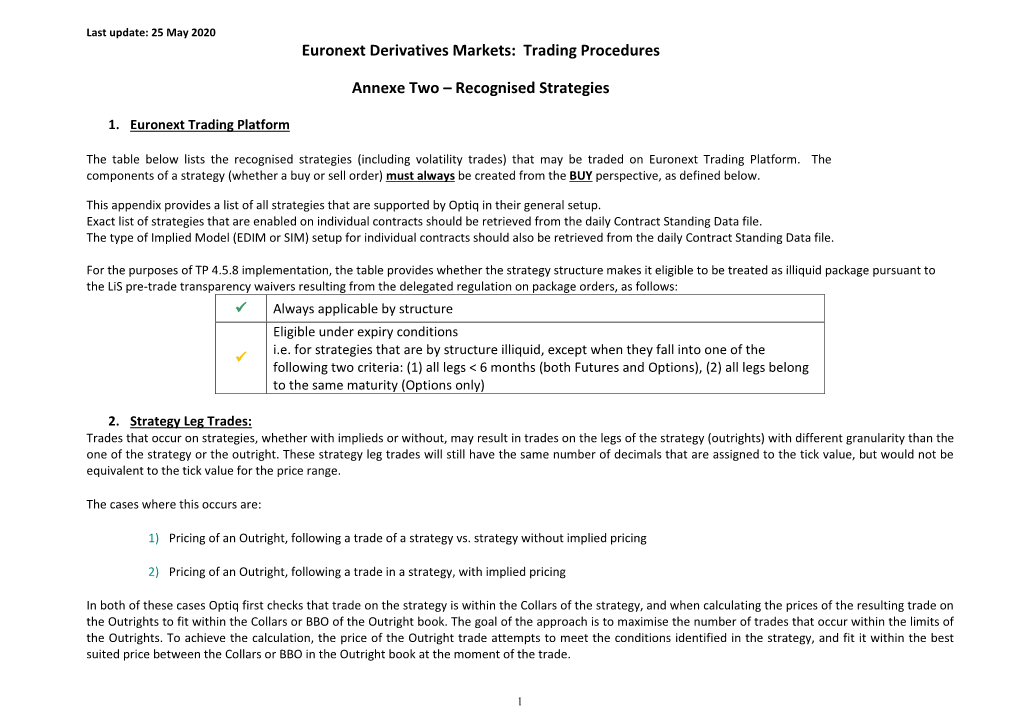

Trading Procedures Annexe Two – Recognised Strategies

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Options in Asset Allocation Problems: an Empirical Model Applied to the Italian FTSE MIB Index

Dipartimento di Impresa e Management Cattedra Asset Pricing Options in asset allocation problems: an empirical model applied to the Italian FTSE MIB Index Prof. Paolo Porchia Prof. Marco Pirra RELATORE CORRELATORE Matr. 705881 CANDIDATO Anno Accademico 2019/2020 1 2 Contents Introduction...................................................................................................................................................... 4 1). What are options? History, definitions, and strategies. .......................................................................... 6 1.1). Options: brief history and general definition. ....................................................................................... 6 1.2). Plain Vanilla and Exotic options: main determinants, greeks, payoffs. .............................................. 11 1.3) The most common options strategies. .................................................................................................. 21 2). The role of options in investors’ portfolios. ........................................................................................... 30 2.1). The role of options in buy and hold portfolios to solve the classic asset allocation problem. ............ 30 2.2). Benefit from including derivatives in optimal dynamic strategies. ..................................................... 37 2.3). Optimal Portfolio’s choices whit jumps in volatility. ......................................................................... 43 2.4). A myopic portfolio to exploit the mispricing. -

Evidence on the Performance of Condor Option Spreads in Australia

APPLIED FINANCE LETTERS VOLUME 06, ISSUE 01, 2017 FLIGHT OF THE CONDORS: EVIDENCE ON THE PERFORMANCE OF CONDOR OPTION SPREADS IN AUSTRALIA SCOTT J. NIBLOCK1* 1. Lecturer, School of Business & Tourism, Southern Cross University, Australia * Corresponding Author: Dr Scott J. Niblock, Lecturer, School of Business & Tourism, Southern Cross University, Gold Coast, Australia +61 7 5589 3098 [email protected] Abstract: This paper examined whether superior nominal and risk-adjusted returns could be generated using condor option spread strategies on a large capitalized Australian stock. Monthly Commonwealth Bank of Australia Ltd (CBA) condor option spreads were constructed from 2012 to 2015 and their returns established. Standard and alternative measures were used to determine the nominal and risk-adjusted performance of the spreads. The results show that the short put condor spread produced superior nominal and risk-adjusted returns, but seemingly underperformed when the upside potential ratio was taken into consideration. The long iron condor spread also offered reasonable returns across both performance metrics. On the other hand, the short call condor, long call condor, short iron condor and long put condor spreads did not perform as well on a nominal and risk- adjusted return basis. The results suggest that constructing spreads on the foundation of volatility preferences could be a driver of performance for condor option spreads strategies. For instance, short volatility condor spreads with negatively skewed return distribution shapes appear to add value, while long volatility condor spreads with positively skewed return distribution shapes seem to be less attractive over the sample period. Overall, condor option spreads demonstrate high risk-return profiles, offer versatility in their construction and intended pay-off outcomes, create value in some instances and can be executed across varying market conditions. -

Using VIX to Help Trade Options

The Option Pit Method Understanding and Trading VIX Option Pit What we will cover in PART 1 • What VIX is and what it is not • What VIX measures • The nature of volatility • A look at the SPX straddle for an Easy VIX • Ways to trade VIX profitably What the heck is the VIX? VIX Facts • VIX has not gone below 8% or above 100% since 2008 • You cannot buy it or sell it • What it measures changes every week • It does not measure fear or complacency • The long term average for VIX is around 20 More VIX facts • Options on VIX only settle to VIX cash once per week • The VIX Index is generated from SPX options with a bid and an offer • At least 100 option series make up the VIX • The time to calculate VIX is measured in minutes VIX measures SPX 30 day implied volatility • Why 30 days? Well, that was all that was available when VIX was invented. • The calendar is very important to trading VIX • Most importantly: VIX DOES NOT MEASURE IV of options expiring this week or next week in the SPX • VIX uses the IV of the SPX options with 23 to 37 days to expiration. VIX is a volatility direction with a limit Volatility as a direction does not compound like A stock, it reverts to a mean Definition of Volatility • Basically the range of a stock over a certain period of time – In the case of the VIX, we are talking about the SPX only • There are RVX (Russell 2000) and TYVIX (10-Year Treasury Note) among others • There is a VIX for AAPL and a VIX for GOOGL So what is Volatility? • A 15% volatility on a $100 stock for 1 year would give us a range of $85 to $115 with a 68.2% degree of confidence. -

Profiting with Iron Condor Option : Strategies from the Frontline For

ptg PROFITING WITH IRON CONDOR OPTIONS STRATEGIES FROM THE FRONTLINE FOR TRADING IN UPOR DOWN MARKETS M I C H A E L H A N A N I A B E N K L I F A Vice President, Publisher: Tim Moore Associate Publisher and Director of Marketing: Amy Neidlinger Executive Editor: Jim Boyd Editorial Assistant: Pamela Boland Development Editor: Russ Hall Operations Manager: Gina Kanouse Senior Marketing Manager: Julie Phifer Publicity Manager: Laura Czaja Assistant Marketing Manager: Megan Colvin Cover Designer: Chuti Prasertsith Managing Editor: Kristy Hart Project Editor: Anne Goebel Copy Editor: Cheri Clark Proofreader: Linda Seifert Indexer: Lisa Stumpf Compositor: TnT Design, Inc. Manufacturing Buyer: Dan Uhrig © 2011 by Pearson Education, Inc. Publishing as FT Press Upper Saddle River, New Jersey 07458 This book is sold with the understanding that neither the author nor the publisher is engaged in rendering legal, accounting, or other professional services or advice by publishing this book. Each individual situation is unique. Thus, if legal or financial advice or other expert assistance is required in a specific situation, the services of a competent professional should be sought to ensure that the situation has been evaluated carefully and appropriately. The author and the publisher disclaim any liability, loss, or risk resulting directly or indirectly, from the use or application of any of the contents of this book. FT Press offers excellent discounts on this book when ordered in quantity for bulk purchases or special sales. For more information, please contact U.S. Corporate and Government Sales, 1-800-382-3419, [email protected]. -

Confronting the Volatility Risk Premium on the S&P500

CBA Copenhagen Business School MSc in EBA Finance & Investment Master Thesis 2017 CONFRONTING THE VOLATILITY RISK PREMIUM ON THE S&P500 INDEX - AN EMPIRICAL STUDY Lea Jochumsen Victor Vogel Jørgensen Supervisor: Agatha Murgoci Time of submission: May 15, 2017 Page numbers and characters: 120 pages, 247,135 characters Confronting the volatility risk premium on the S&P500 index | 2017 Abstract This thesis examines the effectiveness of different short vega option combinations’ ability to capture the volatility risk premium on the S&P500 index. We find evidence that delta neutrality of the option combinations is required to gain factor exposure linked to the volatility risk premium. The short delta-hedged strangle proves to be the most profitable strategy to capture the volatility risk premium. However, neither of the initially tested strategies yields statistically significant returns. Using market timing indicators based on moving averages of the VIX- and CDX index, the returns of the option combinations considered are consistently improved and yield statistically significant returns. When considering transaction costs and margin requirements faced when trying to capture the volatility risk premium, the investment doesn’t seem as attractive, but is perusable when using market timing indicators. 1 ⏐ 144 Table of Contents ABSTRACT ........................................................................................................................................................ 1 CHAPTER 1 - INTRODUCTION ................................................................................................................... -

Options Trading

OPTIONS TRADING: THE HIDDEN REALITY RI$K DOCTOR GUIDE TO POSITION ADJUSTMENT AND HEDGING Charles M. Cottle ● OPTIONS: PERCEPTION AND DECEPTION and ● COULDA WOULDA SHOULDA revised and expanded www.RiskDoctor.com www.RiskIllustrated.com Chicago © Charles M. Cottle, 1996-2006 All rights reserved. No part of this publication may be printed, reproduced, stored in a retrieval system, or transmitted, emailed, uploaded in any form or by any means, electronic, mechanical photocopying, recording, or otherwise, without the prior written permission of the publisher. This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that neither the author or the publisher is engaged in rendering legal, accounting, or other professional service. If legal advice or other expert assistance is required, the services of a competent professional person should be sought. From a Declaration of Principles jointly adopted by a Committee of the American Bar Association and a Committee of Publishers. Published by RiskDoctor, Inc. Library of Congress Cataloging-in-Publication Data Cottle, Charles M. Adapted from: Options: Perception and Deception Position Dissection, Risk Analysis and Defensive Trading Strategies / Charles M. Cottle p. cm. ISBN 1-55738-907-1 ©1996 1. Options (Finance) 2. Risk Management 1. Title HG6024.A3C68 1996 332.63’228__dc20 96-11870 and Coulda Woulda Shoulda ©2001 Printed in the United States of America ISBN 0-9778691-72 First Edition: January 2006 To Sarah, JoJo, Austin and Mom Thanks again to Scott Snyder, Shelly Brown, Brian Schaer for the OptionVantage Software Graphics, Allan Wolff, Adam Frank, Tharma Rajenthiran, Ravindra Ramlakhan, Victor Brancale, Rudi Prenzlin, Roger Kilgore, PJ Scardino, Morgan Parker, Carl Knox and Sarah Williams the angel who revived the Appendix and Chapter 10. -

The Advanced Iron Condor Trading Guide

The Advanced Iron Condor Trading Guide Trading the Greeks and Active Risk Management First Edition By Craig Severson The Advanced Iron Condor Trading Guide Trading the Greeks and Active Risk Management First Edition By Craig Severson © Copyright 2011 by Craig Severson All Rights Reserved No duplication or transmission of the material included within except through express written permission from the author, [email protected]. Additional images courtesy of thinkorswim and TradeStation™. All of the position analyzer graphics were provided through thinkorswim’s analyzer tool, with some augmentation. Cover image © Copyright 2011 by Craig Severson. Be advised that all information is issued solely for informational purposes and is not to be construed as an offer to sell or the solicitation of an offer to buy, nor is it to be construed as a recommendation to buy, hold or sell (short or otherwise) any security. The principals of, and those who provide contracted services for OptionsLinebacker and Hampshire & Holloway LLC: -are neither registered Investment Advisors nor a Broker/Dealers and are not acting in any way to influence the purchase of any security -are not liable for any losses or damages, monetary or otherwise, that result from the content of any written materials, or any discussions -may own, buy, or sell securities provided in written materials or discussed -have not promised that you will earn a profit when or if your purchase/sell stocks, bonds, or Options. You are urged to consult with your own independent financial advisors and/or broker before making an investment or trading securities. Past performance may not be indicative of future performance. -

Derivative Strategies for Market Randomness

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668 PP 01-06 www.iosrjournals.org Derivative Strategies for Market Randomness Chirag Babulal Shah PhD (Pursuing), M.M.S., B.B.A., D.B.M., P.G.D.F.T., D.M.T.T. Assistant Professor at Indian Education Society’s Management College and Research Centre. I. Introduction: The returns of the stock market are very important to the theories of Asset pricing, allocation and risk management of investments. However, we assume that positive index returns means positive trade returns. One very important point missed out by retail investors is that the stock market can be traded with a variety of views. Option strategies allow a trader to take multiple views on the market, and hence many ways to make profits. One of the biggest advantages of options is the ability to create a direction neutral strategy. Strategies like Straddle,Strangle, Butterfly, Iron Condor, etc. are considered Direction neutral strategies. Out of these, the Reverse Iron Condor has proven to be the best strategy for a long term investor. It has a limited loss, if the market remains within a range and a limited profit if the market goes out of a certain range. However, the probability of market moving out of a small range is very high. Moreover, the time period for this movement is one month. In one month, markets generally move as it is its basic characteristic. Observing past data of Nifty, one can infer that the market moves in a random fashion. -

Download the Iron Condor

Everything You Need To Know About IRON CONDORS If you’re relatively new to Iron Condors, welcome to Options Trading IQ. I’ve been trading options since 2004 and Condors since 2008. This book is over 5,000 words and designed to teach you everything you need to know about Iron Condors. - Enjoy! Contents INTRODUCTION ..................................................................................................................... 1 BEAR CALL SPREAD ..........................................................................................................................2 PUTTING IT ALL TOGETHER ...........................................................................................................3 WHEN TO ENTER IRON CONDORS ................................................................................... 5 AFTER A RANGE EXPANSION .......................................................................................................5 ON A VOLATILITY SPIKE ..................................................................................................................6 BASED ON IV RANK ...........................................................................................................................6 ANY TIME? ..............................................................................................................................................7 LONG-TERM OR SHORT-TERM IRON CONDORS ............................................................. 9 SLOW MOVERS ....................................................................................................................................9 -

Theotrade-Gamma-Irons-How-You-Can-Profit-From-Non-Directional-Trades-With-Don

Live @ 7:00 pm Central Time Gamma Irons How You Can Profit From Non-Directional Trades with Don Kaufman © Copyright 2020 TheoTrade, LLC. All Rights Reserved Risk Disclosure • We Are Not Financial Advisors or a Broker/Dealer: Neither TheoTrade® nor any of its officers, employees, representatives, agents, or independent contractors are, in such capacities, licensed financial advisors, registered investment advisers, or registered broker-dealers. TheoTrade ® does not provide investment or financial advice or make investment recommendations, nor is it in the business of transacting trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation. Nothing contained in this communication constitutes a solicitation, recommendation, promotion, endorsement, or offer by TheoTrade ® of any particular security, transaction, or investment. • Securities Used as Examples: The security used in this example is used for illustrative purposes only. TheoTrade ® is not recommending that you buy or sell this security. Past performance shown in examples may not be indicative of future performance. • Return on Investment “ROI” Examples: The security used in this example is for illustrative purposes only. The calculation used to determine the return on investment “ROI” does not include the number of trades, commissions, or any other factors used to determine ROI. The ROI calculation measures the profitability of investment and, as such, there are alternate methods to calculate/express it. All information provided are for educational purposes only and does not imply, express, or guarantee future returns. Past performance shown in examples may not be indicative of future performance. • Investing Risk: Trading securities can involve high risk and the loss of any funds invested. -

Module 4.3 Winged and Ratio Spreads

Module 4.3 Winged and Ratio Spreads Winged and Ratio Spreads This class is a production of Safe Option Strategies © and the content is protected by copyright. Any reproduction or redistribution of this or any Safe Option Strategies © presentation is strictly prohibited by law. The information presented in this class is for education purposes only. Safe Option Strategies © does not make any recommendation to buy or sell stocks or options. Trading stocks and options comes with risk and you are solely responsible for any losses you may incur as a result of trading. Module 4.3 Winged and Ratio Spreads Iron Condors Credit Spread Sell to Open the Trade Bear Call Spread is Combined with a Bull Put Spread on the Same Stock in the Same Month of Expiration Cost Basis is the Total Net Credit of ALL the Options Subtracted from the Difference in The Strike Prices of the Options on Whichever Side of the Trade Has a Greater Spread. Max Risk = Cost Basis Max Reward = Net Credit of All Options. Good Target ROI is 15-50% Good Target Time in the Trade is Under 4 weeks. Module 4.3 Winged and Ratio Spreads LC SC SP LP Module 4.3 Winged and Ratio Spreads Short Call is placed at Long Call is placed at the December $120.00 the December $125.00 Strike and is the Strike and is the •As the price of the stock primary or money secondary or hedge moves down both options on making option on the option on the Bear Call the bear call side lose value. -

Option Strategy Text

LIFFE Options a guide to trading strategies © LIFFE 2002 All proprietary rights and interest in this publication shall be vested in LIFFE Administration and Management ("LIFFE") and all other rights including, but without limitation, patent, registered design, copyright, trademark, service mark, connected with this publication shall also be vested in LIFFE. LIFFE CONNECT™ is a trademark of LIFFE Administration and Management. No part of this publication may be redistributed or reproduced in any form or by any means or used to make any derivative work (such as translation, transformation, or adaptation) without written permission from LIFFE. LIFFE reserves the right to revise this publication and to make changes in content from time to time without obligation on the part of LIFFE to provide notification of such revision or change. Whilst all reasonable care has been taken to ensure that the information contained in this publication is accurate and not misleading at the time of publication, LIFFE shall not be liable (except to the extent required by law) for the use of the information contained herein however arising in any circumstances connected with actual trading or otherwise. Neither LIFFE, nor its servants nor agents, is responsible for any errors or omissions contained in this publication. This publication is for information only and does not constitute an offer, solicitation or recommendation to acquire or dispose of any investment or to engage in any other transaction. All information, descriptions, examples and calculations contained in this publication are for guidance purposes only, and should not be treated as definitive. LIFFE reserves the right to alter any of its rules or contract specifications, and such an event may affect the validity of the information in this publication.