Supplemental Information [PDF:679KB]

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

RHYTHM & BLUES...63 Order Terms

5 COUNTRY .......................6 BEAT, 60s/70s ..................71 AMERICANA/ROOTS/ALT. .............22 SURF .............................83 OUTLAWS/SINGER-SONGWRITER .......23 REVIVAL/NEO ROCKABILLY ............85 WESTERN..........................27 PSYCHOBILLY ......................89 WESTERN SWING....................30 BRITISH R&R ........................90 TRUCKS & TRAINS ...................30 SKIFFLE ...........................94 C&W SOUNDTRACKS.................31 AUSTRALIAN R&R ....................95 C&W SPECIAL COLLECTIONS...........31 INSTRUMENTAL R&R/BEAT .............96 COUNTRY AUSTRALIA/NEW ZEALAND....31 COUNTRY DEUTSCHLAND/EUROPE......32 POP.............................103 COUNTRY CHRISTMAS................33 POP INSTRUMENTAL .................136 BLUEGRASS ........................33 LATIN ............................148 NEWGRASS ........................35 JAZZ .............................150 INSTRUMENTAL .....................36 SOUNDTRACKS .....................157 OLDTIME ..........................37 EISENBAHNROMANTIK ...............161 HAWAII ...........................38 CAJUN/ZYDECO ....................39 DEUTSCHE OLDIES ..............162 TEX-MEX ..........................39 KLEINKUNST / KABARETT ..............167 FOLK .............................39 Deutschland - Special Interest ..........167 WORLD ...........................41 BOOKS .........................168 ROCK & ROLL ...................43 BOOKS ...........................168 REGIONAL R&R .....................56 DISCOGRAPHIES ....................174 LABEL R&R -

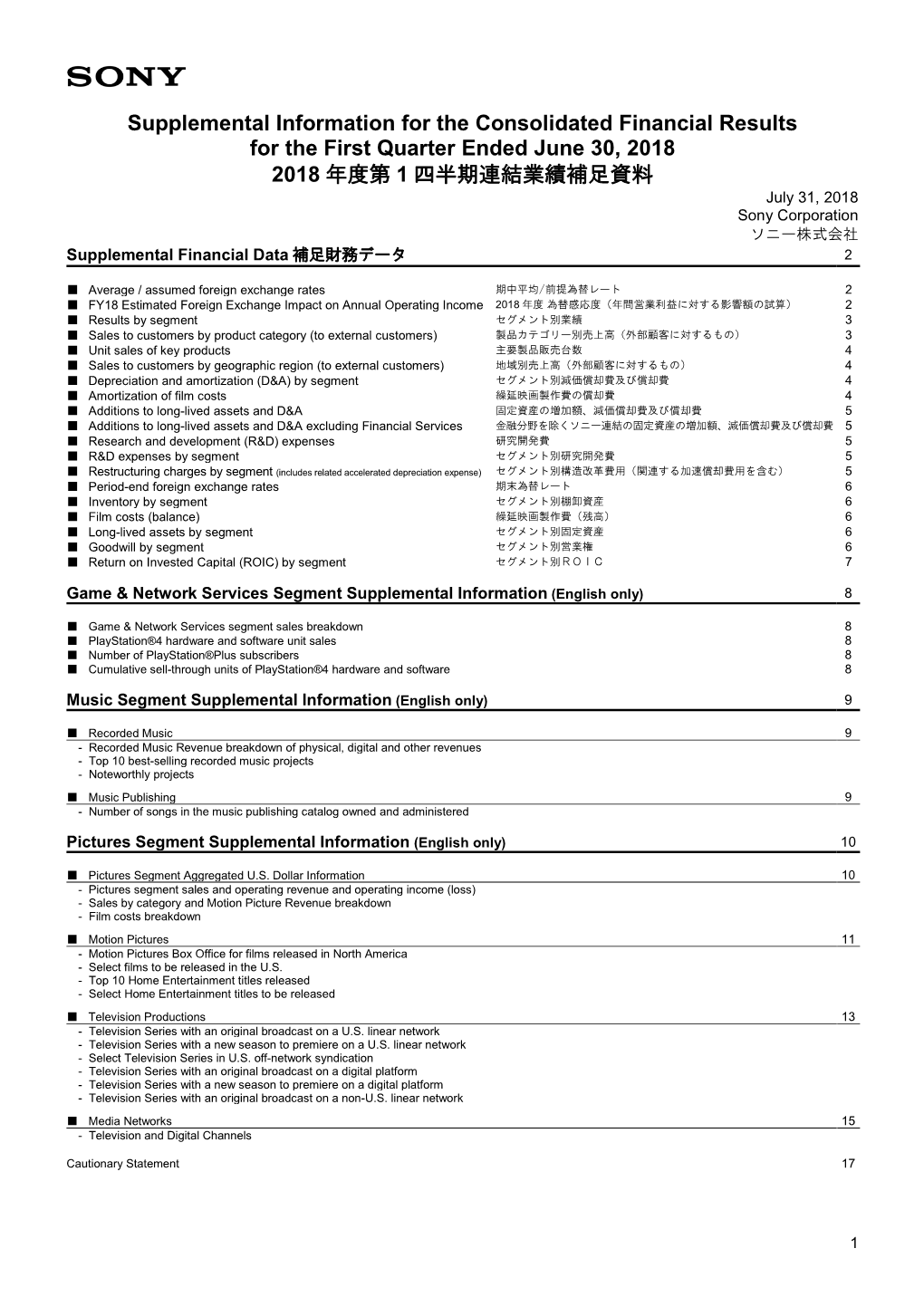

Supplemental Information

Supplemental Information for the Consolidated Financial Results for the Third Quarter Ended December 31, 2017 2017 年度第 3 四半期連結業績補足資料 February 2, 2018 Sony Corporation ソニー株式会社 Supplemental Financial Data 補足財務データ 2 ■ Average foreign exchange rates 期中平均為替レート 2 ■ Results by segment セグメント別業績 2 ■ Sales to customers by product category (to external customers) 製品カテゴリー別売上高(外部顧客に対するもの) 3 ■ Unit sales of key products 主要製品販売台数 3 ■ Sales to customers by geographic region (to external customers) 地域別売上高(外部顧客に対するもの) 3 ■ Depreciation and amortization (D&A) by segment セグメント別減価償却費及び償却費 4 ■ Amortization of film costs 繰延映画製作費の償却費 4 ■ Additions to long-lived assets and D&A 固定資産の増加額、減価償却費 4 ■ Additions to long-lived assets and D&A excluding Financial Services 金融分野を除くソニー連結の固定資産の増加額、減価償却費及び償却費 4 ■ Research and development (R&D) expenses 研究開発費 5 ■ R&D expenses by segment セグメント別研究開発費 5 ■ Restructuring charges by segment (includes accelerated depreciation expense) セグメント別構造改革費用 5 ■ Period-end foreign exchange rates 期末為替レート 5 ■ Inventory by segment セグメント別棚卸資産 5 ■ Film costs (balance) 繰延映画製作費(残高) 6 ■ Long-lived assets by segment セグメント別固定資産 6 ■ Goodwill by segment セグメント別営業権 6 ■ Return on Invested Capital (ROIC) セグメント別 ROIC 6 Music Segment Supplemental Information (English only) 7 ■ Recorded Music 7 - Recorded Music Revenue breakdown of physical, digital and other revenues - Top 10 best-selling recorded music projects - Noteworthly projects ■ Music Publishing 7 - Number of songs in the music publishing catalog owned and administered Pictures Segment Supplemental Information (English only) 8 ■ Pictures Segment Aggregated U.S. Dollar Information 8 - Pictures segment sales and operating revenue and operating income (loss) - Sales by category and Motion Picture Revenue breakdown - Film costs breakdown ■ Motion Pictures 9 - Motion Pictures Box Office for films released in North America - Select films to be released in the U.S. -

Daughtry's New Album Cage to Rattle out Now

DAUGHTRY’S NEW ALBUM CAGE TO RATTLE OUT NOW RELEASES LIVE PERFORMANCE VIDEO OF CURRENT SINGLE “DEEP END” – WATCH HERE HEADLINE TOUR UNDERWAY! “The band fronted by the American Idol alum still stomps and swaggers on this fifth LP, which is loaded with still more no-frills, down-and-dirty area rock. And, of course, there’s the guy behind the mike: He easily upstages most other contemporary rockers”- People Magazine (July 27- New York, NY)— Today, GRAMMY® Award-nominated chart-topping rock band Daughtry unveil their anxiously awaited fifth full-length album, Cage To Rattle [19 Recordings/RCA Records], in stores and at all digital retailers. Additionally, the group releases a performance video of their current single, “Deep End” (watch here). Get the album HERE. The record is currently #2 on the iTunes Top Rock Albums Chart and #5 on the iTunes Overall Top Albums Chart. Cage To Rattle sees Daughtry once again firing on all cylinders. Produced by Jacquire King [Kings Of Leon, Tom Waits, Norah Jones] in Nashville, the album echoes the relentless energy and uncontainable spirit of the group’s most definitive anthems, while advancing boldly into new territory. Whether it’s the bluesy stomp and snap of “Backbone” or the sweeping piano of latest single “Deep End,” the album evinces evolution across the board for the musicians. About the album, Chris Daughtry said, “This is a really special time for us. We feel like we bottled the spirit and energy from our early days and refined it over the last decade together on the road and making records. -

JCS2017 Features-①

新たな取り組みを実施 New services offered 過去最高の来場者数を記録 JC S2017 ! JCS offered new services such as the Business Matching Sessions, IP/ Book Adaptation Symbols on the exhibition 主催者としてビジネスマッチングを提供した他、IPや原作権のマーク booths, newly settled Mini Stage for the purpose of PR and the pitching of exhibitors, and it created the higher をブースに掲示、PRやピッチングの為のミニステージを新設するな Features -① business results. [Japan Content Showcase 2017の特徴①] ど新しいサービスを提供し、商談結果も大幅に飛躍しました。 Business Meetings 商談件数 7,798 IP / BOOK ADAPTATION For exhibition booths dealt with IP(Intellectual Property) 6,805 6,663 and Book Adaptation, relevant symbols were marked. JCS provided its new value to negotiations prior to completion of content or merchandising right. 2015 2016 2017 IP / BOOK ADAPTATIONについて 「IP(Intellectual Property)=知的財産」や書籍の映像化権を取り扱う 出展ブースにマークを表示。映像化権や商品化権の商談に向け新たな価値 Business Matching Service for を提供しました。 Japanese exhibitors & Oversea buyers Provided more than 100 business matching sessions between Total Value Participants Nisa Sittasrivong 成約金額 来場者数 Japanese sellers & oversea buyers and about 80% of them expressed the satisfaction. True Visions Group Company Limited / Thailand *including prospective deals *Excluding live showcase outside market venue We discussed on one IP for live action remake 見込みを含む 商談会場外のライブ来場者数を除く 国内出展者&海外バイヤー向けビジネスマッチングサービス rights. The story is very cute and interesting. とてもかわいらしく、面白い実写のリメイク権について、商談 日本のコンテンツセラーと海外バイヤーとのマッチング&商談を100件以上手 をしました。 $60,050,000 19,549 配し、約8割の参加者より「満足」との評価を得ました。 $53,053,381 $52,720,000 18,191 18,330 Mini Stage for various PR events Mini -

2018/2019 Annual Report

1 CONTENTS Message from General Manager ................................... 3 Message from Cultural Affairs Department .................. 5 Organizational Chart ...................................................... 6 Statement of Purpose ..................................................... 8 Facility Overview ............................................................. 9 Partners .......................................................................... 10 2018/2019 Great Performance Series ......................... 12 Residents ....................................................................... 14 Self-Promoted Events ................................................... 15 Volunteers ..................................................................... 20 Concession .................................................................... 22 Art Gallery ..................................................................... 22 Marketing ...................................................................... 23 YNot Every Event .......................................................... 24 Ticket Sales .................................................................... 25 Foundation .................................................................... 26 Capital Improvement ................................................... 28 Outlook .......................................................................... 29 1 A Message from Spectra Venue Managed SANDLER CENTER FOR THE PERFORMING ARTS GENERAL MANAGER, DAVID SEMON 2 2 Dear Colleagues, -

Supplemental Information for the Consolidated Financial

Supplemental Information for the Consolidated Financial Results for the Second Quarter Ended September 30, 2019 2019 年度第 2 四半期連結業績補足資料 October 30, 2019 Sony Corporation ソニー株式会社 Supplemental Financial Data 補足財務データ 2 ■ Average / assumed foreign exchange rates 期中平均/前提為替レート 2 ■ FY19 Estimated Foreign Exchange Impact on Annual Operating Income 2019 年度 為替感応度(年間営業利益に対する影響額の試算) 2 ■ Results by segment セグメント別業績 3 ■ Sales to customers by product category (to external customers) 製品カテゴリー別売上高(外部顧客に対するもの) 4 ■ Unit sales of key products 主要製品販売台数 4 ■ Sales to customers by geographic region (to external customers) 地域別売上高(外部顧客に対するもの) 4 ■ Depreciation and amortization (D&A) by segment セグメント別減価償却費及び償却費 5 ■ Amortization of film costs 繰延映画製作費の償却費 5 ■ Additions to long-lived assets and D&A 固定資産の増加額、減価償却費及び償却費 5 ■ Additions to long-lived assets and D&A excluding Financial Services 金融分野を除くソニー連結の固定資産の増加額、減価償却費及び償却費 5 ■ Research and development (R&D) expenses 研究開発費 5 ■ R&D expenses by segment セグメント別研究開発費 5 ■ Restructuring charges by segment (includes related accelerated depreciation expense) セグメント別構造改革費用(関連する加速減価償却費用を含む) 6 ■ Period-end foreign exchange rates 期末為替レート 6 ■ Inventory by segment セグメント別棚卸資産 6 ■ Film costs (balance) 繰延映画製作費(残高) 6 ■ Long-lived assets by segment セグメント別固定資産 6 ■ Long lived assets and right-of-use assets by segment セグメント別固定資産・使用権資産 7 ■ Goodwill by segment セグメント別営業権 7 ■ Return on Invested Capital (ROIC) by segment セグメント別ROIC 7 ■ Cash Flow (CF) by segment セグメント別キャッシュ・フロー 7 Game & Network Services Segment Supplemental Information (English only) -

Entertainment

TVml August 28, 2020 National Stock Exchange of India Limited BSE Limited Exchange Plaza, Plot No. C/1, P J Towers G-Block Bandra-Kurla Complex, Dalal Street Bandra (E) Mumbai - 400051 Mumbai - 400 001 Trading Symbol: TV18BRDCST SCRIP CODE: 532800 Dear Sirs, Sub: Annual Report for the financial year 2019-20 including Notice of Annual General Meeting The Annual Report for the financial year 2019-20, including the Notice convening Annual General Meeting, being sent to the members through electronic mode, is attached. The Secretarial Audit Report of material unlisted subsidiary is also attached. The Annual Report including Notice is also uploaded on the Company's website www.nw18.com. This is for your information and records. Thanking you, Yours faithfully, For TV18 Broadcast Limited c ~~ ~"OrJ . )," ('.i/'. ~ . .-...e:--.-~ l \ I Ratnesh Rukhariyar Company Secretary Encl. As Above TV18 Broadcast Limited (eIN - L74300MH2005PLC281753) Regd. office: First Floor, Empire Complex, 414- Senopoti Sopot Marg, Lower Parel, Mumboi-400013 T +91 2240019000,66667777 W www.nw18.com E:[email protected] CONTENTS 01 - 11 Corporate Overview 01 Information. Entertainment. Impact TV18 is as unique as 02 Driven to Inform 04 Inspired to Involve it is impactful. It blends 06 Brands that Stimulate compelling and insightful 08 Letter to Shareholders news with inspiring and 09 Corporate Information stimulating entertainment; 10 Board of Directors an attribute that makes it 12 - 68 stand out amongst peers Statutory Reports regardless of size or vintage. 12 Management Discussion and Analysis 29 Board’s Report 40 Business Responsibility Report India’s largest News Broadcast network and the third 49 Corporate Governance Report largest player in the Television entertainment space, TV18 has infused into the Media and Entertainment industry a large dose of youthful dynamism. -

C Ntent 17-30 April 2017 L

C NTENT 17-30 April 2017 www.contentasia.tv l www.contentasiasummit.com Telkomsel, CatchPlay roll out in Indonesia 2GB data sweetener for SVOD movie package Indonesian telco Telkomsel has added Taiwan’s CatchPlay SVOD to its Video- MAX entertainment platform, bundling movies with a 2GB data sweetener and the promise of “smooth streaming” on Telkomsel’s 4G mobile network. The package costs Rp66,000/US$5 a month. CatchPlay has also acquired exclusive digital rights for award winning Indo- nesian movie, Solo, Solitude, which will stream on the platform in May. In addition to the monthly subscription option, a multi-layered pricing strategy offers consumers in Indonesia free mem- bership and one free CatchPlay movie a month, with a pay-per-view option for lo- cal and library titles at Rp19,500/US$1.50 each or new releases for Rp29,500/ US$2.20 each. CatchPlay CEO, Daphne Yang, de- scribed Indonesia as a market of “huge potential in terms of individuals who use the internet for video streaming”. CatchPlay titles include La La Land, Lion and Lego: Batman Movie. New titles this month are Collateral Beauty, starring Will Smith; Sing with Matthew McConaughey and Reese Witherspoon; and Fences with Denzel Washington and Viola Davis. CatchPlay also has a distribution deal with Indihome in Indonesia. The platform is available in Taiwan, where it launched in 2007, Singapore and Indonesia. www.contentasia.tv C NTENTASIA 17-30 April 2017 Page 2. Korea’s JTBC GMA bets on love triangles in new drama breaks new ground 3 wives, 3 husbands, 3 mistresses drive day-time hopes with Netflix 21 April global debut Philippines’ broadcaster GMA Network global linear network GMA Pinoy TV on has premiered its new afternoon drama, 18 April. -

Annexure I -Channel List of Odisha

Annexure I -Channel list of Odisha NO OF HD NO Of SD CHANNELS 226 CHANNELS 15 ENGLISH ENT HINDI MOVIES LIFE STYLE BENGALI HD CHANNELS STAR WORLD SET MAX FOX LIFE ABP ANANDA MAX HD AXN STAR GOLD NDTV GOODTIMES ATN BANGLA MN+HD FX UTV MOVIES FTV DD BANGLA SONY PIX HD ENGLISH MOVIES MAX2 FOOD FOOD TV SONY AATH HBO HD MOVIES NOW 2 STAR MOVIES UTV ACTION TLC KOLKATA TV HD SONY PIX MOVIES OK CARE WORLD SANGEET BANGLA SONY LEPLEX HD MOVIES NOW WOW CINEMA KIDS STAR JHALSA SONY ESPN HD CARTOON MOVIES NOW2 VAA MOVIES NETWORK AKASH AATH SONY SIX HD ROMEDY NOW CINEMA TV DISNEY JHALSA MOVIES BBC EARTH STAR UTSAV STAR MOVIES ACTION MOVIES HUNGAMA ZEE 24 GHANTA ROX HD HINDI ENT B4U MOVIES POGO MUSIC F SONY HD STAR PLUS GREEN NAAPTOL DISNEY JUNIOR RUPASI BANGLA SAB TV HD SONY BFLIX MOVIES DISNEY XD DHOOM MUSIC TRAVEL XP HD STAR SPORTS HD SAB TV MOVIE HOUSE SONY YAY R PLUS GOLD 1 STAR SPORTS HD LIFE OK SONY WAH DISCOVERY KIDS NEWS TIME 3 ZEE ANMOL BINDASS CINEMA MU BU TV ZEE BANGLA SONY PAL SAHARA FILMY NICK TELUGU SHOP CJ MUSIC BABY TV ABN HOME SHOP 18 SONY MIX KNOWLEDGE GEMINI BLUE NAAPTOL CHANEL V NAT GEO GEMINI MOVIES ZOOM B4U MUSIC DISCOVERY ZEE TELUGU STAR UTSAV BINDAS PLAY SONY BBC EARTH MAA ZEE ANMOL 9X M ANIMAL PLANET MAA GOLD DISCOVERY ID MUSIC INDIA NGC WILD MAA MOVIES EPIC 9X JALWA DISCOVERY TURBO NTV DD NATIONAL NGC MUSIC DISCOVERU SCIENCE GEMINI COMEDY ZEE TV 9XO NGC PEOPLE GEMINI MUSIC DD INDIA 9X TASHAN GYAN DARSHAN GEMINI LIFE COLORS SPORTS DD KISHAN KHUSI TV DD BHARATI STAR SPORS1 HINDI NEWS GEMINI NEWS & TV STAR SPORS2 AAJ TAK TV9 SAHARA -

Annual Report 2019-20

Annual Report 2019-20 Creating Experiences The Group commissioned India’s largest integrated TV and Digital Newsroom at Mumbai. What’s Inside Corporate Overview 01 Creating Experiences 02 Across Mediums 03 Across Languages 04 Across Screens 05 Across Narratives 06 Across Genres 08 Letter to Shareholders 09 Corporate Information 10 Board of Directors Statutory Reports 12 Management Discussion and Analysis 30 Board’s Report 40 Business Responsibility Report 49 Corporate Governance Report Financial Statements 71 Standalone Financial Statements 121 Consolidated Financial Statements Notice 181 Notice of Annual General Meeting View this report online or download at www.nw18.com A large bouquet of diversified brands, crafted to meet the diverse needs of audiences across regions, cultures, segments, genres and languages, defines the ethos of Network18 Media & Investments Limited (Network18). As one of India’s largest media conglomerates, Network18 has redefined the Media and Entertainment sector of the country, while carving a distinctive niche for itself as a thought leader in the industry. With our finger on the pulse of people across the culturally contrasting milieus of Bharat and India, we remain closely connected with audiences through multiple channels of mediums, languages, platforms, screens, devices and formats. At the heart of this consumer connect lies our ability to align ourselves to the differentiated and evolving aspirations, needs and consumption patterns of people across the country. From News to Entertainment and across TV, Digital and Print, our portfolio of offerings is designed to engage with audiences across segments and genres. We create enriching experiences for them with our quality content that caters as effectively to the premium audiences as it does to the masses. -

Festivités Du 14 Juillet Concert Et Feu D'artifice

© Mairie de Toulouse – B. Aïach Festivités du 14 juillet Concert et feu d’artifice Conférence de presse – Mardi 25 juin à 11h30 Contact presse : Aline Degert Maugard [email protected] t. 05 67 73 88 41 / 07 86 52 56 53 Conférence de presse - Festivités du 14 juillet 2019 2 Sommaire Présentation Un 14 juillet au bord de l’eau Le concert avec NRJ Tour p. 4-7 Le feu d’artifice p. 8 Les manifestations dans la ville Festivités le 13 juillet p. 9-10 Spectacle à la Halle aux Grains Programme complet et Infos p. 11-12 Conférence de presse - Festivités du 14 juillet 2019 3 Le 14 juillet, Fête Nationale, est désormais à Toulouse un grand moment de ren- dez-vous à la Prairie des Filtres qui offre son cadre unique au spectacle visuel et sonore proposé par la Mairie de Toulouse et ses partenaires en soirée. Un concert réunira des artistes très populaires sur la scène des bords de Garonne, avant le traditionnel et très attendu feu d’artifice. La journée alliera solennité du défilé militaire et convivialité du spectacle pour les seniors. Auparavant, la célébration de la fête nationale débutera le 13 juillet dans le quartier Reynerie et sur les allées Paul Sabatier, avec animations pour les enfants, feu d’artifice, apéritif concert et bal des sapeurs-pompiers. Ces festivités qui se clôturent depuis plusieurs éditions à la Prairie des Filtres ras- semblent pour le concert et le feu d’artifice quelque 300 000 spectateurs. Conférence de presse - Festivités du 14 juillet 2019 4 § UN 14 JUILLET AU BORD DE L’EAU Au programme, sur la Prairie des Filtres 18h30-22h30 : Le concert avec NRJ Music Tour Bigflo & Oli Considérés comme la relève du rap français, les frères toulousains Bigflo & Oli enflamment les scènes de France depuis quatre ans main- tenant. -

Supplemental Information for the Consolidated Financial Results for the Third Quarter Ended December 31,2019

Supplemental Information for the Consolidated Financial Results for the Third Quarter Ended December 31, 2019 2019 年度第 3 四半期連結業績補足資料 February 4, 2020 Sony Corporation ソニー株式会社 Supplemental Financial Data 補足財務データ 2 ■ Average / assumed foreign exchange rates 期中平均/前提為替レート 2 ■ FY19 Estimated Foreign Exchange Impact on Annual Operating Income 2019 年度 為替感応度(年間営業利益に対する影響額の試算) 2 ■ Results by segment セグメント別業績 3 ■ Sales to customers by product category (to external customers) 製品カテゴリー別売上高(外部顧客に対するもの) 4 ■ Unit sales of key products 主要製品販売台数 4 ■ Sales to customers by geographic region (to external customers) 地域別売上高(外部顧客に対するもの) 4 ■ Depreciation and amortization (D&A) by segment セグメント別減価償却費及び償却費 5 ■ Amortization of film costs 繰延映画製作費の償却費 5 ■ Additions to long-lived assets and D&A 固定資産の増加額、減価償却費及び償却費 5 ■ Additions to long-lived assets and D&A excluding Financial Services 金融分野を除くソニー連結の固定資産の増加額、減価償却費及び償却費 5 ■ Research and development (R&D) expenses 研究開発費 5 ■ R&D expenses by segment セグメント別研究開発費 5 ■ Restructuring charges by segment (includes related accelerated depreciation expense) セグメント別構造改革費用(関連する加速減価償却費用を含む) 6 ■ Period-end foreign exchange rates 期末為替レート 6 ■ Inventory by segment セグメント別棚卸資産 6 ■ Film costs (balance) 繰延映画製作費(残高) 6 ■ Long-lived assets by segment セグメント別固定資産 6 ■ Long lived assets and right-of-use assets by segment セグメント別固定資産・使用権資産 7 ■ Goodwill by segment セグメント別営業権 7 ■ Return on Invested Capital (ROIC) by segment セグメント別ROIC 7 ■ Cash Flow (CF) by segment セグメント別キャッシュ・フロー 7 Game & Network Services Segment Supplemental Information (English only)