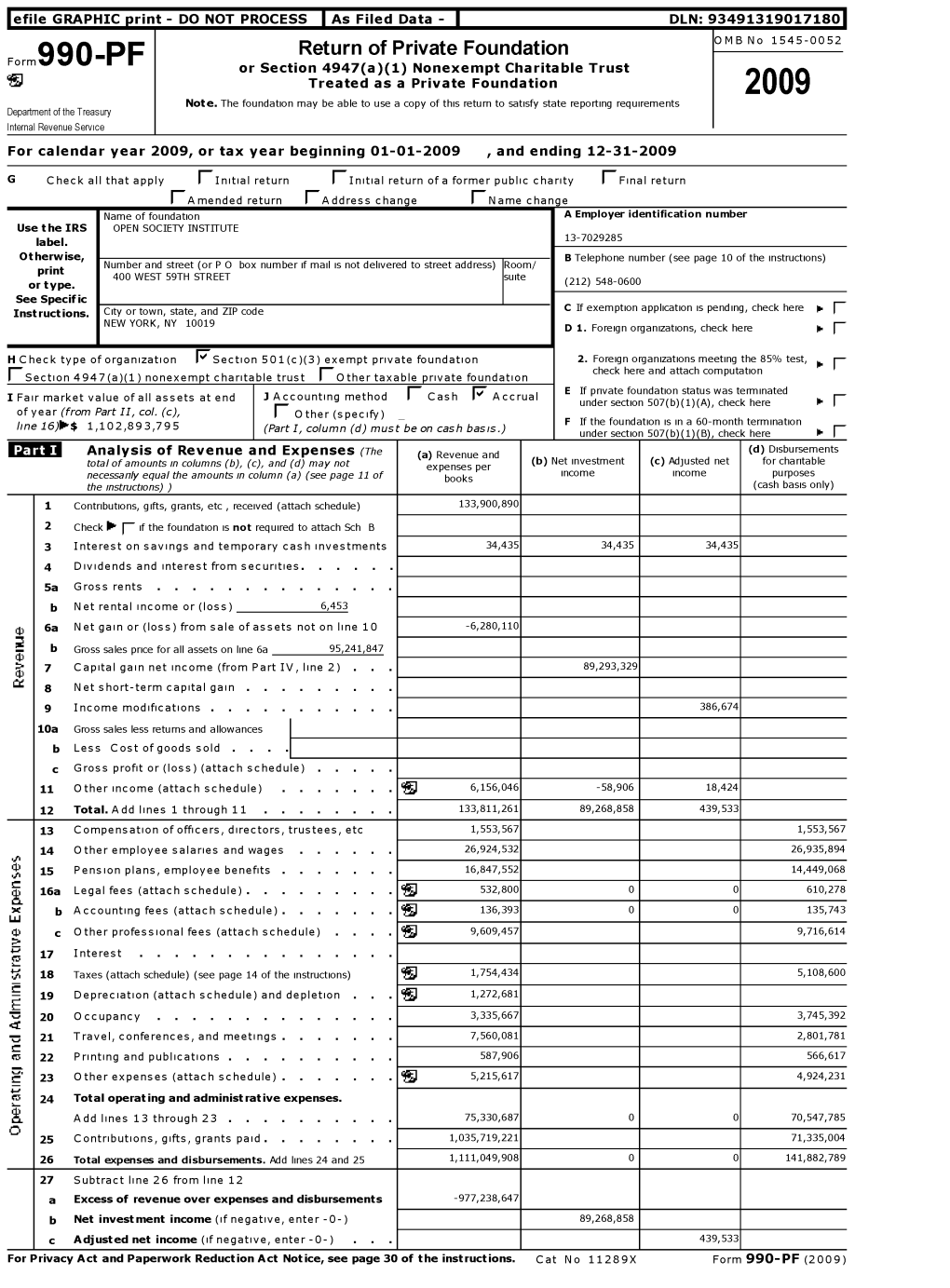

Return of Private Foundation OMB No 1545-0052 Gm Or Section 4947(A)(1) Nonexempttreated Ascharitable a Private Trust Foundation Note

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

And Joan Lamont

rs RETURN DATE: JUNE 9, 2020 SUPERIOR COURT JOAN LAMONT, ANIMAL CONTROL OFFICER, J.D. OF WINDHAM TOWN OF WINDHAM, and the TOWN OF WINDHAM AT PUTNAM V. : ONE (1) CHIHUAHUA DOG, EDMOND BOUCHARD, AND ROB DICKINSON : MAY 19, 2020 VERIFIED PETITION PER COS § 22-329a FOR TEIVIPGRARY AND PERMANENT CUSTODY OF ONE (11 CHIHUAHUA DOG) 1. The Plaintiffs/Petitioners are the Town of Windham, CT ("Town") and Joan Lamont, who since July 26, 2009 has been a municipal Animal Control Officer employed by the Town and who has authority to act as a municipal Animal Control Officer within the Town and the City of Willimantic, CT ("Lamont"). 2. The defendants are Rob Dickinson and Edmond Bouchard, each of Apt. 2F in an apartment building located at 854 Main Street, Willimantic, CT. 3. Upon information and belief, Dickinson is the owner of a small brown Chihuahua dog approximately two years old whose name is believed to be Buddy and who for some time has resided in Apt. 2F with the defendants and another occupant of that apartment. 4. On May 15, 2020 Lamont applied for a search and seizure warrant for Apt. 2F, which was granted by the court and executed on May 15. A redacted copy of the warrant and application marked Exhibit A is attached. 1 Wool, Brennan, Gray & Greenberc, PC. the courtnev building, suite 200, 2 union plaza, post otftce box i-j^i NEW LONDON, CONNECTICUT 06320 TEL. IHbOl .142-JJ 16 lURIS NO o2 I I 1 5. Pursuant to the warrant and Conn. Gen. -

George – Revision 6

I give permission for public access to my thesis and for any copying to be done at the discretion of the archives librarian and/or College librarian. Diana Pho May 2007 2 The Strays of Moscow: and Other Stories Diana Pho May 2007 Submitted to the Department of English of Mount Holyoke College in partial fulfillment of the requirements for the degree of Bachelor of Arts with Honors Faculty Advisor: Stephanie Grant 3 Acknowledgements Through the writing process, I have learned that the act of traveling doesn’t stop when the jetlag wears off, the suitcases are unpacked, and the photos are developed. This year, I have ventured across the world and back again a hundred times while sitting at my desk, and the following people and institutions helped make sure that I arrived home safely (and sane) each time. First, thank you to those who made my travels abroad possible: the Russian Department for providing me with the opportunity to study in Russia as part of the Mount Holyoke College/Colgate University Moscow Study Group. Many thanks also to the English Department for granting me the MacArthur- Leithauser Travel Award, which helped fund my travels. I also want to thank Professor Edwina Cruise for looking over these stories with a Russian eye, as well as for being part of my Thesis Committee. Additional appreciation goes out to Professor Jenny Pyke for her participation in this Committee as well. My family and friends have also been there for support and love; you know who you are. A special thanks goes out to fellow thesis-writer and friend Ariel Franklin-Hudson for her sympathy and Thesis Support Group meetings. -

Reproductions Supplied by EDRS Are the Best That Can Be Made from the Original Document. Revista De Documentacao De Estudos Em Linguistica Teorica E Aplicada, 1998

DOCUMENT RESUME ED 436 953 FL 025 807 AUTHOR Barbara, Leila, Ed.; Rajagopalan, Kanavillil, Ed. TITLE Revista de Documentacao de Estudos em Liguistica Teorica e Aplicada, 1998 (Journal of Documentary Studies in Linguistic Theory and Application, 1998). INSTITUTION Pontificia Univ. Catolica de Sao Paulo (Brazil). SPONS AGENCY Associacao Brasileira de Linguistica, Sao Paulo. ISSN ISSN-0102-4450 PUB DATE 1998-00-00 NOTE 747p.; DELTA is a bi-annual publication with an optional special issue. PUB TYPE Collected Works Serials (022) LANGUAGE English, Portuguese JOURNAL CIT DELTA: Revista de Documentacao de Estudos em Liguistica Teorica e Aplicada; v14 n1-2 spec iss 1998 EDRS PRICE MF04/PC30 Plus Postage. DESCRIPTORS *Applied Linguistics; Foreign Countries; *Language Research; *Linguistic Theory; Linguistics; Speech Communication; Speech Curriculum; Speech Instruction ABSTRACT This document consists of three issues of DELTA, comprising its entire output for 1998. DELTA is a journal of theoretical and applied linguistics and covers a wide variety of material related to language, speech, and education. The journal publishes only original research and ideas presented in the form of articles, debates, squibs, overviews, reviews, and biographical notes. (KFT) Reproductions supplied by EDRS are the best that can be made from the original document. Revista de Documentacao de Estudos em Linguistica Teorica e Aplicada, 1998. U.S. DEPARTMENT OF EDUCATION Office of Educational Research and Improvement PERMISSION TO REPRODUCE AND EDUCATIONAL RESOURCES INFORMATION DISSFMINATE THIS MATERIAL HAS CENTER (ERIC) BEEN GRANTED BY This document has been reproduced as received from the person or organization originating it. Minor changes have been made to .59-407) e improve reproduction quality. -

Sitcom Fjernsyn Programmer Liste : Stem P㥠Dine

Sitcom Fjernsyn Programmer Liste Chespirito https://no.listvote.com/lists/tv/programs/chespirito-56905/actors Lab Rats: Elite Force https://no.listvote.com/lists/tv/programs/lab-rats%3A-elite-force-20899708/actors Jake & Blake https://no.listvote.com/lists/tv/programs/jake-%26-blake-739198/actors Bibin svijet https://no.listvote.com/lists/tv/programs/bibin-svijet-1249122/actors Fred's Head https://no.listvote.com/lists/tv/programs/fred%27s-head-2905820/actors Blackadder Goes Forth https://no.listvote.com/lists/tv/programs/blackadder-goes-forth-2740751/actors Brian O'Brian https://no.listvote.com/lists/tv/programs/brian-o%27brian-849637/actors Hello Franceska https://no.listvote.com/lists/tv/programs/hello-franceska-12964579/actors Malibu Country https://no.listvote.com/lists/tv/programs/malibu-country-210665/actors Maksim Papernik https://no.listvote.com/lists/tv/programs/maksim-papernik-4344650/actors Chickens https://no.listvote.com/lists/tv/programs/chickens-16957467/actors Toda Max https://no.listvote.com/lists/tv/programs/toda-max-7812112/actors Cover Girl https://no.listvote.com/lists/tv/programs/cover-girl-3001834/actors Papá soltero https://no.listvote.com/lists/tv/programs/pap%C3%A1-soltero-6060301/actors Break Time Masti Time https://no.listvote.com/lists/tv/programs/break-time-masti-time-3644055/actors Mi querido Klikowsky https://no.listvote.com/lists/tv/programs/mi-querido-klikowsky-5401614/actors Xin Hun Gong Yu https://no.listvote.com/lists/tv/programs/xin-hun-gong-yu-20687936/actors Cuando toca la campana https://no.listvote.com/lists/tv/programs/cuando-toca-la-campana-2005409/actors -

JOURNAL of the PROCEEDINGS of the CITY COUNCIL of the CITY of CHICAGO, ILLINOIS

(Published by the Authority of the City Council of the City of Chicago) COPY JOURNAL of the PROCEEDINGS of the CITY COUNCIL of the CITY of CHICAGO, ILLINOIS Regular Meeting - Wednesday, July 29, 2009 at 10:00 A.M. (Council Chambers - City Hall - Chicago, Illinois) OFFICIAL RECORD. VOLUME II RICHARD M. DALEY MIGUEL DEL VALLE Mayor City Clerk continued from Volum e / °n page 67258 7/29/2009 REPORTS OF COMMITTEES 67259 COMMITTEE ON AVIATION. PROGRAMMING SERVICE AGREEMENT WITH AC HOLDINGS, INC., DOING BUSINESS AS CNN AIRPORT NETWORK FOR OPERATION OF NEWS SERVICE AT CHICAGO O'HARE INTERNATIONAL AIRPORT. [02009-4238] The Committee on Aviation submitted the following report: CHICAGO, July 29, 2009. To the President and Members of the City Council: Your Committee on Aviation, having under consideration a communication from the Honorable Richard M. Daley, Mayor (which was referred on June 30, 2009) an ordinance authorizing the execution of an agreement with AC Holdings, Inc., doing business as CNN Airport Network, begs leave to recommend that Your Honorable Body Pass the proposed ordinance which is transmitted herewith. This recommendation was concurred in by a viva voce vote of the members of the Committee, with no dissenting vote. Committee meeting on July 27, 2009. Respectfully submitted, (Signed) PATRICK J. LEVAR, Chairman. On motion of Alderman Levar, the said proposed ordinance transmitted with the foregoing committee report was Passed by yeas and nays as follows: Veas--Aldermen Flores, Fioretti, Dowell, Preckwinkle, Hairston, Lyie, Jackson, Harris, Beaie, Pope, Balcer, Cardenas, Olivo, Burke, Foulkes, Thompson, Thomas, Lane, Rugai, Cochran, Brookins, Munoz, Zaiewski, Dixon, Solis, Maldonado, Burnett, E. -

VOLUME II Public School Code of 1949 Goods and Services

Public School Code of 1949 Goods and Services Expenditures Fiscal Year 2015-2016 VOLUME II Temple University Financial Disclosure Report Purchase of Goods and Services Contracts Notes and Definitions The following report provides the required disclosures for reporting the purchase of goods and services contracts. The University’s Banner Finance System does not include data enabling the distinction between the purchases of goods and services. Therefore, a single report is provided that includes both. Expenditures are categorized in the attached report using the following categories: General Supplies & Services: o General supplies, expendable equipment and software. Health Service Programs: o Animal lab, professional billing and other outside professional services. Insurance: o Malpractice, property, general liability, and employees insurances. Interest & Taxes: o Bond interest, real estate tax and debt service costs. Library: o Books, electronic periodicals, subscriptions and film. Professional Fees & Contracts: o Auditing, legal and collection fees and subcontracts. Property, Plant & Equipment: o Capital equipment, buildings and building improvements. Rent: o Equipment, building and office rentals. Repairs & Maintenance: o Equipment repair, maintenance of buildings and grounds. Telecommunications: o Telephone equipment, data communications and cellular services. Travel: o Travel agency fees, foreign and domestic travel expenses. Utilities: o Electric, gas, water, sewer, steam, chilled water and other miscellaneous utilities expenses. Each entry provides the category into which the purchase falls, the vendor name and address and the amount of the purchase. There is no more than one entry per vendor for a single category within a responsibility center. Purchases of goods and services in the Disclosure Report include those which equal or exceed $1,000 for each vendor from all Budgeted Operating Funds including Temple University Physicians. -

Medal Day Book 2005.Qxp

New York’s Bravest PROUDLY SERVING SINCE 1865 FIRE DEPARTMENT, CITY OF NEW YORK MICHAEL R. BLOOMBERG, Mayor NICHOLAS SCOPPETTA, Fire Commissioner PETER E. HAYDEN, Chief of Department 9 MetroTech Center Brooklyn, New York 11201 www.nyc.gov/fdny M E D A L D A Y 2 0 0 5 MEDAL BOARD Frank P. Cruthers Peter E. Hayden Salvatore J. Cassano First Deputy Commissioner Chief of Department Chief of Operations Michael Canty Battalion Chief Index of Medals Index of Medal Recipients James Gordon Bennett Medal . .13 Atlas, FF Scott M. (Dr. J.W. Goldenkranz Medal) . .37 Brooklyn Citizens Medal/FF Louis Valentino Award . .14 Becker, Capt. Brian A. (Bella Stiefel Medal) . .28 Hugh Bonner Medal . .15 Cilento, Lt. Joseph R. (Uniformed Fire Officers Association Medal) . .38 Emily Trevor/Mary B. Warren Medal . .16 Cook, FF Michael N. (Lt. James E. Zahn/ Thomas E. Crimmins Medal . .17 Lt. Peter L. Troiano Memorial Medal) . .48 Cool, FF Jeffery G. (Emily Trevor/Mary B. Warren Medal) . .16 Thomas A. Kenny Memorial Medal . .18 Cullen, FF Brian W. (Mayor Fiorello H. LaGuardia Medal) . .24 Walter Scott Medal . .19 DeCuffa, Jr., FF Rodney A. (Pulaski Association Medal) . .32 John H. Prentice Medal . .20 Donovan, FF Richard P. (M.J. Delehanty Medal) . .22 Engine Company 298: Henry D. Brookman Medal . .21 Lt. Michael D. Golini, FF James Lagattolla, M.J. Delehanty Medal . .22 FF Frank R. Tepedino, FF Daniel C. Mandel, William F. Conran Medal . .23 FF Thomas Carbone, FF Harry F. Schoppmann, III (NY Firefighters Burn Center Foundation Medal) . .49 Mayor Fiorello H. LaGuardia Medal . -

Violência Doméstica

abril 2016 COORDENAÇÃO CIENTÍFICA ADVERTÊNCIAS Paulo Guerra, Juiz Desembargador O presente Manual foi escrito a várias Lucília Gago, Procuradora-Geral Adjunta mãos. PRODUÇÃO EXECUTIVA Foi respeitado o estilo de cada autor, sem uniformizar o texto em demasia, Paulo Guerra, Juiz Desembargador ganhando-se em autenticidade, o que se perde em homogeneidade de escrita. AUTORES DOS TEXTOS CIG – Comissão para a Cidadania e Igualdade de Género A grafia adotada é a do novo acordo or- (Recolha, seleção e compilação de textos realizada por Manuel Albano tográfico, excecionando-se citações de e Marta Silva) obras e arestos em que tal acordo não foi seguido. Ana Massena, Procuradora da República e Docente do CEJ Catarina Fernandes, Procuradora da República e Docente do CEJ Os acórdãos indicados sem outra refe- rência específica estão disponíveis na Diogo Ravara, Juiz de Direito e Docente do CEJ Base de Dados do IGFEJ. Francisco Mota Ribeiro, Juiz de Direito e Docente do CEJ Os conteúdos e textos constantes des- Helena Susano, Juíza de Direito e Docente do CEJ ta obra, bem como as opiniões pessoais Lucília Gago, Procuradora-Geral Adjunta e Docente do CEJ que nela são expressas, são da exclusi- va responsabilidade dos seus Autores Maria Perquilhas, Juíza de Direito e Docente do CEJ não vinculando nem necessariamente Paulo Guerra, Juiz Desembargador e Diretor-Adjunto do CEJ correspondendo à posição do Centro de Estudos Judiciários relativamente às Sérgio Pena, Procurador da República e Docente do CEJ temáticas abordadas. Recolha de jurisprudência portuguesa -

2017-18 Sports Season in Review Faculty Milestones

The Friends Academy Magazine for Alumni, Parents & Friends The Meeting H o use 2017-2018 “Mary Poppins!” featured the largest all-schoool cast of 120 third through twelfth graders. Friends Academy Board of Trustees, 2018-2019 President Debra Del Vecchio Vice President Robin Wachtler ’83 Treasurer Francis Ingrassia Secretary Andrew Menzin ’81 Board Members Paul Broder Isobel Coleman Strong Minds. David Gelfand Kind Hearts. Gregory Hughes Elizabeth McCaul Ingrassia Gregory Jaske The Friends Academy Mission Jeaninne Lostritto Joe Podbela Founded in 1876 by Gideon Frost for “the children George Tsunis of Friends and those similarly sentimented,” Friends Craig White ’61 Academy is a Quaker, coeducational, independent, Honoree Trustee college preparatory school serving 760 students John Gambling ’69 from age three through twelfth grade. Head of School Andrea Kelly The school’s philosophy is based on the Quaker Friends Academy Alumni Association, 2018-2019 principles of integrity, simplicity, patience, President moderation, peaceful resolution of conflict, and a Peter Stein ’79 belief that the silence and simple ministry of the Vice President “gathered meeting” brings the presence of God into Penelope Wylie Mayer ’75 the midst of busy lives. Friends Academy is Secretary Thomas Pascarella ’95 committed to developing a diverse community whose members value excellence in learning and growth in Alumni Board Members knowledge and skill, a genuine commitment to Barbara Shoen Brundige ’63 Lis Dillof Driezen ’78 service and ethical action, and a realization -

Jovanovic V. City of New York

Case 1:04-cv-08437-PAC Document 40 Filed 09/18/06 Page 1 of 34 Case 1:04-cv-08437-PAC Document 40 Filed 09/18/06 Page 2 of 34 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK ------------------------------------------------------------------------------------X DR. OLIVER JOVANOVIC, Plaintiff, AMENDED COMPLAINT -against- 04 CV 8437 (CRC) JURY TRIAL DEMANDED ECF CASE THE CITY OF NEW YORK, DETECTIVE MILTON BONILLA, Shield No. 61, Individually and in his Official Capacity, New York County Assistant District Attorney LINDA FAIRSTEIN, Individually and in her Official Capacity, and New York County Assistant District Attorney GAIL HEATHERLY, Individually and in her Official Capacity, Defendants. -----------------------------------------------------------------------------------X Plaintiff, DR. OLIVER JOVANOVIC, by his attorney, Jon L. Norinsberg, complaining of the defendants, respectfully alleges as follows: PRELIMINARY STATEMENT 1. Plaintiff brings this action for compensatory damages, punitive damages and attorney’s fees pursuant to 42 U.S.C. § 1983 and 42 U.S.C. § 1988 for violations of his civil rights, as said rights are secured by said statutes and the Constitution of the United States. JURISDICTION 2. This action is brought pursuant to 42 U.S.C. § 1983 and 42 U.S.C. § 1988, and the Fourth, Fifth, Sixth and Fourteenth Amendments to the United States Constitution. 3. Jurisdiction is founded upon 28 U.S.C. §§ 1331, 1343 and 1367. Case 1:04-cv-08437-PAC Document 40 Filed 09/18/06 Page 3 of 34 VENUE 4. Venue properly lies in the Southern District of New York under 28 U.S.C.§ 1391(b), in that this is the District in which the claim arose. -

Supplemental Attachments

Percent of Graduates Enrolling in 4-Year Colleges Within 2 Years Positive Outcomes 3 Sussex Central 19 Woodbridge 19 Laurel 19 Seaford 21 Delmar Senior 21 Delcastle Tech 22 Lake Forest 22 McKean 23 Hodgson Vo-Tech 25 William Penn 30 Howard HS of Tech 30 Polytech HS 30 Dickinson 31 Smyrna 32 Milford 32 Indian River 32 Sussex Tech 32 St Georges HS Tech 33 Christiana 33 Moyer Academy CS 34 Cape Henlopen 36 Dover 38 Caesar Rodney 39 Glasgow 41 Delaware Military CS 42 Mount Pleasant 43 Newark 45 Middletown 45 Brandywine 47 Pencader 49 A.I. duPont 52 Concord 54 Cab Calloway 65 Freire Charter 66 Charter HS of Wilm 86 0 10 20 30 40 50 60 70 80 90 100 Percent of Graduates Enrolling in College Within 2 Years 0 10 20 30 40 50 60 70 80 90 100 Freire Charter School 89 Charter HS of Wilm 87 Cab Calloway 78 Concord 72 NATIONAL AVERAGE 68.2 A.I. duPont 68 Middletown 67 Pencader 67 Sussex Tech 67 Newark 65 Brandywine 65 Cape Henlopen 62 Delaware Military CS 62 Caesar Rodney 61 Dover 61 Indian River 60 Glasgow 60 Mount Pleasant 60 Milford 59 Christiana 58 Smyrna 58 Delmar Senior 58 Polytech HS 58 Laurel 57 Howard HS of Tech 55 St Georges HS Tech 54 Seaford 53 Dickinson 52 Woodbridge 51 William Penn 51 Sussex Central 50 Lake Forest 50 Hodgson Vo-Tech 50 McKean 49 Delcastle Tech 48 Moyer Academy CS 44 Positive Outcomes CS 28 2027 Chestnut Street, Philadelphia, PA 19103 Phone: (215) 557-8555 ~ Fax: (215) 557-9051 www.freirecharterschool.org Instructional Principles: Summary Freire’s vision of teaching and learning is both demanding and rewarding. -

Vito Viscomi

VITO VISCOMI – LOS ANGELES 323-314-5448 [email protected] KATHY A ROCCHIO – VANCOUVER 604-506-3460 [email protected] COLLECTIVE PERSONAL CREDITS FOR PARTNERS Vito Viscomi Writer/Story Editor ANIMATION UNTITLED FEATURE FILM Writer Steve Oedekerk/Omation TEAM AWESOME (working title) Writer Disney/Nerd Corps THE LEAGUE OF SUPER EVIL Writer Cartoon Network/Nerd Corps KID VS. KAT Writer YTV/Studio B KICK BUTTOWSKI Writer Disney XD PIRATE ZOE (in development) Writer Cartoon Saloon EL MARIACHI (in development) Writer Studio Moshi/CAKE WALTER AND TANDOORI Writer Image Entertainment WALTER’S CHRISTMAS Writer Image Entertainment Feature Film RICKY SPROCKET: SHOWBIZ BOY Writer Nicktoons/Studio B ROLLBOTS Story Ed/Writer YTV/Amberwood MONSTER BUSTER CLUB Writer YTV/Marathon *BEING IAN Story Ed/Writer YTV/Studio B, Seasons 2, 3, 4 THE MR. MEN SHOW Writer Cartoon Network WEIRD YEARS Writer YTV/Lenz Entertainment THE GODTHUMB Writer Steve Oedekerk, DVD release DIRK DERBY Writer Steve Oedekerk series *AMAZING ADRENALINIS Writer YTV/Studio B YAKKITY YAK Story Ed/Writer Nicktoons/Studio B QUADS Writer Nelvana *YVON OF THE YUKON Writer YTV/Studio B RUGRATS GO WILD Addt’l writing Klasky Csupo Feature Film BARNYARD: THE MOVIE Consultant Nickelodeon Feature Film/Steve Oedekerk SKETCH/REALITY BURNED: BEST OF THE ROASTS Producer Comedy Central GUYS CHOICE AWARDS 2009 Consultant Spike TV AMERICA’S BIGGEST IDIOT Creator/EP Comedy Central Pilot MTV MOVIE AWARDS 2006 Writer MTV FAYVA Co-Producer MTV Pilot LAST LAUGH 2006 Writer Comedy Central LAST LAUGH 2005 Writer Comedy Central BLUE COLLAR TV Co-Producer WB series NICK AND JESSICA VARIETY HOUR Writer ABC variety special VIVA LA BAM Writer MTV series season 1 and 2 JACKASS Writer MTV series season 2 and feature film I’M WITH BUSEY Writer Comedy Central PUNK’D Consultant MTV pilot SCRATCH AND BURN Co-EP MTV pilot LYRICIST LOUNGE SHOW Writer MTV THE ANDY DICK SHOW Writer MTV season 1 THE TOM GREEN SHOW Writer MTV season 2 *THE VACANT LOT Creator/Writer Comedy Central Performer Produced by Lorne Michaels.