Tourism Sector

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Greater Manchester Strategy for the Visitor Economy 2014 - 2020 Introduction

The GreaTer ManchesTer sTraTeGy for The VisiTor econoMy 2014 - 2020 inTroducTion This strategy sets out the strategic direction for the visitor economy from 2014 through to 2020 and is the strategic framework for the whole of the Greater Manchester city-region: Bolton, Bury, Manchester, Oldham, Rochdale, Salford, Stockport, Tameside, Trafford, and Wigan. The strategy has been developed through consultation with members and stakeholders of Marketing Manchester, in particular with input from the Manchester Visitor Economy Forum who will be responsible for monitoring delivery of the identified action areas and progress against the targets set. Albert Square, Manchester 2 The Greater Manchester strategy for the Visitor economy 2014 - 2020 Policy conTexT Holcombe Hill, Bury Exchange Square, Manchester The strategic direction of tourism in Greater Manchester is Four interdependent objectives have been identified to informed by the following national and sub-regional documents: address the opportunities and challenges for England’s visitor economy: • Britain Tourism Strategy. Delivering a Golden Legacy: a growth strategy for inbound tourism • To increase England’s share of global visitor markets 2012 - 2020 (VisitBritain) • To offer visitors compelling destinations • England: A Strategic Framework for Tourism • To champion a successful, thriving tourism industry 2010 - 2020 (VisitEngland) • To facilitate greater engagement between the • Greater Manchester Strategy 2013 - 2020 visitor and the experience Stronger Together Visit Manchester is a key -

Tourism – Its Value to the Local Economy

TOURISM – ITS VALUE TO THE LOCAL ECONOMY ECONOMIC IMPACT EMPLOYMENT SUPPORTED CONFERENCE & BUSINESS EVENTS SECTOR Marketing Manchester works with Global Tourism Solutions UK to provide an Marketing Manchester works with Global Tourism Solutions UK to provide an The conference and business events sector plays a major role in the economic indication of the economic impact of the visitor economy, in terms of the direct indication of the number of full-time equivalent roles supported by the visitor impact the destination generates to the local economy. In 2014, Marketing impact and also the indirect impact (through the supply chain). economy to include direct employment and indirect employment (generated Manchester commissioned an update to the Conference Value & Volume study, to through the supply chain). The following table shows the total FTEs supported by follow the 2010 and 2012 studies. Marketing Manchester commissions this study on behalf of Greater Manchester the activity in Greater Manchester, and also Manchester local authority. and local authority level data is available from the authorities who commission this The 2014 study, reporting on the activity hosted in 2013, identified that the value for their area. FTEs supported by FTEs supported by of the sector to Greater Manchester was £823m. This was generated through Greater Manchester’s Manchester’s hosting 4.9m delegates and servicing 7.9m delegate days. The study also showed HOW WE MEASURE IT Tourism Industry Tourism Industry the average value of a day delegate was £49 and the average value of a staying 2014 91,963 48,097 delegate was £161. Our economic impact figures are calculated from a number of measures and where possible this is gathered at a local level. -

Greater Manchester: Our Year in Culture 2018/2019

GREATER MANCHESTER: OUR YEAR IN CULTURE 2018/2019 CONTENTS 1) INTRODUCTION 2) CULTURE AND SOCIAL IMPACT FUND 3) GREAT PLACE 4) LOOKING AHEAD INTRODUCTION Culture is essential to our identity in Greater Manchester. We have always understood the value of it here. In an ever-troubled and changing world, culture is a foundation in what it is to be Greater Mancunian, outward facing, welcoming and diverse; to express ourselves and forge our place in the world. Culture and creativity has become more prominent in our work over the last year than ever before. Sometimes, culture can be viewed as a ‘nice-to-have’, a ‘bolt-on’ but we take a different view in Greater Manchester; we see culture and creativity as fundamental to who we are, but also essential to the success of our economy and a key enabler for our residents to fulfil their full potential. The Independent Prosperity Review, the largest economic review we’ve undertaken in ten years, highlighted creativity and digital as key areas for economic growth in Greater Manchester, and we must build on this to see our economy and residents flourish. Whilst we can’t know what employment opportunities might look like in ten, 20 or 50 years, we can ensure that our residents have the creative skills necessary to adapt and develop to the jobs of the future. Equally, beyond Greater Manchester, our international reputation, and subsequent visitor economy, is driven by our position as a leading cultural destination. This report outlines how far we have come in the last year, and the hard work of the brilliant 28 organisations we fund through our Culture and Social Impact Fund. -

Tourism – Its Value to the Local Economy

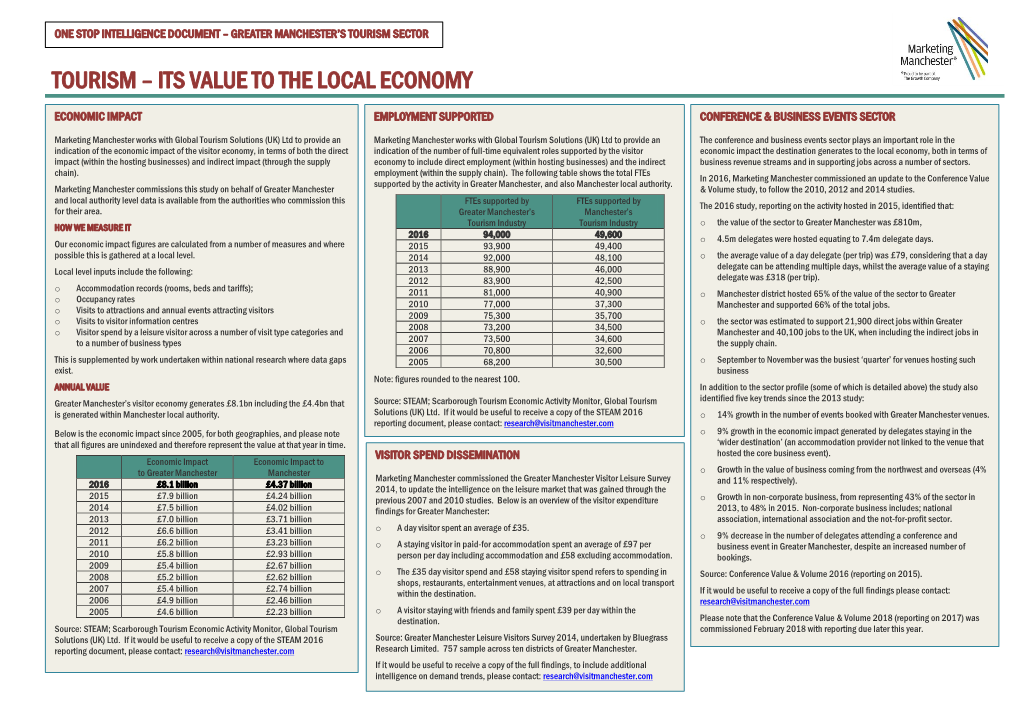

ONE STOP INTELLIGENCE DOCUMENT – GREATER MANCHESTER’S TOURISM SECTOR TOURISM – ITS VALUE TO THE LOCAL ECONOMY ECONOMIC IMPACT EMPLOYMENT SUPPORTED CONFERENCE & BUSINESS EVENTS SECTOR Marketing Manchester works with Global Tourism Solutions (UK) Ltd to provide an Marketing Manchester works with Global Tourism Solutions (UK) Ltd to provide an The conference and business events sector plays an important role in the indication of the economic impact of the visitor economy, in terms of both the direct indication of the number of full-time equivalent roles supported by the visitor economic impact the destination generates to the local economy, both in terms of impact (within the hosting businesses) and indirect impact (through the supply economy to include direct employment (within hosting businesses) and the indirect business revenue streams and in supporting jobs across a number of sectors. chain). employment (within the supply chain). The following table shows the total FTEs In 2016, Marketing Manchester commissioned an update to the Conference Value supported by the activity in Greater Manchester, and also Manchester local authority. Marketing Manchester commissions this study on behalf of Greater Manchester & Volume study, to follow the 2010, 2012 and 2014 studies. and local authority level data is available from the authorities who commission this FTEs supported by FTEs supported by The 2016 study, reporting on the activity hosted in 2015, identified that: for their area. Greater Manchester’s Manchester’s Tourism Industry Tourism Industry o the value of the sector to Greater Manchester was £810m, HOW WE MEASURE IT 2016 94,000 49,600 o 4.5m delegates were hosted equating to 7.4m delegate days. -

Itinerary – Rochdale

Metrolink LUPTS TOUR Having lost its last original tramway in 1949, Greater Manchester was the first conurbation to introduce a modern generation light rail system when the first Metrolink route from Bury to 2013 Altrincham opened in 1992. With extensions, the network now consists of six routes running over 69km of network. It has featured on two previous LUPTS bus tours. In 1992, we travelled on the Saturday Manchester-Bury line, and in 2000 on the recently opened Eccles service. 4 May 2013 The extension to Rochdale opened on 28 February 2013. Today, in addition to the Rochdale line, you have time to do other new routes as well. Trams from Rochdale travel through to St Welcome Werburgh’s Road (opened July 2011). Back from St Werburgh’s Road, and changing at Market Street, you can also do the Droylsden line, which opened in February 2013. Half of the original Welcome to today’s LUPTS tour, the 37th since the series began back in 1977. Today’s trip takes Italian-built trams (1000- and 2000-series) have already been withdrawn as the fleet standardises on us on a round trip to Manchester and back taking in road and rail, old and new. the Bombardier M5000 type (3000-series). Whatever you intend to do today, Deansgate- With over 15,000 Leyland Atlanteans having been built, and them having been part of the Castlefield is the Metrolink stop closest to where the bus will pick up. The schedule lists Merseyside bus scene from 1958 until the last Arriva examples were withdrawn in the early 2000s, recommended latest departure times from remote parts of the network to get you back in time. -

Lancashire Countryside Directory for People with Disabilities

Lancashire Countryside Directory for People with Disabilities Second edition Whatever your needs, access to and enjoyment of the countryside is rewarding, healthy and great fun. This directory can help you find out what opportunities are available to you in your area. Get yourself outdoors and enjoy all the benefits that come with it… Foreword written by: Bill Oddie OBE This directory was designed for people with a disability, though the information included will be useful to everyone. Lancashire’s countryside has much to offer; from the gritstone fells of the Forest of Bowland to the sand dunes of the Sefton Coast. There are some great opportunities to view wildlife too, including red squirrels and marsh harriers. It is more than worth taking that first step and getting yourself involved in your local countryside, regardless of your abilities. For people interested in wildlife and conservation there is much that can be done from home or a local accessible area. Whatever your chosen form of countryside recreation, whether it’s joining a group, doing voluntary work, or getting yourself out into the countryside on your own, we hope you will get as much out of it as we do. There is still some way to go before we have a properly accessible countryside. By contacting Open Country or another of the organisations listed here, you can help us to encourage better access for all in the future. This Second Edition published Summer 2019 Copyright © Open Country 2019 There are some things that some disabilities make “ more difficult. The countryside and wildlife should not be among them. -

Bury Self-Led Walks

BURY SELF-LED WALKS Step outdoors, explore your local green spaces, breathe in the best of Bury and feel the freedom of the fresh air. 12 short self-led walks around Bury complete with illustrated route maps and descriptions. Plus a special additional extra Town Centre Cultural Heritage walk to celebrate Bury’s award as the Inaugural Greater Manchester Town of Culture. WELCOME TO BURY SELF-LED WALKS Health and walk safety… Whilst every care has been taken to ensure the accessibility and suitability of these routes About this booklet… for this booklet, we cannot accept responsibility for any loss or damage to personal property or injury however caused. Therefore, please note that anyone using these mapped Bury Walk with Me is a series of local walks led by trained volunteer walk leaders in association with Bury Live Well Service and The Ramblers Walking for Health Scheme. walking routes does so at their own risk. These mapped routes were correct and accessible on foot at the time of printing and each route has undergone a complete risk assessment With funding support from the Groundworks Project; Ambition for Ageing, the Greater Sport before submission to this booklet. Project: Active Ageing and with help from our own Bury Walk with Me trained Volunteer Walk Leaders, this self-led walks booklet maps out some of our most favoured and popular What to wear and take with me… scheme led walks, (as well as some new ones) within each of the six townships of Bury. The great thing about walking is that it is accessible to WALKING WALKING WALKING F A Y M With each walk having its own colour map and a detailed route description, this self-led almost everyone, it is free to do and aside from a pair S E E IRL A O D AT walks booklet supports independent walking and invites the wider communities of Bury of comfortable, sturdy shoes or boots with reasonable ASY Y E ER to step outside and enjoy exploring their local green spaces. -

All Approved Premises

All Approved Premises Local Authority Name District Name and Telephone Number Name Address Telephone BARKING AND DAGENHAM BARKING AND DAGENHAM 0208 227 3666 EASTBURY MANOR HOUSE EASTBURY SQUARE, BARKING, 1G11 9SN 0208 227 3666 THE CITY PAVILION COLLIER ROW ROAD, COLLIER ROW, ROMFORD, RM5 2BH 020 8924 4000 WOODLANDS WOODLAND HOUSE, RAINHAM ROAD NORTH, DAGENHAM 0208 270 4744 ESSEX, RM10 7ER BARNET BARNET 020 8346 7812 AVENUE HOUSE 17 EAST END ROAD, FINCHLEY, N3 3QP 020 8346 7812 CAVENDISH BANQUETING SUITE THE HYDE, EDGWARE ROAD, COLINDALE, NW9 5AE 0208 205 5012 CLAYTON CROWN HOTEL 142-152 CRICKLEWOOD BROADWAY, CRICKLEWOOD 020 8452 4175 LONDON, NW2 3ED FINCHLEY GOLF CLUB NETHER COURT, FRITH LANE, MILL HILL, NW7 1PU 020 8346 5086 HENDON HALL HOTEL ASHLEY LANE, HENDON, NW4 1HF 0208 203 3341 HENDON TOWN HALL THE BURROUGHS, HENDON, NW4 4BG 020 83592000 PALM HOTEL 64-76 HENDON WAY, LONDON, NW2 2NL 020 8455 5220 THE ADAM AND EVE THE RIDGEWAY, MILL HILL, LONDON, NW7 1RL 020 8959 1553 THE HAVEN BISTRO AND BAR 1363 HIGH ROAD, WHETSTONE, N20 9LN 020 8445 7419 THE MILL HILL COUNTRY CLUB BURTONHOLE LANE, NW7 1AS 02085889651 THE QUADRANGLE MIDDLESEX UNIVERSITY, HENDON CAMPUS, HENDON 020 8359 2000 NW4 4BT BARNSLEY BARNSLEY 01226 309955 ARDSLEY HOUSE HOTEL DONCASTER ROAD, ARDSLEY, BARNSLEY, S71 5EH 01226 309955 BARNSLEY FOOTBALL CLUB GROVE STREET, BARNSLEY, S71 1ET 01226 211 555 BOCCELLI`S 81 GRANGE LANE, BARNSLEY, S71 5QF 01226 891297 BURNTWOOD COURT HOTEL COMMON ROAD, BRIERLEY, BARNSLEY, S72 9ET 01226 711123 CANNON HALL MUSEUM BARKHOUSE LANE, CAWTHORNE, -

Deep Dive Assessment of the Hospitality, Tourism and Sport Sector

Deep Dive: 09 Hospitality, Tourism and Sport Date September 2016 FINAL REPORT Contents Executive Summary .............................................................................................................. 3 1 Introduction ............................................................................................................... 6 2 Definitions ................................................................................................................. 7 3 Significance ............................................................................................................... 8 4 Business and Employment ...................................................................................... 12 5 Skills ........................................................................................................................ 19 6 Key Assets .............................................................................................................. 22 7 Growth Potential ...................................................................................................... 27 8 Spatial Considerations ............................................................................................. 33 September 2016 2 Executive Summary Context The Hospitality, Tourism and Sport sector is broad, encompassing hotels, restaurants, bars, conference and exhibition centres, libraries, museums, entertainment activities, travel agency services, gambling and betting, sports, amusement and recreation. The sector serves both a visitor market, -

Greater Manchester: Our Year in Culture 2018/2019

GREATER MANCHESTER: OUR YEAR IN CULTURE 2018/2019 CONTENTS 1) INTRODUCTION 2) CULTURE AND SOCIAL IMPACT FUND 3) GREAT PLACE 4) LOOKING AHEAD INTRODUCTION Culture is essential to our identity in Greater Manchester. We have always understood the value of it here. In an ever-troubled and changing world, culture is a foundation in what it is to be Greater Mancunian, outward facing, welcoming and diverse; to express ourselves and forge our place in the world. Culture and creativity has become more prominent in our work over the last year than ever before. Sometimes, culture can be viewed as a ‘nice-to-have’, a ‘bolt-on’ but we take a different view in Greater Manchester; we see culture and creativity as fundamental to who we are, but also essential to the success of our economy and a key enabler for our residents to fulfil their full potential. The Independent Prosperity Review, the largest economic review we’ve undertaken in ten years, highlighted creativity and digital as key areas for economic growth in Greater Manchester, and we must build on this to see our economy and residents flourish. Whilst we can’t know what employment opportunities might look like in ten, 20 or 50 years, we can ensure that our residents have the creative skills necessary to adapt and develop to the jobs of the future. Equally, beyond Greater Manchester, our international reputation, and subsequent visitor economy, is driven by our position as a leading cultural destination. This report outlines how far we have come in the last year, and the hard work of the brilliant 28 organisations we fund through our Culture and Social Impact Fund. -

May-June 2016

Edition 57 • May/June2016 @FamiliesManch The local magazine for families with children 0-12 years facebook.com/familiesmanchester FREE www.familiesmanchester.co.uk ® MANCHESTER In this issue > Party up a storm > How to organise holiday childcare Covering: Altrincham, Trafford, Salford, Manchester, Bolton, Bury, Rochdale, Didsbury, Stockport, Cheadle, Bramhall, and surrounding areas. Welcome News In this issue Amazed by Science 2016 Join your local Families Spring into action with new 02: News 04: Education team in Manchester Tennis Tykes classes! 07: Clubs & classes and Cheshire! classes are also available in Bramhall, 08: Holiday camps Handforth, Heaton Moor and Wilmslow. 10: Parties Why not try a FREE taster lesson at one 13: Parents’ place of the venues? 14: What’s on The party season is also upon us, so ask about the Tennis Tykes parties for 2, 3 and 4 year olds! There’s a fun packed Fiddler’s Ferry Power Station, Golden hour of tennis activities, incorporating Square Shopping Centre, Hack Green lots of games and tennis ball skills, Hello! Secret Nuclear Bunker, Jodrell Bank, Marketing Cheshire and Jodrell Bank all supervised by qualified coaches Macclesfield Silk Museum, Lion Salt Works, With a certain other half careering towards his half century mark in May, we are teaming up to deliver the third and trained staff. The Tykes characters, Norton Priory, Tatton Park plus more. You should be: were definitely in the right frame of mind for this issue! But party ideas for Amazed by Science Festival this Tennis Tykes, the fun and educational Tommy and Tessa are also on hand to Many of the activities are Children’s • Enthusiastic and knowledgeable adults are a lot more difficult to decide on and we found ourselves wishing spring half term. -

Tourism – Its Value to the Local Economy

TOURISM – ITS VALUE TO THE LOCAL ECONOMY ECONOMIC IMPACT EMPLOYMENT SUPPORTED CONFERENCE & BUSINESS EVENTS SECTOR Marketing Manchester works with Global Tourism Solutions (UK) Ltd to provide an Marketing Manchester works with Global Tourism Solutions (UK) Ltd to provide an The conference and business events sector plays an important role in the indication of the economic impact of the visitor economy, in terms of the direct indication of the number of full-time equivalent roles supported by the visitor economic impact the destination generates to the local economy, both in terms of impact and also the indirect impact (through the supply chain). economy to include direct employment and indirect employment (generated business revenue streams and in supporting jobs across a number of sectors. through the supply chain). The following table shows the total FTEs supported by Marketing Manchester commissions this study on behalf of Greater Manchester the activity in Greater Manchester, and also Manchester local authority. In 2016, Marketing Manchester commissioned an update to the Conference Value and local authority level data is available from the authorities who commission this & Volume study, to follow the 2010, 2012 and 2014 studies. for their area. FTEs supported by FTEs supported by Greater Manchester’s Manchester’s The 2016 study, reporting on the activity hosted in 2015, identified that the value HOW WE MEASURE IT Tourism Industry Tourism Industry of the sector to Greater Manchester was £810m and that this was generated Our economic impact figures are calculated from a number of measures and where 2015 93,900 49,400 through hosting 4.5m delegates and servicing 7.4m delegate days.