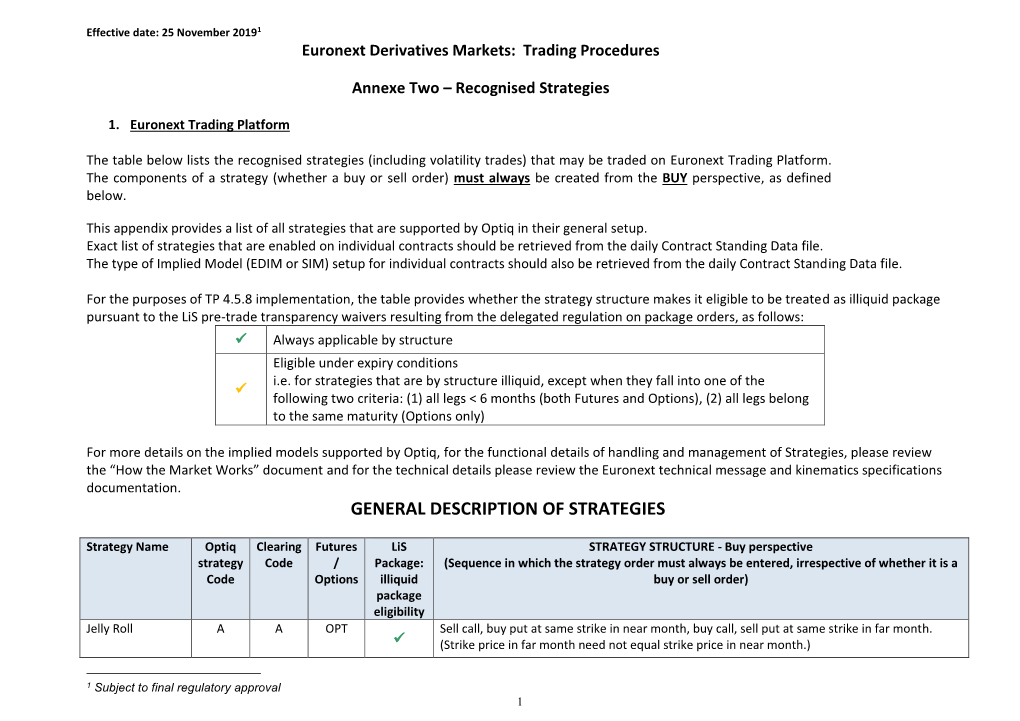

General Description of Strategies

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Section 1256 and Foreign Currency Derivatives

Section 1256 and Foreign Currency Derivatives Viva Hammer1 Mark-to-market taxation was considered “a fundamental departure from the concept of income realization in the U.S. tax law”2 when it was introduced in 1981. Congress was only game to propose the concept because of rampant “straddle” shelters that were undermining the U.S. tax system and commodities derivatives markets. Early in tax history, the Supreme Court articulated the realization principle as a Constitutional limitation on Congress’ taxing power. But in 1981, lawmakers makers felt confident imposing mark-to-market on exchange traded futures contracts because of the exchanges’ system of variation margin. However, when in 1982 non-exchange foreign currency traders asked to come within the ambit of mark-to-market taxation, Congress acceded to their demands even though this market had no equivalent to variation margin. This opportunistic rather than policy-driven history has spawned a great debate amongst tax practitioners as to the scope of the mark-to-market rule governing foreign currency contracts. Several recent cases have added fuel to the debate. The Straddle Shelters of the 1970s Straddle shelters were developed to exploit several structural flaws in the U.S. tax system: (1) the vast gulf between ordinary income tax rate (maximum 70%) and long term capital gain rate (28%), (2) the arbitrary distinction between capital gain and ordinary income, making it relatively easy to convert one to the other, and (3) the non- economic tax treatment of derivative contracts. Straddle shelters were so pervasive that in 1978 it was estimated that more than 75% of the open interest in silver futures were entered into to accommodate tax straddles and demand for U.S. -

Machine Learning Based Intraday Calibration of End of Day Implied Volatility Surfaces

DEGREE PROJECT IN MATHEMATICS, SECOND CYCLE, 30 CREDITS STOCKHOLM, SWEDEN 2020 Machine Learning Based Intraday Calibration of End of Day Implied Volatility Surfaces CHRISTOPHER HERRON ANDRÉ ZACHRISSON KTH ROYAL INSTITUTE OF TECHNOLOGY SCHOOL OF ENGINEERING SCIENCES Machine Learning Based Intraday Calibration of End of Day Implied Volatility Surfaces CHRISTOPHER HERRON ANDRÉ ZACHRISSON Degree Projects in Mathematical Statistics (30 ECTS credits) Master's Programme in Applied and Computational Mathematics (120 credits) KTH Royal Institute of Technology year 2020 Supervisor at Nasdaq Technology AB: Sebastian Lindberg Supervisor at KTH: Fredrik Viklund Examiner at KTH: Fredrik Viklund TRITA-SCI-GRU 2020:081 MAT-E 2020:044 Royal Institute of Technology School of Engineering Sciences KTH SCI SE-100 44 Stockholm, Sweden URL: www.kth.se/sci Abstract The implied volatility surface plays an important role for Front office and Risk Manage- ment functions at Nasdaq and other financial institutions which require mark-to-market of derivative books intraday in order to properly value their instruments and measure risk in trading activities. Based on the aforementioned business needs, being able to calibrate an end of day implied volatility surface based on new market information is a sought after trait. In this thesis a statistical learning approach is used to calibrate the implied volatility surface intraday. This is done by using OMXS30-2019 implied volatil- ity surface data in combination with market information from close to at the money options and feeding it into 3 Machine Learning models. The models, including Feed For- ward Neural Network, Recurrent Neural Network and Gaussian Process, were compared based on optimal input and data preprocessing steps. -

Faqs on Straddle Contracts – Currency Derivatives

FAQs on Straddle Contracts FAQs on Straddle Contracts – Currency Derivatives 1. What is meant by a Straddle Contract? Straddle contracts are specialised two-legged option contracts that allow a trader to take positions on two different option contracts belonging to the same product, at the same strike price and having the same expiry. 2. What are the components of a Straddle contract? A straddle contract comprises of two individual legs, the first being the call option leg and the second being the put option leg, having same strike price and expiry. 3. In which segment will Straddle contracts be offered? To start with, straddle contracts will be offered in the Currency Derivatives segment. 4. What will be the market lot of the straddle contract? Market lot of a straddle contract will be the same as that of its corresponding individual legs i.e. the market lot of the call option leg and the put option leg. 5. What will be the tick size of the straddle contract? Tick size of a straddle contract will be the same as that of its corresponding individual legs i.e. the tick size of the call option leg and the put option leg. 6. For which expiries will straddle contracts be made available? Straddle contracts will be made available on all existing individual option contracts - current, near, & far monthly as well as quarterly and half yearly option contracts. 7. How many in-the-money, at-the-money and out-of-the-money contracts will be available? Minimum two In-the-Money, two Out-of-the-Money and one At-the-Money straddle contracts will be made available. -

Jazz and the Cultural Transformation of America in the 1920S

Louisiana State University LSU Digital Commons LSU Doctoral Dissertations Graduate School 2003 Jazz and the cultural transformation of America in the 1920s Courtney Patterson Carney Louisiana State University and Agricultural and Mechanical College, [email protected] Follow this and additional works at: https://digitalcommons.lsu.edu/gradschool_dissertations Part of the History Commons Recommended Citation Carney, Courtney Patterson, "Jazz and the cultural transformation of America in the 1920s" (2003). LSU Doctoral Dissertations. 176. https://digitalcommons.lsu.edu/gradschool_dissertations/176 This Dissertation is brought to you for free and open access by the Graduate School at LSU Digital Commons. It has been accepted for inclusion in LSU Doctoral Dissertations by an authorized graduate school editor of LSU Digital Commons. For more information, please [email protected]. JAZZ AND THE CULTURAL TRANSFORMATION OF AMERICA IN THE 1920S A Dissertation Submitted to the Graduate Faculty of the Louisiana State University and Agricultural and Mechanical College in partial fulfillment of the requirements for the degree of Doctor of Philosophy in The Department of History by Courtney Patterson Carney B.A., Baylor University, 1996 M.A., Louisiana State University, 1998 December 2003 For Big ii ACKNOWLEDGEMENTS The real truth about it is no one gets it right The real truth about it is we’re all supposed to try1 Over the course of the last few years I have been in contact with a long list of people, many of whom have had some impact on this dissertation. At the University of Chicago, Deborah Gillaspie and Ray Gadke helped immensely by guiding me through the Chicago Jazz Archive. -

307439 Ferdig Master Thesis

Master's Thesis Using Derivatives And Structured Products To Enhance Investment Performance In A Low-Yielding Environment - COPENHAGEN BUSINESS SCHOOL - MSc Finance And Investments Maria Gjelsvik Berg P˚al-AndreasIversen Supervisor: Søren Plesner Date Of Submission: 28.04.2017 Characters (Ink. Space): 189.349 Pages: 114 ABSTRACT This paper provides an investigation of retail investors' possibility to enhance their investment performance in a low-yielding environment by using derivatives. The current low-yielding financial market makes safe investments in traditional vehicles, such as money market funds and safe bonds, close to zero- or even negative-yielding. Some retail investors are therefore in need of alternative investment vehicles that can enhance their performance. By conducting Monte Carlo simulations and difference in mean testing, we test for enhancement in performance for investors using option strategies, relative to investors investing in the S&P 500 index. This paper contributes to previous papers by emphasizing the downside risk and asymmetry in return distributions to a larger extent. We find several option strategies to outperform the benchmark, implying that performance enhancement is achievable by trading derivatives. The result is however strongly dependent on the investors' ability to choose the right option strategy, both in terms of correctly anticipated market movements and the net premium received or paid to enter the strategy. 1 Contents Chapter 1 - Introduction4 Problem Statement................................6 Methodology...................................7 Limitations....................................7 Literature Review.................................8 Structure..................................... 12 Chapter 2 - Theory 14 Low-Yielding Environment............................ 14 How Are People Affected By A Low-Yield Environment?........ 16 Low-Yield Environment's Impact On The Stock Market........ -

Tax Treatment of Derivatives

United States Viva Hammer* Tax Treatment of Derivatives 1. Introduction instruments, as well as principles of general applicability. Often, the nature of the derivative instrument will dictate The US federal income taxation of derivative instruments whether it is taxed as a capital asset or an ordinary asset is determined under numerous tax rules set forth in the US (see discussion of section 1256 contracts, below). In other tax code, the regulations thereunder (and supplemented instances, the nature of the taxpayer will dictate whether it by various forms of published and unpublished guidance is taxed as a capital asset or an ordinary asset (see discus- from the US tax authorities and by the case law).1 These tax sion of dealers versus traders, below). rules dictate the US federal income taxation of derivative instruments without regard to applicable accounting rules. Generally, the starting point will be to determine whether the instrument is a “capital asset” or an “ordinary asset” The tax rules applicable to derivative instruments have in the hands of the taxpayer. Section 1221 defines “capital developed over time in piecemeal fashion. There are no assets” by exclusion – unless an asset falls within one of general principles governing the taxation of derivatives eight enumerated exceptions, it is viewed as a capital asset. in the United States. Every transaction must be examined Exceptions to capital asset treatment relevant to taxpayers in light of these piecemeal rules. Key considerations for transacting in derivative instruments include the excep- issuers and holders of derivative instruments under US tions for (1) hedging transactions3 and (2) “commodities tax principles will include the character of income, gain, derivative financial instruments” held by a “commodities loss and deduction related to the instrument (ordinary derivatives dealer”.4 vs. -

US Options FIX Specification

US Options FIX Specification Version 2.7.37 September 9, 2021 This content is owned or licensed by Cboe Global Markets, Inc. or its affiliates (“Cboe”) and protected by copyright under U.S. and international copyright laws. Other than for internal business purposes, you may not copy, reproduce, distribute, publish, display, perform, modify, create derivative works, transmit, or in any way exploit the content, sell or offer it for sale, use the content to construct any kind of database, or alter or remove any copyright or other notice from copies of the content. Cboe US Options FIX Specification (Version 2.7.37) Contents 1 Introduction.......................................................................................................................... 5 1.1 Overview .............................................................................................................................................. 5 1.2 Document Format ............................................................................................................................... 5 1.3 Hours of Operation .............................................................................................................................. 5 Holiday Sessions (C1 only) (Effective 11/21/21) ............................................................................. 6 1.4 Data Types ........................................................................................................................................... 6 Times .............................................................................................................................................. -

VERTICAL SPREADS: Taking Advantage of Intrinsic Option Value

Advanced Option Trading Strategies: Lecture 1 Vertical Spreads – The simplest spread consists of buying one option and selling another to reduce the cost of the trade and participate in the directional movement of an underlying security. These trades are considered to be the easiest to implement and monitor. A vertical spread is intended to offer an improved opportunity to profit with reduced risk to the options trader. A vertical spread may be one of two basic types: (1) a debit vertical spread or (2) a credit vertical spread. Each of these two basic types can be written as either bullish or bearish positions. A debit spread is written when you expect the stock movement to occur over an intermediate or long- term period [60 to 120 days], whereas a credit spread is typically used when you want to take advantage of a short term stock price movement [60 days or less]. VERTICAL SPREADS: Taking Advantage of Intrinsic Option Value Debit Vertical Spreads Bull Call Spread During March, you decide that PFE is going to make a large up move over the next four months going into the Summer. This position is due to your research on the portfolio of drugs now in the pipeline and recent phase 3 trials that are going through FDA approval. PFE is currently trading at $27.92 [on March 12, 2013] per share, and you believe it will be at least $30 by June 21st, 2013. The following is the option chain listing on March 12th for PFE. View By Expiration: Mar 13 | Apr 13 | May 13 | Jun 13 | Sep 13 | Dec 13 | Jan 14 | Jan 15 Call Options Expire at close Friday, -

PUC Approves CATV Sale Crackdown Ordered Against Hooligans

----------------------S' 1 ^ ■ ■/ ' ■ / -•V, X 'V MANCifiESTER, CONN,, THURSDAY, NOV. 1, 1973— VOL. XCIII, Na; 28 Mqnche,ler^ 4 City of Village Charm _ thirtv.two PACES - two sections - ^I’RICEf KIFTEKN CENTS full Independence Assured It -.fi ~ fire Jaworski had settled on Jaworski and prosecutor not suBject to firing have complete independence. • ’ QJn* * d" nat’ied withouLfirst consulting with the SaxBe. By Nixon. \’ n specified congressional leaders SaxBe said he Believes Nixon SaxBe, a RepuBlican and ^ ' " ^ 1 approved and “ascertaining that their Archibald Cox was fired Oqt. went too far in agreeing to. n - selection of Leon Jaworski consensus is in accord with his former Ohio attorney general, 20 as special Watergate release tapes of presidential - vr ’ths.as new WatergatV soecialspecial proposed action.” “ hacT said earlier In the day he prosecutor for refusing to drop conversations dealing with the prosecutor with full in ■ was “relatively sure” he will Be The firing of Cox after his his court Battle for White House case. dependence and safeguards nominated to Be attorney refusal to aBide by Nixon's tape recordings on Watergate. The 57-year-old senator said’ against Being fired. general. orders to drop efforts in court Elliot L, Richardson resigned he Believes the tapes are The President promised not SaxBe told reporters he was to oBtain confidential White ■ as attorney general the same privileged and “about as in to discharge Jaworski, as -he satisfied "the President has Hqusje. tapes and documents day rather than carry out timate a thing as cart Be.” He had Archibald Cox, without oB act^d honoraBly in the touched off a massive con Nixon’s order to fire Cox. -

A Glossary of Securities and Financial Terms

A Glossary of Securities and Financial Terms (English to Traditional Chinese) 9-times Restriction Rule 九倍限制規則 24-spread rule 24 個價位規則 1 A AAAC see Academic and Accreditation Advisory Committee【SFC】 ABS see asset-backed securities ACCA see Association of Chartered Certified Accountants, The ACG see Asia-Pacific Central Securities Depository Group ACIHK see ACI-The Financial Markets of Hong Kong ADB see Asian Development Bank ADR see American depositary receipt AFTA see ASEAN Free Trade Area AGM see annual general meeting AIB see Audit Investigation Board AIM see Alternative Investment Market【UK】 AIMR see Association for Investment Management and Research AMCHAM see American Chamber of Commerce AMEX see American Stock Exchange AMS see Automatic Order Matching and Execution System AMS/2 see Automatic Order Matching and Execution System / Second Generation AMS/3 see Automatic Order Matching and Execution System / Third Generation ANNA see Association of National Numbering Agencies AOI see All Ordinaries Index AOSEF see Asian and Oceanian Stock Exchanges Federation APEC see Asia Pacific Economic Cooperation API see Application Programming Interface APRC see Asia Pacific Regional Committee of IOSCO ARM see adjustable rate mortgage ASAC see Asian Securities' Analysts Council ASC see Accounting Society of China 2 ASEAN see Association of South-East Asian Nations ASIC see Australian Securities and Investments Commission AST system see automated screen trading system ASX see Australian Stock Exchange ATI see Account Transfer Instruction ABF Hong -

Straddles and Strangles to Help Manage Stock Events

Webinar Presentation Using Straddles and Strangles to Help Manage Stock Events Presented by Trading Strategy Desk 1 Fidelity Brokerage Services LLC ("FBS"), Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917 690099.3.0 Disclosures Options’ trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Options, and call 800-544- 5115 to be approved for options trading. Supporting documentation for any claims, if applicable, will be furnished upon request. Examples in this presentation do not include transaction costs (commissions, margin interest, fees) or tax implications, but they should be considered prior to entering into any transactions. The information in this presentation, including examples using actual securities and price data, is strictly for illustrative and educational purposes only and is not to be construed as an endorsement, or recommendation. 2 Disclosures (cont.) Greeks are mathematical calculations used to determine the effect of various factors on options. Active Trader Pro PlatformsSM is available to customers trading 36 times or more in a rolling 12-month period; customers who trade 120 times or more have access to Recognia anticipated events and Elliott Wave analysis. Technical analysis focuses on market action — specifically, volume and price. Technical analysis is only one approach to analyzing stocks. When considering which stocks to buy or sell, you should use the approach that you're most comfortable with. As with all your investments, you must make your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. -

Volatility As Investment - Crash Protection with Calendar Spreads of Variance Swaps

Journal of Applied Operational Research (2014) 6(4), 243–254 © Tadbir Operational Research Group Ltd. All rights reserved. www.tadbir.ca ISSN 1735-8523 (Print), ISSN 1927-0089 (Online) Volatility as investment - crash protection with calendar spreads of variance swaps Uwe Wystup 1,* and Qixiang Zhou 2 1 MathFinance AG, Frankfurt, Germany 2 Frankfurt School of Finance & Management, Germany Abstract. Nowadays, volatility is not only a risk measure but can be also considered an individual asset class. Variance swaps, one of the main investment vehicles, can obtain pure exposure on realized volatility. In normal market phases, implied volatility is often higher than the realized volatility will turn out to be. We present a volatility investment strategy that can benefit from both negative risk premium and correlation of variance swaps to the underlying stock index. The empirical evidence demonstrates a significant diversification effect during the financial crisis by adding this strategy to an existing portfolio consisting of 70% stocks and 30% bonds. The back-testing analysis includes the last ten years of history of the S&P500 and the EUROSTOXX50. Keywords: volatility; investment strategy; stock index; crash protection; variance swap * Received July 2014. Accepted November 2014 Introduction Volatility is an important variable of the financial market. The accurate measurement of volatility is important not only for investment but also as an integral part of risk management. Generally, there are two methods used to assess volatility: The first one entails the application of time series methods in order to make statistical conclusions based on historical data. Examples of this method are ARCH/GARCH models.