November 27, 2012

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Interbrand-Best-Korean-Brands-2015

Contents 02 Introduction 04 The future of business is personal 06 The Age of You: key questions answered 10 Best Korea Brands 2015 Top50 46 Best Korea Brands 2015 Analysis 54 Authors & Contributors 1 engage customers and generate genuine result, each of us will become our own 2015 will provide the insights you need value for the business. marketplace or “Mecosystem.” to drive your organization forward—and Introduction new inspiration to push creative thought The need to create brand experiences In our report, Jez Frampton, Global CEO Jihun Moon and innovation in these changing times. that are seamless and more holistic has of Interbrand, will elaborate on this new been precipitated by sector convergence era, which we at Interbrand refer to as Congratulations to all of Korea’s Best The origin of the term “branding” was and the rise of Big Data. Harnessing the the “Age of You”—the move from brand Global Brands—in particular those whose lit¬erally to burn one’s name onto prop- potential of Big Data isn’t just for tech as monologue, to brand as dialogue, leadership skills have earned them a erty as a crude mark of ownership. But companies anymore—it offers huge to brand as a communal experience, to place among the nation’s top brands. it’s only in our relatively recent history opportunities for all brands. By collecting brand as a truly personal and curated ex- that branding has become recognized as To your continued success, and analyzing customer data and honing perience created around each and every a business discipline. -

Copyrighted Material

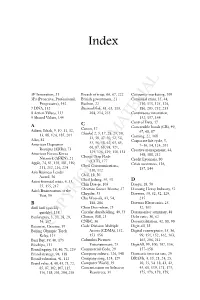

Index 3P Innovation, 31 Breach of trust, 66, 67, 222 Consumer marketing, 109 3Ps (Proactive, Professional, British government, 21 Continual crisis, 35, 44, Progressive), 142 Buchon, 22 110, 113, 125, 126, 7 DNA, 132 BusinessWeek, 43, 63, 113, 186, 205, 232, 233 8 Action Values, 133 204, 214, 235 Continuous innovation, 9 Shared Values, 144 132, 137, 144 Control Data, 17 A C Canon, 17 Convertible bonds (CB), 49, Adizes, Ichak, 9, 10, 11, 12, 67, 68, 87 13, 88, 124, 185, 201 Chaebol, 2, 5, 17, 28, 29, 30, 32, 38, 47–50, 52, 54, Corning, 22, 168 Aibo, 81 Corporate life cycle, 5, American Depositor 55, 56, 58, 62, 63, 65, 66, 67, 68, 94, 121, 7–16, 34, 124, 201 Receipts (ADRs), 73 Creative management, 44, American Forces Korea 124, 126, 129, 130, 131 Charge Trap Flash 148, 188, 212 Network (AFKN), 21 Credit Lyonnais, 80 Apple, 74, 83, 158, 181, 189, (CTF), 177 Cheil Communications, Crisis awareness, 136, 211, 212, 216, 224 137, 144 Asia Business Leader 110, 112 Award, 36 Cheil, 18, 50 Asian financial crisis, 6, 33, Cheil Jedang, 50, 53 D 55, 155, 217 Chin Dae-je, 103 Daegu, 18, 50 Asia’s Businessman of the Christian Science Monitor, 27 Daesung Heavy Industry, 52 Year, 36 Chrysler, 53 Daewoo, 30, 32, 52, 129, Chu Woo-sik, 43, 54, 215 B 188, 206 Daewoo Electronics, 25, Balli balli (quickly Chun Doo-whan, 23 32, 101 quickly), 138 Circular shareholding, 49, 53 Datamonitor summary, 48 Bankruptcy, 3, 20, 28, 29, Clinton, Bill, 21 Debt ratio, 30, 62 54, 107 CNBC, 36 Decentralization, 42, 88, 90 Bateman, Graeme,COPYRIGHTED 39 Code Division Multiple -

1H13 Business Report

1H13 Business Report I. Corporate Overview □ Affiliates As of end-1H 2013, Samsung Group had a total of 77 domestic affiliates. Compared to end-2012, two new affiliates (Jung-ahm Wind Power, and Sungkyunkwan University Dormitory) were added and six (SECRON, SEHF Korea, SB LiMotive, GES, Idea Company Prog, Top Cloud Corporation) were excluded. Among Samsung Group’s 77 affiliates, 17 including Samsung Electronics are listed, and 60 are unlisted. (As of June 30, 2013) No. of affiliates Name of affiliates Samsung C&T, Cheil Industries, Samsung Electronics, Samsung SDI, Samsung Techwin, Samsung Life Insurance, SEMCO, Samsung Heavy Industries, Listed 17 Samsung Card, Hotel Shilla, Samsung Fire & Marine Insurance, Samsung Securities, S1, Samsung Fine Chemicals, Samsung Engineering, Cheil Worldwide, Credu, Samsung Everland, Samsung Petrochemical, Samsung SDS, Samsung General Chemicals, Samsung Total Petrochemicals, Samsung Lions, SERI, STECO, Samsung Thales, SEMES, Living Plaza, Samsung Corning Precision Materials, Samsung SNS, Samsung Electronics Service, Samsung Electronics Logitech, Hantok Chemicals, Global Tech, CVnet Corporation, Care Camp, Allat Corp., SECUI.com, Wealthia.com, Open Tide Korea, Samsung Futures, 365Homecare, Samsung Venture Investment Corporation, Samsung Asset Management, Saengbo, Samsung Claim Unlisted 60 Adjustment Service, Anycar Service, World Cyber Games, SD Flex, Gemi Plus Distribution, Samsung Bluewings, HTSS, RAY, Songdo Land Mark City, S- Core, S1 CRM, Open Hands, S-EnPol, Samsung Medison, Samsung Biologics, Miracom Inc., Samsung Life Service, SMP, STM, SSLM, SU Materials, Colombo Korea, Samsung Display, Samsung Bioepis, Nuri Solution, Samsung Corning Advanced Glass , Natural 9, Daejung Offshore Wind Power, SERICEO, Samsung Real Estate, Jung-ahm Wind Power, Sungkyunkwan University Dormitory Total 77 ☞ Refer to 『□ Affiliates』 in 『III. -

Samsung Electronics Co., Ltd. and Its Subsidiaries NOTES

Samsung Electronics Co., Ltd. and its Subsidiaries NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS 1. General Information 1.1 Company Overview Samsung Electronics Co., Ltd. (“SEC”) was incorporated under the laws of the Republic of Korea in 1969 and listed its shares on the Korea Stock Exchange in 1975. SEC and its subsidiaries (collectively referred to as the “Company”) operate four business divisions: Consumer Electronics (“CE”), Information technology & Mobile communications (“IM”), Device Solutions (“DS”) and Harman. The CE division includes digital TVs, monitors, air conditioners and refrigerators and the IM division includes mobile phones, communication systems, and computers. The DS division includes products such as Memory, Foundry and System LSI in the semiconductor business (“Semiconductor”), and LCD and OLED panels in the display business (“DP”). The Harman division includes connected car systems, audio and visual products, enterprise automation solutions and connected services. The Company is domiciled in the Republic of Korea and the address of its registered office is Suwon, the Republic of Korea. These interim consolidated financial statements have been prepared in accordance with Korean International Financial Reporting Standards (“Korean IFRS”) 1110, Consolidated Financial Statements. SEC, as the controlling company, consolidates its 252 subsidiaries including Samsung Display and Samsung Electronics America. The Company also applies the equity method of accounting for its 46 associates and joint ventures, including -

THE NEXT PHASE the NEXT PHASE Samsung Annual Report 2003

Samsung Annual Report 2003 THE NEXT PHASE THE NEXT PHASE Samsung Annual Report 2003 THE NEXT PHASE MOTIVATION To understand where we’re going, it helps to take a look at what’s driving us there. 9 COLLABORATION Successful companies no longer always go it alone. 23 EXPECTATION Customers are all about expectations. 35 DEMONSTRATION It is important to demonstrate that our standards, values and goals are indeed real. 44 COMPUTATION 61 All Samsung products and services mentioned in this publication are the property of Samsung. ORGANIZATION Published by Samsung in coordination with Cheil Communications Inc. The power of Samsung as a brand is tied Printed by Samsung Moonwha Printing Co., Seoul, Korea to the strength of its organizations. Written by Denis Jakuc 65 Principal Photography by Ashton Worthington Created by The Corporate Agenda: www.corporateagenda.com TEN YEARS AGO, Samsung launched its New Management initiative, with the ultimate goal of becoming one of the world’s premier companies. 1993 June Samsung adopts New Management initiative 1994 1995 1996 February January January January July Chairman Kun-Hee Lee holds Japanese headquarters opens Samsung opens headquarters Samsung Electronics begins Samsung Everland opens Carribean electronics products comparison in USA, Europe and China mass production of 64Mb DRAMs Bay, world’s first indoor and outdoor and evaluation conference July water park in Los Angeles, California, USA Samsung Corporation is the February March first Korean company to reach Samsung Electronics completes Samsung Electronics -

Samsung Press Information

Company Overview History of Samsung Samsung's history dates to 1938 when "Samsung General Stores" opened in North Kyung- sang Province, Korea. The company conducted its trade business until the 1950s when it became a producer of basic commodities such as sugar and wool. In 1958, Samsung be- came involved in the insurance industry by incorporating a local fire & marine insurance company. During the 1960s, Samsung became one of the first Korean companies to actively expand its overseas trade. The group consolidated its manufacturing base by adding paper and fer- tilizer businesses. Samsung continued with expansion into the life insurance business, strengthened its retail operations and then moved into the communications sector, success- fully establishing a newspaper and a broadcasting company. The 1970s were a crucial period in shaping present-day Samsung. Its strengths in the semi- conductor, information and telecommunications industries grew from the significant in- vestments made during this period. Samsung also took a meaningful step toward heavy industries by venturing into aircraft manufacturing, shipbuilding and construction, as well as chemical industries. In the 1980s, Samsung expanded its efforts into exploring the larger markets overseas. The group began contributing to foreign economies by building facilities in the US, the UK and Portugal. Samsung also invested considerable resources into fostering Korea's rich heritage by supporting a wide range of cultural and artistic activities. The final decade of the 20th century saw the evolution of Samsung's new approach to management. Chairman Kun-Hee Lee's insightful vision and the introduction of the "New Management" in 1993 acknowledged the need to transform management philosophy in or- der to keep up with a rapidly changing global economy. -

Innerex Co., Ltd

Innerex Co., Ltd. ( 2011 ) Overview Head Office 5F, Jeongjin Building, 936-9 Bangbae-dong, Seocho-gu, Seoul, Korea Tel: +82-2-521-3450 Fax :+82- 2-521-3234 Plant 451-42,Hangmok-ri,Shinchang-myeon,Asan-city,Chungcheongnam-do, Korea Tel: +82-(0)43-546-4040 Fax : +-82-(0)43-546-5040 Web Site: www.innerex.co.kr E-mail : [email protected] Number of employees: 110 Parent Company : Bio Smart Co., Ltd. Organization CEO Executive Director Perso. Center Management Sales & Marketing C . I Card Production (Chip, Magstripe) Planning Team Production support General Affairs Team Sales Dep’t 1 Issuance Team Design Team Printing Team Sales Dep’t 2 Financial Team Card Mang.Team Manufacturing Team Sales Management Q. C Team Smart Card Team Main Business Card Manufacturing Visa, MasterCard, JCB, AMEX Magnetic stripe Card Contact / Contacless / Hybrid / Combi card PET Card : Magnetism coated Card USIM card Chip / Mag Stripe Card Personalization Chip initialization / personalization Magstripe personalization Highway prepaid card ID Card(PHOTO Card) / Membership Card Equipment & Maintenance Toll Collection System PVC Card Printing system PET Card personalization system Hologram Inspection system History 1989. • Kocoma established Pyeong-chang FACTORY established 1991. • Installed Magnetic Card production line • Designated as official supplier for Korea Telecommunication Card • Installed the Public Telephone IC Card production line 1992. • Participated in the EXPO Entrance Project with Samsung Electronics - Received a medal of Suk –Tap industry - Received a medal from the Ministry of Chamber of Commerce • Increased Capital to 2 billion won • Developed PET Card Reader / Writer ( F9001, F5001) 1994. • Established new plant • Installed PET Card production line 1995. -

SAMSUNG ELECTRONICS Co., Ltd. Interim Business Report for the Quarter Ended March 31, 2015

SAMSUNG ELECTRONICS Co., Ltd. Interim Business Report For the quarter ended March 31, 2015 Note about forward-looking statements Certain statements in the document, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements.” Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in our financial reports available on our website. See, also, 『Note on Forward-Looking Statements』 in preamble of 『II. Business Overview』. Samsung Electronics Interim Business Report 1 / 170 WorldReginfo - 35d6727f-d380-43ba-b636-eb9cfe08293a Table of Contents Certification ................................................................................................................................................................................ 3 I. Corporate Overview ............................................................................................................................................................... 4 II. Businesses Overview ........................................................................................................................................................ -

Will the Chaebol Reform Process Move Forward Under the Moon Jae-In Administration? —Future Directions and Challenges—

Will the Chaebol Reform Process Move Forward under the Moon Jae-in Administration? —Future Directions and Challenges— By Hidehiko Mukoyama Senior Economist Economics Department Japan Research Institute Summary 1. Collusive links between politics and business were a major focus during South Korea’s 2017 presidential election. In an address to the national after his election victory, President Moon Jae-in promised to carry out reforms targeting the chaebol (industrial conglomerates) and eliminate collusion between politicians and business people. The purpose of this article is to clarify how the chaebol reform process is likely to proceed, what the focal points will be, and the issues that could arise. 2. The economic policy of the Moon Jae-in administration is based on the four pillars of income-driven growth, the establishment of an economy that will generate jobs, fair competition (including chaebol reform), and growth through innovation. Immediately after taking power, President Moon Jae-in announced policies targeted toward income-driven growth. Efforts to achieve growth through innovation began in the fall of 2017. The chaebol reform process has not yet begun. 3. Chaebol reform is necessary for several reasons. First, the concentration of economic power in the hands of the chaebol is producing harmful effects, including growing economic disparity, and a lack of jobs for young workers. Second, there have been numerous fraud cases relating to the inheritance of management rights by members of the chaebol families. Third, the chaebol have repeatedly colluded with politicians. 4. One reason for repeated cases of business-political collusion is the enormous amount of au- thority wielded by the South Korean president. -

Samsung Electronics Is Established, Beginning Its Journey for the Future of Samsung and Korea

“Change everything.” – Kun-Hee Lee This book is about It is about those who have pioneers. come before us, who served as catalysts to our ascent. Both inside and outside Samsung. It is about those who come to work for us, who see the world in a different way, and envision a future that is nothing like today. It is about those who lead us to a higher level by sharing their vision and inspiration. 2 3 Enter the Pioneers A look back on our 75-year history 1 5 Beginnings In 1938, in the midst of Japanese colonial rule, Byung-Chull Lee establishes Samsung, planting a seed of hope that begins to germinate in the gloomy period. A A MARCH 1938 Samsung begins as a small trading company selling dried fish, vegetables, and fruit. B NOVEMBER 1965 Samsung Foundation of Culture is formed to preserve and promote the brilliant achievements of Korean traditional art. C JANUARY 1969 Samsung Electronics is established, beginning its journey for the future of Samsung and Korea. B C 1 5 The big idea E F Taking over from his father, Kun-Hee Lee becomes Chairman of Samsung in 1987. With his entrepreneurship, he dives into uncharted waters and lays the groundwork for Samsung’s corporate transformation. D MARCH 1988 E JANUARY 1990 Kun-Hee Lee succeeds his father as Chairman Samsung starts a Regional Specialist Program in and announces the “Second Foundation” of the order to train our employees to become leaders company, directing Samsung’s growth toward of globalization. becoming a world-class enterprise. -

Company Profile

Company Profile MKT Special Group UK 1 +Agenda -About us -Business -Organization -History -Client -Success Case -Work -Contact +About us MKT Special Group UK UnwiredKorea Inc. is a company specializes in Integrated Digital Marketing established Apr. in 2000. UK has successfully grown up with lots of corporations by offering variety solutions rising in value effectively, leading marketing strategy and accurate market estimation. UnwiredKorea Inc. uses abundant marketing experiences to provide optimization services for business what customer wants. Corporate Name UnwiredKorea Inc. CEO Keun Soo, Lee The Date of Incorporation Apr. 24th. 2000 Capital $ 1.2 billion Employees 30 Persons Sales $ 10 Billion Service Ad agency, Production > Full-services agency Contact Information T 02.558.1021 F 02.511.3740 Address 3F, 35, Eonju-ro 130-gil, Gangnam-gu, Seoul (135-867) Website www.ukay.co.kr / www.unwiredkorea.com MKT Special Group UK 3 +Business Digital Integrated Marketing Communication UnwiredKorea Inc. uses abundant marketing experiences to provide optimization services for business what customer wants. Online AD + Web & Mobile + Social Media Service Service Display Banner Web/Mobile Site Facebook/Twitter/Community/Blog Rich Media Mobile Application WOM Manage Campaign Creative Responsive Web/Word Press Contents Planning Promotion Strategy Web Access Viral Marketing Maintenance MKT Special Group UK 4 +Organization CEO A Research Institute Management Support affiliated with UnwirdKorea Team Strategy Planning Creative Group Technology/Development Social Marketing Group Group Group - Team 1, 2, 3 - Design Team 1 - Development Team - Marketing Team - Contents Planning Team - Design Team 2 - Publishing Team - Management Team IMC Strategy Consulting Web/Mobile Design Web/Mobile Development SNS Marketing Web/Mobile Service Planning Online AD Design System Development Social Channel Management Ad/Promotion Planning GUI Design System Management App. -

Modern Korean Economy: 1948–2008 Written by Yongjin Park

UNDERSTANDING KOREA SERIES No. 1 Hangeul Written by Lee Ji-young Understanding Korea No. 8 No. 2 Early Printings in Korea outh Korea is known for its rapid and continuous economic ECONOMY ECONOMY KOREAN MODERN Written by Ok Young Jung Sgrowth in the latter half of the 20th century. After liberation from Japanese colonial rule in 1945 and the Korean War About the series No. 3 Korean Confucianism: Tradition and Modernity (1950‒53), Korea has seen its per capita GDP shooting up from Written by Edward Y. J. Chung just US$290 in 1960 to an amazing US$28,384 in 2010. The Understanding Korea Series aims to share a variety MODERN KOREAN of original and fascinating aspects of Korea with those This book looks at the country’s modern economic overseas who are engaged in education or are deeply No. 4 Seoul development starting from the end of the Korean War, the Written by Park Moon-ho interested in Korean culture. economic problems Korea faced after the conflict, efforts to solve ECONOMY No. 5 A Cultural History of the Korean House these problems, and the results produced. It will also describe 1948–2008 Written by Jeon BongHee changes in economic policy objectives from liberation from Japanese colonial rule in 1945 through today in detail. No. 6 Korea’s Religious Places Written by Mark Peterson Yongjin Park No. 7 Geography of Korea Written by Kwon Sangcheol, Kim Jonghyuk, Lee Eui-Han, Jung Chi-Young No. 8 Modern Korean Economy: 1948–2008 Written by Yongjin Park ISBN 979-11-5866-427-5 Not for sale Cover Photo The night view of Seoul © gettyimages Korea Cover Design Jung Hyun-young, Cynthia Fernandez Modern Korean Economy Understanding Korea No.