautical Society (RAeS) The RAeS is the world’s only professional body dedicated to the entire aerospace community. Established in 1866 to further the art, science and engineering of aeronautics, the Society has been at the forefront of developments in aerospace ever since. We seek to i) promote the highest possible standards in aerospace disciplines; ii) provide specialist information and act as a central forum for the exchange of ideas; and iii) play a leading role in influencing opinion on aerospace matters. The RAeS is also working with the Government and industry leaders within the Aerospace Growth Partnership (AGP). About the Honorable Company of Air Pilots The Company was established as a Guild in 1929 in order to ensure that pilots and navigators of the (then) fledgling aviation industry were accepted and regarded as professionals. From the beginning, the Guild was modelled on the lines of the Livery Companies of the City of London, which were originally established to protect the interests and standards of those involved in their respective trades or professions. In 1956, the Guild was formally recognised as a Livery Company. In 2014, it was granted a Royal Charter in the name of the Honourable Company of Air Pilots. Today, the principal activities of the Company are centred on sponsoring and encouraging action and activities designed to ensure that aircraft are piloted and navigated safely by individuals who are highly competent, self-reliant, dependable and respected. -

TTF Aerospace, LLC, Modification To

Federal Register / Vol. 76, No. 19 / Friday, January 28, 2011 / Rules and Regulations 5061 § 122.153 Limitations on airport of entry or Location Name must mark your comments: Docket No. departure. NM440. You can inspect comments in (a) Aircraft arrival and departure. The Los Angeles, Los Angeles International the Rules Docket weekdays, except owner or person in command of any California. Airport Federal holidays, between 7:30 a.m. and aircraft clearing the United States for or Miami, Florida .... Miami International Airport 4 p.m. entering the United States from Cuba, FOR FURTHER INFORMATION CONTACT: John ■ 5. In § 122.154, revise paragraph (b)(2) whether the aircraft is departing on a Shelden, FAA, Airframe/Cabin Safety to read as follows: temporary sojourn or for export, must Branch, ANM–115, Transport Airplane clear or obtain permission to depart § 122.154 Notice of arrival. Directorate, Aircraft Certification from, or enter at, the Miami * * * * * Service, 1601 Lind Avenue, SW., International Airport, Miami, Florida; (b) * * * Renton, Washington 98057–3356; the John F. Kennedy International (2) Directly to the CBP officer in telephone (425) 227–2785; facsimile Airport, Jamaica, New York; the Los charge at the applicable airport (425) 227–1320. Angeles International Airport, Los authorized pursuant to § 122.153. SUPPLEMENTARY INFORMATION: The FAA Angeles, California; or any other airport * * * * * has determined that notice of, and that has been approved by CBP pursuant opportunity for, prior public comment to paragraph (b) of this section, and Janet Napolitano, on these special conditions are must comply with the requirements in Secretary. impracticable because these procedures this part unless otherwise authorized by [FR Doc.